AI is transforming the world. The benefits of using AI in financial services are obvious. AI can personalize and improve the digital experience for customers, as well as increase efficiency and automation of internal operational processes. There is another promising area of AI use for financial brands ─ marketing and brand communication. The UXDA team assessed the potential of humanizing financial brands using ChatGPT and Midjourney by creating digital mascots based on the mobile service interface.

The success of Chat GPT's generative AI shows that, in the near future, those financial service companies that will improve the experience of their customers using AI will have an advantage. The transition to digital self-service and automation of financial transactions has already led to the closure of thousands of bank branches.

The use of digital technologies, and AI in particular, improves the efficiency of financial companies in all areas, but one area, external communication, leaves much to be desired. It seems that some marketers in banks still believe that advertising on TV and outdoors is the most effective communication channel.

Social networks today are a powerful communication channel, the importance of which is difficult to overestimate. Along with the bank’s digital applications, social media communications can shape the brand’s image and digital identity. It is the ideal channel to convey a brand's values, uniqueness and benefits to a mass audience.

Unfortunately, traditional financial service companies often miss out on digital communication opportunities for their brands. Just look at bank profiles on social networks. In most cases, they are inactive or you'll find promotional posts and alerts about banking system outages. It's boring and doesn't create an emotional connection with the social media community. And, soon, AI will start a real revolution here!

The Power of Social Influence on the Financial Industry

Look at social media influencers; they engage huge audiences. They illuminate, exploit and set trends. Of course, we have seen a few successful cases of influencer marketing in the financial industry, such as Revolut, Monzo and Starling, or Klarna with Snoop Dogg and Cash App with Travis Scott. However, the use of AI will allow financial brands to take this communication tool to the next level in the near future. AI solutions can help financial brands themselves become influencers for their clients and build truly emotional and engaging communication that reveals the human face of the brand.

Incorporating social influencers into digital strategies signifies a major shift toward authenticity and emotional engagement, meeting modern consumers' demands. This approach not only improves the consumer experience but also creates new opportunities for brands to establish meaningful connections and achieve measurable outcomes. Fifty-six percent of Gen Z and millennials report they intentionally seek out financial advice online or through social media.

According to Statista, approximately 78.6% of U.S. marketers in companies exceeding 100 employees planned to leverage influencers for marketing endeavors, growing from 64% in 2020. Statista data shows that already 26% of marketing agencies and brands spent over 40% of their budgets on influencers marketing globally in 2024. Influencers are the primary product discovery channel for Gen Z, and eight in ten social marketers believe that the majority of brands will soon have social influencers as their brand face.

AI is playing an increasing role in influencer marketing. According to an Influencer Marketing Hub study, 63% of surveyed companies plan to use AI in executing their influencer campaigns. And, according to the Influencer Marketing Factory 2023 report, 95% of influencers use AI to generate or edit content in social media. And some of the TOP influencers, themselves, are created by artificial intelligence.

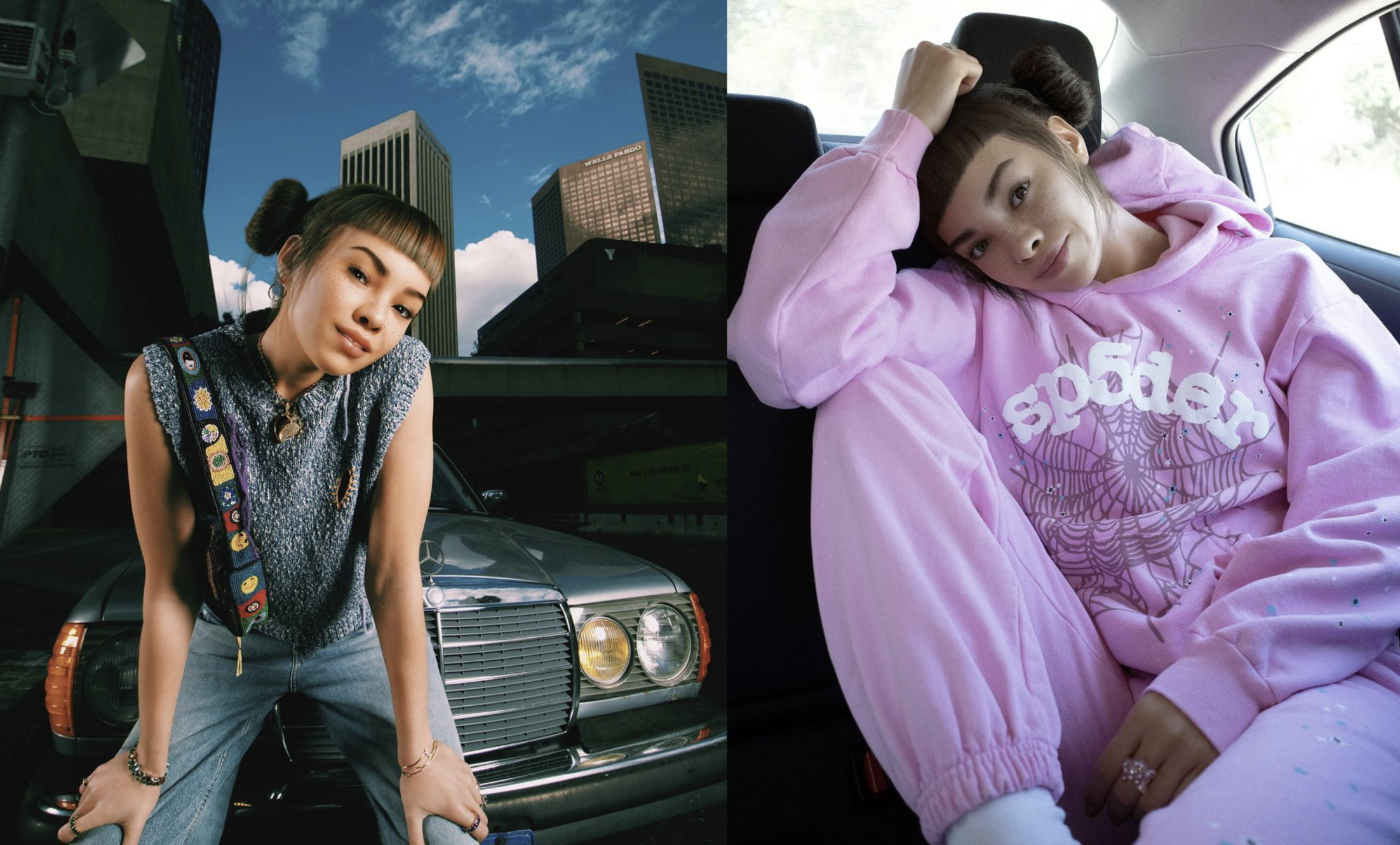

For example, Magazine Luiza, оne of the biggest retail companies in Brazil, created the virtual influencer, Lu do Magalu, to market iBlogTV on YouTube. She now has 15 million followers on Facebook, 6 million followers on Instagram and more than 3 million YouTube subscribers! Another virtual influencer is Brazilian-American AI-generated model and singer Miquela Sousa, aka Lil Miquela, created by Brud, a startup based in Los Angeles. She has 3 million Instagram followers and 3.5 million TikTok followers, and, in June 2018, Miquela was named one of Time’s 25 Most Influential People on the internet.

There is a growing concern that the rapid digitalization of financial services could result in sacrificing human touch and emotional connection with customers. Digital banking is already accused of lacking humanity and empathy. Therefore, influencer marketing and AI-generated content can be an effective solution to ensure an emotional connection with financial brands through digital media.

UXDA’s financial UX agency mission is to humanize finance. Seeing generative AI and neural networks doing incredible things, we wondered if they could turn digital financial services into unique digital mascots. So we thought this could be a great opportunity to personify digital financial services and bring out their "human face."

What is a Digital Mascot and How is it Crafted?

A mascot refers to a character or an anthropomorphized figure that embodies the essence of a brand, organization or public entity. This concept traces back to the French word "mascotte," which translates to "lucky charm." Due to their potential for creating emotional connection, mascots have become very popular in sports and children's products.

A digital mascot is a virtual character designed to represent and promote a brand, product, service or organization in the digital realm. Unlike traditional mascots, which might appear in physical form or as part of live events, digital mascots are specifically created for online platforms, social media, apps, websites and digital advertising campaigns. They serve as engaging and relatable figures that embody the values, personality and identity of the brand they represent, aiming to create a memorable and emotional connection with the audience through storytelling techniques.

The UXDA team conducted a range of experiments to generate a prompt with ChatGPT and then visualize the digital mascot in Midjourney. And the results were fascinating! We received highly realistic, vibrant and stunning human and animal mascots that accurately reflect the identity of the digital application that was used as the source.

The UXDA team started the first experiment with our team Spatial Banking design concept for Apple Vision Pro. Associated with the future and the new era of spatial computing, we adopted the technological and innovation sense of the next-gen experience. We chose a dragon as one of the mascots because it is the animal of 2024, the year Apple launches its first revolutionary Vision Pro headset.

AI-generated mascots could perform as virtual influencers in social media and symbolize a new era of hyper-personalization. Crafted to meet the distinct needs and preferences of target audiences, these digital entities offer an unparalleled level of authenticity, especially in the realm of financial products.

Below you can see 10 digital mascots we created for our clients to explore how our clients' digital financial products can be humanized by artificial intelligence. It was inspiring for our team to see these results.

Next, you will explore how 50 top banks and Fintech companies, including HSBC, Lloyds Bank, Barclays, Revolut, Robinhood, Chime, Bunq and more, are seen through the eyes of AI. These AI-generated digital mascots show that unique design and authenticity of the app results in key differences, even in the perception of the robot. In the case of standardized template-based banking app design, AI generates mascots similar to one other, while the unique interface design and visual language ensures individuality and brand recognition, even in the digital interpretation of AI.

AI-Generated Digital Mascots for UXDA Designed Financial Products

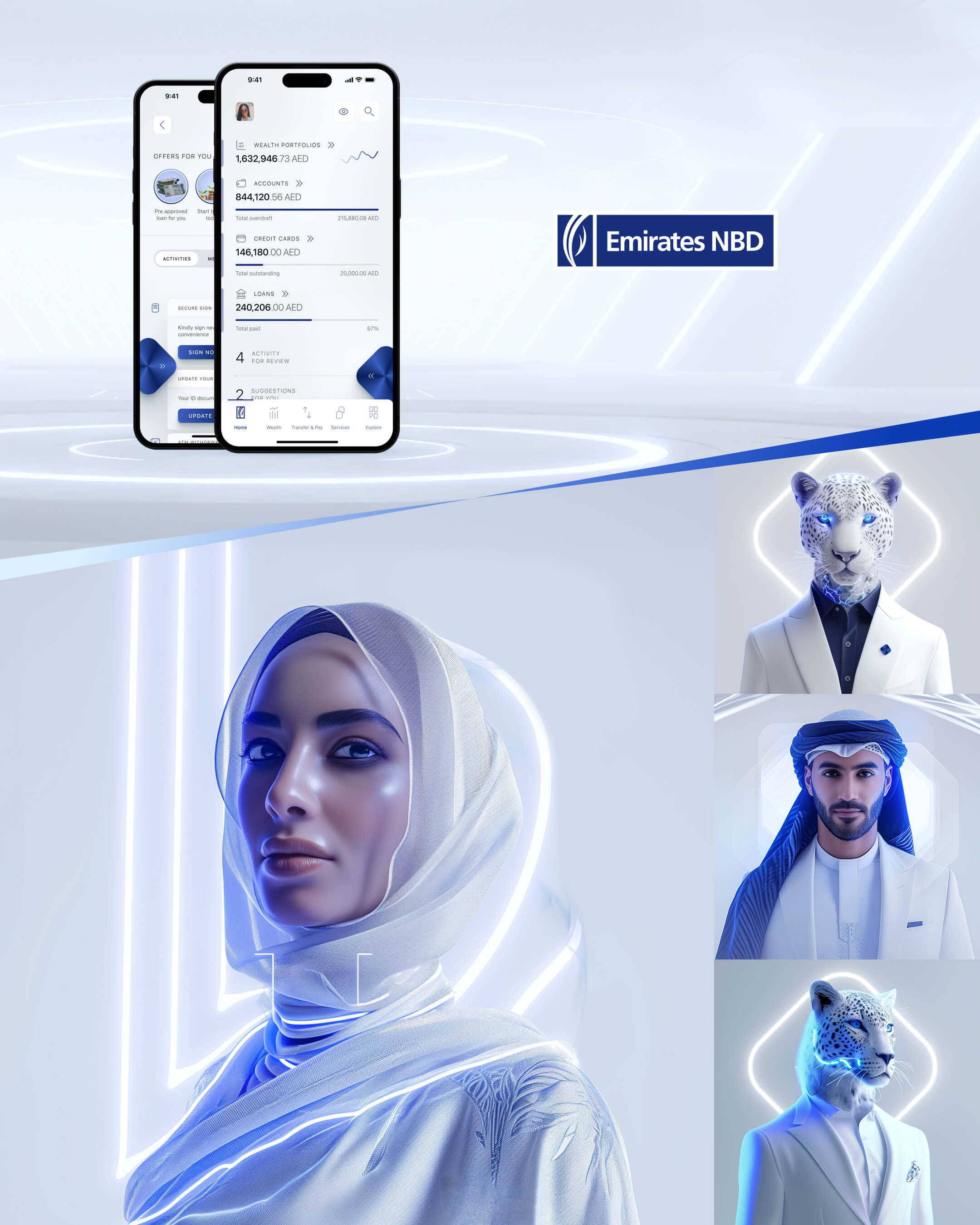

Emirates NBD AI mascot

CRDB Bank AI mascot

Banka Kombetare Tregtare AI mascot

Bank of Jordan AI mascot

Private Wealth Systems AI mascot

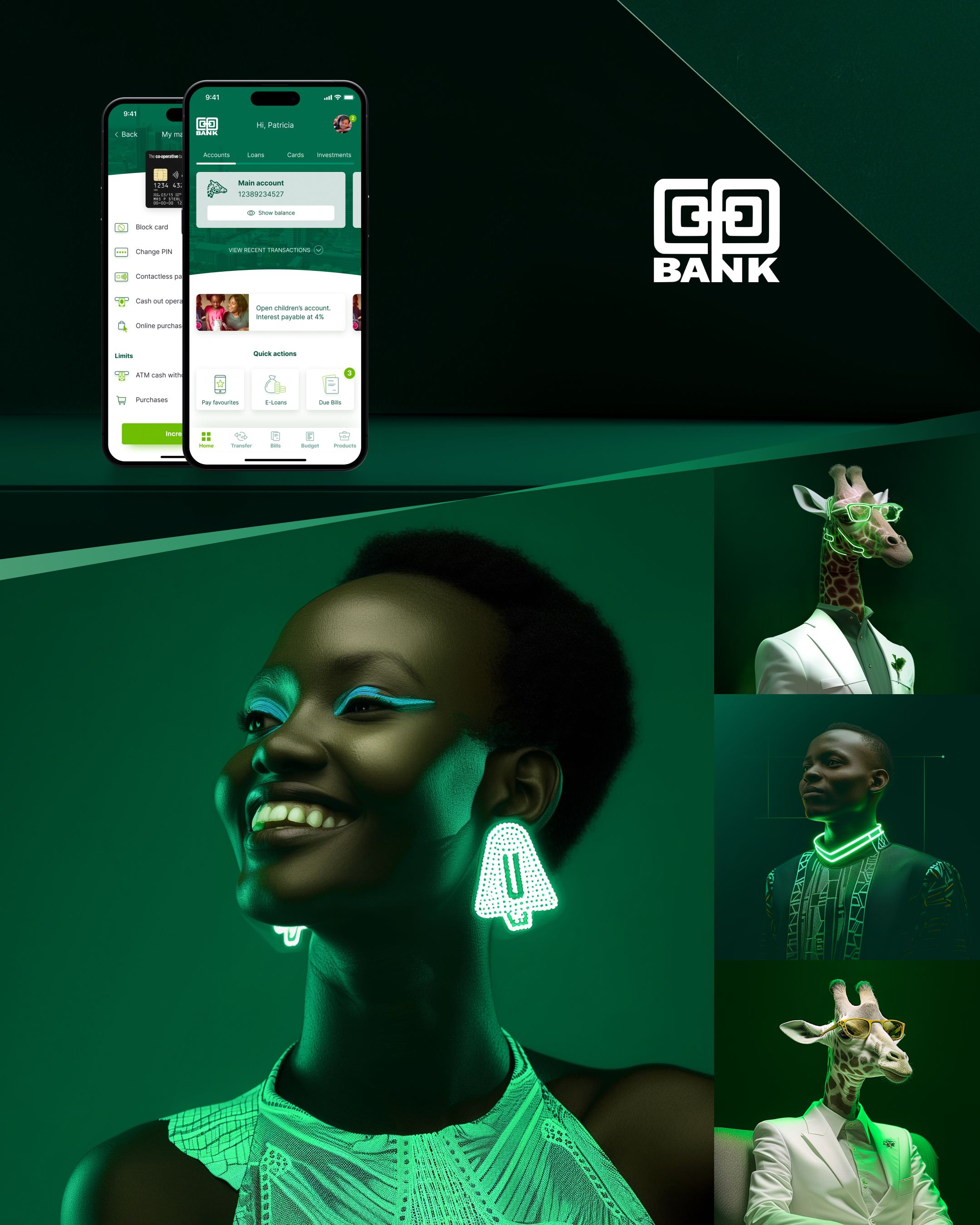

Co-operative Bank AI mascot

Magma Capital Fund AI mascot

United Arab Bank AI mascot

my.t money AI mascot

Integrating emotion into communications with customers is tough in finance, but AI can generate visual ideas for marketers in seconds that range from genius to insanity.

Top Banks and Fintechs Apps Through the Eyes of AI

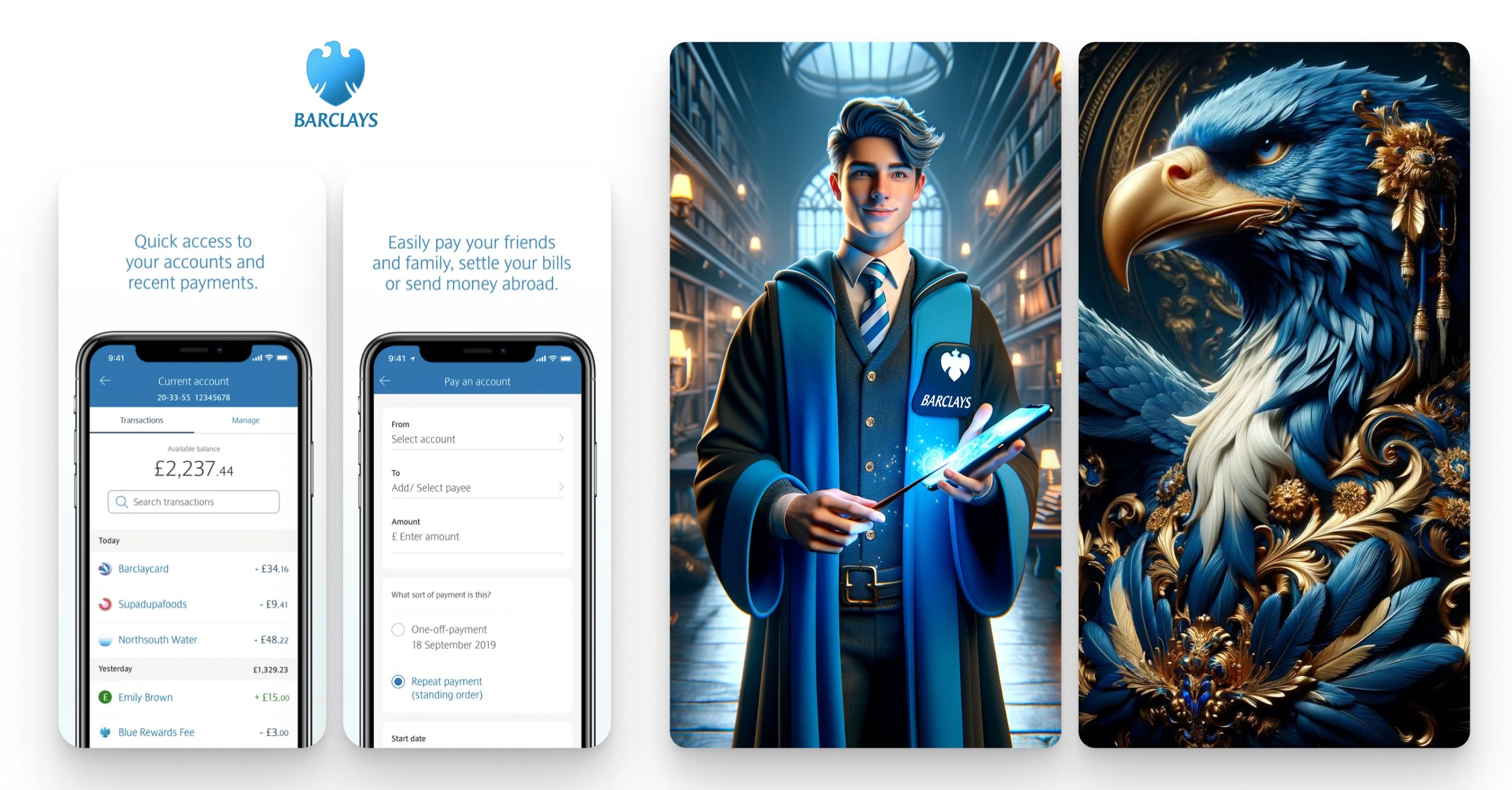

Barclays Bank AI mascot

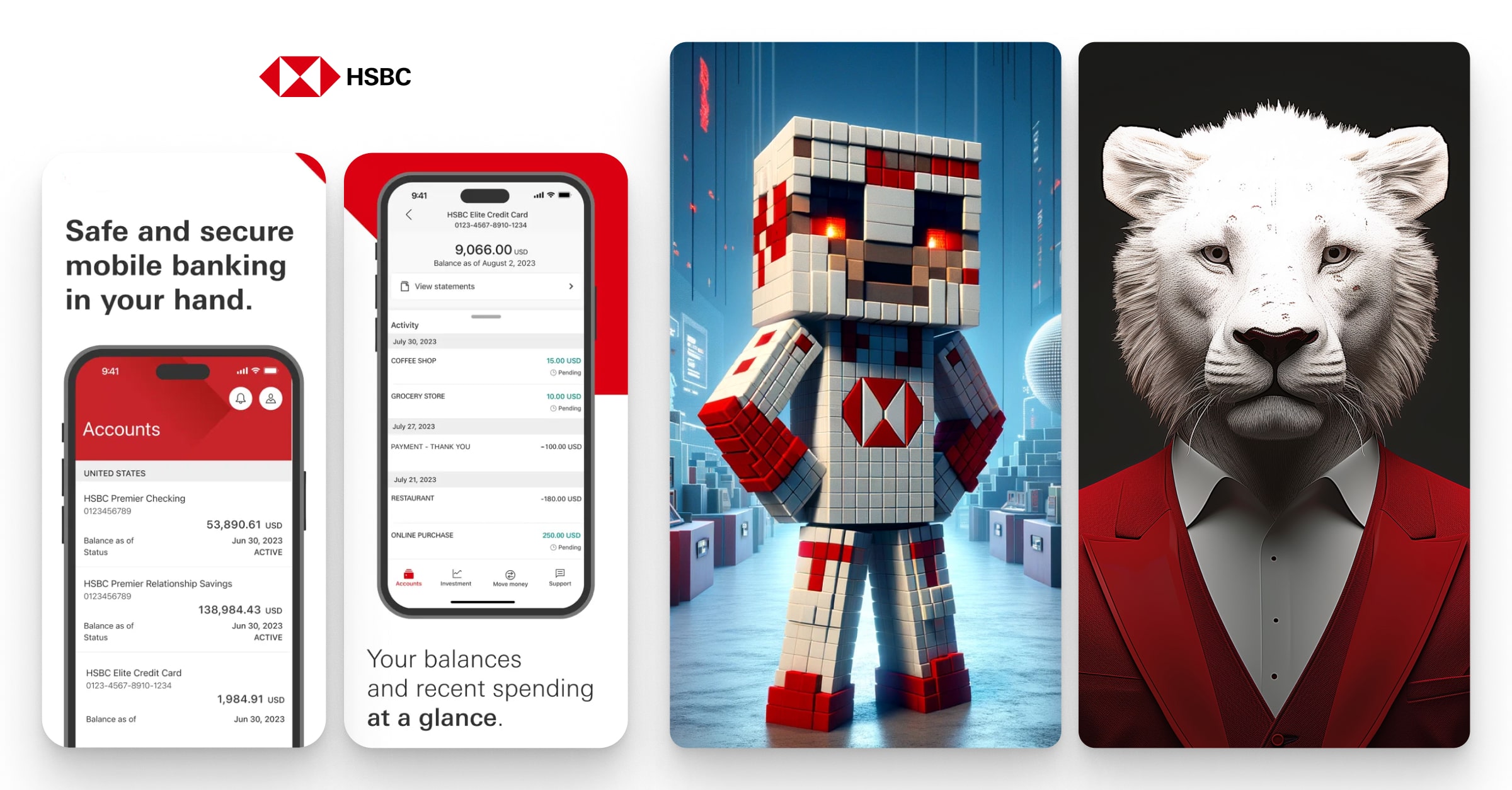

HSBC Bank AI mascot

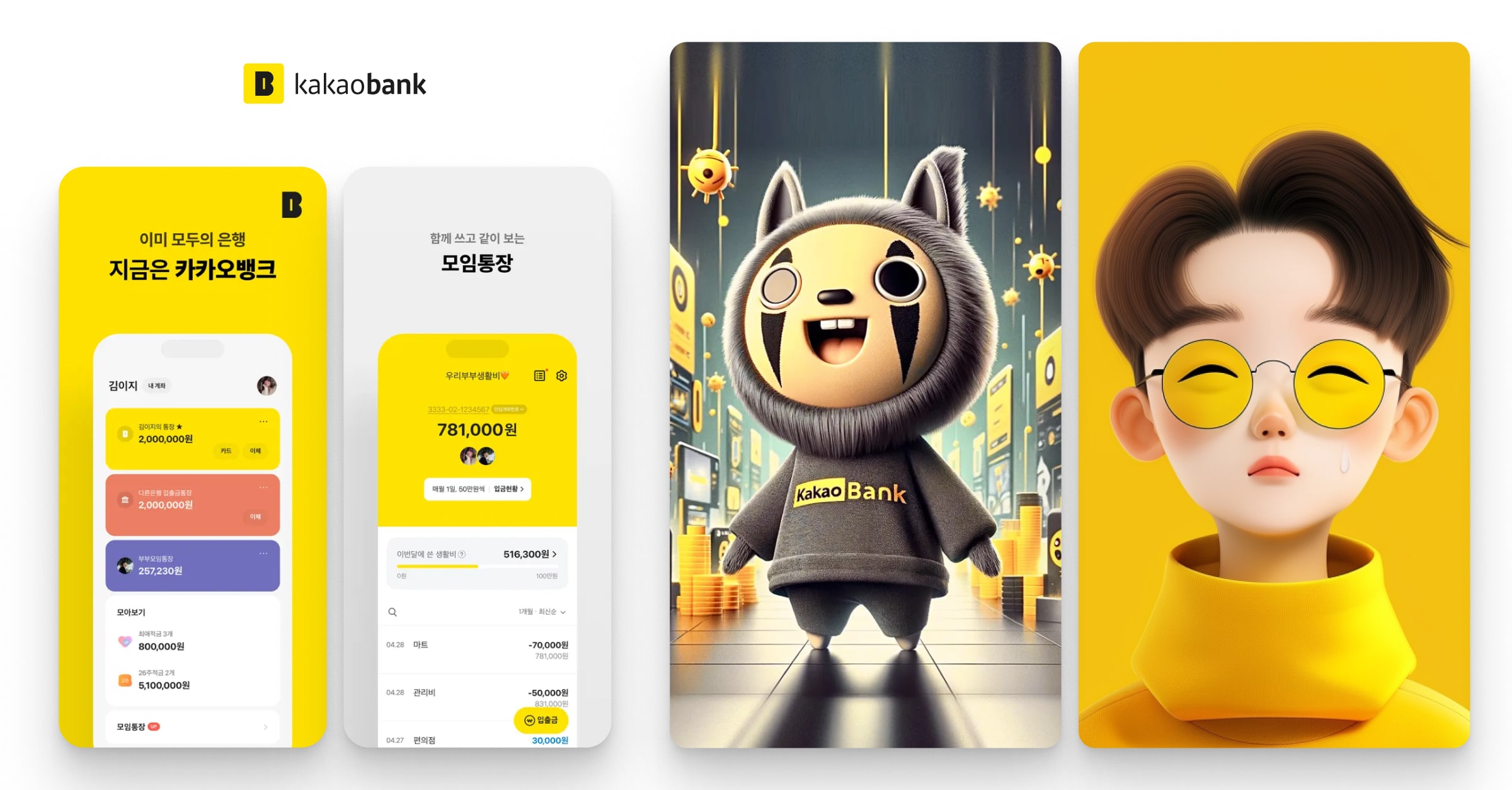

KakaoBank AI mascot

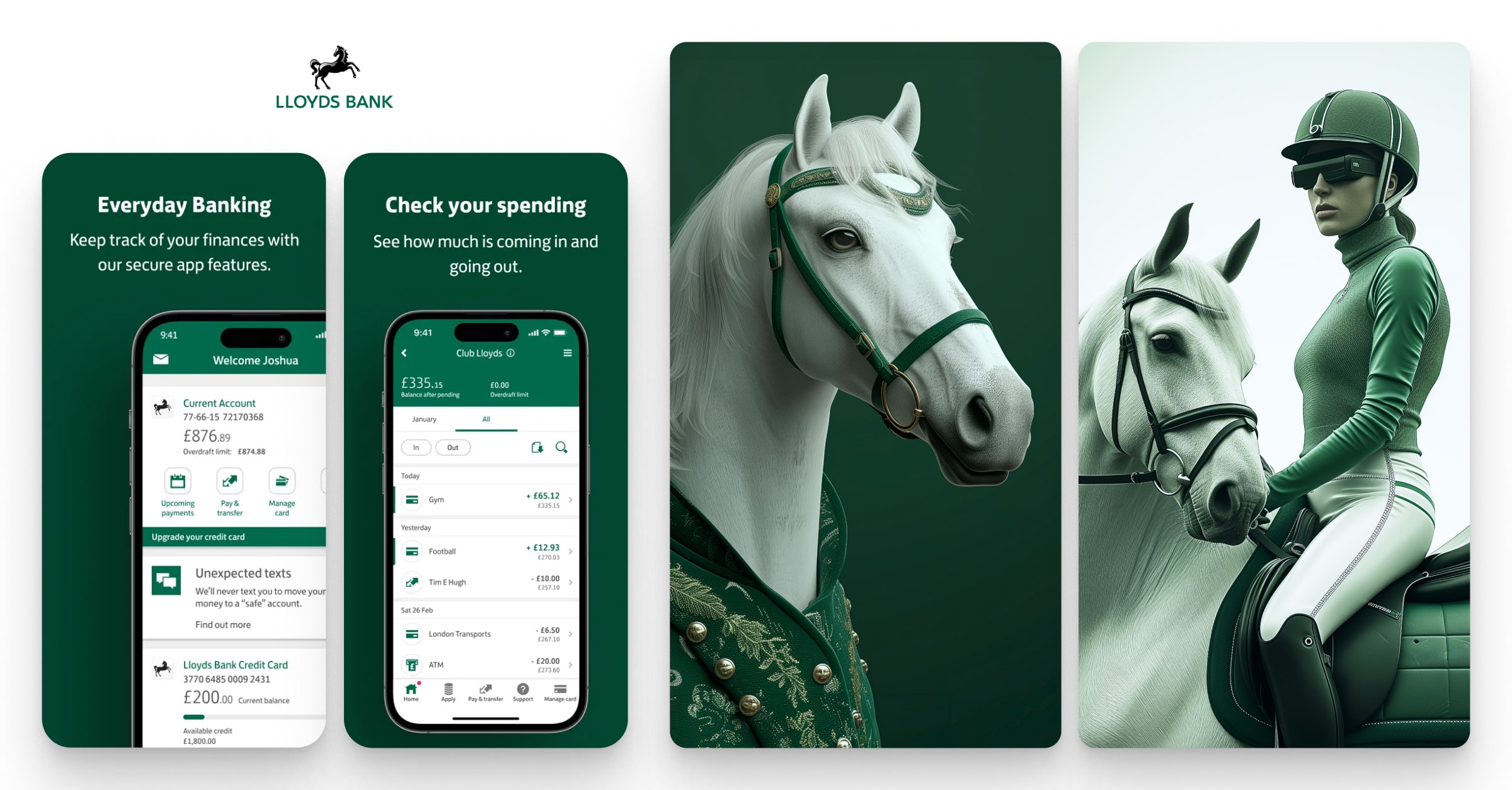

Lloyds Bank AI mascot

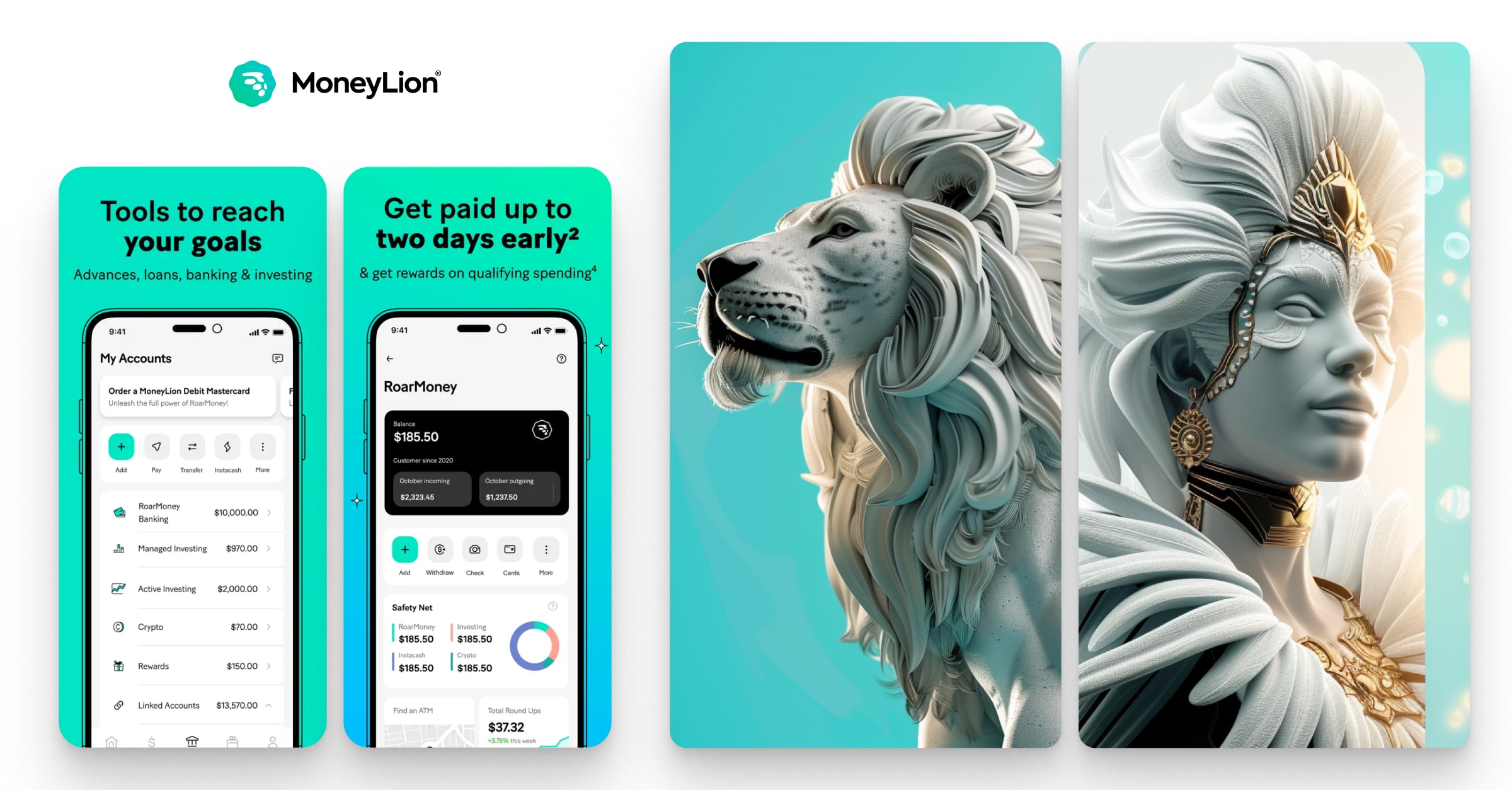

MoneyLion AI mascot

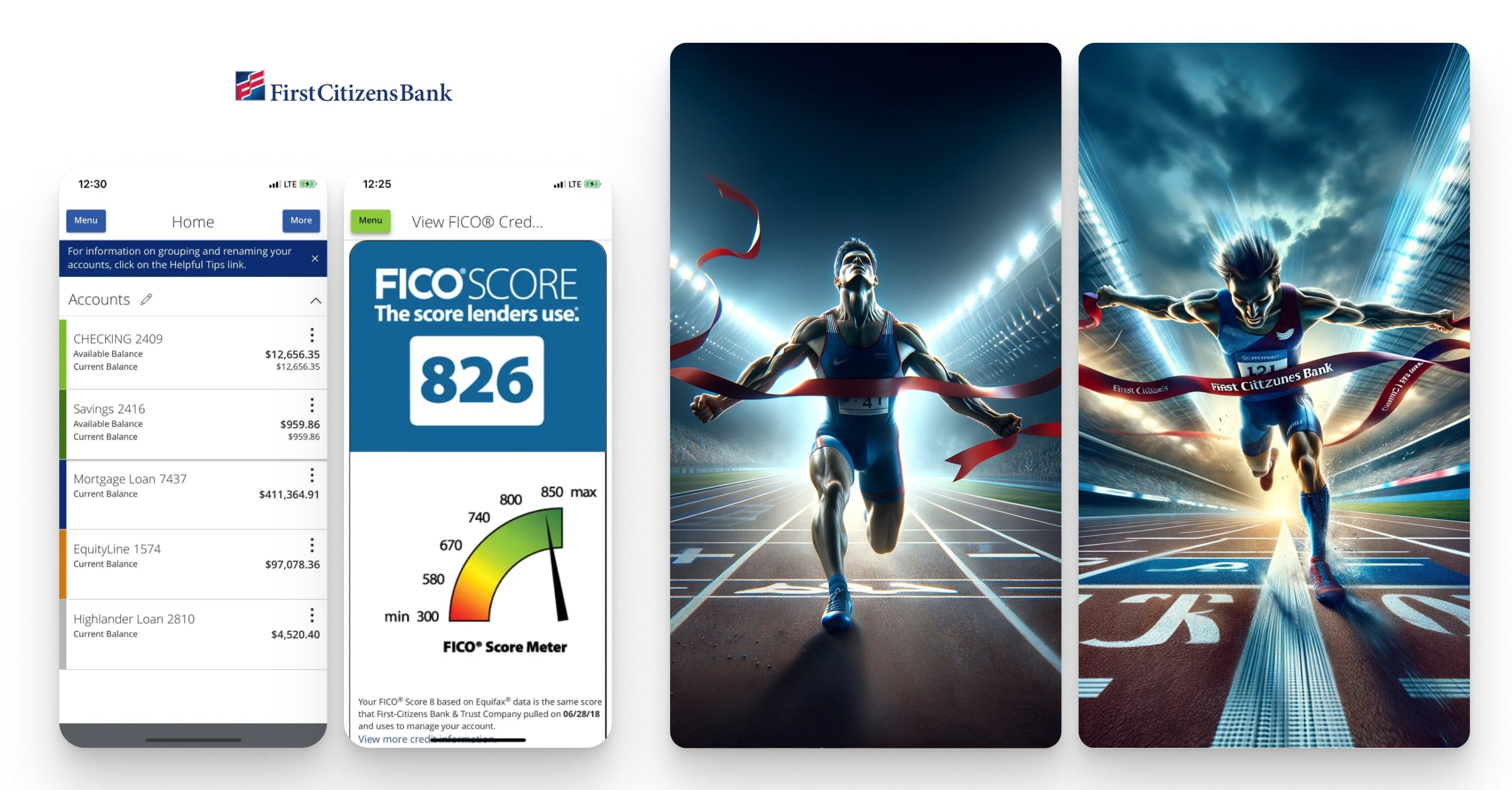

First Citizens Bank AI mascot

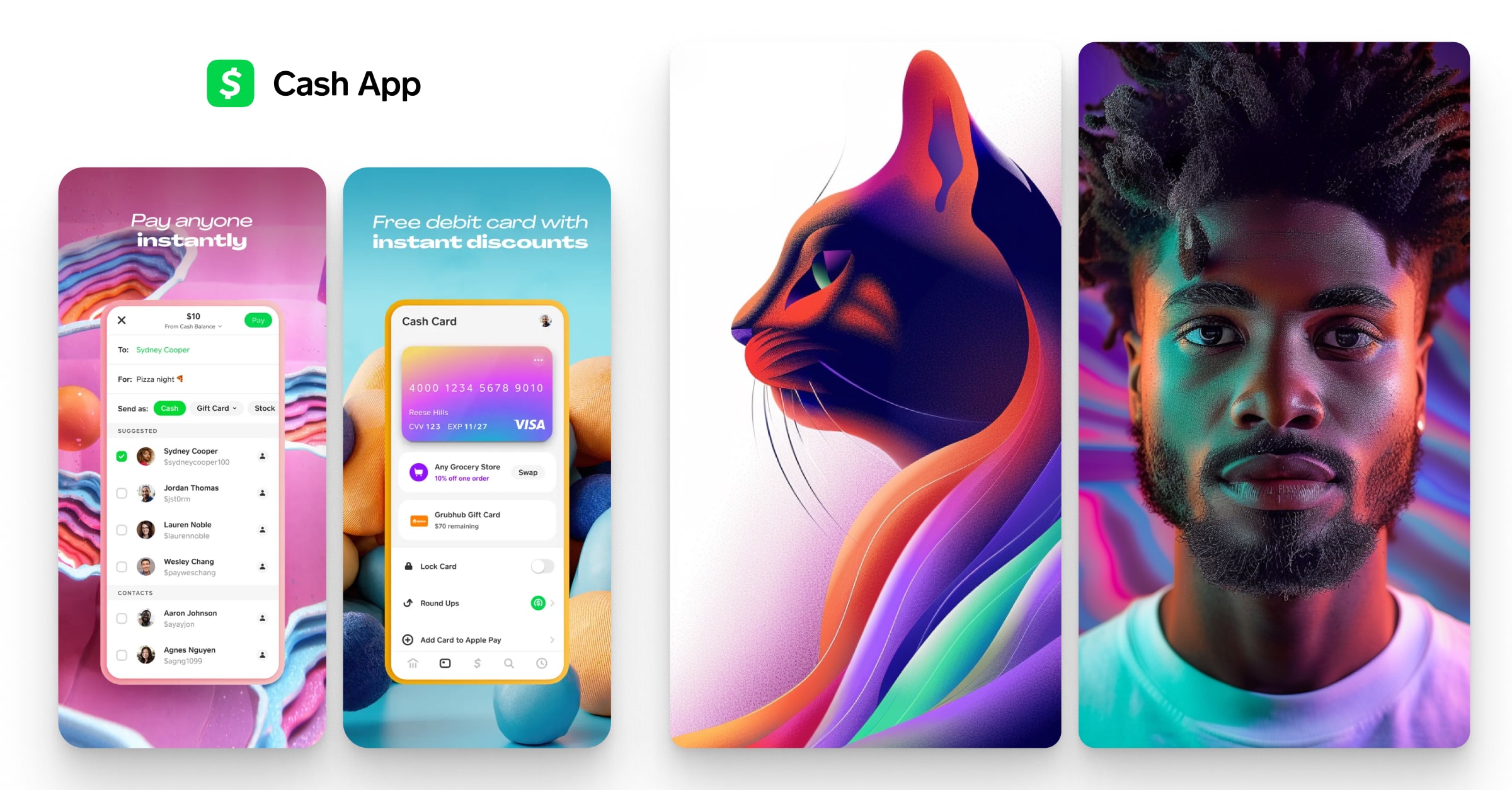

Cash App AI mascot

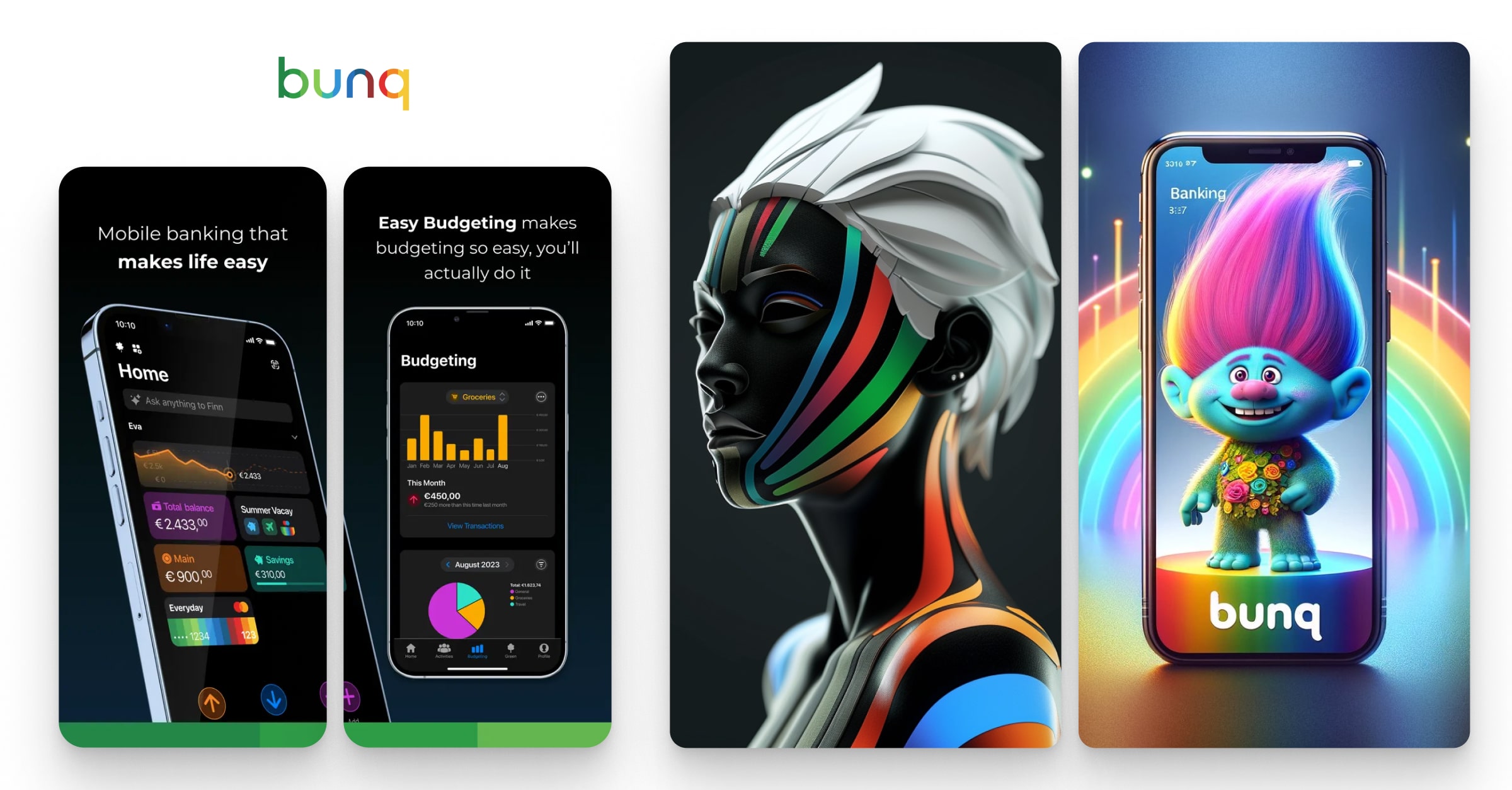

bunq AI mascot

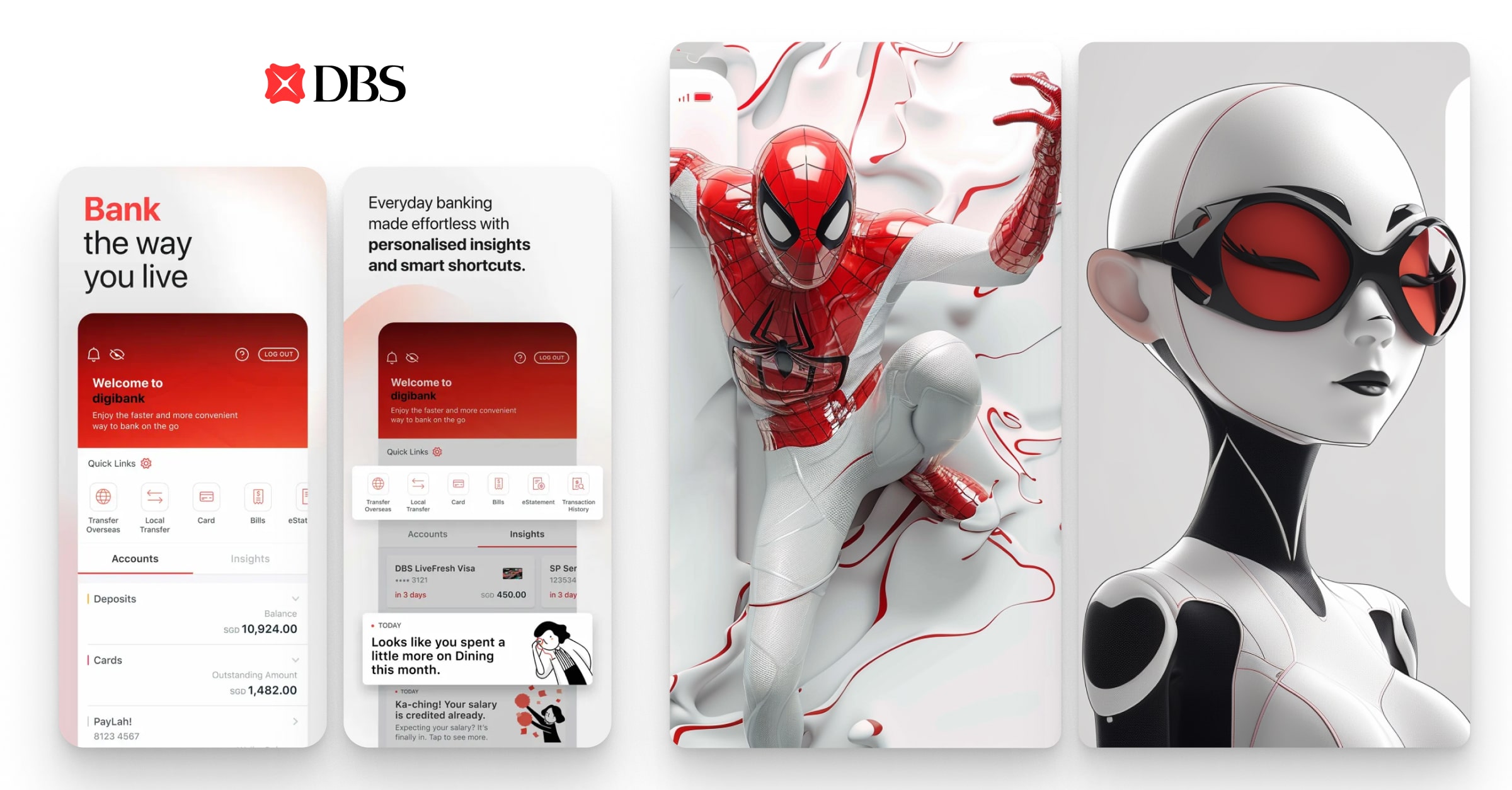

DBS Bank AI mascot

Revolut AI mascot

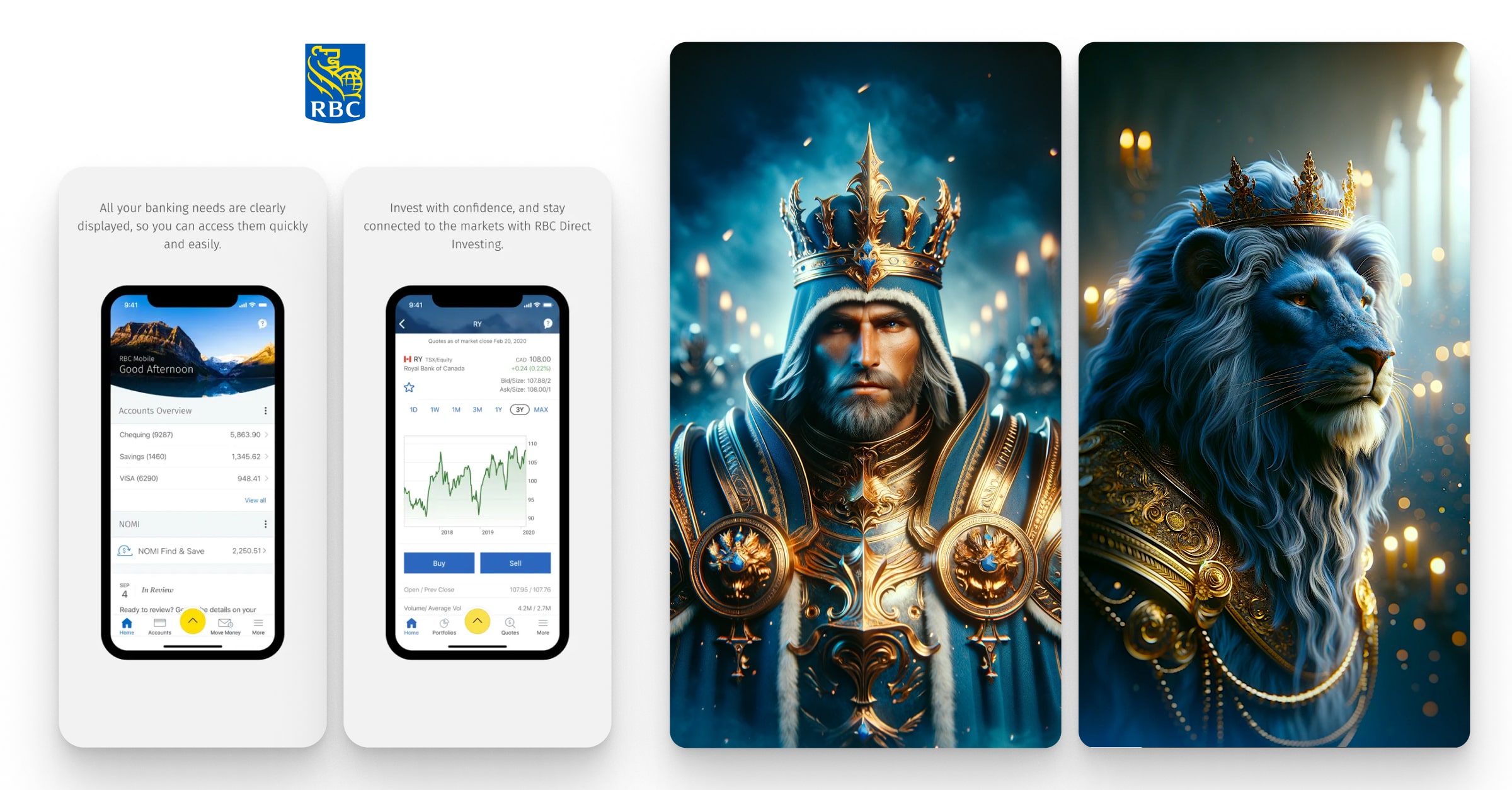

Royal Bank of Canada AI mascot

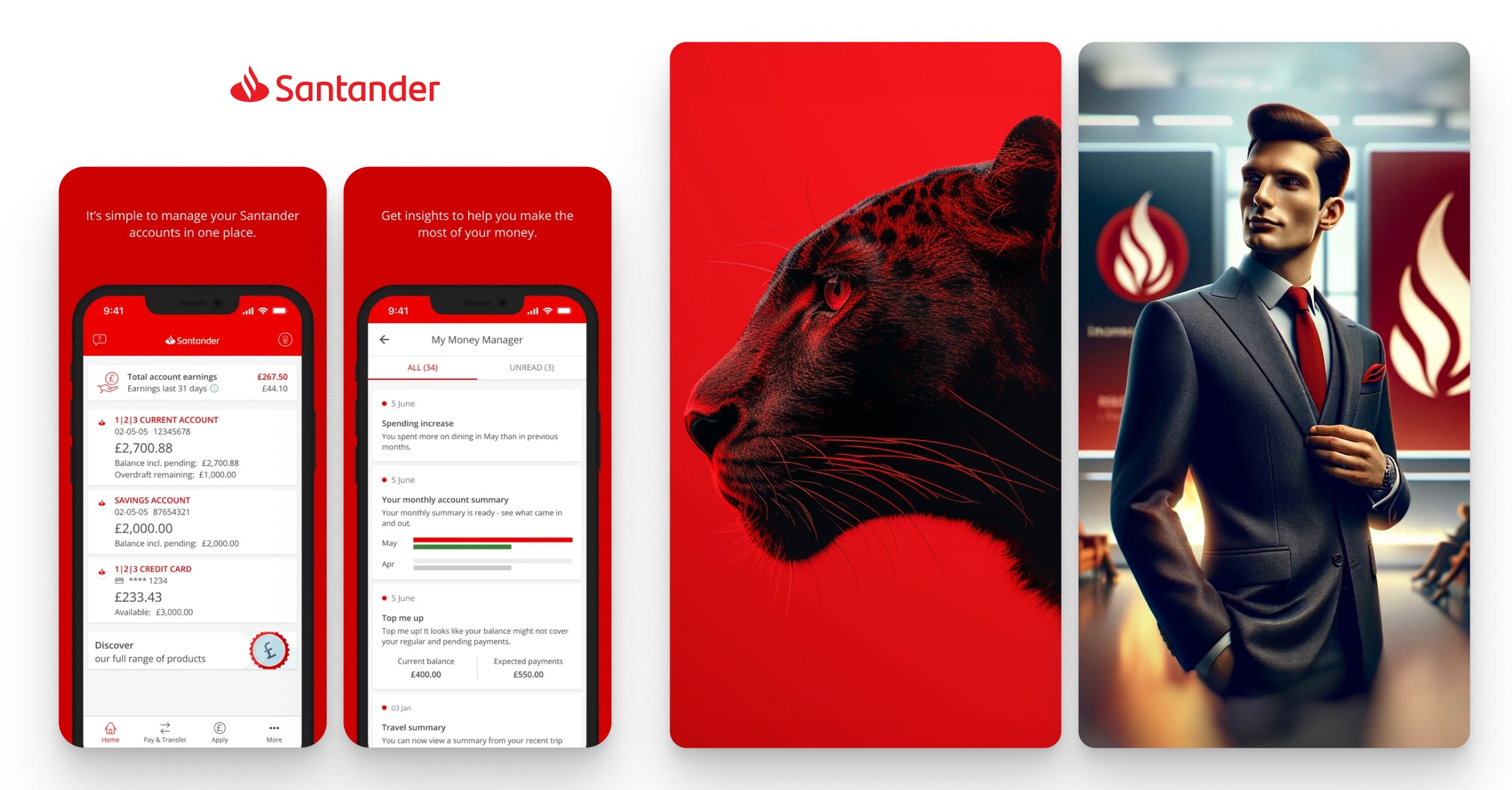

Santander Bank AI mascot

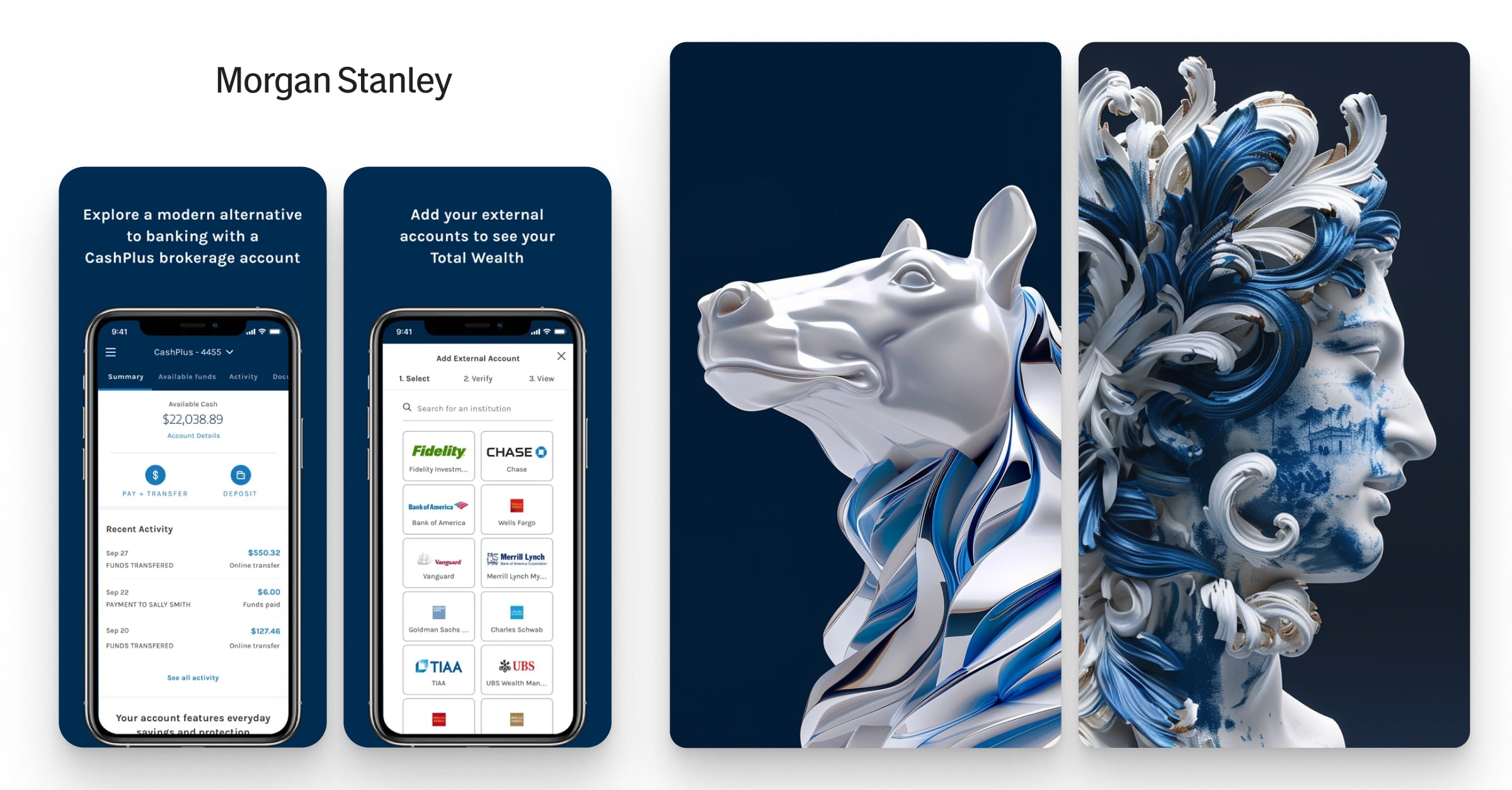

Morgan Stanley Bank AI mascot

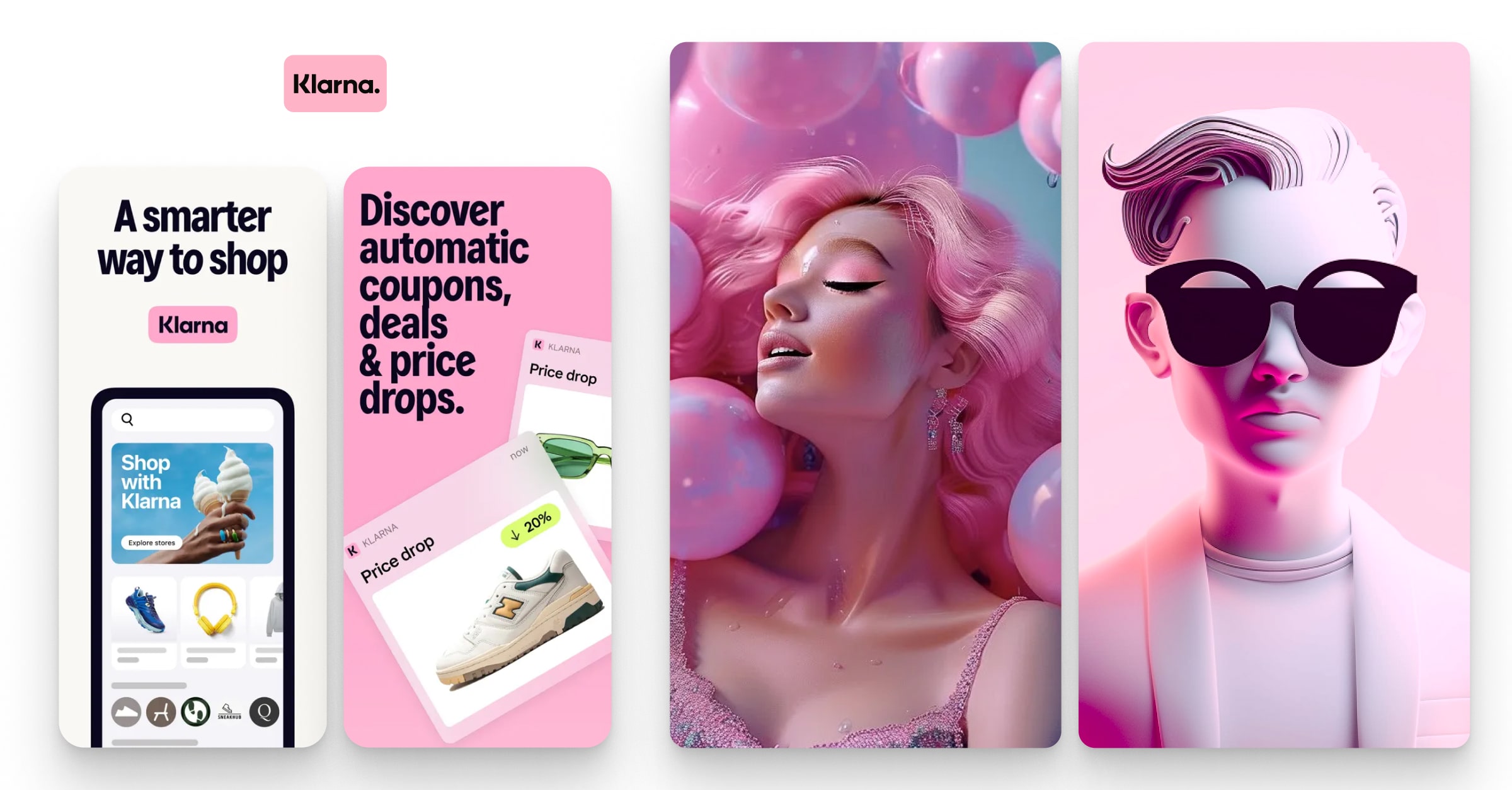

Klarna AI mascot

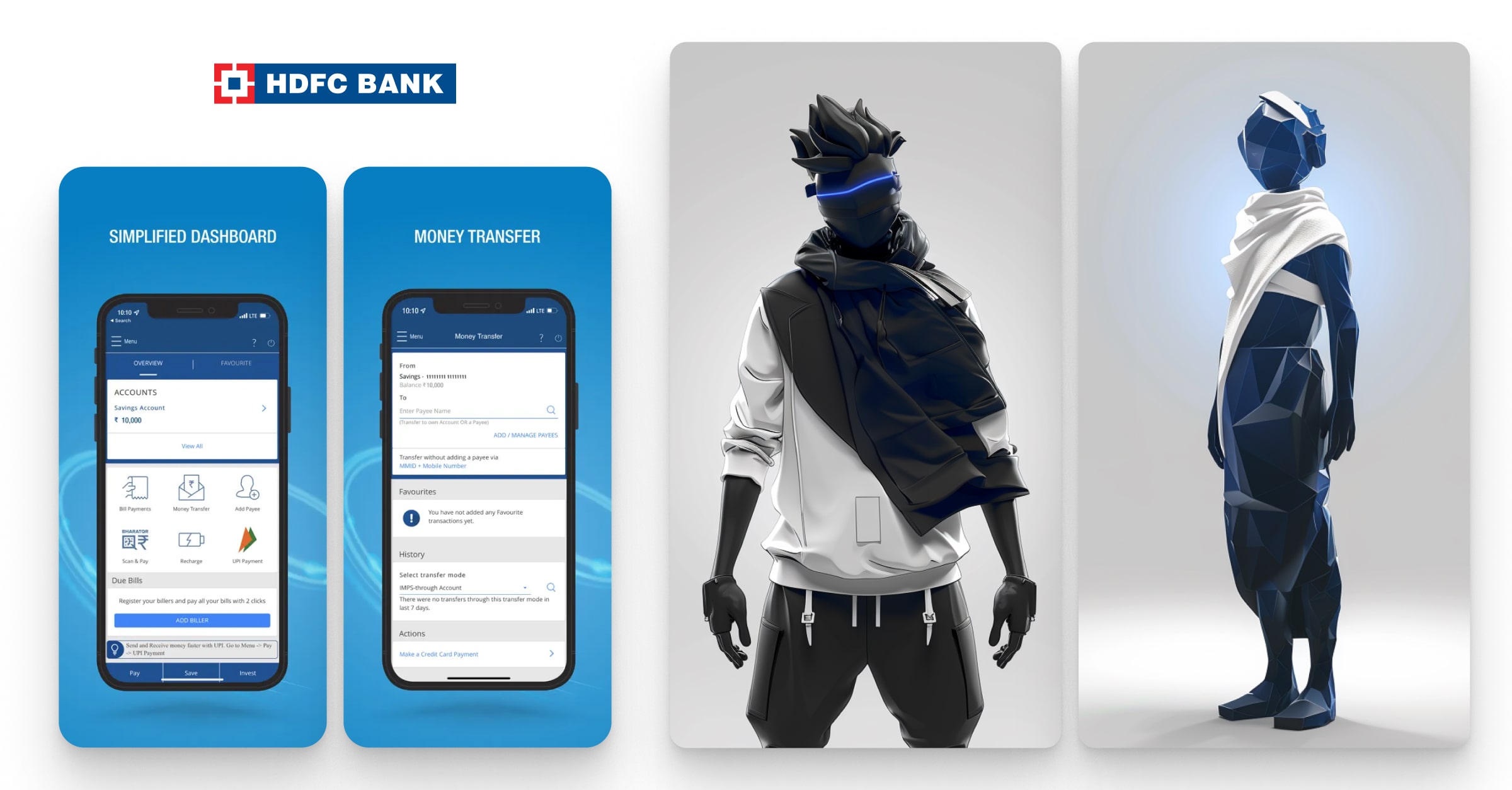

HDFC Bank AI mascot

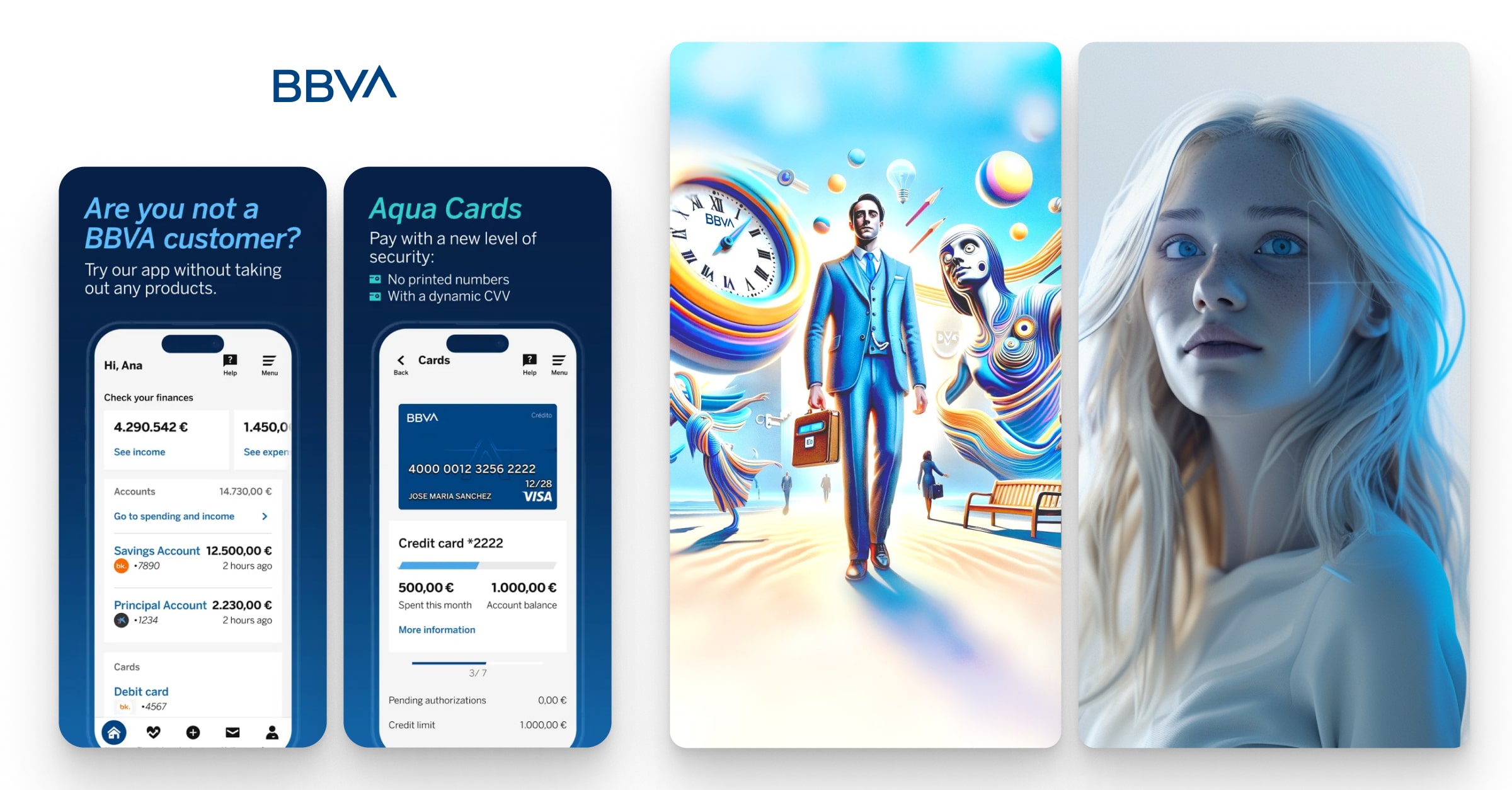

BBVA Bank AI mascot

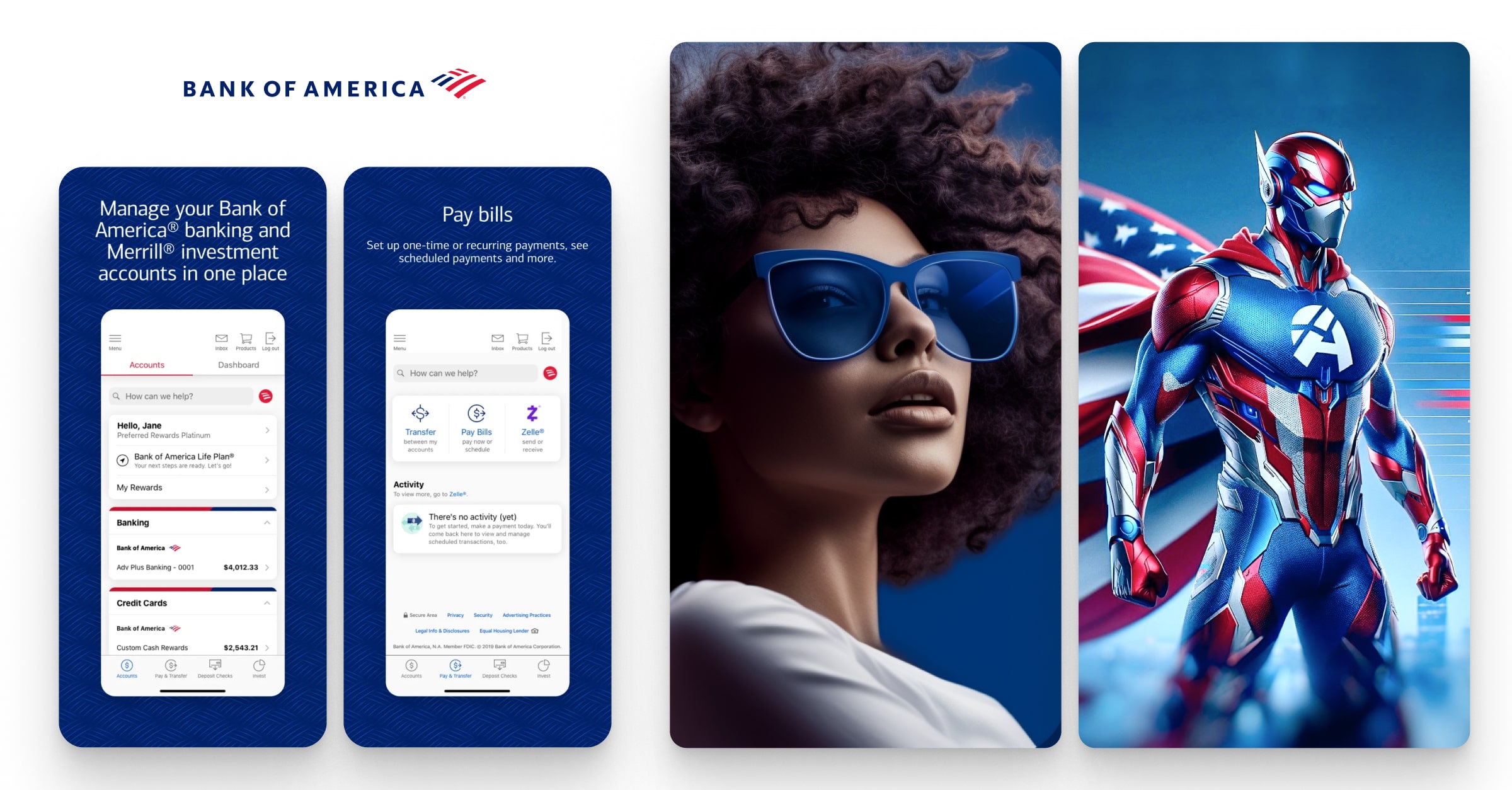

Bank of America AI mascot

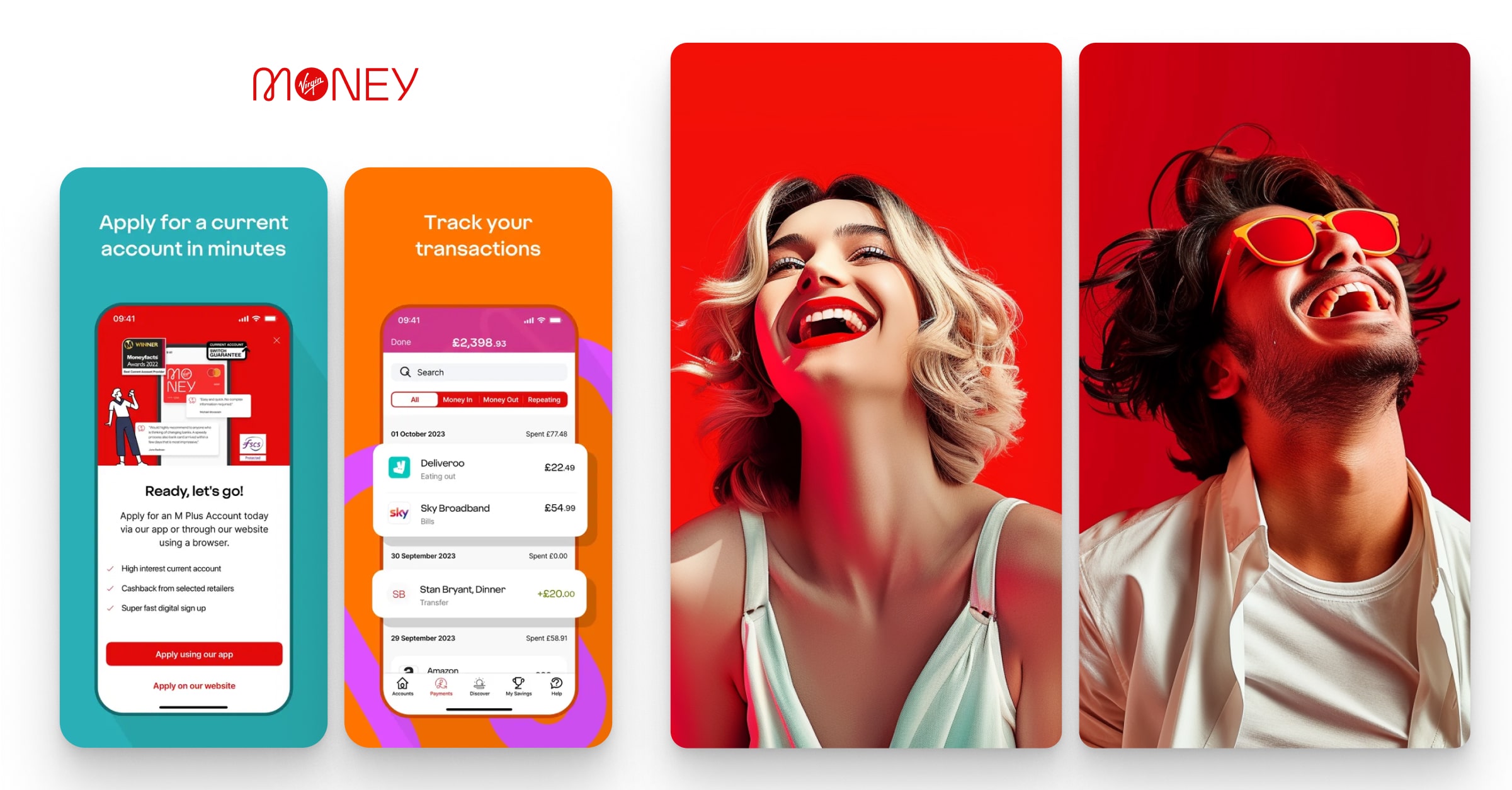

Virgin Money AI mascot

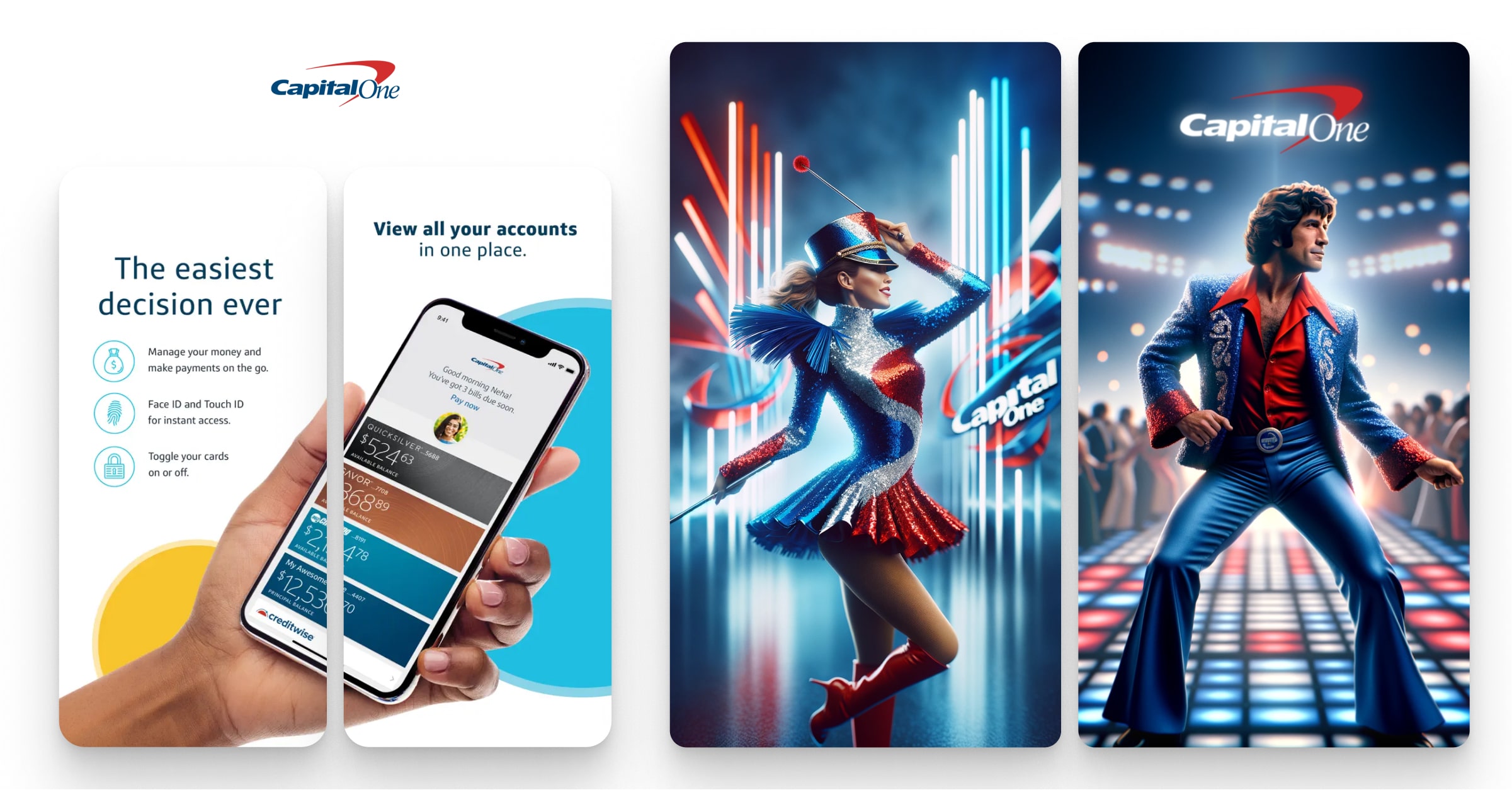

Capital One Bank AI mascot

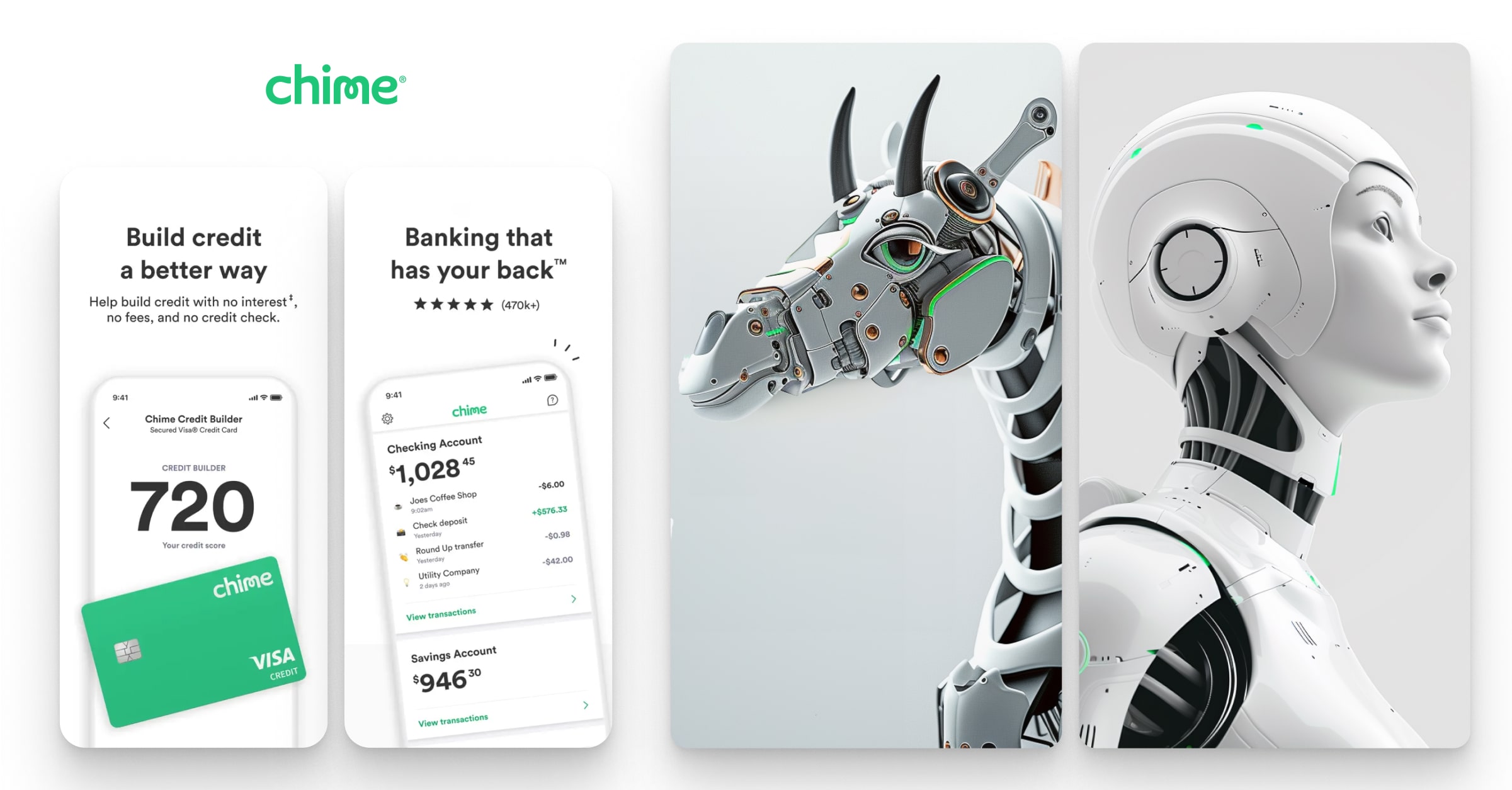

Chime AI mascot

Deutsche Bank AI mascot

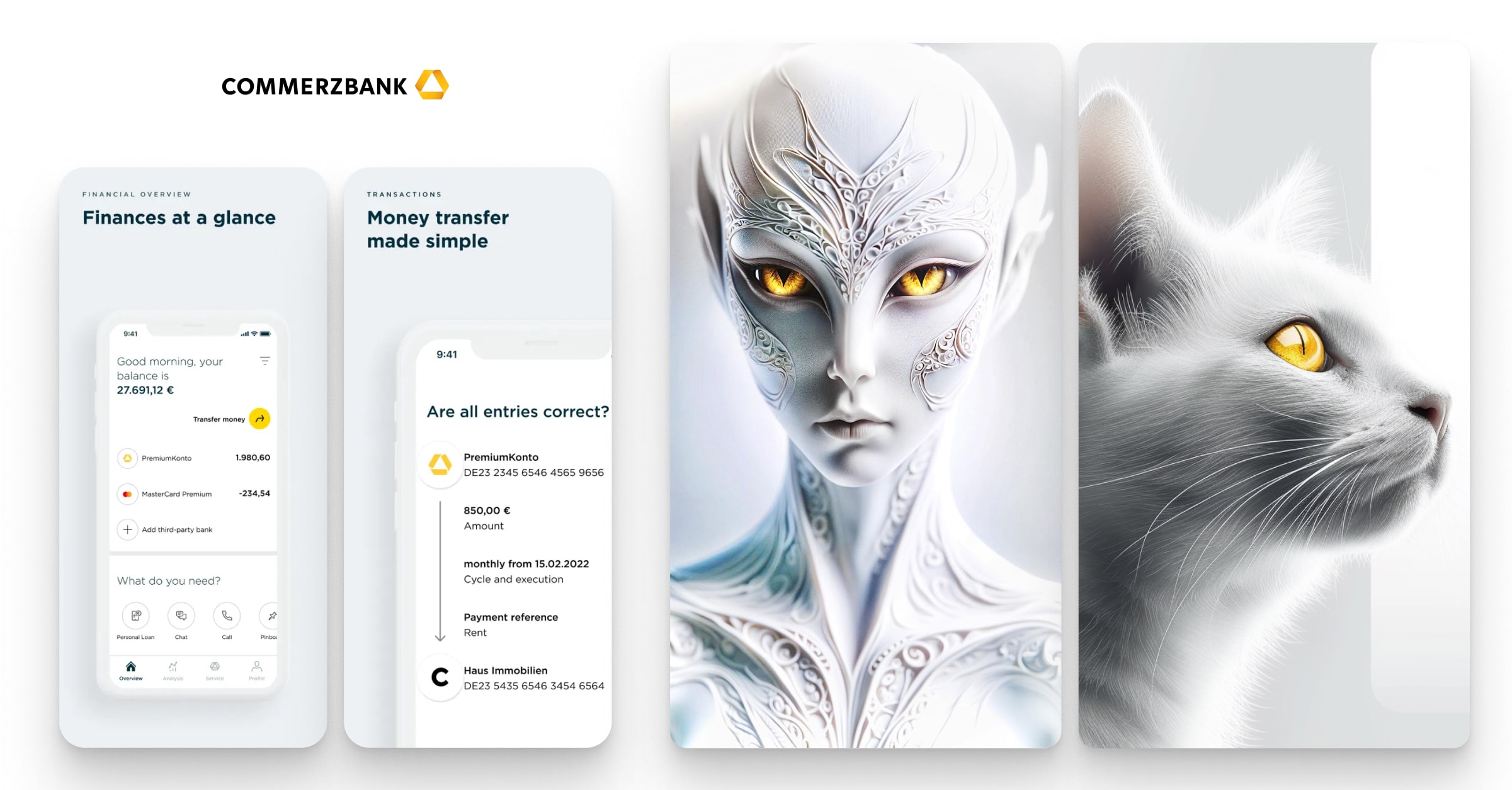

Commerzbank AI mascot

J.P.Morgan AI mascot

Chase Bank AI mascot

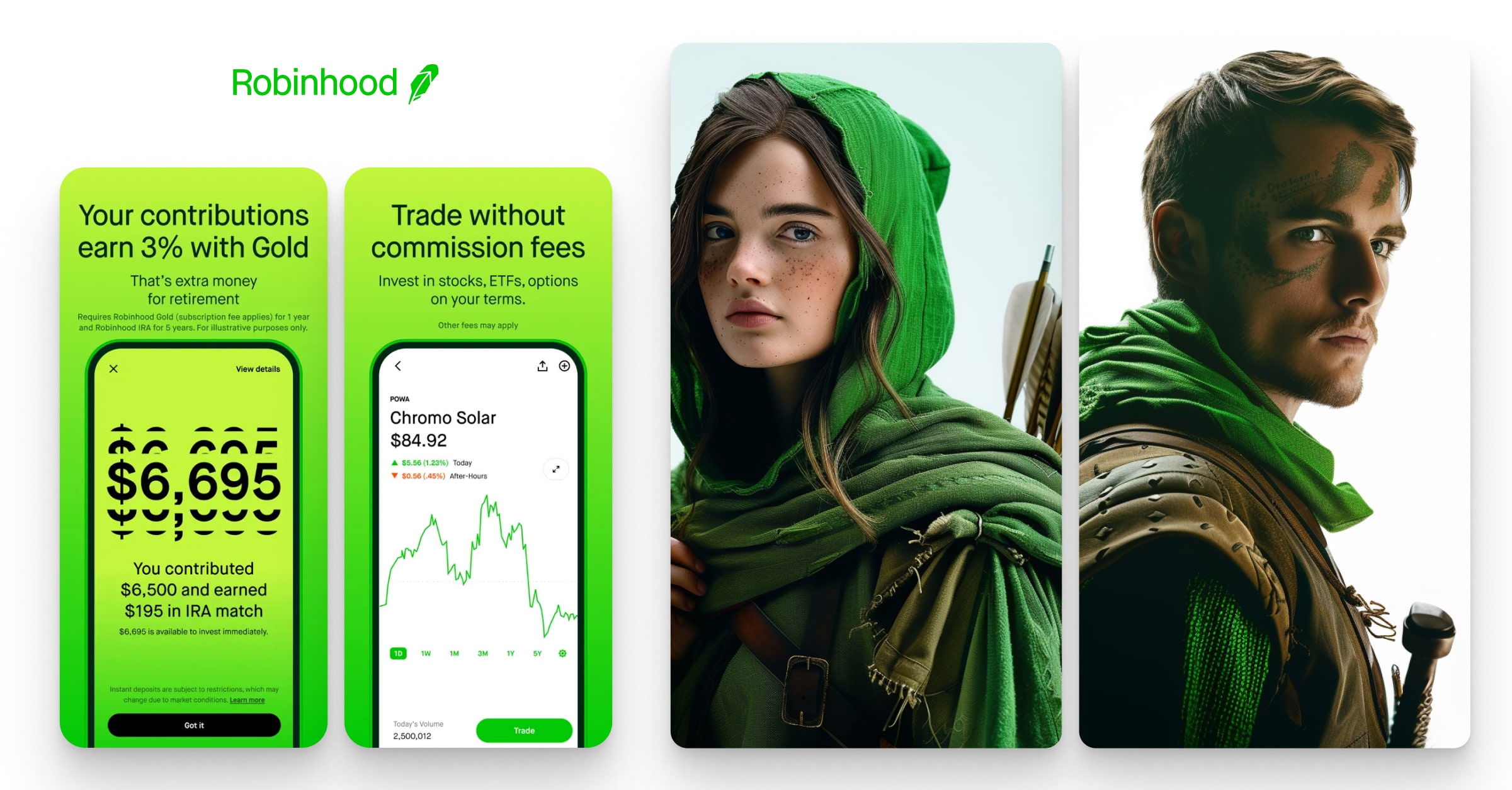

Robinhood AI mascot

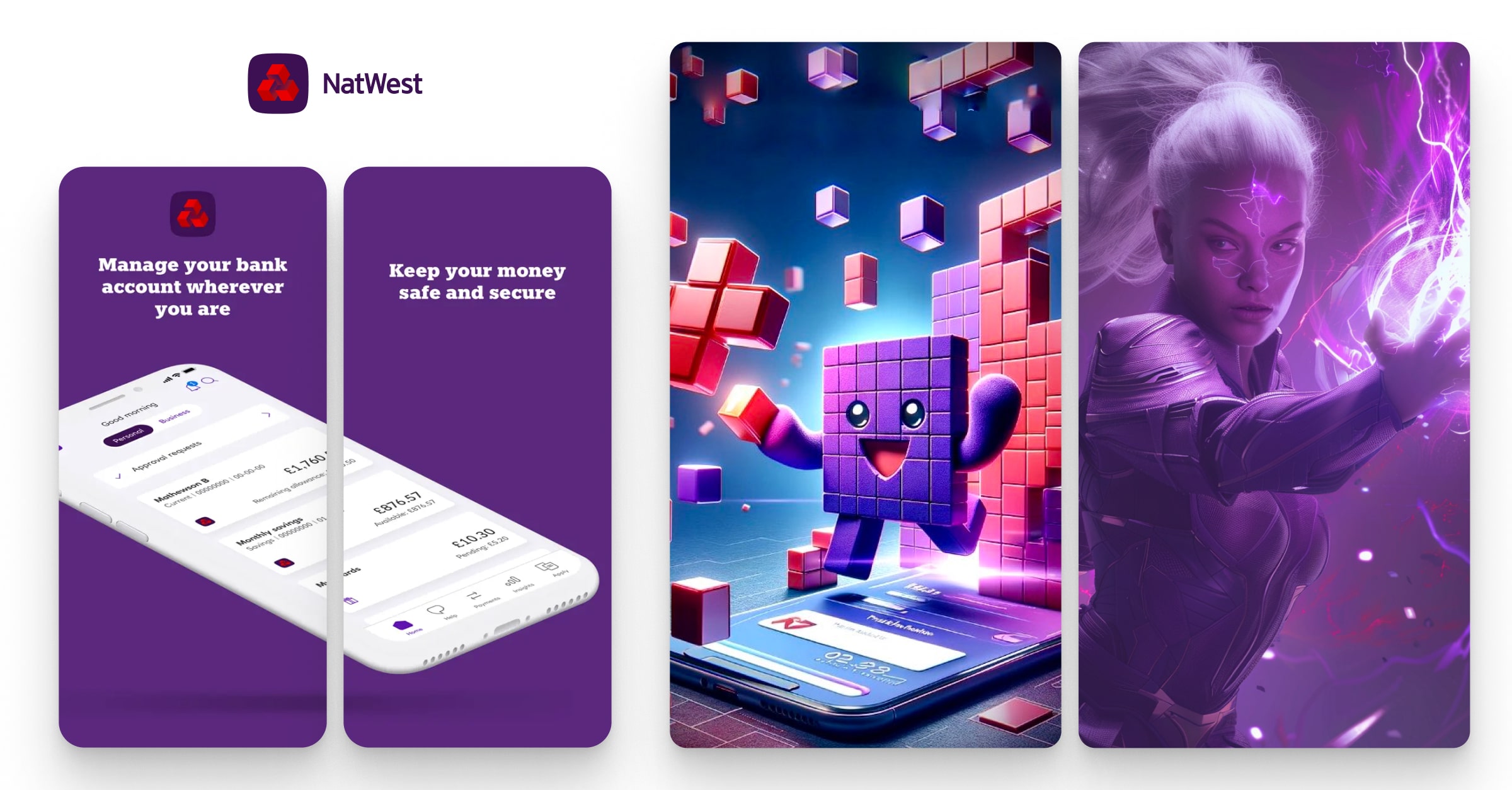

NatWest Bank AI mascot

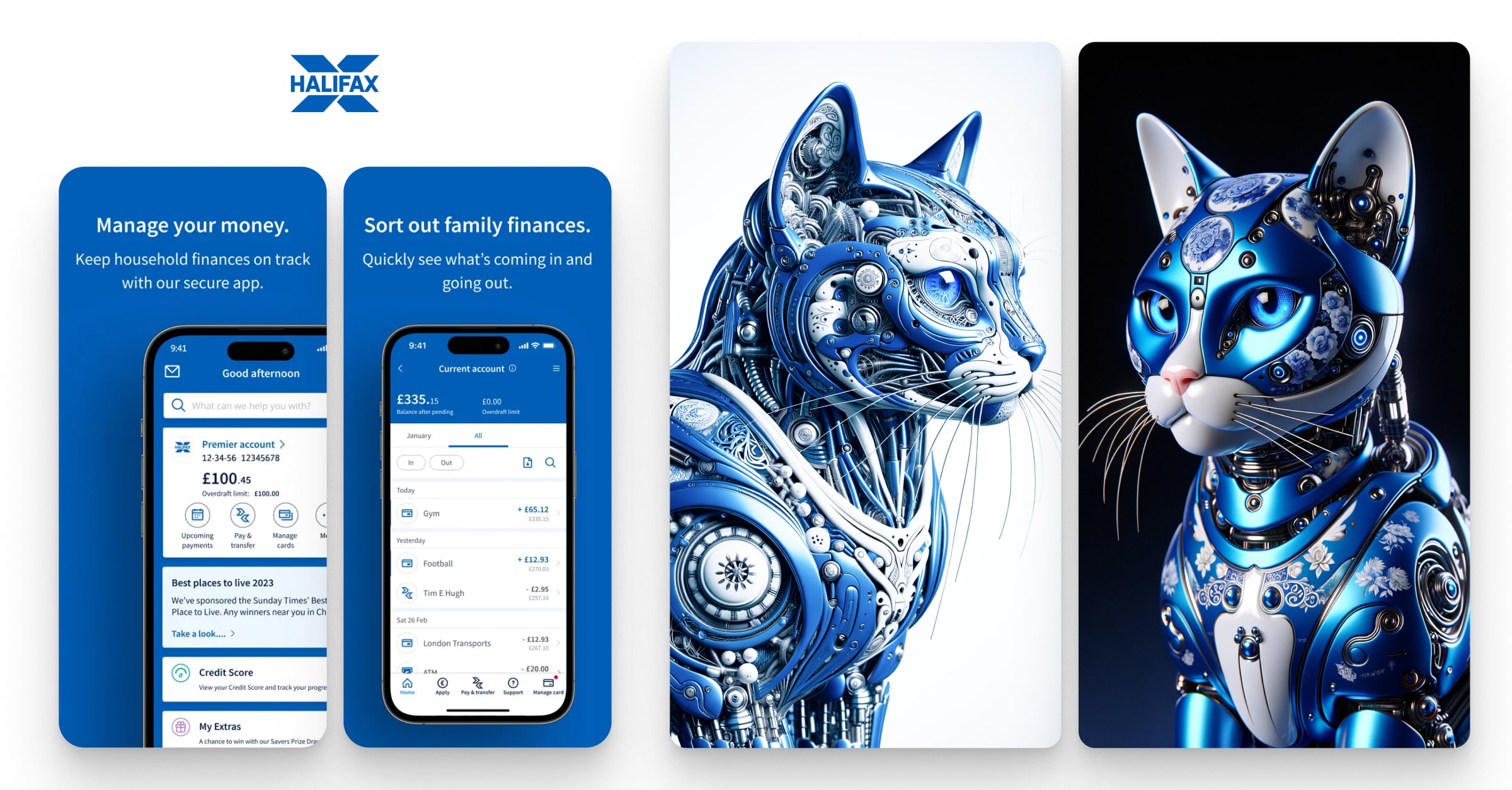

Halifax Bank AI mascot

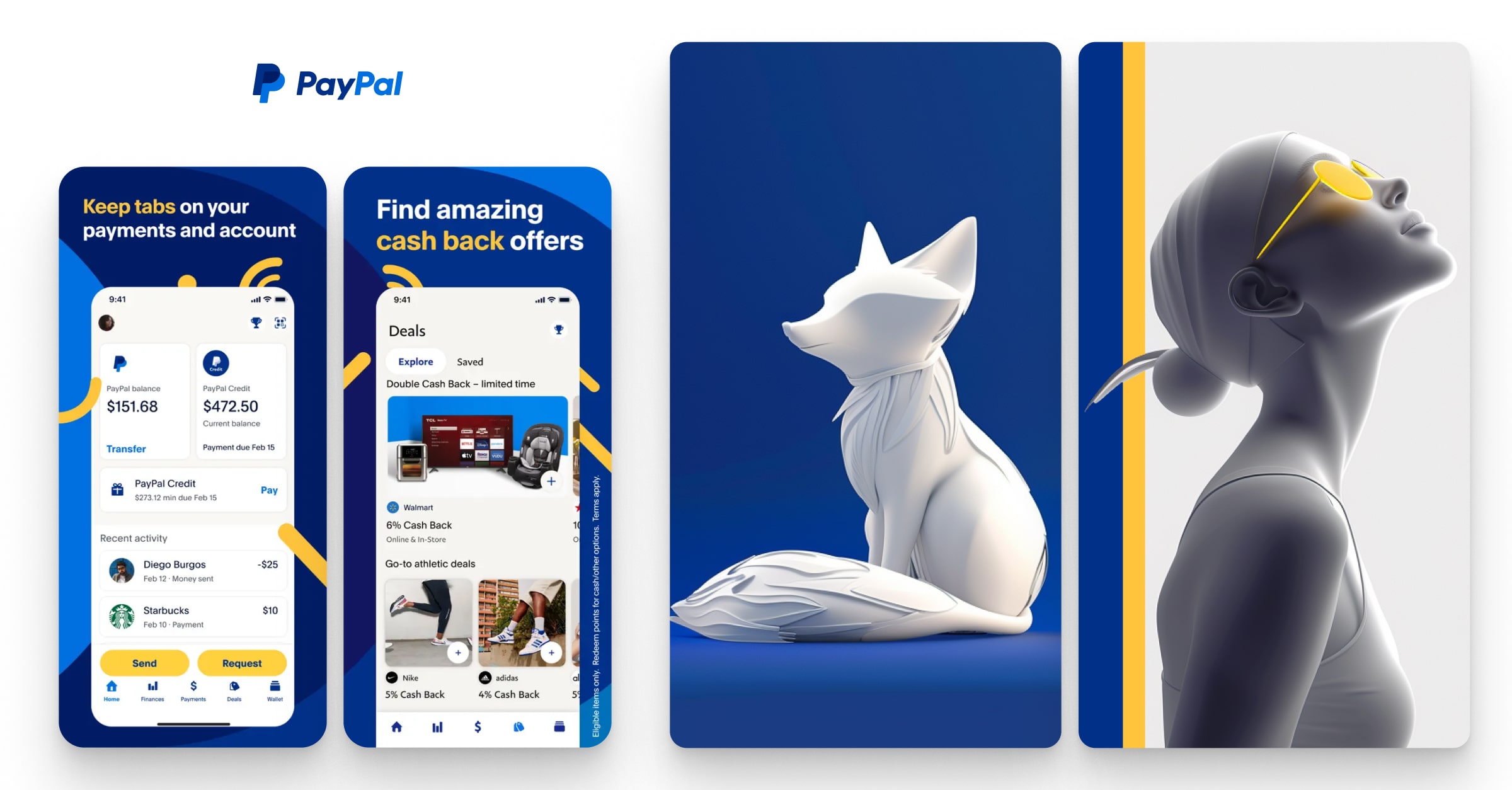

PayPal AI mascot

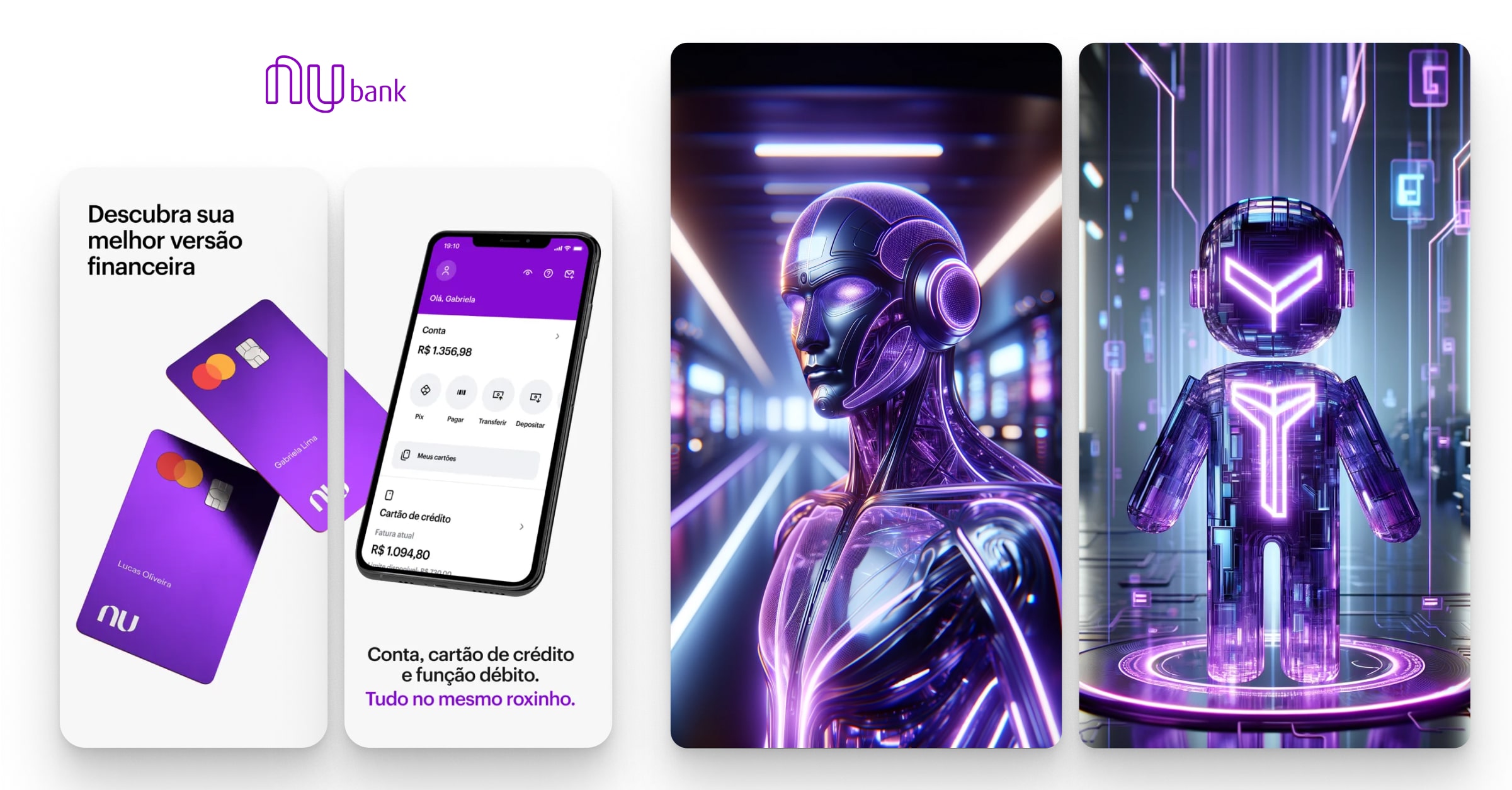

Nubank AI mascot

Paytm AI mascot

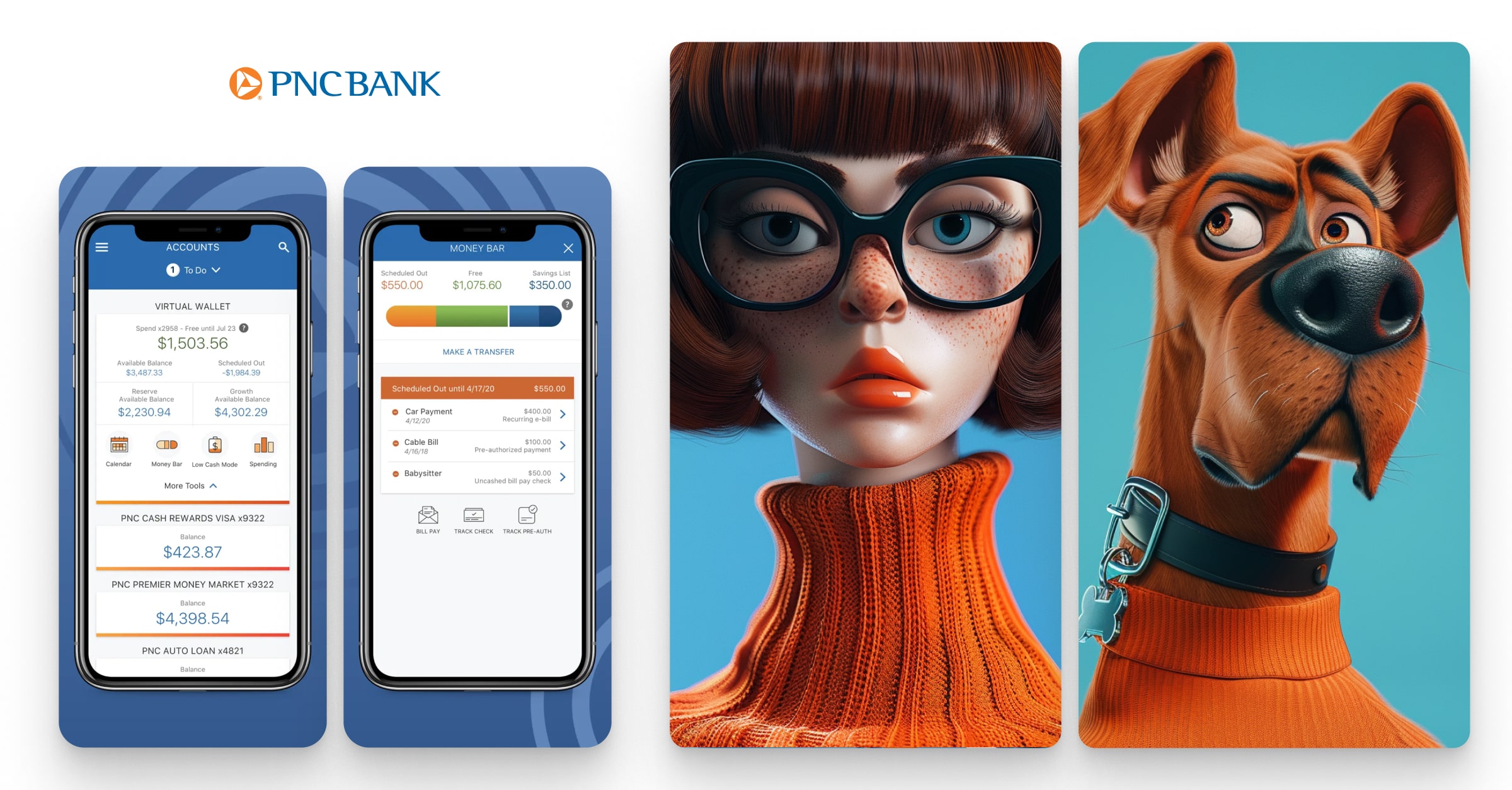

PNC Bank AI mascot

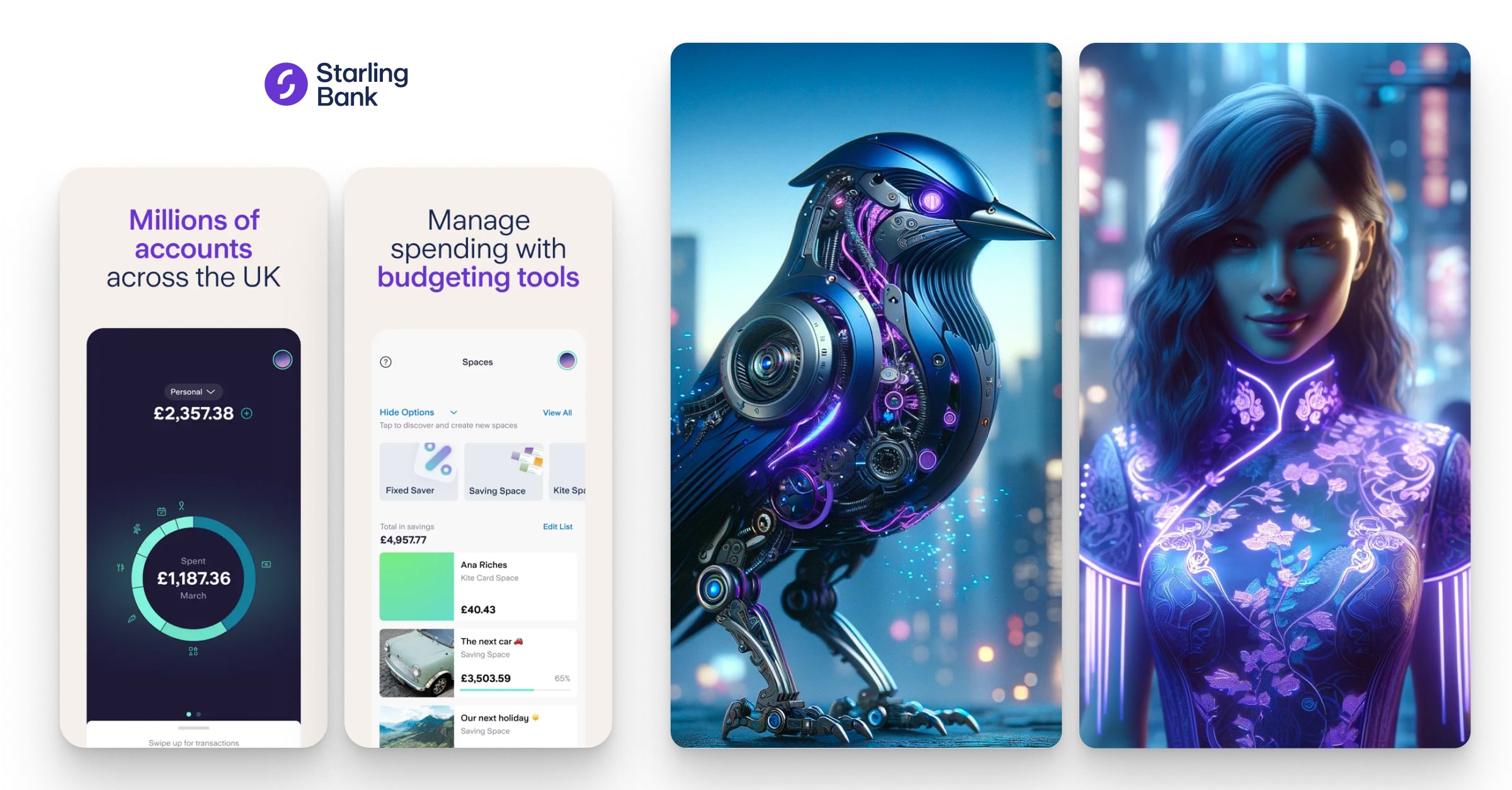

Starling Bank AI mascot

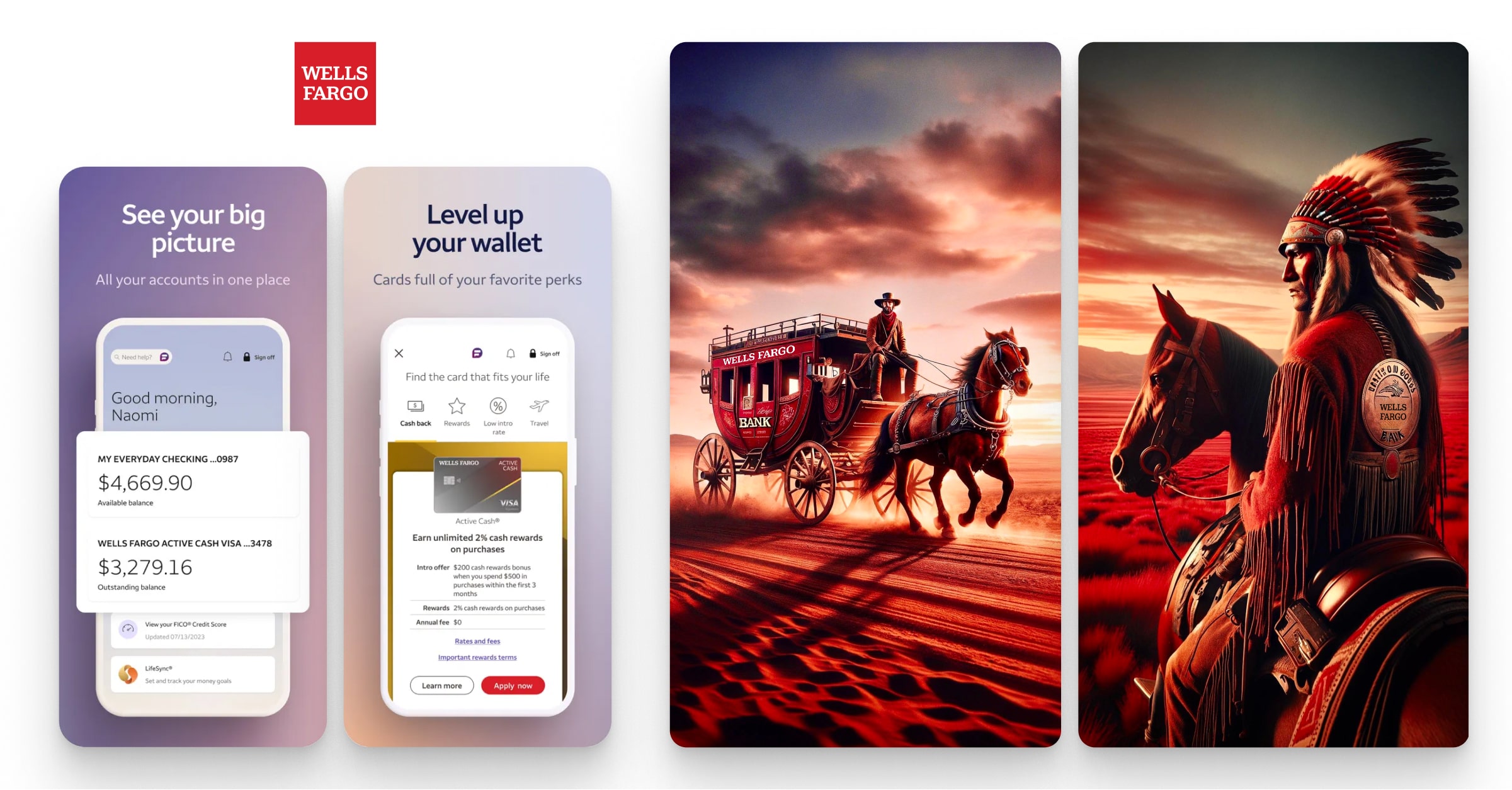

Wells Fargo Bank AI mascot

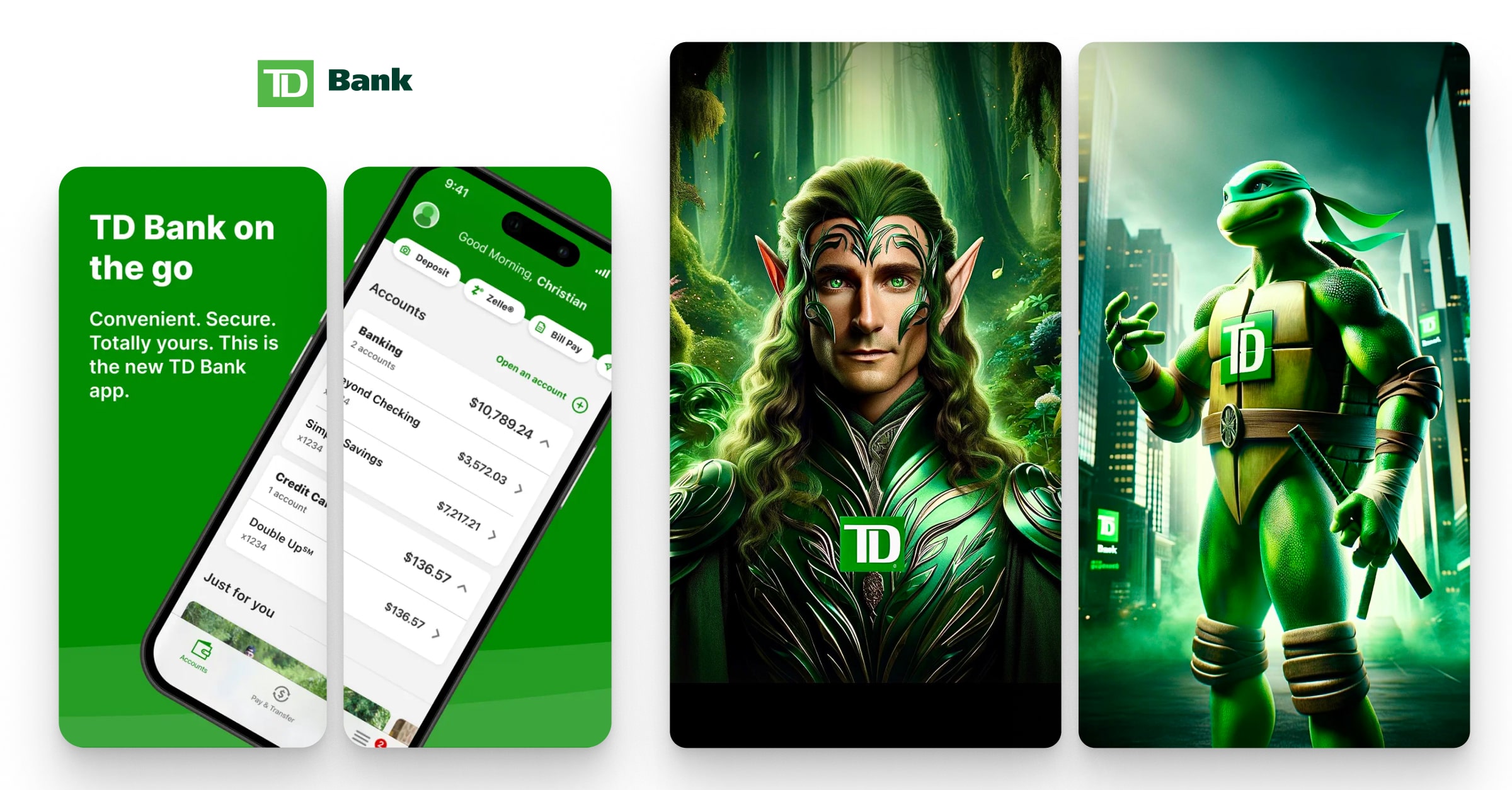

TD Bank AI mascot

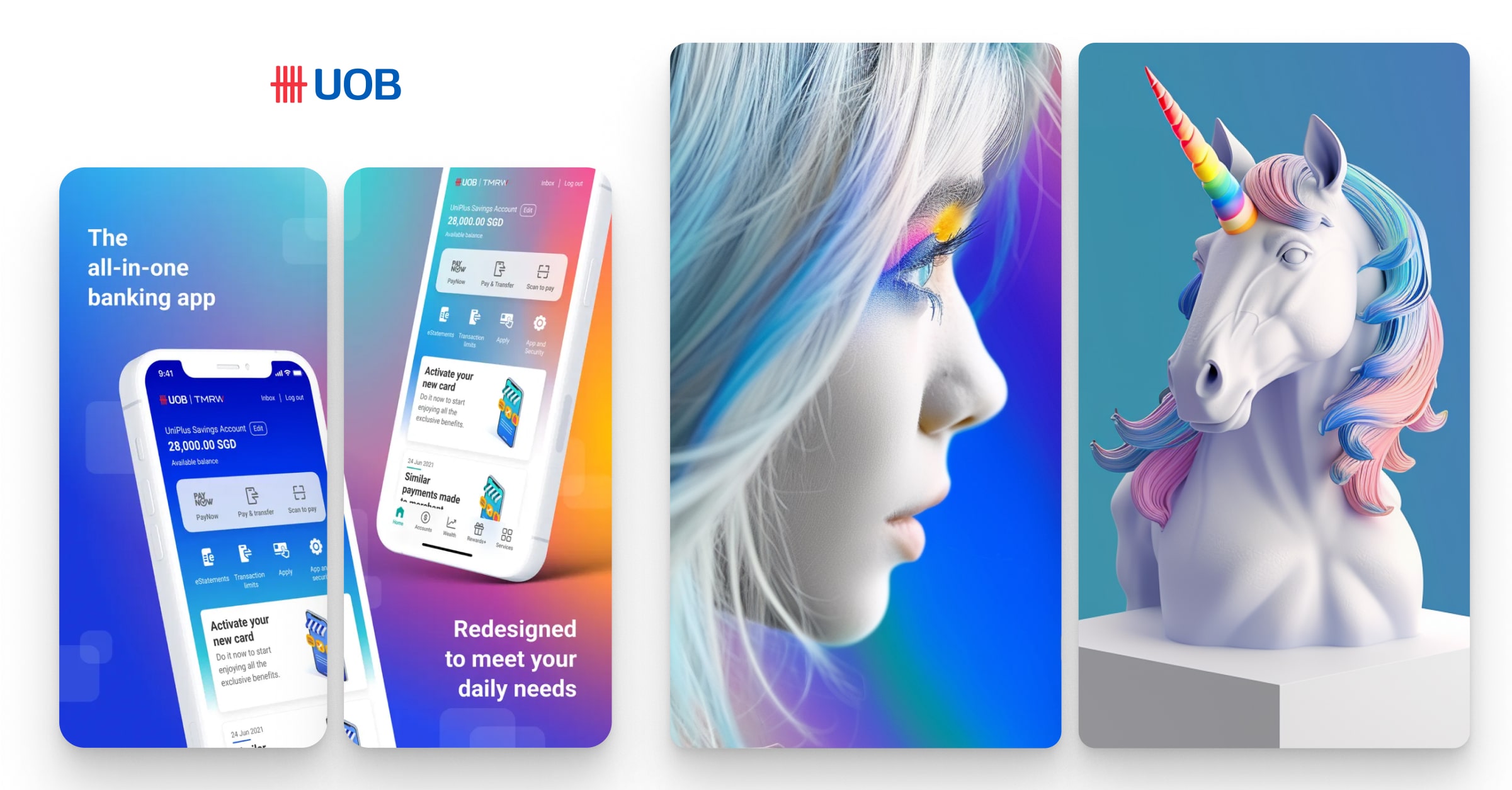

United Overseas Bank AI mascot

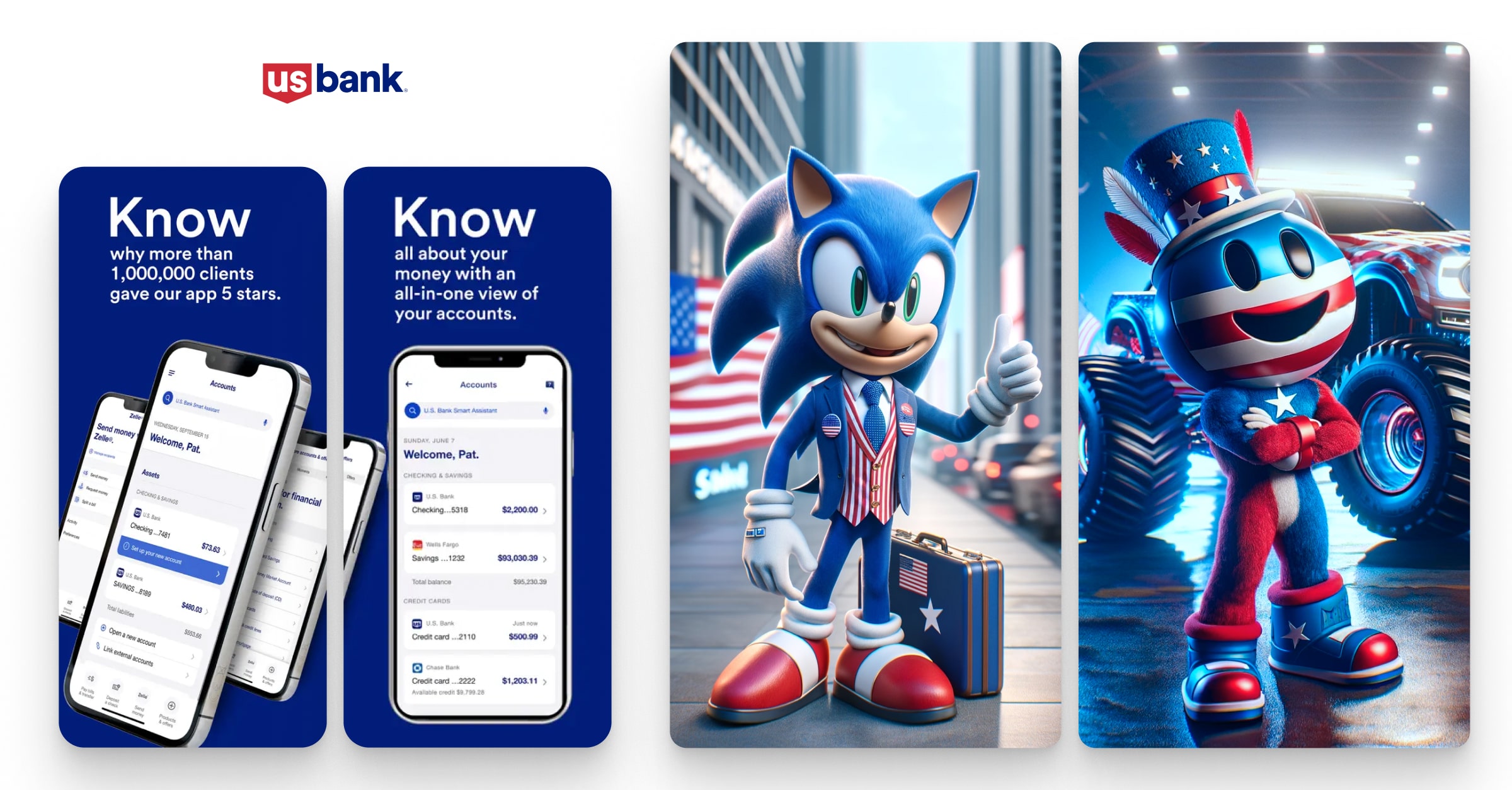

U.S. Bank AI mascot

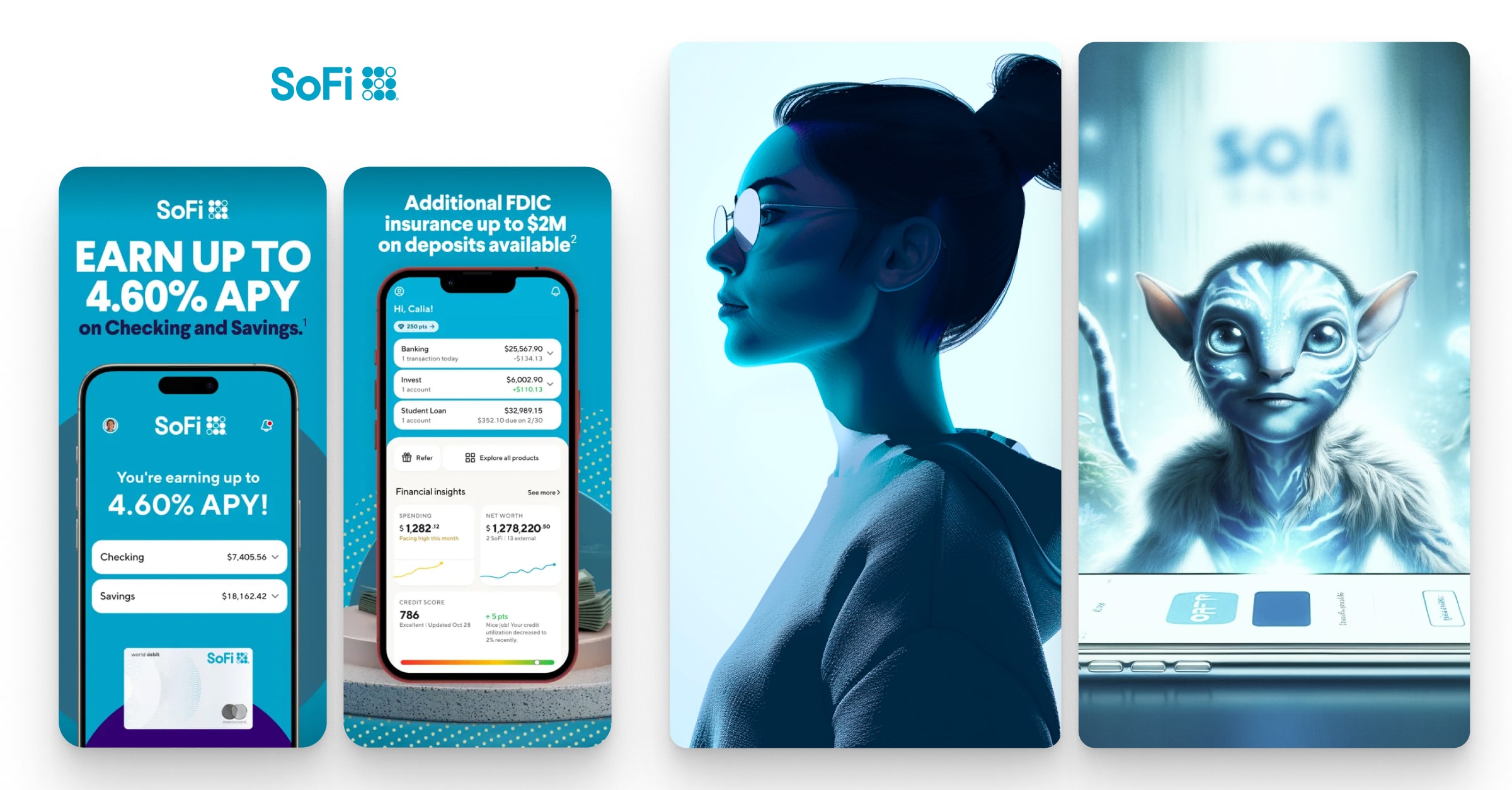

SoFi Bank AI mascot

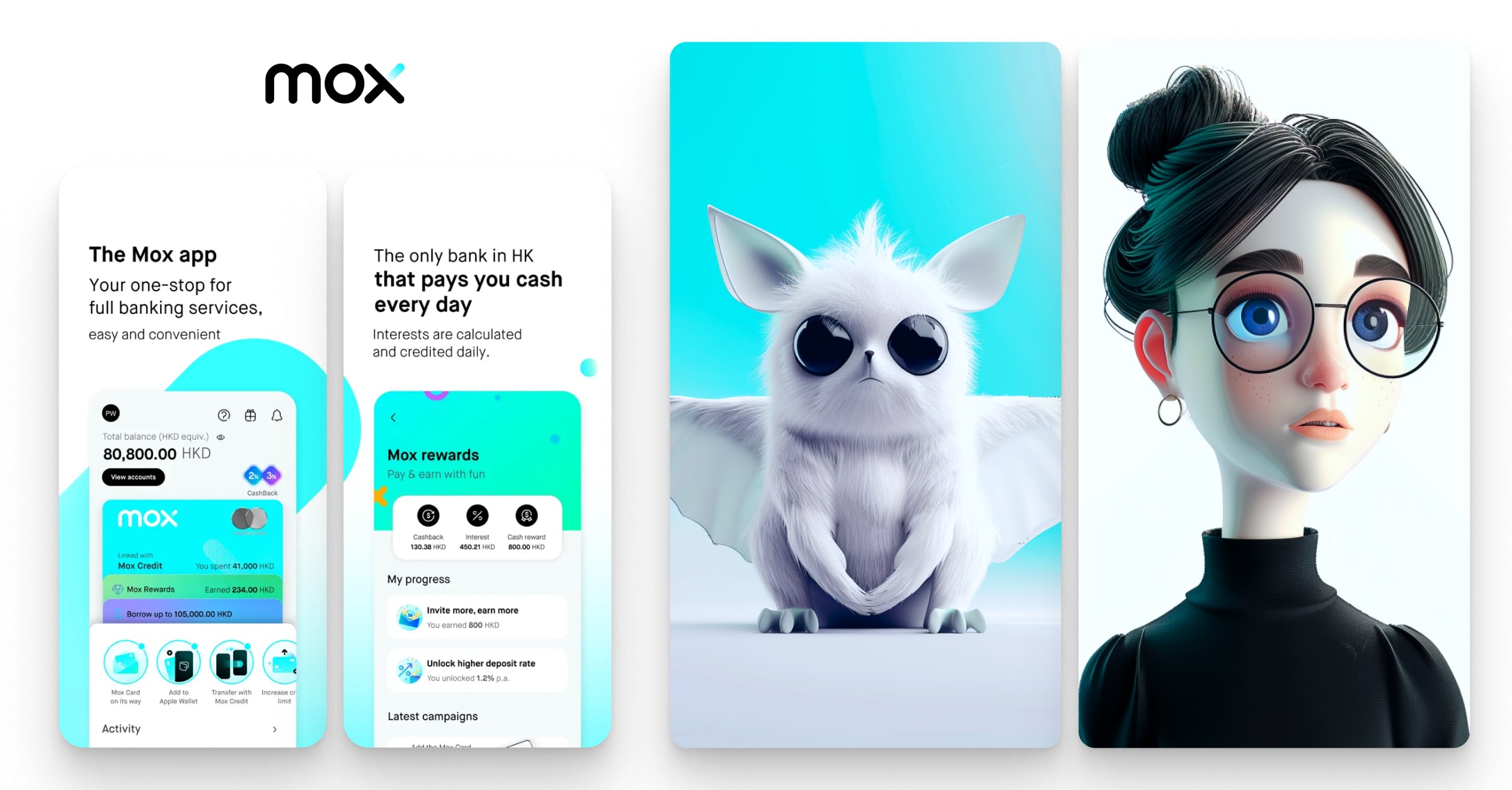

Mox Bank AI mascot

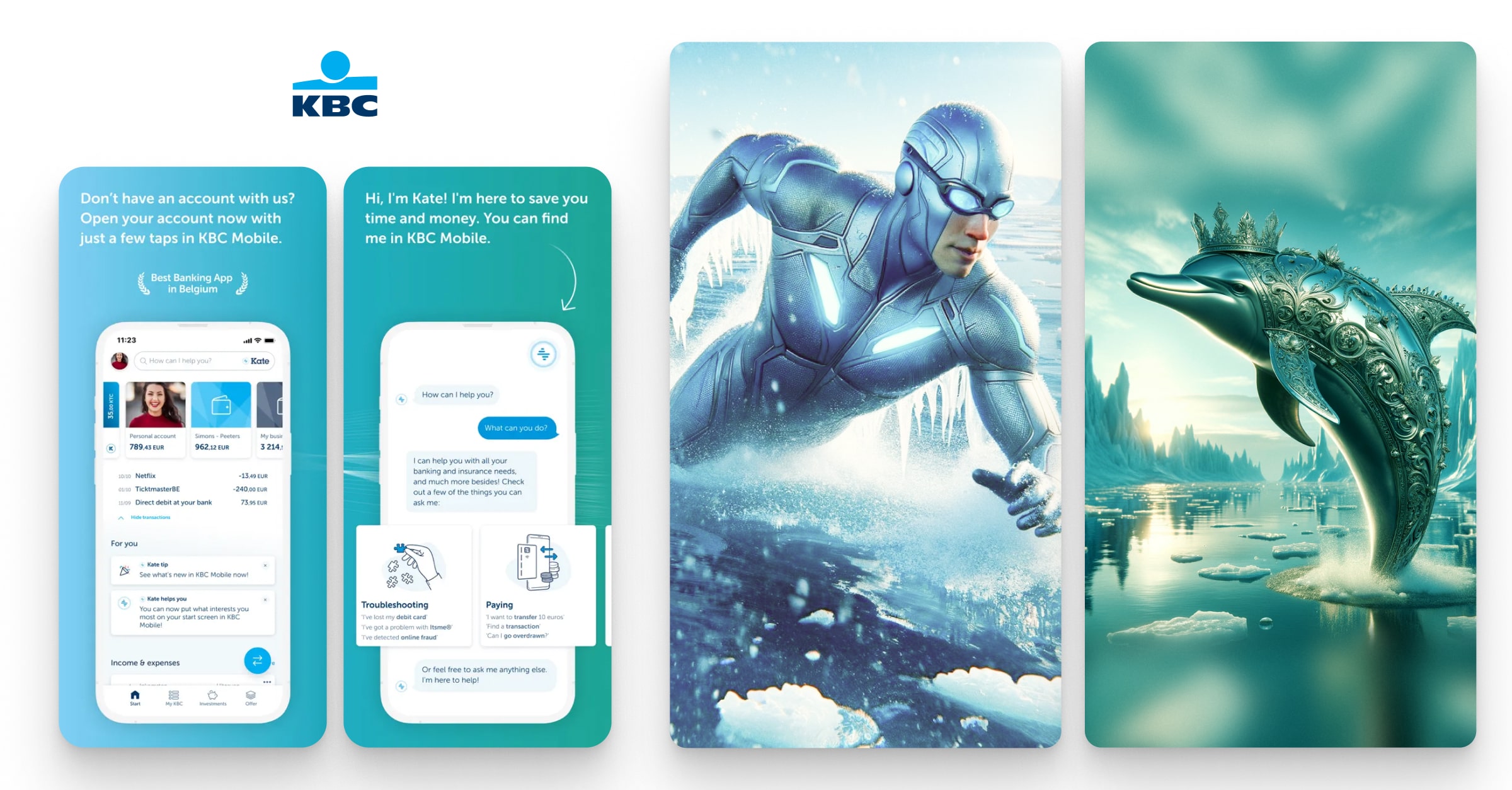

KBC Bank AI mascot

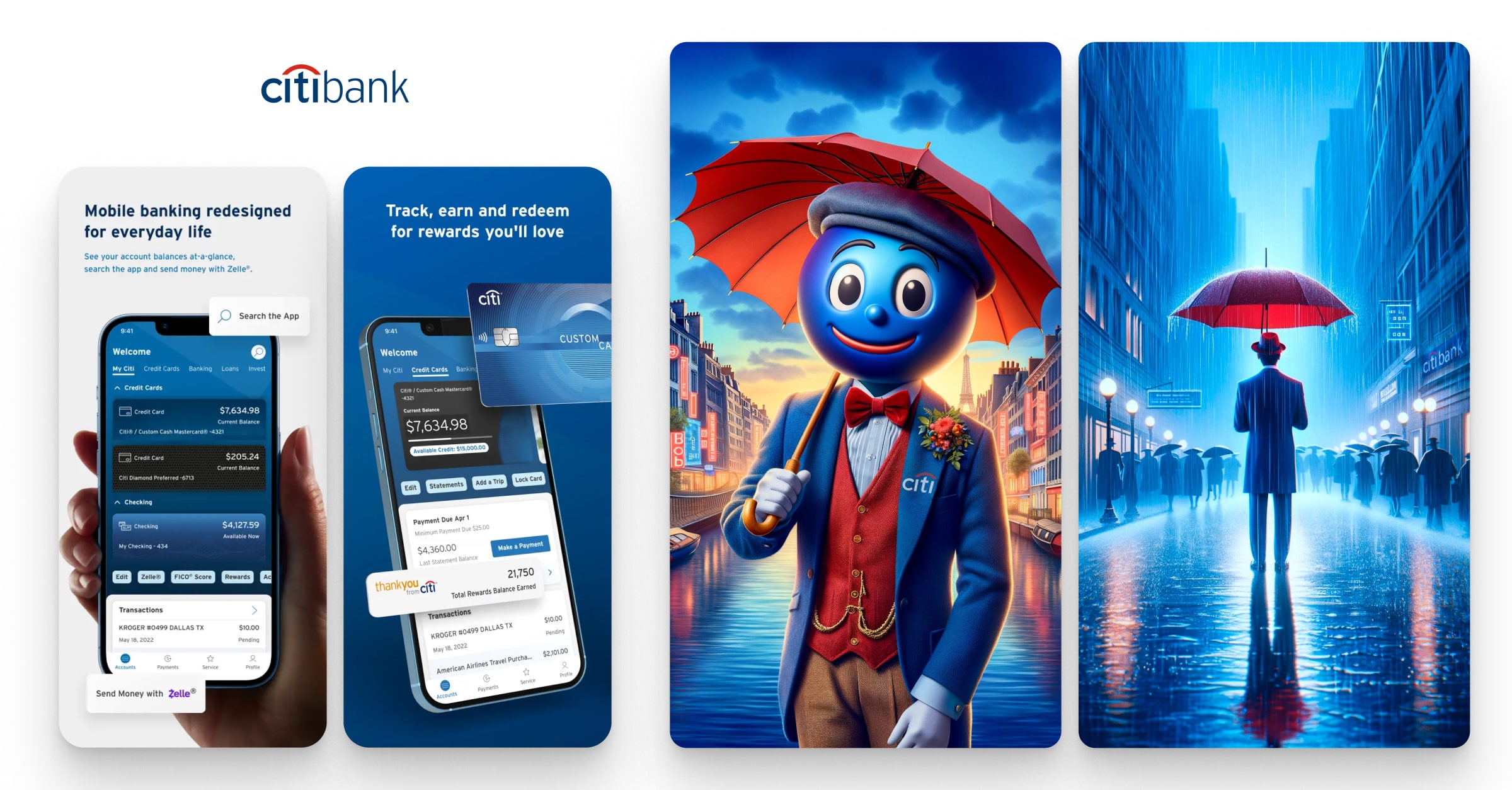

Citibank AI mascot

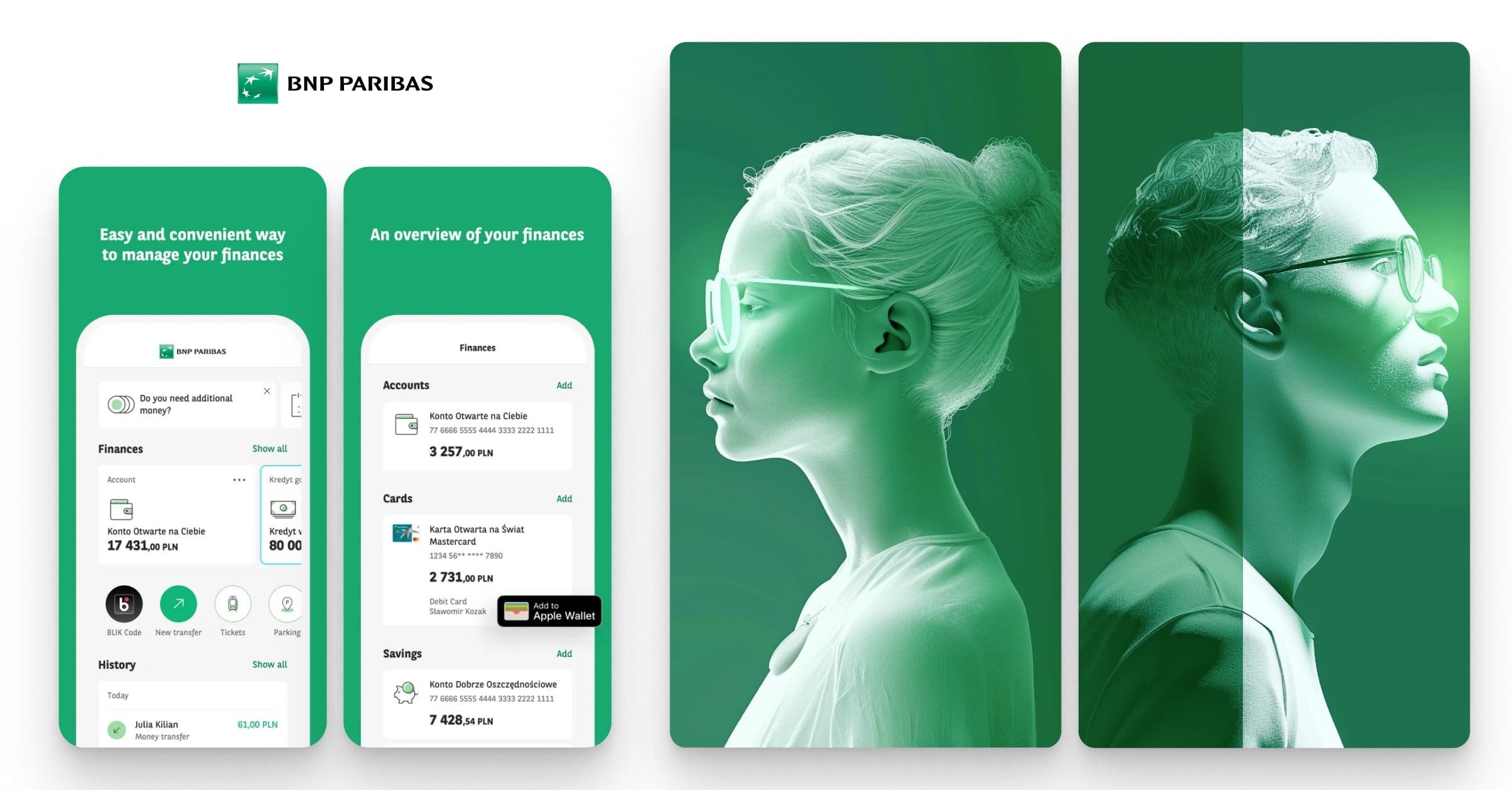

BNP Paribas AI mascot

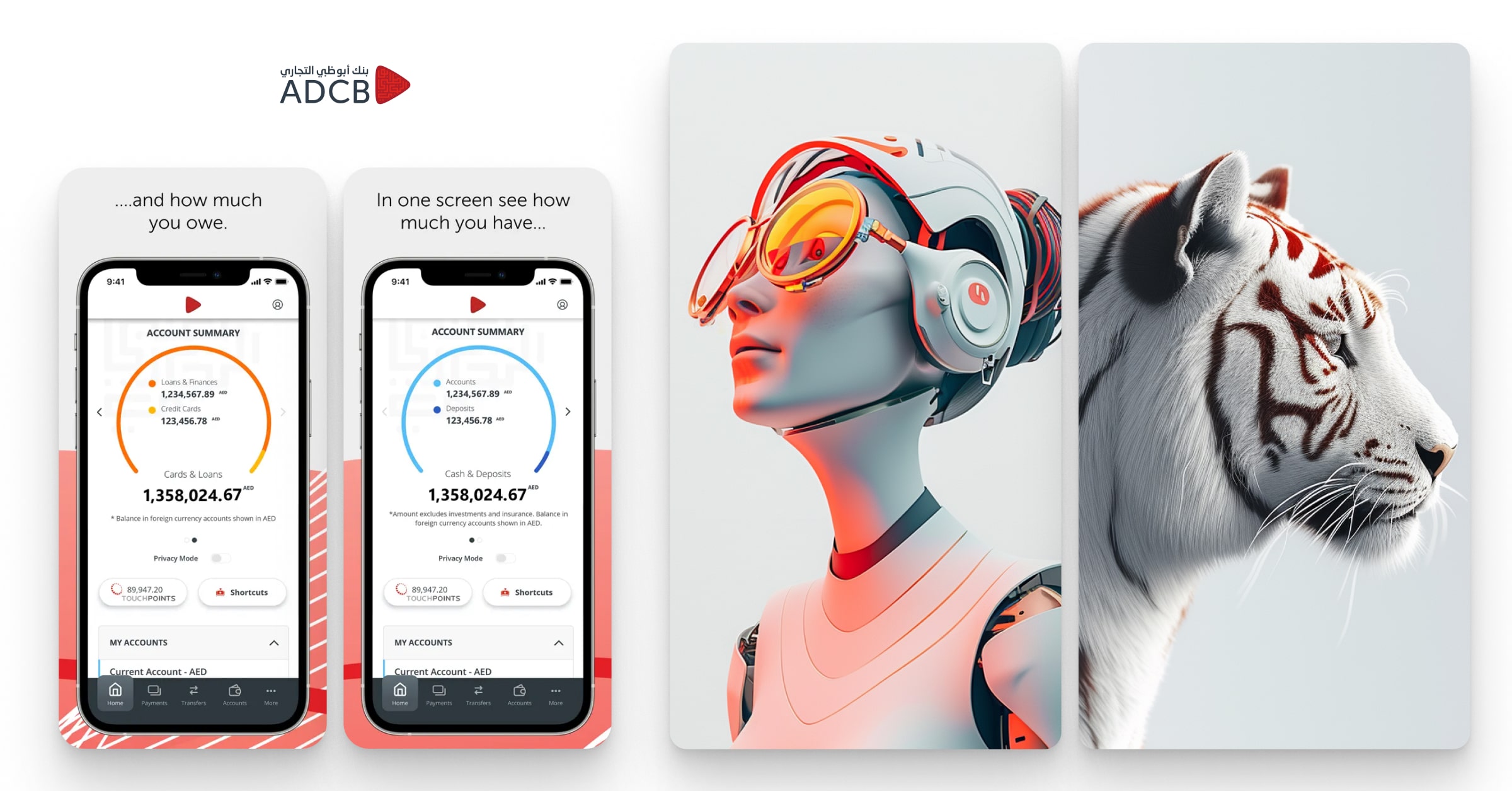

Abu Dhabi Commercial Bank AI mascot

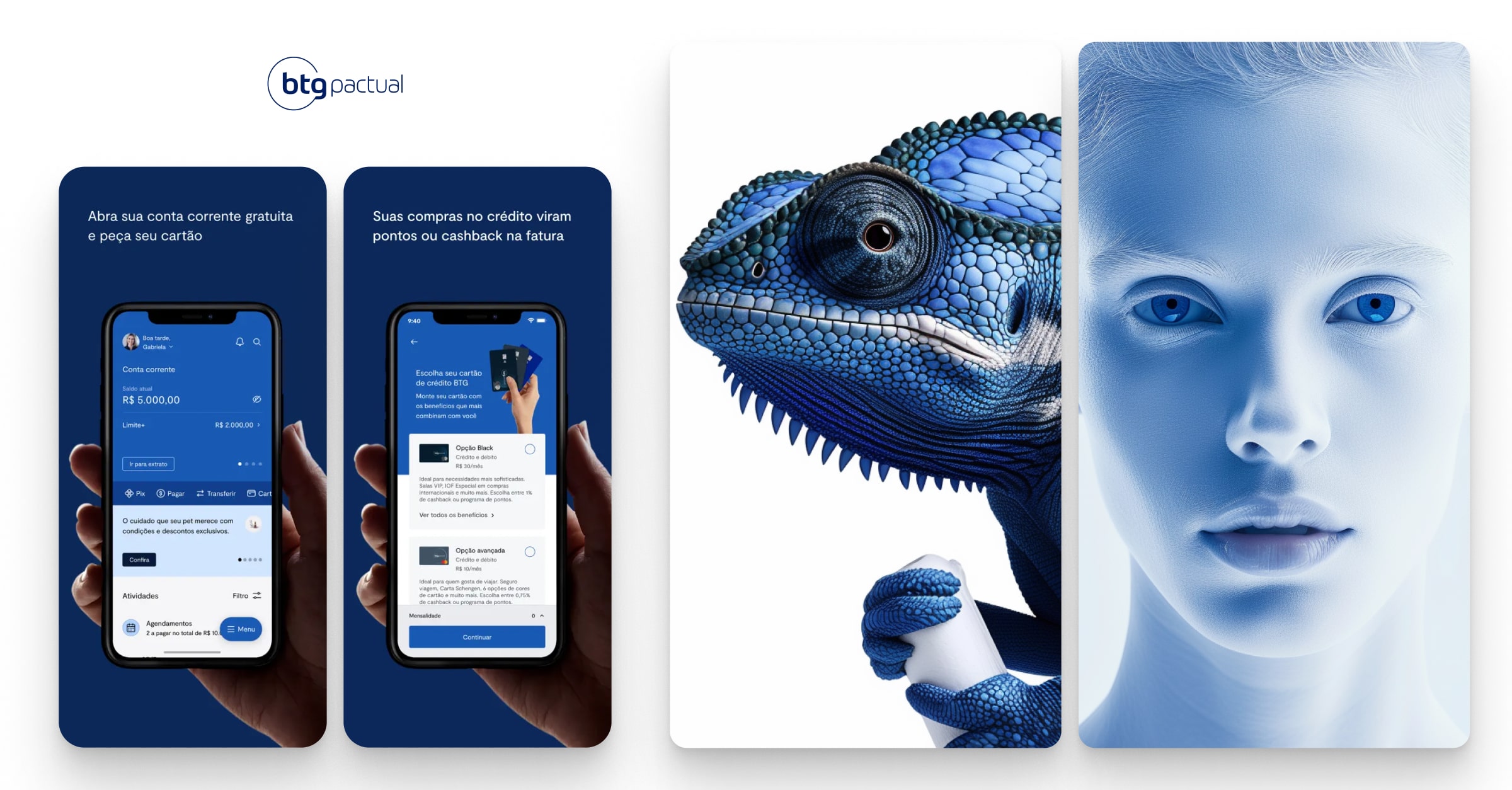

BTG Pactual AI mascot

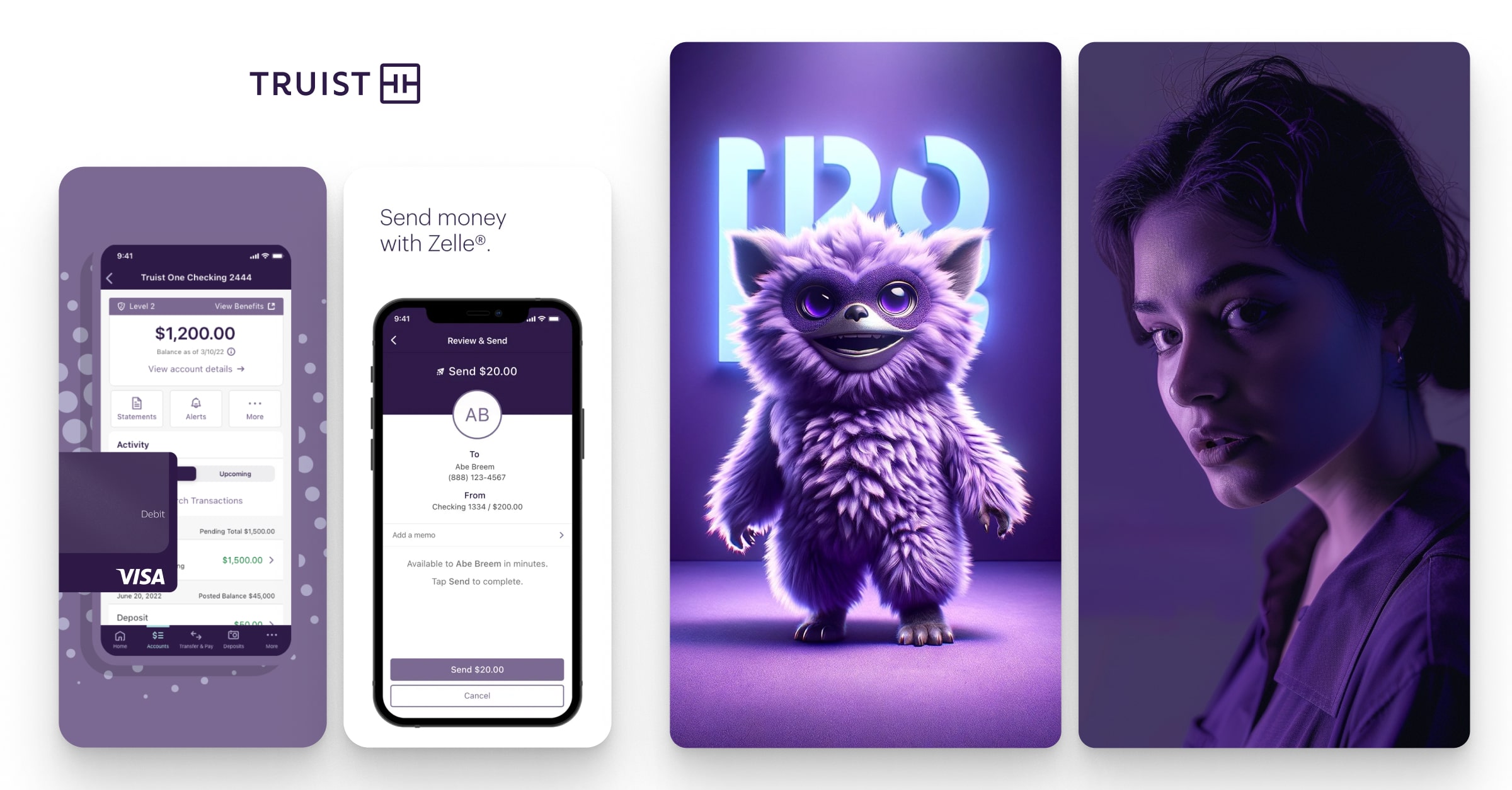

Truist Bank AI mascot

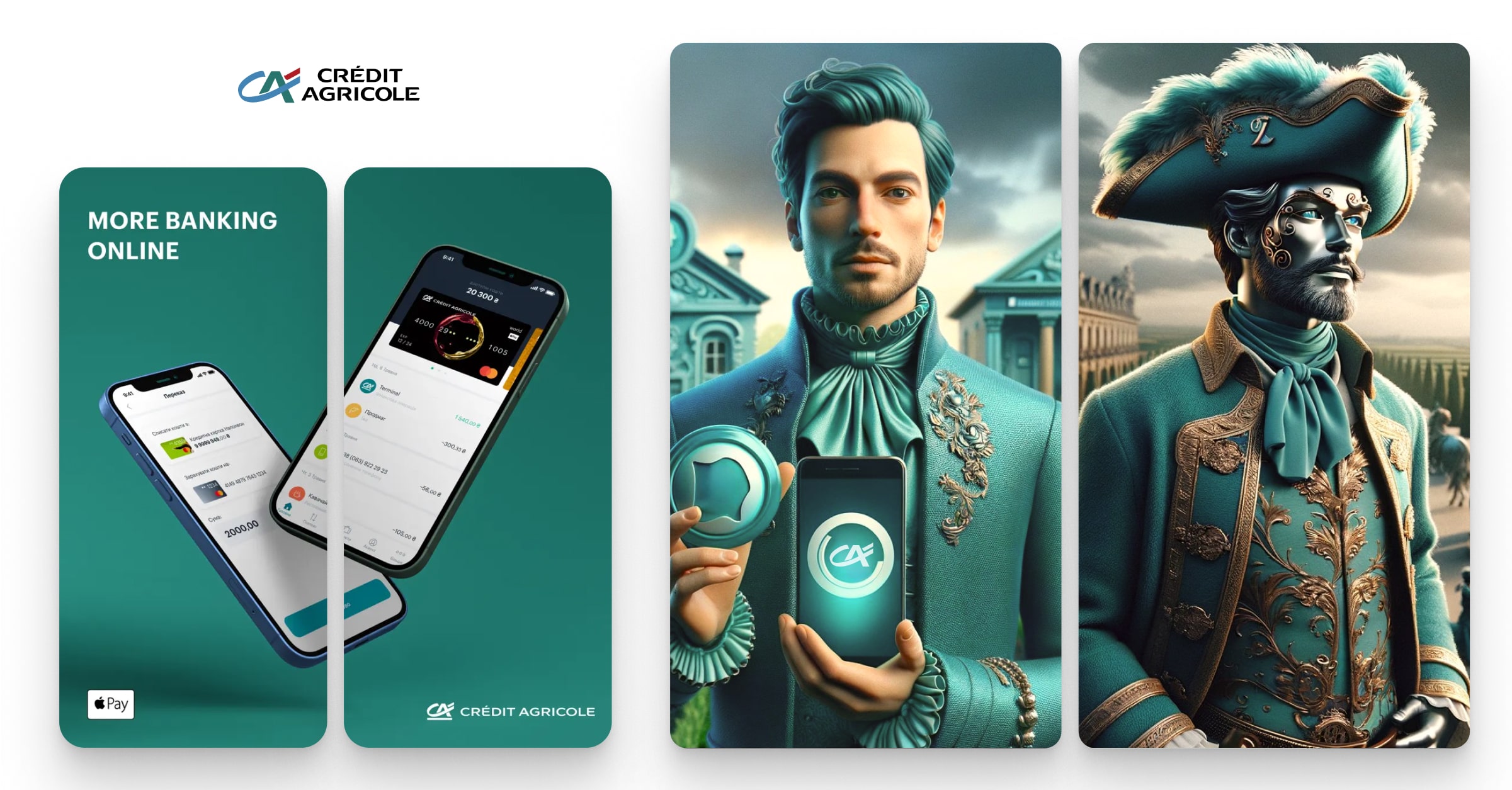

Crédit Agricole AI mascot

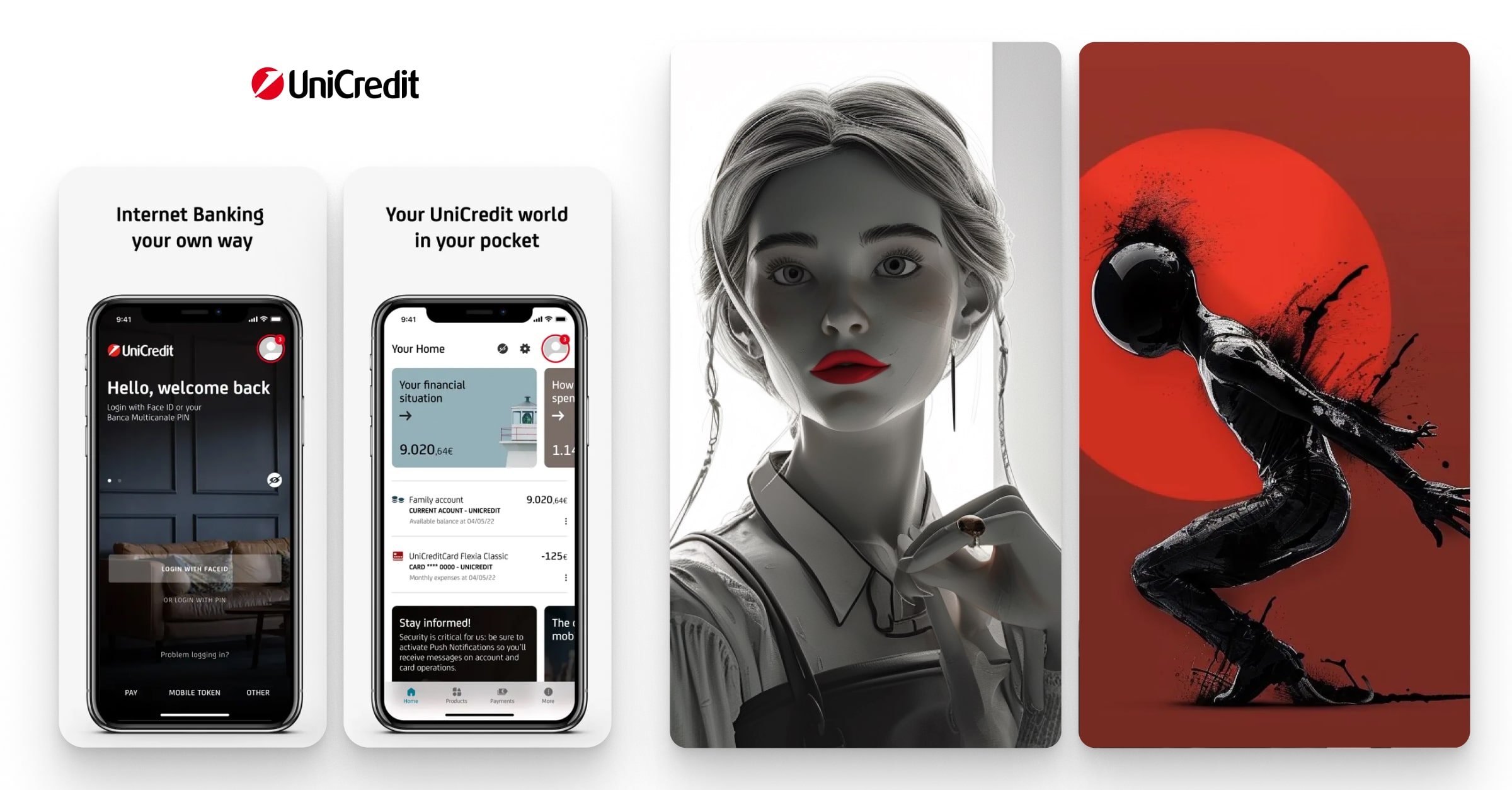

UniCredit AI mascot

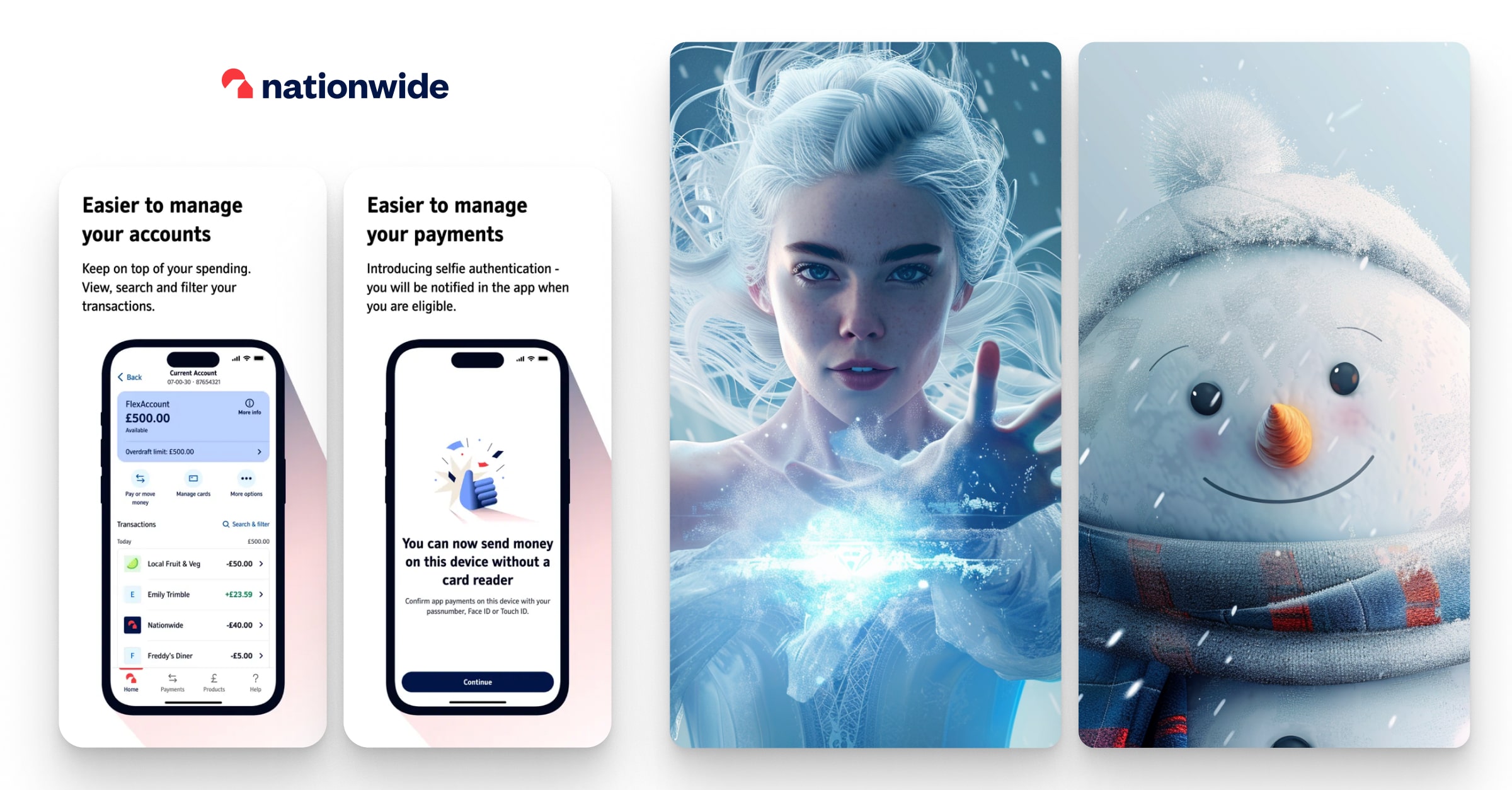

Nationwide AI mascot

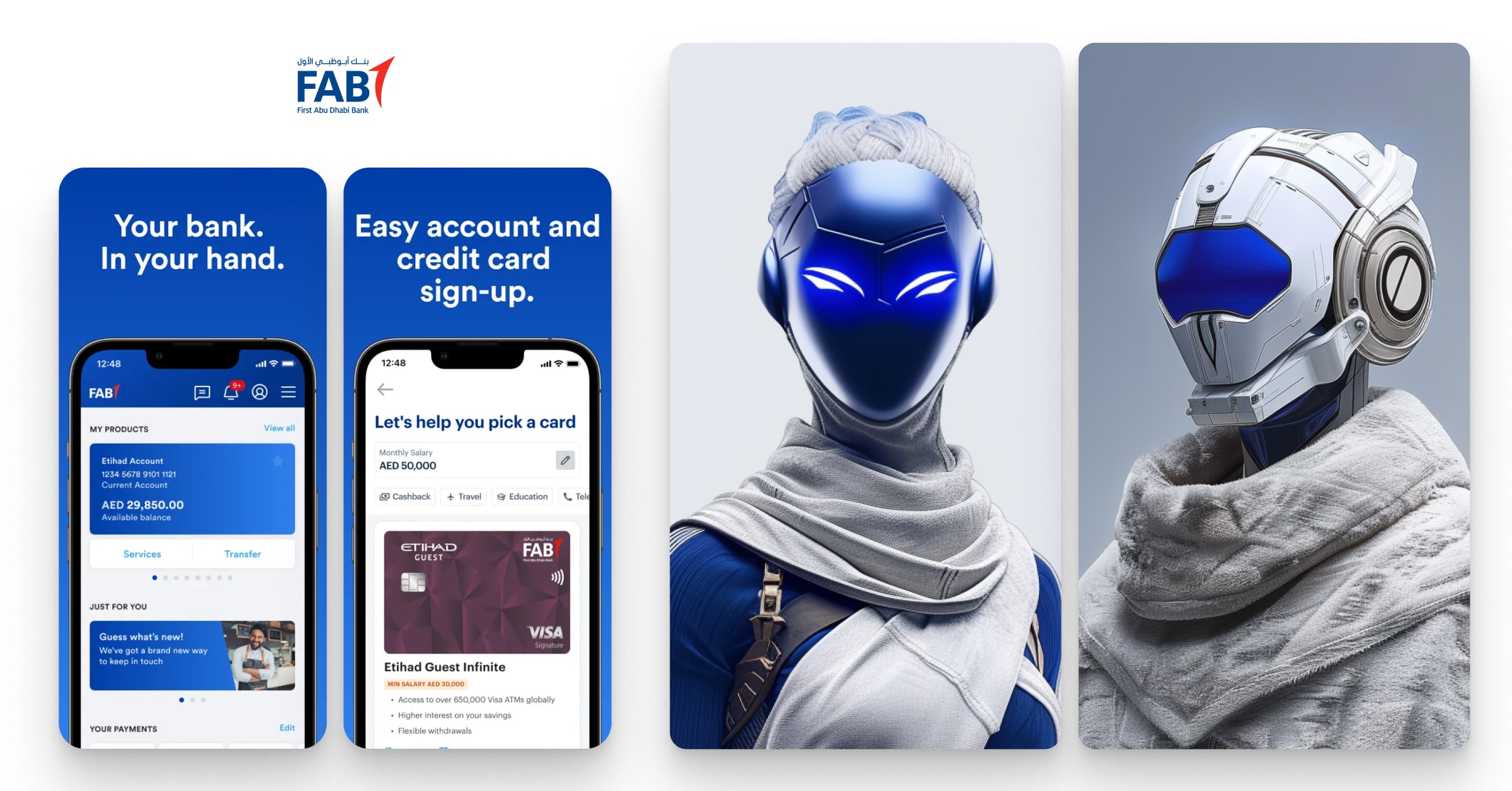

First Abu Dhabi Bank AI mascot

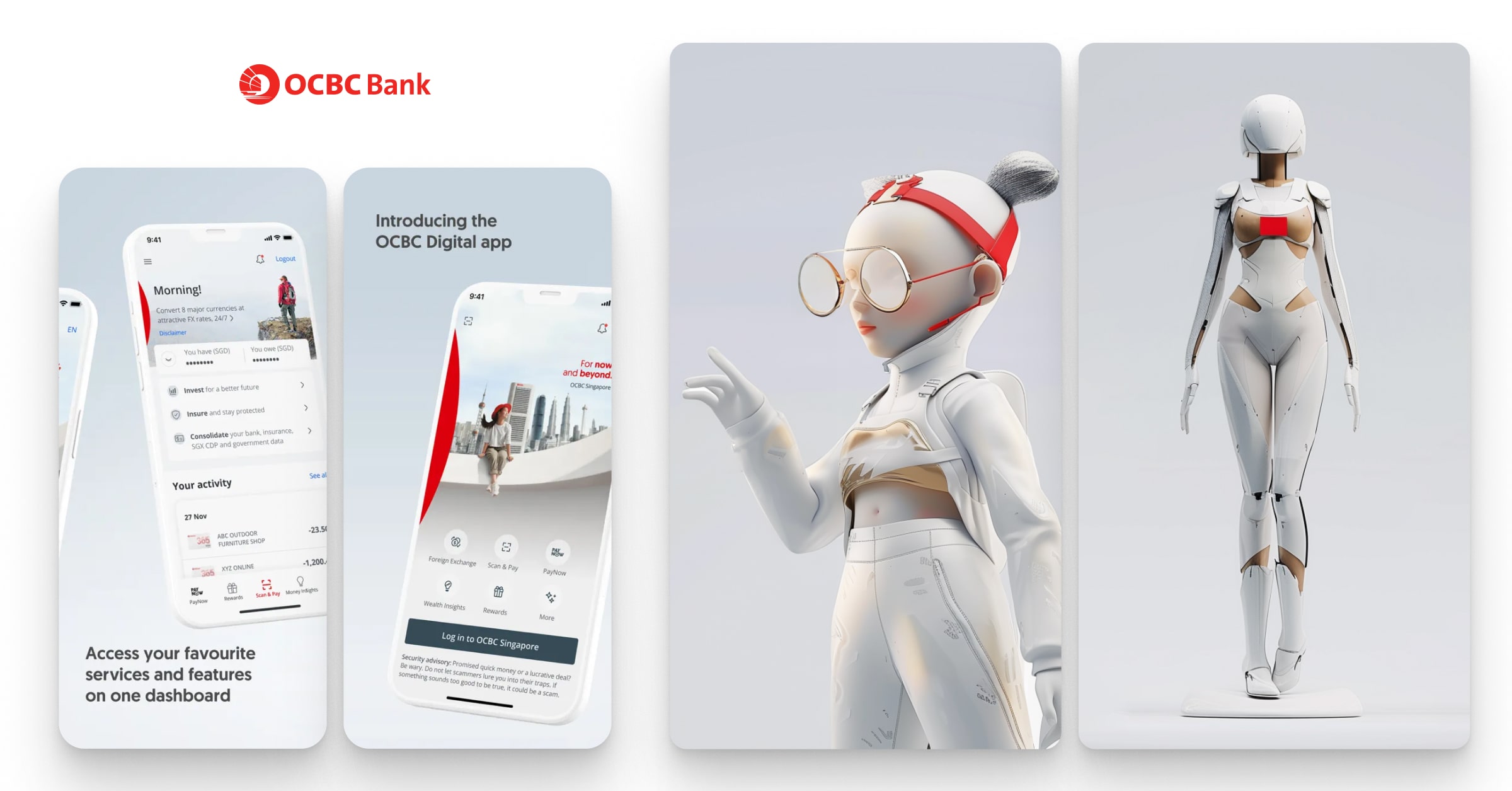

OCBC Bank AI mascot

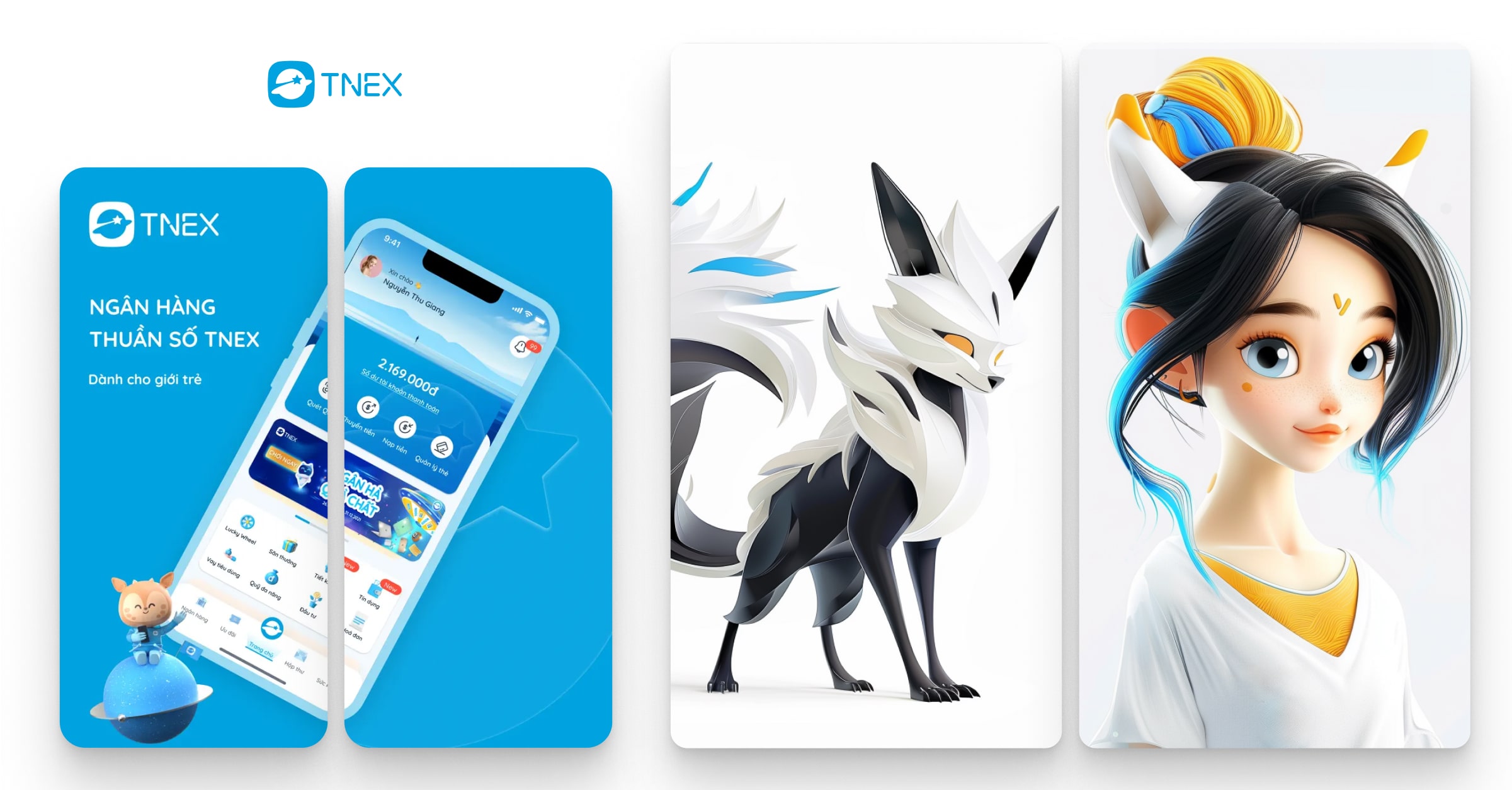

TNEX AI mascot

© The rights to all recognizable characters generated by AI belong to their authors, this article is for informational and research purposes only, and does not constitute commercial use.

The Impact of AI in Financial Brand Marketing on Social Media

Creativity is crucial for financial brand marketing on social media for several reasons, each contributing to the brand's overall success and resonance with its audience:

Differentiation

The financial industry is highly competitive, with many brands offering similar products and services. Creativity in marketing helps a brand stand out, grab attention, and differentiate itself from competitors. It's about presenting traditional financial products in innovative ways that resonate with the audience's needs and interests.

Engagement

Social media platforms are cluttered with content competing for users' attention. Creative content—whether it’s engaging visuals, compelling stories, or interactive posts—can captivate the audience, encourage interactions, and foster a community around the brand. High engagement rates also improve visibility due to the algorithms of social media platforms favoring content that generates interactions.

Building Trust

Financial services are highly based on trust, especially in a digital environment where personal interaction is limited. Creativity in marketing can help humanize the brand, making it more relatable and trustworthy. Through storytelling and innovative campaigns, financial brands can connect emotionally with their audience, building confidence and trust.

Educational Value

Financial concepts can be complex and intimidating for many people. Creative marketing strategies can simplify these concepts, making them accessible and understandable to a broader audience. Educational content that is engaging and easy to digest encourages better financial literacy and empowers consumers to make informed decisions.

Adaptability to Trends

Social media trends evolve rapidly. Creativity enables financial brands to adapt to these changes, adopting new formats, platforms, and communication styles. This adaptability is crucial for staying relevant and maintaining the attention of younger demographics, who are future customers.

Customer Insights

Creativity in campaigns can lead to more interactive engagement with the audience, providing valuable insights into their preferences, behaviors, and feedback. These insights can inform product development, customer service improvements, and future marketing strategies, ensuring that the brand remains customer-centric.

ROI and Conversion Rates

Creative marketing strategies can lead to higher engagement rates, which often translate into better conversion rates and return on investment (ROI). By effectively capturing attention and building brand affinity, creative campaigns drive more leads and sales, contributing to the financial success of the brand.

Conclusion

AI-infused creativity in financial brand marketing on social media is not just about standing out; it's about building a meaningful connection with the audience, fostering trust, and communicating complex financial information in an accessible and engaging way. This next-gen approach could not only improve brand image but could also lead to tangible business results.

Explore our client's next-gen financial digital products showcased in the UXDA showreel:

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedinof thousands of bank branches