Premier Blog on Financial UX Design and UX Innovation

Traditional UX in finance focuses on cleaner interfaces and smoother flows — but that’s not enough for high-stakes financial decisions. This article explores how Systemic UX shifts the focus to decision architecture, trust and resilience across the full customer lifecycle, helping banks reduce churn and build lasting loyalty in an increasingly skeptical market.

Digital Banking Clone Wars: Stand Out in a Copy-Paste World

In a world where most banking apps look and feel the same, “safe design” has quietly become the fastest path to irrelevance. This article explores why copy-paste interfaces are killing emotional connection with customers — and how banks can break out of the clone trap by designing digital experiences that create real differentiation, loyalty and brand value.

Outcompeting the Financial Industry Through Experience, Not Features

Financial brands have long competed on speed, safety, and features—but real loyalty comes from emotion, not functionality. As expectations shift from efficiency to feeling, the winners will be those who design relationships, not just interfaces. This article shares 10 principles to turn financial apps into emotionally engaging growth engines.

Customer-Led Banking Is Reshaping Inside-Out Financial Institutions

For decades, banks were built inside-out—core systems first, then products, and only later the customer. Digital-first challengers invert this logic, starting with brand purpose and experience and building the core to serve it. This article shows how traditional banks can turn their architecture upside down to compete in the outside-in era.

Most popular

Apple Vision Pro could start the next digital revolution. Wizards from Cupertino offer a mind-blowing spatial experience on the visionOS platform. But how could spatial banking feel and look?

UX Case Study: Implementing AI to Shape the Future of Spatial Banking

Apple Vision Pro could start the next digital revolution. Wizards from Cupertino offer a mind-blowing spatial experience on the visionOS platform. But how could spatial banking feel and look?

Emirates NBD Case Study: Driving Ecosystem ROI with Strategic UX in Middle East Banking

This case study delves into how the strategic UX approach transformed Emirates NBD’s digital ecosystem, setting a new standard of excellence for digital banking worldwide and solidifying the Emirates NBD brand’s position as a leader in the Middle East financial industry.

Garanti BBVA Securities Case Study: Designing a World-Class Investing Experience

Garanti BBVA Securities aimed to move beyond third-party solutions by setting a new standard for investment experience in the Turkish market. The challenge was to transform eTrader into a highly personalized, user-centered app that delivers outstanding digital experience.

Why Banks Get Blacklisted by Design Agencies—And What Leadership Misses

Partnerships with design agencies can unlock innovation for banks—but repeated “red flag” behaviors risk damaging trust. This article reveals what blacklisting really means in the design industry and why premium agencies quietly avoid difficult clients.

Executive Buy-In as the Missing Link in Banking UX and Digital Branding

Banks don’t lose customers over rates—they lose them over experience. While fintechs set the standard for seamless UX, many banks still treat it as “just design.” This article reveals how you can get executive buy-in for UX to future-proof your digital strategy.

Fatal Delusions: Ten Assumptions Undermining Digital Banking

This article reveals ten dangerous myths that threaten traditional banks from within. Drawing lessons from the downfall of companies like Kodak and Nokia, it shows how internal misconceptions — not external competitors — can be the real cause of failure in the digital age.

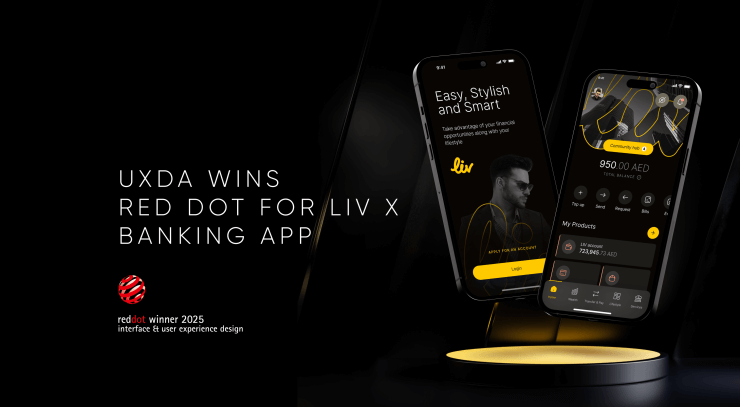

UXDA Receives Red Dot 2025 for Liv X Lifestyle Banking Experience

UXDA has won another Red Dot Award in "Interface & User Experience Design" for Liv X — the UAE’s first lifestyle-driven digital banking app, powered by Emirates NBD. This recognition reinforces UXDA’s role as a financial UX pioneer, redefining how banking apps enhance modern lifestyles.

Black Swan Events and the Fragility of Banking Models

Discover how digitalization blindsided traditional banks, transforming customer expectations overnight. This article explores why tech shifts like mobile and AI are “Black Swan” events—and what banks must do to stay relevant in a disrupted world.

Legacy Lipstick: The Limits of In-House Innovation in Digital Banking

Behind the polished surface of “digital transformation” lies a truth most banks avoid: relying on internal teams and legacy thinking often stalls real progress. This article reveals how pride, control, and risk aversion quietly sabotage innovation and leave banks trailing behind Fintechs.