What is “banking user-experience” and how to improve it? Actually this is exactly where banking innovations are born. We hear about “banking disruption” all the time, but what is it all about? New banking technology providers are in continuous development. All these “Fintech unicorns” first of all disrupted traditional banking experience. They opened new opportunities to consumers to solve their financial problems. Now we call the founders of these “unicorn” companies — genius. And there is no ready-made answer on how to enhance experience in the banking industry. You have to embark on this whole journey by yourself to find it out, but to help with this we will reveal few insights from Retail Banking Report 2016 by Capgemini and Efma.

1. Customer experience in banking industry is focused on older customers

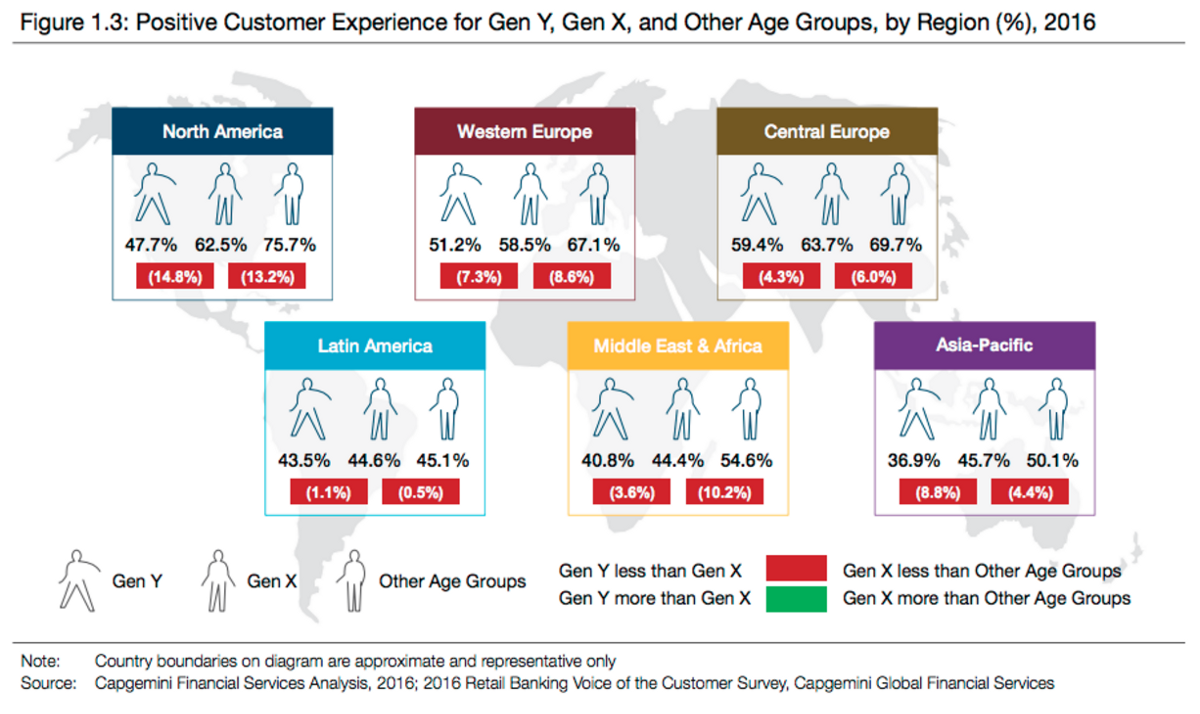

Despite of overall positive banking customer experience growth (up to 50% in last 2 years in Central Europe and Eastern Europe) Gen Y is 20% less satisfied comparing to older generation customers. Difference is especially apparent in North America, where only 47.7% of Gen Y customers reported positive experiences, compared to 62.5% of Gen X customers and 75.7% customers of older age groups. It’s clearly seen that banks focused their service on older customers, and have lack of attention to the younger generation.

Why is it significant? Gen Y lives in digital age and their expectations from financial industry are really high. In next 10 years they will become main users of digital banking services. It means that banks have to learn “Gen Y language” switching their focus to younger customers. Оne of the difference between banks and Fintech startups is about age of decision-makers. Startup founders are millennials in general, and it`s obvious for them that banking service have to be customer-centered.

Figure from Retail Banking Report 2016 by Capgemini and Efma

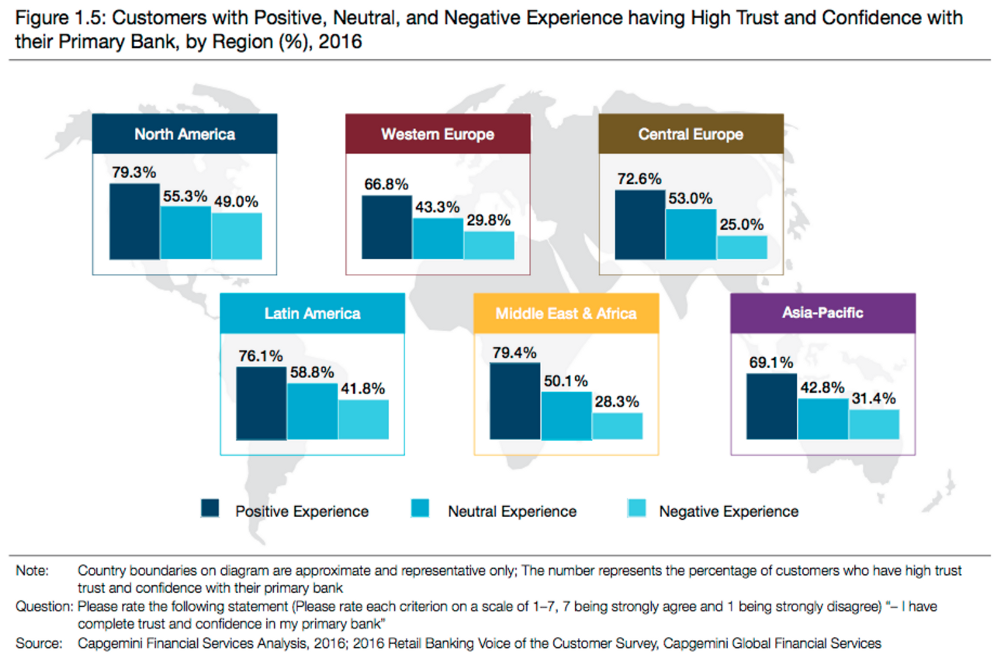

2. Banks have to generate positive experience to gain trust

We can see there is an obvious correlation between the experience and the trust level. We can see up to 300% difference in trust and confidence between customers with negative and positive experiences. In Central Europe only 25% of customers with negative experience have trust and confidence in their primary bank, comparing to 72.6% for customers with positive experience.

Figure from Retail Banking Report 2016 by Capgemini and Efma

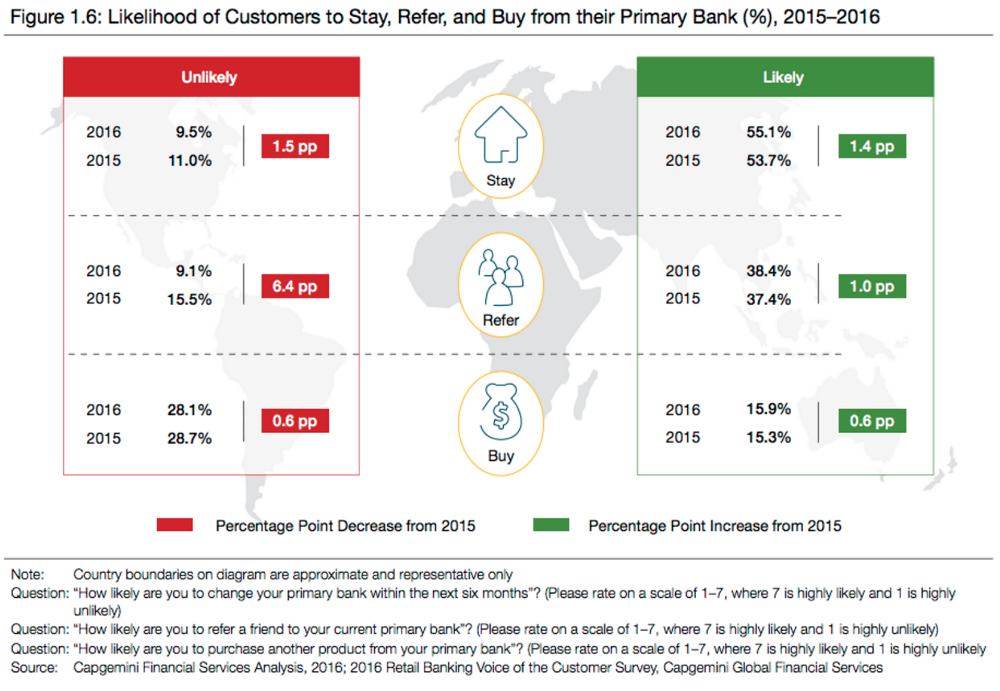

As you see, old-school marketing is not enough to ensure loyalty nowadays. You can`t keep your clients just because their parents also are your customers. Only 55% customers are likely to stay with their primary bank in next 6 month, and only 38% are likely to refer their bank to a friends. What would you say if a half of your customers are under question mark? And there is even more — 10% admitted that they are unlikely to stay loyal in next 6 months.

Figure from Retail Banking Report 2016 by Capgemini and Efma

Customer-centered thinking is the only way to make business. Customers expectation level is raised by modern service providers, especially startups. Old and famous brand do not have an advantage today, it`s all about bank user experience (UX) you deliver comparing with other financial services in the banking industry. Buzz about outstanding experience goes viral, and puts unknown brand to highest ranks just in a months.

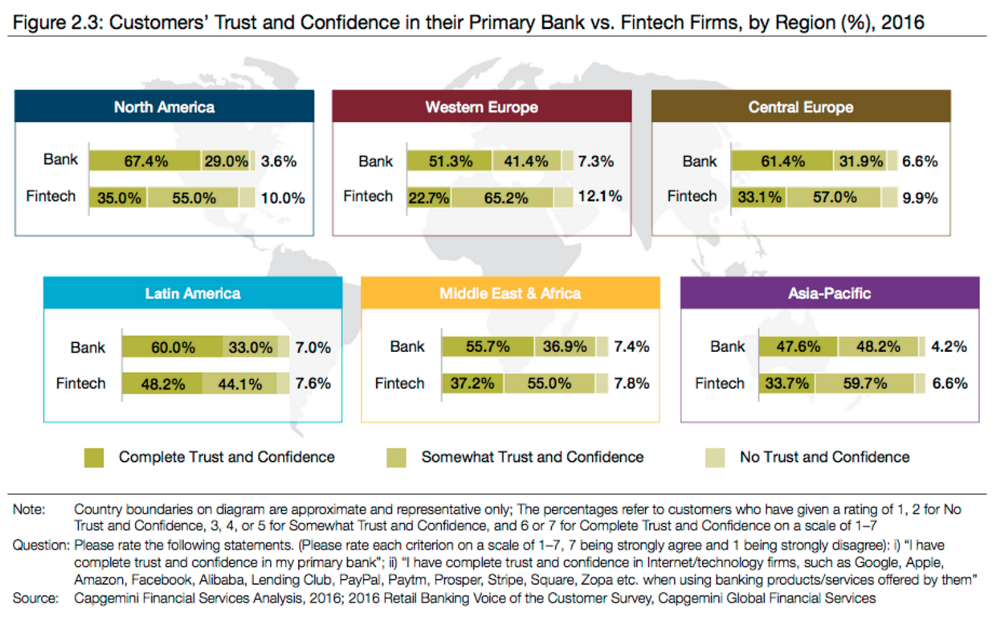

In a few years Fintech startups almost achieved the same level of customers trust and confidence as banks. How Fintech companies, that we never heard before can outcompete 100-years old banks? The only answer is banking UX. Оften Fintech startups do not even have their infrastructure, they just get it from banks. So, basically it`s not about tech innovation, they are digital banking UX providers. And experience is something where traditional banking have troubles.

Figure from Retail Banking Report 2016 by Capgemini and Efma

3. Impact of the banking user experience is underestimated

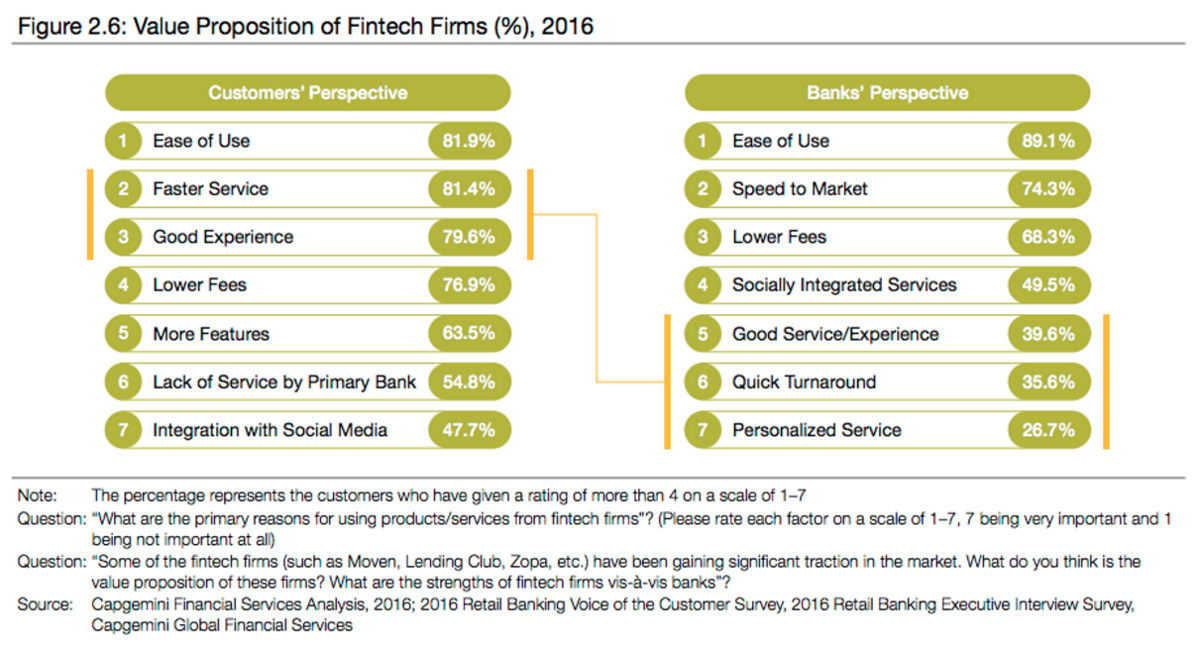

Most interesting part of Capgemini and Efma research is about gap in banks and customers understanding about Fintech startups advantages. Only 40% of banks believes that good experience are Fintech firms value proposition, despite the fact that 80% of customers are assured.

This lack of customer-centered vision is clearly seen comparing other differences. Banks believe that source of startups power is more about marketing: speed to market, social integration, quick turnaround. Customers choose Fintech because of digital banking UX: faster service, more features, lack of service by primary bank. And only the main strength was agreed by both parties — ease of use.

Figure from Retail Banking Report 2016 by Capgemini and Efma

Of course marketing still important part of any business, but this concept changes. In the past you were able to create any product and sell it. Because of the deficit. In growing competition need of marketing appeared. Create nice legend, make bright package, launch advertising campaign and that’s it — sold out.

We live in age of over-production. Everyone can sketch their product, get funded on Kickstarter, place order in China and sell it on Amazon. Technology opened amazing opportunities to produce services and goods, even without leaving your home. But do we really need all this stuff? And the same happens in financial services with all this impressive funding and tons of startups.

Product-centered approach does not work anymore, we need to change our mindset. Life-cycle of goods and services are extremely short, so you have to develop them at the same time to keep your positions. In this chaos the only stable centre for your business is customer. And this means that traditional push-marketing is dead, It’s time for financial experience design. Look at Facebook, it`s fully integrated in billions life routine because of friends connection experience they provide.

Main takeaways

Do not underestimate millennials

Gen Y are the future success of your business in financial industry. Find what they like, dream of, their pain points and passions about your banking user experience. Discover their expectations and provide best possible experience through right channels.

Generate trust

No, it`s not the numbers game anymore. Today it`s not enough to put some budget and count leads. Get to know your customers and give them what they need. This is the only way to gain more trust to your brand, keep customers and generate referrals.

Explore consumers

Go back to the real world to look at it through the eyes of your customers. Go to field and see how customers use your service. Ask about your competitors, ask about best practice in banking industry. Reveal their thoughts and emotions. Make user-centered banking and deliver delightful experience that solves customers problems.

Get UXDA Research-Based White Paper "How to Win the Hearts of Digital Customers":

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedin