Almost 60% of all working-age have no retirement savings. Four in ten adults couldn’t cover a $400 emergency expense in the U.S. Adults struggle to manage their finances, but they want to see their kids have good financial habits. Parents provide their children with pocket money from the age of 6, but at the same time, 49% of parents do not know how to discuss finances with their children. Most banks do not have special products suitable for children's needs and expectations.

CHALLENGE: Kids Face Discrimination in Finance

For centuries, we haven’t forced children to use the same stuff as adults, but finance still discriminates against children. Digital financial services could provide the perfect opportunity to serve our kids, teach them how to handle money and take care of building the right attitude. We just need to rethink financial services... make them "speak" the kids' language.

To broaden the horizons of banking applications beyond primitive banking functions, we need to explore finance in the context of family relationships. Parents are too busy to explain digital money to kids, and kids want to play games and buy toys, not listen to morality.

The goal was to add joy, excitement, friendliness, encouraging kids to let their eyes shine while using the app. We dove into the kids' world of mobile games, children's movies, cartoons. Carefully studying how the content was made, what elements stood out and why kids like them.

SOLUTION: Kids'Banking as a Game

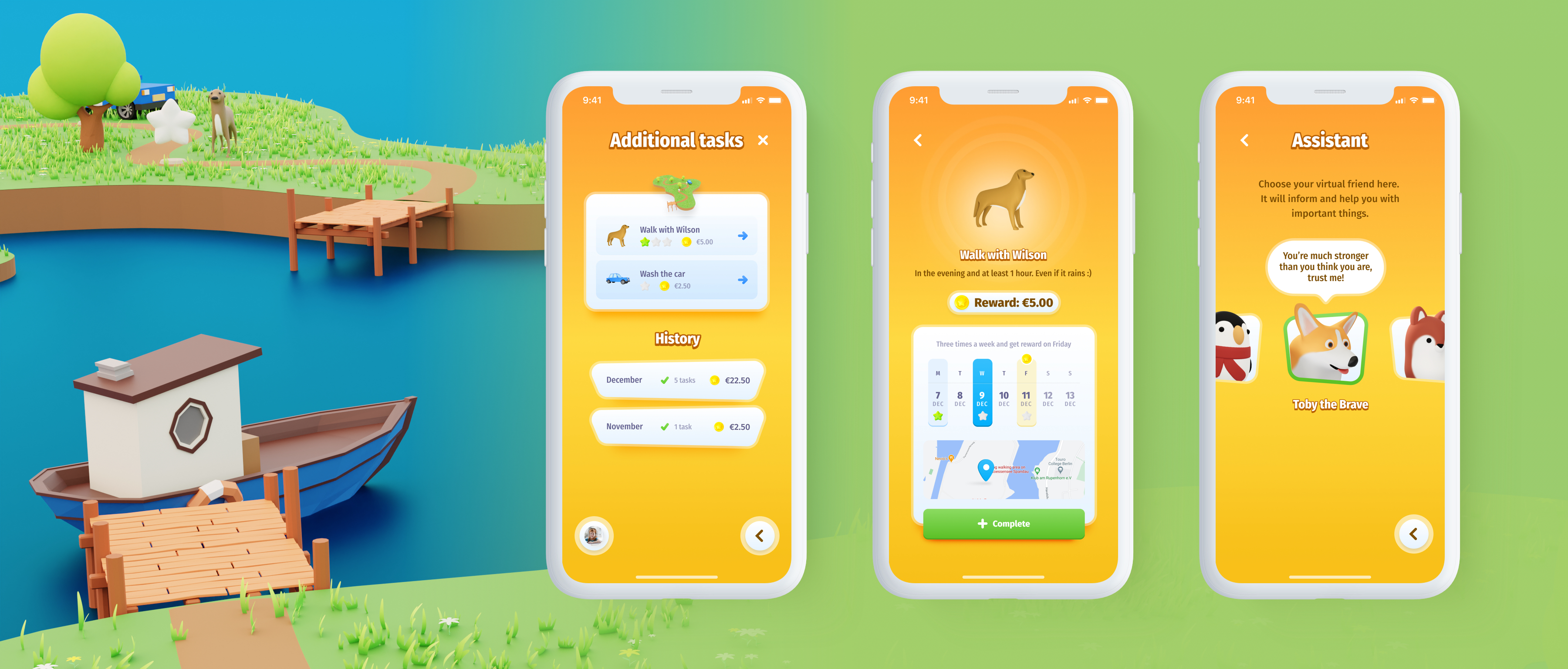

In a digital world, you have apps almost for everything. So why don't we offer parents mobile application that will not only allow them to transfer money to their kid's card but will help teach kid to pay in the store, collect money for big goals, motivate to do home tasks and show the value of money through paid tasks? And all this through an intuitive, child-friendly game interface.

To do so, the UXDA team wireframed an e-wallet that combined a game with education, and task manager, creating a digital bridge between parents and kids to transform children's first financial experiences into an exciting journey.

EXECUTION: Creating an unprecedented 3D banking experience

We needed to go beyond the traditional approach to banking app design.

To create a game-based innovative financial app we decided to use an animated 3D interface, to provide kids with an experience previously not available in digital banking. Thus we achieved the emotional connection and created a visually stunning dynamic environment to make feel the kids banking app alive.

We have created 2 parts of the app interface. One for kids and the other for parents.

Because parents are busy and are more goal oriented, they want to complete specific tasks as soon and easy as possible.

RESULTS: Kids were interested, excited and surprised

By sharing kids' banking concept case study with the public through the UXDA blog, Linkedin, Medium, Youtube, ect. we inspired over 5K financial professionals to empathize with families. And some of the financial companies told us that they are making first steps to shape their brand and digital strategy for families with kids.

READ FULL "Kids Banking" Case Study

As a result - a vital banking app concept was born that offers support to families worldwide, combining the elements of game, joy, fun and finance that:

- Speaks the kids language, educating them about financial literacy;

- Prevents fights about money matters and improves family relationships;

- Creates a good foundation for kids' financial futures;

- Ensures a successful inclusion of children in the modern digital economy.

We tested the concept on kids and they were thrilled! They say: "Is it a game?", "I want to play this game!", "This is like a quest. Cool!". After seeing their kids so excited during the testing session, parents said that they would like to have such an app in their family.

Financial institutions have the ability to become an important part of the whole family by sharing knowledge and integrating young kids into the world of a digital economy. This is an excellent opportunity for financial institutions to provide their future customers with positive associations and emotions from their brand.

Get UXDA Research-Based White Paper "How to Win the Hearts of Digital Customers":

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedin