How would you react if your financial company spent millions in two years on developing a new app but after launching it, the customer satisfaction decreased? There are several non-obvious factors that can completely sabotage all of the huge investments and efforts of creating delightful customer experience in banking or Fintech. So, let's explore customer experience gap model to find out why customers might not like your expensive new product.

There's no doubt that great customer experience (UX/CX) is mandatory to retain a competitive edge in the digital world.

Despite that, the efforts to ensure exceptional customer experience do not always lead to success due to certain critical blindspots. It happens that failure is pre-installed into the service, regardless of the budget size and the efforts of the team.

In fact, if implemented inaccurately, it can lead to losses caused by the so-called “customer experience gap”.

The customer experience gap refers to the difference between the level of customer service that a company aims to provide and the actual level of service that customers experience. For example, if a company has a goal of providing excellent customer service, but customers frequently have negative experiences or report poor service, then there is a gap between the company's desired level of service and the actual level of service that customers are receiving. Various factors, such as inadequate business mindset, profit-driven corporate culture, inefficient processes, lack of customer-centricity or poor funding can cause this gap. Closing the customer experience gap is often a key focus for companies, as it can help to improve customer satisfaction and loyalty.

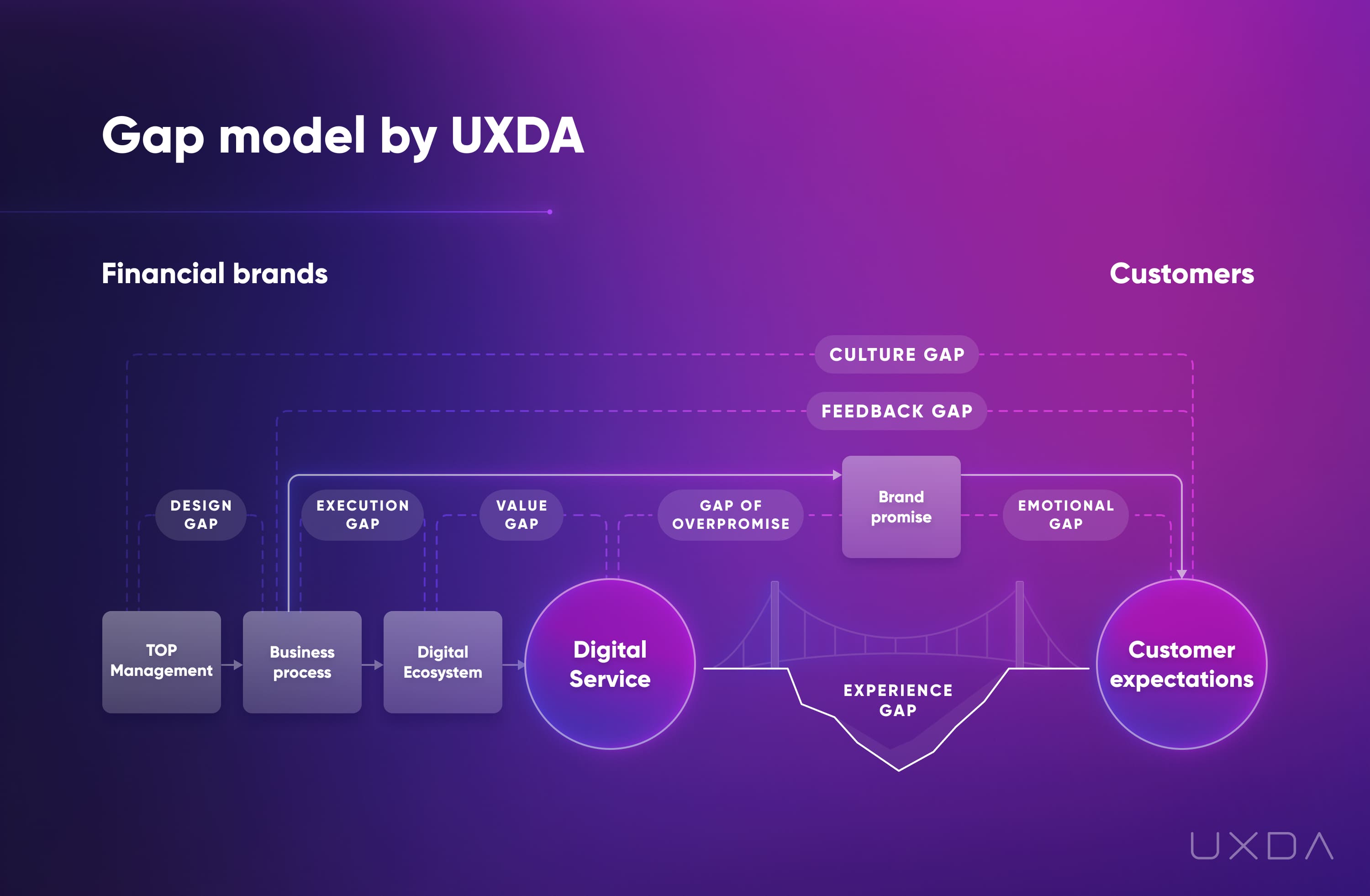

Banking customer experience Gap Model as a part of UXDA's Financial UX Design methodology

Download the Customer Experience Gap Model framework in PDF to share and discuss with your team.

A certain bank invested a few million dollars to improve its mobile banking app but it resulted in a decrease of overall customer satisfaction. The root cause of it was several internal experience gaps at different levels of the financial company that the team failed to spot and prevent. We need to identify and avoid these blindspots in time to protect the success of expensive, large-scale digitization projects.

Banking CX Efforts Can Fail Even With Huge Budgets

In the last decade, a huge amount of research has been carried out confirming the priority influence of customer experience on a company's market efficiency. If bad CX leads to multiple business problems, then positive CX increases referrals, retention rates and revenue, because 86% of customers are ready to pay more for a better customer experience, according to Oracle report.

It would seem that everything is simple - to see a significant increase in profits it's enough to provide the best customer experience. But in real practice, this is not that easy. 80% of CEOs believe they deliver a superior experience, while only 8% of customers agree with that, according to Bain & Company research.

The main reason for that can be explained through the “experience gap”. It is the negative difference between customers' expectations and the experience they get from a financial digital service. If the experience is significantly worse than expected, it can have many unpleasant consequences, like decreased customer loyalty, tons of negative reviews, and even customers who decide to leave the brand.

In most cases, the real experience gap is not recognized. It is hard for leaders and employees of the company to detect what exactly and why to improve, even if they feel that something is wrong. If something is not consciously realized, it is not possible to manage it.

Closing the customer experience gap is important for banks and other financial companies because it helps them to provide better service to their customers, which can lead to increased customer satisfaction and loyalty. Customers today have high expectations for their banking experience, and if a bank is unable to meet those expectations, they may be more likely to switch to a different institution. By bridging the customer experience gap, financial brands can differentiate themselves from their competitors and build stronger relationships with their customers. In addition, providing a seamless and consistent customer experience across all channels (e.g., online, mobile, in-person) can help banks to reduce operational costs and improve efficiency.

In general there are several steps that financial companies can do to close the customer experience gap:

1. Identify the root causes of the gap

The first step to bridging the customer experience gap is to identify the underlying causes of the gap. This should involve gathering feedback from customers, conducting surveys, and analyzing customer service data.

2. Develop a customer-centric strategy

Financial organizations should focus on developing a customer-centric strategy that is designed to address the needs and concerns of customers. This may involve creating a customer journey map to understand the customer experience and identify bottle-necks for improvement.

3. Invest in training and development

Providing customer service staff with the necessary training and development can help to improve the level of service that customers receive. This may involve training on customer service best practices, product knowledge, and communication skills.

4. Implement efficient processes

Inefficient processes can contribute to a negative customer experience. Banks can work to streamline processes and eliminate unnecessary steps to make it easier for customers to get the help they need.

5. Make it easy for customers to get in touch

Providing multiple channels for customers to get in touch with customer service can help to improve the overall customer experience. This may include phone, email, live chat, and social media.

6. Follow up with customers

After a customer has interacted with customer service, following up with them can help to ensure that their needs were met and any issues were resolved to their satisfaction. This can help to build trust and improve the customer experience.

7. Leverage technology

Technology can be used to improve the customer experience in a number of ways, such as by implementing self-service options or using AI chatbots to handle simple inquiries fast.

8. Foster a customer-centric banking culture

Creating a culture within the organization that puts customer in the center can help to ensure that all employees are focused on delivering a positive customer experience.

9. Measure and track progress

It is important for banks to measure and track progress towards closing the customer experience gap. This may involve collecting and analyzing customer feedback, conducting surveys, or tracking customer-centric key performance indicators such as NPS, CSI.

10. Continuously improve

Finally, banks should be proactive in seeking out opportunities to continuously improve the customer experience. This may involve soliciting feedback from customers, identifying new technologies or processes that could enhance the customer experience, and researching customer needs and concerns.

Real-Life Example: Customer Experience Gap Model in Action

To explain the way that the “experience gap” might cause trouble, I'd like to share a real-life example. Several years ago a quite known and respectable Central European bank embarked on a voluminous digital transformation journey. The bank's application had a rating of 3.5 and was outdated. In order to digitalize, improve the bank's image and the competitive chances in the growing digital market, the management intended to urgently create and launch a modern looking banking application. Therefore, the initial design and development period was 6 months.

Nevertheless, the bank spent three times as much time building the new application by themselves: 1 year and 8 months. This was a serious project not only in terms of time but also the budget invested.

However, the result did not live up to expectations at all. After the new application was released it decreased to 2.4 from the previous 3.5 and has kept dropping even a year after its first release as it did not improve, but significantly worsened the customer experience.

How could this happen if the bank did everything to improve the user experience and the whole team worked hard for almost two years?

In this case, there was an “experience gap”. Despite that dozens of the bank's top professionals have spent 20 months and half a million creating an improved product, it has failed to meet user expectations.

Though the real reason for customer dissatisfaction is the unconscious experience gap, often the financial companies tend to explain it by blaming external circumstances. Such as changes in the market, the activity of competitors, the emergence of innovations, changes in consumer patterns. Of course, there's objective truth in that, but a company capable of effectively adapting uses these factors for its growth, not as a scapegoat.

But the most important way how the effectiveness of adaptation can be measured is by how well the company's service meets or even exceeds the expectations of consumers.

Companies that are unaware of the gap between their service and customer expectations are unable to adapt.

In some cases, the company's actions even lead to broadening the experience gap to critical levels. This often leads to an alarming drop in demand for the company's products and services.

If we go back to the example, it seemed that management was confident about the success of the significant improvements made, and devoted large funds and efforts to advertising. The ads promoting the brand new modern, innovative, and user-friendly mobile app caused overestimated expectations among consumers that significantly exceeded the actual quality of the service. As a result, when the product was finally released, the customers were surprised to find out that their expectations are disappointed and that the new app is even worse than the old one. This led to a massive wave of negative reviews not only on the App Store and Google Play but also on social media. People were tweeting their struggles ironizing about the failed digitalization project of the bank.

Unawareness of the Gap is the Main Threat

Let's explore how the gap was formed between the digital service and user expectations, and why no one was able to prevent it. In fact, the biggest challenge is that these types of gaps are often not noticed in the organization. Their reasons are not obvious and are found at several levels of the organization at once. Moreover, their influence is so imperceptible that it leads to destructive consequences unexpectedly. In the end, no one understands what the reason is until the team faces the product failure in the market.

The main difficulty in bridging the gap is that the higher the hierarchy level, the higher the unawareness of the experience gap. In fact, at the top of the hierarchy, the root cause of the gap is usually found. The lower in the hierarchy, the more employees feel problems and gaps, but they often do not have the authority and ability to eliminate them, they are constrained by culture.

In this particular case, the support department received thousands of calls every day about the struggles caused by the new product but due to fragmented business processes, they weren't able to do anything about it.

Customer frustration grew even stronger. They faced issues that made it difficult to execute even the simplest everyday scenarios but the “support” they got from the bank employees was that they are not the only ones struggling and that currently, the bank is busy working on new features, instead of fixing the current ones.

What makes things complicated is the fact that the internal processes behind the experience gap are caused by the same mechanisms that have facilitated company survival and growth in the past. Since any organization has inertia, these mechanisms are supported by inner beliefs and values and create resistance to attempts to recognize and close the experience gap.

First of all, the gap should be addressed at the management level. Thus, the lower in the hierarchy, the farther from the leadership and the closer to clients, the more the gap is felt and recognized. Naturally, front-line workers will have the most data. They got it from the clients whose expectations are not being met.

The 7 Specific Types of Experience Gaps in Banking CX / UX

According to Forrester's research top challenges to delivering a good CX are internal struggles: the lack of a cohesive strategy across teams (48%) and silos of various CX operations and functions across the organization (38%). The main experience gap may be caused by blindspots in one or several of the seven levels (culture, feedback, execution, design, value, brand promise, emotional connection) in the financial organization.

1. The Culture Gap

The lack of customer-centricity at the level of culture prevents employees from bringing service closer to customer expectations and causes a "culture gap". The processes and activities that contribute to customer-centricity in a company with a "culture gap" will not have priority and resources will not be allocated to them.

2. The Feedback Gap

Lack of data about customer expectations and their experience with a product or service creates a "gap of feedback". Here, financial companies often even collect the data but it's not analyzed and no action is taken to improve the situation.

3. The Design Gap

Even if a customer-centered approach is a priority and a large amount of data about customer expectations is collected, there could still be a gap concerning the design competence and methodology. Having the right expertise in place allows to build a high-quality ecosystem of digital products that will provide the best possible service according to customer needs.

4. The Execution Gap

This gap is associated with poor design execution. If user-centered product design is not a priority, decisions and efforts to create the final product and service are of low quality and efficiency. This determines the company's ability to create competitive services and products in the digital age.

5. The Value Gap

The value gap can form if the design ecosystem is not in compliance with user expectations at the five levels of the Value pyramid: functionality, usability, aesthetics, status, mission.

6. Gap of Overpromise

As my example with the bank demonstrates, if a company aggressively promotes its service, promising something that the product is not able to provide, it will lead to even higher disappointment in user expectations. As a result, the negative assessment of the service could double since the advertising promises don't meet reality.

7. Emotional Gap

If brand communication is purely informational, focused on functional features, then an emotional connection with users can't be formed. Since humans make decisions based on emotions, building service value on an emotional basis has a positive effect on customer expectations and the end user experience.

Bridging the 7 Specific Types of Experience Gap in Banking

Each client unconsciously evaluates the service they receive according to their expectations.

By addressing each of these gaps with targeted strategies, financial companies can significantly enhance their digital customer experience. This comprehensive approach ensures that every aspect of the customer's interaction with the company is optimized—from the underlying culture to the emotional connections formed. Implementing these recommendations will not only bridge existing gaps but also position the organization for sustained success in a competitive market.

The emotions caused by the quality of user experience form the brand's reputation. In the modern world, digital channels have become the main “marketing” and PR of the brand. A negative experience with a mobile application can sabotage all the efforts of brand promotion even if it has a hundred-year history of serving clients and an excellent service on other channels.

Identifying gaps in the digital customer experience is the first step toward enhancing customer satisfaction and loyalty in the financial sector. The following are detailed recommendations for addressing each of the seven specific experience gaps: Culture Gap, Feedback Gap, Design Gap, Execution Gap, Value Gap, Overpromise Gap, and Emotional Gap.

1. Bridging the Culture Gap

When it comes to culture, the transformation begins with a change in the mindset of the top management, spreading this influence over the entire culture of the company and inner values. In particular, the customer-centered experience mindset could be implemented.

Leadership Commitment:

- Executive Sponsorship: Ensure that top management publicly commits to customer-centric values.

- Role Modeling: Leaders should demonstrate customer-focused behaviors in their daily actions.

Define Customer-Centric Values:

- Mission and Vision Alignment: Update the company's mission statement to reflect a commitment to customer satisfaction.

- Core Values: Incorporate customer-centricity into the organization's core values.

Employee Engagement:

- Training Programs: Implement training that emphasizes the importance of customer experience.

- Empower Employees: Encourage employees at all levels to make decisions that benefit the customer.

- Recognition Systems: Reward employees who exemplify customer-focused behaviors.

Cross-Department Collaboration:

- Break Down Silos: Promote collaboration between departments to ensure a unified approach to customer experience.

- Shared Goals: Establish common objectives related to customer satisfaction across all teams.

Continuous Communication:

- Internal Communications: Regularly share customer success stories and feedback within the organization.

- Open Forums: Create platforms for employees to discuss customer experience improvements.

Outcome: A unified organizational culture that prioritizes customer needs, leading to consistent and improved customer experiences.

2. Bridging the Feedback Gap

In our particular example with the bank, the first step to start bridging the gap would be to dive deep into the most common of complaints shared on social media and calls to the support department. These are the clients who are closest to the gap. In fact, they have more insight into fixing it, than the management, and are often eager to actively share their emotions and be heard. If a company is open enough and ready for critics, it can use this data to bridge the gap and improve agility.

Implement Robust Feedback Mechanisms:

- Multiple Channels: Offer various channels for feedback, such as surveys, in-app feedback forms, social media, and customer interviews.

- Ease of Use: Ensure that providing feedback is straightforward and user-friendly.

Systematic Data Collection and Analysis:

- Centralized Database: Use a Customer Relationship Management (CRM) system to collect and store feedback.

- Data Analytics Tools: Employ analytics to identify patterns, trends, and key areas for improvement.

Actionable Insights:

- Feedback Loop: Establish a process to convert feedback into actionable items.

- Prioritize Issues: Focus on issues that have the most significant impact on customer satisfaction.

Close the Loop with Customers:

- Acknowledgment: Thank customers for their feedback and inform them of any actions taken.

- Updates: Regularly update customers on improvements made based on their input.

Internal Sharing:

- Cross-Departmental Meetings: Share feedback insights with all relevant teams.

- Dashboards and Reports: Provide accessible reports that highlight key feedback metrics.

Outcome: Enhanced understanding of customer needs and expectations, leading to targeted improvements and increased customer satisfaction.

3. Bridging the Design Gap

To create a strategy for overcoming the execution gap through the integration of the design approach and design thinking Design Pyramid can be used. This framework determines five levels at which design integration will significantly increase the overall efficiency of the company: the process, the team, actions, results, and value.

Invest in UX/UI Expertise:

- Hire Qualified Professionals: Employ designers with expertise in user-centered design methodologies.

- Ongoing Training: Provide professional development opportunities for the design team.

Adopt a User-Centered Design Process:

- User Research: Begin projects with thorough research to understand user behaviors and needs.

- Persona Development: Create detailed user personas to guide design decisions.

- Usability Testing: Conduct regular testing with real users throughout the design process.

Implement Design Thinking:

- Empathize: Encourage designers to view problems from the user's perspective.

- Ideate and Prototype: Develop multiple solutions and iterate based on user feedback.

- Collaborative Workshops: Involve stakeholders from different departments in the design process.

Establish Design Standards:

- Design System: Create a cohesive design system with guidelines for components, typography, colors, and interactions.

- Accessibility Compliance: Ensure designs meet accessibility standards (e.g., WCAG).

Integrate Technology and Design:

- Cross-Functional Teams: Facilitate collaboration between designers and developers for seamless implementation.

- Stay Updated: Keep abreast of the latest design tools and technologies.

Outcome: High-quality, user-friendly digital products that meet or exceed customer expectations.

4. Bridging the Execution Gap

You need a proven design execution approach such as Financial UX design methodology with a step-by-step system for designing digital financial products that live up to customer expectations and are able to bridge the execution gap. This approach includes Design Thinking, BUP (brand, user, product) frame, and a wide range of UX design tools.

Streamline Processes:

- Project Management Methodologies: Adopt agile methodologies like Scrum or Kanban to enhance flexibility and responsiveness.

- Clear Roadmaps: Develop detailed project plans with timelines, milestones, and responsibilities.

Improve Communication:

- Regular Meetings: Hold daily stand-ups and regular check-ins among teams.

- Collaboration Tools: Use project management and communication tools (e.g., Jira, Slack) for transparency.

Enhance Skills and Resources:

- Training: Provide team members with training in the latest technologies and best practices.

- Resource Allocation: Ensure teams have the necessary tools and personnel to execute projects effectively.

Quality Assurance:

- Testing Protocols: Implement rigorous testing procedures at each stage of development.

- Code Reviews: Conduct regular code reviews to maintain quality standards.

Risk Management:

- Identify Risks Early: Proactively identify potential obstacles and develop mitigation strategies.

- Flexible Adaptation: Be prepared to adjust plans in response to changing circumstances.

Performance Metrics:

- Set KPIs: Establish clear Key Performance Indicators for project delivery and quality.

- Monitor Progress: Use dashboards to track progress against KPIs and adjust as needed.

Outcome: Efficient project execution leading to timely delivery of high-quality digital products.

5. Bridging the Value Gap

The Value pyramid helps to bridge the value gap. Creation of true value and benefit for the customers begins at the functionality level of the product and expands through delivering an exceptional usability; aesthetics - visual identity that WOWs; status - personalization for a specific audience of the product and, finally, a mission statement that builds a community around it.

Deliver Functional Excellence:

- Core Features: Ensure that all fundamental functionalities work reliably and efficiently.

- Continuous Improvement: Regularly update features based on user needs and technological advancements.

Enhance Usability:

- Simplify Interfaces: Design intuitive navigation and reduce complexity.

- Consistency: Maintain consistency across all platforms and devices.

Elevate Aesthetics:

- Visual Appeal: Invest in high-quality visual design that resonates with your target audience.

- Emotional Design: Use colors, images, and typography that evoke positive emotions.

Provide Status Value:

- Personalization: Offer customizable features that allow users to tailor their experience.

- Exclusive Features: Introduce premium features or services that enhance the user's status.

Inspire with Mission Value:

- Communicate Purpose: Clearly articulate the company's mission and how it benefits society.

- Social Responsibility: Engage in initiatives that demonstrate a commitment to social and environmental causes.

Customer Education:

- Onboarding: Provide guided tutorials and support to help users understand all features.

- Content Marketing: Offer valuable content that aligns with users' interests and needs.

Outcome: A product that delivers comprehensive value, fulfilling users' functional needs and higher-level aspirations.

6. Bridging the Gap of Overpromise

The customers of the digital age demand transparency, care, honesty and open communication. Due to the network effect, it has become nearly impossible to sell a bad quality product because everyone can post negative feedback on social media. This damages customer trust deeply. So, it's crucial to make promises that can be not only fulfilled but even over delivered on.

Align Marketing with Reality:

- Truthful Advertising: Ensure all marketing messages accurately reflect product capabilities.

- Set Realistic Expectations: Avoid exaggerations and be transparent about limitations.

Interdepartmental Collaboration:

- Marketing and Product Sync: Facilitate regular meetings between marketing and product teams.

- Shared Documentation: Provide marketing teams with up-to-date product information and features.

Customer Communication:

- Transparency: Inform customers about any changes or issues proactively.

- Manage Expectations: Clearly communicate timelines for new features or updates.

Monitor Customer Feedback:

- Reputation Management: Keep track of customer reviews and address concerns promptly.

- Feedback to Marketing: Use customer insights to refine marketing messages.

Underpromise and Overdeliver:

- Exceed Expectations: Aim to deliver more value than what is promised in marketing materials.

Outcome: Enhanced customer trust and satisfaction due to consistent and honest communication.

7. Bridging the Emotional Gap

Empathy and care toward customers is more important than ever. Building an emotional connection between the brand and its clients is essential to ensure long term loyalty and demand. This connection is built through all of the previously covered stages - the right mindset that puts the customers first; collecting feedback and making improvements based on it; using the right tools and methodology to create product design and the ecosystem; creating true value and benefit, and, finally, by being honest and over delivering on promises.

Build Emotional Connections:

- Storytelling: Use narratives that resonate with customers' values and aspirations.

- Brand Personality: Develop a relatable and consistent brand voice.

Personalize Interactions:

- Customer Segmentation: Tailor communications and offerings based on customer profiles.

- Dynamic Content: Use personalization in digital channels to reflect individual preferences.

Engage Customers:

- Community Building: Create forums, events, or social media groups where customers can interact.

- Interactive Campaigns: Launch initiatives that encourage user participation.

Empathetic Customer Service:

- Training: Train customer-facing staff in empathy and active listening.

- Prompt Support: Offer timely and compassionate assistance across all channels.

Celebrate Milestones:

- Acknowledgment: Recognize customer anniversaries, birthdays, or significant achievements.

- Rewards Programs: Implement loyalty programs that appreciate customer engagement.

Social Responsibility and Ethics:

- Cause Alignment: Support causes that are important to your customers.

- Ethical Practices: Ensure all business practices reflect integrity and respect.

Outcome: Stronger emotional bonds with customers, leading to increased loyalty and advocacy.

Find out how UXDA methodology bridge the gap

Pathway Towards Becoming a Beloved Financial Brand

This covers the seven main experience gaps that can sabotage the creation of digital financial products, as well as the seven bridges that can help to avoid and solve them. The financial brands aware of these banking CX blindspots can instantly gain a significant market advantage of their competitors who are still in the blind zone.

In particular, overcoming the customer experience gap in banking can help financial company to grow profit through several aspects:

1. Reduced customer churn

By providing a better customer experience, banks can reduce the number of customers who switch to a different institution, which can help to increase profit by retaining customers and avoiding the cost of acquiring new ones.

2. Increased customer acquisition

Providing an exceptional customer experience can also attract new customers to the bank, which can help to increase profit by expanding the customer base.

3. Increased customer lifetime value

Satisfied customers are more likely to engage in more profitable behaviors, such as using more products and services or referring others to the bank. This can help to increase the overall lifetime value of each customer.

4. Increased cross-selling

By understanding customer needs and preferences, banks can better tailor their products and services to meet those needs, which can lead to increased cross-selling and upselling opportunities.

5. Increased efficiency

By improving the customer experience, banks can also increase efficiency by reducing the time and resources needed to resolve customer issues or inquiries. This can lead to increased profit by allowing banks to serve more customers in the same amount of time.

6. Increased customer advocacy

Satisfied customers are also more likely to recommend the bank to others, which can help to increase profit through word-of-mouth advertising.

7. Enhanced brand image

Providing a good customer experience can help to improve the bank's brand reputation and image, which can lead to increased profit by attracting new customers and building trust with existing ones.

8. Reduced operational costs

Providing a seamless and consistent customer experience across all channels can help banks to streamline their processes and reduce operational costs, which can lead to increased profit.

9. Increased customer loyalty

Providing a good customer experience can also increase customer loyalty, which can lead to increased profit through repeat business and positive word-of-mouth advertising.

10. Increased market share

By providing a better customer experience than competitors, banks can increase their market share and capture a larger share of the overall banking market, which can lead to increased profit.

Awareness of the customer experience gap in banking alone makes a huge difference, but awareness combined with action leads to a long term success in becoming a greatly demanded and loved financial brand.

Detect Digital Customer Experience Gaps in Your Company

This survey is designed to help financial companies identify gaps in their digital customer experience. By assessing various aspects of your organization's culture, processes, and customer interactions, you can pinpoint areas for improvement and develop strategies to enhance customer satisfaction and loyalty.

Instructions: For each statement below, please indicate your level of agreement based on the following scale:

1 - Strongly Disagree

2 - Disagree

3 - Neutral

4 - Agree

5 - Strongly Agree

Scores 4 and 5 indicate strengths in that area.

Scores 1 and 2 suggest potential gaps that need addressing.

Section 1: Culture Gap

Purpose: Assess the level of customer-centricity within your organization's culture.

- Our leadership emphasizes the importance of customer satisfaction in all business decisions.

- Employees at all levels prioritize customer needs over internal metrics.

- We foster a culture that encourages innovation to improve customer experience.

- Customer-centric values are embedded in our company's mission and values.

- Resources are primary allocated to initiatives that enhance customer experience.

Section 2: Feedback Gap

Purpose: Evaluate how effectively your organization collects and utilizes customer feedback.

- We regularly collect customer feedback through surveys, interviews, or focus groups.

- Customer feedback is systematically analyzed and shared across departments.

- Action plans are developed based on customer feedback to improve services.

- We have easy-to-use channels for customers to provide feedback or report issues.

- Feedback from customers directly influences our product development and service improvements.

Section 3: Design Gap

Purpose: Determine the effectiveness of your digital product design and UX methodologies.

- Our digital products are designed using user-centered design principles.

- We involve actual users during the design and testing phases of product development.

- Our design team has the expertise and tools needed to create high-quality user experiences.

- Usability testing is a standard part of our product development process.

- We have a clear design strategy that aligns with our brand and user expectations.

Section 4: Execution Gap

Purpose: Assess the quality and efficiency of executing design and development projects.

- Projects are delivered on time and meet the defined quality standards.

- There is effective collaboration between design, development, and marketing teams.

- We have efficient UX tools and customer-centered processes in place to execute digital initiatives.

- Our team can quickly adapt to changes in project scope or market demands.

- We conduct regular reviews to improve our execution processes.

Section 5: Value Gap

Purpose: Evaluate whether your products deliver value across all levels of the Value Pyramid.

- Our digital products fulfill the basic functional needs of our customers effectively.

- Users find our digital platforms intuitive and easy to navigate.

- The UX/UI design of our products enhances user engagement and satisfaction.

- Our products offer features that align with the needs, lifestyles, and aspirations of our target audience.

- We communicate a clear mission that resonates with our customers and inspires them.

Section 6: Overpromise Gap

Purpose: Check if there's alignment between marketing promises and actual customer experience.

- Our marketing accurately reflects the capabilities of our products and services.

- Customers feel that our digital products meet or exceed their expectations.

- We avoid making unrealistic promises in our advertising campaigns.

- Marketing and product teams collaborate to ensure consistent messaging.

- We monitor customer satisfaction to ensure our promises align with their experiences.

Section 7: Emotional Gap

Purpose: Assess the emotional connection between your brand and your customers.

- Our brand messaging evokes positive emotions in our customers.

- Customers feel a personal connection with our brand.

- We engage with customers on an emotional level, not just transactional.

- Our customer service interactions are empathetic and personalized.

- We foster a community where customers feel valued and connected.

By completing this survey, you will gain insights into areas where your organization excels and areas that may require improvement to enhance your digital customer experience. Analyzing the results can help you develop targeted strategies to close these gaps, leading to improved customer satisfaction, loyalty, and business performance.

Next Steps

- Share Results: Distribute the survey findings with key stakeholders and teams.

- Develop Action Plans: Create specific strategies to address identified gaps.

- Monitor Progress: Set up regular check-ins to assess improvements over time.

- Foster a Customer-Centric Culture: Encourage all employees to prioritize customer experience in their roles.

Get UXDA Research-Based White Paper "How to Win the Hearts of Digital Customers":

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedin