In the evolution of retail banking, a significant shift is underway, pressing modern banks to move beyond the traditional sales-driven mindset to embrace the humanization of finance. This transition is not just a change in strategy but a profound transformation in how banks interact with their customers, design products, and measure success.

Huge budgets are spent on promoting products that users do not need, and that are not easy and pleasant to use. Product designers and user experience specialists often work under marketing departments in retail banks and become hostages to the race for profit. Unfortunately, a sales-driven strategy, mindset and culture ruin the banks' digital transformation and retail banking customer experience. Because in the world of digital products, profits and success await those who do exactly the opposite.

Why “sales-driven mindset” can ruin retail banking customer experience

In this article, you will find important topic that arise after we published Purpose-Driven Mindset article. We will explain exactly what we mean by "Sales-Driven Mindset / Marketing Mindset / Profit-Driven Mindset" and why we believe it completely ruins the customer experience in digital banking and leads to financial losses in the long run.

Let’s start from considering two opposite types of companies:

"Sales" mindset

The first company is aimed at increasing sales and profit in any way possible. To do this, the company evaluates every action in order to maximize profitability and reduce costs. From one side, it knocks out discounts from vendors and reduces staff costs. From the other side, the company does everything to increase sales by imposing products on every living soul the sales agents can reach. Salespeople have targets set so high that they're ready to use any kind of argument just to secure a sale.

The whole strategy of this company is strictly scheduled, their main goal get the most resources for themselves to ensure a maximum income for shareholders.

Therefore, any actions are evaluated in terms of potential returns and risks. And, in the case of losses, the guilty are severely punished. That’s why employees are afraid to take responsibility and prefer to dump it on expensive consultants. At the end of the day, people fear for their positions, and departments fear for their budget limits.

Such a company views the world as something dangerous... competitive. Executives perceive business like a war. Cunning and strength are qualities needed to win a piece of cake from the world. But, after they do, they need more effort to protect it. All data, all processes, and all actions are classified. As a result, communication and decision-making are slowed down so the digital product design, development, and improvement are stretched out for years. And, unfortunately, often customers become a bargaining chip in this war.

"Purpose" mindset

However, there is also an opposite type of company - the kind that views the world as a space of opportunities filled with potential friends, those to whom this company wants to provide help and some benefit.

Instead of focusing on themselves, this type of company desires to deliver the maximum value to the world, thus improving it for the better.

It does not mean such a company does not care about profit. Profit, to them, is an important resource that allows an increase in the amount of value created. But, profit is not the meaning of existence; it is merely a consequence directly proportional to the level of benefit created.

Such a company is very selective in its activities and values; it does not clutch for the sake of money in any of its work. Instead, it is focused on a long-term strategy and often refuses unethical offers despite possible profitability.

This company does not perceive employees as costs but rather as providers of exceptional customer service. The management not only welcomes and encourages their employees’ initiative but also considers this the only development path. That’s why no one is afraid to take responsibility and show initiative. Mistakes sometimes occur but are carefully studied to increase the adaptability of the company. Everything is done to raise and manifest the potential of its employees.

There is no multi-level hierarchy or internal power struggle, as employees are united around the company's mission, in which they strongly believe. And, instead of a direct sales department, there is a quality department to improve the customer experience.

Actions are discussed openly, and decisions are made quickly. Here, everything is questioned in search of more effective solutions. Instead of protection, what is fostered is openness, flexibility and the search for growth points aimed at increasing value for the customer.

Which company will customers and employees choose?

What do you think? Which of these companies is more likely to succeed in the modern digital world? Which is more adaptive and effective from a digital age perspective? Which is able to win the hearts of consumers and gain the most powerful support on social networks? Which will survive the dramatic changes caused by the rapid development of technology? Whose employees will walk through fire for the sake of their company?

These companies are opposed in their strategy, in their modus operandi, in their priorities. The massive emergence of companies of the first type was caused by the market conditions of the industrial age. It was an authentic form of business that met the requirements of that time, and required an aggressive “Sales-Driven Mindset.”

The tectonic switch to digital technology has fundamentally disrupted the market, user behavior and, accordingly, business requirements. In leading companies of the digital age, we see radically opposed values and human-centered culture based on a “Purpose-Driven Mindset.”

But, is it possible for companies of the first type to move to the next-gen level simply by copying the human-centered modus operandi of new-century companies by implementing Agile, CX, UX, Design Thinking, etc.? Evaluating the products of such companies, we often see cosmetic improvements that do not create a qualitative improvement in customer experience. They are still focusing on sales more than on customer satisfaction. Obviously, successful digital transformation requires a cultural shift in the organization’s mindset and product design approach.

We see that the only way to transform such a company and move it into the digital age is through a change in mindset and values. This requires the entire company to implement a new way of perceiving the world and the company’s place in it.

How does one do this? Check this out to explore how to create a customer-centered banking culture and get some tips, but anyway let's discuss further.

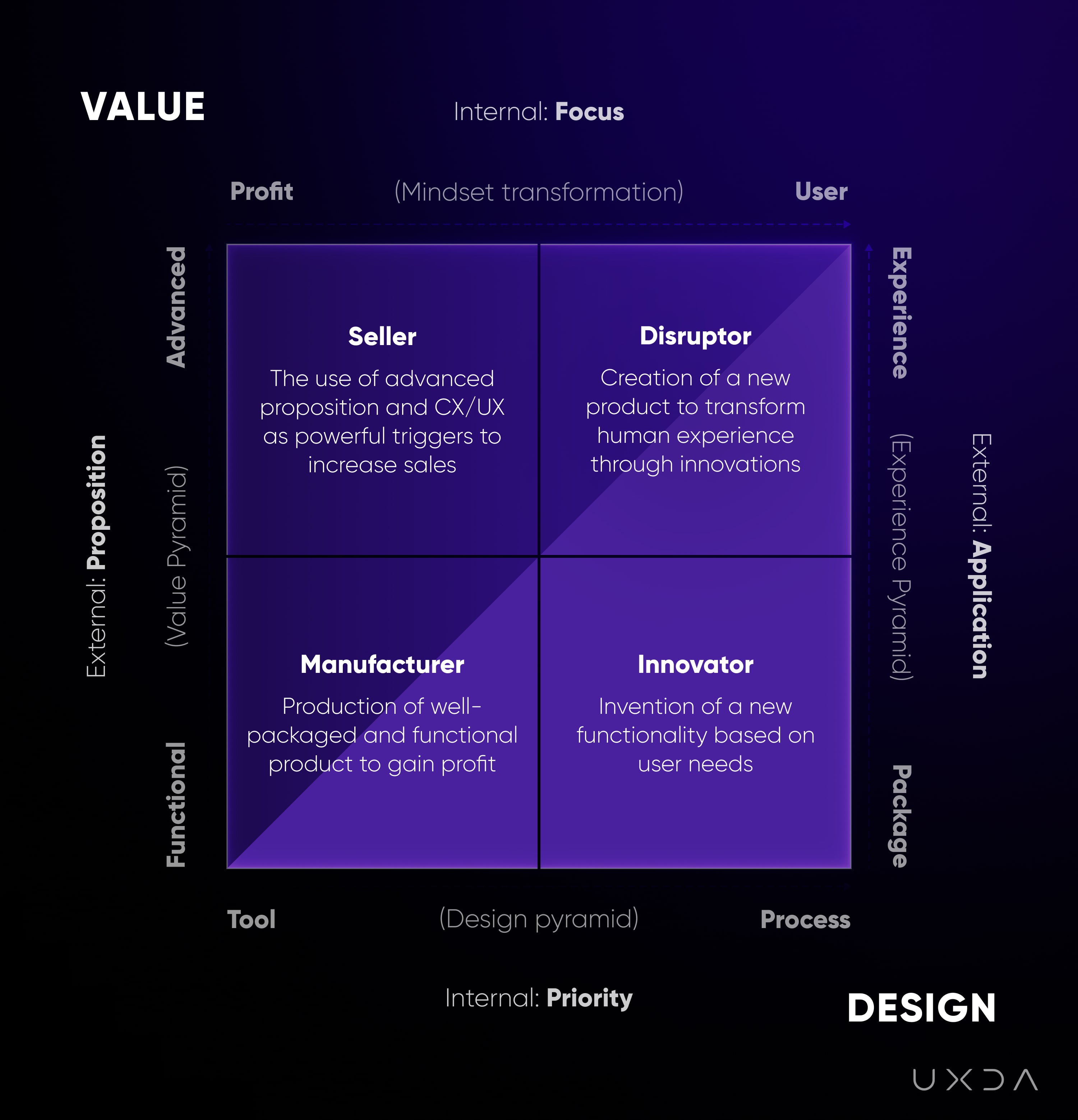

Change the sales-driven mindset to humanize finance

It is really important to clearly understand what we mean by "sales" or “marketing” as a mindset. Here we are talking about differences in two mindsets that are not directly associated with the terms “marketing” or “customer experience.” We do not want to confuse people by using the word “marketing” in this case. You can label this previous industrial century mindset as “profit-driven,” “sales-driven,” “package-centered”, "industrial age" mindset or something else because it is not about naming, it’s about the meaning behind the idea of differences.

The downfall of a sales-driven business mindset

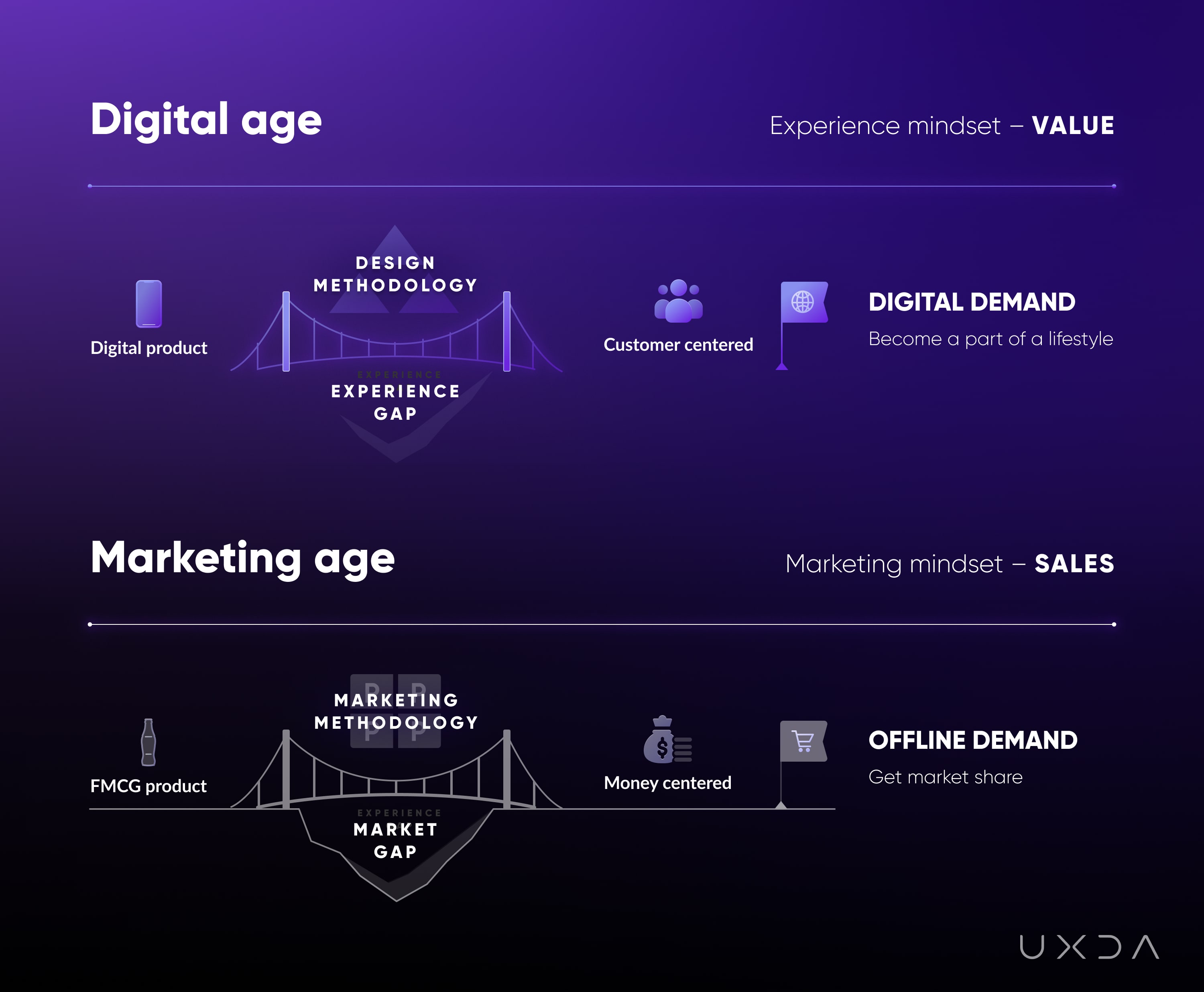

The thing is that we believe the modern digital business is no longer about selling priority. The term “marketing” evolved from its original meaning, which literally referred to going to market with goods for sale. This meant a direct way of thinking and perceiving things that was established in the previous age as a result of the industrial revolution. In general, it helped to stimulate the consumption of a billion similar FMCGs (fast moving consumer goods).

At the beginning, when the competition was not strong, it was enough to simply inform consumers about new products through advertising. Rising competition resulted in such techniques as positioning, brand essence and unique selling proposals needed to explore the differences and benefits of a particular offer. But, in real life, there is not that much difference between two washing powders, right? Some people say: "they simply colored some granules in blue and claimed it works better".

The majority of marketing research didn't try to find a need for the new product, but, instead, searched for the trigger to raise sales of the existing one. Why? Because it is straightforward business thinking oriented toward sales, which worked really well during the previous age.

The problem is that it no longer works in the digital age. There are tectonic shifts in the business paradigm because of changes in consumption values. Consumers change their behaviors and decision-making processes due to the digital environment, and business should adapt to it by changing its values as well. We already see a big difference in the capitalization of traditional and digital companies.

The traditional 4P marketing framework of Product, Price, Place, Promotion has been foundational in shaping successful brand strategies for almost a century, addressing the challenges of competitive markets, distribution barriers, and costly advertising to sell FMCG products effectively. However, with 87% of shoppers now beginning their purchase journey on digital channels, as per Salesforce research, the rise of global digitalization has significantly altered consumer behavior, necessitating a shift in marketing strategies for brands.

In the digital age, particularly within the financial services sector, the effectiveness of a brand hinges not on advertising, but on how well its digital products integrate into and enhance the customer's lifestyle and experiences through design. As a result, the 4P model has evolved to prioritize Purpose, Process, Platform, People—focusing on creating deep, meaningful connections with customers digitally, marking a pivotal strategy for success in the modern landscape, including conservative fields like finance.

Explore how traditional 4P (Product, Price, Place, Promotion) changes to digital 4P (Purpose, Process, Platform, People).

Embracing a human-centered approach through emotional product design

The digital age demands a reevaluation of a sales-driven mindset. Modern customers seek more than just financial transactions; they desire meaningful interactions, personalized services, and products that genuinely add value to their lives. This shift towards humanizing finance involves adopting a customer-centric approach, where products and services are designed with the customer's best interest at heart. It means recognizing customers as individuals with unique needs, preferences, and emotions, and creating digital experiences that resonate on a personal level.

User experience (UX) design principles play a crucial role in this transformation. By emphasizing empathy, usability, and emotional engagement, banks can create digital products that not only meet the functional needs of customers but also connect with them on an emotional level. Such an approach not only enhances customer satisfaction but also fosters loyalty and advocacy, which are vital in the competitive retail banking landscape.

For example, UXDA's Product Value Pyramid adapts Maslow's hierarchy of needs to the financial product market, outlining a framework that progresses from basic functionality to fulfilling users' higher aspirations, mirroring human needs development. This pyramid emphasizes the necessity for financial services to evolve beyond mere functional value to embrace usability, aesthetics, status, and ultimately, brand mission, in order to connect deeply with customers' human nature in a competitive environment.

Incorporating emotional design into retail banking services means going beyond plain functionality to create experiences that evoke positive emotions, build trust, and make banking more relatable and human. This involves understanding the psychological aspects of design, such as the importance of aesthetics in usability and the influence of brand personality on customer perceptions.

The necessity for modern banks to discard the sales-driven mindset in favor of humanizing finance is evident. This shift, grounded in UX design principles and a deep understanding of customer needs, paves the way for creating more meaningful, engaging, and trustworthy retail banking experiences. As banks embrace this transformation, they not only enhance their relationship with customers but also secure a sustainable and prosperous future in the digital age.

Explore 10 examples of experience-driven financial product transformations.

Cost of sales-driven approach could be over $100 billion

Of course, all of the above does not mean that profits are not essential for the “next-gen” company. They differ from the “old” by making even more profit out of satisfied customers who are loyal to the company and recommending the product to their friends saving promotional budget.

This kind of strategy builds trust and long-term success instead of fast money made from aggressive sales of low-quality useless products.

We believe that for the digital product to be successful in the long term, it has to be:

- exceptionally useful;

- valuable for the customer;

- pleasant to use and attractive.

It is a question of priorities affected by the executive mindset. For many incumbent financial companies, digital apps are just a part of their marketing. For them, it is important to push sales, explore triggers, and design an attractive package to make a profit. For the digital age companies, it's the other way around, marketing becomes just a tool in their product customer experience strategy - a way to ensure maximal value to the customer and get profit as a reward.

Sales-driven mindset could lead to a bad customer experience in retail banking and cost banks billions. Check out these multiple industries examples from Yahoo Finance and GetCRM:

Bank of America knowingly sold toxic mortgages

- February 2008.

- For years, Bank of America unloaded toxic mortgage loans on Fannie Mae and Freddie Mac with false representations that the loans were quality investments, playing a significant role in the subprime mortgage crisis in 2008.

- The 2008 banking crisis raised concerns about risk assessment and lending practices in the global financial industry.

- After the fall, the path to restoring the BoA stock price to before-2008 levels took 10+ years.

- In 2014, US authorities imposed a $16.65 billion fine on BoA to settle allegations that it knowingly sold toxic mortgages to investors. The sum represents the largest settlement between the government and a private corporation in the United States’ history.

- BoA stock price impacted for 12 months and declined -90%.

- A loss of -$135 billion in value.

Wells Fargo creates fake accounts for customers

- September 2016.

- Due to an aggressive, pressure-filled sales culture, Wells Fargo employees created an estimated 3.5 million fraudulent accounts for customers without their knowledge.

- Though stock prices weren't impacted for long, Wells Fargo had to pay $185 million in fines and $142 million to a class action lawsuit. This event also caused CEO John Stumpf to retire.

- Stock price impacted for 2 months and declined -9%.

- A loss of -$23.3 billion in value.

Samsung sells exploding phones

- September 2016.

- The Samsung Galaxy Note 7 had a faulty battery, which caused some phones to burst into flames. This forced Samsung to recall the device and eventually halt production permanently.

- Though Samsung's stock prices are back up, the recall cost them $5 billion in losses and lost sales. According to the 2017 Harris poll of the 100 most visible companies, their reputation dropped from 7th to 49th.

- Stock price impacted for 2 months and declined -19%.

- A loss of -$96.7 billion in value.

Valeant Pharmaceuticals engages in shady business practices

- September 2015.

- Valeant Pharmaceuticals receives a federal subpoena over their drug pricing strategy and a Wall Street Journal investigation finds shady business dealings with a company called Philidor. A report by Citron Research accuses the company of accounting fraud.

- Valeant hasn't recovered from the multiple scandals, subpoenas, and fraud hearings as their stock price has continued to plummet. They've even considered changing the company name to help restore their reputation.

- Stock price impacted for 2+ months and declined -69%.

- A loss of -$55.9 billion in value.

Volkswagen cheats on emission testing

- September 2015.

- The EPA issues a notice of violation to Volkswagen for rigging diesel-powered vehicles with devices that helped the cars cheat on regulatory emissions testing.

- Volkswagen has struggled to regain the trust of American car buyers after the scandal greatly tarnished their reputation.

- Stock price impacted for 1 month and declined -43%.

- A loss of -$33.4 billion in value.

Toshiba commits accounting fraud

- April 2015.

- Toshiba committed accounting fraud by overstating company profits by ~$2 billion.

- Toshiba started to recover almost a year after the scandal and stock prices were trending up until they announced that their nuclear power plant acquisitions lost them billions.

- Stock price impacted for 10 months and declined -42%.

- A loss of -$7.8 billion in value.

Mylan aggressively hikes prices of life-saving Epipen

- August 2016.

- News stories shed light on the fact that mylan had increased the cost of their life-saving Epipen by 400% leading to multiple investigations and subpoenas. Mylan's CEO Heather Bresch's response of "no one's more frustrated than me" outrages the public further.

- Mylan had one brief surge in February where its stock price nearly reached pre-controversy levels, but since then its stock price has continued to decline. They've also lost business, now controlling about 71% of the market, down from 95%.

- Stock price impacted for 4+ months and declined -18%.

- A loss of -$4.3 billion in value.

Carnival launches the "poop cruise"

- February 2013.

- An engine fire caused a loss of power and propulsion, which also led to raw sewage backing up into the passenger decks.

- Carnival has, for the most part, stayed out of the news and continues to enjoy a large (21%) worldwide market share.

- Stock price impacted for 4 months and declined -10%.

- A loss of -$3.1 billion in value.

Lululemon CEO body-shames his customer base

- November 2013.

- Lululemon CEO Chip Wilson blames "certain women's bodies" for the sheerness of Lululemon pants, which were practically see-through.

- Only the removal of Wilson as CEO and some strong sales quarters have helped the company.

- Stock price impacted for 1 week and declined -14%.

- A loss of -$1.4 billion in value.

United Airlines drags passenger off plane

- April 2017.

- After United overbooked a flight, they forcibly removed a passenger who refused to give up his seat by battering and dragging him down the plane's aisle. The entire incident was captured on video.

- When traveling, customers often look for the best deals, not the best customer service.

- The stock price has declined -2.5% over 11 days.

- A loss of -$700 million in value.

Chipotle poisons their customers and has data breach

- October 2015 and may 2017.

- Outbreaks of E.Coli and norovirus were traced back to Chipotle causing them to close multiple locations. There has recently been a major data breach, compromising customer data.

- Although chipotle's stock has had a couple brief surges, it has never really recovered to where it was pre-outbreak. The latest data breach has plunged the stock even lower.

- The stock price has declined -40% over 2+ years.

- A loss of -$8.3 million in value.

How UXDA can help

The UXDA team specializes in crafting exceptional user experiences exclusively for financial services. Our experience, competence, and deep focus on the financial sector positions us uniquely to assist banks and financial institutions in transitioning from a sales-driven approach to a human-centered customer experience. Here's how UXDA could facilitate this transformation:

1. Customer-Centric Product Development

UXDA employs thorough user research and empathy to understand the deep-seated needs, frustrations, and desires of customers. By analyzing these insights, we can help banks design products and services that genuinely resonate with users, moving beyond mere transactions to create meaningful financial experiences.

2. Emotional Design and Brand Personality

Drawing from principles of emotional design, UXDA can aid banks in developing interfaces and interactions that evoke positive emotions, ensuring a deeper connection between the brand and customers. This approach not only enhances user satisfaction but also cultivates loyalty and trust.

By defining a unique and relatable brand personality for financial services, UXDA can guide banks in expressing their values and mission through every digital touchpoint, ensuring consistency and emotional resonance across all customer interactions.

3. Simplifying Complex Financial Processes

Financial services often involve complex processes that can overwhelm users. UXDA specializes in simplifying these processes through intuitive design, making retail banking more accessible and user-friendly. This not only improves customer satisfaction but also encourages the use of digital banking services, and new products onboardings.

4. Future-Proofing Financial Services

UXDA stays at the forefront of UX design trends and technological advancements. We can help any financial company to innovate and adapt to future changes in the financial sector, ensuring that their services remain relevant and appealing to modern users.

5. Strategic Design Consulting

Beyond immediate design solutions, UXDA approach includes strategic UX consulting to align the digital experience, with the bank's business goals and customer needs. This strategic approach helps to embed the humanization of finance in the bank's culture and operations, leading to sustainable growth and customer loyalty.

By partnering with UXDA, banks and financial institutions can effectively navigate the shift from a sales-driven to a human-centric approach, leveraging UX design's power to create services that truly matter to their customers. This transformation not only elevates the customer experience but also positions the bank as a leader in the competitive financial services landscape.

Get UXDA Research-Based White Paper "How to Win the Hearts of Digital Customers":

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedinexperience-driven financial product transformations.