There's no doubt about the huge potential and possibilities of ChatGPT alike Generative Artificial Intelligence (AI) in digital banking and conversational banking in particular. AI is already used in digital banking to improve the customer experience, automate processes, and reduce the risk of fraud. But the hyper-personalization of banking opens up even more incredible prospects for customer experience.

In just two months after its launch, GPT-3-powered ChatGPT has reached 100 million monthly active users, becoming the fastest-growing app in history, according to a UBS report.

ChatGPT is a language model that uses natural language processing and Artificial Intelligence (AI) machine learning techniques to understand and generate human-like responses to user queries.

I compare GPT's appearance with the launch of the internet, in terms of impacting the future of humanity. It enables machines to understand and generate language interactions in a revolutionary way. GPT (Generative Pre-trained Transformer) AI has the power to disrupt the way we engage with technology, much like the internet did.

It's only been two months since the launch, but we can already see how much ChatGPT impacts our experience. The internet is full of examples of crazy prompts, to which ChatGPT provides accurate and competent answers. People are rapidly adopting ChatGPT power to leverage their regular work. It has already become a personal AI assistant and advisor for millions of content creators, programmers, teachers, sales agents, students, etc.

ChatGPT has shown the benefits of using AI in terms of user experience, and the big names are already declaring the launch of rival AI GPT solutions. And the main question for me, as a financial UX strategist, is how AI technology will impact the banking and financial customer experience.

Customer experience is the key to business success in the digital age. According to a North Highland survey, 87% of business executives perceive CX as a top growth engine. Harris Interactive research, in 2022, showed that almost 4 out of 5 respondents would quit a brand to which they are loyal after three or fewer unsatisfactory customer encounters. According to an Accenture study, 91% of consumers are more likely to buy from brands that identify, recall and provide relevant offers and recommendations.

To secure a primary competitive advantage, the customer experience should be contextual, personalized and tailored. And this is where AI will become the breakthrough technology to ensure it. According to Temenos, 77% of banking executives believe that AI will be the deciding factor between the success or failure of banks. According to the McKinsey Global AI Survey 2021, 56% of respondents report AI usage in at least one function.

We can forecast that ChatGPT technology will impact the user experience in the banking industry in several ways.

First, it can analyze customer data to understand their preferences and needs, and use this information to provide personalized customer service and support to users, addressing their queries and concerns in real time. It could include customized financial advice, targeted product recommendations, proactive fraud detection and the reduction of support wait times to zero. ChatGPT in banking can guide customers through onboarding, verifying identity, setting up accounts and providing guidance on available products and services.

Second, ChatGPT in banking can automate many routine tasks, such as account balance inquiries and password resets, freeing customer service representatives to focus on more complex issues. It can increase efficiency and reduce costs for banks while providing faster and more accurate customer support, allowing banks to avoid the need for large customer support teams. And all of this would be available 24/7, making it easy for customers to get help whenever needed by answering questions, resolving issues and providing financial education outside of regular business hours.

Third, ChatGPT in banking can provide a conversational banking experience, integrating with banking applications to provide a single point of contact for users to make transactions, view account information and receive alerts through the chat or voice interface in multiple languages. It can simplify the user experience and reduce the complexity of banking operations, making it easier for even non-native speakers to use banking and financial services worldwide.

Find more from 21 digital banking AI case studies in CX transformation

Generative AI in Digital Banking Supercharges the Future

The banking industry has been pressured to adapt new technologies for some time now. The growing pressure from competition with Big Tech companies and the emerging number of Fintechs was largely accelerated by the impact of the pandemic, leaving no choice but to take immediate action.

It's clear that the explosive growth of the challengers’ customer base depends on the ability to remove obsolete practices and adopt a new, user-centered approach to doing business by adjusting to growing customer needs and digital tendencies.

In fact, when it comes to a competitive threat, 50% of bankers would consider PayPal and ApplePay, while 34% name the Big Tech firms like Google, Facebook and Alibaba, according to The Economist Intelligence Unit.

Sixty-six percent of banking executives say new technologies will continue to drive the global banking sphere for the next five years. They point toward AI, machine learning, blockchain or the Internet of Things (IoT) as having a significant impact on the sector, according to Temenos.

As the number of advanced technological solutions of data processing and personalization through AI are becoming more and more accessible, it is broadening the opportunities financial institutions (FIs) can offer their customers. The question is how well will these be executed?

"The number one bank in the world will be a technology company,” as Brett King, Fintech influencer, author and futurist, predicted. It's true. The banks of the future need to become digital and create their digital strategies accordingly. It's unimaginable that a digital company would be slow in adapting to technological advancements.

According to Temenos, 33% of bankers are currently using banking AI platforms for developing digital advisors and voice-assisted engagement channels. The superpowers of AI also uncover the benefits of increased productivity, customer retention, risk assessment, prevention of fraud, improved processes for anti-money laundering (AML) and enhanced know-your-customer (KYC) regulatory checks.

The impact of AI on customer experience (CX) in the banking industry is significant. AI technology has the potential to revolutionize the way banks interact with their customers, providing more personalized, efficient, and secure services. There are multiple potential benefits to using AI in digital banking, including:

Personalized financial advice

AI can be used to provide personalized financial advice and recommendations to customers, based on their individual data and preferences. This can help customers make more informed financial decisions, and potentially improve their financial well-being.

Automated customer service

AI-powered chatbots can provide fast and accurate responses to customer queries, freeing up human customer service representatives to handle more complex issues. Virtual assistants can provide personalized support to customers, answer their questions, and assist them with tasks such as making transactions or managing their accounts.

Fraud detection

AI can help identify potential fraud by analyzing large amounts of data and identifying patterns that may indicate suspicious activity, and take appropriate action to prevent losses. This can save time and resources for the bank, and reduce the risk of financial losses.

Enhanced decision-making

AI-powered natural language processing (NLP) technology can be used to automatically analyze and understand large volumes of customer feedback and other unstructured data. This can provide valuable insights for banks, helping them to improve their products and services and make more informed decisions.

Predictive analytics

AI can be used to analyze historical data and make predictions about future customer behavior, which can be used to optimize products and services.

Risk management

AI can help banks to identify and manage risks by analyzing data and providing insights in real time.

Immersive experience

AI will help to enable banking operations using alternative interfaces, such as voice, gestures, neuro, VR and AR in Metaverse. This will allow the implementation of banking solutions into different experiences.

Main Outcomes of Using AI Solutions in Banking

1. Increased Workforce and Cost Efficiency

Many banks clearly know what they aim to achieve from AI, not only in terms of increased customer satisfaction but also in productivity and efficiency.

It's predicted that, in the upcoming years, AI will completely replace most of the jobs in banking and other industries. AI software would only require some regular maintenance as opposed to vacations, breaks, the risk of human error and the demand for raises. Banks are already seeking ways to optimize the capabilities of AI chatbots and voice assistants so that it would be possible to solve almost any customer inquiry without a living person in sight.

For example, CaixaBank of Spain is using AI to process over 12,000 transactions per second in peak hours and boasts a 900 terabytes data pool to improve the customer experience. The bank’s 100-strong business intelligence unit uses big data, AI and machine learning to communicate with customers more efficiently. As a result, branch staff levels are half the eurozone average and CaixaBank’s costs are the lowest of its domestic peer group.The Economist Intelligence Unit & Temenos study

Even though many traditional professions are being gradually replaced by machines, as long as there will be a need for empathy, there will be jobs for emotionally intelligent people.

It's essential to note that the essence of a new technology like AI is to ease our lives, so it's very important that the innovations are easy to understand and use by the majority of non-tech-savvy customers. To ensure that, it's not enough to have brilliant engineers with a highly developed IQ.

There is a need for highly emotionally intelligent people who serve as translators between customers and the complexity of the opportunities uncovered by new technologies.

This explains why the demand for digital banking CX/UX experts is rapidly increasing. They are the user advocates that ensure a user-centered approach in digital product development.

What differentiates robots from people is the ability to feel emotions and empathy toward one another. This means that, while future technology might uncover superpowers for mankind, it's up to the actual people behind the machines to determine the success of the outcome.

The other side of the coin is how the skills and capabilities of the professionals who will remain in their places will be enhanced by the power of AI. There's no doubt that the speed and efficiency of the daily duties of a UX architect or a designer, for example, would skyrocket, as the AI would sort huge amounts of available data to offer a selection of best choices for the UX expert to make a decision.

2. Champions in Personalization Skyrocket Customer Experience

According to Wunderman’s research, 79% of customers in the United States are certain that brands should demonstrate understanding and care toward their customers, and 89% are willing to engage with businesses that not only show care but go above and beyond that.

It's true that the key to becoming a successful financial company post-COVID is having 100% focus on solving the customers’ problems in the most effective way possible, instead of following a standardized scenario.

It requires true empathy toward the customers─getting to know them, feeling their pain like your own and delivering a solution that will make their lives better and easier. This calls for personalized, contextual banking experiences.

In the digital age, the one-size-fits-all approach no longer works as customers demand and are surrounded by a more personalized experience. As conducted in a study by Wunderman, 63% of consumers state that the best brands are the ones that exceed expectations throughout the customer journey. The best way to exceed expectations and show customers that the financial brand cares about them is by offering a true value and benefit that is tailored to the specific needs the customers face.

Using big data and AI assistants, people will be able to get hyper-personalized insights and recommendations on how to improve their financial health and what products they might want to consider even before they have thought of it themselves.

3. Possibilities of Personalized, Contextual Financial Products

Personalized, contextual financial products powered by technology should:

- inform the users about any situation that requires their attention;

- help to improve users’ financial health by monitoring it and providing recommendations;

- make financial forecasts and offer uniquely crafted possibilities according to the user's specific needs and goals, in a specific context;

- in the near future, it should also enable the users to conduct financial operations using voice processing, gestures, neuroscience, VR and AR.

An app that provides a contextualized experience should be able to predict the exact moment when a user needs a specific product and provide it by combining big data with behavior-based predictive analytics. The data already available to the incumbents could be used to provide personalized offers based on the user’s purchasing and financial behavior even before the user has requested it.

This would provide not only an amazing experience for the users but also a key factor that so many financial services of today lack─speed.

4. Contextual, Personalized Offers Instead of Annoying Ads

The mobile apps and websites of many FIs are often loaded with redundant promotional information about the FI itself and the benefits of its products and services. But, if this specific information is not relevant to the customer, it just becomes annoying and creates a feeling of pushiness.

Users forget information but remember experiences, and experiences are created from emotions. This means that information should be integrated into a context of usage.

It should become an organic part of the banking user experience. Personalized offers created by AI allow connections with customers on an emotional level, rather than annoying them with tons of useless product description and information overload.

One of the most powerful features that digital banking AI can provide is personalized promotions. This can be ensured by using predictive analytics.

It should combine analysis of the user's financial activity, their social environment and big data analysis on typical behavioral patterns, geolocation data and contextual analysis.

For example, location-based push notifications about the location of local ATMs may appear when the user crosses the border. Purchasing a flight ticket could be a good chance to offer an insurance policy for travel. Child expenditures or maternity grants detected by the banking AI could become an ideal reason to offer a loan on increasing the living space.

In the marketplace of UXDA's future banking concept Light Bank, users don’t have to browse a long list of financial products. Instead, using Open Banking APIs, Light Bank itself will choose the right solution from hundreds of products delivered by third-party providers. Artificial Intelligence prepares a pre-approved personalized offer in just a few seconds by scoring users’ financial profiles.

UXDA's future banking concept Light Bank

The future banking user experience should be fully personalized and able to come up with solutions that fit each customer's specific needs in specific circumstances, right when the customers need it.

To provide customized proposals for each customer, AI could be used for a more accurate customer credit scoring based not only on the user's bank's profile and credit history, but also social profiles and offline activity. This would allow the bank to generate a personalized proposal even before the user has requested it. All that the customer has to do is choose the proposal that best fits his/her needs and tap a single button.

For example, UXDA's banking super app UX concept provides recommendations on potential savings generated by the app's AI that has analyzed the user’s unique financial situation.

AI-powered spending insights that provide additional value

5. AI Requires Human-Centеred Culture and Strategy

The possibilities of AI are grand, but, in the end, its potential boils down to one central aspect─the shift of the company’s culture and mindset.

The huge force powered by the technology of AI can either make our lives better than ever before or result in disaster. This could happen if AI is integrated without a sharp focus on human centricity.

There are already concerns among customers about how AI technologies will use their data and whether it is safe. According to The Economist Intelligence Unit & Temenos study, 34% of customers are concerned about the lack of clarity surrounding data use, while 40% were concerned about the security of their personal financial information.

There's also uncertainty within the leadership of organizations.

According to a report by Board Agenda, 78% of board chairs, directors, CEOs, CFOs and other executives could not confirm that the board and senior management sufficiently understand the implications of AI for the business and industry, including its impact on society or geopolitics.

Many executives emphasize the main business gains of AI, such as cost savings and efficiency, while 76% are concerned that “the use of AI in the firm will introduce significant ethical or cultural changes within the firm that will need to be carefully managed.”

It's clear that many organizations and their leaders lack clarity on the matter, as well as the knowledge and skills to ensure a successful AI integration that would truly do good. What can be done about it?

Generative AI Use Cases in Banking

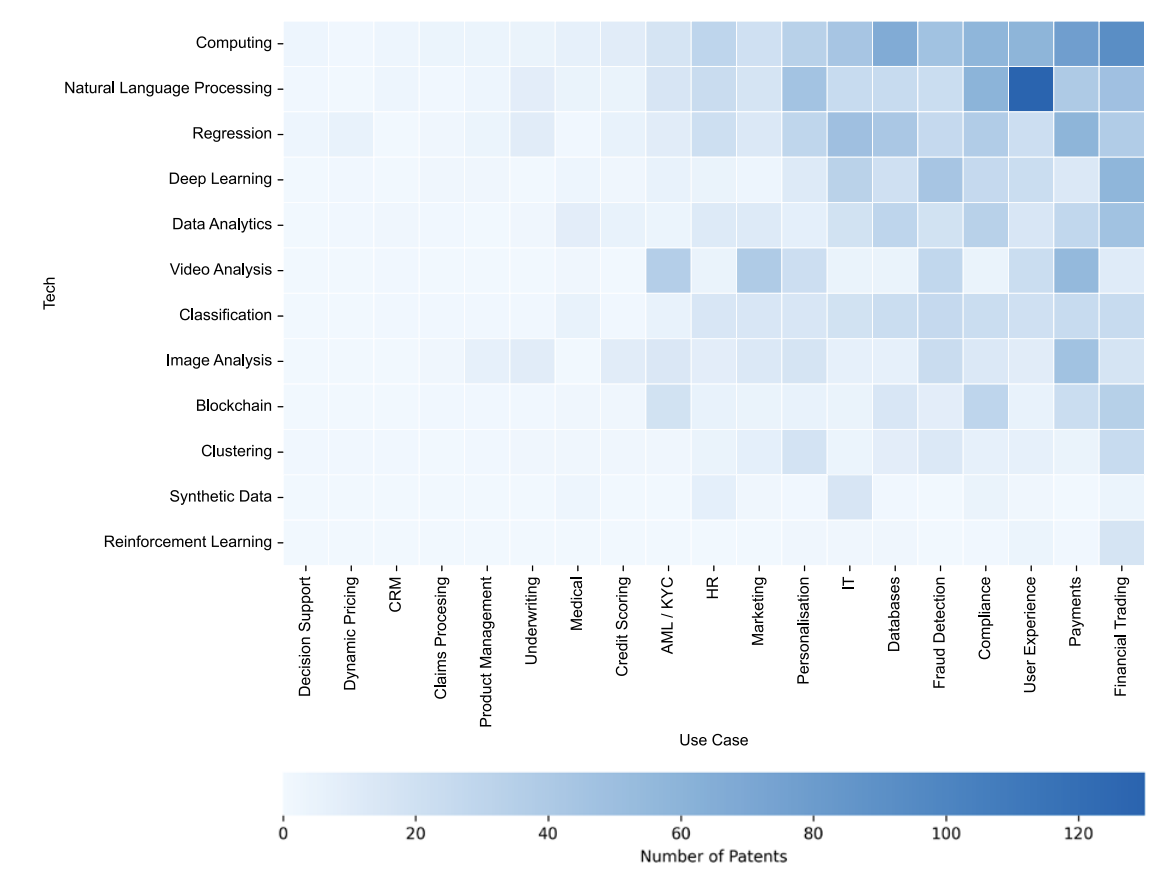

In the Evident AI Innovation Report 2023 we see a heavy focus on user experience and NLP patents amongst the banks, indicating a strong focus on chatbots and financial assistants.

Despite the inspiring prospects that AI technology opens up for improving the customer experience in banking, implementing ChatGPT alike Generative AI into banking products can pose some challenges. One of the main challenges is safeguarding the security and privacy of customer data. Banks must ensure that the chat interface is secure and that sensitive data is protected from unauthorized access or disclosure.

Another challenge is training banking ChatGPT to understand the language and terminology specific to the financial industry. Banks must provide relevant training data and integrate the model with their existing systems to ensure that it can provide accurate and appropriate responses to user queries.

And the last challenge is customer adoption. Banks need to ensure that customers are aware of the chat interface and its benefits, and are comfortable using it. It requires additional product design and education efforts to provide an easy-to-use chat interface to demonstrate its benefits to customers.

By leveraging its natural language-processing capabilities and understanding of customer data, ChatGPT banking technology can become an excellent solution to provide a more personalized, efficient and convenient user experience in financial services.

There are 10 obvious use cases for ChatGPT in banking:

1. Account inquiries

Banking users can employ chatbots to monitor their account balances, transaction history and other account-related information.

2. Money transfers

Users can make fund transfers to other accounts or to pay merchants through chatbot.

3. Loan applications

Chatbots can assist users in applying for loans and guiding them through the application procedure.

4. Credit score monitoring

Chatbots can assist users in checking their credit ratings and provide advice on how to improve them.

5. Financial advice

Chatbots can provide investment advice and assist users in making informed investment decisions.

6. Fraud prevention

Chatbots can assist banks in preventing fraud by monitoring user transactions and spotting unusual activity.

7. Customer service

Chatbot can provide rapid and effective customer care by answering common questions and fixing simple issues.

8. Account management

Chatbots can assist users in managing their accounts by arranging automatic payments, changing personal information and more.

9. Insurance claims

Users can utilize chatbots to submit insurance claims and get information about the claims procedure.

10. Financial planning

Chatbots can assist users with financial planning tasks, such as budgeting and setting financial objectives.

Customer-Centered AI Integration

To ensure that the integration of AI is successful, both for the business and the customers, it's essential to have an in-depth understanding and expertise in technology and customer centricity.

To ensure the user experience enhancement through future integration of ChatGPT alike conversational banking and AI-empowered digital transformation financial organization need a proper customer-centered mindset at all levels of the company that is executed by carefully selected team members who partner with external tech experts within a holistic digital strategy. Here's how it could work:

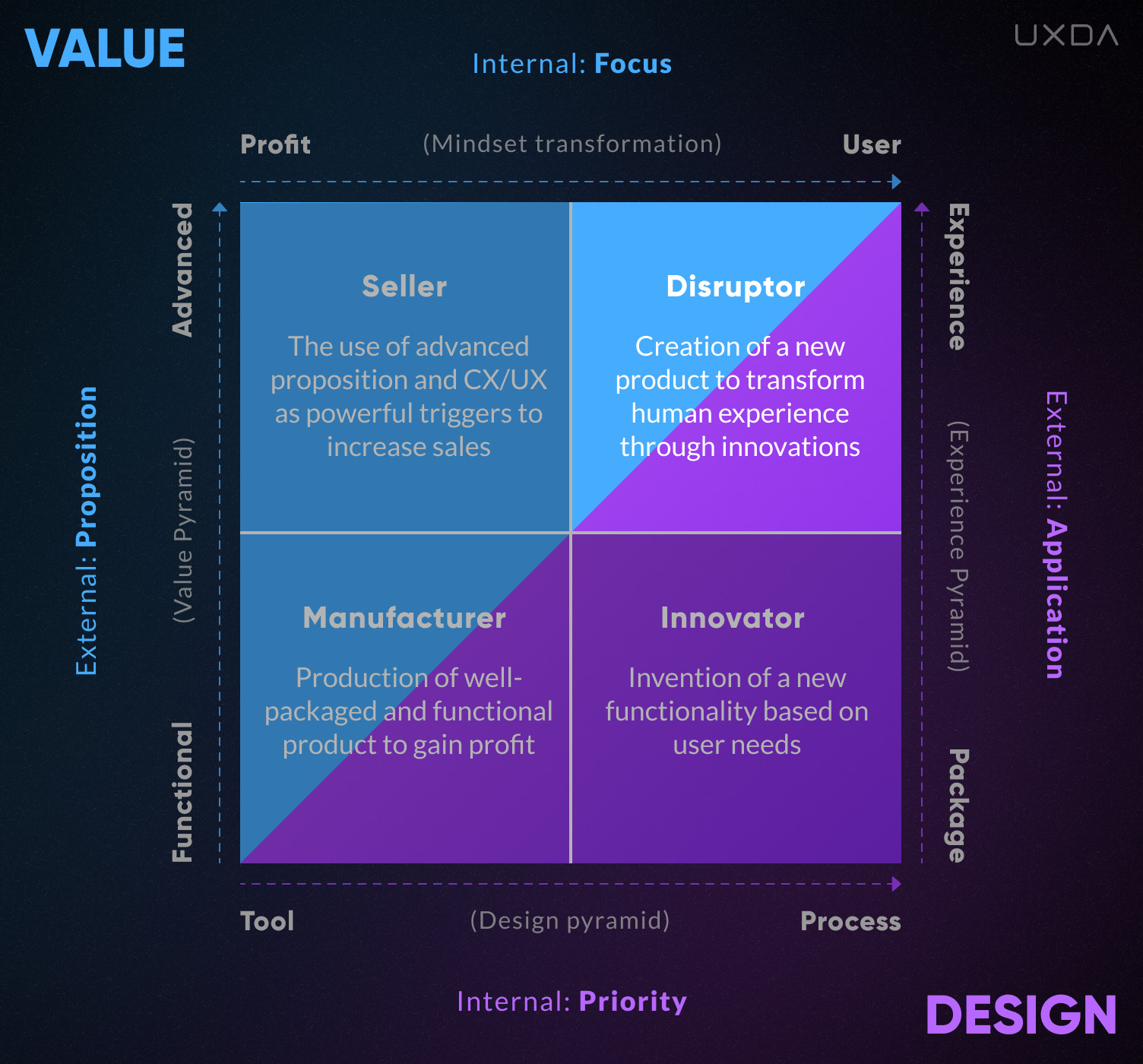

1. Embrace the Experience Mindset

The first step toward maximizing the power of AI in a way that would do good to mankind is to adopt an Experience mindset. It's a way of thinking that consists of serving the customers, providing an emotional experience, offering solutions instead of over featuring, disrupting the industry and ensuring a smooth flow throughout the customer journey.

An Experience mindset is the way a financial brand thinks, acts and perceives the world to make it a better place for people to live. In this kind of mindset, the financial company and all of its employees view the customers as friends or family members, aiming to help them in the best way possible.

It is critical to start to perceive design as a mindset or an ideology that puts the customer at the center of all business operations.

Customer Experience in Banking - Mindset Change

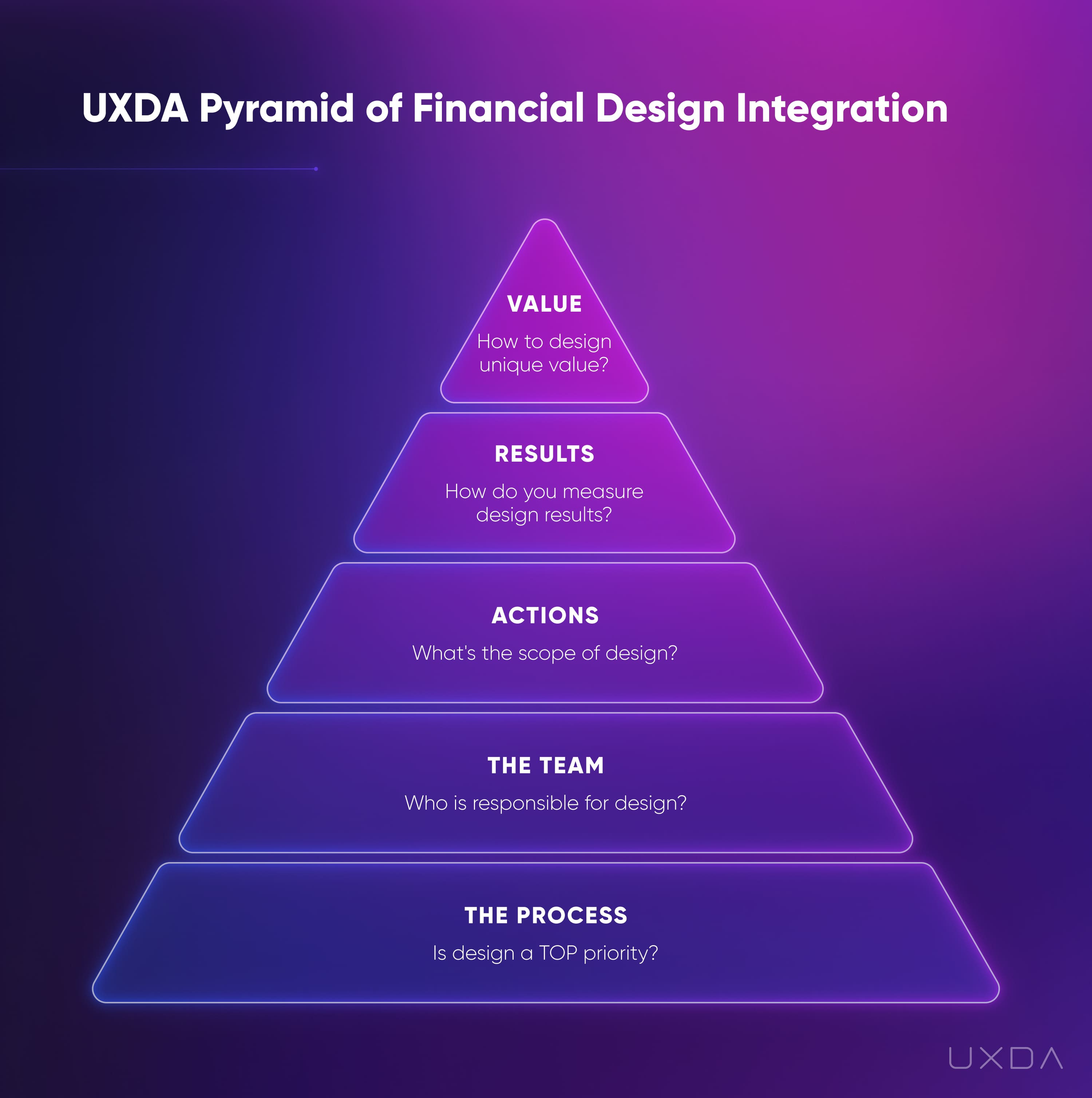

2. Integrate Customer Centricity at All Levels of the Company

It's not enough to have a human-centered mindset at the executive level of the company. To ensure a successful adaptation to AI, customer centricity is integrated at all levels of the company, starting from business processes and ending with the ultimate value that the financial brand provides.

This involves the entire company in seeking and executing innovative ideas on how to better solve customer problems with the possibilities of AI and other new technology. It's an approach for creating demanded financial digital products that live up to the customers’ needs and expectations throughout the changing times and technological possibilities.

Here are five key aspects to focus on to accelerate FIs’ ability to adapt AI in an optimal way:

- transform a business model into one that puts the processes of user centricity first;

- implement UX expertise that will ensure the product brings true value to the customers;

- execute the right actions guided by UX experts who are able to impact in-depth processes of the financial company;

- have the correct criteria to evaluate the results your team is producing;

- define and focus the authentic value your product will provide to the customers.

UXDA's Pyramid of Financial Design Integration

3. Adopt a Disruptive, Human-Centred Culture

Keeping up with technological innovations like AI requires great agility. This can be achieved if your FI adopts a disruptive company culture. This agile way of thinking and operating allows you to be flexible and adapt to any new technological and customer trends.

A disruptive company culture aims to transform the customer experience, bringing it to a new level and offering a solution that's way more pleasant and enjoyable than any other alternative on the market.

Think about providing an exceptional customer experience that's easily accessible throughout all of the platforms that people integrate into their lifestyles, specifically the ones of the future. Think about the ways to safely maximize the power of AI to bring even more value to your customers.

Constantly monitor and detect any change in the digital behavior of your customers and have the technological resources to adapt to it quickly and efficiently. By staying alert to rising changes in customers' needs, you will be able to prepare in advance and react in time, thereby expanding your digital solution to new platforms in a way that's enjoyable for your customers.

4. Expand the Digital Perspective and Team-up With Tech Companies

It's a fact that any FI that wishes to succeed in the future should develop their digital competencies. This kind of digital strategy includes all of the existing products and services as well as a clear vision for future development. Before we are faced with brand-new innovations, there is a lot that can be done right now to improve the value customers receive from the already existing solutions. All we need is to expand our digital perspective. This will make the transition to the future smoother and easier, as the new technologies will be integrated into the existing products, providing a superb banking customer experience.

However, this doesn't mean that the FIs have to deal with all of this on their own. Technologies implemented by Big Tech companies set the vectors for the future AI development of the digital world. Some will ignore them and get disrupted soon, while others will collaborate and actively integrate to gain a competitive advantage.

Include guidelines for tracking, using and collaborating with Fintech and Big Tech companies in your digital strategy. Your future digital potential depends on how quickly you will be able to utilize and adopt technologies introduced by Big Tech. It's no secret that the Big Tech companies are a huge step ahead of the finance industry in exploring and maximizing the possibilities of AI.

Look outside of the traditional financial industry and bring in digital experts by collaborating with Fintech startups, UX architects, interface design professionals and user researchers who have an understanding of digital customers’ needs and behavior to create delightful financial products.

5. Create a Digital Ecosystem

Forty-five percent of banking executives are transforming their existing business models into digital ecosystems. Banks are continuing to adapt their internal structures to digital technologies in order to enhance the customer experience, product offerings and new revenue streams, according to The Economist Intelligence Unit & Temenos study.

A consistent digital ecosystem is a pre-condition to maximize the potential and opportunities AI can provide. Without it, all of the benefits would just go to waste because of a confusing series of unusable, unconnected products, no matter what features it can provide.

Create a proper UX/UI design system. It ensures that everyone working on the ecosystem products are on the same page and can easily develop consistent digital solutions in their specific field of responsibility, and upgrade them consistently with the broadened possibilities AI uncovers.

AI in Digital Banking Will Make a Bridge Between Your Financial Brand and Customers

In an industry in which complexity and similarity have dominated for years, it's not so difficult to attract customer attention with a brand-new level of customer experience, possibilities and personalization. It is the one crucial condition to ensure the amazing world that AI uncovers for the banking industry and its customers.

People seek an emotional connection and a personalized attitude from others, and digital banking is no exception. AI can become the catalyst to building strong, valuable human-centered relationships with customers. It all depends on our preparedness and willingness to humanize digital technology and make the world a more friendly place for living OR unleash a greed-powered monster that will turn us into slaves.

AI will transform the banking industry in a number of ways. One of the main ways it will be used is to improve the customer experience by providing personalized and efficient services. For example, AI-powered chatbots can be used to answer customer questions and provide information about products and services, allowing banks to better serve their customers.

Another way that AI will be used in the banking industry is to improve risk management and fraud detection. Machine learning algorithms can be trained to analyze large amounts of data and identify patterns that may indicate fraudulent activity, allowing banks to better protect their customers and themselves from financial losses.

Additionally, AI will be used to automate many of the tedious and repetitive tasks that are commonly performed by bank employees, such as data entry and processing transactions. This not only improves efficiency, but it also frees up bank employees to focus on more value-added tasks, such as providing personalized financial advice to customers.

Overall, the use of AI in the banking industry will help to improve the customer experience, reduce costs, and increase efficiency.

Additional answers that might be helpful:

What are the biggest challenges in implementing generative AI in digital banking?

The biggest challenges in implementing AI in digital banking include:

1. Ensuring the security and privacy of customer data.

2. Addressing potential bias and ethical concerns in AI algorithms and decision-making.

3. Integrating AI technology with existing systems and processes.

4. Ensuring the accuracy and reliability of AI predictions and recommendations.

5. Educating and training employees on the use and benefits of AI in digital banking.

6. Lack of understanding or expertise in AI technologies and their applications in the banking industry.

7. Resistance to change and adoption of AI technology by employees and customers.

Read more about the future of AI in banking >>

What are the disadvantages of generative AI in banking?

Some potential disadvantages of AI in banking are:

1. Concerns about the security and privacy of customer data.

2. Potential bias and ethical concerns in AI algorithms and decision-making.

3. High upfront costs and potential difficulty in integrating AI technology with existing systems and processes.

4. Potential job losses and displacement of workers as AI automates certain tasks and processes.

5. Uncertainty and potential legal and regulatory challenges as the use of AI in banking continues to evolve.

Explore digital disruption traits in banking industry >>

Will generative AI take over banking jobs?

Over the past few years, thousands of bank clerks have lost their jobs after branch closures caused by the digitization of the industry. At the same time there are 400,000 jobs available in banks for digital professionals, designers, programmers, banking customer experience experts, and others related digital banking jobs.

While AI technology has the potential to automate certain tasks and processes, it is also expected to create new job opportunities and roles in the banking industry. The increased use of AI will need more specialized roles in areas such as data analysis and AI ethics.

The implementation of AI in the banking industry is likely to impact jobs in several ways:

1. Such jobs as bank clerks and bank tellers will become obsolete as AI technology automates routine tasks and decision-making.

2. Some jobs may be transformed or augmented by AI technology, requiring employees to learn new skills and adapt to new ways of working.

3. The demand for digital specialists with knowledge of AI and data science may increase, creating new job opportunities.

4. The use of AI technology may lead to increased productivity and efficiency, resulting in job growth in some areas.

5. Overall, the impact of AI on jobs in the banking industry is likely to be complex and vary depending on individual roles and organizations.

Read more about jobs cuts in banking industry >>

Get UXDA Research-Based White Paper "How to Win the Hearts of Digital Customers":

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedin