Liv Bank by Emirates NBD, the first digital-only lifestyle bank in the UAE, approached UXDA with an ambitious rebranding strategy to redefine banking for the sophisticated Gen Now segment. With innovation at its core, Liv sets out to establish new standards for lifestyle-driven banking in the MENAT region. Through a strategic and forward-thinking UX approach, we expanded the Liv ecosystem to three groundbreaking solutions: the Liv X app for seamless lifestyle and financial management, an immersive spatial banking experience for enriched user engagement and the Liv Lite app to empower children's financial education. This bold evolution in both brand and product demonstrates how innovative UX design can drive market leadership and reshape the future of finance.

Client: UAE's First Digital-only Lifestyle Bank

Launched in 2017 by Emirates NBD, Liv is the UAE’s first digital-only lifestyle bank. Backed by the credibility and innovation of the Emirates NBD Group, Liv leads the digital-only banking segment in the UAE. It goes beyond traditional banking and integrates lifestyle offers and deals into a seamless experience that helps over half a million users enrich their financial and lifestyle experience.

Liv's success and commitment to innovation are recognized through multiple awards, including the “Digital Bank of the Year in MENA 2024” by the Meed-Mena Banking Excellence Awards, “Virtual Bank of the Year in UAE 2024” by the Asia Banking and Finance Retail Banking Awards and the “Best Digital Bank - United Arab Emirates 2024” by Middle East & Africa Retail Banking Innovation Awards.

In 2023, Liv repositioned itself with the "Liv Ahead" value proposition to target the evolving expectations of Gen Now (Millennials and Gen Z) and empower them to "bank ahead" and "live ahead." That included the region's first zero-fee digital lending, a versatile credit card and the "Game On Deposit" activity, which gamified interest rates on fixed deposits based on the 2024 European Football Tournament. Liv became the first in the region to offer in-app IPO subscriptions, reinforcing its commitment to lifestyle-driven financial solutions.

“As banking and financial services become increasingly digital, Liv addresses the need for simple, secure, and accessible transactions. With digital-first products, Liv offers UAE customers innovative banking solutions powered by technology.”

Pedro Sousa Cardoso, CDO of Retail Banking and Wealth Management at Emirates NBD

Challenge: Redefining the Digital Banking Ecosystem for Gen Now

Liv's main challenge was to bring the latest innovation to the table to create a next-gen digital-only banking ecosystem. New banking experiences had to fit Gen Now's sophisticated and fast-paced lifestyle in the MENAT (Middle East, North Africa, and Turkey) region and embed the new "Liv Ahead" value proposition. This aimed to strengthen Liv's positioning as a banking innovation pioneer, empowering deeper customer engagement, loyalty and brand differentiation from competitors.

Expanding the previous successful collaboration between UXDA and Emirates NBD, the bank chose UXDA as a strategic partner for Liv's product experience and innovative design upgrade across the new digital ecosystem under the leadership of Tuncay Tuncer, Tribe Lead at Liv.

The main challenge was complicated by three aspects:

- Product innovations for different user segments: The Liv team challenged UXDA to not only upgrade their mobile app but also expand their digital ecosystem with an immersive spatial banking experience for Gen Now users and an app for children, all tailored to meet their unique needs and expectations, blending lifestyle and financial services seamlessly.

- Maintaining brand consistency while innovating the design: Adhere to Emirates NBD’s design system while integrating unique, uplifting design elements that differentiate each product without compromising brand identity or design consistency.

- Strict timeline: All products had to be designed within a very tight deadline to maintain a competitive advantage in the market and present innovative experiences at the largest regional exhibition.

Solution: Creating Diverse Digital Experiences in Sync with Gen Now’s Lifestyle

UXDA designed three key digital products, each tailored to different customer and family needs, positioning Liv as a forward-thinking brand deeply integrated into users’ everyday lives:

- A digital banking and lifestyle app for Millennials and Gen Z, combining banking with lifestyle offers and deals, designed with the aesthetics and sophistication that MENAT customers expect.

- An immersive spatial banking experience concept, showcased with Apple Vision Pro at the Dubai FinTech Summit 2024, demonstrating Liv's commitment to pioneering future technologies shortly after the device's release.

- A digital banking app for kids aged 8 to 18, focused on financial education, fostering good financial habits and confidence with money starting at a young age.

Aligning Digital Banking with a Stylish Lifestyle

Gen Now in UAE demands exceptional design and personalized services that reflect their modern lifestyles and high living standards. From enjoying coffee and art at Alserkal Avenue or being inspired by the Museum of the Future to participating in Dubai Fashion Week, they just live ahead with style. They are quick to switch services if their values and expectations are not met.

Recognizing that traditional financial solutions failed to resonate with the affluent Millennial and Gen Z demographic, Liv took on the challenge of creating a digital banking experience that not only addressed essential financial needs but also aligned with their cosmopolitan lifestyle and aesthetic standards.

Recognizing that traditional financial solutions failed to resonate with the affluent Millennial and Gen Z demographic, Liv took on the challenge of creating a digital banking experience that not only addressed essential financial needs but also aligned with their cosmopolitan lifestyle and aesthetic standards.

Taking all these factors into consideration, UXDA designed the Liv X app, seamlessly blending innovative financial and non-financial services. This approach aimed to position Liv as the top choice for those seeking a tailored, aesthetic and stylish banking experience, enhancing customer loyalty through a digital-only service. Users have shared positive feedback, clearly appreciating the new experience.

A New Dimension in the Banking Experience

With the launch of Apple Vision Pro glasses, the Liv team saw an opportunity to push the boundaries of banking innovation. Recognizing UXDA's expertise in creating next-gen and innovative experiences, including spatial banking, Liv challenged UXDA to create an unprecedented immersive spatial banking experience concept for the Dubai FinTech Summit 2024.

UXDA designed the Liv X Spatial banking experience to showcase the opportunities new technologies offer for banking, which are made possible through immersive spatial interactions. A key aspect was enhancing the emotional connection and delight in the experience using spatial design features.

UXDA designed the Liv X Spatial banking experience to showcase the opportunities new technologies offer for banking, which are made possible through immersive spatial interactions. A key aspect was enhancing the emotional connection and delight in the experience using spatial design features.

At the summit, which attracted over 8,000 industry leaders from 100+ countries, visitors experienced Liv X Spatial banking firsthand through Apple Vision Pro, just four months after the device's launch. This initiative highlights Liv's commitment to pioneering new standards in the financial sector.

We were thrilled to hear that the summit audience was abuzz with talk about the fantastic Liv X Spatial banking experience they just had and expressed a strong desire to have this innovative experience daily. They highlighted how seamless, intuitive and celebratory banking could be, especially when using the advantages of new technologies and AI.

We were thrilled to hear that the summit audience was abuzz with talk about the fantastic Liv X Spatial banking experience they just had and expressed a strong desire to have this innovative experience daily. They highlighted how seamless, intuitive and celebratory banking could be, especially when using the advantages of new technologies and AI.

Building the Future for Kids and Teens

Many parents struggle to teach their children sound financial habits, resulting in a gap in early financial education. Liv aimed to solve this by offering children a personalized, age-appropriate banking experience.

UXDA designed the Liv Lite app—an easy and engaging way for children to learn about money management that fits their ages and needs. This app reduces financial complexity and strengthens Liv's emotional connection with families, building a strong foundation for future customer segment growth.

UXDA designed the Liv Lite app—an easy and engaging way for children to learn about money management that fits their ages and needs. This app reduces financial complexity and strengthens Liv's emotional connection with families, building a strong foundation for future customer segment growth.

Launched in August 2024, Liv Lite has been warmly received by Liv users. They have praised its innovative features and expressed a desire for similar financial products as a companion during their childhood.

Approach: Inspiring the Market with Next-Gen Digital Products

Liv’s strategy was to win the market with a digital financial product that goes beyond traditional banking, integrating lifestyle services to meet the daily financial and lifestyle needs of Millennials and Gen Z. Through an innovative digital experience and a sophisticated, user-centric design, Liv aims to become the premier secondary bank for those seeking convenience and innovation.

To help the Liv team achieve its goals, UXDA refined the user journey and optimized the UX/UI in every product to closer align with the needs of Gen Now and their families. We also implemented Liv's new "Liv Ahead" value proposition into the product experience by highlighting transparency, personalization and innovation.

Liv X App: Elevating Banking into a Lifestyle Experience

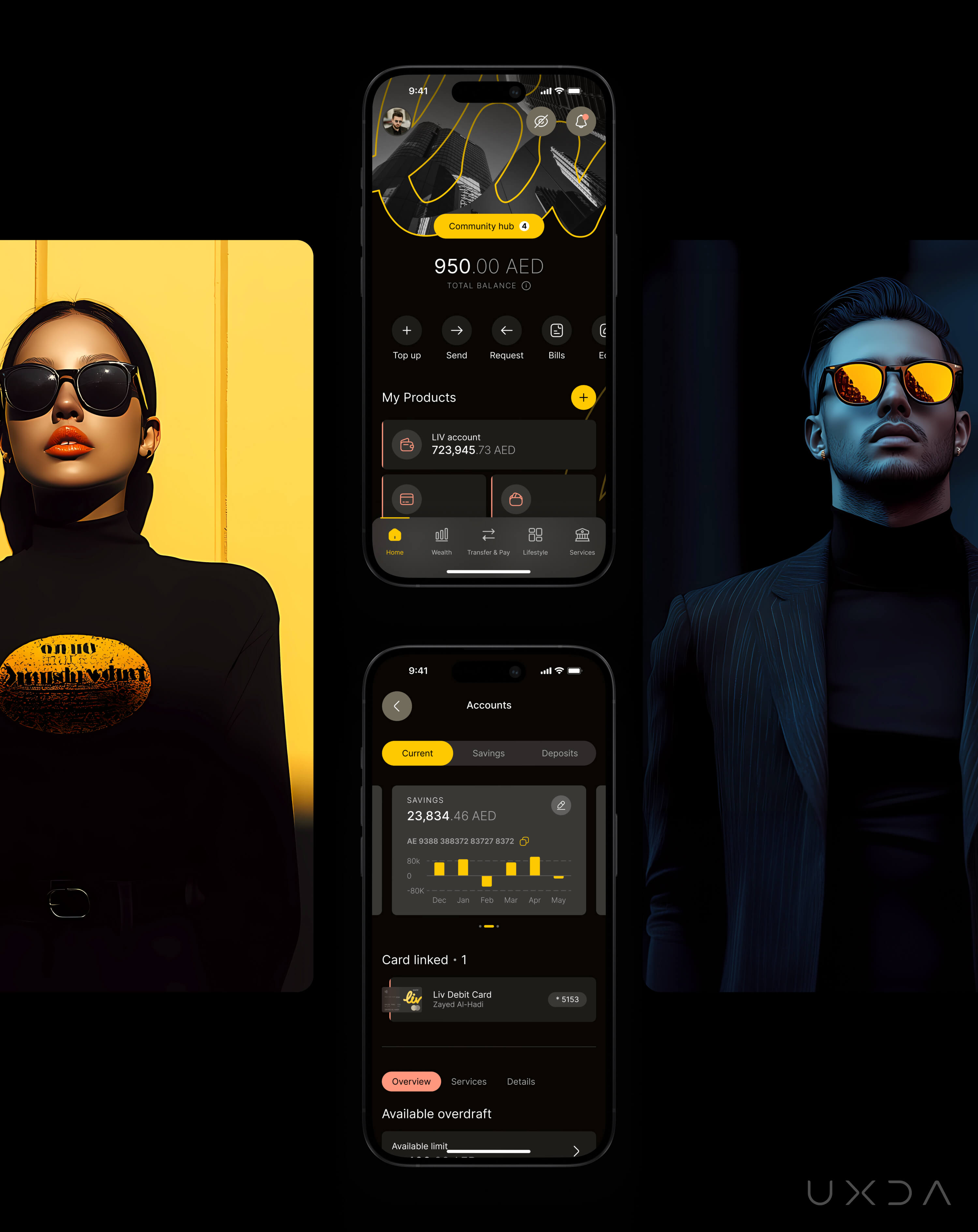

The Liv X app, a digital lifestyle banking app, was designed to transform banking into an artful extension of the sophisticated lives of UAE’s Millennials and Gen Z users. Reflecting UAE's modern aesthetics and vibrant energy, Liv X aimed to become more than a digital lifestyle banking app─a stylish companion to users' elevated lifestyles.

To deliver this innovative experience, we used a strategic UX approach based on research into user profiles and behavioral trends. Our goal was to create a visually satisfying and engaging product that resonates deeply with its audience.

The target segment is tech-savvy individuals and fashion enthusiasts who value aesthetics in all aspects of their lives—from accessories to digital experiences. To resonate with this segment, UXDA designers draw inspiration from the elegance of Vogue, Harper's Bazaar and L’Officiel fashion magazines, the sophistication of Leila Heller Gallery and Opera Gallery Dubai, the modern luxury of Bearbrick and the elegance of Zaha Hadid’s designs, all while aligning with Liv's updated brand.

The target segment is tech-savvy individuals and fashion enthusiasts who value aesthetics in all aspects of their lives—from accessories to digital experiences. To resonate with this segment, UXDA designers draw inspiration from the elegance of Vogue, Harper's Bazaar and L’Officiel fashion magazines, the sophistication of Leila Heller Gallery and Opera Gallery Dubai, the modern luxury of Bearbrick and the elegance of Zaha Hadid’s designs, all while aligning with Liv's updated brand.

From the vivid backgrounds to the sleek design accents, Liv X captures UAE's youthful energy and modern vibe. Integrating the Liv logo as a core design element enhances its stylish and artistic presentation. Whether ordering a card or exploring exclusive lifestyle features, Liv X provides an inspiring experience that reflects users’ values and style, making it a true artistic showcase in the digital banking landscape.

Customizing Users' Digital Banking Experience

McKinsey research reveals that 71% of consumers expect personalized interactions, with 76% feeling frustrated when these aren't met. To allay these frustrations, UXDA made personalization a key focus in creating the Liv X app design vision.

Liv's target audience values authenticity, aesthetics and individuality, and the digital environment should reflect their refined tastes. To meet these expectations, we created five design themes with varying color accents using a trending palette tailored to an art-inspired lifestyle. This customization allows users to adjust the app's visual appearance based on their preferences and moods, turning it into an extension of their lifestyle.

Inspired by art and elegance, the Liv X app's bold colors and vibrant energy set it apart from traditional banking apps. The result is a visually striking, fun and engaging product that combines financial functionality with personal expression.

Strengthening Relationships with the Brand and Product

Liv aimed to move away from the traditional and impersonal banking approach. UXDA helped bring Liv's customer-centric vision to life by embedding the “Liv Ahead” brand tagline into the design and experience of the Community Hub section. It consists of three sections, each serving a specific purpose.

The Engagement section informs users about their relationship with Liv, outlining necessary actions or updates. The Liv Explorer offers personalized product suggestions to enhance users' financial well-being, replacing random marketing banners with relevant recommendations. The Empowerment section provides lifestyle-aligned tips and financial advice to help users manage their goals more effectively.

To enhance engagement, we integrated gamification elements, such as membership levels and progress tracking, allowing users to see the value of their relationship with the Liv X app. This personalized, user-focused approach ensures that Liv X strengthens users' loyalty, creating a meaningful connection while fulfilling the brand's promise to help users live and bank ahead.

Refining User Experience with a Human Touch

We designed a dedicated Lifestyle section tailored to diverse user needs to infuse the human touch often missing in banking products and align with Liv’s lifestyle-driven vision. This section serves as a seamless gateway, enabling users to explore and access both banking and lifestyle opportunities effortlessly. It highlights Liv's mission to be more than just a place to make payments but also meet users' lifestyle-related needs.

Enhancing Brand Connection with Every Interaction

To convey Liv's brand core attributes of optimism, energy, confidence and vibrancy, we extended these qualities from digital interactions to the physical design of the payment card. UXDA designers explored various design versions, incorporating brand colors and accents into a sleek, premium black card with striking highlights from the Liv logo. This minimalist and elegant design reinforces the brand's aesthetic, delivering a cohesive, elevated experience that strengthens brand recognition and boosts user engagement.

The card design provides users with a consistent and elevated connection with the Liv brand across digital and physical environments. This seamless brand experience bridges the gap between the virtual and real world, reinforcing the brand’s presence in users' lives.

Liv X Spatial: Experiencing Future Immersive Spatial Banking Today

Apple's Vision Pro offers a truly futuristic way to interact with finances, far beyond the capabilities of mobile apps. Working with Liv's Tribe Lead, Tuncay Tuncer, we focused on scenarios that maximize the immersive potential of Apple Vision Pro, aligning them with the Gen Now banking and lifestyle needs.

The design is harmonized with the Liv X app's aesthetics and the ambience of a modern gallery, following Apple's Vision Pro guidelines. It provides real-time and contextual AI suggestions, allowing users to engage with their finances in extraordinary ways. Just imagine walking through the corridors of the Louvre, admiring art, and being able to invest in a masterpiece in just a blink of the eye!

By leveraging UXDA's extensive experience, we created an inspiring, UAE-lifestyle-aligned future banking experience for Liv in just two months. We transformed the user experience with innovative, future-ready design for three groundbreaking usage scenarios embracing spatial design capabilities─household finances, tangible asset investments and car purchases─offering users a glimpse into the future of banking.

Streamlining the Household Finance Overview

An account overview is critical in digital banking, offering users a quick snapshot of their financial status. In today's fast-paced world, users expect instant updates and personalized advice that help them manage finances on the go without the need to analyze complex graphs or tables.

To address these evolving expectations, we designed a streamlined information architecture for account overview, enhanced with AI capabilities. The solution expands upon individual insights by providing a comprehensive view of household finances, an area often overlooked by traditional financial services. Users can easily review spending across linked family accounts, fostering transparency and encouraging meaningful financial discussions.

The AI-powered insights help users make informed decisions and align with family goals. With interactive visuals, personalized insights and recommendations, Liv transforms financial management into an intuitive and dynamic experience, empowering users to take proactive steps toward a more secure financial future for the entire household.

Transforming Asset Investment into Art-inspired Experiences

Investing in luxury tangible assets has gained popularity among investors, offering a sense of ownership and connection that financial instruments like stocks or bonds cannot replicate. We designed a unique investment flow that engages users in an immersive experience.

Our art gallery-inspired investment journey allows users to explore and invest in tangible luxury assets through dynamic 3D asset representations. This approach enhances the emotional connection, making the investment process more appealing.

Incorporating AI and data-driven insights, we visualized tailored recommendations based on user preferences and market trends, ensuring access to critical information for informed decision-making. Our research into tangible asset investing was a basis for creating an intuitive and inspiring user experience, showcasing insights on trending objects and recently viewed items. Users can even try on a Patek Philippe watch on their hand before investing, making them feel whether it's the right choice.

This innovative flow redefines the typical investment process, creating an immersive experience that fosters calm and confidence—similar to the tranquility of a yacht cruise along Dubai’s coastline at sunset. Here, serenity meets the satisfaction of making meaningful, informed investments in truly unique assets.

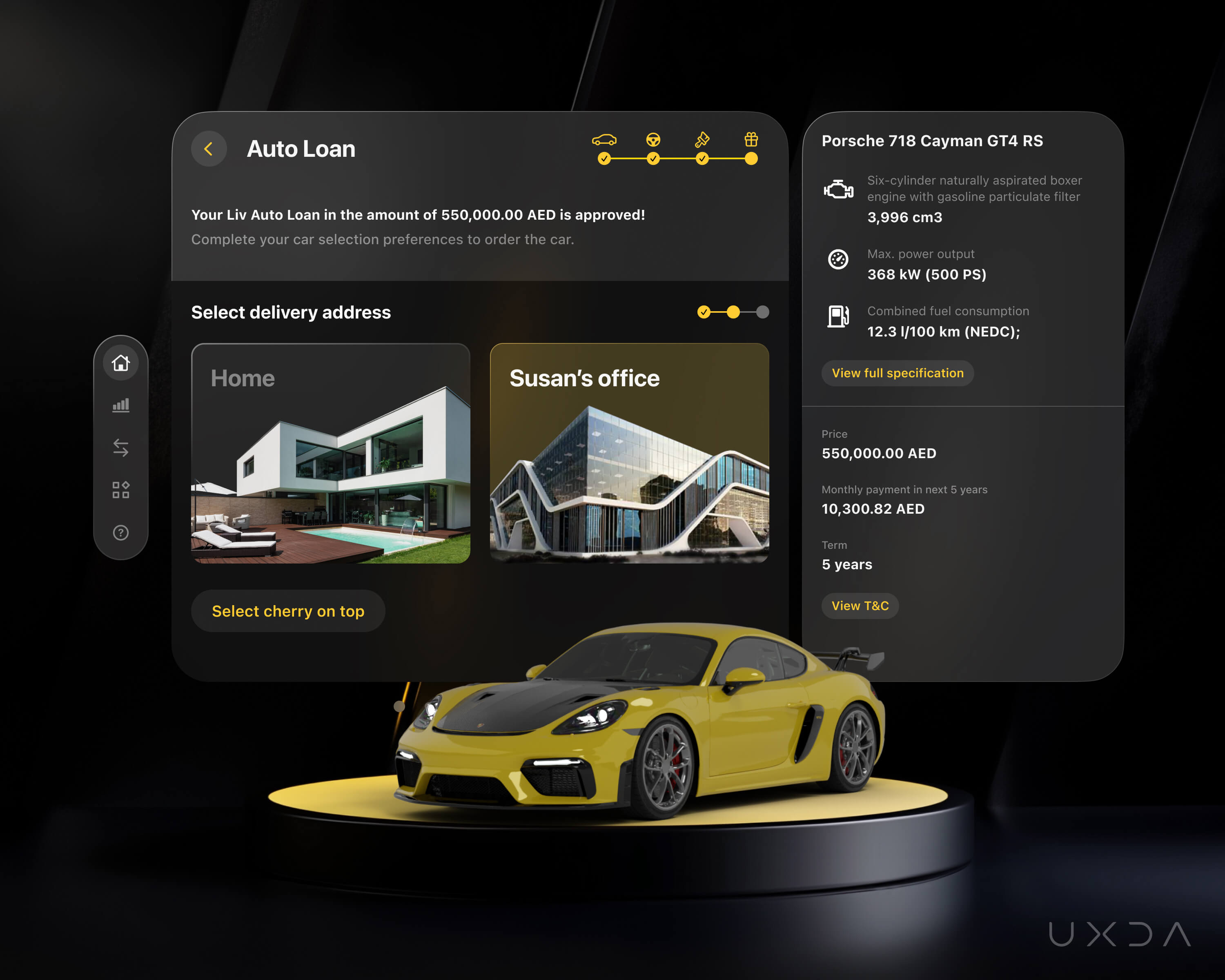

Reimagining Car Loan Stress into a Celebratory Experience

Purchasing a dream car using a bank loan can be stressful and uncertain. We aimed to transform this process from anxiety into a moment of celebration. By leveraging the immersive capabilities of spatial design, we created an experience that blends virtual and real-life elements, reflecting the emotional significance of buying a car.

Users can preview and interact with a 3D model of their desired vehicle, customizing features like color and rotation for an exciting, detailed view of their soon-to-be-owned car. This tangibility allows users to visualize their purchases in a personalized way.

To elevate the excitement, we introduced a unique celebratory touch: users can add personal touches like a bow or flowers to their car, which will appear upon delivery to a selected delivery address. This emotional integration into the financial process amplifies the joy of a new car purchase.

By empathizing with users throughout this critical process, we prioritized security and transparency to ensure every step—from selecting car features to finalizing the loan—was clear and seamless. This immersive journey makes the car loan process as effortless and delightful as enjoying a coffee at Armani Lounge while admiring the breathtaking Dubai skyline from the Burj Khalifa. Users can feel the same excitement and accomplishment digitally as they would in reality.

Liv Lite App: Empowering Kids with Smart Money Skills

Liv Lite, a digital banking app for kids, is Liv's forward-thinking initiative to shape the financial habits of tomorrow's leaders. Understanding that children's interests and behavior vary by age, the Liv team envisioned various product designs for different age groups. As a result, UXDA designed two distinct experiences for children aged 8-12 and teens 13-18, ensuring an engaging experience that evolves alongside its young users.

For children aged 8-12, the app features a playful, energetic design with an in-app buddy that encourages trust and curiosity to help children make confident financial decisions. As users age, Liv Lite transitions to a sleek, contemporary design for teens aged 13-18, aligning with the Liv X aesthetic. This app progression prepares children for the adult Liv X app they would transition to at age 18. This dynamic approach sets Liv Lite apart from its one-size-fits-all competitors, offering a personalized and age-appropriate experience.

Through careful research and a sophisticated design vision, Liv Lite evolves into a lifelong companion. It seamlessly guides users from childhood to adulthood, ensuring the Liv brand remains an essential part of their lives.

Stepping into Children's Shoes Through Research-Driven Design

Redesigning the Liv Lite app, UXDA aimed to transform the existing banking experience by infusing fresh emotions and engaging elements tailored to specific age groups of children. Given the broad age range of the Liv Lite users, we explored the commonalities and differences within these groups to consider in the design process. Our research focused on younger users' needs, preferences and behaviors, particularly their relationships with money, spending habits and social interactions. We also examined popular apps and games that capture children's attention to better understand their motivations.

Our findings revealed that children desire to see their banking cards in both their physical and digital wallets, which helps them feel more grown up and independent while mirroring their desire to emulate their parents.

We discovered that younger children respond best to emotional, playful designs like those used in mobile games. In contrast, teens seek more sophisticated experiences that reflect their desire for independence and identity. Features like bill payments and money requests resonate with this age group, empowering them to navigate their own financial journeys.

We conducted usability tests with children, integrating their feedback into the design process to ensure the product was understandable and met their expectations.

Guiding Children Through Banking with the In-app Buddy

Liv's team had an idea of the in-app buddy—a friendly character designed to embody confidence, engagement and curiosity for children aged 8-12. This aligns with children's preference for visual communication, infusing the banking experience with a sense of lightness and enjoyment.

Leveraging AI capabilities, UXDA designers created the in-app buddy as a realistic 3D visual element, enhancing the product's fun and energetic atmosphere. The buddy showcases various moods and playfully represents tasks, capturing the emotional tone of each task and providing motivation through positive reinforcement.

Liv Lite adjusts its communication style, using simple, relatable language, making interactions understandable and engaging for younger users. This thoughtful visualization allows children to perceive Liv as a friend, reinforcing the brand's image as an essential ally in their financial management, learning and family activities.

Enhancing Brand Connection with Interactive Stickers

Knowing children's enthusiasm for stickers, glasses, clothes and school bags with their beloved movie or game characters, the Liv team had an idea to create a set of stickers for Liv Lite users.

We designed a vibrant set of stickers featuring the buddy, allowing children to personalize their physical cards or other belongings. Imagine children exchanging these stickers with friends, fostering real-life communication and building their own community around the brand!

Collaboration: Driving Success Through Strong Partnerships

Product design is a continual evolution, and our collaboration with the Liv team reflects that dynamic process. Through constant remote communication, we ensured our UX/UI ideas aligned with Liv's mission to create an exceptional user experience. Our commitment to refining concepts and exploring innovations enables MENAT customers to benefit from a cutting-edge digital banking experience.

Working closely with Tuncay Tuncer, who leads the Liv team, we maintained a strong alignment on the product vision. With over 18 years of experience in digital banking transformation across the Middle East, Asia and Africa, Tuncay provided invaluable insights into user behavior, banking processes and market trends. His deep understanding of local customer needs enriched the project with forward-thinking ideas.

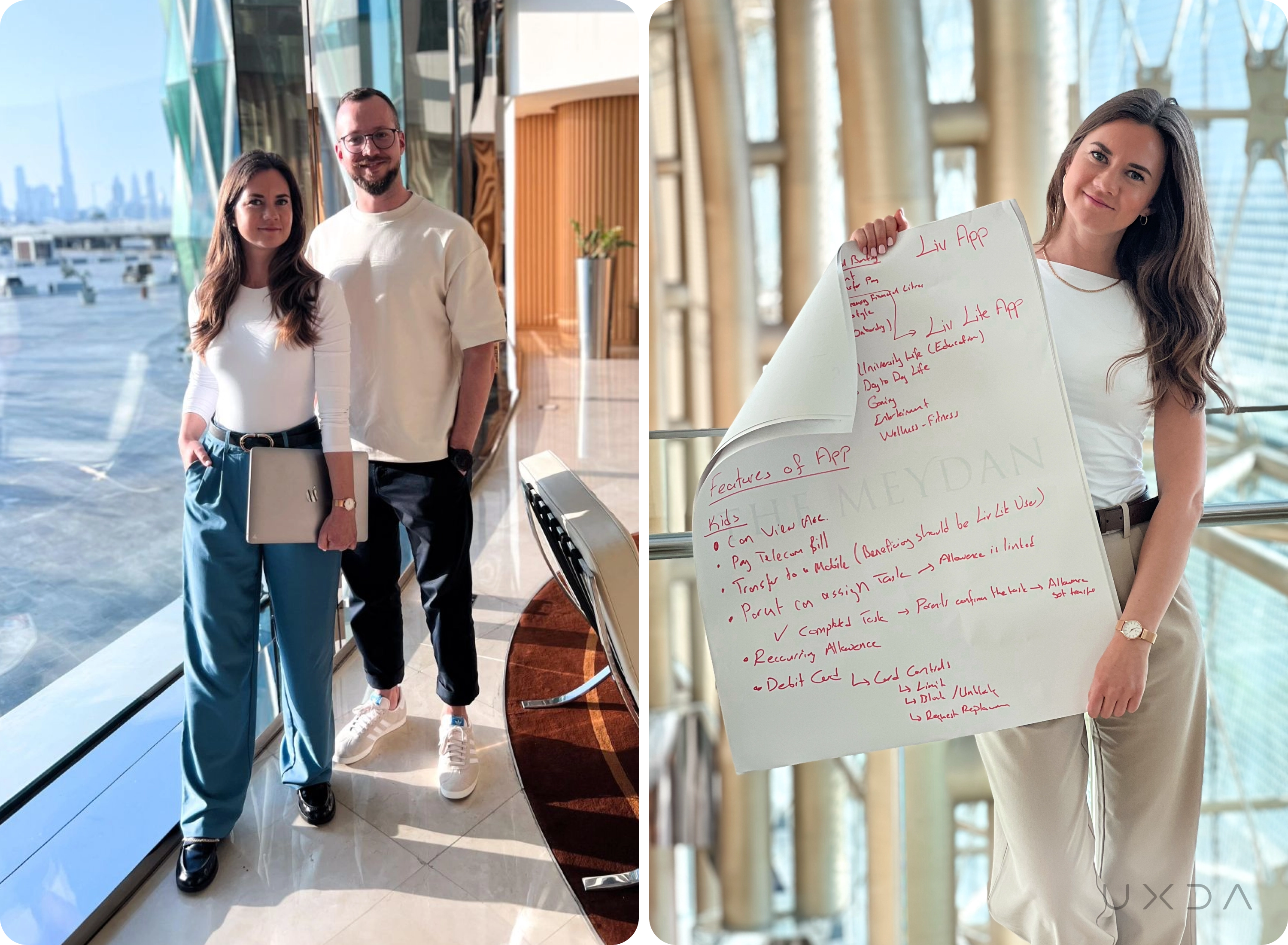

UXDA's Lead UX Architect, Inese, and Lead UX/UI Designer, Dmitry, visited Dubai to collaborate with the Liv team, sharing ideas and fostering synergy for future product enhancements. During the workshops, they discussed ideas and created a features and ideas prioritization map, which played a key role in evaluating and aligning ideas to Liv's strategic priorities for product advancement. The vibrant atmosphere of Dubai served as a powerful source of inspiration, driving innovative ideas to level up the sophisticated and lifestyle-driven banking experience even further.

The Liv team embodies an energetic, fast-paced, effective approach, enthusiastically tackling challenges. This strong alignment, driven by Tuncay’s leadership and UXDA’s strategic focus, created the perfect environment for creating innovative products powered by a shared vision for the future.

Takeaway: Strategic Alignment to the Rapidly Evolving Financial Services Landscape

The rapidly evolving financial services market, driven by digital advancements, demands a clear alignment between business objectives and customers' needs and lifestyles. Success in this landscape hinges on flexibility, efficient resource use and consistency across all channels.

Liv exemplifies this by tailoring its digital-only banking experiences to meet Gen Now's aspirations in the MENAT region. Liv boosts user satisfaction and loyalty by offering tools that teach financial management to families. While many banks strive to improve accessibility, few align as effectively with customer needs and local trends as Liv, which has crafted products like Liv X and Liv Lite that resonate with the unique lifestyles of Millennials and Gen Z and their families.

As customer expectations shift with generations, banks must continuously adapt to remain relevant. Liv’s “Live Ahead” value proposition is integrated into its app design and experience, empowering users to stay ahead and set new standards for engagement. Liv continues to enhance its Liv X and Liv Lite apps to meet users' growing needs and aspirations. Liv’s focus on pioneering technologies and enhancing customer experiences highlights it as a key driver of innovation and transformation in the MENAT market.

Discover our clients' next-gen financial products & UX transformations in UXDA's latest showreel.

Get UXDA Research-Based White Paper "How to Win the Hearts of Digital Customers":

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedin