What is bank innovation through UX design?

The digital age requires a new way of operating and thinking from the financial industry. And, this is not possible without innovation in banking services. We could define bank innovation as using new technology and service processes to provide solutions that better serve customer and business requirements, meet their needs (often unarticulated) and move the market to the next level of development.

Today, we hear a lot about digital banking innovation, because digital technology transforms the way that banks operate. Banking digitization leads to the closing of bank branches, focusing instead on online channels: mobile banking, wearable banking, desktop banking and, in the near future, conversational and virtual and augmented reality banking. In general, Fintech innovation is the only way to move banking into the future.

The main question is how to best provide innovation in banking services. It is not enough to buy or develop innovative banking solutions for long-term success because the digital age requires not just new technology, but innovative banking ideas that will help banks to meet customer needs. This is what banks can learn from innovative Fintech products in the banking sector.

In other words, in the digital age, financial innovations start with the users, not technology.

Check out the best UXDA articles about bank innovation.

Customer-Led Banking Is Reshaping Inside-Out Financial Institutions

For decades, banks were built inside-out—core systems first, then products, and only later the customer. Digital-first challengers invert this logic, starting with brand purpose and experience and building the core to serve it. This article shows how traditional banks can turn their architecture upside down to compete in the outside-in era.

Executive Buy-In as the Missing Link in Banking UX and Digital Branding

Banks don’t lose customers over rates—they lose them over experience. While fintechs set the standard for seamless UX, many banks still treat it as “just design.” This article reveals how you can get executive buy-in for UX to future-proof your digital strategy.

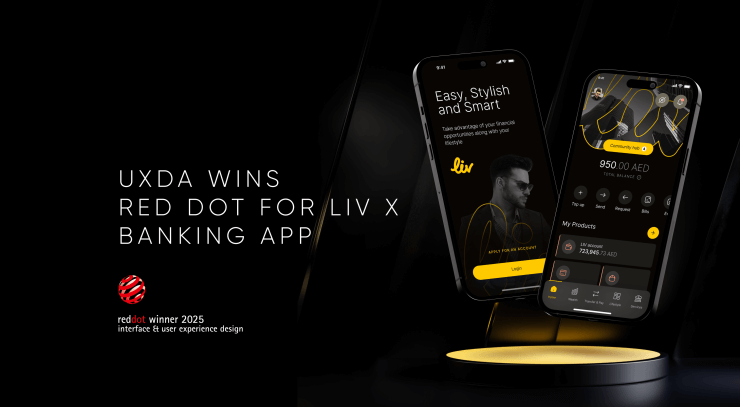

UXDA Receives Red Dot 2025 for Liv X Lifestyle Banking Experience

UXDA has won another Red Dot Award in "Interface & User Experience Design" for Liv X — the UAE’s first lifestyle-driven digital banking app, powered by Emirates NBD. This recognition reinforces UXDA’s role as a financial UX pioneer, redefining how banking apps enhance modern lifestyles.

Financial AI in Practice: 21 Case Studies of Artificial Intelligence in Banking CX

This article explores how 2024 became the breakthrough year for AI in banking—no longer a future experiment, but a strategic powerhouse reshaping digital customer experience. Discover how leading banks are using AI to unlock deeper personalization, smarter self-service, and faster, more human-centric digital interactions.

How Digital Customer Experience Drives Acquisition, Efficiency, and Loyalty in Financial Institutions

As traditional growth levers in financial services converge, Digital Customer Experience (DCX) is emerging as a critical competitive advantage. Digital Customer Experience is now a key growth driver in financial services. This article explores ten ways DCX impacts trust, loyalty, and long-term success.

Dopamine Banking: UXDA’s 10‑Year Anniversary at Digital Art House

In 2025, UXDA celebrated 10 years of transforming the financial industry through emotional user experience design, growing from a bold startup into an award-winning agency with a global impact, serving nearly 100 clients across 39 countries and millions of users worldwide.

Toxic Behaviors to Avoid: Building a Sustainable Culture of Innovation in Banking Product Teams

In digital finance, many banks face a hidden barrier: dysfunctional team dynamics. Common fixes miss the root cause—toxic behaviors that block innovation and user-centered design. Discover what these toxic behaviors are and how to fix them in UXDA’s latest article.

Applying Neuromarketing to Digital Banking Apps and Fintech Design

Despite a decade of digital innovation, financial services often remain cold and overwhelming. At UXDA, we use neuroscience and neuromarketing to transform emotion into engagement. Discover how neuromarketing transforms digital banking by addressing emotional barriers, building trust, and creating empowering user experiences.

The Hidden Cost of Standing Still in UX and Digital Banking Branding

For decades, stability was banking’s greatest strength. But in today’s digital-first world, playing it safe with outdated legacy systems and generic white-label solutions isn’t just holding banks back—it’s driving customers away.

Why Feature-First Digital Banking Strategies Could Break Brand Trust

Financial companies obsessively copy features, buy them and invent them, but sustainable product success lies in aligning digital service with a deeper strategic vision. Vision rooted in a clear brand promises an emotional connection with customers.

UXDA’s DXB System for Building Strong Financial Brands Digitally

How can financial brands meet today’s user expectations? UXDA’s Digital Experience Branding Framework offers a practical, actionable tool to help ambitious financial institutions create strong, future-ready digital brands.

- 1

- …

- 3