We are living in a very competitive age. There are all kinds of digital financial services to choose from, and plenty of new ones enter the market every year. Customers are overwhelmed with the choices, and their expectations are constantly rising. For many entrepreneurs, this turns out to be a dead end, leading their businesses to bankruptcy. Meanwhile, there are finance companies that use it as an opportunity to conquer the market. Their financial solutions are successful, demanded and loved. Their customers are loyal and eager to recommend the service to their friends. What's their secret?

Digital Financial Services Have to Help People

Digital financial service success is directly dependent on its ability to ease users’ daily lives and solve their problems. If the product does not live up to user expectations, they will seek another alternative.

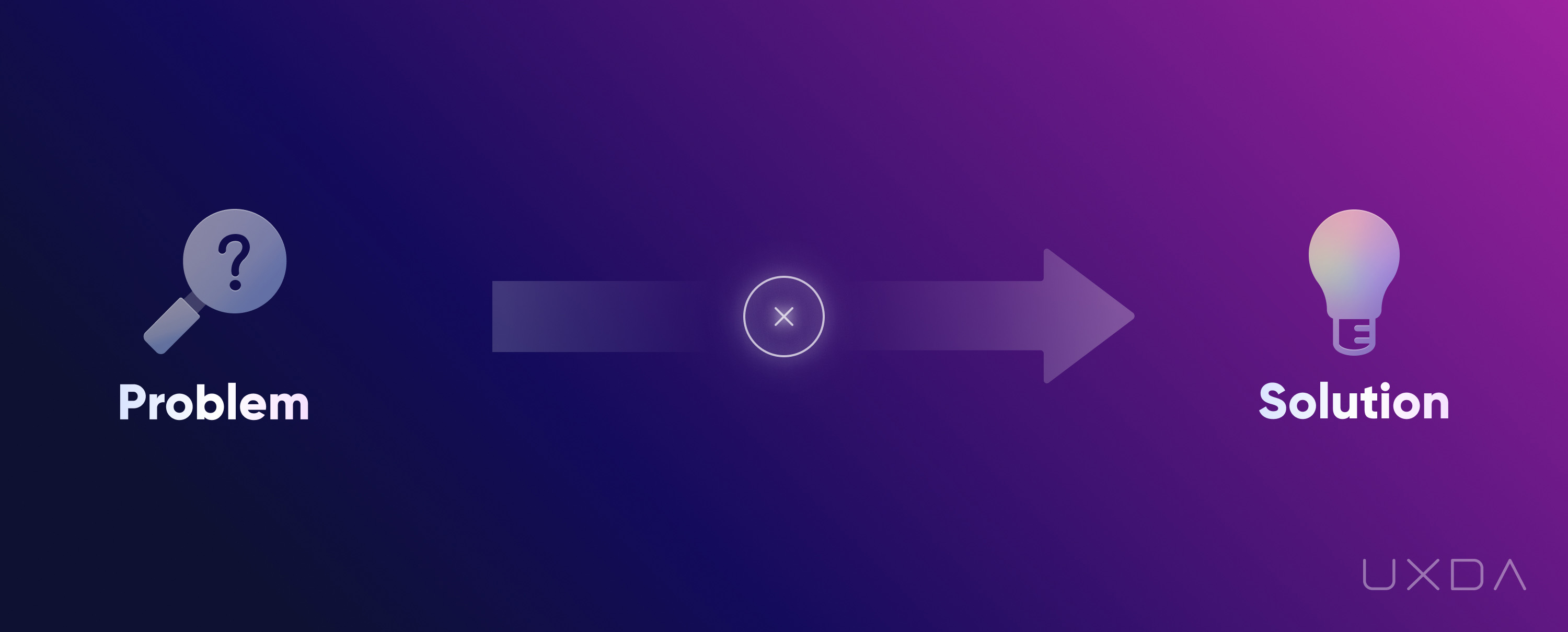

There's a common faulty belief among many entrepreneurs. They are certain that it's enough to understand the user's problem in order to create a product that will solve it. Have you ever thought that way? Unfortunately, it's not that easy. There's no one straight way right from the problem to the solution.

This mistake ruins thousands of new products and businesses every year. Offering a solution for a specific problem is not enough to ensure customer demand.

The confusing thing is that it all starts with coming up with a good solution to an important problem. But, between the problem and the solution, there are three crucial conditions that differentiate whether or not a product will be a success.

Problem-Solution Cycle Meets Financial Service Design

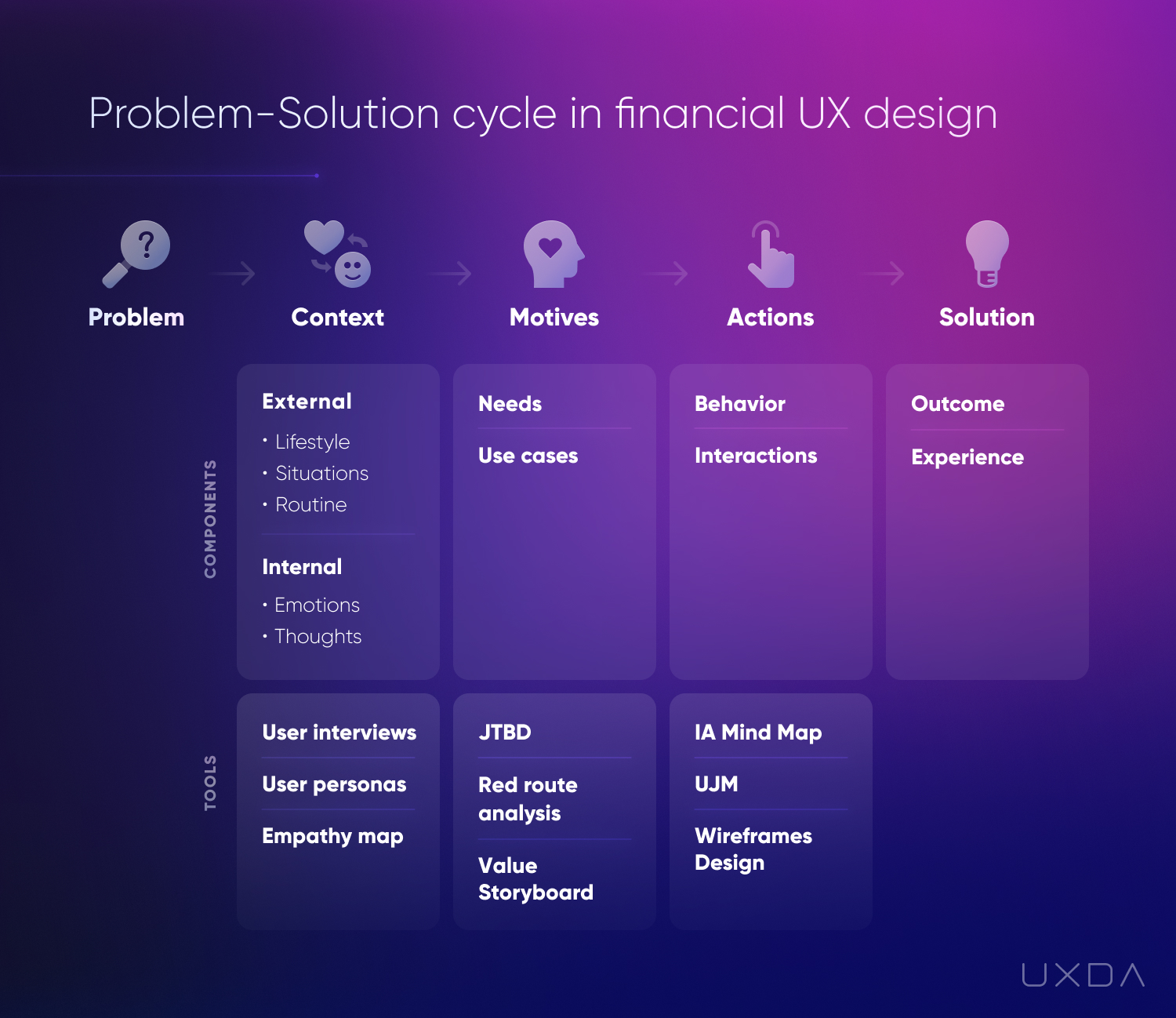

To understand what these three conditions are, we need to explore the problem-solution cycle from the human perspective. It's an approach to defining a problem and finding a solution through three conditions that start with the context that defines the motives that then lead to actions. At each point, we use specific tools that reveal the process and give us an idea of exactly how the financial service should work.

Context

First of all, a person who is facing a problem has a context. There is an external context, for example, the situation in which the problem arose, the routine in which a person operates and the lifestyle of the person in general. There is also an internal context such as emotions, thoughts and hopes.

To identify the external context, we collect information about the potential users of the digital financial service. We create a user profile that describes the lifestyle and habits of the user persona.

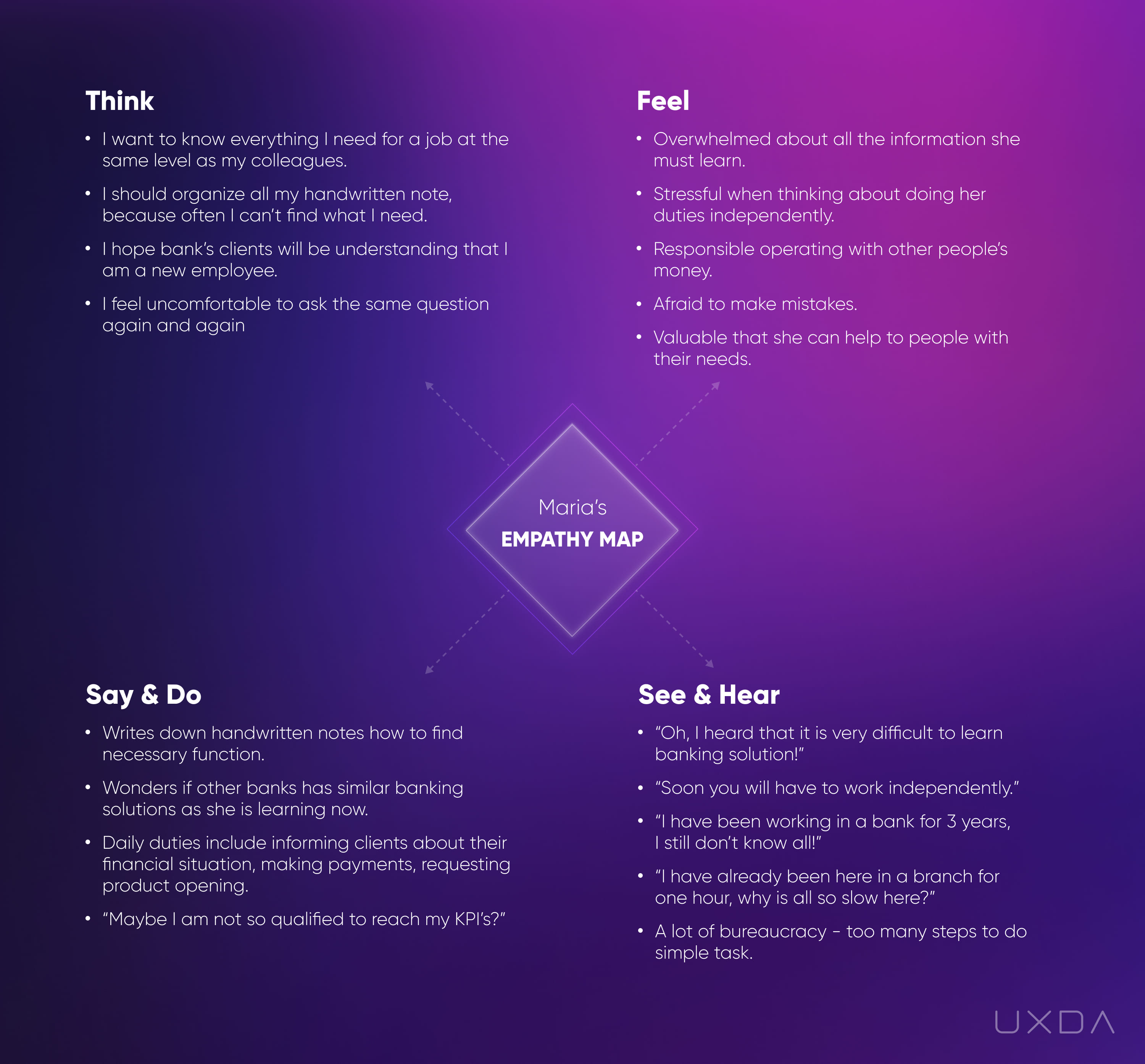

Then, an Empathy map is created to uncover the deepest understanding of the internal context. A look at the future banking product from the point of view of the user allows us to better understand the limitations and/or opportunities associated with the product use context. For example, a product user Maria's empathy map:

There are many banking products on the market that lack demand. The finance companies have invested a lot of money and time resources in creating them. They based the solutions on a problem, but the customers refuse to use their financial services. Why? Because such banks and finance institutions have not taken into account the expectations of the users.

And there is no way to research user expectations without investigating both the internal and external user contexts. Truth be told, if you do not get to know your user's habits, lifestyle, environment, emotions and cognitions, you cannot understand how your product can help solve their daily tasks and problems, and it will be impossible to create a successful product.

Motive

The identified context determines the person's expectations in searching for a solution to the problem─how he/she perceives this problem, where he/she will look for the solution, and how he/she will evaluate the effectiveness and quality of it. This defines the motive for using the exact banking product or financial service. In fact, this is the job for which users hire the product.

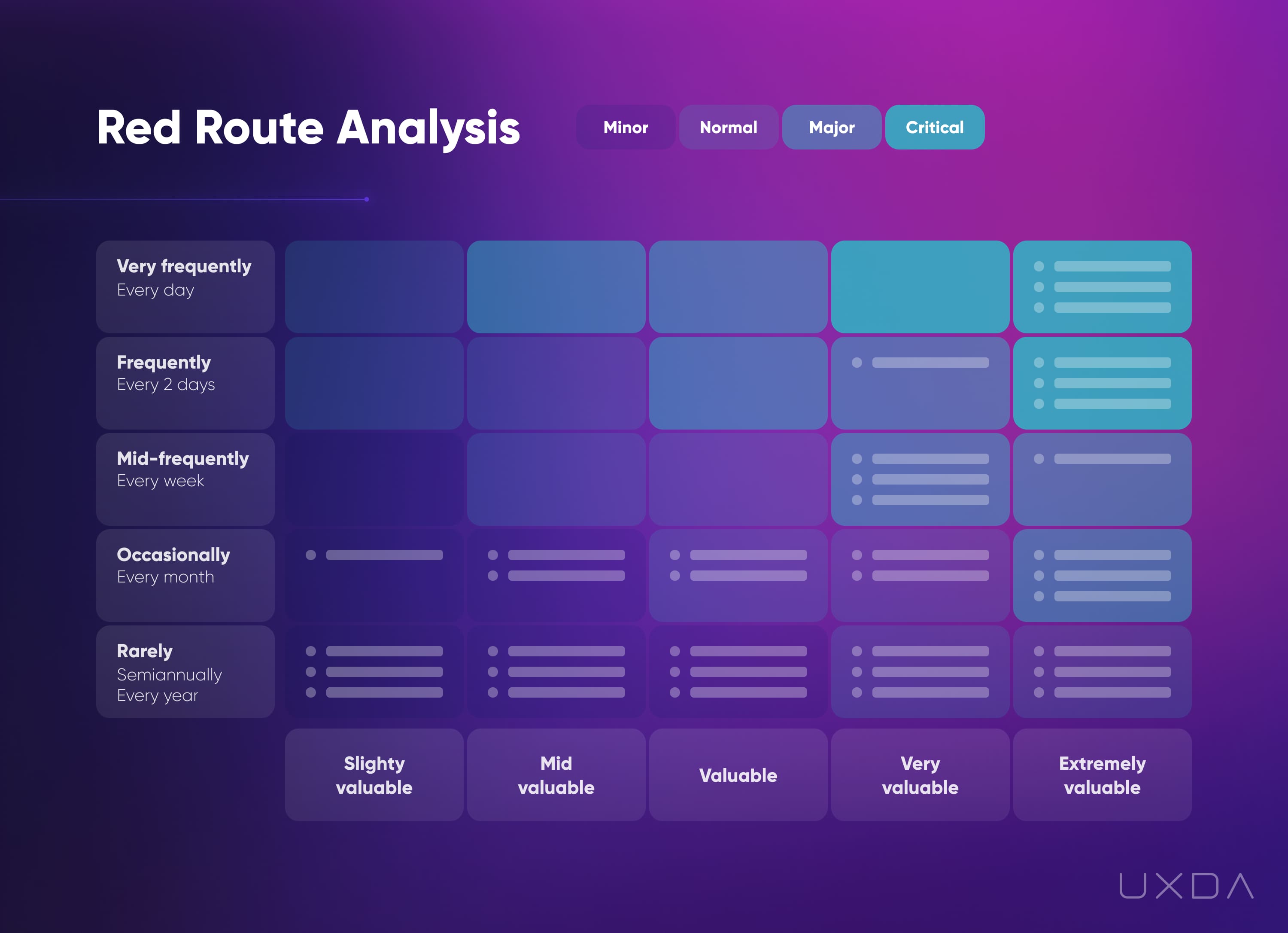

We can specify this job using the Jobs To Be Done framework (JTBD), and set the key priorities through the Red Route Analysis. We need to look deep enough to find the true motives that affect the actions of the user and his/her mental model. This is not something abstract; on the contrary, it's seeking concrete solutions for very specific tasks that will allow us to bring the conceptual model of the product in line with the mental model of the user.

There are many who are certain it's enough just using the JTBD framework. Though it's better than nothing, we believe the most effective way to utilize the full potential of the JTBD framework is to define the scenarios based on the internal and external context of the user.

Actions

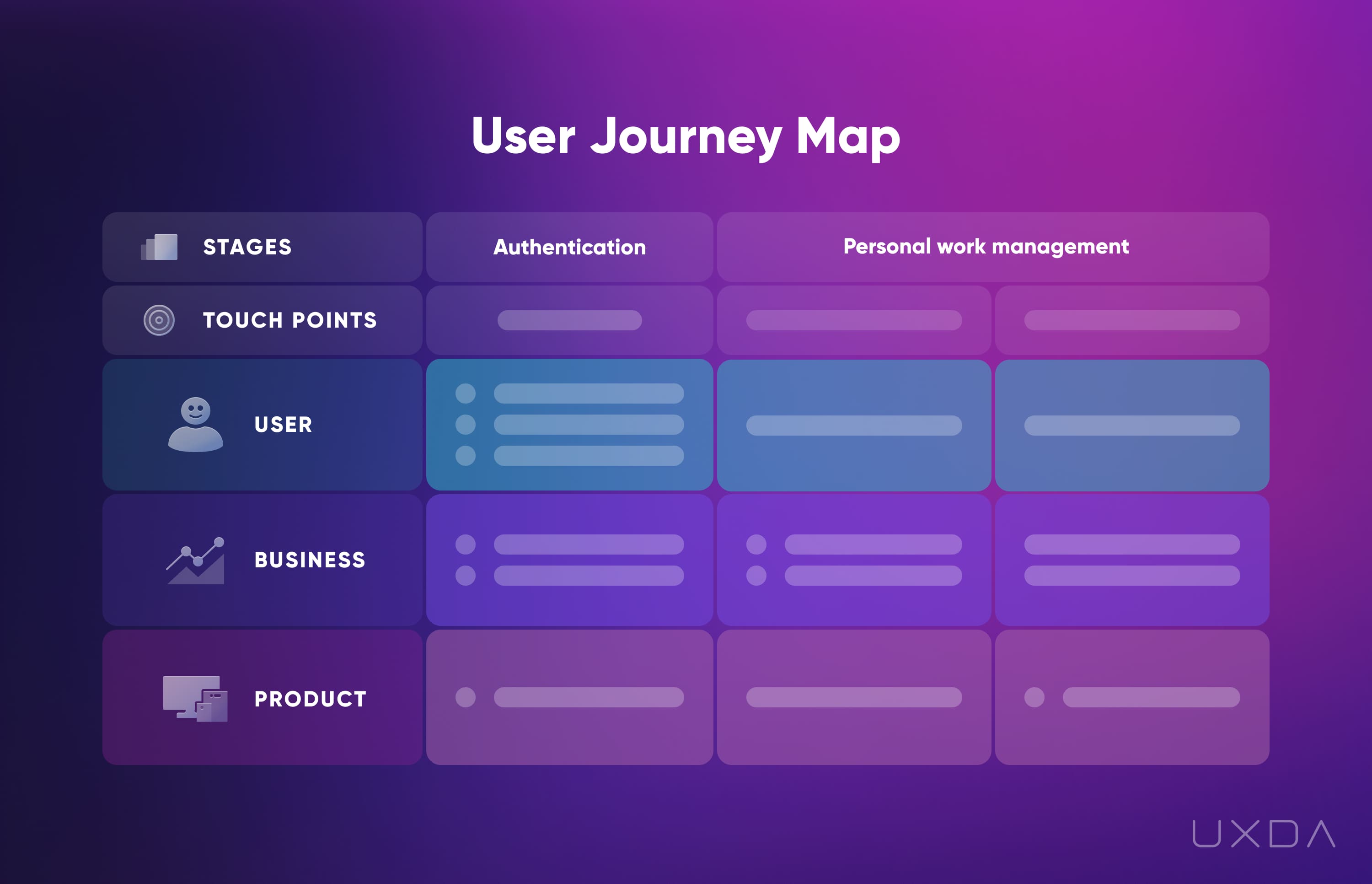

Next, the user takes action to achieve the needed solution. He/she uses the product and interacts with it. Our task is to ensure that the product provides the user with a clear, enjoyable and effective solution to their initial problem.

This is where the User Journey Map (UJM), user flow map, wireframes, UI design and testing come in as user experience design (UX) tools.

Problem-Solution for a Financial Service Design in Practice

Now that we have guided you through the theory, we'd like to offer a practical example for you to better understand this model which helps to design banking user experience.

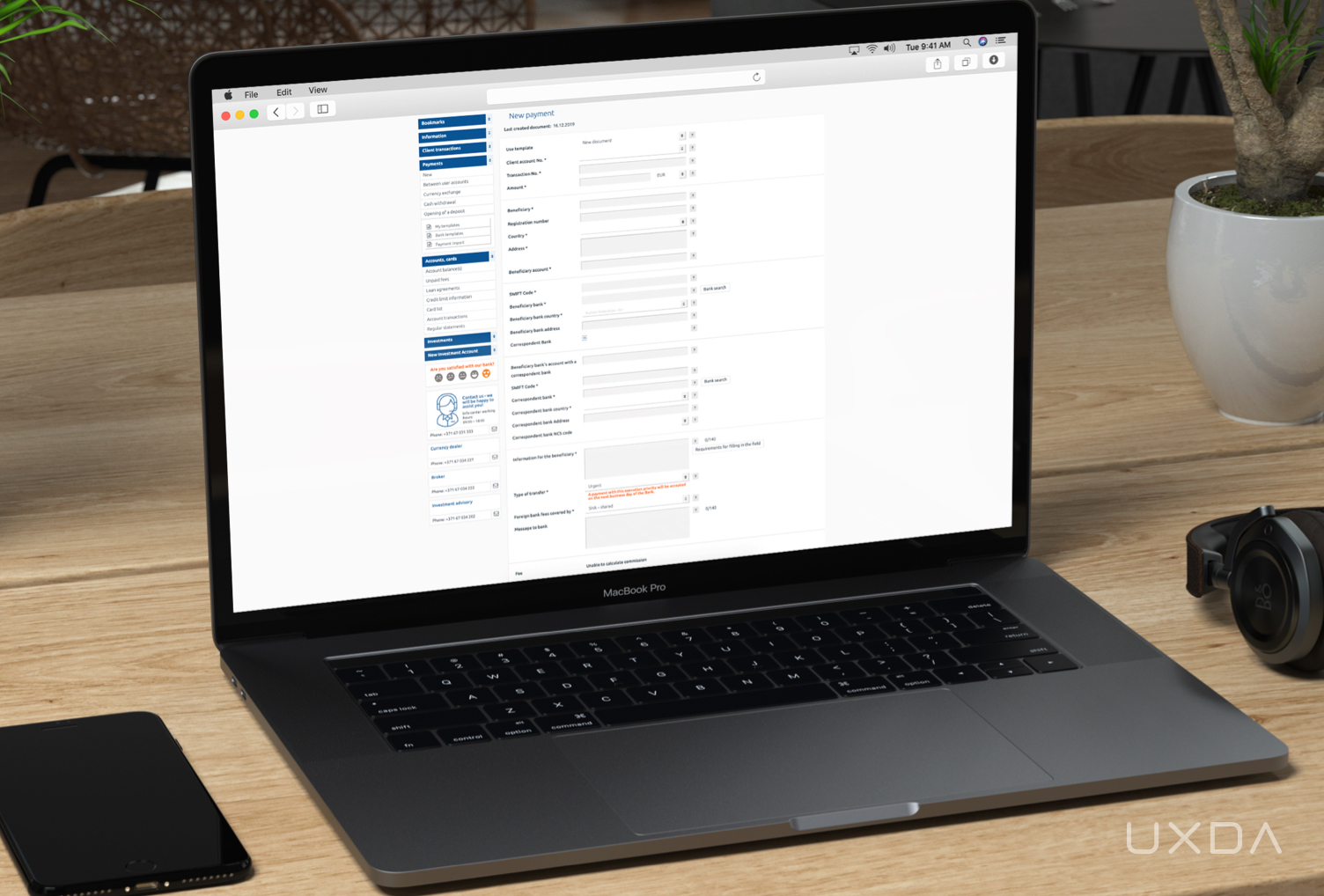

International transfers can be a major headache. The problem or challenge here is sending money to someone abroad. Every traditional bank offers a straightforward solution─wire transfer. All you need to do is fill in a long and difficult form that requires specific information about your recipient.

A screenshot from a standard international transfer form from a European bank.

So, at first glance, the provided solution seems to resolve the previously defined problem. But, when we ask users about it, we will discover that they feel frustrated and dissatisfied because, when you ask a recipient abroad about the needed data, they usually don't even know where to get it and what it is. In addition, the transfer itself takes days, or even weeks, and the user is charged an unreasonably high fee for such banking service.

This leaves millions of people feeling angry, and even threatened, because the usage context has not been taken into account.

But, what could happen if we implement the problem-solution cycle described above? We would find that usually personal international transfer is requested ASAP because some of the customer’s relatives or friends need immediate financial help due to extraordinary circumstances.

They often don't have the time and knowledge to search for the complex data requested on the wire transfer banking form. Also, as it comes with unexpected events and troubles that may happen in life, the whole process is led by stressful emotions that make the lengthy procedure even more painful.

The main motive of the customer is to collect data on the recipient and send money to them in an easy, fast and cost-effective manner. What if we offer to make the transfer by entering only the recipient’s account number instead of all the complex data?

This is exactly what Transferwise provides─a P2P international transfer service. Their fees are surprisingly low, and it's clear that their solution is based on a thorough analysis of the user’s context, motives and actions. The result speaks for itself─in 8 years, the Transferwise community has grown to more than 6 million people, sending £4 billion abroad every month. That’s a savings of £1 billion a year compared to conducting these transactions through local banks.

Takeaway

In financial user experience methodology, to design demanded digital products that will be loved by the customers, we start with the problem. To clearly define the problem and the tasks, we explore the problem-solution cycle impact on banking user experience by creating user personas and defining their Jobs To Be Done. Throughout this UX process, we crystallize the context in which the problem takes place, the motives of the users that dictate the actions and the people it will take to apply the right solution. During this process, Financial UX design methodology including such UX tools as an Empathy map, Red Route Map, UJM, user flows, wireframes, UI design and testing are used.

This article can be used as a “cheat sheet” for finance companies in designing innovative financial services that can conquer the market amid the growing competition.

Get UXDA Research-Based White Paper "How to Win the Hearts of Digital Customers":

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedin