The lightning-fast development of technologies is fundamentally changing the concept of finance and money. This change is based on a new kind of experience that has become available through digital innovation. Digital technology democratizes the financial industry by making financial products and services more accessible and convenient for a broader range of customers. Let's explore recent banking trends in terms of customer experience to define how innovations could bring more value to customers by shaping their experience and expectations soon.

Humanization Due to a Global Digitization

61% of consumers interact weekly on digital banking, and 20-25% of consumers would prefer to open a new banking account digitally but are unable to do so according to PWC study.

The global digitization of the banking industry has significantly impacted how banks operate and serve their customers. Some of the key ways that digitization has affected the banking industry include:

Increased automation and efficiency

Digital technologies have allowed banks to automate many of their processes, reducing the need for manual labor and increasing efficiency. This has led to faster transaction processing times, lower operating costs, and improved customer satisfaction.

Enhanced security and fraud prevention

Digital technologies have also made it easier for banks to implement advanced security measures to prevent fraud and protect customer data. This has helped reduce the risks associated with online banking and other digital financial services.

Lowered market entry barriers

The global digitization of the banking industry has reduced investment requirements to banking service providers resulting in more players entering the market and offering digital financial services. This has pressured traditional banks to improve their digital offerings to remain competitive.

New business models

Digital technologies have also enabled the development of new business models in the banking industry, such as mobile payments and digital lending. This has allowed banks to diversify their revenue sources and reach new customer segments.

Biometric authentication

The quest for frictionless, secure financial transactions has never been more pressing in the dynamic digital services landscape. Biometric authentication leverages unique physiological traits such as fingerprints, facial recognition, and even retinal scans enabling users to access their accounts, authorize transactions, and perform a host of financial operations without the need for digital devices or cards.

In November 2022, humanity surpassed 8 billion, and the digital age changed the rules, personal relations, businesses, communication and how everyone uses their time. Businesses try to adopt new rules through digital transformation, but it’s difficult. Data from BCG research shows that only 35% of companies achieve their digital transformation objectives. Unfortunately, most do not consider the various phenomena caused by changes in how people consume, behave and interact using digital technology.

The network effect allows us to immediately get honest information from first product users, whether it’s good or not, regardless of the promises in their advertising. Information transparency allows us to share data on businesses' critical impact on the environment and society, thus making the world more responsible. And automation, in turn, helps to solve routine tasks a lot easier to focus on more important things.

These and many other digital world transformations make the emotional experience, human-centricity and ethical consumerism into social trends. At the same time, in response to information overload, more and more people improve their quality of life through mindful living, enjoying everyday activities and practicing sincerity and honesty.

Mindless consumerism is losing ground, and human needs come to the fore.

This brings us to the first and foremost banking disruption we want to address. Every member of the finance community should ask themselves this simple question: Are my expertise and resources increasingly focused on developing customers' well-being, or am I prioritizing profit and cash flow instead?

To place people over profit, a business should become purpose-driven, which requires exceptional human-centricity. And, in the digital age, this is the most profitable long-term strategy. According to Havas research, 77% of consumers buy meaningful brands that match their values, and, by making the world a better place, those brands outperform the stock market by 134%. Sixty-six percent of consumers are even ready to switch from a known brand to an unknown, purpose-driven brand, according to a Cone/Porter Novelli study.

Unfortunately, it's not so easy to adapt to the digital disruption and become a human-centered business. There are multiple blind spots in a company’s mindset, culture, processes and services that sabotage what could be a delightful customer experience delivery. The only way to bridge the gap between company services and customer expectations in the digital age is to identify and improve all of these blind spots.

Read more on how to create purpose-driven products and remove disturbing blind spots >>

5 Innovative Trends Shaping the Future of Banking

As we journey further into the heart of the digital era, a wave of groundbreaking innovations is poised to reshape the landscape of banking and redefine our interactions with financial services.

Trend 1. Personalization Provided by AI and ChatGPT Alike Technology

At the end of 2022, the world was shocked by the ability of AI to recognize, respond and generate human speech implemented in ChatGPT by OpenAI. This tool was a revolution, instantly becoming an automated assistant for millions of people, significantly increasing the speed and efficiency of their work. This was achieved with GPT-3 neural network language model based on 175 billion parameters.

Temenos found that 77% of banking leaders believe that artificial intelligence (AI) will be the differentiator between winning and losing banks. The latest McKinsey Global Survey on AI indicates that 56% of the respondents report AI adoption in at least one function.

Of course, we can talk about automation by AI that has already caused the largest banking jobs to be cut off throughout history. But, from the customer experience perspective, AI has a more powerful outcome.

Harris Interactive research, commissioned by Emplifi, shows that over 4 out of 5 respondents would leave a brand to which they are loyal after three or fewer poor customer experiences. That's why 87% of business executives see CX as a top-growth engine, according to a North Highland survey.

Accenture study finds that 91% of consumers are more likely to purchase from brands who recognize, remember and provide relevant offers and recommendations.

A contextual and personalized customer experience becomes the key competitive advantage. And, AI is the main technology to ensure such an experience.

Imagine having AI aggregate all the data from all your financial accounts, activities and life aspects to generate and provide valuable financial insights on the go and support you as your personal financial advisor. This will drastically impact the financial industry (as contextual Google ads did for advertising).

Personalization provided by AI in the banking industry is important because it can help improve the customer experience and drive business growth. Some key reasons include:

Improved customer satisfaction

Personalization can help banks tailor their products and services to individual customer needs and preferences, which can lead to higher levels of customer satisfaction. For example, an AI-powered personal finance management tool can help customers better understand and manage their finances, leading to improved financial health and satisfaction.

Increased customer engagement

Personalization can also help banks engage with customers more effectively and build stronger relationships with them. For example, an AI-powered chatbot can provide personalized responses to customer inquiries, helping to improve the customer experience and build trust.

Enhanced customer loyalty

Personalization can lead to increased customer satisfaction and engagement, which can in turn help to improve customer loyalty. By providing personalized experiences that meet customer needs, banks can increase the likelihood that customers will continue to use their products and services and recommend them to others.

Increased revenue and business growth

Personalization can also help banks drive business growth by increasing customer retention and acquisition. By providing personalized experiences, banks can increase customer lifetime value, resulting in more revenue and growth for the business.

This way, when AI technology becomes more and more advanced, we will experience a much more serious impact than could ever be imagined. Thanks to AI, every user will have the opportunity to make more effective and impactful decisions in their daily lives using appropriate insights extracted from the big data collected by financial services. But, there is another side to this coin-mass-generated AI, decisions can create a resonance effect that will destroy self-regulation of the free market.

At any rate, there is no doubt that AI will disrupt the traditional financial industry, and we need to find an effective way for this technology to improve financial services for the consumers.

Read more on how AI impacts banking and can finally transform mankind >>

Trend 2. Extension by the Metaverse

The metaverse is an interconnected network of digitally enhanced surroundings that use virtual reality (VR) and augmented reality (AR) to provide consumers with a variety of immersive experiences. And, this whole new world in virtual reality is fast approaching.

The renaming of the Facebook company to Meta caused a surge of interest in the metaverse, but by the end of 2022 it had decreased a bit. And yet the announcement of Apple Vision Pro speaks of the intentions of big tech in developing VR / AR technologies. So in the near future, we will see the next, even more exciting stage in the development of the metaverse.

In general, we may say that the current digital world as we know it now is just in the preparation stage of the metaverse, which will be drastically expanded in a few decades. A Gartner survey of 324 consumers during January 2022 found that 58% of respondents had heard of the metaverse but do not know what it means or how to explain it, and 35% said they had never heard of the metaverse. Gartner predicts that 25% will spend at least one hour a day in the metaverse by 2026, either for work, shopping, education, social or entertainment. According to the McKinsey forecast, the metaverse may generate up to $5 trillion in value by 2030.

The metaverse will undoubtedly be the source of the next revolutionary disruption. In the gaming industry, VR and AR have already become commonplace. “Vendors are already building ways for users to replicate their lives in digital worlds,” said Marty Resnick, research vice president at Gartner.

For decades, the expansion of banking activity was determined on the plane of two coordinates: the service range and the number of branches. Global digitization has changed the rules of the game. Today we see that a Fintech application with one usable and clear feature can gain more customers in a shorter period of time than a hundred-year-old bank with myriad branches and features. Digitization and the mass transition to cashless finance already provide a relatively low-cost way to quickly scale any financial service, but the metaverse will go even further.

The development of the metaverse will create a new virtual world in which people can experience immersive interaction, entertainment and work through spatial interfaces. And, financial transactions will certainly be in demand there as well as in the real world, but from the users’ point of view, it should be free from territorial, temporal or spatial boundaries.

The metaverse will definitely become the next milestone in the extension of financial services.

Disruption caused by the metaverse will require a transition from a mono-dimensional market to a spatial digital space, consisting of multiple dimensions with different rules of interaction in general ruled by a creative economy. Instead of the two familiar coordinates, such as range of features and the network of branches, the financial industry will have to adopt unique coordinates of multiple connected virtual worlds in which users can easily create new virtual stuff that can be sold or exchanged.

After all, in an unbelievable digital world, equally unbelievable financial services will be in demand. In time, overall metaverse capitalization will greatly surpass the real world. And, the only way to identify and prepare for such a demand is to start building up financial competencies in the metaverse today. But, there is no need to rush; just take your time.

Read more on how to use a UX approach to adapt a financial brand for the metaverse and how banking design in VR/AR could look >>

Trend 3. Simplification Powered by Embedded Finance

This recent financial trend is carried out by integrating financial services into non-financial enterprises, making it easier for consumers to buy products or services that are being offered. Embedded finance is a great way to ensure the customer has a frictionless and efficient service when they need it the most.

The outcome of rethinking services in terms of the user experience has huge potential. Old and well-known consumer loans features opened up a new, trendy Buy-Now-Pay-Later market through an embedded experience. The BNPL model gained great popularity, making Swedish Fintech Klarna the biggest unicorn in Europe in only five years at a more than $10 billion valuation. And, big tech also comes in with Apple Pay Later no-fees announced at WWDC.

Retailers, big tech and software businesses, vehicle manufacturers, insurance providers and logistics organizations are all considering or ready to introduce embedded financial services to serve their businesses and customers.

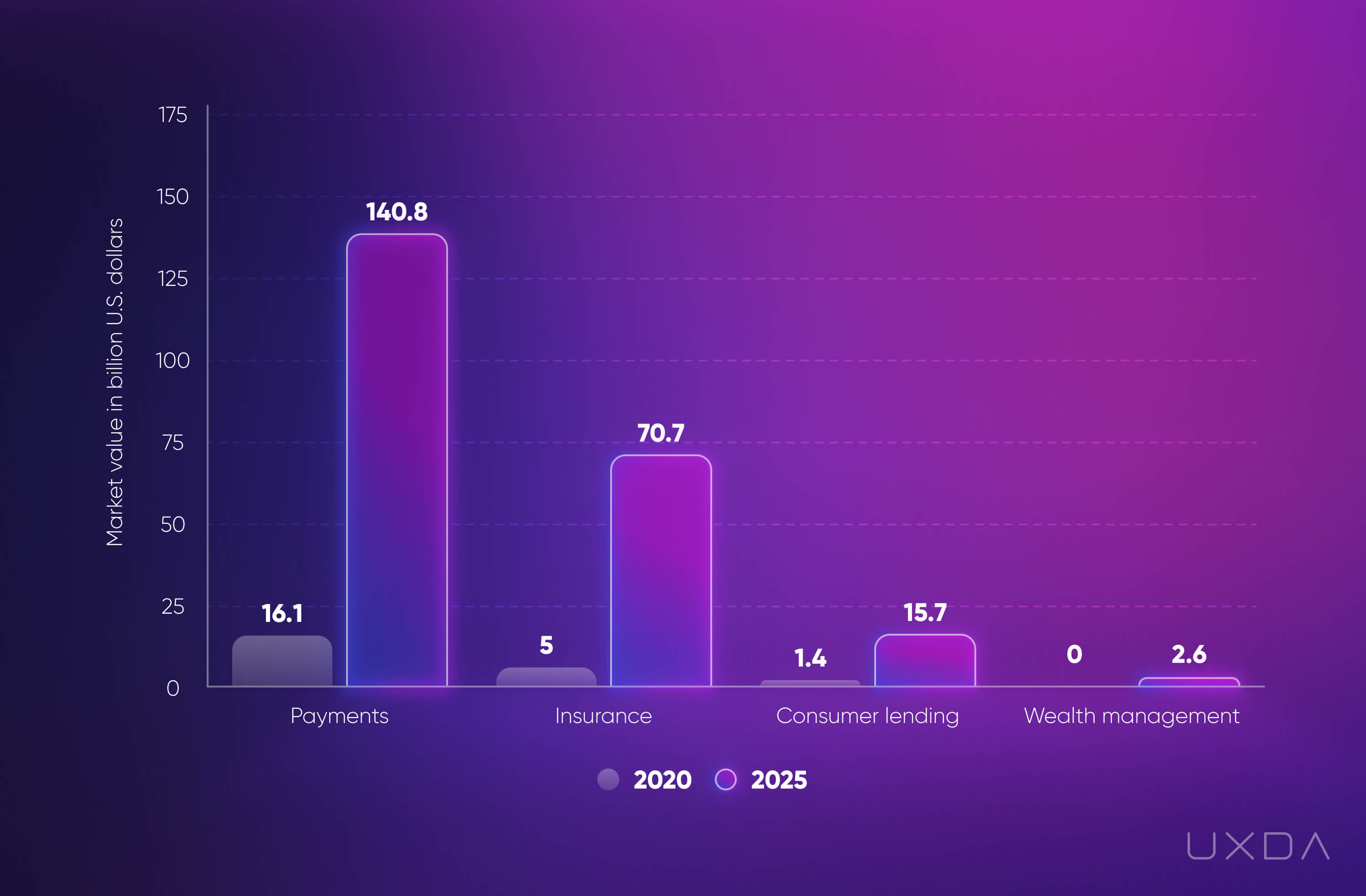

According to Statista data, in the United States, the revenue generated by embedded finance in 2020 was estimated at $22.5 billion and was forecasted to reach over $230 billion by 2025. Oracle predicts that the embedded finance market will be worth over $7 trillion in the next ten years.

Embedded finance primarily refers to the integration of financial services and technologies into non-financial products and platforms. This trend is likely to have a significant impact on the banking industry, as it will change the way that banks engage with customers and compete in the market:

Increased competition

As more non-financial companies start to offer financial products and services, traditional banks will face increased competition for customer attention and market share. This could lead to lower profit margins and increased pressure to innovate and improve their offerings.

New revenue streams

Embedded finance also offers new revenue opportunities for banks, as they can partner with non-financial companies to provide financial services and technologies. For example, a bank could provide payment processing capabilities to a retailer, or offer a digital lending platform to a car manufacturer.

Increased regulation

As the boundaries between financial and non-financial companies become blurred, there is likely to be increased regulatory scrutiny of the embedded finance market. This could lead to new rules and requirements for banks and other financial institutions operating in this space.

Changed customer experience

Embedded finance will change the way customers interact with financial services. As more financial services become integrated into non-financial products and platforms, customers will start to engage with financial institutions through these channels, rather than directly with the bank getting needed financial services on the go in the background. This will extremely simplify the financial experience.

This simplified financial experience will drive the prominent financial industry disruption from embedded finance. Embedded finance removes friction from the purchase cycle, making it more affordable and faster for the customer.

Simplicity changes the traditional paradigm in which consumers come to banking providers in search of the required service. Instead, embedded means that the customer receives the service exactly when it is needed almost without any effort.

Simplicity provided by embedded financial services will definitely take customer experience and expectations to a whole new level. Consumers will require easy-to-use and fast digital service from every financial provider, so even those who do not provide embedded finance should be ready to compete for simplification.

Read more on the 7 steps to make financial service simple >>

Trend 4. Democratization Driven by Decentralized Finance

The current global economic system was built on the opportunities and requirements of the industrial age. The world's transition to the digital age results in new demands with advanced possibilities for financial interactions.

Today, almost every aspect of banking is managed by centralized systems. Consumers can only access financial services through financial intermediaries. All intermediaries, such as banks, exchanges and lenders, set fees and conditions for access to each financial transaction.

Fintech has greatly expanded the experience of financial consumers by increasing the number of avenues and making financial services, capital and assets more accessible to everyone. It has essentially undermined the monopoly of banks and traditional financial institutions on access to financial instruments, thereby democratizing it.

The next step in the development of financial relations, after democratization of access to financial instruments, is the democratization of financial instruments themselves. We are now seeing the first attempts in this direction: cryptocurrencies as a digital alternative to money, NFT as a digital alternative to investment assets and ICO as a digital alternative to IPOs.

Already, these experimental digital alternatives have created a multi-billion dollar market. There are more than 18,000 cryptocurrencies, and the total capitalization, despite the market decline, is about $1 trillion. This demand is justified because the market needs a solution for the further upgrade of the economic system for the digital world.

We are talking about a global democratization of value and liquidity that will allow billions of unbanked people to participate in the creation and distribution of value just as the internet has democratized access to information, entertainment, learning, commerce and communication. And, at the heart of this new economic paradigm will be decentralized finance (DeFi).

At the moment, decentralized finance uses cryptocurrency and blockchain technology to manage financial transactions. DeFi aims to democratize finance by replacing outdated centralized institutions with P2P relationships that can provide a full range of financial services, from everyday banking, loans and mortgages to complex contractual relationships and trading of a variety of assets, including non-digital ones.

In November 2023, HSBC became the first bank to announce the first gold token transactions, where physical gold is stored in HSBC's London vault. Using distributed ledger technology (DLT), institutional clients create a digital twin of a physical asset.

DeFi will make everything around us liquid through the appropriation of tokens, so people who do not currently have liquid assets will be able to turn everything they have into it and participate in global economic exchange without intermediaries. In effect, this is a total democratization of the financial and investment market.

Transparency of blockchain technology will make it possible to trace the path of each transaction and include full responsibility in the exchange of value. A smart contract will automatically ensure fair execution of the terms of the transaction. This will greatly increase the security of financial settlements and significantly reduce corruption, crime and fraud in economic relations, which is extremely important for low-income and unprotected groups. A single transaction will be enough to identify the entire chain of participants, but this will probably require regulation and deanonymization.

As a result, DeFi will fundamentally change people's financial experience, as the very perception of value will change. Virtually anything can be turned into an asset and used without intermediaries in a financial exchange with sufficient liquidity. Most likely, decentralized liquidity markets for different types of assets will be created spontaneously every second, just as easily as content is now being published on social networks, or instant transactions are being made. Pop! Someone wakes up with the idea of tokenizing their dreams, and, by the end of the day, millions of people around the world are already entering into smart contracts to sell and exchange their dreams.

It makes sense for all players in the financial industry to think about their place in the world of DeFi right now━what kind of upgrade your service will need and how you can start integrating it ahead of time. Everyone who starts to work on providing a new generation financial experience today will undoubtedly have an advantage in the DeFi market of the future banking.

But don't forget about a central bank digital currency. CBDC is a digital form of a nation's fiat currency that will be issued and backed by a central bank. And, with the increasing popularity of cryptocurrencies and the advancements in technology, many central banks around the world are exploring the idea of launching their own e-money in the form of CBDCs.

CBDC in banking can be used for a variety of transactions, including peer-to-peer payments, online purchases and money transfers. But CBDCs are different from cryptocurrencies, such as Bitcoin, in that they are backed by a central authority and have legal tender status. However, the launch of CBDCs could have a significant impact on consumer behavior and the financial industry, particularly on the traditional banking model. E-money will become a digital representation of existing currencies like yuan, rupee or euro, at the same time connecting every user to the central bank.

At the moment, 114 countries, representing over 95 percent of the global GDP, are exploring a CBDC banking strategy.

Read more on how CBDC Banking Could Disrupt Banks and “Steal” Their Funds in Three Years >>

Trend 5. Acceleration Based on Cloud Banking

Another paradigm-shifting trend is the migration of financial services and banking operations to the cloud. This transformative shift holds the potential to redefine not only how banks operate but also how customers interact with their financial institutions.

McKinsey’s analysis shows that Fortune 500 banks could generate as much as $60 billion to $80 billion in run-rate EBITDA in 2030 by using cloud banking. But, according to Banking Cloud Altimeter, a survey by Accenture, only 12% of total workloads in US banking have been migrated to the cloud at the moment. And in Europe it’s only 5%. A global survey of 150 banking executives whose institutions are planning to or have already started to migrate their mainframes to the cloud found that 82% plan to move more than half of their mainframe workloads to the cloud.

Capco and Wipro global study of 1,300 executives finds that banks' cloud spending averaged $36M in 2021, rising to $41M for capital markets firms and $55M for insurance companies. Currently, 38% of firms on average run their business applications through the cloud, and they anticipate that percentage will increase to 55% in two years. According to Capco 62% of banks improved profitability using cloud computing, 55% increased revenue, 55% increased market share/expanded client base, and 50% decreased costs by using cloud.

Cloud computing provides the indispensable infrastructure that supports the implementation of AI-based solutions in the financial realm.

By centralizing data in the cloud, banks can gain comprehensive insights into customer behaviors and preferences. Using machine learning algorithms it allows to detect fraudulent activities, identify unusual patterns, and mitigate risks in real time. Moreover, cloud-based AI solutions empower banks to offer personalized experiences to customers, tailoring services that resonate deeply with customers.

In the cloud banks can experiment, prototype, and roll out updates faster than ever before. Cloud banking infrastructure allows developers to focus on the designing, developing and delivering frictionless user experience rather than being bogged down by the intricacies of managing hardware and software infrastructure. Moving bank’s applications to the cloud reduces time to market by 30–50%, and cuts their operational costs by 10–20% according to Accenture.

According to data published in The Financial Brand, 70% of banks elevated the priority of cloud usage to improve the customer experience. Cloud banking offers the flexibility to scale resources up or down rapidly in response to fluctuations in demand. This elasticity ensures that banks can efficiently allocate resources during peak times, preventing downtimes or slowdowns. As digital transactions surge and customer interactions transcend physical boundaries, the cloud's ability to swiftly scale becomes a competitive advantage, enabling seamless customer experiences and uninterrupted service delivery.

Open banking is redefining the boundaries of the industry, emphasizing collaboration and co-creation with third-party partners and vendors. Cloud computing serves as the bedrock for building an interconnected ecosystem through open banking APIs. These APIs facilitate secure data sharing, enabling partnerships that drive innovation and expand service offerings. By leveraging cloud infrastructure, banks can seamlessly integrate with fintech startups, technology giants, and other financial institutions, thereby cultivating a global diverse ecosystem that caters to the evolving needs of customers.

Conclusion

Each of the future banking trends discussed above leads to the global democratization of finance. Democratization of finance increases the accessibility of financial services and products to a wider range of people, through the development of new technologies, the introduction of new regulations, and the creation of new financial products with the goal to ensure that everyone has equal access to the financial tools and services they need to manage their money and achieve their financial goals.

At the same time, technological innovations will push the development of the financial experience both vertically and horizontally.

Vertical development means deepening the experience, for example, AI-driven personalization of services based on user context and big data or integrating financial solutions at a deep service level, be it metaverse worlds or finance embedded into the everyday experience.

To provide a deep customer experience financial companies must be a step ahead and be very flexible and, in some cases, even invisible.

The horizontal development of financial services implies going beyond the existing economic paradigm and considerably expanding the range of massively accessible financial instruments. In essence, we are talking about creating new principles of value creation and exchange, in which value can become a much wider range of phenomena different from our traditional perceptions.

For example, the development of crypto coins and tokens has created a trillion-dollar liquid market in digital assets, but the same principle can also be applied to non-digital objects, such as real and movable property. According to expert estimates, this will happen within 10-15 years. Also, the horizontal increase in the number of financial instruments and transactions will occur through the development of the metaverse, that is, the expansion of the reality available for the customer experience.

The democratization of finance provided by future banking trends will lower barriers to entry and more people will be able to participate in the financial system in both dimensions. It also will increase financial literacy by educating people about financial concepts and tools, so they will be able to make informed decisions about their financial lives and take advantage of the financial products and services that are available to them. And of course, leveraging technology will make financial products and services more accessible and convenient for people who may not have access to traditional financial institutions yet.

Overall, the democratization of finance is about expanding global access to financial products and services and empowering more people to take control of their financial lives.

Get UXDA Research-Based White Paper "How to Win the Hearts of Digital Customers":

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedin