SME owners often face the challenge of adapting business strategy to a highly dynamic environment while simultaneously managing day-to-day financial operations. It's like Formula 1 racers, where only precise and quick decisions can save them from failure. But how exactly can business banking services help business owners? Find out how we used a customer-centric approach to transform the next-gen SME financial platform.

SMEs Lack More Value from Banking Providers

Small entrepreneurs face fragmented financial management experience because they need to use several services to cover all their daily business needs. It emphasizes the need for more than basic account services and the fact that banks don't satisfy all their service needs. SMEs are looking for support and guidance on managing finances, understanding where to focus attention and interpreting KPIs. They often lack financial experience and need a simple, clear connection between financial data and the business to make the best decisions for the future.

Recent EY research reveals that only 18% of SMEs and self-employed individuals feel they are understood by their banks and have strong relationships with their business banking providers, while others expect financial institutions to have a stronger knowledge of their business industry and initiate proactive communication.

However, banks hold a powerful resource: the financial data of SMEs they gather with their consent. Leveraging this data, banks can offer customer-centric and tailored business banking solutions, including cash flow analysis and fund allocation guidance, aligning with customer expectations.

Additionally, the EY report reveals that 82% of SMEs actively endorse data sharing, driven by a desire for enhanced services and tailored financial advice to fuel their business development efforts. Furthermore, armed with data from SMEs spanning diverse industries, banks have the potential to facilitate connections among like-minded and complementary clients, fostering the growth of their businesses. A significant portion of SMEs (81%) would find the offer of tailored networking opportunities very valuable for their business and would use it.

“The bank is helpful with daily things like account administration and even troubleshooting, but they don’t come up with new ideas or technology,” Barbara Fretter and Maarten Lammens, owners of Solids Development Consult.

Which Digital Banking Services do SMEs desire?

Financial institutions can provide SMEs with a range of valuable digital services using innovative technologies and next-gen user experience design:

AI-powered personal finance advisors

More and more banks integrate AI into their operations, potentially limiting SMEs' dissatisfaction points. An EY analysis of over 5,000 SMEs worldwide reveals striking frustration levels: 69% of SMEs express dissatisfaction about lacking the proactive communication regarding their businesses from the bank's side, and 76% lack confidence in how banks understand their industry.

AI emerges as a powerful ally for banks and SMEs in addressing these issues. It enhances proactive communication by keeping SMEs informed with industry updates, preserving banks' human resources for advanced SME business growth consultations. AI-powered personal finance advisors also enable banks to offer predictive cash flow insights, optimizing resource allocation and fostering business growth.

Additionally, AI aids in categorizing and tracking business expenses and identifying areas for cost-cutting or optimization. With limited time and the absence of finance education, AI can step in and educate business owners about financial management essentials and answer complex questions in a straightforward, simple and focused way to help business owners save time.

All-in-one platform

As super apps for individuals become commonplace, the question arises: what about the needs for SMEs? Envision a landscape in which banks seamlessly integrate the most valuable platforms and tools for SMEs, such as SaaS solutions Xero, Sage, Quickbooks, Debitoor or Lexware. These platforms already serve as the primary financial interface to enhance the business banking UX, consolidating bank accounts, transactions and accounts payable and receivable.

By integrating different financial services and other financial management tools, banks could completely change the financial management habits of SMEs, resulting in a significant boost in customer base and loyalty as they would fulfill all of the SMEs' banking requirements in one place.

This transformation can turn banks' digital solutions into comprehensive ecosystems regardless of the device or platform they choose. As a result, SMEs would receive a smooth and seamless user experience, eliminating the complexity of using multiple financial platforms and tools.

In EY's research on SMEs' digital expectations, 56% of respondents expressed their desire for a single integrated platform for financial management, consolidating financial products from multiple banks and financial providers. It is worth mentioning that banks are the ones SMEs expect to provide these integrations: 22% of research respondents would prefer accessing this through a bank, while 17% of SMEs are open to paying additional fees for such a service.

Digital experience and contextual personalization

It is worth mentioning that business owners have high expectations when it comes to SME banking UX, which is continuously influenced by advancements in digital interactions with other banks, financial providers and digital experiences from other industries.

Ernst & Young's research on business banking transformation highlights SMEs' strong demand for a seamless digital experience from their financial service providers, with 53% viewing it as crucial for business development. Additionally, 68% of SMEs aim to digitally manage various aspects of their business, including financial management.

Today, we witness the blurred boundaries between experiences with products from various industries. The McKinsey's report illustrates a growing consumer desire for cross-sector, real-time, personalized and convenient services. People desire uniform and seamless experiences, whether they're watching suggested movies on Netflix, getting notifications on their iPhones or acquiring offered products in a mobile banking app.

Therefore, banks should explore transferring their digital capabilities and the lessons they have gleaned from retail banking to business banking. Banks can extend personalized notifications that keep businesses informed about critical changes in their operations or account balances.

Furthermore, by having all the financial data of SMEs, banks can gain a comprehensive understanding of the customer's financial needs, offer tailored solutions and, in some cases, proactively prevent threats by informing business owners about unusual transactions. Through a personalized approach, banks can enhance customer loyalty by making SMEs feel valued and confident in the bank's proficiency in serving businesses within a specific industry.

Customer care

Customer care is a cornerstone of enhancing SME customer loyalty and satisfaction with financial service providers. Recent data from a McKinsey survey of German SMEs highlights 36% of respondents citing excellent customer service as their top reason for choosing their primary bank. Emphasizing the fundamentals is essential, as 75% of SMEs from the same survey look for responsiveness, speedy service and streamlined processes from their bank or financial services provider. This supports the banks' need to integrate a customer-centric mindset while serving businesses.

In light of evolving global conditions and external influences, SMEs now, more than ever, seek financial guidance and support to sustain profitability. Leveraging decades of experience navigating various crises and instabilities, traditional banks are well-positioned to share invaluable insights and expertise with their customers.

EY's research reveals challenges, such as 22% needing help accessing financial advice and 21% seeking general business management support from their bank. This data underscores the need for banks to reevaluate their customer care strategies to meet SMEs' banking needs, thereby ensuring they remain competitive in the market.

Of course, there are already great banks on the market that successfully serve SMEs' needs. For example, the OCBC Bank business banking app is a personal assistant for small and medium enterprises. The bank's integrated tools allow SMEs to access a 360-degree view of their sales, expenses and cash flow trends to better understand their business and make reasonable and strategic business decisions. Businesses can also receive an expense analysis of spending to control costs and manage changing expenses needs effectively.

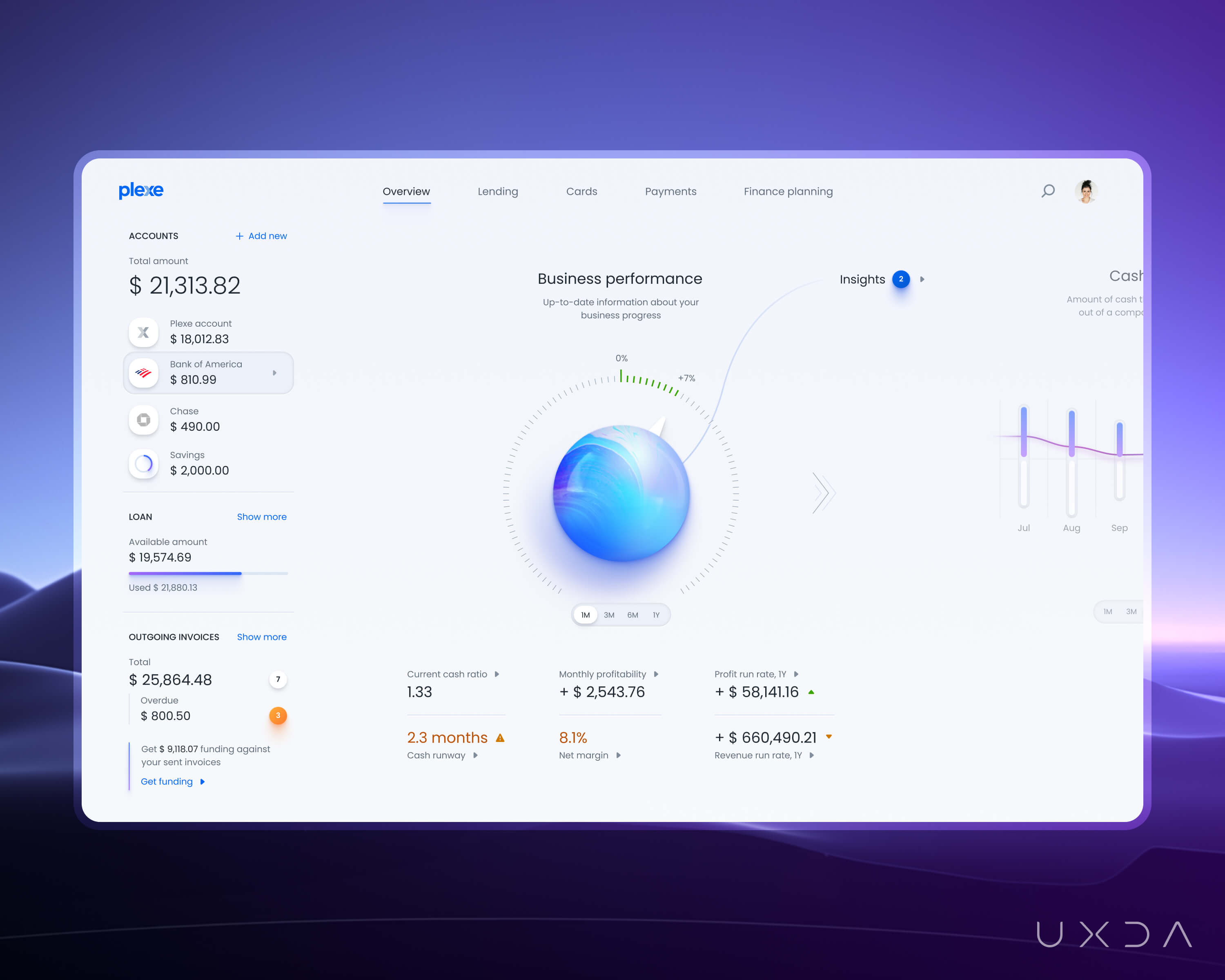

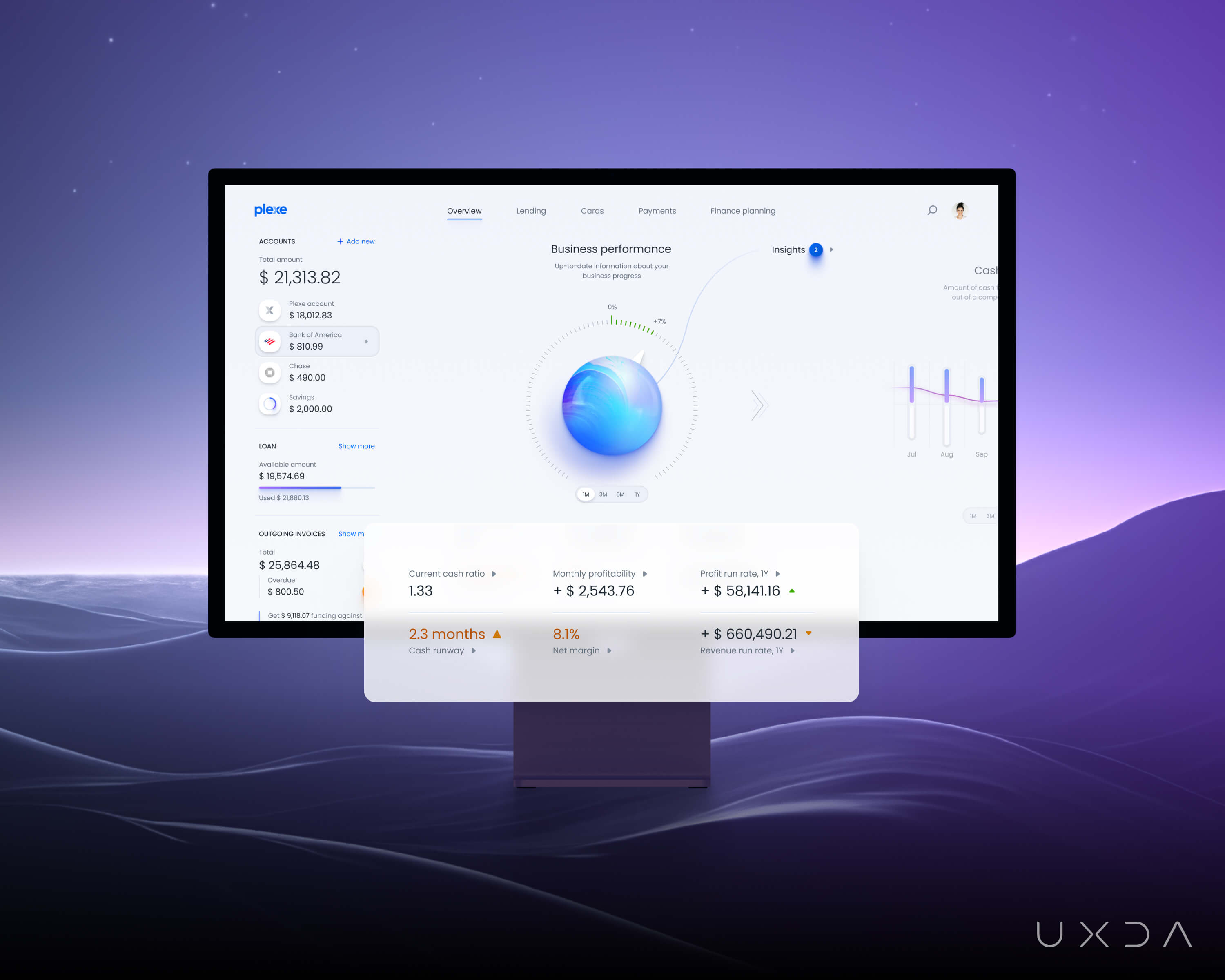

Business Banking UX Case Study: Plexe Design by UXDA

Despite some banks being open to elevating their services for SMEs minimizing the gap of underserving this group, we see the greatest focus on developing digital banking services for SMEs among Fintech startups. One of them, called Plexe, approached UXDA to design a next-gen digital product for SME banking. Explore the full Plexe SME product video story here.

Client: Finance management platform with a mission to help businesses grow

Plexe's groundbreaking Fintech platform seamlessly integrates business banking services and financial management tools, offering SMEs a unified service to quickly streamline financial operations and access funding. This is not just a finance management platform; it's a partner that tracks SMEs' businesses, offering real-time insights on cash flow and available funding opportunities with the main ultimate goal ─ to facilitate the growth of every SME business.

Since 2018, the Australian-owned finance company has served as the bridge connecting SME finance management tools and open banking to provide immediate financial support. In 2021, Plexe's management decided to elevate their product features and customer outreach, venturing into the American market and localizing their existing offering. The inception of Plexe stems from a profound understanding of the historical challenges SMEs faced in securing funds for business development.

Challenge: From complicated banking processes to a trusted financial partner

The Australian SME Fintech entered a new market with a great willingness to help small and medium entrepreneurs in the US. To grasp the needs and challenges of American SMEs and self-employed individuals, UXDA researchers found and interviewed local entrepreneurs and secured crucial insights. The experience and expectations of potential clients in the field of SME banking contributed to the creation of a platform that met their needs.

Respondents' key pain points supported the stakeholders' insights on the complicated loan application process of traditional banks, which included gathering all necessary documents and enduring weeks of waiting for a decision.

Additionally, many business owners struggle to manage their finances effectively due to time constraints and a lack of financial knowledge. As respondents mentioned, they feel lost and out of control and don't know what to expect.

As a result, SME managers spend significant time and effort manually entering data into spreadsheets to make calculations and understand their company's financial health, adding to their stress and uncertainty.

Recognizing the widespread demand for financial planning and support among SMEs, Plexe aimed to become a trusted, long-term partner, offering a unique and personalized experience and guidance that surpassed the capabilities of existing financial management platforms, ultimately enhancing the lives of business owners.

Plexe perceives SME owners like F1 pilots navigating their businesses through rapidly changing circumstances at a high speed, dealing with daily stress and uncertainty while constantly being in survival mode.

To implement Plexe’s strategic vision into design, we defined product values to empower business owners: provide business owners with control over their finances and future direction; provide support to facilitate financial management and open new business opportunities; and help to detect and use the shortest path to achieving business goals.

Solution: All-in-one SME platform for successful finance management

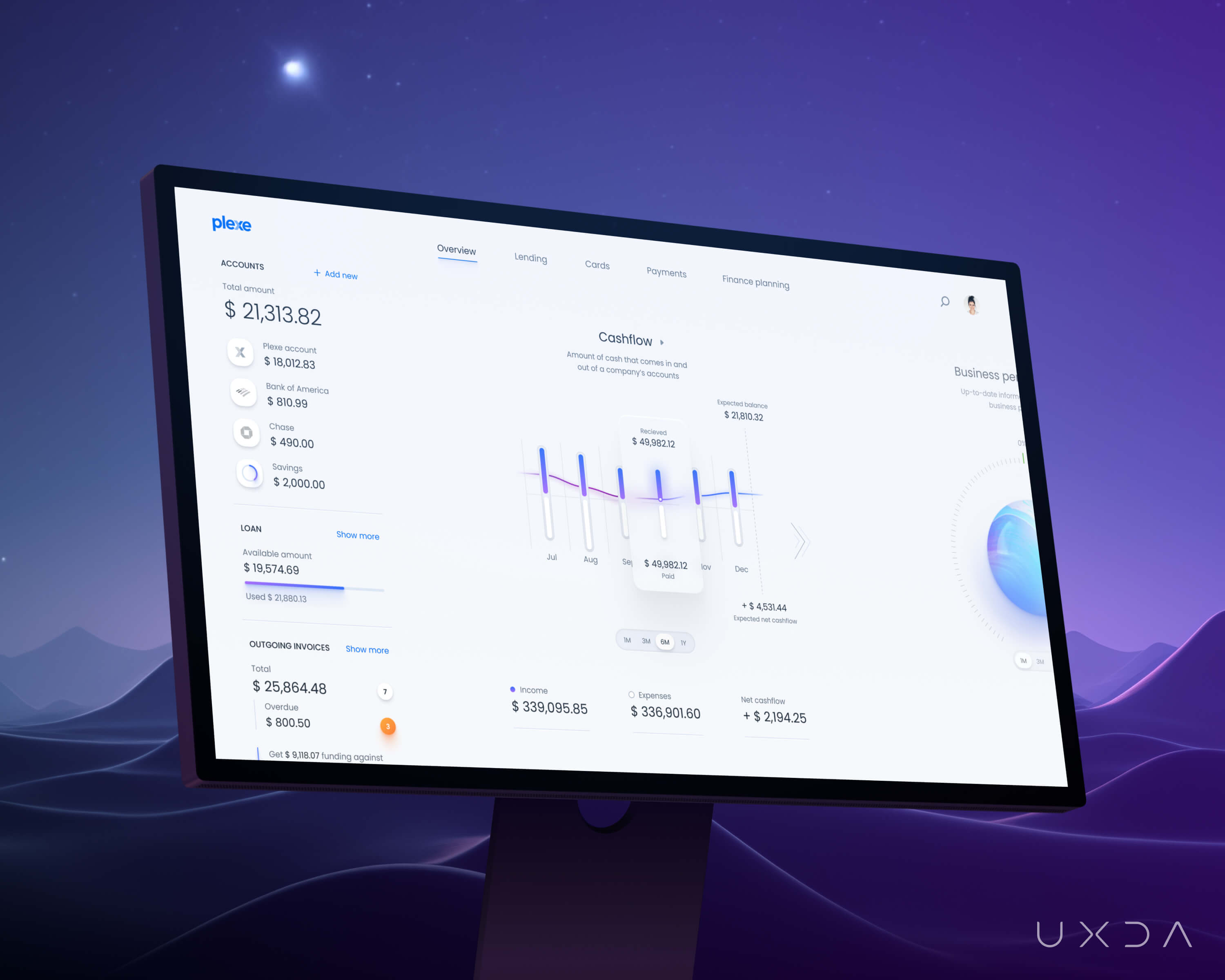

Designing an SME Fintech platform to embody care and confidence resulted in an inspiring product aligned with Plexe's mission and product values. Leveraging integrated capabilities, we crafted a streamlined design architecture for a user-friendly experience. The dashboard promptly presents crucial insights about the business and financial situation to help the business improve its current financial situation and leverage its growth.

A simplified user journey to secure and use needed funding was essential to remove complexities and bureaucracy in developing the business. In this way, business owners can quickly and fully exploit the most valuable business opportunities that require additional financing. With smooth integrations and a crystal-clear dashboard design, users can make business decisions with the speed and precision reminiscent of Formula 1 racing.

Plexe emphasizes essentials like key business indicators on the dashboard, funding opportunities, overdue outgoing invoices and providing guidance and future planning through AI-generated personalized insights. By connecting other bank accounts and accounting software services, business owners can see a complete overview of their finances and get more valuable insights and future predictions regarding all finance matters from the Plexe platform.

For example, the business owner gets a notification about a percentage increase in office rent payments, prompting them to evaluate the impact on other operations. Analyzing outgoing invoice information, Plexe forecasts potential shortages and suggests the business owner work on business operations enhancement or use factoring to meet its short-term liquidity needs.

Beyond being a Fintech platform, Plexe becomes a friendly financial companion for self-employed individuals and SMEs that navigate them through business cash flow and provide opportunities for business growth through instant access to funding based on business performance. The service empowers users to make informed decisions and enhances financial literacy, so business owners can have peace of mind about the future and more time and energy to enjoy life and their business.

The platform's key design element ─ crystal ─ is a business performance indicator that combines the past, present and future of business, providing valuable insights and understanding of how the business is going. It guides users into discovering what is the most helpful for the business in their path toward growth.

The design fosters a sense of freedom with a spacious layout, transcending boundaries and drawing inspiration from life's dynamic flow. Providing a fresh design with quick, at-a-glance business insights, users can empower their financial situation with a forecast for the upcoming month and strategic planning based on performance indicators.

Approach: Simplicity and full control for higher efficiency

We aimed to simplify financial management for those who drive their own business and were inspired by consistent user experiences provided by giants like McDonald's and Apple.

McDonald's ensures consistent quality in every location by simplifying processes and building operational excellence. At the same time, Apple is a master of combining several products into one solution, becoming a leader in technology. These inspirations, combined with a user-centered approach, were a foundation in designing a next-gen financial service for SMEs ─ namely, the Plexe platform.

The UXDA team closely communicated with the Plexe team and gathered input that was extremely valuable for the project, as the Plexe team understood the needs of SMEs and self-employed people like no one else. Gathered stakeholders’ insights, market research and end-user interviews resulted in a clear path to a customer-centric SME banking design.

Together with the client's team, we built a new financial management platform to inspire SMEs and self-employed entrepreneurs to enjoy life while being confident the business is growing with the Plexe platform. As the Plexe team said: “With Plexe - let your business fly!”

Presenting a serene harbor

Plexe's new design prioritizes simplicity, aiming to eliminate chaos and stress associated with business financial management. Acting as a trusted guide, it easily and quickly provides users with the information they need, while instilling positive emotions, such as trust, calm and inspiration.

At the heart of the platform's design is the AI-powered crystal indicator that consolidates crucial business information. It offers a sanctuary of control and a clear vision for future success. It goes beyond mere data, providing insights and suggestions that not only illuminate the current state of affairs but also offer a roadmap for improvement.

Using data collected from different linked services and accounts, AI technology analyzes all aspects of the business and timely informs as to what to expect in the future and where to pay attention. The Plexe platform ensures that everyone, regardless of financial knowledge level, can comprehend and steer their business toward prosperity.

Instant access to funding opportunities

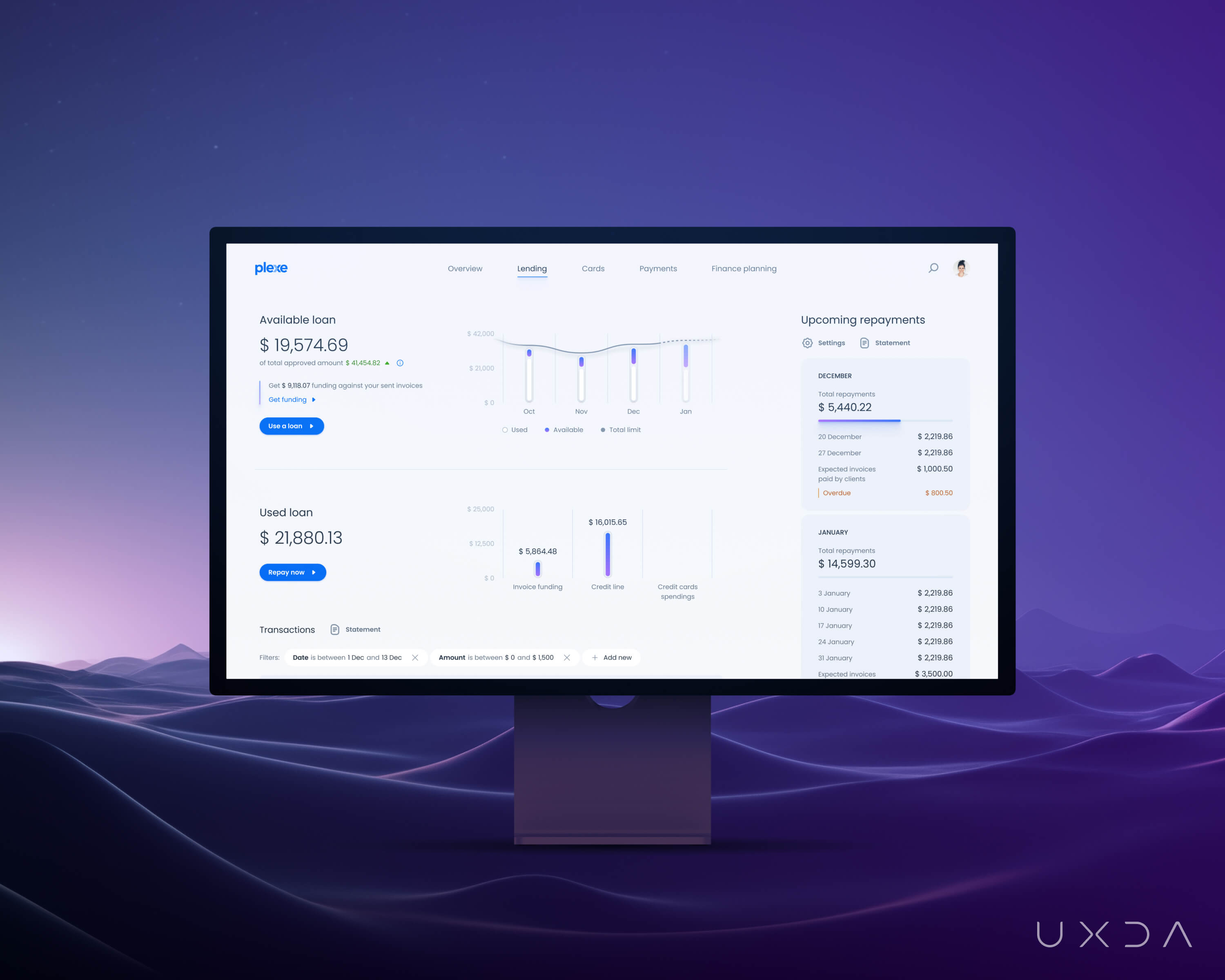

The platform processes all cash flow and invoice data automatically, calculating available loan amounts based on the business performance and allowing users to view it at any time.

Acknowledging the difficulties SMEs encounter in sustaining consistent cash flow, the platform provides users the flexibility to adapt lending repayment options to their specific needs, offering them more control over their financial commitments. This flexibility caters to the unique circumstances of business owners, enabling them to opt for either a fixed amount or a percentage of their income.

From challenges to efficiency

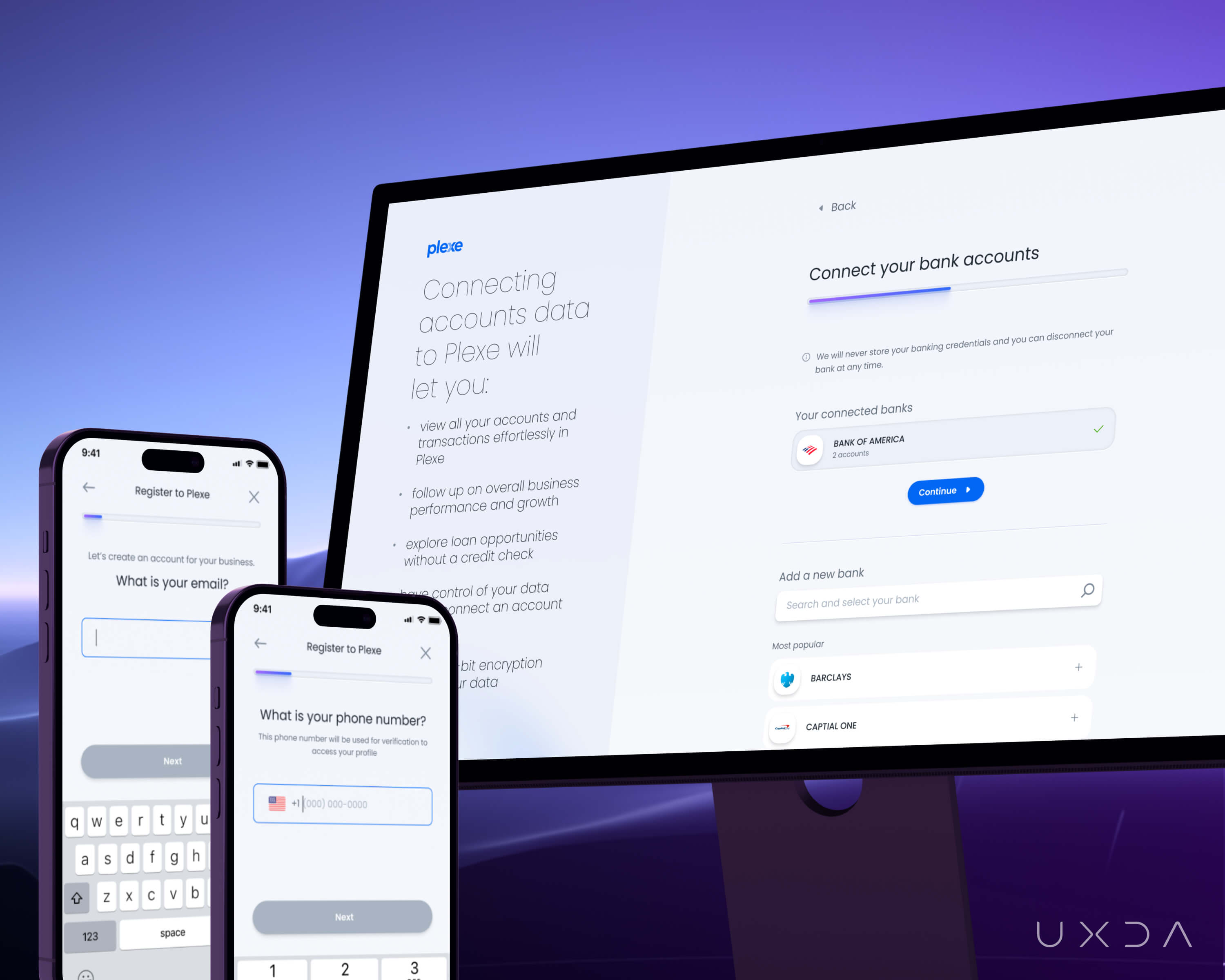

Thoughtful UX components made it possible to implement all key platform scenarios on a limited set of screens. Effective communication helped us navigate challenges, and collaborating with the client's team allowed us to find the best solutions for user experience within the platform.

We've created the foundation for an exceptional user experience in SME banking and significantly reduced the complexity of the critical onboarding flow. We suggested making the onboarding process shorter, split into manageable steps, and provide quicker access to the service while ensuring compliance with legal requirements.

Takeaway

The growing demand for financial guidance and management assistance among SMEs and self-employed individuals is undeniable. Business owners are actively looking for digital banking solutions that will meet their financial needs at the same level as retail banking.

Over the past decades, banks have gained a powerful asset that gives them an advantage in the market ─ trust from SMEs ─ but unfortunately the user experience has lagged behind. This is an ideal market window for Fintech companies. They are becoming active players in the business banking market with user-centric technologies. They bring together various services on one platform, providing greater convenience to SMEs' financial management.

A clear mission and flexible approach allowed the Plexe SME platform to significantly simplify the complexities of financial management and offer its clients a product that is easy and pleasant to use. Personalized notifications, insights, frictionless digital experiences and responsive customer service are gaining customer satisfaction and loyalty.

The next generation of SME banking will be based on an analysis of customer expectations and a willingness to implement optimal customer service strategies. In addition, AI integration is a powerful extra for a competitive advantage today, but soon it will become a mandatory requirement in the industry.

Discover our clients' next-gen financial products & UX transformations in UXDA's latest showreel.

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedin