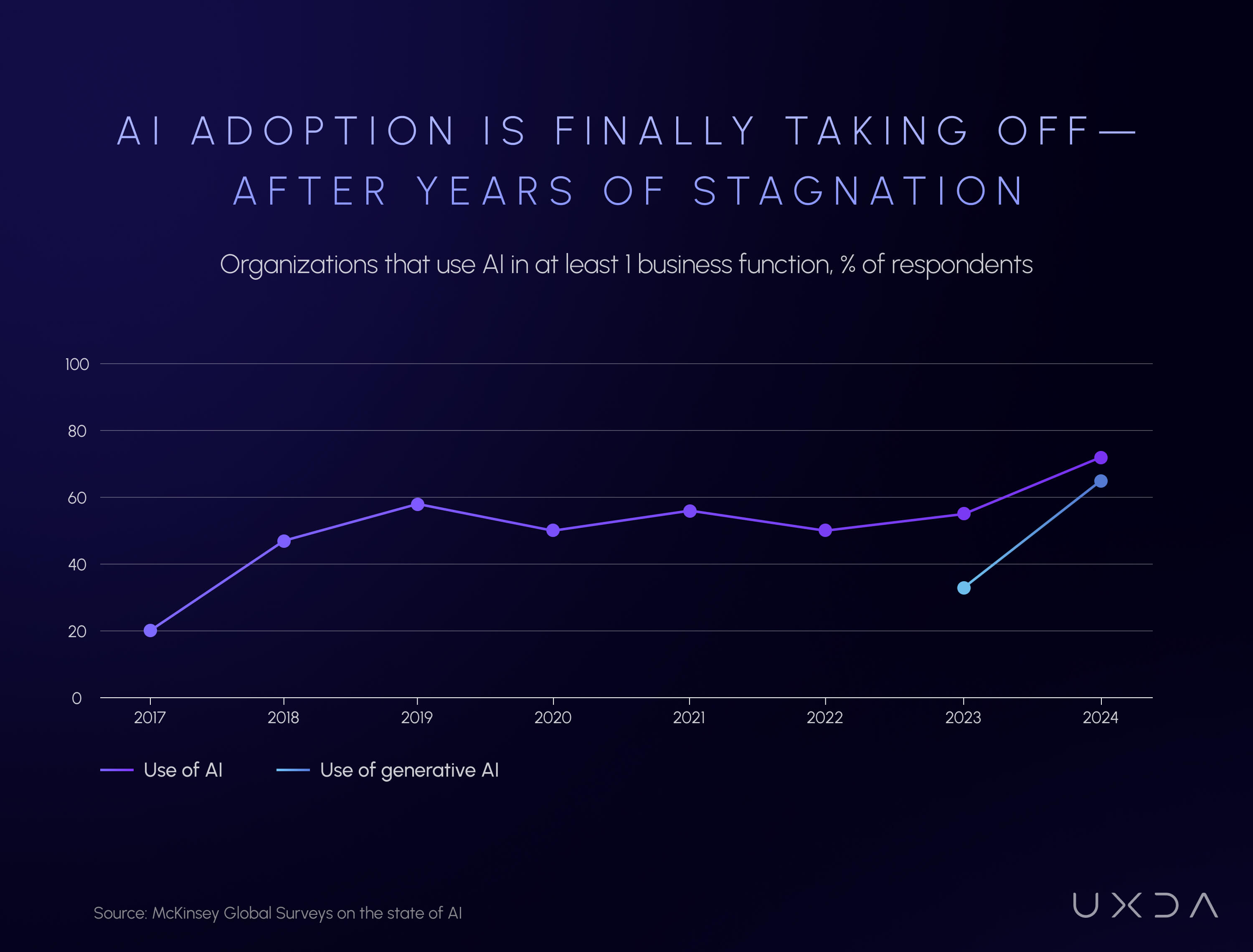

Until recently, most banks and financial organizations treated artificial intelligence in banking as tomorrow’s experiment. That changed in 2024—the year financial AI stopped being a side project and became the engine of digital banking. Super-charged by breakthroughs in generative models and an investment rush, financial institutions everywhere began weaving AI into customer and employee touchpoints. The shift was dramatic: global AI adoption rocketed to 78% of all organizations—up from just 20% in 2017—while an extraordinary 91% of bank boards formally approved Gen-AI programs, according to NTT and McKinsey. The payoff is already visible in richer digital experiences, sharper personalization and faster, safer service. In other words, while banking’s AI journey may be in its early chapters, chapter one has opened with a bang.

In banking, AI is no longer experimental—it became a cornerstone of strategy for improving how customers engage with their banks online and via mobile. Within this article, we analyze how financial AI adoption in recent years impacted key areas of digital CX, highlighting global trends as well as specific insights from major markets like the US and UK. We examine both quantitative gains— such as higher customer satisfaction scores, rising self-service usage and digital adoption rates—and qualitative developments, including more personalized services, smarter virtual assistants and greater accessibility in digital banking.

Overall, banks that deployed AI at scale reported significant improvements in digital channel usage and customer feedback. For example, Bank of America (US) announced its clients reached 26 billion digital interactions in 2024 (a 12% year-over-year increase), including 676 million interactions with its AI virtual assistant “Erica.” In the UK, NatWest’s AI assistant, “Cora,” handled 11.2 million customer conversations in 2024, roughly equal to all interactions handled by the bank’s call centers and branches.

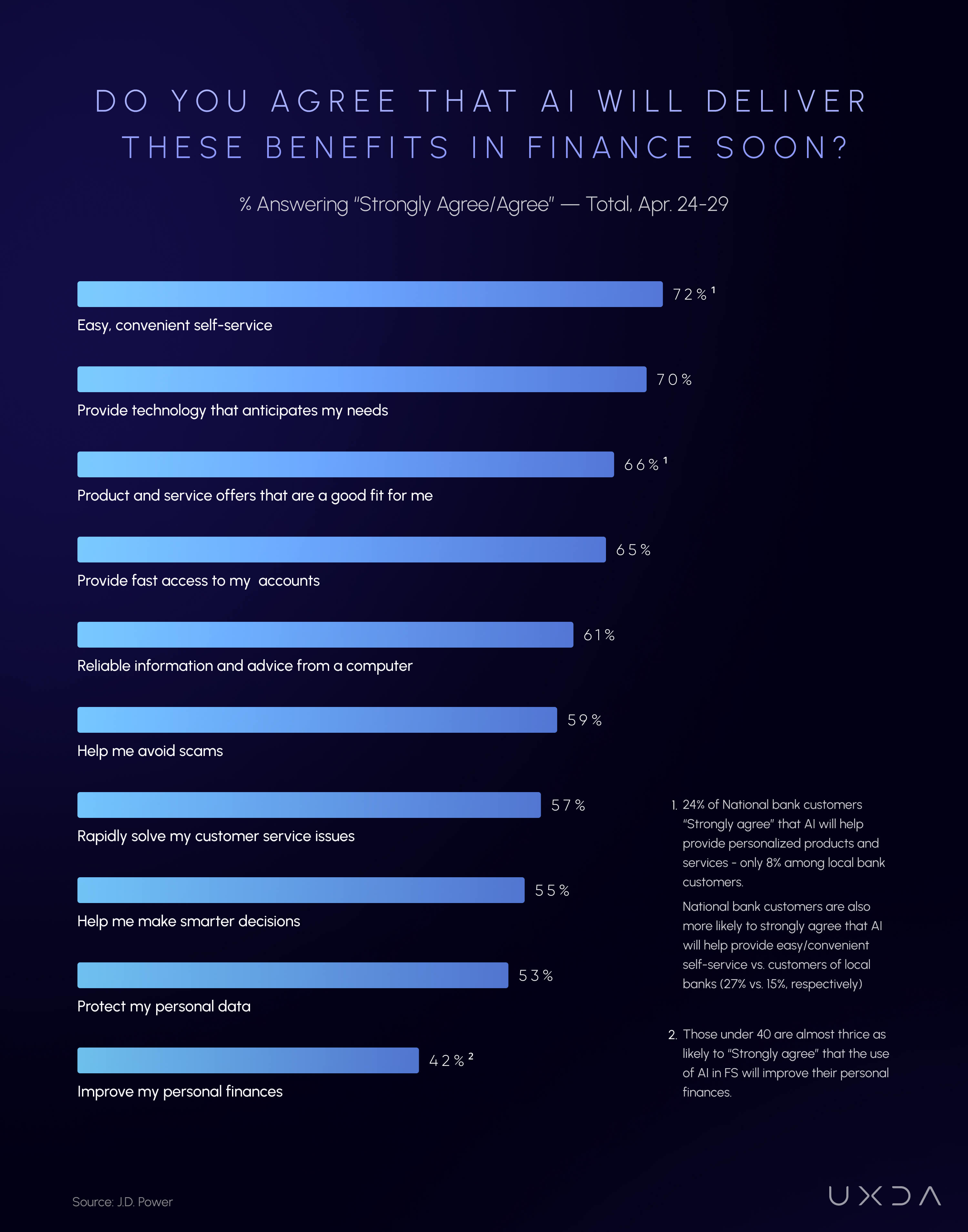

These examples illustrate the global trend: AI is enabling higher engagement on digital platforms and scaling up customer support without sacrificing quality. At the same time, a J.D. Power survey shows consumers are largely optimistic about AI’s benefits: 72% agree AI will deliver easy, convenient self-service but also highlight areas to improve, such as building trust and ensuring human-like empathy in AI interactions. In the sections below, we break down the impact by five key areas of customer experience: personalization, self-service, customer engagement, support automation and accessibility.

Source: J.D. Power

Source: J.D. Power

Market Impact: Banking Industry Leads in AI Adoption

A McKinsey survey indicates that AI adoption is now mainstream across industries. Overall, about 78% of organizations worldwide report using some form of AI in at least one business function in 2024, a huge increase from just 20% in 2017. Within this landscape, banking/financial services is a leading adopter of AI.

IDC estimates the banking industry will invest about $31.3 billion in financial AI, making it the second-largest industry for AI spending (after software/IT services at $33 billion and ahead of retail at approximately $25 billion). Together, software, banking and retail account for 38% of the global AI spend.

Source: McKinsey Global Surveys on the state of AI

Source: McKinsey Global Surveys on the state of AI

The years 2023–2024 saw an explosion of interest in generative AI (GenAI)—AI that can produce human-like text, code, images, etc. And banking has been at the forefront of deploying generative AI compared to other sectors.

Source: Insider Intelligence © August 2024 Digital Banking Report

Source: Insider Intelligence © August 2024 Digital Banking Report

GenAI Seduced Wall Street

Globally, generative AI usage by companies surged over the past year. 71% of organizations reported using generative AI regularly in at least one business function, according to a McKinsey Global AI Survey. This suggests that across all industries, a majority have begun experimenting with or deploying GenAI.

However, financial services firms are among the heaviest adopters. In a cross-industry survey by SAS, banking and insurance executives reported the highest current usage of generative AI—60% in each sector are already using GenAI in some capacity, the top rate among industries. Banking was singled out as leading all industries in GenAI integration, with the most use cases deployed per organization (on average).

Almost every bank is at least planning for GenAI. A global survey found that 98% of banking leaders either use generative AI now (60%) or plan to within two years (38%). This virtually unanimous interest is unique—other sectors showed lower current usage and more hesitancy. Banks also back up these plans with resources: 90% of banks surveyed have a dedicated GenAI budget for the coming year, indicating significant investment in AI talent and tools.

First-Mover Advantage: Banking’s AI Head-Start

Banking (often grouped with finance/insurance) figures prominently among the industries with the highest AI adoption. Research by IBM found that about 50% of enterprises in financial services have actively deployed AI, the highest of any sector. By comparison, the next-highest was telecommunications, at 37%, with other sectors generally lower.

Research from Boston Consulting Group likewise shows 35% of banking companies qualify as financial AI “leaders” (having scaled AI with high impact), a proportion surpassed only by fintech (49%) and software/IT firms (46%)

While detailed GenAI adoption rates for every industry vary by study, indicators show sectors like technology, finance and insurance are ahead of others like manufacturing or government in GenAI experimentation. For instance, a 2024 Statista study noted generative AI usage in financial services jumped to 52% of firms actively using it (up significantly from 2023).

Another survey of AI-savvy firms found that industries that underwent early digital disruption (e.g. finance, tech) have been quicker to adopt GenAI as well. A recent survey from SAS underscores that financial institutions lead in integrating AI into operations. The study found nearly 98% of banks (and insurers) either already use or plan to use generative AI in the near term—the highest among industries.

In contrast, sectors like healthcare and manufacturing show more cautious adoption. For example, based on a McKinsey survey in healthcare found that 85% of healthcare leaders reported their organizations were exploring or had already adopted generative AI capabilities, with 15% not yet having started to develop proofs of concept. This indicates significant interest in the sector.

Overall, banking’s head start in digital transformation has given it an edge in AI implementation, with analysts noting it is “leading other industries” in realized AI use cases. In contrast, heavily regulated or traditionally offline sectors are moving more cautiously. That said, even sectors such as healthcare and retail are rapidly exploring GenAI for their use cases (e.g. clinical decision support in healthcare, and AI-assisted marketing content in retail).

Proof in the Profits

Banks report concrete gains from GenAI deployments, more so than many peers in other industries. In banking, early adopters say GenAI is already improving employee productivity and customer experience.

For example, among banks that have implemented GenAI, 88% have seen improvements in risk management and compliance, and 85% report time/cost savings. These are significant positive outcomes.

Banks also use GenAI in diverse departments: marketing is the most common area (47% of banks use GenAI there), followed by IT (39%), sales (36%), finance (35%) and customer service (24%)—all higher rates than cross-industry averages.

Few other sectors have GenAI permeating so widely across functions. This broad applicability in banking (from automating fraud reviews to generating customer communications) underscores how financial firms are integrating GenAI into their core workflows more aggressively than most.

Beyond Fraud: Use Cases Expands

Banks initially applied AI in areas like fraud detection, risk management and credit analytics—core operations in which financial AI could immediately reduce losses and improve decisions. Indeed, 64% of finance leaders report using AI for fraud detection and risk management in their institutions.

These risk-oriented uses remain vital, but as AI capabilities have matured, banks are expanding into customer-facing and efficiency-driven applications. According to a 2024 banking technology report, chatbots/virtual assistants and personalized marketing are now seen as the AI use cases with the greatest future value in banking (cited by 87% and 83% of surveyed banks, respectively), alongside back-office automation (74%).

Traditional areas like fraud prevention (65%), credit underwriting (62%) and regulatory compliance (58%) are still heavily prioritized, reflecting that these were some of the first uses of artificial intelligence in banking and continue to be critical for reducing losses.

In summary, banks today leverage AI across a wide range of functions: from customer service chatbots to algorithmic trading, but they lead particularly in risk, fraud and personalization use cases.

Global Heat-Map: Where AI Burns Brightest

AI adoption—including generative AI—varies significantly by country and region. Generally, countries in Asia and the Middle East are reporting the highest rates of business AI adoption, often outpacing Western nations in early experimentation. Key statistics include:

Leading Countries (Enterprise AI)

According to IBM’s 2023 Global AI Index, India has the highest level of AI usage among enterprises. About 59% of organizations in India were actively using AI, closely followed by the United Arab Emirates (58%), Singapore (53%) and China (50%).

These countries have invested heavily in AI and show a strong cultural receptiveness to new tech. In contrast, many Western economies have a smaller share of companies actively deploying AI: e.g. Australia (~29%), Spain (~28%), and France (~26%) were among the lower rates.

The United States and UK fall in the middle range. Roughly one-third of businesses in the US are actively using AI (U.S. firms “fall between 30% and 40%” active use), and the UK is similar, with the majority exploring but not as many fully deployed yet.

Generative AI in the Workforce

When looking at individual usage of generative AI, emerging markets also lead. In a late 2023 Salesforce survey of general populations in major countries, India had the highest generative AI usage—73% of surveyed Indians said they use generative AI in some form.

Other countries had lower, though still substantial, usage: in Australia 49% of adults were using genAI, in the U.S. 45%, while the UK was at 29% usage. This illustrates a trend in which India and other middle-income countries have embraced genAI tools fastest, possibly due to leapfrogging behaviors and enthusiasm for new tech.

Developed countries like the US and UK have large numbers of users as well, but also a greater share of non-users or cautious adopters.

Policy and Adoption

It’s worth noting that national policy and data availability also influence genAI adoption. For example, Europe’s stricter regulatory environment (e.g., GDPR, upcoming AI Act) can slow down deployment of generative models in EU countries compared to the relatively laissez-faire approach in the U.S. and China.

Meanwhile, countries like UAE have national AI strategies and even government services powered by generative AI, thus boosting adoption. China saw a boom in domestic generative AI models in 2023, with many companies adopting local versions (due to restrictions on Western models), contributing to high usage rates within Chinese enterprises as well.

U.S. Banks Bet Big: GenAI Pioneers

In the United States, the banking sector has dramatically ramped up its focus on financial AI in the past year, especially generative AI. 2024 has been a pivotal year for AI in U.S. banking, with nearly all major banks announcing AI initiatives or investments. Key U.S.-specific insights include:

High Adoption Rates

Surveys of U.S. financial institutions show the vast majority are already using AI or plan to imminently. A PYMNTS report in 2024 found 72% of finance leaders at banks say their departments utilize AI technologies in some form. Even regional and mid-sized banks have started deploying AI for automation and analytics.

Critically, bank leadership is on board—according to an Ernst & Young survey, “nearly every bank’s board now stamps ‘yes’ on generative AI” initiatives. In fact, 91% of bank boards have endorsed GenAI projects as of late 2023. This top-down support indicates that U.S. banks view generative AI as strategically important.

Use Cases and Impact

U.S. banks are applying AI in a range of use cases. On the risk and operations side, common uses include fraud detection, anti-money-laundering pattern detection, credit risk scoring and trading optimization. About 64% of U.S. finance leaders cite fraud and risk management as areas in which they use AI.

Automation of routine processes (like loan processing or compliance checks) is also significant (over half report using AI for automation). An EMarketer report suggests that on the customer-facing side, many U.S. banks introduced AI virtual assistants/chatbots in recent years (e.g., Bank of America’s Erica chatbot).

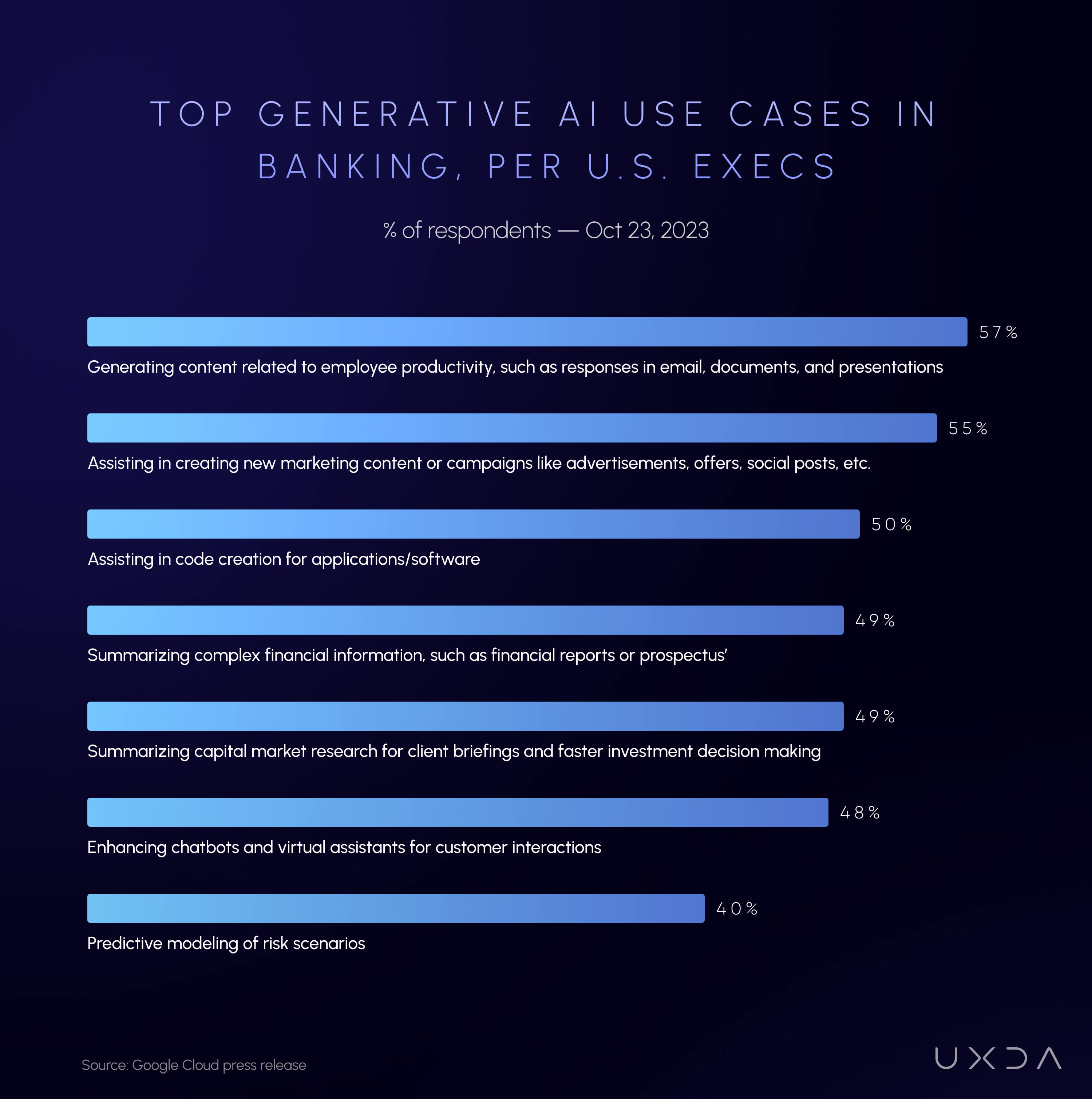

Source: Google Cloud press release / 2023

Source: Google Cloud press release / 2023

Generative AI now promises to make these bots more conversational and powerful. According to a late 2023 survey, 48% of U.S. bank executives plan to use generative AI to enhance customer-facing chatbots and virtual assistants, indicating a wave of next-gen AI chatbots in development. Banks are also exploring GenAI for personalized marketing (creating tailored financial advice content) and for software code generation to speed up development.

Investment Figures

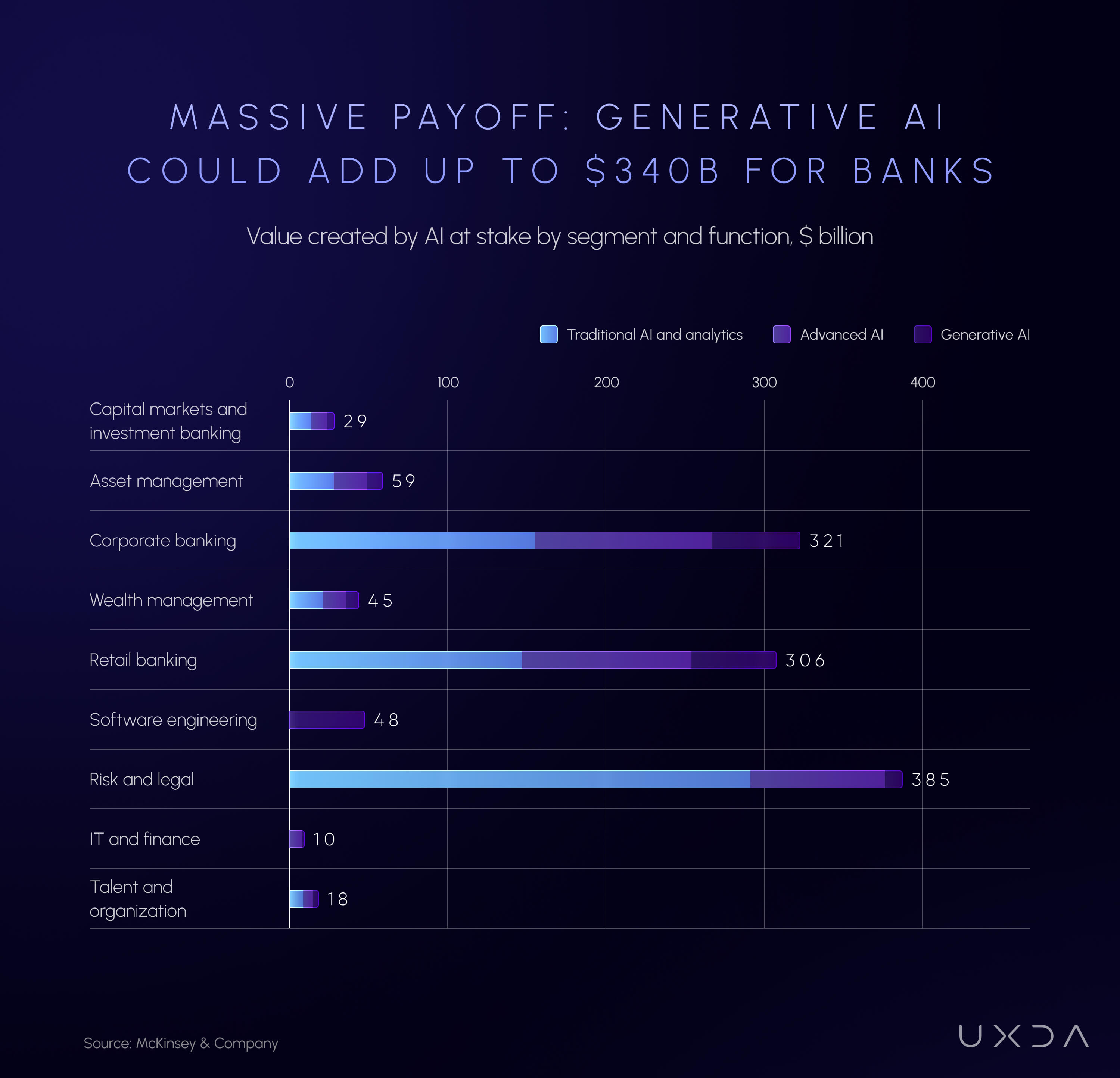

The U.S. banking sector is rapidly ramping up investments in generative AI, signaling a transformative shift in financial services. According to McKinsey, generative AI could unlock between $200 billion and $340 billion annually for the global banking industry, with a substantial portion of that value expected to be captured by U.S. institutions given their scale and technological leadership.

Leading the charge is JPMorgan Chase, which has allocated a record-breaking $18 billion to technology spending for 2025, a significant portion of which will support AI initiatives. A significant share of this budget supports its proprietary generative AI platform, already used by over 200,000 employees and powering more than 100 AI-driven tools across business units. These tools are driving operational efficiencies, including a 30% reduction in servicing costs and a 10% decrease in headcount in some functions.

Such an aggressive investment trend reflects a broader recognition that generative AI is no longer a future bet—it’s a current imperative. With such figures, U.S. banks are positioning themselves to lead the next wave of AI-enabled innovation in global finance.

Source: McKinsey & Company

Source: McKinsey & Company

Notable Developments 2024

In 2024, U.S. banks pioneered from exploration to implementation of generative AI. A few highlights:

- JPMorgan launched a ChatGPT-like internal tool (“IndexGPT”) to assist wealth advisors with research.

- Morgan Stanley rolled out a GPT-4 powered assistant for its financial advisors (to query internal research databases).

- Goldman Sachs used generative AI to automate parts of its coding and document analysis, reporting significant productivity boosts.

- Regional banks and credit unions also started leveraging AI-as-a-service from cloud providers (e.g., using Microsoft Azure OpenAI service to build custom chatbots for customer service).

These initiatives illustrate the breadth of adoption—from Wall Street giants to smaller banks, generative AI became a key theme in 2024.

Challenges

U.S. banks face challenges in AI adoption, such as regulatory compliance and risk management. Banks must ensure AI models (especially GenAI, which can be a “black box”) do not violate fair lending laws or produce biased decisions.

Data privacy is also a concern. Banks handle sensitive customer data that cannot be simply fed into public AI models without safeguards. In 2024, U.S. regulators (like the OCC and Federal Reserve) increased scrutiny on banks’ use of AI, urging robust governance. Nonetheless, banks are addressing these by developing AI governance frameworks and using techniques like model explainability and data anonymization.

According to PYMNTS, 55% of U.S. banking leaders are optimistic about AI and already recognizing benefits, but a portion remain cautious, emphasizing the need for clear ROI and risk controls.

In summary, the U.S. financial sector in 2024 embraced generative artificial intelligence in banking at high rates. Virtually every major bank has financial AI pilot programs, with common use cases around fraud detection, chatbot customer service and credit risk analysis. The momentum is driven by both competitive pressure and clear early wins (e.g., cost reductions and improved customer engagement).

London Calling: The UK’s Gen AI Sprint

The United Kingdom’s banking and financial services sector is similarly pressing ahead with AI, with strong adoption seen in 2024. Surveys by regulators and industry groups show that AI usage is now widespread among UK banks, and generative AI is a top strategic priority.

Prevalence of AI

A joint Bank of England and FCA survey in 2024 found 75% of UK financial services firms are already using AI, up sharply from 58% in 2022. In banking specifically, adoption is even higher: nearly 94% of international banking institutions in the UK reported employing AI technologies in some capacity. This aligns with EY’s European FS AI Survey, which reported that 91% of UK financial firms have integrated AI into their operations to some degree.

In other words, virtually all major UK banks have started on their AI journey (only a small minority have not started at all). However, most are still in early or pilot stages rather than full maturity—EY noted only 5% of UK firms consider themselves “ahead of the curve” on AI and truly at scale.

Acceleration in 2024

The 2024 year saw a big jump in AI investment by UK banks. Lloyds Bank’s 2024 survey of financial institutions found AI adoption/usage in the UK financial sector “doubled to 63% in one year,” implying the share of firms implementing AI went from ~30% to 60%+ within a year.

Banking executives in the UK widely view AI as essential to competitiveness. 32% of UK’s financial firms said they accelerated AI adoption in the last year alone, as they race to realize efficiency gains, according to EY. Additionally, 82% of UK’s financial leaders plan to increase their investments in generative AI going forward, a strong signal of intent to scale projects beyond the pilot phase.

Generative AI Focus

Generative AI became a buzzword in UK banking circles in 2023–24, much as in the U.S. The Bank of England’s survey specifically added questions on GenAI for the first time, reflecting its rapid emergence. While quantitative adoption figures for GenAI in UK banks are still being gathered, anecdotal evidence and qualitative data show high interest:

- UK banks are exploring GenAI for similar use cases as U.S. banks, e.g., enhancing customer chatbots, automating code and document generation and improving fraud detection with AI that can analyze unstructured data.

- An EY UK survey noted GenAI is considered a top priority by UK financial execs, yet many feel their organizations are not fully prepared (77% admitted their workforce lacks strong GenAI skills). Only 27% of UK firms have rolled out GenAI training programs so far, indicating that banks recognize a skills gap as they adopt these tools.

- Collaborative industry efforts have started in the UK to harness GenAI. For instance, UK Finance (the industry trade body) released reports in late 2024 on “Generative AI in action,” encouraging banks to responsibly adopt GenAI and sharing best practices. This suggests UK banks are coordinating on how to implement GenAI within regulatory guardrails.

Use Cases and Early Benefits

UK banks mirror global trends in AI use cases. According to a BoE/FCA survey, the most common AI use cases already in deployment at UK firms included optimization of internal processes (41% of firms), cybersecurity enhancement (37%) and fraud detection (33%). These are areas in which UK banks have historically invested in analytics and are now augmenting with AI.

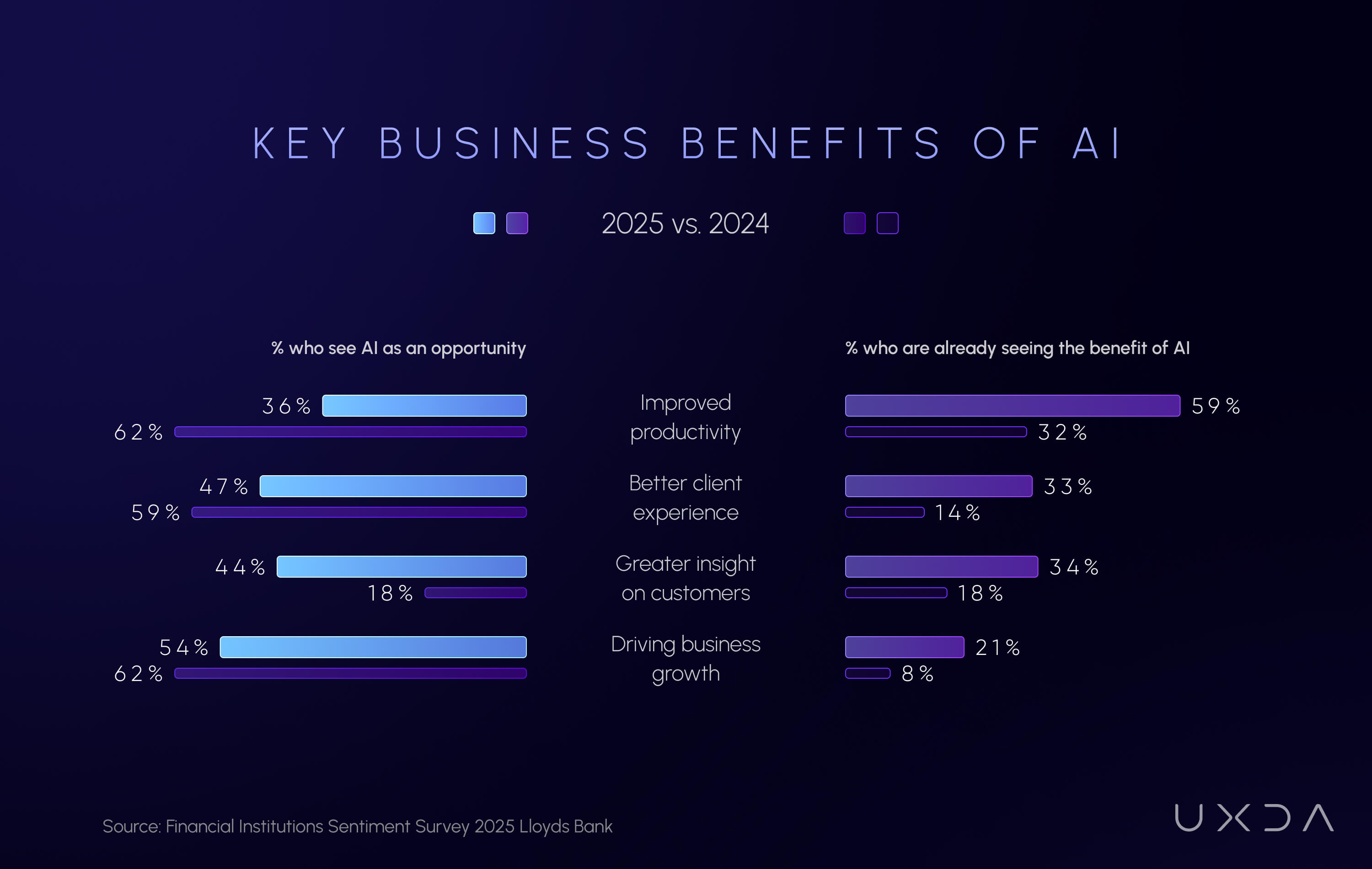

The expected benefits align with productivity and innovation. In a Lloyds survey, 32% of UK banks already noted productivity gains from AI, 22% cited a competitive edge, and 18% saw better insights for decision-making as a result of AI adoption. Furthermore, 69% of UK institutions expect even more benefits as they continue to innovate with AI.

Source: Financial Institutions Sentiment Survey 2025 Lloyds Bank

Source: Financial Institutions Sentiment Survey 2025 Lloyds Bank

Regulatory Environment

The UK’s regulators have been proactive in studying AI use in finance, which has helped clarify usage. The BoE/FCA reassures in their survey that regulators are monitoring AI’s impact and gathering data. While there are not yet AI-specific financial regulations in force, UK banks anticipate incoming rules. However, only 9% of UK bank executives felt their firm was well prepared for upcoming AI regulations. This has prompted industry calls for more guidance.

Meanwhile, data privacy and model transparency are top concerns in the UK (as they are elsewhere). A Statista poll in 2024 showed data security was the leading barrier to scaling GenAI in UK finance, cited by 33% of firms. UK banks are thus balancing innovation with caution, ensuring AI outputs are explainable and compliant. The upshot is that UK banks are moving fast on adoption, but with an eye on governance—an approach encouraged by regulators.

In summary, UK banks in 2024 have broadly embraced AI, with adoption rates comparable to the U.S. and global leaders. Nearly all major UK banks use AI for something, and many have ramped up investments in the past year, particularly in generative AI pilots. Fraud detection, compliance and customer service are prime areas of focus.

Executives in London’s financial hub view GenAI as a transformative opportunity to boost productivity: 82% plan to spend more on it, yet they are mindful of challenges like talent training and regulatory compliance. The UK banking sector’s next step is moving from experimentation to scaling these AI solutions enterprise-wide, a journey still moving forward in 2025.

Banking, Tailored: Personalized Banking Experiences

Financial AI turns one-size-fits-all into one-size-fits-one, driving double-digit revenue and CSAT jumps. Personalization emerged as a top priority for banks’ AI initiatives, driven by customer expectations for services tailored to their needs. According to a McKinsey study, 71% of consumers now expect personalized experiences from their banks, and 76% feel upset when personalization is lacking.

Source: McKinsey study / Next in Personalization Report

Source: McKinsey study / Next in Personalization Report

Banks responded by leveraging AI (including machine learning and predictive analytics) to analyze vast troves of customer data—from transaction histories to digital behavior—and deliver more individualized experiences.

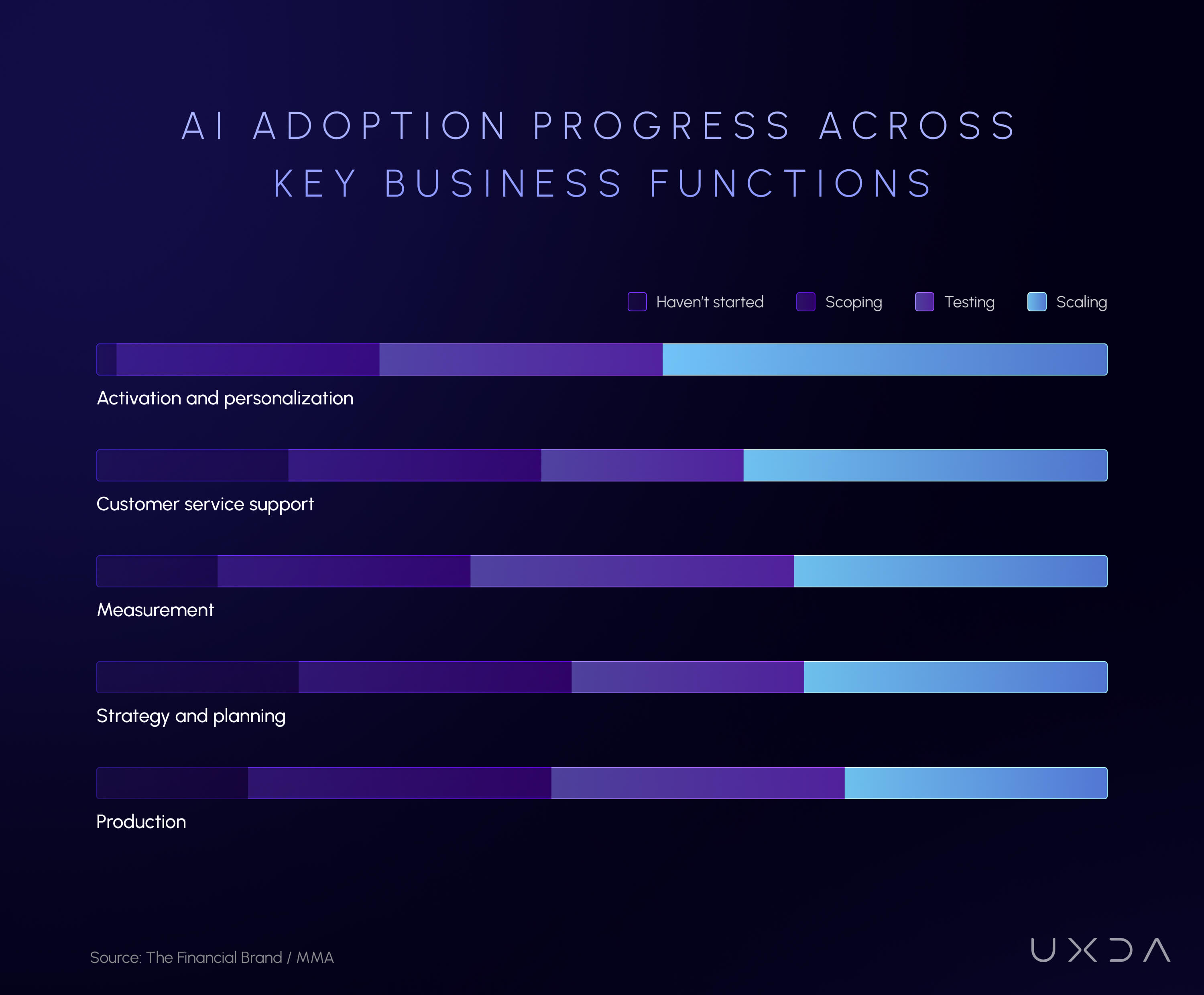

In fact, a global marketing survey found personalization is the predominant use case for AI in finance, with 44% of organizations scaling AI to tailor customer experiences, anticipate needs and boost loyalty. This shift toward hyper-personalization is yielding tangible results: one analysis reported that using AI-driven insights for customer experience led to “double-digit boosts in revenue, customer satisfaction and campaign conversions” for financial institutions. In other words, AI isn’t just a gimmick; it’s translating into happier customers and improved business outcomes.

Source: The Financial Brand / MMA

Source: The Financial Brand / MMA

Banks around the world rolled out AI-powered personalization features in 2024. Many mobile banking apps started offering AI-generated insights and advice customized to each user’s financial situation. For example, some banks use AI to automatically notify customers of unusual spending, predict upcoming bills or suggest budget adjustments—all tailored to the individual. In the US, Wells Fargo began leveraging predictive analytics and generative AI for dynamic content creation, aiming to deliver “hyper-personalized interactions that drive engagement and revenue.”

Regional banks also saw success: First Horizon Bank’s marketing team integrated AI to predict client needs and personalize messages, reporting “promising results” in deepening customer relationships. Meanwhile, in the UK, both incumbents and digital challengers invested in personalization. Digital-only banks like Starling Bank and Revolut (which reached 52.5 million customers in 2024) built their growth in part on personalized financial tools, prompting incumbents to follow suit.

The demand is high: a large majority of banking customers (in all age groups) want more personalized experiences, and almost half are willing to let banks use their data for this purpose. This pushed banks in 2024 to use AI not only for targeted product offers, but also to tailor content, notifications and even the user interface to each customer’s profile.

Beyond marketing, AI-driven personalization extended to financial advice and planning. Some banks piloted virtual financial advisors that analyze a customer’s goals and spending patterns to offer bespoke advice—for example, suggesting how to save for a house or which debt to pay down first. While these AI advisors gained some traction, trust remained a hurdle for sensitive advice: a survey found only 27% of consumers fully trust AI for financial guidance. To address this, banks paired AI insights with human validation or made AI recommendations fully transparent.

The overall trajectory is clear: personalization became a must-have aspect of digital banking, and AI provided the engine to deliver it at scale. Banks that executed well saw improvements in customer loyalty, whereas those with generic one-size-fits-all digital experiences risked falling behind.

As Capgemini’s global head of data for financial services noted, “AI and generative AI are rapidly transforming how we view personalized banking experiences… enabling analysis of vast data to generate tailored content, recommendations and interactions,” which is proving “transformational” for customer engagement.

DIY Banking Takes Over: Rise of Self-Service

AI adoption in 2024 also turbocharged self-service capabilities in banking. Customers increasingly prefer to handle their banking needs digitally, without having to visit a branch or call a helpline for routine tasks. Banks used AI to make these self-service options smarter, more intuitive and more comprehensive than ever. The result was a continued climb in digital banking usage across markets.

A Cornerstone Advisors study showed digital banking users reached 77% of checking account customers in 2024, reflecting that digital adoption is at near-saturation among many demographics.

Even in markets with traditionally high branch usage, the trend is similar. In the UK, for instance, 87% of adults use online banking, and 60% use mobile banking as of 2024, according to UK Finance, and 40% of Brits in 2025 have an account with a digital-only bank—a number that has risen sharply in recent years. This mass migration to digital channels has been facilitated and accelerated by AI-driven enhancements to self-service.

One of the clearest impacts of AI is the proliferation of virtual assistants and chat interfaces that empower customers to get things done on their own. From simple tasks, like checking a balance or paying a bill, to more complex actions like applying for a loan, AI has made self-service more convenient. A survey by Zendesk noted that self-service adoption in financial services has grown 5.4× in recent times, as banks provide more useful tools like searchable knowledge bases and intelligent chatbots.

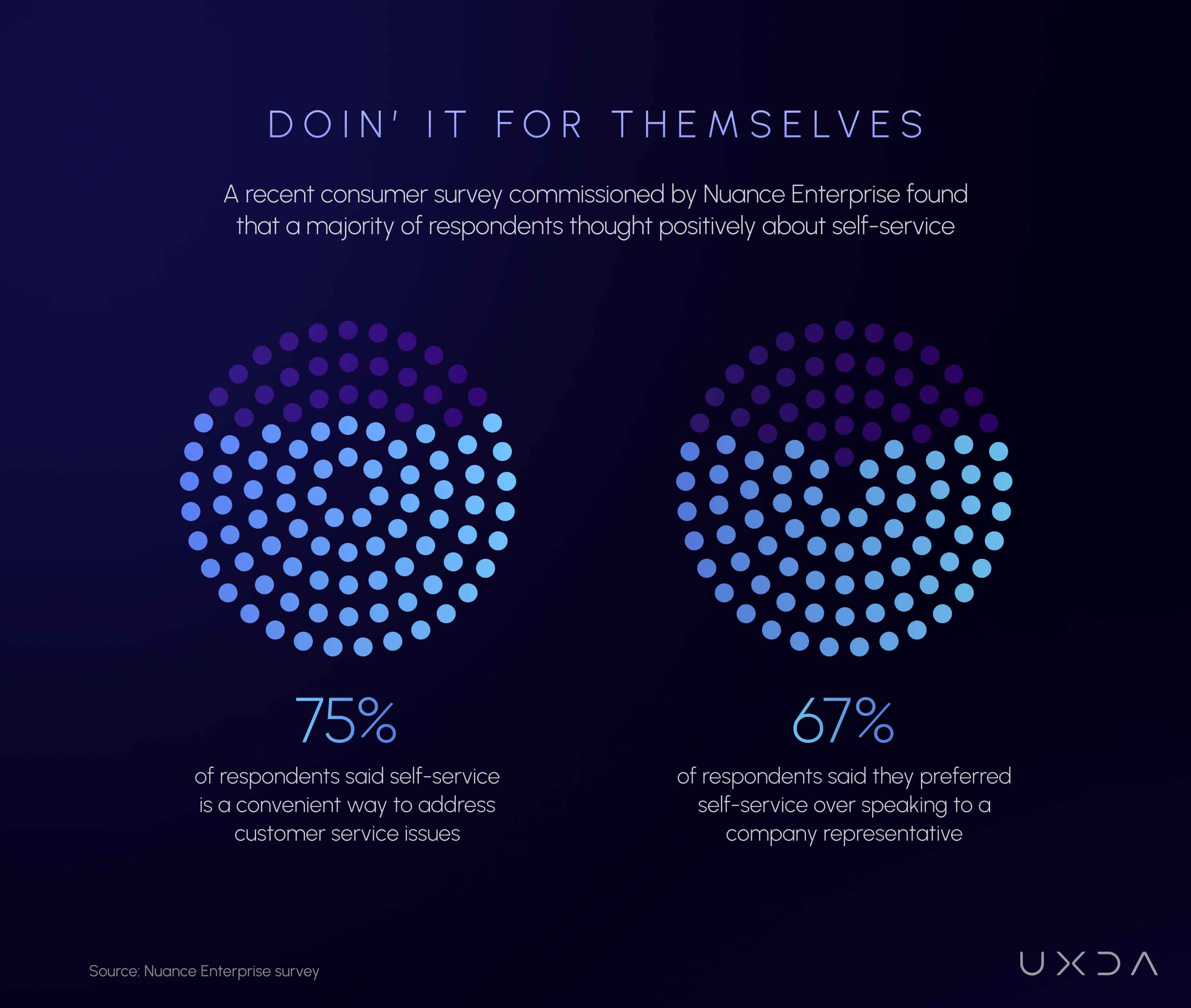

Customers appreciate these improvements: about 75% say self-service is a convenient way to address issues, and 67% actually prefer self-service over speaking to a human rep.

Source: Nuance Enterprise survey

Source: Nuance Enterprise survey

Especially for tech-savvy segments (millennials and Gen Z), digital banking is the default – 60% of millennials primarily use mobile banking apps as their main way to bank. In 2024, banks responded to this demand by expanding what customers can do without human intervention.

AI-powered chatbots and voice assistants played a dual role in boosting self-service. First, they act as 24/7 guides: an AI bot can understand a customer’s query in natural language and either provide the answer or walk the user through the steps to complete a task. Second, these bots leverage AI to handle multi-step requests that previously might have required an employee.

For example, Brazil’s Nubank (one of the largest digital banks) offers a self-service model in which customers can do “everything from paying a bill or raising their credit limit to setting travel notices” via the app. Over 80% of Nubank’s customers handle their needs through these digital self-service features without the need for additional support.

This kind of comprehensive self-service became a benchmark in 2024. In the US, Bank of America (BofA) expanded the capabilities of its virtual assistant, “Erica,” to allow in-app money transfers and more complex queries, further reducing the need to visit a branch or ATM. And at Wells Fargo, the new AI assistant, “Fargo,” was introduced to simplify everyday banking tasks in the mobile app, contributing to a staggering 245.4 million customer interactions via the assistant in its first year.

The convenience of AI-driven self-service translated into higher digital engagement and cost savings. Automated self-service options deflect routine inquiries that would otherwise flood call centers, freeing human staff to focus on high-value or complex cases.

Industry analysis estimated that bank chatbots will save around $7.3 billion globally in customer service costs, roughly $0.70 per interaction handled by AI instead of a human. Moreover, customers who get quick, effective answers on their own tend to be more satisfied. A survey by Zendesk in 2024 found 77% of consumers say AI is helpful for simple issues, indicating that when AI works, it meets customer expectations. However, it’s worth noting that AI self-service is not yet perfect.

The J.D. Power 2024 banking satisfaction study found that while overall satisfaction with big banks rose, the one area that saw a dip was when customers tried to contact the bank through self-service digital channels for help. This suggests that some banks’ self-service tools in 2024 still left a gap when customers had more detailed questions or problems. Banks are learning from this, enhancing their knowledge bases and making AI bots more context-aware so they can handle nuanced inquiries.

In summary, 2024 cemented self-service as an essential component of banking CX—largely enabled by AI—with customers embracing the flexibility to “do it yourself” and banks enjoying higher digital adoption rates as a result.

Next-Gen CX in Banking: Proactive Customer Engagement

Beyond enabling transactions, AI has transformed how banks engage and build relationships with customers through digital channels. In 2024, banks used AI to become more proactive, conversational and timely in customer interactions, rather than just reactive. This led to higher customer engagement, measured by increased logins, more frequent interactions and deeper usage of digital services.

A striking example comes from Bank of America, which reported that its clients logged into digital banking 14.3 billion times in 2024, and nearly 38 million customers subscribed to proactive digital alerts (up 7% from the prior year). Those alerts, powered by AI analysis of account activity, delivered nearly 12 billion personalized notifications in 2024, giving customers real-time insights into things like low balances or unusual charges.

This kind of AI-driven engagement keeps customers continuously connected with their finances and with the bank’s app. As a result, BofA saw users logging in on average more than once per day, and digital interactions overall jumped by double digits year-over-year.

A Forrester analyst noted that BofA’s mobile app “at least meets and often exceeds customers’ expectations” in most categories, thanks in part to useful features like these AI-powered alerts. The lesson echoed globally: when digital banking is helpful and personalized, customers engage with it frequently, creating a virtuous cycle of value for both the user and the bank.

AI also enabled conversational engagement through chat and messaging interfaces. In 2024, many banks rolled out or upgraded chat services (e.g., in-app chat, WhatsApp banking, etc.) in which AI would be the first to respond. This effectively turned customer service into a continuous, two-way dialogue.

For instance, NatWest (UK) saw its chatbot, Cora, manage millions of conversations that not only answered questions but also guided customers to relevant services. With the launch of Cora+ (a generative AI-enhanced version), NatWest’s assistant became even more engaging—able to converse more naturally about products and financial guidance, almost like a human agent. Early pilots suggest that these AI chats can handle complex queries with a more conversational tone, making customers feel heard and supported.

Similarly, banks in the US like Capital One expanded their AI chat capabilities. For example, Capital One’s Eno can proactively warn customers about suspected fraud or duplicate charges, engaging them in real-time via text message.

By analyzing customer data and context, AI allows banks to initiate contact at the right moment: sending a helpful tip, a security alert or a personalized offer exactly when it’s relevant. 70% of consumers value a consistent experience across channels, and AI helps achieve this by maintaining context across mobile apps, web and chat. A customer might start a task in a chatbot and finish in the app, or vice versa, with AI ensuring a seamless handoff. This omnichannel fluidity was a key engagement theme in 2024.

Major markets demonstrated the impact of AI on engagement through concrete metrics. In the U.S., banks that invested heavily in AI-driven CX saw higher Net Promoter Scores (NPS) and loyalty drivers. While overall NPS can depend on many factors, leading banks like Chase and Capital One (both noted for their advanced digital experiences) continued to rank at the top of customer satisfaction surveys. In the U.K., digital challengers dominated customer advocacy: Forrester’s 2024 survey of European banks found that app-centric banks, such as Starling Bank, earned the highest NPS in the UK market (beating even other fintechs by a few points).

From a qualitative standpoint, AI-powered engagement in 2024 meant banks could anticipate customer needs instead of waiting for customers to reach out. Predictive models identified which customers might be shopping for a home, need a savings boost or be at risk of overdraft—and then proactively offered assistance or deals. This not only drives sales; it also improves the customer’s financial health, thus building goodwill.

One survey noted that 62% of consumers would immediately try AI-driven personalized alerts to help avoid fees, showing that engagement efforts that clearly benefit the customer are warmly welcomed.

In summary, AI made digital banking more engaging in 2024 by turning it into an ongoing conversation—through alerts, chats and personalized content—rather than a static utility. Banks in the U.S. and UK that mastered this saw stronger customer loyalty and higher usage of their digital platforms, while globally the norm shifted toward AI-enabled “smart” engagement as a key to CX success.

AI Takes Care: Support at the Speed of Thought

Perhaps the most visible impact of artificial intelligence in banking has been in customer support automation. In 2024, nearly every major bank either launched or upgraded an AI-driven virtual assistant to handle customer inquiries, marking a significant shift in how service is delivered. These AI assistants (e.g., text-based chatbots and increasingly voice bots) became front-line support, capable of resolving many issues that used to require a phone call or branch visit.

The volume of inquiries handled by AI is staggering: by late 2024, it’s estimated that more than 987 million people worldwide use AI chatbots for various services, and banking is a leading sector in this trend. Banks like Bank of America reported that since launching the “Erica” chatbot a few years ago, it had facilitated over 2.5 billion interactions in total, with hundreds of millions in 2024 alone.

In the UK, NatWest’s Cora not only answered routine questions but also helped perform transactions, effectively handling workload equivalent to thousands of support agents. Cora handled 11.2 million retail banking conversations in 2024, matching the scale of their human-assisted contacts.

These examples underscore how AI automation scaled customer support to new levels, improving response times and availability. Customers can get help 24/7, in seconds, which is reflected in high satisfaction with these tools: a Capgemini study found 89% of customers were satisfied with generative AI virtual assistants, and 73% trust content written by AI, indicating growing confidence in automated support.

NatWest’s Cora+ was trained with safeguards (in partnership with IBM) to avoid the pitfalls of open AI models (like inaccurate “hallucinations” or bias), emphasizing trust and reliability in its answers. In the U.S., banks were more cautious but still active in exploring generative AI for support.

JPMorgan Chase, for example, invested in developing AI models (sometimes dubbed “IndexGPT”) for both customer service and investment advice, while Wells Fargo’s Fargo assistant used Google’s Dialogflow AI for robust understanding of customer requests. Even regional banks and credit unions began deploying AI chatbots through cloud providers or fintech partners, recognizing that automated support is becoming an expected part of digital banking.

The quantitative benefits of support automation are significant. AI assistants resolve a large portion of common inquiries—balance requests, card activation, password resets, loan rate questions, etc.—in a self-service manner. This has led to shorter wait times and faster issue resolution for customers. For example, one report highlighted that customer service teams using AI can scale productivity without adding headcount, deflecting repetitive inquiries and freeing human agents for more complex issues. This improved first-contact resolution rates and reduced call center volumes.

A Gartner study noted that 61% of banking executives planned to increase AI investments specifically to enhance areas like customer service in the coming year. In 2024’s AI strategy, leading banks integrated a seamless escalation to human agents when needed, often with AI assisting in the background by summarizing the issue for the agent. This human-in-the-loop approach ensured that while AI handles the heavy load, the human touch remains essential for sensitive matters.

Both the U.S. and UK saw case studies of improved support due to AI. BofA’s Erica not only answered questions but could perform actions (like bill pay or Zelle transfers via voice commands), and the bank attributed part of its high digital engagement to Erica’s success.

20 million BofA clients used Erica in 2024, and feedback has been positive enough that Erica’s capabilities keep expanding. In the UK, Lloyds Bank and HSBC also enhanced their AI chat assistants in 2024, with HSBC launching an AI-powered customer support chat on its mobile app to complement phone service (especially valuable as branch networks contract).

As a broader trend, a PYMNTS report noted only 12% of banks provided AI-powered customer service as of early 2024, but about half plan to implement it in the next months—signaling that support automation was a major focus industry-wide. Consumers increasingly embraced these AI helpers when well-implemented: one survey found 72% of retail banking customers actually prefer an “intelligent virtual assistant” over a standard chatbot, likely because the former provides a more accurate and conversational experience.

Further AI-driven support in banking will evolve from simple chatbots to more advanced virtual agents. This evolution will improve the speed, availability and consistency of customer service, thereby lifting overall customer satisfaction despite initial skepticism.

Inclusive by Design: Enhancing Accessibility

An often underappreciated aspect of artificial intelligence in banking is how it can improve accessibility and inclusivity of digital services. In 2024, banks began applying AI to ensure that digital banking works better for all customers, including those with disabilities or special needs.

Traditionally, accessibility in finance focused on accommodating visual or hearing impairments (e.g., screen reader compatibility or text-to-speech for phone banking). But 2024 brought a broader vision: banks started to tailor digital experiences for people with cognitive differences, mental health challenges, language barriers and more—areas in which AI’s adaptability is key. Accessibility and inclusivity are finally receiving greater attention across the banking sector, with advances in AI helping to drive this progress.

For instance, AI can detect when a customer is having difficulty navigating an app (through behavior patterns) and proactively offer simplified explanations or switch to a voice-assisted mode. AI-driven personalization also means interfaces can adjust to a user’s needs in real time.

Financial products should be designed for users with anxiety, depression or other mental health conditions in mind, not just physical disabilities, and AI can stitch together behavioral data across touchpoints to help banks understand and support each customer holistically. This represents a more compassionate use of AI: using data to identify when a customer might be financially stressed or confused and responding with empathy through the digital channel.

In practical terms, 2024 saw banks introduce features like AI-powered voice assistants for those who prefer speaking to navigating a screen. These go beyond basic IVR systems; they use natural language processing to carry out banking tasks via voice (useful for visually impaired customers or the elderly who find apps challenging).

Some banking apps added real-time transcription and translation services (AI translating speech or text on the fly), making services accessible to non-native speakers or customers with hearing impairments. For example, a customer could speak in one language and have the chatbot respond in another, bridging communication gaps.

Another development was AI-driven image recognition for bill payment or check depositing, simplifying processes for those who struggle with manual input, just snapping a photo and letting AI do the work. These kinds of features improved the overall usability of digital banking for a wider audience.

In the U.S., where regulatory focus on accessibility is growing, large banks worked to ensure their websites and apps meet ADA standards and WCAG guidelines, often using AI tools to test and fix accessibility issues (like adjusting color contrast or adding AI-generated descriptions for images). In the UK, banks collaborated with fintechs specializing in inclusive design—for instance, leveraging AI fintech solutions that help dyslexic users by changing fonts or reading out text.

The benefits of AI-driven accessibility enhancements are both social and commercial. They empower more customers to confidently use digital banking, which in turn increases digital adoption among groups that might have been left behind. A more accessible app can turn reluctant users into active digital customers, raising adoption rates. It also strengthens trust and loyalty: customers feel the bank cares about their individual needs. While quantitative metrics here are harder to measure, one can look at engagement from traditionally underserved segments.

Banks reported, for example, increased usage of mobile apps among senior customers after adding voice-command features and larger, adaptive text, indicating that AI features can bring in demographics that previously stuck to branches. Moreover, designing for extreme use cases often improves the experience for everyone (the curb-cut effect).

A Forrester study on CX drivers noted that feeling “valued” is a key loyalty driver, and providing accessible, inclusive digital services is a concrete way to show every customer they are valued.

In summary, 2024’s AI push in banking was not only about efficiency and personalization, but also about humanizing digital experiences and leaving no customer behind. From adjusting to a user’s pace (as simple as noticing if someone is scrolling slowly and might need extra help) to providing emotionally intelligent responses via chat, AI made digital banking more accommodating.

Both the U.S. and UK saw forward movement: U.S. banks like Citi invested in AI-driven document readers for visually impaired users, while UK banks such as Lloyds emphasized mental health–friendly banking apps with calming designs guided by AI feedback. These efforts, while still emerging, set the stage for a more inclusive digital banking landscape.

AI Best Practices in Banking and Fintech: 21 Real-World Case Studies

We collected 21 real-world case studies showcasing how leading banks and fintech companies implemented AI in 2024 and 2025. Each example highlights a recent banking AI application project that significantly enhanced the user, customer or employee experience, outlining the company involved, the AI solution applied, its use case, the resulting impact or benefits, the year of implementation and a source for further exploration.

In these case studies, you will see that across the global banking industry, AI has shifted from pilot to profit generator: intelligent tools now accelerate back-office work, raising employee productivity and shrinking response times, while smarter analytics empower advisors to deliver faster, better-informed guidance. On the customer side, AI assistants can handle 20 million chats around the clock—driving record engagement and a 150 percent jump in satisfaction scores even as call-center volumes fall by half.

Fraud-fighting models double detection rates, block over $350 million in attempted theft for the case and slice scam losses by up to 50 percent, with one bank saving 17 percent more funds for clients and processing 250,000 security queries each month. Instantaneous self-service resolves most issues in under two minutes, trims wait times by 40 percent and cuts repetitive contact by 55 percent, while algorithmic credit engines approve 44 percent more borrowers at 36 percent lower rates—proof that AI can widen access as well as convenience.

Each of these cases exemplifies how banks and fintechs are leveraging various AI technologies—from large language models and voice recognition to machine learning analytics—to improve user experience, personalize services, fight fraud and streamline operations. The past year has seen rapid adoption of generative AI (like chatbots and assistants), as well as continued gains from predictive models in fraud detection and credit. These real implementations in 2024–2025 demonstrate tangible benefits, such as faster customer service, increased financial security, more inclusive products and higher customer satisfaction across the banking industry.

In short, from faster payments (60 percent quicker) to safer transactions and $40 million profit bumps from automated support, AI is quietly rewriting banking’s cost, risk and customer-experience equations in real time.

1. JPMorgan Chase (2024)

AI Application: Employee productivity and research

Experience Impacted: EX - Banking Employee Experience

Internal ChatGPT-Like Research Assistant: The largest U.S. bank rolled out a generative AI assistant called “LLM Suite” to ~50,000 employees in its asset and wealth management division. This AI tool helps bankers with writing research reports, generating investment ideas and summarizing documents, essentially doing work akin to a research analyst.

Impact: It boosts employee productivity and idea generation, which can translate to faster, better service for clients.

2. Morgan Stanley (2023–2024)

AI Application: Financial advisors support and research retrieval

Experience Impacted: CX - Banking Customer Experience

Advisor Knowledge Chatbot: Morgan Stanley partnered with OpenAI to deploy a GPT-4 powered chatbot for its financial advisors. This assistant (launched in late 2023) gives advisors instant access to the firm’s vast research and intellectual capital. The assistant was adopted by 98% of Financial Advisor teams.

Impact: Advisors get quick, precise answers from firm knowledge, enabling more informed and timely advice to clients. This generative AI tool has improved the quality and speed of client consultations.

3. Goldman Sachs (2024–2025)

AI Application: Internal workflow automation

Experience Impacted: EX - Banking Employee Experience

“GS AI Assistant” for Employees: The investment bank introduced an AI assistant to 10,000 employees with plans to expand to all staff. This generative AI tool can summarize and proofread emails, draft code and answer internal queries, operating within Goldman’s secure environment.

Impact: It has streamlined daily workflows,, e.g., reducing time spent on email and coding tasks, and is expected to improve employee productivity and response times. Goldman views it as augmenting staff efficiency rather than replacing humans.

4. Bank of America (2024)

AI Application: Customer self-service assistant

Experience Impacted: UX - Banking User Experience

“Erica” Virtual Assistant: BofA’s AI-driven virtual financial assistant, Erica (launched in 2018) reached new milestones by 2024. Erica surpassed 2 billion client interactions in total, doubling from 1 billion just 18 months prior. Integrated in BofA’s mobile app and online banking, Erica uses advanced NLP and predictive analytics (though not yet generative AI) to help 42+ million customers with tasks like bill payments, balance queries, budgeting tips and even telling jokes.

Impact: Clients now engage with Erica about 2 million times per day, getting instant self-service help. This has improved customer satisfaction and digital adoption, acting as a “personal concierge” that saves time and provides personalized insights (e.g., spending alerts, subscription monitoring).

5. Wells Fargo (2023–2024)

AI Application: Customer virtual assistant

Experience Impacted: UX - Banking User Experience

“Fargo” AI-Powered Assistant: In 2023, Wells Fargo launched “Fargo,” a virtual assistant in its mobile app powered by Google’s Dialogflow and PaLM 2 LLM. By late 2023, Fargo had handled 20 million interactions since launch and was on track for 100 million/year as capabilities expanded. Fargo can answer everyday banking questions via voice/text and execute tasks like transferring funds, paying bills, providing transaction details and more.

Impact: Customers have a “sticky” engagement (averaging 2.7 interactions per session) with Fargo for quick self-service. It runs 24/7, improving service availability, and new features (e.g., showing paycheck history and credit score changes) are being added through 2024 to enrich the personalized banking experience. Wells Fargo reports this generative AI assistant is speeding up customer service while also informing future AI deployments internally (Source: VentureBeat).

6. Citibank – Hong Kong (2024)

AI Application: Personal finance management

Experience Impacted: CX - Banking Customer Experience

“Wealth 360” AI Personal Finance Manager: Citi’s Hong Kong division launched Wealth 360 in its mobile app in 2024, a digital wealth management and personal finance feature powered by AI and open banking. Developed with fintech partner Planto, it uses AI-driven data enrichment to provide customers with personalized insights, e.g., cash flow analysis, spending reports, budgeting tips and even carbon footprint tracking of purchases. The app aggregates data from multiple banks (via Hong Kong’s open banking initiative) and uses AI to deliver over 20 tailored insights and recommendations per user.

Impact: Wealth 360 offers a next-gen personal finance experience: customers get a holistic view of finances across accounts and receive proactive advice (including sustainability insights) to improve their financial health and decisions. This enhances CX by turning raw data into actionable, personalized guidance.

7. Royal Bank of Canada (2024)

AI Application: Automated savings and financial guidance

Experience Impacted: CX - Banking Customer Experience, UX - Banking User Experience

NOMI Insights and Forecast: RBC has leveraged AI within its app through NOMI, a suite of smart money management tools. In 2024, RBC integrated NOMI Insights with its InvestEase platform to help clients save and invest more effectively. NOMI uses machine learning to analyze account activity and send timely, personalized notifications—for example, spotting when a customer has “spare cash” and suggesting moving it to savings or investments. Other AI-driven features include NOMI Budgets (auto-categorizations and budget tracking) and NOMI Forecast (7-day cash flow predictions).

Impact: These AI features act as a “virtual financial coach,” nudging users toward better habits. RBC reports that NOMI’s personalized alerts have helped customers stick to plans, contributing to improved savings rates and financial confidence.

8. HSBC (2024)

AI Application: Fraud detection, customer service, personalization

Experience Impacted: CX - Banking Customer Experience

AI-Powered Services and GenAI Sandbox: HSBC has been investing in AI at scale. Hundreds of AI use cases are in production across the bank’s global operations. These include fraud detection and transaction monitoring systems, customer service chatbots and risk management models deployed over the past decade. For example, HSBC’s AI can flag suspicious transactions and assist compliance teams in real time. In 2024, HSBC was selected for the Hong Kong Monetary Authority’s Generative AI Sandbox, where it is developing new GenAI solutions. Planned use cases include GenAI chatbots for customer inquiries, AI that delivers tailored market insights to sales staff and AI to automate parts of fraud investigations.

Impact: HSBC’s broad AI adoption has already enhanced security and efficiency (the bank publicly shared that AI helps in areas from fraud prevention to better customer service). The 2024 GenAI initiatives aim to further improve CX by providing more personalized, instant support to customers and faster incident resolution, all while ensuring ethical and responsible AI use.

9. DBS Bank (2024)

AI Application: Fraud prevention, customer service automation, personalization

Experience Impacted: CX - Banking Customer Experience

Enterprise-Wide AI (Fraud, Personalization & Service): Southeast Asia’s largest bank, DBS, has “industrialized” AI across its business. By late 2024, DBS had moved from 240 experimental projects to 20+ deployed AI use cases. One headline result: using AI in risk management led to a 17% increase in funds saved from scam/fraud attempts for customers. DBS built 100+ algorithms analyzing up to 15,000 data points per customer to offer hyper-personalized financial advice (for example, using behavioral and location data to tailor offers for parents or shoppers).

It also rolled out a GenAI-powered “CSO Assistant” to 500 customer service officers in Singapore, HK, Taiwan and India. This internal assistant transcribes and summarizes customer calls and suggests solutions, helping staff handle over 250,000 queries a month more efficiently.

Impact: AI has boosted both operational efficiency and customer engagement at DBS. Customers benefit from reduced fraud losses, more relevant product recommendations and faster service (the CSO Assistant speeds up call resolution). Internally, DBS’s employees are empowered by AI tools (including an internal “DBS GPT” chatbot) to serve customers in a more personalized and productive way.

10. Mastercard (2024)

AI Application: Fraud prevention and transaction security

Experience Impacted: CX - Banking Customer Experience

Generative AI for Fraud Detection: Mastercard deployed a new generative AI plus graph analytics system to combat payment card fraud. In mid-2024, the company announced that this AI approach doubled the detection rate for compromised cards before fraud occurs. By analyzing network patterns and using GenAI to identify subtle signals of card-testing or enumeration attacks, Mastercard’s AI flags at-risk card credentials much earlier.

Impact: This proactive detection prevents fraud before customers even realize an issue. It also means fewer false declines during purchases. Merchants see reduced fraud losses and legitimate transactions aren’t erroneously blocked, thereby improving the checkout experience.

11. Visa (2024)

AI Application: Fraud detection and transaction scoring

Experience Impacted: CX - Banking Customer Experience

AI Scam Disruption and Payment Security: Visa has scaled up its AI-driven security systems to protect the payments’ ecosystem. By late 2024, Visa’s AI and machine learning tools enabled it to block 85% more fraudulent transactions on Cyber Monday compared to the year prior, even as attempted fraud spiked by 200% (fraudsters are using AI, too). One notable 2024 rollout was Visa’s Account Attack Intelligence (VAAI) Score, which uses generative AI to detect and score the likelihood of card enumeration attacks in real time. This helps banks stop bot-driven card testing (in which fraudsters rapidly guess card details) before fraud occurs.

Impact: Thanks to AI, Visa reports it prevented over $350 million in fraud attempts in 2024. Cardholders benefit through safer transactions and fewer disruptions. – for example, more genuine purchases are approved, and there are fewer instances of cancelling cards due to fraud. Visa’s AI defenses ultimately make digital payments more secure and seamless for millions of users.

12. NatWest (2024–2025)

AI Application: Customer service chatbot

Experience Impacted: CX - Banking Customer Experience

“Cora” Chatbot Enhancement with OpenAI: UK’s banking group, NatWest, put AI at the core of its customer experience strategy. In 2024, it began collaborating with OpenAI to supercharge “Cora,” its customer-facing virtual assistant, and an internal assistant “Ask Archie.” The goal is to use GenAI to handle more complex inquiries and even streamline fraud reporting. Early results are impressive: NatWest says adding generative AI to Cora boosted customer satisfaction scores by 150% and significantly reduced how often a human agent needed to intervene. For example, more customers are able to resolve issues via Cora alone.

Impact: Customers get faster, smarter self-service for support (Cora is available 24/7 and now more accurate and helpful), freeing up bank staff for harder cases. NatWest is also exploring using AI to let customers report suspected fraud via the chatbot (instead of phone), which would secure accounts faster and cut call wait times. This pioneering use of OpenAI tech in UK banking is expected to save customers time and enhance digital banking safety.

13. Revolut (2024)

AI Application: Fraud detection (APP scams)

Experience Impacted: CX - Banking Customer Experience

AI Scam Detection for Payments: The global fintech Revolut (with 52+ million customers) launched an advanced AI-powered scam-prevention feature in its app in February 2024. This machine learning system monitors outgoing transfers and card payments in real time, and if it detects patterns indicative of an Authorized Push Payment scam (e.g., a customer being tricked into sending money), it will intervene and even decline the payment. The app then prompts the user with an “intervention flow,” asking extra questions and showing educational warnings to “break the spell” of scammers. It can also escalate to a human fraud specialist via chat.

Impact: In testing, Revolut’s AI feature reduced fraud losses from such scams by 30%. This directly protects customers from losing money and gives them an added layer of security without overly restricting genuine transactions. It also offers peace of mind: Revolut can allow legitimate payments to go through while blocking what is likely fraud, striking a balance between safety and user freedom.

14. Klarna (2024)

AI Application: Customer support and shopping assistance

Experience Impacted: CX - Banking Customer Experience

Generative AI Customer Service and Shopping Assistant: The Swedish fintech Klarna (BNPL and shopping platform) deployed a gen AI assistant that, by early 2024, was handling two-thirds of all customer service chats for its 150 million users. Built on OpenAI’s tech, this chatbot can manage multilingual customer inquiries about refunds, returns and orders, effectively doing the work of 700 full-time support agents. It also powers a conversational shopping feature (a ChatGPT plugin) that offers product recommendations.

Impact: Within one month of launch, Klarna’s AI assistant had 2.3 million conversations and achieved customer satisfaction on par with human agents. It resolved issues so efficiently that repeat inquiries dropped 25%, and average resolution time fell from 11 minutes to under 2 minutes. Available 24/7 in 35+ languages, this AI has greatly improved CX by cutting wait times and providing instant help. Klarna estimates a ~$40M annual profit uplift from this, due to support cost savings and happier customers driving more business.

15. bunq (2024)

AI Application: Conversational banking assistant

Experience Impacted: CX - Banking Customer Experience, UX - Banking User Experience

“Finn” – Europe’s First Conversational Banking AI: Netherlands-based bunq, one of Europe’s largest neobanks, upgraded its AI money assistant, “Finn”, in May 2024 to make it fully conversational. Finn (launched in late 2023) uses generative AI to answer customer questions about their accounts, spending habits and even provide travel recommendations based on other users’ reviews. It essentially replaces the app’s search function with a chatbot that remembers context and can handle follow-up questions.

Impact: In its beta, Finn answered over 100,000 customer questions within a few months. Now, with conversation mode, it delivers personalized, context-rich answers much faster (twice the speed of before). It’s also helping bunq’s operations: Finn now fully resolves 40% of user support queries and assists in an additional 35% of all queries daily without human intervention. This means that 75% of bunq users get instant help for many issues, improving service experience, while the bank scales support efficiently as its user base (17 million across the EU and growing) expands.

16. Lunar (2024)

AI Application: Voice banking assistant

Experience Impacted: UX - Banking User Experience

GenAI Voice Banking Assistant: The Danish fintech Lunar launched Europe’s first GenAI-powered voice assistant for banking in October 2024. Unlike typical phone IVR systems, Lunar’s solution uses a voice-native GPT-4 model to hold natural conversations. Customers can speak to it for 24/7 support with no wait times. It can handle both simple requests and complex queries (like guiding a PIN change or giving spending breakdowns) with the ability to understand interruptions and follow-ups.

Impact: Still in beta, it’s already creating a smoother, more intuitive call experience. Lunar’s CTO noted it especially helps customers who might struggle with traditional digital interfaces, by being more “patient and understanding” in handling queries. The bank expects this voice AI will eventually handle about 75% of all customer calls, dramatically reducing wait times and freeing human agents. Ultimately, Lunar’s customers will get instant, personalized service by voice, making banking more accessible and human-like through AI.

17. Nubank (2023-2025)

AI Application: Customer service and operational support

Experience Impacted: CX - Banking Customer Experience

Generative AI Virtual Assistant: In March 2025, Nubank, Latin America’s largest digital bank, partnered with OpenAI to integrate advanced AI solutions across its operations. This collaboration uses OpenAI's models, such as GPT-4o and GPT-4o mini, to significantly enhance both customer experience and operational efficiency. Through this partnership, Nubank is improving various aspects of its services—from internal operations to real-time customer support.

In a pilot phase in 2023, with its NuCommunity users, Nubank employed AI to optimize several customer-facing features. For instance, the AI-powered assistant helped manage customer service inquiries, while the Call Center Copilot assisted agents with providing quick and relevant responses by analyzing internal knowledge bases. The fraud detection system uses GPT-4o vision to detect fraudulent transactions by combining natural language processing with image recognition.

Impact: The integration of AI tools has already led to faster decision-making among employees, with over 5,000 users accessing internal AI solutions. Additionally, 55% of Tier 1 inquiries are now handled autonomously by the AI assistant, improving customer satisfaction while reducing chat response times by 70%. This partnership is a critical step for Nubank in achieving its goal of offering personalized financial services and cutting-edge operational tools, all of which aim to deliver an improved customer experience and greater efficiency.

18. Pix via Nubank (2024)

AI Application: Conversational payments

Experience Impacted: CX - Banking Customer Experience, UX - Banking User Experience

AI-Powered Pix Payments via WhatsApp: Nubank also applied generative AI to Brazil’s instant payments system, Pix. In late 2024, it rolled out a feature for customers to send Pix payments using voice, text or even images through WhatsApp, with AI handling the interpretation and execution. From October to December 2024, a test was conducted using 2 million users. The AI can understand a message like “Send R$50 to João” (even via voice note or a photo of a handwritten note) and then process that payment.

Impact: This made transferring money even more convenient; users can simply talk or message instead of manually using the app. Thanks to AI optimizations, transaction processing time was cut by up to 60% without compromising security. For WhatsApp users, it removes the need to switch apps at all. By meeting customers in their preferred channels with AI, Nubank is enhancing UX through speed and simplicity, all while keeping payments fee-free and safe under Pix’s guarantees.

19. Upstart (2024)

AI Application: Loan underwriting and risk assessment

Experience Impacted: CX - Banking Customer Experience

AI Loan Underwriting Platform: The fintech Upstart has pioneered AI-based lending, and by 2024 its platform was adopted by 500+ banks and credit unions for personal and auto loans. Upstart’s AI models evaluate credit risk more holistically than FICO scores. According to Upstart’s results (2023), this led to 44% more loan approvals at 36% lower average APRs for the same risk level, compared to traditional models. Essentially, many borrowers who would be declined by legacy criteria can be approved by Upstart’s model with affordable rates, because the AI finds subtle signals of creditworthiness.

Impact: Upstart’s lending AI has expanded access to credit for underserved populations (one study noted it approved 35% more Black borrowers and 46% more Hispanic borrowers than traditional methods) while maintaining or even improving loan performance. For consumers, the experience is also smoother. Over 80% of Upstart-powered loans are approved instantly with no human intervention, enabling nearly immediate decisions and funding. This case shows AI’s power to make credit more inclusive and convenient.

20. Commonwealth Bank of Australia (2024)

AI Application: Fraud prevention, customer service, security alerts

Experience Impacted: CX - Banking Customer Experience

Holistic GenAI Transformation: Commonwealth Bank of Australia (CBA), the nation’s largest bank, shared a strategic update in November 2024, showcasing significant advancements from its recent AI deployments. As one of the first banks worldwide to embed generative AI in customer-facing features, CBA has reduced customer scam losses by 50% through AI-powered safety tools like NameCheck, which flags payee name mismatches, and CallerCheck, which verifies the authenticity of calls claiming to be from the bank. Additionally, GenAI-driven suspicious transaction alerts have led to a 30% reduction in customer-reported fraud cases by proactively notifying users of unusual activity. CBA’s AI-enhanced in-app messaging and virtual assistant have also decreased call center wait times by 40% over the past year, enabling customers to self-serve or resolve issues more efficiently before contacting support.

Impact: CBA’s AI initiatives have delivered substantial customer experience improvements, with a 50% reduction in scam losses, a 30% drop in fraud cases and a 40% decrease in call center wait times. CEO Matt Comyn emphasized that AI is pivotal to providing “superior customer experiences,” enhancing both security and personalized service. The bank is also exploring AI automation for processes like business loan reviews to further save clients time.

21. Capital One (2024–2025)

AI Application: Voice/text banking assistant

Experience Impacted: CX - Banking Customer Experience, UX - Banking User Experience

“Eno” AI Assistant and Voice Banking: Capital One’s Eno is an AI-powered chat and voice assistant that supports customers with tasks such as tracking spending and answering account-related questions. Originally launched as a text-based service, Eno expanded to voice interfaces and smart speakers. By 2024, Capital One reported that Eno reduced call center contact volumes by 50%, according to a case study by Redress Compliance. The assistant conversationally handles basic banking requests, provides insights like alerts for ending free trials or unusual charges and enables hands-free task execution.

Impact: Eno’s 24/7 availability has driven a 50% reduction in call center contacts, significantly improving service efficiency and consistency. Customers benefit from immediate responses, reducing wait times and frustration. Additionally, Eno enhances security through AI-driven account monitoring and background authentication. Serving Capital One’s approximately 100 million customers, Eno demonstrates how an AI chatbot and voice assistant can scale customer support while delivering a human-like, seamless digital banking experience.

Conclusion: from Hype to Habit

Banks worldwide are leading the charge in AI adoption, leveraging the technology more extensively—and investing more heavily—than most other industries. By 2024, an overwhelming majority of banks have integrated AI into business functions—from back-office automation to customer-facing chatbots. This outpaces adoption in sectors such as manufacturing or healthcare, where AI use is growing but is not as ubiquitous.

The advent of generative AI over the past year has only widened this gap, with banks quick to pilot GenAI for improved customer service, risk management and operational efficiency. Globally, financial institutions in regions like North America, Europe and Asia are all onboard the AI trend, though uptake is fastest in countries like India, China and the UAE, and somewhat slower in others due to regulatory or cultural factors.

Both in the United States and the United Kingdom, 2024 can be seen as a breakthrough year for artificial intelligence in banking. Virtually every major bank in every major market is now either using generative AI or actively planning to use it. They are motivated by clear benefits: better fraud detection, cost reductions, personalized customer experiences and by competitive pressure as fintech players and “AI-native” firms disrupt traditional banking. Surveys show upwards of 90% of bank executives in the US and UK have greenlit AI projects or increased budgets for GenAI, demonstrating strong confidence in the technology.

Going forward, the banking sector is expected to continue investing aggressively in AI capabilities. Analysts project exponential growth in AI spending by banks (e.g., global generative AI spending in banking could reach ~$85 billion by 2030). Key use cases like fraud detection, chatbots, credit scoring and algorithmic trading will become further enhanced by advanced AI. Banks will also likely collaborate with regulators to develop frameworks for responsible AI (as seen in the UK’s surveys) and address challenges like bias and transparency. In sum, banking’s early embrace of AI—now turbocharged by generative AI—is positioning the sector for significant transformation in the years ahead, outpacing many other industries in the AI adoption curve.

2024 was a pivotal year for artificial intelligence in banking, as institutions worldwide moved from pilot projects to real deployments that tangibly improved the digital customer experience. Globally, banks observed that AI could boost both customer satisfaction and operational performance—a true win-win. By automating routine tasks and augmenting human employees, AI allowed banks to serve more customers with greater consistency.

Quantitatively, we saw metrics trend in the right direction: higher Net Promoter Scores in markets in which digital CX was strong, record digital adoption rates (with active digital users exceeding 75%–80% at many banks) and significant increases in self-service transactions and chatbot interaction counts. One Capgemini study even linked AI-driven CX improvements to double-digit gains in satisfaction and revenue, underscoring the financial payoff of more satisfied customers. Qualitatively, customers in 2024 enjoyed more personalized, convenient and engaging banking services than ever before—from receiving tailored financial advice in-app to getting instant help from a friendly AI assistant at midnight. Use cases like generative AI chatbots went from novelty to mainstream, with major banks in the US and UK launching or refining such tools.

Source: Capgemini, Shaping the AI-enabled customer experience for financial services

Source: Capgemini, Shaping the AI-enabled customer experience for financial services

Of course, the transition was not without challenges. Banks had to address customer trust and security concerns around AI. Surveys revealed that while people welcomed convenience, many remained cautious about AI handling their finances: over 57% of customers hesitated to use AI-generated financial advice, and a minority outright refused to use AI for banking tasks. Incidents of AI errors (or “hallucinations”) were taken seriously, and institutions implemented guardrails and testing to maintain accuracy.

The human element also proved vital—leading banks found the best outcomes by combining AI efficiency with human empathy, ensuring that customers could seamlessly escalate to a person when needed. Regulatory and ethical considerations started to surface as well, prompting discussions on transparent AI algorithms and data privacy. Nonetheless, the overall impact in 2024 was clearly positive.

Banks that embraced AI saw improved customer engagement, whether through more frequent app usage or deeper emotional connection (feeling that the bank “understands me”). In markets like the US and UK, which we highlighted, AI became a key differentiator among competitors: those who leveraged it wisely reaped reputational gains, while those who lagged faced pressure to catch up.

In conclusion, AI’s adoption in banking during 2024 fundamentally elevated the digital customer experience. By delivering personalization at scale, enabling full-service banking at customers’ fingertips, engaging users in proactive conversations, automating support and broadening accessibility, AI made banking more customer-centric than ever. The past year’s advancements indicate that we are entering a new era of digital banking—one in which AI is embedded in every facet of the customer journey, often invisibly, making interactions smoother and more meaningful.

As we move into 2025 and beyond, banks will likely build on this momentum. We can expect even smarter virtual assistants, more predictive financial wellness tools and further integration of AI into everyday banking operations. The competitive bar for digital CX has been raised: customers will gravitate toward banks that continue to innovate with AI in ways that genuinely improve their financial lives. The “age of AI” in banking has truly begun, and 2024 will be remembered as the year that kick-started a transformation in how we all experience banking in the digital age.

Discover our clients' next-gen financial products & AI innovations in UXDA's latest showreel: