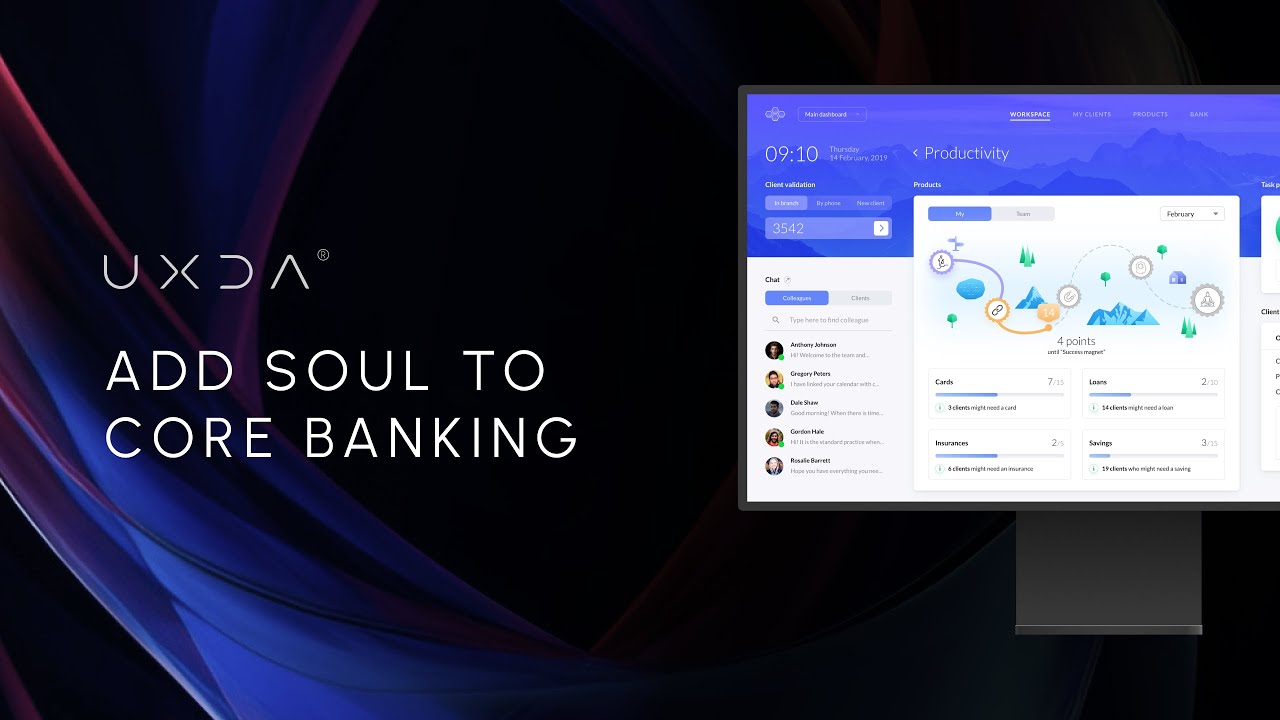

UX governance partner exclusively focused on next-gen financial services, fintech, and banking ecosystems

Closing digital CX gaps for financial brands through strategic UX system

Cases: strategic outcomes

UX governance across strategy, research, and large-scale design systems in 28 financial product categories

- Retail banking

- Corporate banking

- SME banking

- Core banking

- Islamic banking

- Kids and family banking

- AI and Conversational

- Spatial banking

- VR/AR banking

- ATM's solutions

- Credit Unions

- Trade finance

- Financial advisory

- Remittance

- Super Apps

- Wealth management

- Payment processing

- Savings

- Investing

- Trading

- Insurance

- Lending

- Tax automation

- PFM

- Crypto

- Credit scoring

- Sustainable finance

- White-label solutions

Driving ROI with Strategic UX in Middle East Banking

Emirates NBD’s digital platform was restructured to support scale, personalization, and long-term adoption in one of the world’s most digitally mature markets.

Cost of this type of UX/UI: from 500 000 €

Rebuilding a Reliable Trading & Investing Platform

The eTrader mobile platform was redesigned to balance accessibility for new investors with control and depth for experienced traders.

Cost of this type of UX/UI: from 500 000 €

Establishing a New Digital Banking Standard in Mexico

Bineo was designed as Banorte’s first digital-only bank, structured around clarity, guidance, and personalization to support informed financial decision-making.

Cost of this type of UX/UI: from 450 000 €

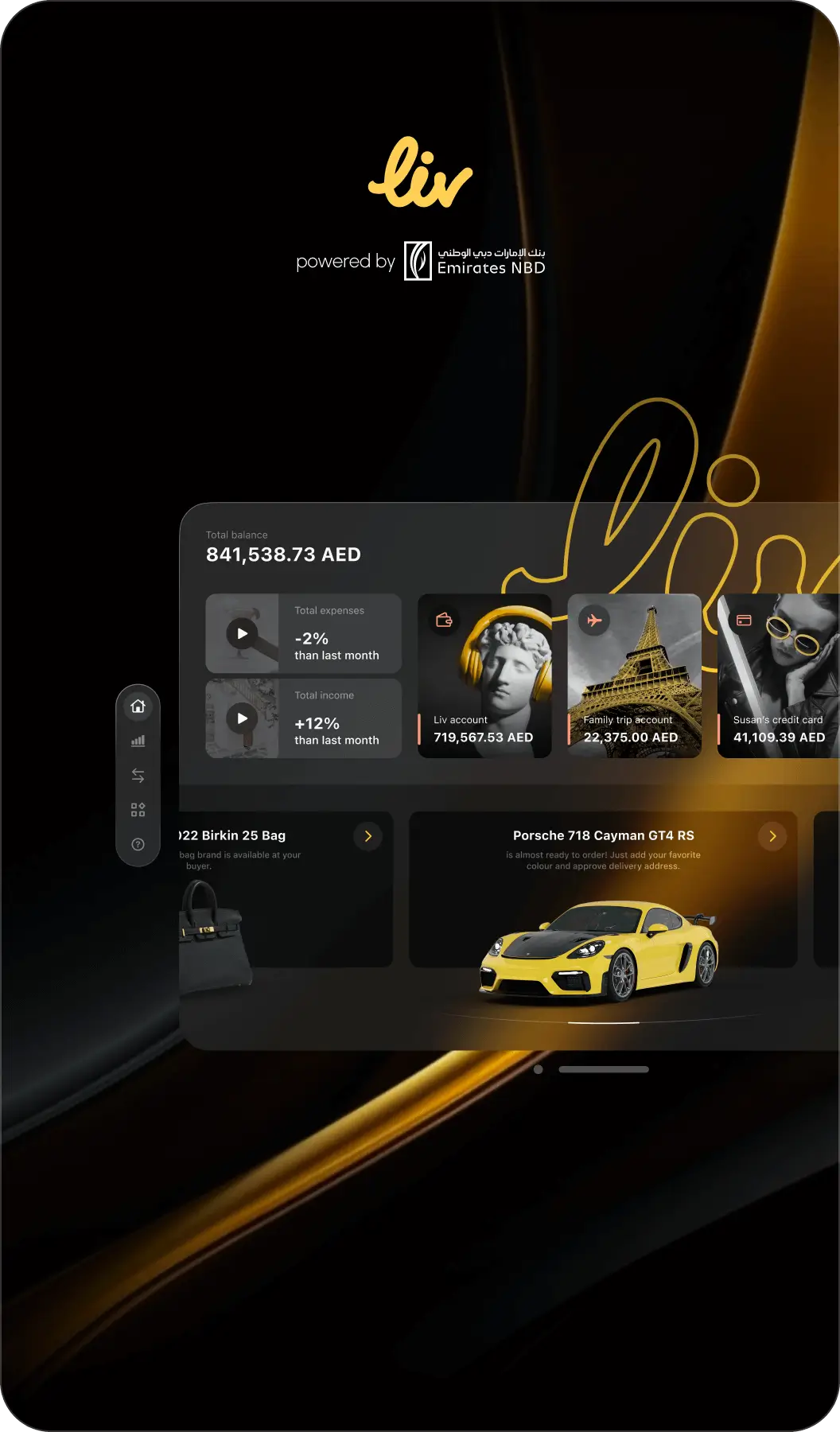

Exploring the Future of Spatial Banking with Liv Bank

This innovative concept reimagines digital banking within a spatial environment, demonstrating how core banking use cases could operate beyond traditional screens.

Cost of this type of UX/UI: from 500 000 €

Scaling Investment Experience for a 90M Market Audience

Designed for scale, the investment experience supports more than 90 million users by simplifying access, education, and progression within the GInvest journey.

Cost of this type of UX/UI: from 350 000 €

Defining a Distinct Digital Banking Identity

The Liv X digital platform was structured to express a strong digital identity while maintaining usability and control.

Cost of this type of UX/UI: from 450 000 €

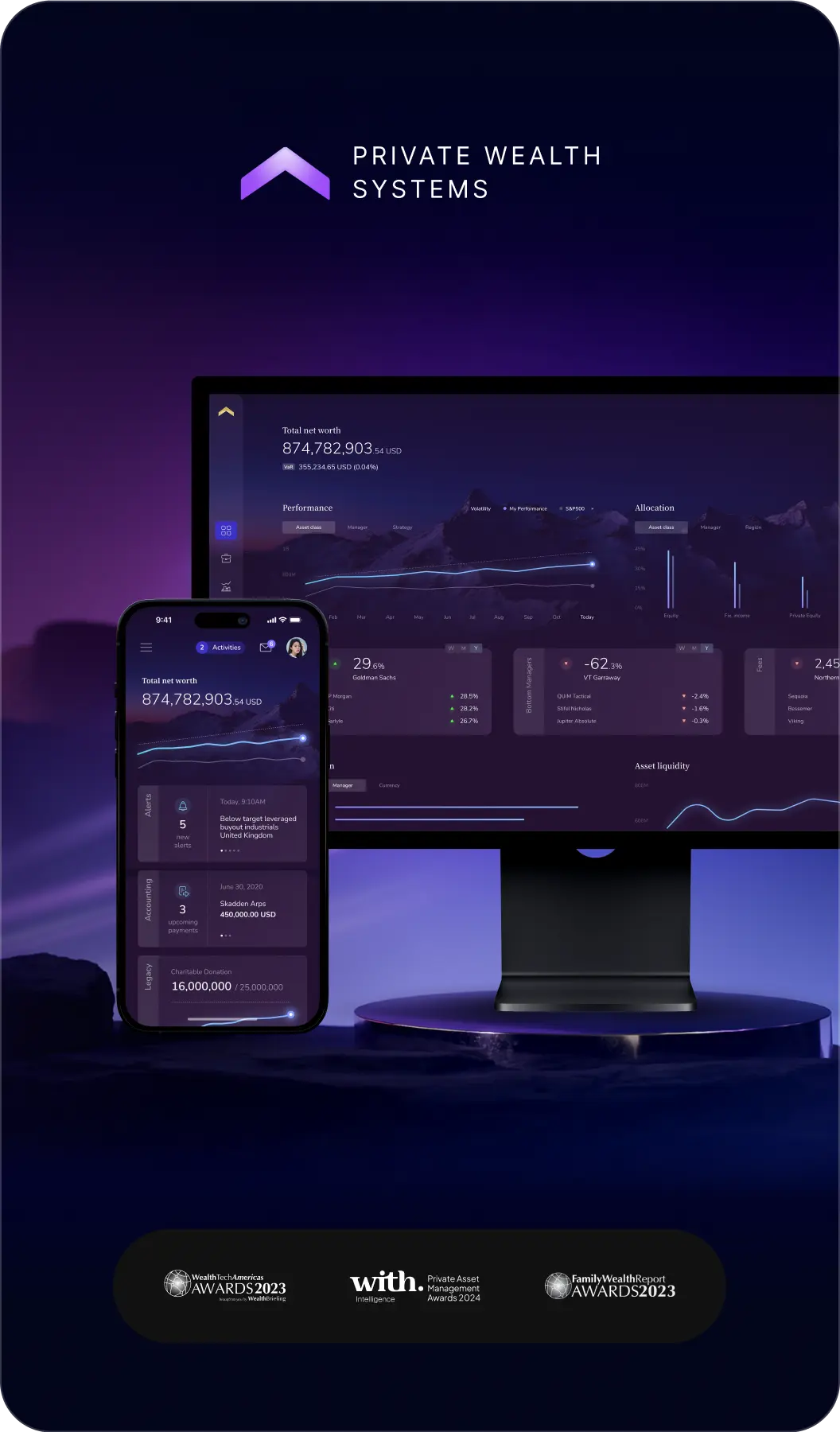

Redefining Wealth Management for UHNWI

Designing an innovative platform that reduces friction in managing complex wealth portfolios by introducing clarity, transparency, and control into high-stakes financial workflows.

Cost of this type of UX/UI: from 450 000 €

Resetting Digital Banking Perception in Albania

The BKT mobile platform was redesigned to remove dependency on physical support by enabling users to complete everyday banking tasks independently and remotely.

Cost of this type of UX/UI: from 450 000 €

Thought leaders in financial UX

Traditional UX in finance focuses on cleaner interfaces and smoother flows — but that’s not enough for high-stakes financial decisions. This article explores how Systemic UX shifts the focus to decision architecture, trust and resilience across the full customer lifecycle, helping banks reduce churn and build lasting loyalty in an increasingly skeptical market.

Digital Banking Clone Wars: Stand Out in a Copy-Paste World

In a world where most banking apps look and feel the same, “safe design” has quietly become the fastest path to irrelevance. This article explores why copy-paste interfaces are killing emotional connection with customers — and how banks can break out of the clone trap by designing digital experiences that create real differentiation, loyalty and brand value.

Outcompeting the Financial Industry Through Experience, Not Features

Financial brands have long competed on speed, safety, and features—but real loyalty comes from emotion, not functionality. As expectations shift from efficiency to feeling, the winners will be those who design relationships, not just interfaces. This article shares 10 principles to turn financial apps into emotionally engaging growth engines.

Customer-Led Banking Is Reshaping Inside-Out Financial Institutions

For decades, banks were built inside-out—core systems first, then products, and only later the customer. Digital-first challengers invert this logic, starting with brand purpose and experience and building the core to serve it. This article shows how traditional banks can turn their architecture upside down to compete in the outside-in era.

Our impact in numbers

150+

financial platforms architected across retail, corporate, and fintech domains

80+

financial institutions repositioned through coherent digital experience

39

countries with sustained client partnerships

15

years institutionalizing a proprietary financial experience methodology

30+

international design and finance awards received

81

Net Promoter Score - 87% of clients recommend UXDA at the highest rate

4.8

average App Store and Google Play rate of financial apps designed by UXDA

1M+

readers across 127 countries engaging with UXDA’s articles and analysis

Stop Copying. Start Leading.

Enduring financial brands are built through deliberate strategic decisions, not imitation. Digital experience now determines trust, relevance, and competitive position—defining whether an institution follows market standards or sets them.

Exclusive Engagement. Institutional Accountability

Excellence requires restraint. UXDA operates as a selective strategic partner, limiting engagement to seven institutions per year to ensure depth, control, and outcome ownership. Over more than a decade, UXDA has defined and governed the digital experience of 150+ banking and fintech platforms across 39 countries, strengthening trust between institutions and their customers. A partner for organizations that choose long-term leadership.

Digital Experience Defined, Not Replicated

Standardized solutions create parity, not advantage. When digital products rely on shared patterns and copied features, institutions lose identity and become interchangeable. UXDA addresses this gap by defining experience positioning at a strategic level—translating brand values into clear experience principles and enforceable behavioral rules. Research, prototyping, and interface systems are developed in-house to ensure coherence, differentiation, and long-term defensibility across the digital ecosystem.

Long-Term Focus on Financial Brand Growth

Superficial improvements address symptoms, not structural risk. Across 24 financial categories—including enterprise platforms exceeding 6,000 screens—UXDA focuses on governing digital experience coherence as a long-term brand asset. Interface enhancement improves usability; strategically transforming digital experience protects trust, strengthens differentiation, and compounds financial brand value over time.

Pioneering Innovation in Financial Products

Trend adoption is temporary. Reference-setting defines leadership. With 30 international awards and more than 300 industry publications, UXDA contributes to the evolution of financial services through the design of banking superapps, cloud-native core platforms, AI-driven banking systems, and emerging spatial interfaces. The focus is not novelty, but establishing cross-platform experience systems that remain credible, consistent, and defensible over time.

Proprietary UX Governance DXG System

For us digital experience is not a creative activity—it is an institutional system that governs brand behavior over time. UXDA operates through DXG (Digital Experience Governance) System, a proven and proprietary operating system with a mandatory nine-step sequence that consolidates 44 validated UX strategy and UI design methods. DXG System enables financial institutions to replace fragmented product efforts with a predictable, governable path to long-term trust, differentiation, and control that protects multi-million digital investments.