The traditional banking model is based on the intermediation of funds. Banks collect deposits from customers and use these funds to provide loans to borrowers. The launch of Central Bank Digital Currency (CBDC) in the banking industry could start a new age by impacting the financial customer experience and, as a result, disrupting the traditional business model. Will this CBDC banking trend be a threat or bailout for the industry, and how can UX design help banks to prepare for it?

New Player Threatens Bulletproof Banking Model

There are different opinions about what could become the main disruptor of traditional banking. And I don't mean some evolutionary change, but a disruption that will force traditional banks to change their business model or leave.

Some believe it will be the emergence of Fintech companies, some say it will be the metaverse, and others believe that this force will be the widespread introduction of ChatGPT-like AI tech based on financial Big Data. There are also those who say that open banking will be the model that breaks the monopoly of banks and turns them into BaaS providers for embedded finance.

But, in fact, these digital trends appeared in the process of digital evolution by helping banks gradually adapt to it. Of course, they impact the competition and push banks toward the inevitable digital transformation, but they are not a threat to the position of traditional banks and their business model.

Banks' customers deposit their income, and banks lend that money as loans and make investments, thus generating significant income. And the inertia of this model is so high that even better, more convenient and cheaper banking services offered by Fintech companies still do not threaten banks.

The real threat may appear only if there are opportunities in the market that will seduce bank customers to transfer their deposits elsewhere and subsequently leave all their income outside the banks. In this case, the banks' excessive funds will dry up, and they will be forced to fight for their clients in the highly competitive market, as Fintech companies do.

Of course, given the importance of banks as a system-forming factor in the economy and the provision and regulation of financial flows, central banks, state regulators and governments are unlikely to allow such a threat. If, however, they become new players themselves, for example, in the form of a more effective alternative to money, this could change consumer behavior on the financial market and create significant competition for banks. I'm talking about Central Bank Digital Currencies, of course.

Is the Emergence of CBDC in Banking Inevitable?

We all know that a central bank digital currency is a digital form of a nation's fiat currency that is issued and backed by a central bank. And, with the increasing popularity of cryptocurrencies and the advancements in technology, many central banks around the world are exploring the idea of launching their own e-money in the form of CBDCs.

CBDC in banking can be used for a variety of transactions, including peer-to-peer payments, online purchases and money transfers. But CBDCs are different from cryptocurrencies, such as Bitcoin, in that they are backed by a central authority and have legal tender status. However, the launch of CBDCs could have a significant impact on consumer behavior and the financial industry, particularly on the traditional banking model. E-money will become a digital representation of existing currencies like yuan, rupee or euro, at the same time connecting every user to the central bank.

At the moment, 114 countries, representing over 95 percent of the global GDP, are exploring a CBDC banking strategy. As of December 2022, all G7 economies have now moved into the development stage of a CBDC. In particular, the European Union has already sent a directive to member countries to start the development of their centralized national wallets.

There are rumors surrounding different deadlines for implementation; some experts believe that it is a matter of a few years, as there are a number of factors that create additional pressure on this issue. This has already happened in four countries, and in some countries a launch is planned in the next 3-5 years. China's CBDC is the most ambitious, and, when it launches in 2023, it will likely be the first to be launched from a large nation, states Richard Turrin, CBDC expert and author of Cashless - China's Digital Currency Revolution. For example, the European Commission announced that a bill for a digital euro will be proposed in 2023.

There are a number of factors that stimulate the adoption of cashless payments and push for the rapid implementation of CBDC banking e-wallets, including:

Transition to a Cashless Economy

Services around the world are going digital. This allows global consumers to not limit their search for the best product or service to local suppliers, but to choose regardless of location. And here, the cost, convenience, simplicity and security of cashless financial payments come to the fore. Now these components depend on many links in the payment chain between the seller and the buyer. The introduction of CBDCs will significantly reduce the number of links, decreasing the cost and increasing the ease, speed and security of cashless payments, just like what happened with the elimination of roaming fees in Europe.

Impact of the Pandemic

The pandemic has greatly accelerated the migration of consumers to digital channels. The share of cashless payments has obviously increased, shaping new habits and standards of consumer behavior. But the pandemic has not only accelerated the adaptation of digital payment and remote purchases;it has instilled in the minds of consumers the fear of using contact methods of payment due to the possibility of transmission of viral infections.

Trust Crisis in Banks

Another factor has to do with the banking industry itself. In the framework of the traditional banking model, investing depositors' money remains a significant source of income for banks. And the inflation-induced sharp increase in the refinancing rate has shaken the position of large banks, leading to a bank run. The downfall of Silicon Valley Bank, Credit Suisse and Signature Bank shook consumer confidence in the banking system, and the capitalization of major global banks declined. Banks' customers considered finding more reliable forms of storing their deposits. In this case, a central bank digital wallet would become an ideal alternative to a safe place for residents' funds.

Discrimination of the Unbanked

The widespread transition to non-cash payments has led to the emergence of a special form of social inequality─the unbanked and underbanked. These are people who, for various reasons, do not or cannot have a bank account, which means they cannot participate in digital money transactions. Depending on the country, the number of unbanked can reach about 6% in developed countries (in the US, 18% of the population are unbanked or underbanked), and up to 70% of the total population in developing countries .

Providing such residents with a default digital wallet at the country's central bank will help reduce inequality and integrate them into the overall economic system.

The Need for Regulation

Cash causes a big problem because it supports the gray and black economy. The country does not receive taxes, workers are deprived of social protection, and corruption and crime involving money laundering flourish.

In the digital world, cash is losing its relevance and is being replaced by anonymous cryptocurrencies. But, while the issue of cash is regulated by the state, cryptocurrencies are not regulated by anything. They are extremely volatile, and huge crashes such as Therra and FTX have led to significant losses of depositors' funds and has shaken consumers’ confidence in cryptocurrency. A CBDC issuance will allow the government to provide more transparency and buy out these problems.

CBDC's Banking Impact on the Financial User Experience

Of course, not everyone welcomes the introduction of the CBDC in banking. Some fear that it will lead to the prohibition of cash and the launch of a cashless economy, which will increase government control and threaten democracy and the right to privacy by making finance a lever for repression by the system. In particular, the Swiss Freedom Movement announced in February that it had garnered over 111,000 signatures to hold a referendum on the prohibition of a cashless society.

A member of the Executive Board of the ECB (European Central Bank), Fabio Panetta, stated that the ECB would not set any limitations on where, when or whom people can pay with a digital euro. ECB has no intention to replace other electronic payment methods or cash with digital euros. Rather, it would complement them. The digital euro would be for the public good, so it would therefore make sense for its basic services to be free of charge─for example, when using the digital euro to pay another person, as is currently the case with cash.

According to an EY India report, the CBDC wallet user should be able to initiate offline payments using any channel: contactless, email, QR Code and the same terminals and standards currently used for card payments. The offline CBDC payments can be received by any device (secured or not), with or without an internet connection to the ledger. CBDC banking users can also send and receive funds by exchanging multi-digit authorization codes, either manually or using near-field communication (NFC) connections.

First of all, the introduction of CBDCs will be aimed to benefit people who have already switched to cashless payments, for example in the closest to cashless countries with 98% of cashless transactions, i.e., Norway, Finland, New Zealand, Hong Kong, Sweden, Denmark, UK, Singapore and the Netherlands. In 2021, 41% of respondents in the US say none of their purchases in a typical week are paid for using cash, up from 29% in 2018.

CBDC banking e-wallet adoption could be accompanied by a number of benefits for consumers:

Security by National Currency

In some countries, people still withdraw their salaries from current accounts and keep cash at home because they are afraid of bank downfalls or cyber crimes. A CBDC wallet secured by the central bank will allow them to store and make deposits in the national digital currency without intermediaries. CBDCs will be more secure than cash, which is vulnerable to theft and counterfeiting.

Transactions and Settlements will be Free

Transactions will be free for P2P payments as well as for purchases. Today merchants pay 2-3% of every card transaction to financial intermediaries. For most merchant businesses, an ROS (return on sales) of between 5% and 10% is excellent. This means that free CBDC banking transactions could increase their profit by 30-60%.

Currently, banks play a key role in facilitating cross-border payments. However, CBDCs could allow individuals and businesses to make cross-border payments directly, without the need for a traditional bank.

Stability of the Central Bank

CBDCs will make it easier for central banks to implement a monetary policy, which will increase financial stability. Unlike cryptocurrencies, CBDCs are a national currency and will not carry the volatility and risk that cryptocurrencies do. It is not a high-risk investment tool but, rather, an optimal form for storing money digitally.

The Birthright to Money

Moving digital payments out of the domain of banks and into the public sector will make the right to use e-money a civil law. As private entities, banks will not be able to decide who can or cannot open an account.

Instead of making banks individually improve digital payment services, CBDCs will ensure focus on a centralized approach. CBDCs will provide national digital wallets to every resident from birth. This allows access to all of the main financial services by default without the need to open a bank account.

Transparency

CBDCs will make it more difficult for criminals to commit fraud with a person's money, as transactions will be traceable. In the case of a fraudulent transaction, digital currency allows one to trace the chain of transactions and recover the money, which is often not an easy task for banks.

CBDC's Impact on the Banking Industry

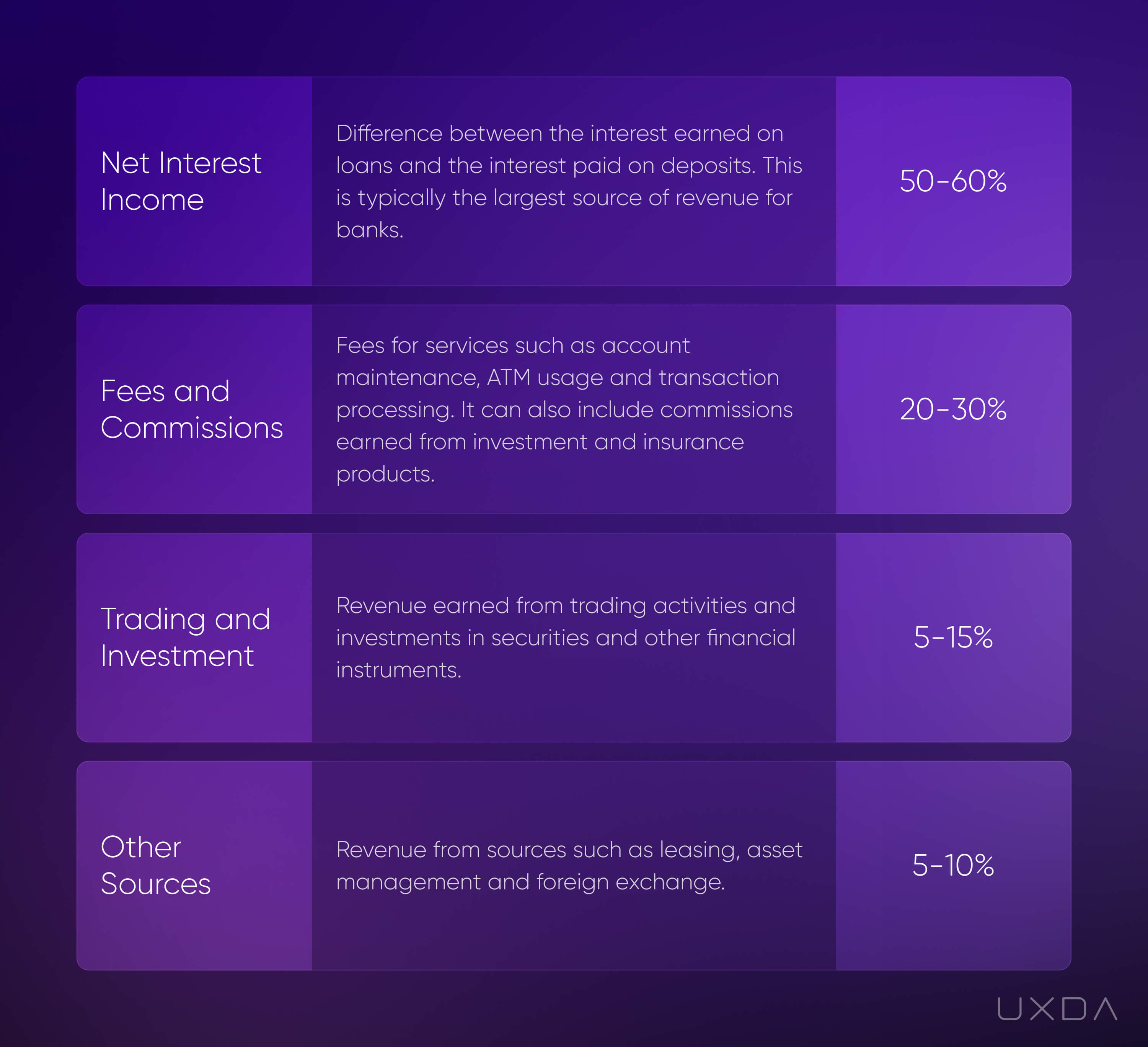

Unlike other digital technologies, the mass introduction of a central bank's digital wallet for storing CBDCs will have a direct impact on a bank’s sources of profit. Currently, banks make money in a variety of ways, including holding deposits, lending money and providing payment services.

The main profit sources for banks can vary depending on the bank and the market in which they operate. Of course, percentages depend on different banks' strategies for generating revenue. However, here are some of the most common sources of revenue for banks and their approximate share:

This basic understanding of the traditional banking model is enough to assess the possible impact on the banking industry. CBDCs’ digital wallets may disrupt the traditional business models of incumbent banks in a number of ways:

1. Loss of Deposit Base

Today, incumbent banks have a significant advantage in terms of customer deposits. However, CBDCs would enable consumers to hold digital currencies directly with the central bank, bypassing the need for a bank account. This could provoke the most significant deposit drop in traditional banks and a subsequent decrease in their funding base and account fees. As a result, banks may see a decline in their funding sources, which could impact their profitability and sustainability. Fintechs, on the other hand, do not have the initial advantage of default deposits and are therefore better prepared to face fierce competition once centralized wallets are launched.

2. Elimination of Banking Transfers

CBDCs will reduce the need for intermediaries, such as payment processors and other third-party service providers, potentially leading to a shift in the competitive landscape. This could eliminate transaction costs, speed up transaction times and enable real-time settlements, providing improved customer experience and faster payments. Reduction in banks' provided P2P payments, P2M payments, cross-border payments and bill payments will decrease banks' revenue streams.

3. Trust Leaks

If CBDCs' central digital wallets offer better services and lower fees, customers may be more likely to switch providers, decreasing customer loyalty for incumbent banks and Fintechs. Also, digital finance has created new security risks, such as hacking and other forms of cybercrime that lead to reputational damage for banks. CBDCs would be designed with strong security measures to prevent fraud, theft and other forms of financial crime. This also could shift customer confidence away from banks toward a new player in the form of central bank wallets.

4. Disintermediation of Banks

If CBDCs become widely adopted, the role of commercial banks in the economy could be significantly reduced. The issuance of CBDCs could potentially disintermediate banks by allowing individuals and businesses to hold and transact directly with the central bank. This will allow central banks to directly control the money supply, rather than relying on commercial banks. CBDCs will reduce the need for physical cash, which will have an impact on banks and cash-in-transit companies.

5. Inclusion of Additional Consumers in the Financial System

CBDCs could impact people who lack access to traditional banking services. CBDCs will make it easier for the unbanked and underbanked to access financial services, as they will not require a traditional bank account to use CBDCs. CBDCs should be easily accessible to anyone, which could greatly enhance financial inclusion and increase demand in the financial system.

6. New Business Opportunities

CBDCs will change the existing payment infrastructure, potentially leading to new opportunities for banks and Fintechs to offer innovative services. Banks and Fintechs may then form new partnerships with central banks and other stakeholders in the CBDC banking ecosystem to offer new services and features.

7. Increased Regulatory Oversight

CBDCs will enable regulators to monitor transactions in real time, which will increase transparency in the financial system and enhance consumer protection, thereby preventing financial crime. This will require a new set of regulatory challenges. Incumbent banks may have an advantage in adapting to these challenges, as they already have established relationships with regulators. However, Fintech companies may have to work harder to get regulatory approval and establish themselves as reliable CBDC operators.

8. Increased Competition

CBDCs will increase competition among banks and Fintech companies as they will have to compete with a new player─the central bank. The introduction of CBDCs and central digital wallets may increase competition between incumbent banks and Fintechs, as consumers may have more options for storing and transferring funds. This could lead to greater innovation, better customer experiences and improved financial services overall. Incumbent banks may find it harder to compete with Fintechs, who have already established themselves as digital-first financial providers.

9. Need for Innovation

The introduction of CBDCs and digital wallets is likely to require banks and Fintechs to innovate and adapt their business models. Incumbent banks may need to invest in new technology and processes to remain competitive, while Fintechs may need to expand their offerings and become more regulated to gain wider acceptance.

10. Changes in User Experience

Overall, CBDCs' central digital wallets may offer new user experiences that could disrupt traditional banking consumers' behavior patterns, potentially leading to new winners and losers in the market.

Prepare for CBDCs by Perfecting Your UX Today

As you can see, the impact of CBDCs on traditional banks' business models could be significant. Since CBDCs are backed by the central bank, they offer a risk-free and convenient way for individuals and businesses to store their funds. This could lead to a decline in the demand for traditional bank deposits, which is the main source of funding for banks. If the majority of customers will move their deposits directly into central banks' digital wallets instead of banks, it will change the way banks make money and weaken their power in the financial system.

Moreover, CBDC banking could enable individuals and businesses to conduct transactions without the need for traditional banks. This could reduce the role of banks as intermediaries in the financial system, decreasing their profitability.

But this does not mean that banking services will no longer be needed. Even when some people transfer their deposits directly to the central bank, there will still be a need for other traditional banking services, such as lending, budgeting, investment, asset management, advisory services, etc. Banks could offer new CBDC-based services and partner with Fintech companies to stay competitive in the changing financial landscape.

Of course, for incumbent banks who provide only basic financial services, CBDC banking wallets will become a huge game changer. Overall, banks' survival will depend on the ability to provide their customers with additional value. And here, technology and user experience (UX) will become the main differentiator. The digital value proposition and the customer-centricity level of digital services that can attract and retain customers will come to the fore. Customers will need to be offered a value proposition that outweighs the basic functionality of centralized digital wallets.

Banks, for example, can share some revenue with customers by offering additional interest for keeping a deposit with the bank, allowing them to invest it through credit products. Such models have already been tested by P2P lending Fintechs. In a P2P lending model, the bank would act as an intermediary between borrowers and lenders, connecting borrowers with individuals willing to lend money. The bank would earn a fee for facilitating the transaction and serving both sides, and lenders would receive a portion of the interest charged on the loan. P2P lending is not without risks; however, banks have the best expertise to carefully manage these risks and ensure the safety and stability of their operations.

Of course, there is already Fintech competition here, but banks have a competitive advantage in the form of their reputation, historical reliability and established system of work. In this way, a timely review of traditional product strategies could stop capital outflows after CBDCs’ wallets launch, so that banks can continue to operate within their established processes. But, to do so, banks' digital product UX needs to be in perfect shape.

Design thinking and UX design approach will be key technologies to help implement a digital strategy and add value to digital offerings for customers. The technology trends we discussed at the beginning of this article will help take value to the next level. Banks that use AI to personalize their services and provide their customers with highly valuable insights based on Big Data analysis will gain a digital market advantage. The metaverse will open up a new borderless market for financial transactions, and open banking and embedded finance will create synergies that dramatically enhance the customer experience.

To survive the launch of CBDCs’ digital wallets by central banks, incumbent banks could adapt their digital strategies today by:

1. Implementing a Focus on User Experience

If banks prioritize the user experience of their digital products, it could help to remain relevant in the digital era. This includes offering a delightful digital service, personalized service and exceptional customer support. This is where external expertise, such as UXDA, comes in to help banks think out of the box and create world-class competitive products.

2. Ensuring a Consistent Digital Ecosystem

Enhancing a bank’s digital infrastructure could help to make it maximally customer-centered, competitive and scalable prior to CBDC's implementation. This includes updating payment systems, digital wallets and other digital banking services as a consistent digital ecosystem that provides a seamless customer journey.

3. Embracing New Technologies

New technologies, such as blockchain, artificial intelligence and machine learning stimulate Fintech competition and increase customers' expectations. This requires banks to develop new digital banking services and improve existing ones to secure their place in the digital world with an attractive offering to the next generation of consumers.

4. Designing Value-Added Services

In case basic digital financial functions become monopolized by central banks, banks could switch to value-added services beyond traditional banking offerings. The additional value will ensure long-term customer loyalty and demand, and now is the best time to explore new digital business models and revenue streams.

5. Partnering with Fintech Companies

Banks also could partner with Fintechs to enhance their digital strategy, leverage their expertise and stay ahead of the curve. Fintech companies can bring innovative solutions and technologies to the table, helping traditional banks to develop new services and stay competitive.

6. Investing in Security

Banks should invest in advanced security measures to ensure the safety and integrity of upcoming CBDC banking transactions and customer data in light of potential changes in financial regulation.

7. Collaborate with Regulators

Banks need to collaborate with regulators and central banks to ensure future compliance with CBDC requirements and standards, as well as to stay informed of upcoming changes.

Takeaway

Facing possible digital financial monopolization by CBDCs' digital wallets, traditional banks have very little time to prepare. They need to increase the value of their digital products, build competencies in digital service UX design and development, build a consistent digital ecosystem and implement digital innovations.

This requires adapting their business strategy, defining objectives, finding contractors and agreeing on terms, which can take from six months to a year. Following research, design or redesign of an adapted digital product and further development and launch could take banks one to three years.

So it looks like, if banks do not start preparing today for the three to five-year emergence of CBDC wallets in their digital strategy, then, after six months, it may be too late.

You can find various detailed examples on how to create and improve the value of financial digital products through UX design and design thinking in the UXDA blog.

Get UXDA Research-Based White Paper "How to Win the Hearts of Digital Customers":

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedin