What is purpose-driven product design in finance and banking?

The UXDA team defines purpose-driven product design as an iterative process of planning and delivering maximal value to the customer using digital channels. Purpose-driven banking design employs user experience design methodology and user interface design tools to create solutions that solve customers’ problems.

In the digital age, demand for digital product designers has significantly increased. Every industry digitizes rapidly, and finance is no exception. The purpose-driven design agency UXDA provides the financial industry with full expertise and services to architect, design and prototype user-centered financial products.

Purpose-driven banking design requires extensive knowledge and experience in finance, UX and UI design, business, marketing, psychology and user behavior. As one of the leading digital product design companies for financial products, UXDA has combined years of experience in serving 70+ financial institutions in 37 countries, becoming the leader in financial UX design.

Check out the best UXDA articles about digital product design for banking and Fintech.

Digital Banking Clone Wars: Stand Out in a Copy-Paste World

In a world where most banking apps look and feel the same, “safe design” has quietly become the fastest path to irrelevance. This article explores why copy-paste interfaces are killing emotional connection with customers — and how banks can break out of the clone trap by designing digital experiences that create real differentiation, loyalty and brand value.

Outcompeting the Financial Industry Through Experience, Not Features

Financial brands have long competed on speed, safety, and features—but real loyalty comes from emotion, not functionality. As expectations shift from efficiency to feeling, the winners will be those who design relationships, not just interfaces. This article shares 10 principles to turn financial apps into emotionally engaging growth engines.

Emotionally Intelligent UX as a Growth Lever in Digital Banking

This article highlights the emotional trust gap in digital banking, revealing that speed and convenience alone aren’t enough. To build loyalty, financial brands must prioritize empathy, transparency, and human-centric UX that fosters confidence and connection.

Restoring Trust Through Digital Experience Governance (DXG) System in Banking

As financial services become increasingly sophisticated, customers demand not only security but transparency and reliability—making trust the ultimate driver of success and resilience.

The Rise of “Dopamine Banking”: How Fintechs and Neobanks Are Redefining the Customer Experience

Fintech disruptors and neobanks are transforming finance with “Dopamine Banking”—where flashy visuals, gamified challenges, and social interactivity turn every tap into a rewarding experience. This blend of emotions and entertainment is reshaping how we view financial services.

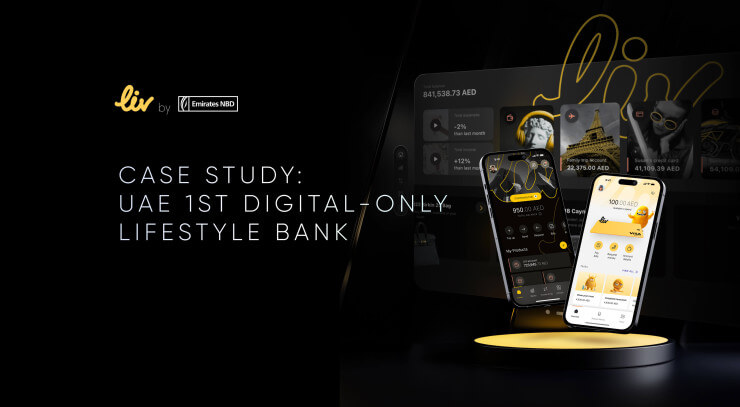

Liv Bank Case Study: Lifestyle-Driven Innovation of MENAT Digital Banking

Through a strategic and forward-thinking UX approach, we expanded the Liv ecosystem to three groundbreaking solutions: the Liv X app for seamless lifestyle and financial management, an immersive spatial banking experience for enriched user engagement and the Liv Lite app to empower children's financial education.

Garanti BBVA Securities Case Study: Designing a World-Class Investing Experience

Garanti BBVA Securities aimed to move beyond third-party solutions by setting a new standard for investment experience in the Turkish market. The challenge was to transform eTrader into a highly personalized, user-centered app that delivers outstanding digital experience.

Digital Transformation in Banking as a Branding Challenge

The most successful transformations in banking are not those that simply leverage technology, but those that seamlessly integrate powerful digital branding to create an emotional connection with customers.

UX Case Study: a Bugatti-Caliber Experience for UHNWIs with $200 Billion in Assets

Private Wealth Systems aimed to revolutionize wealth management by delivering a user-friendly and visually stunning solution that meets the luxurious needs of multi-millionaires. Delve deeper to understand how UXDA partnered with Private Wealth Systems to facilitate a fundamental shift in wealth management.

Digital Excellence as a Strategic Imperative in Financial Services

This article delves into the tension between the urgent need for next-gen, customer-centered financial products and the significant hurdles financial brands must overcome to deliver them and achieve digital excellence.

The $23B Cost of Sales-Driven Mindset in Retail Banking

We highlight the differences between thinking in a “new way” versus “the old one.” These differences can explain why some products are successful in the modern digital environment while others are not.

- 1

- …

- 3