There is a tremendous responsibility in the hands of wealth management platforms when presenting data that can impact users' financial lives, especially while serving an exclusive customer base as ultra-high net-worth individuals (UHNWIs). Recognizing the absence of digital tools that cater to the demands of a luxury lifestyle, Private Wealth Systems, a US-based global financial technology company, embarked on a mission to create something unprecedented – a premium-feel, easy-to-understand, multi-asset class portfolio management and performance reporting platform for UHNWIs.

Private Wealth Systems aimed to revolutionize wealth management by delivering a user-friendly and visually stunning solution that meets the luxurious needs of multi-millionaires. Delve deeper to understand how UXDA, partnering with Private Wealth Systems, facilitated a fundamental shift in wealth management, delivering an innovative Bugatti-caliber asset management experience for UHNWIs.

Client: Dream to Redefine Wealth Management

Private Wealth Systems is an innovative wealth management platform exclusively designed for UHNWIs, providing instant oversight of their wealth worldwide. It was founded in 2014 by Craig Pearson, who remains the CEO today. Currently, the company oversees a daily assets under management (AUM) of $200 billion, with an average of $233 million in assets per customer.

UHNWIs seek ultra-luxury technologies that reflect their status and aspirations. Private Wealth Systems is at the forefront, meeting these expectations with its innovative features and sophisticated design. The platform consolidates investment data, ensures accuracy and generates reports on multi-asset class portfolio performance, providing critical insights for investors and their teams to effectively manage performance, risk and liquidity.

The platform's cutting-edge technology has revolutionized private wealth and fund administration by offering a comprehensive view of assets like equity, income and venture capital globally. Mr. Pearson came to UXDA in search of extreme usability with a sense of sophistication and luxury, intending to bridge the gap between existing and desired user experiences.

The company's philosophy is that the individual wealth owner and their trusted advisors should have total transparency regardless of the asset’s financial complexity. High net-worth investors should have the freedom to access the information they want, when they want, in the format they want, on the device they prefer regardless of their location. The Private Wealth Systems platform became the primary partner for UHNWIs, empowering them to take an active and independent role in managing their wealth rather than solely relying on advisors.

Craig Pearson, Private Wealth Systems CEO, states:

Whether you want to fund a school in Ghana, build a health clinic in Guizhou or finance a new startup that will become the next Apple or Amazon, you need to engage and be an active participant in how your wealth is managed. I hope our platform can help individuals engage at an elevated level of knowledge, align their wealth with their personal values, and make an impact that they can be proud of in order to create their own unique legacy.

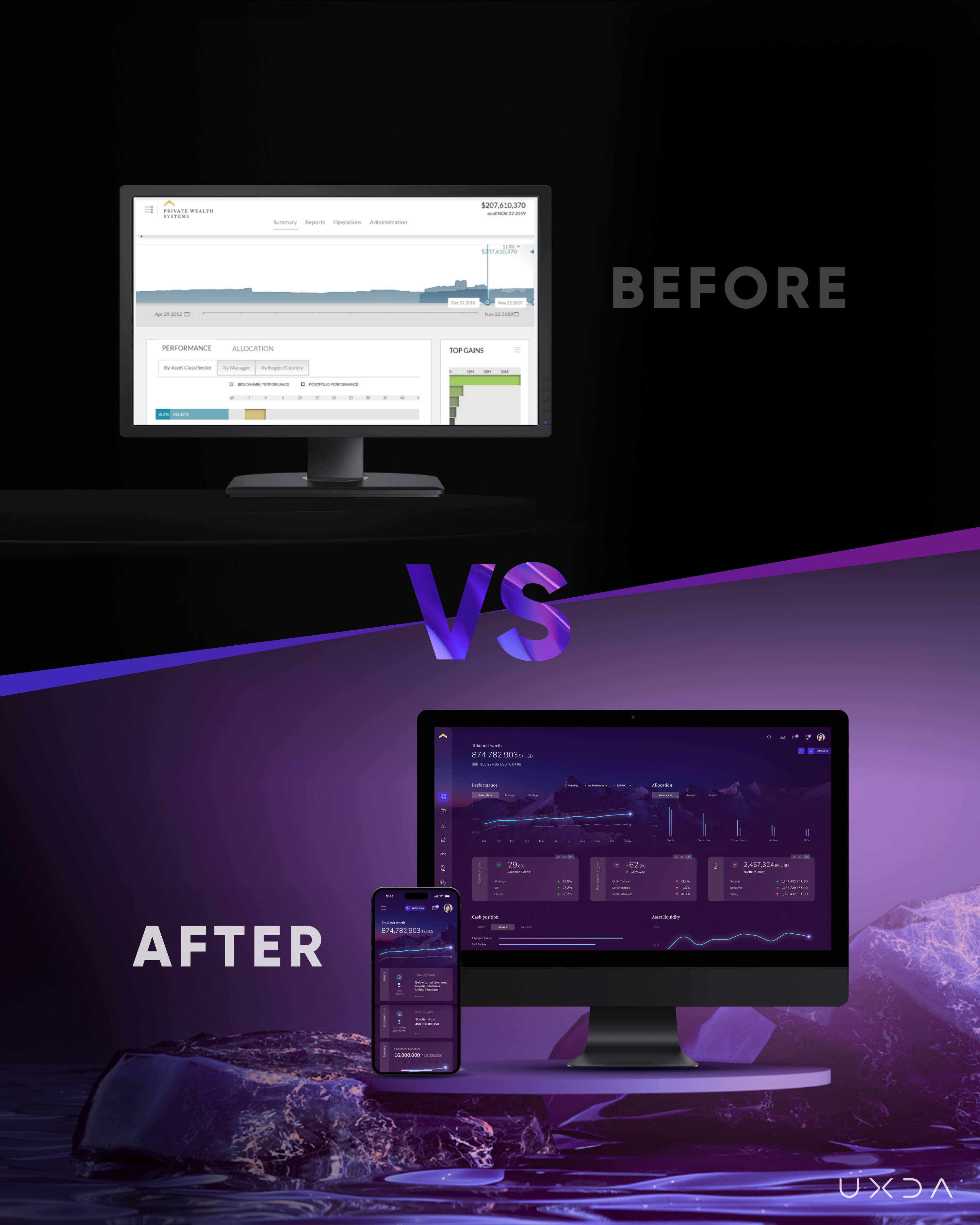

With this philosophy at heart, Private Wealth Systems approached UXDA to upgrade its wealth management platform and deliver a modern, intuitive and engaging customer experience. Their existing user interface lacked a premium feel and clear overview, preventing UHNWIs from gaining a comprehensive understanding of their wealth.

Challenge: Addressing UHNWI Needs in Asset Management

Craig aimed to break away from a conventional wealth management platform designed for the masses by crafting a bespoke solution tailored to the unique needs of UHNWIs, simplifying data visualization and enabling non-financial users to easily manage their family's legacy wealth. Considering the absence of industry best practices, creating a UX/UI for this kind of platform from scratch required specific knowledge and a different approach from mass-market financial solutions. The stakes were high, as billions are at play, and a poorly executed user experience could result in a substantial loss of potentially millions of dollars.

The hidden stress of wealth accumulation

There's a widespread belief that increased wealth equates to decreased stress, but the truth is actually the opposite. UHNWIs often experience heightened stress due to the complexities of managing their assets and the need for expert insights. Recent reports, like The UBS Global Wealth Report 2023 and Forbes' World's Billionaires 2023 list, highlight significant declines in millionaire and billionaire counts and collective wealth, reflecting the volatile economic landscape. Rising interest rates and geopolitical tensions further underscore the need for reliable, real-time financial tools.

UHNWIs need a cloud-based tool for real-time updates to swiftly respond to changes, preventing potential losses and maintaining their millionaire or billionaire status. Faced with the absence of a solution for consolidating globally dispersed assets, the UXDA team embarked on a challenge to reinvent wealth management for UHNWIs through the Private Wealth Systems platform.

Addressing the needs of UHNWIs in asset management

UHNWIs face unique challenges, including safeguarding assets, ensuring growth and preparing for intergenerational wealth transfer. Our research revealed that younger generations often feel disconnected from family wealth due to the perceived complexity of financial management. According to the HSBC report, they often prepare assets for family management rather than directly involving children and other family members. This generational gap in financial knowledge and engagement poses a significant challenge for wealth management.

Engaging these heirs is crucial for long-term wealth preservation and growth. UXDA focused on designing an intuitive platform that would equally engage younger generations in managing family finances while also meeting the needs of experienced hedge fund managers, striking a balance between user friendliness and advanced functionality.

Craig Pearson emphasizes:

A twenty year old with ten thousand in savings has plenty of FinTech tools available to gain oversight over their money. Yet someone with $10 million to $100 billion has literally no means of actionable independent oversight over their advisors and investments, placing their family legacy at risk.

Taking wealth management away from spreadsheets

The shocking truth is that the main player in the wealth management market is none other than the Excel spreadsheet. With customization options to create individual charts and formulas, a wide range of analytical tools and functions and a high level of familiarity among people worldwide, Excel remains an understandable choice. Despite these advantages, it's worth noting that Excel has its limitations, especially as wealth and financial complexities increase.

UHNWIs and their wealth management advisors require more advanced and secure systems tailored to handle millions or billions of portfolios, enabling informed strategic decisions about their total wealth. Another aspect to consider is that individuals accustomed to a luxurious lifestyle want to manage their finances with the sensation of driving a premium car, having similar extraordinary experiences that evoke strong emotions and enriching their personal journey. They don't want to feel like accountants systematically adding numbers to their Excel spreadsheets.

Solution: Inventing an Intuitive Premium Wealth-Management Platform

When starting to work on Private Wealth Systems, the UXDA team was constantly looking for inspiration. We explored dozens of luxury products and found the one that inspired us the most. Bugatti's design and approach serves as a benchmark and a stunning example of combining advanced technology and magnificent aesthetics.

To create an exceptional Bugatti-caliber user experience in wealth management, UXDA designed a cloud-based platform combining luxurious aesthetics that fit UHNWIs’ lifestyles with an intuitive user experience, enabling them to view and control thousands of assets seamlessly.

We've aimed to establish new standards in UHNWI wealth management, delivering an unparalleled digital experience that surpasses other solutions, ensuring investors have peace of mind in analyzing and investing to preserve and build multi-generational wealth.

Key Differentiators

- Real-Time Performance Review: Comprehensive and clear asset graphs provide immediate access to wealth overviews, reducing reliance on advisors. The platform's functionality and information architecture promote feelings of calmness and control, offering a 360-degree asset overview 24/7 from anywhere in the world.

- Personalized Dashboard: Users can customize their dashboards, adding modules like top losses or goals, promoting better decision-making. This flexibility allows users to switch between different representations, such as asset allocation by class, manager or region, enabling comprehensive analysis and informed decision-making.

- Sophisticated Design: Drawing inspiration from luxury products and nature, the design evokes feelings of opulence, wealth and calmness. The frosted glass effect enhances individuality and adds a premium feel, ensuring UHNWIs experience the sophistication they deserve.

Inspired by our design, Private Wealth Systems established a unified brand identity across all communication touchpoints, ensuring a consistent premium experience. Additionally, with the designed platform, Craig has inspired important partners for his business and signed agreements with top financial service companies to power their global family offices.

The Private Wealth Systems platform is constantly improving. For example, it will allow users to track their personal collections, such as wine, artwork and private jets. Imagine real-time insights of a Picasso painting’s market value after simply snapping a photo and uploading it to the platform.

We are expanding the desktop platform to a mobile app, broadening the ability of UHNWIs to manage their wealth on the go, aligning with their lifestyles and engaging younger generations in wealth management.

Approach: Setting New Standards for Digital Wealth Management

The Private Wealth Systems team, with their daily experience communicating with UHNWIs, provided us with insights that helped identify their pain points, needs and characteristics, leading to surprising conclusions. It turns out that many rich people behave counterintuitively. They postpone wealth management due to the perceived challenges of handling large amounts of wealth, thereby increasing their financial risks.

Empathizing with multi-millionaires’ struggles

We extensively researched the lifestyle of UHNWIs, considering not only their financial management expectations but also their life aspirations, values and behavior. We recognized the demand for a premium experience that mirrors their luxurious lifestyle, akin to driving luxury cars, residing in exquisite homes and overseeing global businesses. However, millionaires struggle to manage various types of assets across multiple platforms, making it difficult to gain a comprehensive overview and understand their wealth, resulting in heavy reliance on financial advisors.

Guided by our experience designing over 150 different financial digital products and financial UX methodology, after conducting user research, we mapped a user journey and defined key personas to dive deep into the needs and expectations of UHNWI customers.

The platform offers UHNWIs a comprehensive overview of their multi-asset class portfolio and the entire household's staff, managers and advisors. Imagine sitting in your NYC apartment on Park Avenue and reviewing your historic Italian vineyard on camera after communicating with your private driver to pick you up from the airport in Bora Bora tomorrow and asking your chef to prepare your favorite meal by 8 PM.

This ensures clarity and control over who is involved in wealth management. Considering the need for consultation with an advisor and quick decision-making, we found an opportunity to add value by integrating communication features. This includes a feature for clients to contact their household manager abroad and inform them of their visit, ensuring smooth communication with advisors across distributed assets.

Data-driven innovation

Due to the lack of alternative platforms serving the same customer segment in the market and reflecting best practices for designing wealth management platforms for UHNWIs, our team was given free rein to explore and innovate heavily. But across all design decisions, we remained focused on delivering value to users and meeting their primary needs: having a clear overview and control over their wealth situation.

Our UX architects spent weeks conducting various usability tests and underwent 32 design iterations to achieve the platform's interface that would satisfy the user scenarios with a simple and clear navigation and exclusive UX. Testing prototypes in real-world scenarios provided valuable feedback, refining the platform's functionality based on a data-driven approach.

Ensuring million-dollar decisions with intuitive architecture

Our goal was to craft a luxury item that goes beyond being merely desirable to becoming an essential part of UHNWIs' lives — a platform that earns their trust and becomes their go-to for wealth management.

Given that many UHNWIs lack professional expertise in investments and wealth management, our focus was to make the platform's experience clear, pleasant and easily understandable, providing essential information for decision-making at a glance. Thus, our team has thoughtfully analyzed how users engage with non-financial digital platforms, with the goal of identifying effective methods for incorporating a clear view of hierarchy nodes.

UHNWIs view time as their most valuable asset. Our task was to ensure them more time for what truly matters rather than spending hours stressing over their wealth and consulting with advisors to decipher reports. With the intuitive architecture and cutting-edge digital features, UHNWIs can perform detailed investment analysis and get instant reports, chilling in the lobby between business meetings or flying on their jets to the Seychelles.

Private Wealth Systems enables UHNWIs to oversee the entire family tree's wealth and make informed decisions accordingly. When one person's decisions can impact the family's entire wealth, it's crucial to have a clear overview before making important choices. Additionally, understanding the importance of up-to-date information for this group, we integrated a news section on the dashboard to provide customers with the latest industry updates, enabling faster and more informed decision-making.

Craig Pearson, Private Wealth Systems CEO, highlights:

In this highly complex industry, every solution is complex. To succeed in this field, we need to create a system that is hyper-simple for use, ensuring that an 18-year-old heiress who has inherited 100 million euros can and will want to use it. Simultaneously, the system needs to be powerful and sophisticated enough to meet the demands of a 50-year-old hedge fund manager who has achieved a $10 billion portfolio.

Providing a personalized dashboard for a tailored experience

To empower UHNWIs to make informed decisions with confidence based on the highest quality data available, we equipped them with a comprehensive analysis irrespective of custodian, asset class or global jurisdiction.

Performance and asset allocation graphs provide a quick overview of the most crucial wealth-related information on the dashboard. And an asset allocation graph offers flexibility, allowing users to switch between different representations, such as asset allocation by class, manager or region.

Users can also personalize their dashboard by adding new modules, like top losses or goals, to suit their unique preferences. Interacting with the graphs on the platform's first page enables users to make faster, data-driven decisions, allowing them to identify trends, anomalies and potential fraud instantly. This promotes faster decision-making and reduces cognitive load and stress while saving them time.

Creating an emotional connection

Investors have criticized wealth management platforms for being overly tech-focused, lacking visual appeal and having outdated aesthetics. In response, we’ve concentrated on crafting an inspiring design that instills a sense of tranquility and security — a space where UHNWIs can feel supported and receive the experience they deserve.

The UXDA designers have brainstormed collaboratively to find inspirations to evoke feelings of opulence, wealth, inspiration, freedom and calmness, drawing inspiration from nature, outer space and luxury products like purple diamonds or even Bugatti vehicles.

Placing mountains in the background represents the expansive opportunities to reach greater heights while inspiring people to balance their emotions. Focusing on these associations in design has allowed our team to create a unique synergy of calm and motivation, transforming stressful wealth management into an enjoyable and positive process.

Additionally, it is fueled by the UHNWI lifestyle and hobbies, so they can easily relate to mountains and resonate with the feelings and emotions that the Private Wealth Systems platform evokes.

UXDA designers have also found a way to enhance individuality and add a premium feel by incorporating a frosted glass effect into the design. The platform is designed to ensure UHNWIs experience the sophistication they deserve, rather than sitting in their Lamborghini and stressfully managing finances using Excel spreadsheets.

Fostering trustful and reliable collaboration

Our collaboration with Private Wealth Systems and Craig Pearson has grown into a strong partnership over the years, contributing to the success of Private Wealth Systems. Craig granted the UXDA team the necessary resources and full creative freedom in designing the Private Wealth Systems digital ecosystem's user experience.

This collaborative relationship between Private Wealth Systems and UXDA demonstrates our client's complete reliance and trust. The key to this was Craig's focus on finding solutions that outperform his customers' needs and high expectations instead of being limited by technical constraints. And the feedback from users is a testament to the excellence of the product:

The services provided by Private Wealth Systems are truly outstanding. Their platform is user-friendly and efficient, making it easy to manage my investments.

Private Wealth Systems has provided me with an exceptional wealth management platform. The user interface is intuitive, and it has helped me stay organized in tracking my investments.

Using Private Wealth Systems has been a game-changer for me. The platform is seamless, and their customer support is exceptional.

I've been using a wealth management platform from privatewealthsystems for a while now and I must say, I'm impressed. The platform is intuitive and offers a great user experience. It has helped me streamline my financial planning and investments.

Amazing experience! Their wealth management platform has greatly simplified my financial management process. The team is helpful and efficient. I appreciate their commitment to providing excellent services.

The Private Wealth Systems platform consistently receives awards from prestigious entities. For instance, it recently won two awards at the 2024 Private Asset Management Awards for Best Fund Administration Service and is a finalist for the Best Consolidated Reporting Solution at the 2024 Family Wealth Report Awards.

Takeaway: Empathize to Reinvent the Digital Experience for UHNWIs

Private Wealth Systems' innovative platform sets new standards in wealth management, delivering a Bugatti-caliber experience for UHNWIs. The challenge was understanding the unique expectations and pain points of UHNWIs and addressing them through a meticulous user experience design and user interface aesthetics.

Empathy was crucial in this customer-centered approach. By deeply understanding the needs and lifestyles of UHNWIs, UXDA crafted a next-gen user experience that resonates with their luxurious expectations. The sophisticated design and intuitive interface empower users to manage their wealth independently, offering a comprehensive, real-time overview that aligns with their high standards.

Platforms like Excel frequently lack visual clarity and personalization, relying heavily on technical calculations and potentially impacting the standing of UHNWIs due to the absence of current news and user-intuitive design. Going beyond traditional data presentation, Private Wealth Systems provides clear and user-friendly overviews vital for multi-asset management. This focus on purpose-driven service ensures the platform enhances users' status and lifestyle, delivering a premium feel and exceptional service.

Founded by pioneers of the consolidated investment reporting industry, Private Wealth Systems balances innovation with industry best practices. The platform offers a total wealth dashboard with transaction-level transparency, enabling users to understand the drivers of risk and return across all investments. This clarity optimizes investment strategies, multi-asset allocation and financial planning, benefiting both young inheritors and seasoned hedge fund managers.

At the core of establishing new standards is the analysis of customer needs and the skill to interpret them to find the most suitable solution. Innovation-focused companies prioritize customers, aiming to deliver value by identifying opportunities and offering tailored solutions to meet their needs. Ultimately, Private Wealth Systems exemplifies how empathizing with UHNWIs and addressing their expectations and pain points through elegant UI and empathetic design can reinvent the digital experience for wealth management.

Private Wealth Systems goes beyond graphs and reports. Its purpose is to support the UHNWIs’ status and lives by offering a clear and user-friendly overview crucial for multi-asset management. Serving UHNWIs, the platform meets and exceeds the highest expectations with its premium feel and exceptional service. The platform brings calm to the lives of UHNWIs by providing space for multi-asset control and freeing up time for enjoying life.

Discover our clients' next-gen financial products & UX transformations in UXDA's latest showreel.

Get UXDA Research-Based White Paper "How to Win the Hearts of Digital Customers":

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedin