When building a digital banking product, banks require fast, reliable digital solutions, making white-label platforms appealing. However, while these platforms accelerate time to market, they also introduce challenges that can hinder long-term success. The good news is that, with the right approach, financial institutions—whether they already have a vendor agreement or are still considering one—can achieve both technical efficiency and a product that truly reflects their brand and meets user needs. After all, the goal isn’t just to launch something that works today, but to create a solution that fuels business growth and adapts to the changing financial landscape for years to come.

Over the years, we’ve noticed that many of our clients either consider or have already chosen white-label solutions when approaching UXDA. This makes the topic one of the most frequent discussions at the start of a collaboration. In these cases, our role is to bring experience, empathy and strategic UX guidance to support financial brands in unlocking the full potential of their business with any chosen technical solution. To provide clarity and guidance, we’ve compiled our expertise and key observations and incorporated them into this article.

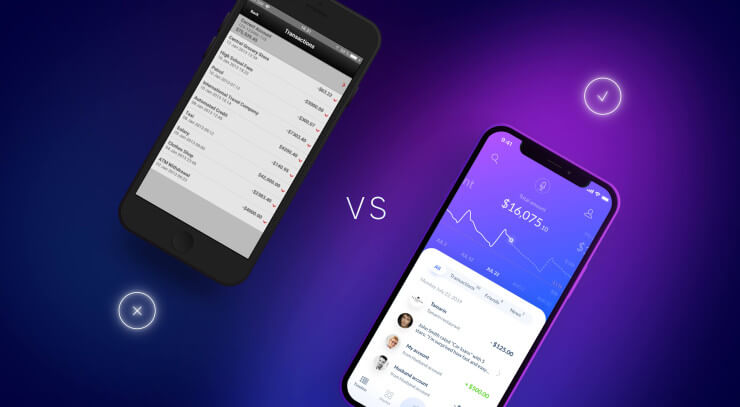

White-label platforms, marketed as quick to market and highly customizable, can be a good choice. Yet, when clients approach us with these solutions already in place, they frequently share similar challenges—customization capabilities that fall short of expectations, constraints that limit their ability to stand out and uncertainty about where to start.

Imagine if every automobile manufacturer decided to sell the exact same model produced in the same factory, simply slapping their logo on the hood. While the badge might be different, the car itself would look and drive the same, and consumers would struggle to see what sets one brand apart from another.

In the same way, a bank’s true competitive edge—its distinctive product interface, feature set, and customer experience—risks getting lost when a white-label solution doesn’t allow for meaningful differentiation. Over time, this can weaken the bank’s brand perception and make it more challenging to retain customer loyalty or justify premium offerings.

However, with strong vendor collaboration, the right UX strategy can turn white-label limitations into competitive strengths. This approach may not always be quick or easy, but it could maximize the potential of white-label products and align with long-term business strategies

So, what are the main pros and cons, and how do you tackle the challenges on the journey to digital product excellence? After a decade of working on over 150 digital financial products across 37 countries, we've gained extensive experience in designing digital experiences within white-label platforms.

This article, drawing on UXDA’s expertise and real-world examples, will guide you through the benefits and complexities of white-label product design options. Whether you're focused on rapid deployment or differentiation, already have a white-label vendor or are considering one, we'll help you implement a solution that propels your business forward in a highly competitive digital landscape.

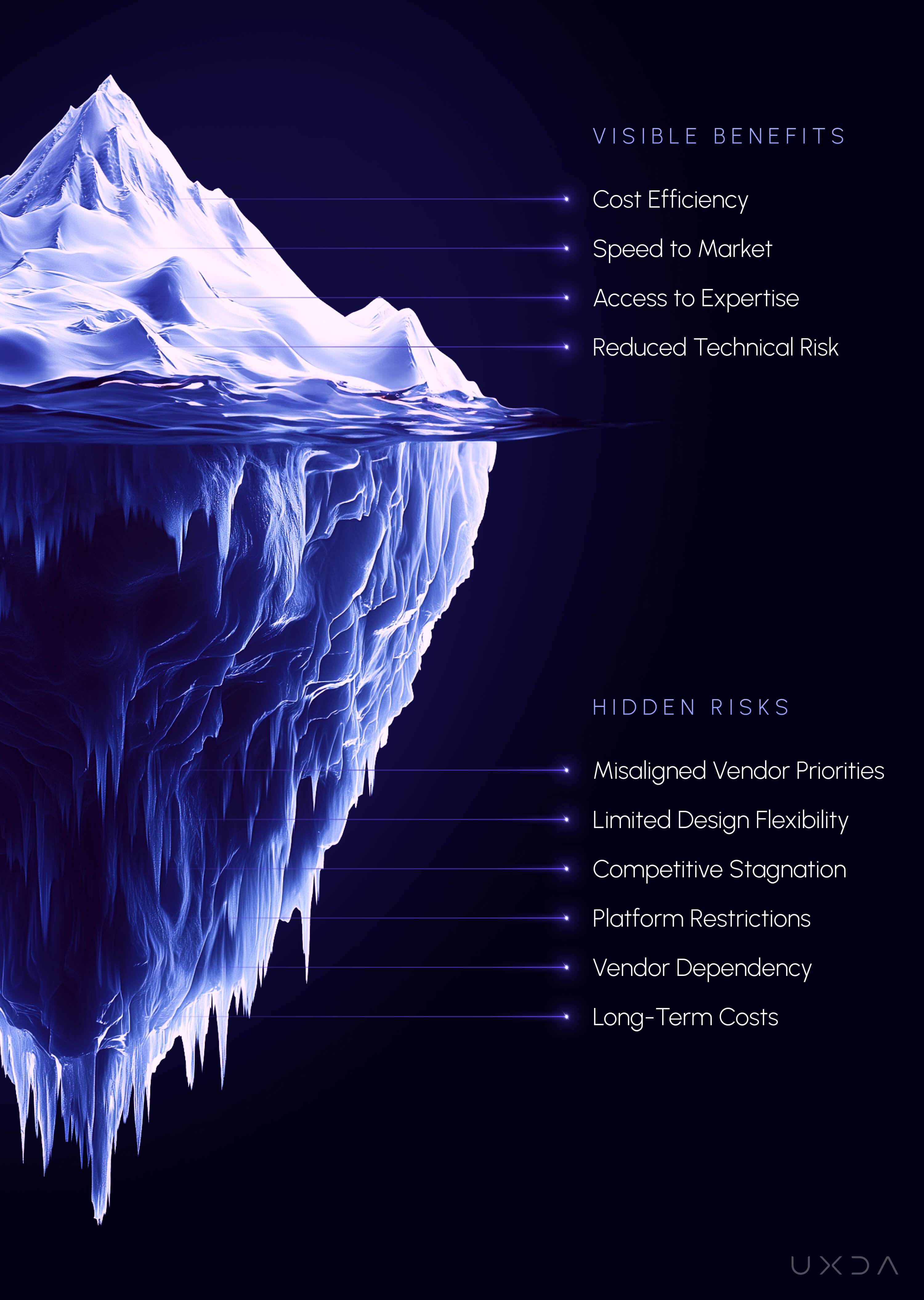

Benefits of White-Label Solutions in Banking

White-label platforms can be a powerful solution when speed and efficiency take priority over deep customization. According to a report by Research and Markets, the global white-label banking market is expected to grow at an annual rate of 10.6% through 2028, making these solutions particularly well-suited for businesses with standardized product offerings that need to enter the market quickly and cost effectively.

While white-label solutions provide a strong foundation for quick product launches, their success often depends on a strategic evaluation of financial institution goals and the vendor platform's ability to accommodate the company's unique needs. By understanding their strengths and limitations, businesses can make informed decisions and maximize the benefits these platforms offer.

Key Benefits:

Quick to Market and Cost Effective

White-label solutions enable businesses to launch digital products rapidly without extensive in-house development. This makes them ideal for businesses entering competitive markets or addressing time-sensitive opportunities. The pre-built infrastructure reduces upfront costs while streamlining the deployment process.

Reduced Technical Risks

Entrusting development, maintenance and updates to a third-party provider reduces the risks associated with in-house development, such as errors, bugs and security vulnerabilities. Vendors typically offer stable, tested platforms that minimize downtime and ensure compliance with industry standards. This allows internal teams to focus on other strategic initiatives rather than managing technical issues.

Quick Customization at the UI Level

White-label solutions often offer simple adjustments, such as changing colors or adding a logo, which can work well for businesses focused on basic functionality. However, this limited level of customization may not support long-term goals of differentiation and deeper user engagement, so it requires careful consideration before committing.

Access to Expertise

White-label vendors often bring specialized knowledge and resources, such as banking professionals, IT specialists and compliance consultants. This expertise ensures the solution is user-tested, secure and compliant with financial regulations, reducing the need to build an in-house team with the same breadth of knowledge. For businesses entering a complex and highly regulated financial industry, this access can be invaluable.

Streamlined Operations for Core Focus

By delegating many of the platform’s operational complexities—such as hosting, compliance and frequent updates—to the white-label provider, businesses can redirect their internal resources toward core competencies like strategy, marketing and customer engagement. This not only enhances operational efficiency but also accelerates innovation and responsiveness to market changes, providing a competitive edge.

Collaborating with experienced partners who understand strategic priorities can make all the difference in creating a solution that aligns with business goals. To explore the key factors in evaluating vendors—such as customization capabilities, compliance expertise and user experience standards—check out How to Choose the Best Banking Software Vendors in Terms of UX.

By strategically leveraging white-label platforms, businesses can achieve rapid deployment without overextending their resources. However, the benefits depend on a clear understanding of both the opportunities and constraints, ensuring alignment with the company’s long-term vision and market goals.

Hidden Risks in White-Label Banking Solutions

When a bank opts for a white-label solution that offers limited room for customization, the end product ends up looking and functioning much like the hundred other banks that subscribed to the same platform. This creates a “one-size-fits-all” effect that can dilute the bank’s unique identity and value proposition.

Generic digital solutions turn any financial brand into a generic one. Instead of standing out in customers’ minds, the bank’s or other financial company's digital experience becomes virtually interchangeable with that of its competitors—all built on the same underlying architecture, using the same user interface design patterns, and following the same customer journey flows.

This way despite being marketed as efficient, white-label platforms often introduce hidden challenges that affect operations, client satisfaction and long-term growth. These limitations often surface post-implementation, requiring costly adjustments. Addressing these risks often requires additional time, resources and strategic intervention, as businesses struggle to align their vision within the constraints of these platforms.

Below, we explore the most common risks, their broader business implications and how UX approach can help overcome these challenges to meet the established business goals and create a user-centered experience.

Misalignment to Brand

Most white-label platforms are developed with a broad target market in mind. They offer limited customization options, such as basic visual adjustments (logos and colors). However, they often lack the flexibility needed to create a distinct and cohesive brand experience.

This one-size-fits-all approach can lead to significant misalignment between the platform’s design and your brand identity, making it difficult to deliver a user experience that truly resonates with your target audience. Without the ability to differentiate through tailored design, businesses risk appearing generic, making it harder to build trust, foster loyalty and stand out in a competitive market.

Strategic Impact:

- A lack of customization options can result in a fragmented brand experience across touchpoints, diminishing the perceived value of your product.

- Over-reliance on generic interfaces may dilute your brand's unique identity, making it less memorable to users and making it harder to attract and retain customers.

- Misalignment between the platform’s design and your brand identity can erode trust, as users may struggle to connect the digital experience with the expectations set by your brand’s promise.

UXDA Approach:

A retail bank in the U.S., seeking a modern, innovative banking experience, partnered with UXDA to align the design with brand values and business strategy while fully leveraging the technical capabilities of their newly acquired white-label platform.

Our team began by defining the bank’s business strategy and identifying its unique value propositions, which underpin the brand and must be effectively reflected in its digital experience. Using our expertise and the User Journey Map framework, we conducted an in-depth analysis of the existing solution to pinpoint key gaps between the bank’s value propositions and the white-label platform’s technical capabilities.

As a result, we identified critical areas for improvement early in the process and collaborated with the white-label partner to assess their feasibility and provide feedback. Together, we implemented feasible solutions and negotiated compromises where necessary. This approach ensured that the brand identity and vision remained intact and were seamlessly integrated into the white-label platform, ultimately creating an exceptional user experience and digital brand interaction.

Platform Restrictions

White-label platforms often come with rigid technical architectures designed for stability and scalability. While this provides a reliable foundation, it significantly limits a business’s ability to tailor functionality or adapt user flows to meet specific needs.

For instance, modifying the sequence of steps in a user journey or introducing custom features often demands extensive developer resources, lengthy timelines and vendor approval, creating bottlenecks in the process.

What is often marketed as "extensive customization" frequently refers to aesthetic adjustments like changing colors or logos, while more meaningful and thorough customization requires additional resources, specialized teams and higher costs.

Strategic Impact:

- Dependency on the vendor for technical changes slows agility, limiting your ability to quickly launch new features and stay competitive in a fast-paced market.

- Significant delays and the need for resource allocation, even for minor adjustments, increase operational costs over time, thereby straining budgets and resources.

- Such restrictions can erode customer satisfaction and trust, as the platform struggles to meet user expectations or deliver a seamless experience.

UXDA Approach:

An ambitious U.S.—based Fintech company partnered with UXDA after signing a contract with a white-label solution provider, seeking to create a distinctive and engaging financial management UX/UI.

While the white-label platform was marketed as highly customizable, in practice, its flexibility was limited to basic color changes. Most modules were locked in their default configurations.

Faced with these challenges, our team leveraged our expertise to conduct a comprehensive platform review, map out its design system and strategically navigate the platform’s constraints. Through meticulous planning and innovative problem-solving, we designed a tailored user interface library in which pre-configured platform modules were seamlessly integrated.

The result was a cohesive, user-friendly and visually inspiring experience that elevated the product far beyond its original limitations and was cost- and time-efficient to implement for a Fintech company.

Competitive Stagnation

In highly competitive industries, differentiation is vital, as highlighted in a Bain & Company report emphasizing personalization as a key driver of customer loyalty. However, businesses relying on the same white-label platforms as their competitors can face significant challenges in standing out in the marketplace. Limited customization options often result in products that look and function like their competitors, diluting their unique value propositions.

This issue is compounded by dependency on the white-label vendor’s ability to implement and update innovative features. For instance, if competitors introduce advanced capabilities like Buy Now, Pay Later (BNPL), AI chatbots or facial recognition login, a bank using a white-label solution may fall behind if the vendor cannot promptly deliver these updates. Such delays allow competitors to quickly meet evolving customer expectations, gaining a significant edge.

Even with considerable marketing investments, a generic user experience can undermine customer engagement and loyalty. Over time, the inability to differentiate and innovate may lead to stagnation, making it increasingly difficult to compete. The effort and cost required to maintain relevance can eventually outweigh the initial convenience and affordability of a white-label solution, placing the business at a strategic disadvantage.

Strategic Impact:

- Lack of differentiation can erode your brand’s perceived value, requiring additional investments in marketing to compensate for the lack of unique appeal.

- The saturation of similar solutions in the market diminishes your competitive advantage, making it increasingly difficult to capture and/or retain market share.

- The inability to evolve can risk customer attrition as users shift toward competitors offering more personalized and innovative experiences.

UXDA Approach:

A Tanzanian bank, already leveraging a white-label solution, partnered with us to integrate its unique value proposition, service offerings and brand identity into its digital ecosystem.

Since the bank was determined to not be constrained by the white-label platform’s technical limitations, we started by creating an ideal user journey that showcases the bank’s distinctive market position and clearly communicates its competitive advantages.

As we later reached key project milestones, we conducted a thorough analysis of the vendor’s platform to fully understand its capabilities, limitations and deviations, if any, from the best-in-class modern user experience.

With this understanding, we aligned the design vision with practical adjustments, ensuring the bank’s unique value proposition was seamlessly reflected throughout the digital journey. By combining in-depth research with our expertise, we effectively addressed user pain points while maximizing the platform’s potential.

The result was a tailored, innovative experience built on top of a white-label platform that supported the bank’s business goals, positioned it as a market leader and delivered product excellence without compromise.

Vendor Availability and Delays

White-label vendors often serve multiple clients simultaneously, which can lead to significant delays in addressing requests or rolling out updates. While vendors may offer access to dedicated development teams, these resources are rarely exclusive, making your project timelines dependent on their availability.

Furthermore, white-label vendors typically operate on a predefined development roadmap designed to cater to a broad client base. These roadmaps may prioritize features or updates that do not align with your specific business goals or user demands.

Strategic Impact:

- Dependency on vendor timelines and priorities can disrupt project schedules, inflate costs and hinder your ability to meet critical market deadlines, reducing competitiveness in fast-paced industries.

- Misalignment with the vendor’s roadmap can restrict your ability to innovate or respond to changing market demands, leaving you constrained by the vendor’s long-term plans.

- Features or updates prioritized by the vendor that add little value to your product can lead to inefficiencies and missed opportunities.

UXDA Approach:

A Fintech company from Mauritius chose UXDA as their strategic UX partner, leveraging our design leadership to bring their ambitious vision to life.

Despite resistance from the outsourced development team, which often cited the limitations of the white-label platform, we took a proactive approach to pushing boundaries and finding solutions. This required a massive increase in regular check-ins and synchronization with the white-label team during and after the development process. And it turned out to be invaluable for this specific project.

By challenging the team to explore creative possibilities and providing hands-on support to identify the best tools and implementation methods, we transformed constraints into opportunities. Through close collaboration, strategic problem-solving and unwavering determination, we delivered an exceptional user experience that exceeded expectations and earned industry recognition, culminating in an award-winning product.

These hidden risks highlight the importance of evaluating your business objectives, operational needs and long-term goals before committing to a white-label solution. While white-label platforms can provide speed and efficiency, their limitations can hinder innovation, differentiation and growth.

At UXDA, we’ve helped financial institutions navigate these challenges, making strategic adjustments that mitigate risks and maximize customer-centered opportunities. By addressing these issues early and ensuring alignment with business goals and brand positioning, you can create a solution that not only meets today’s needs but also supports sustainable growth in the future.

Tailor-Made Customization Built on White-Label Technology

White-label platforms provide a strong foundation, but they may lack personalization options. Customization fills this gap, allowing financial institutions to fine-tune the platform’s functionality, design and usability to suit their specific needs. Customizing a white-label solution that aligns with the brand presents a valuable opportunity for financial companies to create a unique product that fulfills business goals, meets user expectations and delivers long-term value. This approach allows businesses to leverage the operational efficiency of white-label platforms while tailoring key elements to reflect their brand identity and strategic objectives.

However, this process comes with its own set of challenges, requiring additional financial and human resources, time and a commitment to collaboration among all parties involved to ensure a seamless user experience. Of course, it requires additional efforts and time, but with the right strategy, expertise and collaboration, successful customization is completely achievable.

At UXDA, we have worked with numerous banks, investment platforms, trading companies, and Fintechs to create tailored solutions using white-label solutions. Through close partnerships with our clients and white-label vendor developers, we have helped deliver a wide range of customized solutions that combine the speed and efficiency of white-label platforms with a personalized, tailor-made digital experience.

With a well-defined UX strategy and advanced design system, it’s possible to effectively navigate the limitations and opportunities of white-label platforms, ensuring swift and efficient implementation. This approach results in a solution that not only aligns with user needs and business goals but also reflects the client’s brand identity and delivers a seamless, personalized and engaging experience for the audience.

Strategic Takeaways

White-label banking won't get your app a five-star rating because of the inherent lack of true differentiation. When you adopt a white-label banking solution, you’re effectively plugging into a pre-built, standardized platform whose features, functionalities, and user interfaces are replicated across multiple providers. While this may expedite your time-to-market, it often undercuts any unique customer experience you hope to achieve. Customers sense when an app or portal feels generic, and even minor inconsistencies—like inconsistent branding elements or inflexible feature sets—can exacerbate that perception.

There’s also the risk of limited control. Customizing a white-label product beyond superficial branding or basic UI tweaks can be challenging. If a critical feature or integration breaks—or if you need an innovation pivot—the rigid infrastructure may constrain your options. And in today’s world, users demand responsive, personalized experiences that adapt to their specific preferences. If they detect a mismatch between your brand’s messaging and what the app can deliver in practice, no amount of marketing hype or white-label promises will earn that coveted five-star rating.

Designing a digital product with a white-label solution isn’t a black-and-white decision, requiring either full customization or complete design limitations. Instead, it’s a strategic balancing act that depends on alignment of your business goals, available resources and long-term vision. White-label solutions offer quick market entry and cost efficiency, but they come with unique challenges that need to be considered. The success of a white-label solution depends on the strategy behind its integration—how flexible your vendor is and how much time and resources you're willing to invest.

To navigate this decision successfully, consider the following insights:

Define Your Priorities

Clearly outline whether your immediate goal is rapid deployment or long-term differentiation. If speed to market is critical, a white-label solution may better align with your current objectives. However, for businesses aiming to establish market leadership and deliver a unique, branded user experience, the vendor's flexibility is essential to achieving deeper alignment with your vision.

Account for White-Label Constraints

While white-label platforms offer quick deployment and cost savings, their inherent limitations can impact long-term growth, scalability and differentiation. These restrictions often require additional resources for customization, vendor management or alternative solutions, which can erode the initial cost benefits. Understanding these constraints early ensures you can proactively plan for necessary adjustments.

Engage in Early Collaboration

Bringing together UX experts, developers and stakeholders from the beginning is critical. This early collaboration ensures alignment on goals, feasibility and timelines, helping to avoid costly rework and accelerate delivery. Open communication between teams allows for thoughtful design adjustments that merge the efficiency of white-label solutions with tailored elements.

Future-Proof Your Platform

Design your platform with scalability and adaptability in mind. As markets, user expectations and technologies evolve, your platform should be able to grow and adapt without requiring costly overhauls. A future-proof product ensures your business remains competitive and aligns with its long-term strategic goals.

Leverage Expert Support

Successfully navigating the complexities of integrating white-label solutions requires deep expertise and strategic collaboration. The right partner can help evaluate your business objectives, mitigate risks and unlock opportunities for innovation, ensuring your product is built to meet both immediate and future needs.

Crafting digital product designs for white-label solutions with technical limitations is far from a one-size-fits-all challenge. When aligned with the right strategy, expertise and collaboration, white-label solutions have the potential to deliver exceptional results. The essence lies in how well this solution is integrated into your business, taking into account not just immediate goals but also long-term growth and differentiation.

In an ever-evolving financial landscape, success depends on precision, scalability and user-centric innovation, and having a strategic partner can make all the difference. At UXDA, we work alongside financial institutions to guide these critical decisions, helping businesses optimize and customize white-label platforms or build tailor-made products. Our approach ensures that every solution supports your business objectives, enhances user experiences and positions your brand for sustainable success.

By engaging experts early, accounting for vendor constraints and prioritizing strategic design, financial institutions can create solutions that not only meet today’s needs but also secure long-term growth and a competitive edge. The decision you make today will shape your business’s future and the experience you deliver to your customers for years to come.

Discover our clients' next-gen financial products & UX transformations in UXDA's latest showreel:

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedin