In an era defined by relentless innovation and unprecedented customer expectations, the nature of financial services marketing has changed. The rapid shift to digital-first lifestyles has disrupted traditional financial services, forcing companies to rethink their approach to branding. A recognizable logo or clever tagline is no longer enough. Today's customers expect financial brands to deliver deeply personalized, seamless digital experiences at every touchpoint, consistently reinforcing what they stand for. How can financial brands meet these expectations? UXDA’s Digital Experience Branding (DXB) System provides a practical, actionable tool to help ambitious financial institutions build strong, future-ready digital brands.

Why a Brand Matters More Than Ever in the Digital Age

The accelerating shift to digital banking and Fintech solutions means customers interact with financial service providers through multiple digital channels—mobile apps, websites, smart watches, social networks, third-party services, voice assistants and more. Each of these touchpoints becomes a stage on which the brand’s identity must shine consistently. This is not just a design exercise; it’s the essence of building long-term trust, loyalty and engagement.

Historically, many financial brands were shaped by their physical presence: ornate bank branches, trusted bank tellers in suits and tangible collateral. But in a fully digital ecosystem, these old touchstones fade. Customers today form their perceptions of a financial institution based on an app’s interface, an online support chat or a well-timed push notification.

However, bankers struggle to translate customer service from offline to online modes. They are ignoring brand-driven consistent UX and often associate digital banking with just adding standard features. But when executed properly, a strong digital brand fills the gap left by the lack of a physical presence and offline banking marketing, providing reassurance, emotional resonance and a compelling reason to choose one financial platform over another.

The battleground has shifted to mobile apps, websites and digital interactions. Without a strong and consistent digital brand, financial institutions risk being overshadowed by nimble Fintech startups or tech giants like Apple and Google that excel in user experience.

A strong digital brand ensures:

- Customer Loyalty: A seamless and intuitive digital experience keeps customers engaged.

- Differentiation: In a crowded market, your brand’s unique personality and approach set you apart.

- Trust: Consistency and usability across digital platforms build confidence.

The Anatomy of a Digital Financial Brand in a Nutshell

Nowadays, designing a powerful digital brand for a financial company doesn’t require costly marketing in banking but, rather, primarily aligning every digital interaction with the core brand promise. Your digital ecosystem must revolve around the user. Whether it's simplifying onboarding or providing intuitive investment tools, the design should reflect your customers' needs and emotions. As Fintech firms like Robinhood have shown, ease of use can transform how customers view investments.

Unlike traditional banks that often rely on vendor solutions, top Fintechs like Chime and Revolut create custom digital experiences. These tailored interfaces allow for seamless integration of features and maintain brand authenticity. Custom development ensures every feature aligns with the brand’s values and customer expectations.

Consistency in design, tone and functionality—from mobile apps to chatbots—is crucial. For instance, Monzo, a UK-based Fintech, ensures its brand personality shines through in every customer interaction, whether on its app or customer service channels.

Your digital brand should connect with users on an emotional level. Stripe, for instance, has turned complex payment systems into an elegant and approachable experience, making developers and businesses fall in love with its brand.

A strong financial brand must effectively communicate its values and services through modern digital tools and platforms. Leveraging social networks, AI chatbots and personalized digital media campaigns helps maintain consistent and engaging communication.

For example, AI-driven customer support systems, like those used by HSBC, ensure quick and branded interactions, and Revolut's social media campaigns resonate with their target audience by blending their unique tone with actionable content. Digital artifacts, such as explainer videos, interactive calculators and gamified content provide an additional layer of engagement that informs as well as entertains. Combined, these tools amplify the brand's reach while reinforcing its core message across digital ecosystems.

A modern digital financial brand isn’t just about colors, logos and fonts. It’s a holistic system that weaves together strategy, design, functionality and authenticity. Consider the following elements:

- Brand Strategy and Positioning: Before embarking on a digital brand makeover, financial institutions must clarify their mission, values and brand promise. In a crowded Fintech market, what fundamental purpose do they serve, and how do they do it differently from everyone else?

- Digital Customer Experience (dCX): A brand is only as strong as the experience it consistently delivers. The user journey—from the first login screen to the advanced investment dashboard—must reflect the institution’s identity. Seamless navigation, personalized product recommendations and intuitive interactions differentiate leading brands from generic alternatives.

- Cohesive Visual Identity Across Channels: This goes beyond a simple color palette. It’s about delivering a cohesive identity that adapts gracefully across mobile, tablet, desktop, wearable devices and even virtual reality interfaces. The identity’s look and feel should be instantly recognizable no matter where and how the customer engages.

- Emotional Connection Through Content and Messaging: Authentic storytelling and transparent communication help forge a genuine emotional bond. Customers today expect more than just transactional efficiency. They want to know the institution’s vision, how it uses technology ethically and how it serves communities, and it also should be reflected in your digital banking marketing activities

- Adaptability and Scalability: A digital brand is never “finished.” Platforms evolve, user preferences shift, and new technologies emerge. The most successful brands are agile, continuously refining their identity to meet the evolving needs of their customers.

Is it possible to combine all these elements into a clear and straightforward framework? We believe that we have found a successful solution and tested it on our clients. Below, we will tell you how.

The Pillars of a Successful Financial Brand

As the financial landscape grows increasingly digital, the role of a strong brand will only become more critical. Institutions that treat brand-building as a holistic, ever-evolving process—one that merges strategy, design, technology and empathy—will be best positioned to stand out in a crowded marketplace.

To thrive in this new age, financial brands must think beyond standard functionality. They must craft authentic, meaningful digital experiences that consistently reassure, delight and inspire. The payoff? A loyal, engaged customer base that views the brand as a trusted digital partner in achieving their financial goals.

In a digital-first world, trust is established not through marketing in banking, but through the quality and reliability of each interaction. Customers have countless alternatives at their fingertips, so even a minor friction point—an overly complex onboarding form or inconsistent messaging between mobile and web—can lead them to abandon one platform for another.

Consistency, therefore, is not just “nice-to-have” but crucial. When a brand’s values and messaging are seamlessly integrated into every touchpoint, it creates a sense of stability and reliability. Over time, this fosters customer confidence and cements brand loyalty. A thoughtful, unified experience sends a message that the institution cares deeply about its customers’ time, comfort and aspirations.

- Digital Experience is the Brand: In the decline of physical branches, digital is your storefront. Cash App’s online-only e-wallet, for example, has built a reputation and gained as a tech-first banking provider with no branches by consistently innovating its digital platform. As of 2024, Cash App reports 57 million users and $14.7 billion in annual revenue.

- Authenticity Through Customization: Vendor-built solutions might save time, but they fail to differentiate. Nubank, for instance, created a completely custom user experience, ensuring every element aligns with its bold and disruptive brand personality. This authenticity is what attracts and retains millions of loyal customers, increasing Nubank’s customer roster from 41.1 million to 91.7 million in the last three years.

- Consistency as a Trust Builder: Trust is the cornerstone of financial services. A disjointed experience—say, radically different functionality between a mobile app and desktop dashboard—can erode trust. Fintech leaders like Chime, Revolut and Monzo excel by ensuring authenticity across every touchpoint—from notifications to in-app support.

Emerging and established Fintech companies, as described below, are proving that a strong digital brand identity is central to success:

- Revolut: Rather than using off-the-shelf vendor solutions, Revolut designed its own user interfaces from the ground up. Each super app element—from the minimalist customizable dashboard to interactive budgeting tools—is tailored to meet customer needs. The result is a unique aesthetic and functional identity that conveys agility, innovation and simplicity. Revolut meets customer needs at every touchpoint, providing contextual guidance, personalized insights and a rich user experience. The Revolut super app offering goes far beyond finance by including cutting-edge lifestyle services.

- Chime: By focusing on intuitive navigation and thoughtful prompts, Chime makes the onboarding process as painless as possible. Clear messaging, positive reinforcement and well-timed nudges guide users through each step, ensuring that the digital brand isn’t just a veneer but a living manifestation of the company’s mission to empower customers financially. By designing its digital experience for everyday users, Chime has redefined banking for millennials. Its tailored features, like no-fee overdrafts, resonate deeply with its audience.

- Monzo: The UK-based challenger bank built an app experience that feels more like a lifestyle tool than a traditional financial product. Bright colors, friendly language and micro-interactions turn mundane banking tasks into engaging touchpoints. This distinct look and feel helps Monzo stand out in a crowded market while reinforcing the brand’s personality and approachability. A focus on community building and transparency has turned Monzo’s customers into brand advocates. Their digital products are built to reflect this ethos, ensuring authenticity.

These top Fintech brands have two key qualities in common: authenticity and purpose-driven innovation. They don’t simply buy a standardized online banking module, slap their logo on it and strongly promote their brands through standard banking marketing. Instead, they start with their brand values and customer needs, then craft tailor-made digital experiences that reflect those principles at every turn. This approach ensures the brand’s digital identity is not only distinctive but also deeply meaningful to customers, turning them into referrals and brand advocates.

By continually revisiting their brand strategy, analyzing user feedback and embracing new technologies, these Fintech brands never lose sight of what made them successful in the first place. They differentiate themselves from legacy competitors not just through better rates or product features, but by delivering a cohesive, emotionally resonant experience that aligns with their brand’s promise and purpose.

UXDA's Framework to Empower Your Digital Financial Brand

After creating more than 150 financial products in 37 countries over the course of ten years, UXDA discovered a crucial industry gap: financial brands were only making use of around 10% of their potential for digital services.

The complex needs of financial institutions and their clients are not well met by standard design and development methodologies, even if digital services have emerged as the main delivery channel. This leads to fragmented and impersonal user experiences that don't live up to the standards set by contemporary digital innovations.

UXDA's DXB (Digital Experience Branding) System provides a blueprint that integrates high-level brand strategy with on-the-ground execution across various channels. By aligning mission and vision with market insights, product offerings and customer interactions, it ensures that the brand is a meaningful, consistent and evolving presence that resonates with customers in every interaction—critical for building a strong, enduring financial brand in the digital age.

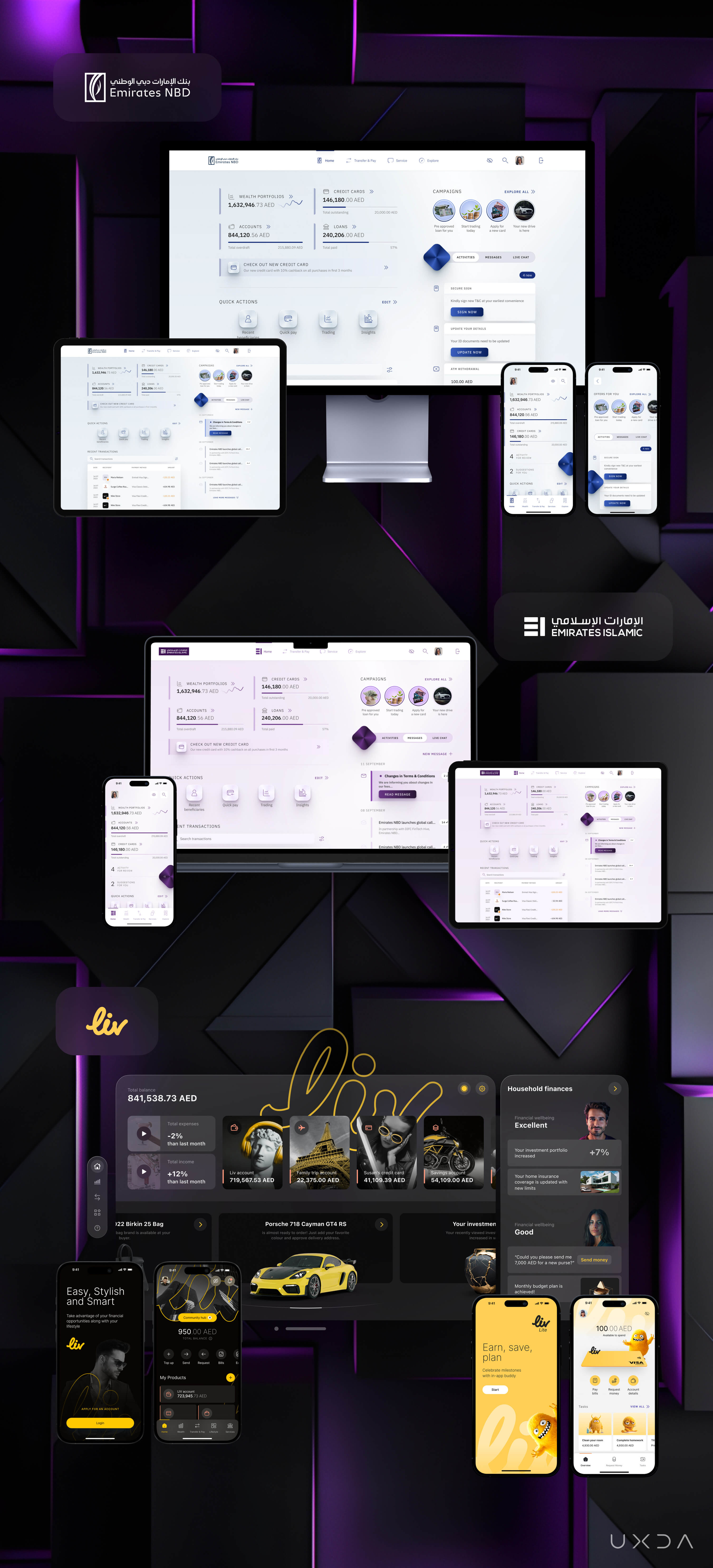

UXDA employed this cutting-edge framework to connect Emirates NBD brand and digital experience across digital ecosystem transition. It secured scalable design systems uniformity across digital products and efficient product management throughout the bank's divisions.

UXDA's DXB (Digital Experience Branding) System enabled a seamless Emirates NBD digital experience evolution by integrating brand strategy, values and identity with cutting-edge product design. This supported Emirates NBD in pioneering its entire digital ecosystem innovation across contemporary digital platforms.

Such a strategic UX approach through UXDA's framework has delivered remarkable results: a 91% digital adoption rate on the ENBD X app, a 1,600% increase in wealth clients, a 50% surge in transaction activity, an app rating improvement from 2.0 to 4.7 on the App Store and recognition as the region's top banking app in 2023.

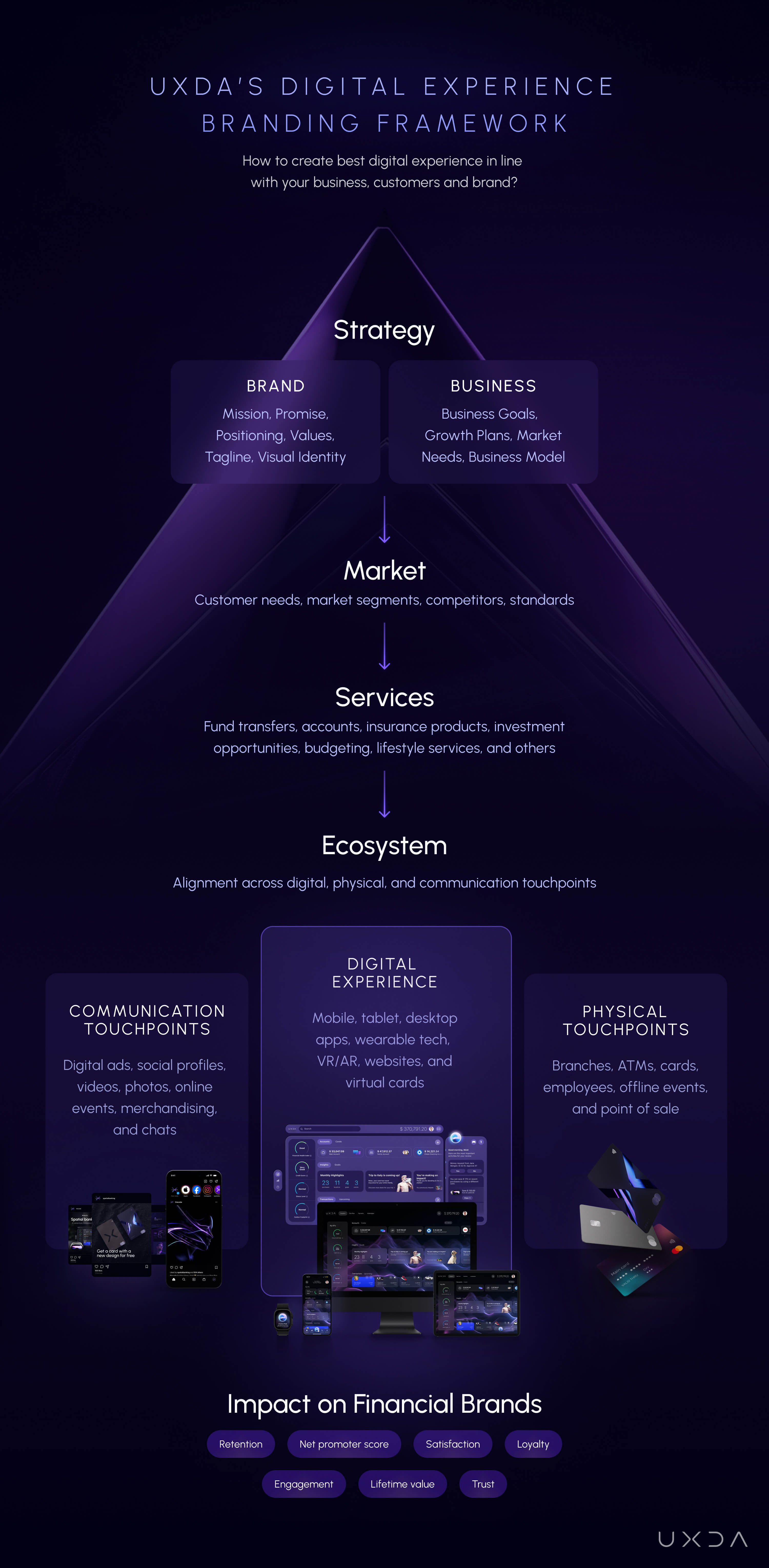

UXDA's DXB system is essentially a structured roadmap that guides financial institutions through key layers of brand creation and expression in a digital ecosystem. Instead of viewing branding as just a logo or color scheme, this model encourages a holistic approach in which the brand’s core strategy, market positioning, service offerings and ecosystem alignment all contribute to a cohesive, meaningful digital experience.

Here’s how it helps build a strong financial brand suited for the digital age:

1. Strategy: Aligning Brand and Business

A successful digital financial brand starts with a clear strategy that integrates two foundational pillars:

- Brand: Define the mission, promise, positioning, values, tagline and visual identity that reflect your organization's unique purpose.

- Business: Align the brand with business goals, growth plans, market needs and the overall business model.

By clearly defining these foundational elements, the institution establishes a strategic compass that informs all subsequent branding efforts. We need to align every digital touchpoint—from a mobile banking app to a social media campaign—reinforcing the brand’s core identity rather than presenting a fragmented image.

Take, for example, the Fintech brand identity of Revolut or Stripe. Their strategies combine a clear brand mission with the business objective of delivering growth through tailored, user-friendly digital platforms.

2. Market: Understanding Your Customer

Traditional financial brands often struggle to keep up with rapidly changing customer demands and market conditions. This framework places the market—customer needs, segments, competitors and industry standards—immediately after strategy.

By bridging strategy and market understanding, the institution aligns its brand with evolving consumer expectations and industry benchmarks. This ensures that the brand voice and experience aren’t developed in isolation but actively resonate with what customers truly want and need.

The financial landscape is highly competitive. A strong digital brand focuses on customer needs, market segmentation, competitor positioning and industry standards to create experiences that truly resonate.

Fintech disruptors like Chime and Cashapp succeeded because they understood the frustrations of underserved users and created solutions that simplified banking for specific segments—millennials and digital natives. By listening to customer pain points, they designed products that met real needs while aligning perfectly with their brand promises.

3. Services: Crafting Tailored Offerings

Financial services—such as accounts, transfers and investment tools—are often viewed as commodities. The framework encourages viewing services as brand expressions.

Instead of delivering generic offerings, each product and feature becomes an opportunity to embody the brand’s mission, solve customer problems and differentiate themselves from their competitors. This turns functional services into meaningful brand moments, making them memorable and emotionally resonant rather than purely transactional.

Strong financial brands deliver tailored products and services that align with user expectations and business goals. These include:

- Fund transfers, accounts and payments

- Investment tools for first-time investors

- Insurance products and budgeting tools

- Lifestyle services and personalized recommendations

For instance, Robinhood disrupted traditional investment services by offering simple, engaging tools for novice investors. Their mobile-first approach and transparent brand message—“democratizing finance”—align seamlessly with their service offerings.

4. Ecosystem: Ensuring Consistency Across Touchpoints

In the digital age, a financial brand doesn’t just live on websites and apps. It extends across multiple channels—branch experiences, ATMs, wearable technologies, social media and more. The framework emphasizes ecosystem alignment, ensuring that these diverse touchpoints tell a consistent brand story. Whether a customer is interacting with a chatbot at midnight or visiting a branch during the day, the brand identity, values and messaging should feel coherent and familiar.

A modern financial brand thrives when it provides an omnichannel ecosystem that aligns:

- Communication Touchpoints

- Digital Experience

- Physical Touchpoints

This unified approach ensures overall brand consistency, improves trust and enhances usability across every interaction.

Communication Touchpoints: Brand-Driven Engagement

Any modern financial brand communicates its value and personality across digital channels through:

- Digital Ads: Brand campaigns that connect with audiences emotionally.

- Social Profiles: Authentic engagement on platforms like LinkedIn and Instagram.

- AI Chatbots: Personalized and instant customer support.

- Videos and Digital Artifacts: Explainer videos, interactive calculators and gamified experiences.

- Influencer Marketing in Banking: Brand and product reviews in top blogs.

For example, Monzo leverages social media and user-centric campaigns to reflect its transparent and community-driven ethos, ensuring the brand feels approachable and relatable.

Digital Experience: Delivering Seamless Usability

Your digital experience is where the brand truly lives and breathes. This includes:

- Mobile, tablet and desktop apps.

- Wearable tech, VR/AR tools and gen AI chatbots.

- Virtual cards and third-party platforms.

Fintechs like Revolut and Chime prioritize custom-built interfaces over off-the-shelf solutions to provide tailored digital journeys that align with user needs, differentiate themselves from competitors and strengthen their brand. The result? High retention, loyalty and brand advocacy.

Physical Touchpoints: Bridging Online and Offline

While digital dominates, physical touchpoints remain essential for incumbent financial companies. But even offline digital technologies will drive transformations to enrich customer experience:

- Branches will be transformed into “phygital” spaces using digital tech.

- ATMs transformed into smart "one-stop" ATM stations.

- Payment cards could be enriched with AR technology.

- Support and service call centers will be transformed with gen AI solutions.

- Events marketing and offline advertising (outdoor displays/kiosks) will be enriched through video.

To create a holistic experience, physical touchpoints must mirror the digital brand identity and include digitally-enriched experiences. Akbank demonstrates this perfectly by integrating digital innovation with redesigned physical branches in the “Next Generation Akbank Branch Model,” which reflect its tech-first identity rebranding.

Conclusion: Customer Experience Consistency Ensures Brand Success

The framework visually illustrates that a successful digital financial brand is not just about the digital interface. It must encompass communication efforts (e.g., digital ads, social media content, online events), digital experiences (e.g., apps, VR/AR, websites) and physical presences (e.g., branches, ATMs).

By viewing each of these elements as integral parts of one ecosystem, the framework ensures no channel is neglected or mismatched. Consistency across channels fosters trust, credibility and loyalty.

At the heart of every strong financial brand lies the ability to combine communication and experience. A clear strategy, user-driven services and a seamless omnichannel ecosystem allow financial companies to:

- Build trust through consistency

- Establish loyalty by meeting user needs

- Achieve growth by differentiating from competitors

By adopting the UXDA's DXB System, financial institutions can craft digital experiences that inspire, engage and deliver real value to customers.

In finance, UX is increasingly the brand differentiator. The framework underscores that brand-building isn’t separate from user experience—these elements are intertwined. By connecting strategic brand elements directly to digital interfaces and customer journeys, the institution can create intuitive, visually compelling and user-friendly digital platforms. This approach transforms the brand from a static concept into a living, breathing experience that delights users and reinforces brand promises.

At its heart, the framework ensures authenticity. It encourages financial institutions to first define who they are and what they stand for, then manifest these qualities through products, services and every point of contact with customers. In the digital age, trust is built through consistent, transparent interactions. The framework’s holistic approach ensures that authenticity—once established at the strategic level—carries through to the smallest details of the user experience, strengthening customer trust over time.

The financial landscape is dynamic. The framework’s layered structure makes it easier to identify where changes can be made to maintain relevance. If customer needs evolve or new technologies emerge, the institution can return to earlier layers (e.g., market insights, services, ecosystem touchpoints) to adjust brand strategies and realign experiences, ensuring the brand remains fresh, competitive and aligned with customer expectations.

In the words of former ING’s CEO Ralph Hamers, “If you want to compete in the world of tech and if you, increasingly, want to become a tech company, you have to organise like a tech company.” Now is the time for every financial brand to step up and deliver experiences worthy of the digital age.

The financial industry’s future is digital, and success depends on your ability to align business goals, brand values and user experience. Fintech leaders like Revolut, Nubank and Chime have shown that a strong digital financial brand identity is not just about sleek design or functionality—it’s about delivering a human-centric, consistent and engaging experience across every interaction. In the digital age, your experience is your brand.

Get UXDA Research-Based White Paper "How to Win the Hearts of Digital Customers":

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedin