Trust has always been the bedrock of financial services—from the days when merchants relied on trusted agents to protect their wealth, to today’s complex financial systems. In the digital age, trust is more vital than ever. As financial services become increasingly sophisticated, customers demand not only security but transparency and reliability—making trust the ultimate driver of success and resilience.

The Erosion of Trust in Banking

Historically, trust in banking was built through personal relationships and consistent service. Customers knew their local bankers, and this personal connection provided reassurance that their money was in safe hands. This personal touch fostered a sense of security and loyalty that kept customers returning year after year.

The advent of digital technology has revolutionized how banks operate. Online platforms and mobile apps have replaced many face-to-face interactions, prioritizing convenience and autonomy. As a result, satisfied customers often become advocates, helping to build trust through positive word-of-mouth.

However, rapid digitalization and innovation can undermine this trust. The warm handshake has been replaced by digital clicks, making it challenging for banks to maintain the same level of personal connection.

The Enduring Importance of Trust

Customers today are not just more informed—they are more discerning. They value transparency and honesty in their banking experiences, placing trustworthy information even above service speed or convenience. This shift signals that reliability and transparency are no longer optional—they are essential. A study by The Financial Brand (2024) found that 61% of consumers consider trustworthy information the most crucial aspect of their banking experience, making transparency a non-negotiable expectation.

When banks fail to communicate clearly, the consequences are far-reaching. Customers are more likely to leave quietly, without formal complaints, and this "silent departure" has become a serious concern. Without actionable feedback, banks remain in the dark, unable to address the root causes of dissatisfaction or take corrective actions.

Traditional feedback methods—such as phone surveys, emails or in-branch conversations—are becoming less effective. Many customers prefer to leave quietly rather than engage directly. To keep up, banks must adapt to evolving feedback channels. By embracing modern listening strategies like social media monitoring and transactional data analysis, they can gain real-time insights into customer sentiment, identifying concerns that traditional methods often miss.

Brand Trust Dissolves in Innovation

There are plenty of innovations that financial institutions can’t ignore—from AI implementation, cloud computing, embedded banking and cybersecurity enhancements to open banking, blockchain and crypto solutions, RegTech automation, ESG data platforms and customer-centric experience technologies that will define the future of banking.

Innovations are crucial for financial institutions to remain competitive, but they can unintentionally erode the trust that customers have built over time. Primary reasons are the disruption of brand consistency and bad digital experience. As banks and Fintech companies rapidly introduce new technologies and services, they may create fragmented experiences across different platforms.

According to MX Research of 1,010 random US consumers, 68% prefer simple and easy digital experience instead of friendly and helpful staff. 34% of respondents opened an account with a new financial institution to get a better digital banking experience, but 22% admitted they would do it if it were easy. Moreover, one in five responded that they lost trust in their financial institution due to a bad digital banking. One in three people complain that they find themselves frustrated with mobile banking every month, and have even stopped using their banking app because of the terrible experience.

For example, Bank of America, one of the largest banks in the U.S., also faced issues with consistency across its digital platforms. Some Trustpilot users complained that they could add a new account on the website but struggled to do the same in the mobile app, causing confusion and forcing them to use an inconvenient channel. This inconsistency can frustrate customers and make the brand seem unreliable.

Another factor is the apprehension customers feel toward new technologies. Financial services involve sensitive personal information and significant monetary transactions. Rapid innovation can introduce unfamiliar systems that customers may not fully understand or trust, such as artificial intelligence algorithms or blockchain technologies. Without transparent communication about how these innovations benefit and protect the customer, fear and skepticism can grow. Concerns about data security, privacy breaches or the loss of personal interaction can harm the reputation of financial institutions and lead customers to question their reliability.

The AI Paradox: Balancing Technology and Human Touch

The integration of artificial intelligence (AI) into banking services presents a double-edged sword. While AI can greatly enhance customer experiences by personalizing services like budgeting advice, streamlining communication and identifying savings opportunities, it also raises concerns about privacy and a diminished human connection. Customers are worried about how their data is used and fear that automation might lead to impersonal service.

This creates the "personalization paradox"—customers expect tailored services but are hesitant to share the personal data required for customization. Trust is essential here. According to a 2024 PWC report, 92% of South African consumers say data protection is crucial for earning their trust. When customers believe their data is handled responsibly, they are more likely to share it. Clear communication about data usage, along with offering tangible benefits, will help ease concerns and foster stronger relationships between customers and financial institutions.

Digital Transformation Can Ruin Brand Consistency

Digital transformation is an ongoing process that is aimed to enhance user experience and streamline banking services. However, if executed poorly, it can have the opposite effect—fragmenting the brand experience and damaging customer trust. Inexperienced implementation can lead to confusion and frustration, causing users to make mistakes while struggling with navigation. Inconsistent interfaces make it difficult for customers to find information or complete transactions smoothly. As a result, loyalty can erode, with customers seeking more seamless and cohesive experiences from competitors who provide a more unified digital offering.

What Causes Brand Inconsistency

Internal miscommunication often creates inconsistencies between digital services and the brand’s overall identity. Teams working on different platforms or touchpoints may lack alignment with the brand's overarching strategy, resulting in redundant or conflicting features. Without collaboration and communication, teams risk developing fragmented customer experiences that confuse and frustrate users.

Overemphasizing trends without considering user needs can lead to irrelevant, poorly adopted features. For instance, the 2019 Feature Adoption Report found that 80% of features in digital products go unused, emphasizing the need for validation before implementing trends. This not only wastes resources but also alienates customers who struggle to navigate unfamiliar or unnecessary functionalities.

New features or services that don’t reflect the brand’s mission can feel disjointed, confusing customers and diluting the brand’s identity. If too many changes are introduced without clear guidance, customers can become overwhelmed, leading to decreased product usage. Clear guidance and support are essential to ensure a smooth adoption process.

Inconsistent visual elements, such as mismatched logos or design, can mislead customers and hinder brand recognition. A 2022 survey by Marcom agency found that 7 out of 10 people under 55 would switch banks for a better experience, underscoring the critical role of brand consistency in financial services. Without clear and unified messaging, a brand risks appearing unprofessional and unreliable.

A lack of a cohesive brand identity also impacts internal teams, making it difficult to align decision-making with the brand’s vision. This results in inconsistent messaging and design across platforms, leading to a disjointed customer experience that undermines trust and loyalty.

Strategies to Harmonize Innovation with Trust

To maintain customer trust, financial institutions can implement strategies that balance innovation with brand strategy and identity.

- Develop and Communicate a Unified Brand Vision: Clear brand guidelines are essential for defining a company's mission, values, visual identity and communication style. They act as a roadmap, keeping all teams aligned and focused on the same goals. Regular communication of these standards, for example during brand workshops, helps keep everyone on the same page and reinforces consistency across touchpoints.

- Ensure Cross-Department Collaboration: Collaboration among departments like marketing, IT and customer service brings together different perspectives and expertise. Regular meetings and collaborative platforms help teams align on shared goals and integrate their efforts, ensuring that innovations stay aligned with the brand strategy.

- Prioritize Customer-Centric Design: Involving customers in the development process through A/B testing, surveys or focus groups ensures that new features truly meet their needs and expectations. Usability tests help identify pain points, enabling teams to create user-friendly interfaces and make improvements based on real feedback, building trust and keeping users engaged.

- Emphasize Security and Compliance: Data security is a cornerstone, building and maintaining trust in financial services. Measures such as robust encryption, regular audits and compliance reviews protect customer information and ensure regulatory compliance. Equally important is transparent communication—sharing security practices through in-app updates, dedicated dashboards or email notifications—reassures customers that their assets are safe and secure.

- Balance Innovation with Brand Consistency: Innovations should reflect the brand’s mission and values. Rather than rushing to follow trends, prioritize quality and thoroughly test every new feature before launch. Keeping visual design, messaging and user experience consistent across platforms builds brand recognition and customer loyalty.

Design Can be Used to Instill Trust Back into Finance

How can digital financial products appeal to users and earn back their trust? Customer-centered design plays a crucial role. Research from Frontiers in Psychology (2021) shows that attractive product designs positively impact consumer behavior, making users feel more favorable toward the product. However, customer trust goes beyond just aesthetics or technical features. It’s built on smooth, intuitive experiences in which every step feels natural and easy.

According to EPAM research data (2020), 63% of respondents cited trust as the main reason for choosing their main bank. Trust in finance is shaped by factors such as brand identity, values, digital reputation, communication and marketing strategies, service speed and quality, customer support and social media presence. To build and maintain trust, these elements must align with digital product design and user experience (UX), ensuring consistency in the brand experience, business strategy and customer needs.

The Importance of Brand Identity in Building Trust

Trust in financial services goes beyond strong technology or flashy innovations—it's about building a connection that feels personal and reliable. Customers want to know their financial partner is not only safe and transparent but also aligned with their values. This is where brand identity plays a pivotal role. It encompasses everything from visual elements, like logos and colors, to the tone of your messaging and the way you communicate with your customers.

A strong brand identity creates an emotional connection with customers, leading to trust and lifelong relationships. This connection is vital in financial services, where customers entrust institutions with their personal information and financial well-being. According to a Deloitte study (2019), 77% of customers value a brand's honesty, especially when it comes to personal data. A consistent and authentic brand identity reassures customers that their institution is credible and has their best interests at heart.

The Digital Reflection of Trustworthiness

Customers increasingly turn to online research before making decisions, and a strong digital reputation often tips the scales. According to ReviewTrackers findings, 55% of consumers consider reviews and reputation when choosing a bank or financial services provider, making this step highly influential in their decision-making process. Proactively managing online reviews and feedback demonstrates a commitment to customer satisfaction and transparency. Addressing concerns promptly and effectively can turn negative experiences into opportunities to build trust.

Every touchpoint with the customer shapes the overall brand experience. Consistency across all channels—whether it's a mobile app, website, customer service or in-person interaction—plays a crucial role in reinforcing trust. McKinsey’s study (2014) shows that consistency across customer journeys is 30% more important for overall satisfaction than individual interactions. For digital services, the user experience must align with the brand's identity and values. When the experience doesn’t reflect the brand promise, it can confuse customers and erode trust.

Aligning Product Design with Business Strategy and Customer Needs

A financial brand’s digital product design should clearly reflect its strategic positioning—whether the brand aims to be innovative, customer-focused or secure. This consistency between a brand’s values and its digital experience helps build a strong and trustworthy connection with customers.

Understanding and meeting customer needs is fundamental to building trust. Actively collecting customer feedback and adjusting strategies accordingly demonstrates that the brand values its customers and is dedicated to continuously improving its service. When products are designed with the user in mind—simple to use, accessible and relevant—it creates a positive experience. This not only strengthens the brand’s credibility but also reinforces its reliability, helping establish long-term trust with its customers.

What Shapes Financial Brands in the Digital Space

Incorporating a strong digital brand experience is crucial for a holistic branding strategy. It not only enhances the way customers perceive and interact with the brand but also provides valuable opportunities for engagement, personalization and growth.

By effectively leveraging digital channels, financial institutions and other businesses can strengthen their brand identity, increase customer loyalty and maintain a competitive edge in the market.

What is a Digital Brand Identity?

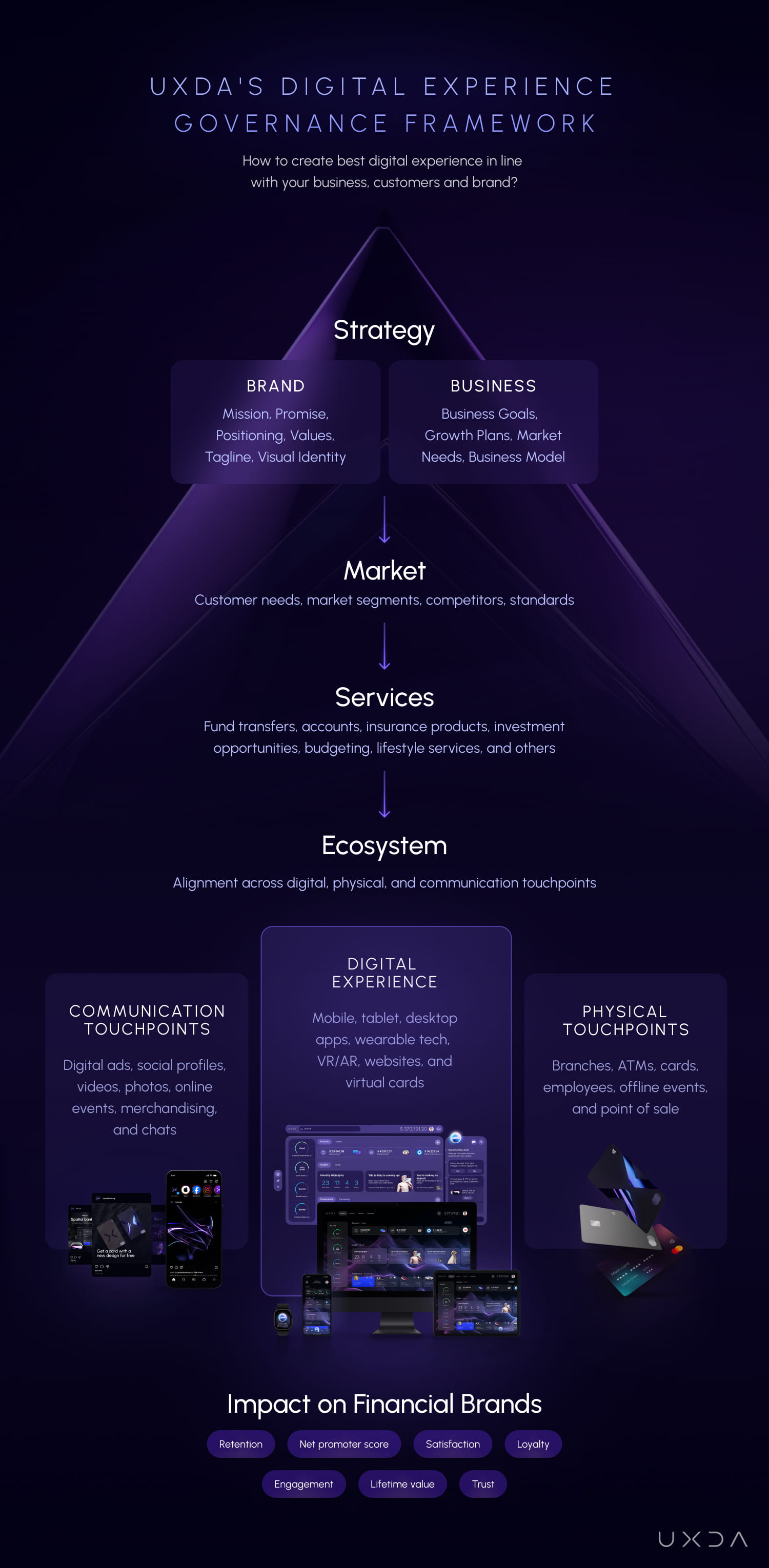

A digital brand identity reflects a company's brand in digital services and how it is perceived across digital channels. It encompasses all the touchpoints that contribute to a customer's digital experience with the company, as shown below.

Elements of Digital Brand Identity for Financial Brands

Embracing digital experiences isn't just an add-on to traditional branding—it's a fundamental shift that aligns brands with the evolving expectations of today's consumers. As technology advances, the digital brand experience will play a pivotal role in shaping successful branding strategies.

For financial institutions, user experience and user interface design are key components of digital brand identity. In an industry in which trust, security and efficiency are paramount, a well-designed UX/UI design can enhance brand perception, customer satisfaction and competitive advantage.

The consistent design of digital brand identity elements collectively defines how the financial brand is perceived and experienced across digital channels.

1. Visual Identity and Branding

A strong visual identity is essential for brand recognition and strengthening trust in the financial sector. It is critical to focus on the following elements:

- Logo and Iconography: Design a distinctive, scalable logo that adapts seamlessly across all digital formats, ensuring brand visibility on any device or platform.

- Color Palette and Typography: Choose colors and fonts that represent the brand's personality while instilling trust and stability. Consistency is key in driving recognition.

- Imagery and Graphics: Utilize high-quality, relevant imagery that resonates with the target audience, reinforcing the brand's core values and message.

- Brand Guidelines: Develop detailed brand guidelines to maintain consistency across all digital touchpoints, ensuring cohesive brand communication.

2. Verbal Identity and Communication

A well-defined verbal identity helps establish an emotional connection with users. Pay attention to the following:

- Tone of Voice: Define a communication style that mirrors the brand's personality—be it formal, approachable or innovative.

- Messaging Consistency: Establish clear messages and content themes that convey the brand’s mission and values consistently.

- Microcopy: Use consistent and user-friendly language in small text elements—such as buttons, labels and instructions—to enhance usability and reflect brand character.

- Clear Communication: Simplify complex financial jargon to empower users with easy-to-understand information, fostering trust and confidence and reducing frustration.

3. User Experience and User Interface

A seamless, intuitive experience is crucial for customer loyalty. Shine the spotlight on the following:

- Intuitive Design: Ensure user-friendly navigation and interactions across all platforms for a seamless experience.

- Accessibility and Inclusivity: Prioritize design that is accessible to all users, including those with disabilities, and offer multilingual support.

- Responsive Design and Mobile Optimization: Optimize digital platforms for various devices, ensuring a smooth experience for users on the go.

- Consistency Across Platforms: Maintain a cohesive look and feel across websites, apps and other digital touchpoints.

4. Trust and Security

Building trust through robust security measures and transparent practices is essential in finance. Key areas to focus on are:

- Security Features: Use industry-standard security measures like SSL certificates, encryption protocols and multi-factor authentication to safeguard customer data.

- Regulatory Compliance: Ensure full compliance with relevant legal standards, such as GDPR, and prominently display compliance badges to instill confidence in your practices.

- Privacy Policies: Be transparent in communicating how customer data is handled, reinforcing your commitment to privacy and security.

- Trust Signals: Incorporate trusted security icons, professional visuals and certificates to further build credibility.

5. Personalization and Data-Driven Insights

Leveraging data to personalize user experiences enhances engagement and loyalty. Critical components to prioritize are:

- Tailored Experiences: Use analytics to offer relevant content and services based on user behavior.

- Feedback Loops: Collect and respond to user feedback to refine digital experiences.

- User Testing and Analytics Integration: Test different designs and track performance to optimize user engagement.

- Customer Data Platforms: Manage customer data effectively for insights and personalization.

6. Digital Touchpoints and Platforms

Expanding and optimizing digital channels increases brand reach and user engagement. Important aspects to keep in mind are:

- Website and App Design: Develop responsive, user-friendly platforms that offer an intuitive experience and consistent design.

- Social Media Engagement: Maintain an active presence across key social platforms, creating valuable, engaging content that fosters a sense of community.

- Customer Support: Provide responsive, omnichannel customer service, using live chats, help centers and AI-powered chatbots to deliver fast and effective support.

- Targeted Messaging: Use timely push notifications and email marketing to provide timely updates and keep users engaged with personalized content.

7. Content and Engagement

Engaging content fosters emotional connections and builds a community. Essential factors to focus on are:

- Purpose-Driven Content: Share impactful stories that highlight your brand’s mission, values and positive social contributions.

- Interactive Elements: Integrate interactive features, such as videos, quizzes and surveys, to boost engagement and offer an immersive experience.

- Community Building: Encourage user-generated content and create opportunities for customers to connect, share and collaborate online with one another.

- Influencer Partnerships: Collaborate with industry influencers to expand brand reach and credibility, thereby tapping into new audiences.

8. Innovation and Emerging Technologies

Staying ahead of the curve and adopting new technologies ensures continued growth and a competitive edge. Key strategies include:

- Embracing New Tech: Utilize AI, blockchain, augmented reality (AR)/virtual reality (VR) and automation to enhance services.

- Continuous Improvement: Regularly update platforms based on technological advancements and user feedback.

- Scalability: Design digital assets that can grow with the business and adapt to market changes.

- Innovation Leadership: Promote cutting-edge features and innovations to position your brand as a leader in the industry.

9. Marketing and Brand Reach

Effective digital marketing strategies amplify brand visibility and attract new customers. Key considerations include:

- Targeted Advertising: Use data-driven insights to create hyper-targeted campaigns that maximize ROI.

- Search Engine Presence: Optimize for SEO and utilize SEM to improve search rankings.

- Email Marketing: Craft personalized newsletters and email campaigns to engage users with relevant, timely content.

- Strategic Partnerships: Expand reach through affiliate marketing and co-marketing initiatives that bring in new audiences and customers.

10. Reputation Management and Crisis Control

Proactively managing the brand's online reputation protects and enhances trust. Key aspects to focus on include:

- Brand Sentiment Monitoring: Use social listening tools to track brand mentions and customer sentiment across platforms, addressing concerns proactively.

- Transparent Communication: Tackle any issues openly, demonstrating accountability and building trust with your audience.

- Crisis Response: Develop a well-defined crisis management strategy, ensuring swift and effective communication when needed.

- Customer Testimonials: Manage and showcase positive reviews and testimonials to shape brand perception.

11. Omnichannel Integration

A unified experience across all channels ensures that customers feel connected and valued at every touchpoint. Key considerations include:

- Employee Empowerment: Equip employees with the tools and training they need to provide consistent, high-quality service across all channels.

- Brand Consistency: Ensure a seamless brand experience across all platforms—whether digital or physical—maintaining consistency in tone, design and messaging.

- Integrated Communication: Provide smooth transitions between online and offline channels, ensuring customers experience continuity throughout their journey.

- Personalized Service: Leverage real-time data to tailor interactions and offer personalized service at every touchpoint, enhancing the customer experience.

12. Innovation and Agility

To stay ahead in today’s rapidly evolving market, embracing agility and innovation is essential. Key strategies include:

- Rapid Adaptation: Continuously iterate and improve digital platforms based on emerging trends and user feedback, ensuring that your brand stays ahead of the competition.

- Cross-Department Collaboration: Foster collaboration among marketing, tech, customer service and design teams to drive creative, innovative solutions.

- Customer-Centric Development: Actively involve customers in the development process through surveys, beta testing and user groups, ensuring solutions align with their needs.

- Fast Prototyping: Create and test prototypes quickly, allowing for faster and smoother delivery of innovative products and services.

Upscale UX Design to Digital Experience Governance in Banking

To ensure consistency across all digital touchpoints, brand strategy should be holistically integrated into every aspect of digital UX. Failing to align digital service design with the company's brand identity and strategic objectives leads to an inconsistent user experience that fails to build a strong emotional connection with customers.

In the financial sector, a brand is more than just a logo or color scheme—it embodies the institution's values, mission and promise of financial security to its customers. Only by maintaining consistency across all touchpoints can a financial brand create a cohesive, emotionally resonant experience that strengthens customer loyalty and differentiates the brand in a competitive market.

Why UX Design Is Not Enough

While digital service UX design is very essential, it's not the ultimate objective for the business. The primary goal is to build a strong and cohesive financial brand identity that resonates with customers and drives business success. Key priorities include:

- Brand Experience Over Platform Experience: Users remember how a brand makes them feel overall, not just how a single digital product functions.

- Cohesive Approach Over Feature Delivery: Building a digital brand goes beyond product features, encompassing marketing, customer service and social media engagement.

- Fostering Long-Term Relationships Over One-Time Interactions: A strong brand establishes relationships that go beyond individual interactions or platforms.

Standard UX design approaches often overlook the specific pain points of financial users. However, financial products and services frequently involve complex concepts that can feel intimidating to users. To address this, it’s essential to conduct in-depth user research to uncover the unique needs, concerns and motivations of financial consumers. McKinsey highlights that banks can leverage granular customer data—such as online behavior, location data and payment patterns—to build detailed customer profiles. By creating personas and customer journey maps that mirror real-world scenarios, banks can simplify complex financial information into intuitive, user-friendly designs that align with the brand's identity.

Innovation is a critical area in which a specialized Digital Experience Governance (DXG) system by UXDA offers significant advantages. To design future-proof and scalable financial services, it is crucial to stay updated on the latest technological advancements within the finance sector, such as blockchain technology, ESG banking, AI-driven banking, personalized banking solutions and others.

Strategic alignment with business objectives is what truly distinguishes a digital experience branding approach in the financial sector. Design is not simply about creating functional interfaces; it’s a strategic tool that drives business growth. This perspective is supported by the InVision study of 2,200 companies across 77 countries, which shows that brands integrating design practices into their overall strategy achieve cost savings, increased revenue and improvements in brand value and market position. Unlike the traditional lean design approach, which often focuses on delivering a product’s functionality, a branding-focused approach ensures that design aligns with the company’s long-term objectives, strengthening the overall brand.

Digital Experience Governance Matters More Than Ever

The Digital Experience Governance (DXG) system by UXDA is deeply rooted in industry expertise, strategically aligned with business goals and tailored to the unique challenges and opportunities of the financial sector. It integrates brand strategy with user-centered design, focusing on trust, security, innovation and continuous improvement to address several key challenges:

- Evolving Customer Expectations: Modern consumers are tech-savvy and expect intuitive digital interfaces. Brands that fail to meet these expectations risk losing customers to competitors with more modern, user-friendly interfaces. A strong digital brand shows that a financial institution is innovative, trustworthy and focused on meeting customer needs.

- Rising Competition from Fintechs: Fintech startups are disrupting traditional banking with streamlined digital-first services that appeal to younger, tech-driven consumers. To remain competitive, established financial institutions must strengthen their digital branding to attract and retain customers in a rapidly-evolving landscape.

- Building Trust in a Digital Age: Trust is paramount in financial services. Effective digital branding creates credibility by providing secure platforms, transparent communication and consistent user experiences. Customers are more likely to trust and remain loyal to brands that prioritize their digital interactions.

Benefits of a Strong Brand Identity

A well-established brand identity serves as a foundation upon which financial institutions can build customer loyalty, differentiate themselves in a crowded market and drive sustainable growth. A financial brand development is essential because of the benefits it brings, including:

1. Building Trust and Credibility

Financial services involve managing people's money, assets and financial well-being. A strong brand conveys reliability and integrity, all essential for customers to trust the institution with their finances. A reputable brand minimizes perceived risk, making customers feel more confident in their decisions, whether they are opening a savings account or investing in complex financial products.

2. Differentiation in a Competitive Market

The financial industry is crowded with institutions offering similar services. A distinctive brand identity helps a financial institution stand out by highlighting unique value propositions. Through branding, institutions can communicate their values, culture and mission, which resonates with their customers.

3. Customer Loyalty and Retention

A strong brand strengthens an emotional bond with customers, leading to increased loyalty and long-term relationships. Satisfied customers are less likely to switch to competitors, even in the face of minor service issues or slightly better rates elsewhere.

4. Enhanced Perceived Value and Pricing Power

Strong brands can command higher prices or fees because customers perceive them as offering superior value or service quality. Customers may prioritize the trust and reliability associated with a strong brand over lower-cost alternatives.

5. Efficient Marketing and Communication

A well-known brand reduces the need for extensive explanation in marketing materials, as customers already recognize and understand the brand. This makes marketing efforts more efficient and effective, as brand messages reinforce established perceptions rather than creating them from scratch.

6. Attraction and Retention of Talent

A reputable brand attracts high-quality employees who are proud to be associated with the institution. Strong brands are often linked to a positive workplace culture and higher employee satisfaction, which in turn helps reduce turnover.

7. Facilitating Growth and Expansion

A strong brand makes it easier to enter new markets or introduce new products and services, as customers are more willing to try offerings from a trusted source. In addition, other businesses are more inclined to collaborate with well-branded institutions, opening avenues for partnerships and alliances.

8. Resilience in Times of Crisis

During challenging times, customers are more likely to remain loyal to brands they trust. A strong brand can better withstand negative publicity or economic downturns due to the goodwill built over time.

9. Increased Customer Acquisition

Satisfied customers of strong brands are more likely to recommend their institution to others. Loyal customers become brand ambassadors, organically promoting the institution without the need for additional marketing costs.

10. Innovation and Adaptability

Strong brands usually have engaged customer bases that provide valuable feedback. This feedback allows for continuous improvement and innovation, helping institutions adapt to market changes while maintaining trust and stability.

It's Time to Transform Financial Brands into Digital Brands

Financial institutions need to embrace digital brand identity to ensure authentic and consistent brand representation across all digital touchpoints. Once rooted in physical branches and paper processes, traditional financial brands now face the urgent need to adapt to the digital landscape. According to a 2024 research of Onfido, a software technology company, 80% prefer a fully digital banking experience. This highlights the urgency for financial brands to adapt and create seamless, digital-first customer journeys.

For financial brands to thrive in the digital world, they need to constantly evolve their brand identity. This means updating everything from marketing materials to visual design and ensuring consistency across all digital touchpoints. When a brand transitions from offline to online, it’s crucial that customers see the same authenticity and reliability across websites, apps, emails and more. This approach helps build trust and loyalty, which is key in a world that's becoming more digital every day.

Building a Future-Ready Digital Brand

The transition isn’t a one-size-fits-all process. It requires a strategic, multifaceted approach, ensuring that branding, messaging and design evolve while staying true to the brand’s core values. Consider a leading global bank that recognized the need to adapt. Through a rebranding initiative, they redesigned their logo for digital scalability, refined their visual language for cross-channel consistency and shifted their focus to digital marketing. This initiative resulted in increased customer engagement and acquisition, strengthening their competitive edge.

This transformation is more than a response to evolving customer needs—it positions financial brands for long-term success. Embracing digital experience governance isn’t just about keeping up; it’s about setting the standard for memorable customer experiences that drive lasting loyalty and growth.

Strategic Partner for Transformation

Digital brand transformation is a complex process that cannot be accomplished overnight. It involves key elements such as industry expertise, a deep understanding of human behavior, strategic planning and the resources needed for close collaboration, among others.

UXDA is a strategic UX design agency focused on redefining digital experience governance, helping financial brands create seamless and consistent digital strategies. Our team works closely with financial institutions to identify gaps and align digital experiences with the brand’s core values and business goals. With a 100% focus on financial UX design, our experts—including UX strategists, financial UX architects and UX/UI designers—are dedicated to solving digital growth challenges and driving long-term success for financial brands. We ensure that customers receive a unified experience, regardless of how or where they interact with the brand.

Conclusion: Redefining Trust in Digital Finance

Trust is the cornerstone of the financial industry, and in today's digital landscape, it must be woven into every aspect of a brand's online presence. It's no longer enough to offer secure transactions—financial institutions must create an authentic, cohesive brand experience that resonates with customers on a personal level, even through a screen.

By thoughtfully integrating brand identity with user-centric design, banks and Fintech companies can bridge the gap between technological innovation and genuine human connection. Transparency, such as clearly explaining how technologies like AI are used and ensuring consistent messaging across platforms, is key. Keeping the customers' needs front and center at all times is essential to building lasting trust.

To achieve this, financial brands must transform into digital-first entities by adapting all brand assets to meet digital standards and ensuring consistent brand presence across every touchpoint. This includes updating logos, color schemes and visual elements while ensuring brand consistency across every touchpoint—whether it's through mobile apps, websites or social media. By doing so, financial brands create a seamless and trustworthy brand experience that reinforces confidence with every digital interaction.

The path forward is clear: embracing systemic digital experience governance is no longer optional—it's a strategic necessity. Those who adapt will foster stronger customer relationships, differentiate themselves in a crowded market and redefine the meaning of trust in the digital finance landscape. The opportunity to reshape the future of finance is here, and it starts with reimagining how trust is built online.

Get UXDA Research-Based White Paper "How to Win the Hearts of Digital Customers":

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedin