Financial and banking product owners face complex challenges and must stay ahead by implementing key design concepts. These principles enhance user experience, ensure products are efficient and engaging and align with business goals. By applying these design concepts, product owners can create user-friendly, intuitive, next-gen digital services that empathize with users, organize content logically and design accessible, visually appealing interactions. This approach leads to higher user satisfaction, better usability and increased adoption rates, ultimately improving user retention, reducing support costs and providing a stronger competitive edge in the financial market.

Digital product ownership is probably the most challenging job in finance nowadays as financial products directly influence the company's revenue and reputation. Given the financial sector's reliance on customer trust, it is essential for business success to ensure products meet customer needs, comply with regulations and remain competitive. Any mishandling of products can lead to loss of confidence, legal issues and damage to the brand.

Digital financial products must adhere to strict regulations to protect consumer rights and prevent fraud. Their development and maintenance are challenging due to complex algorithms, large datasets and system integrations. Non-compliance can result in severe penalties and legal action.

Keeping up with fast-paced technological advancements requires continuous learning and adaptation, which can be resource-intensive for the product team. Balancing the conflicting demands of stakeholders, such as executives, developers and customers, requires exceptional communication and negotiation skills. And modern design concepts could be very helpful here.

Key Challenges of Financial Product Owners

Facing challenges as a financial product owner is both important and difficult due to the complexity and sensitivity of the financial sector:

1. Balancing Stakeholder Expectations

Product owners in the financial sector often have to juggle the expectations of various stakeholders, including executives, developers, designers and, most importantly, customers. Balancing these diverse needs while aligning products with the overall business strategy and quality requirements can be challenging. Effective communication and transparency are essential for managing these diverse needs and ensuring a product's success.

2. Prioritizing Features

Deciding which features to prioritize for development is a significant challenge. Product owners must consider the business value, technical feasibility and user needs. Methods like the MoSCoW prioritization (must-have, should-have, could-have, won't-have) and Impact vs. Effort matrix are often employed to make informed decisions.

3. Staying Updated with Industry Trends

The financial industry is rapidly evolving, with new technologies and regulations emerging regularly. Product owners must stay informed about these changes to keep their products competitive and compliant, while continuously learning through reading industry publications, attending conferences and engaging in professional networks.

4. Ensuring Usability and User Experience

Creating a user-friendly and intuitive product is paramount. Product owners must ensure that digital interfaces are easy to navigate and meet user needs by conducting extensive user research, testing and iterating on designs based on feedback.

5. Technical Challenges

Working closely with development teams to address technical constraints and ensure the feasibility of proposed features is another common challenge. Product owners must have a good understanding of the technical aspects of their products to make informed decisions and facilitate effective communication between technical and non-technical stakeholders.

6. Regulatory Compliance

Financial products must comply with stringent regulatory requirements. Keeping up with these regulations and ensuring that the product adheres to them without compromising user experience or business goals is a complex task for product owners.

7. Managing the Product Backlog

Effectively managing and updating the product backlog is crucial for reflecting changing priorities and feedback, requiring the product owner to organize tasks, set priorities and ensure the development team focuses on delivering the most valuable features.

8. Customer Satisfaction

Ultimately, the goal is to ensure high customer satisfaction by continuously gathering and acting on customer feedback to improve the product. Product owners must be adept at understanding user pain points and addressing them through the creation and deployment of product enhancements.

9. Data Security and Privacy

Financial product owners must ensure that products comply with data security and privacy regulations, such as GDPR and PCI-DSS. Maintaining customer trust relies on effectively safeguarding data amidst the constantly evolving nature of cyber threats. This involves protecting sensitive information through robust encryption, regular security audits and up-to-date security practices.

10. Integration with Legacy Systems

Many financial institutions depend on outdated legacy systems that are critical to their operations. Integrating new products with these systems can be complex due to differences in technology, data formats and processing capabilities. Ensuring seamless integration while minimizing disruptions to existing services requires careful planning, significant technical expertise and often creative problem-solving.

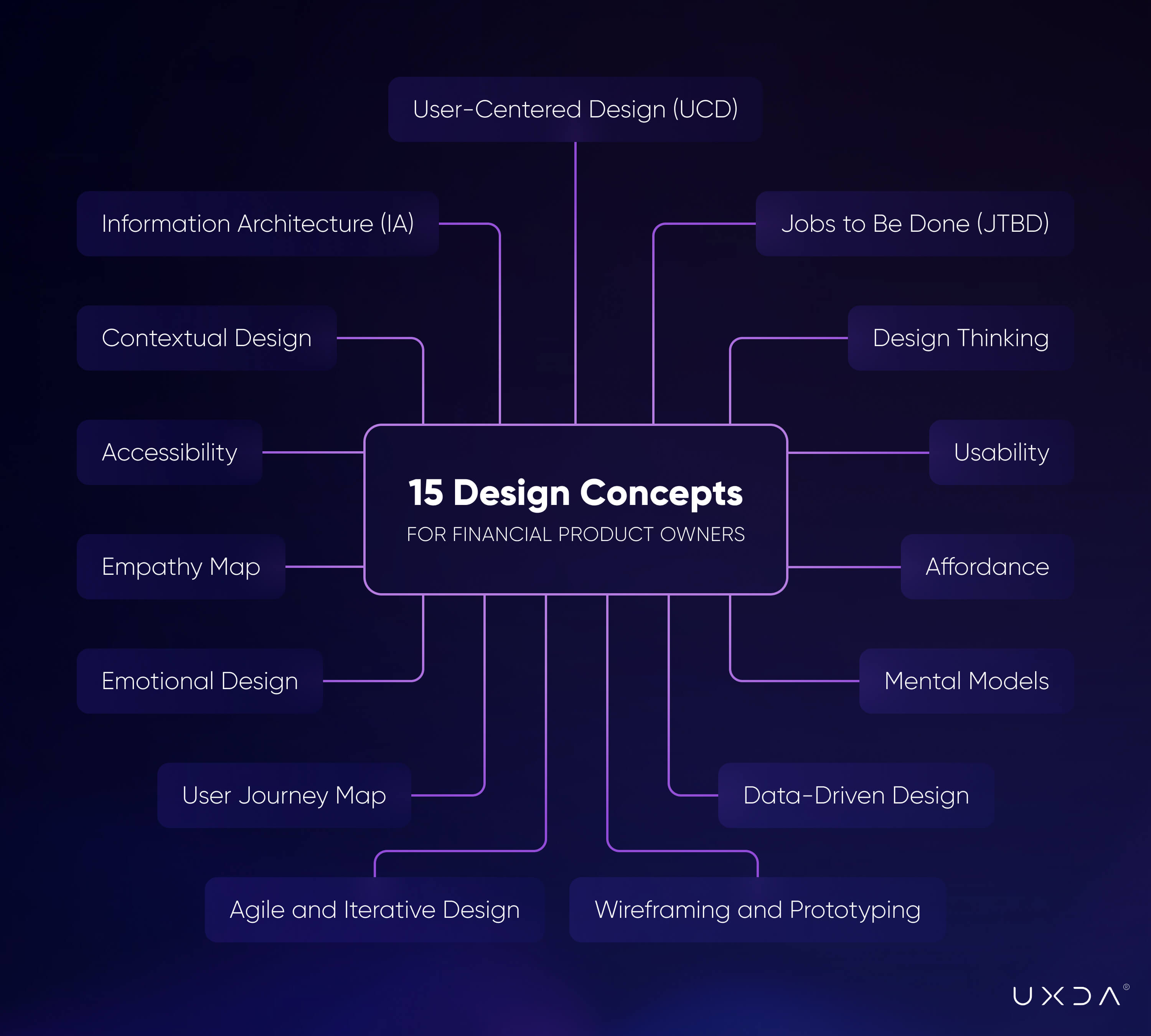

15 Design Concepts That Empower Fintech and Banking Product Owners

To overcome these and many more challenges, financial product owners must stay ahead of the curve by understanding and implementing design concepts and ensuring the creation of user-friendly, intuitive and engaging digital services.

By applying these principles, product owners can empathize with users, organize content logically and design interactions that are both accessible and visually appealing. This approach leads to higher user satisfaction, better usability and increased adoption rates, which ultimately result in improved user retention, reduced support costs and a stronger competitive edge in the financial market.

These principles not only enhance user experience but also ensure that products are efficient, engaging and aligned with business goals. Here are 15 essential design concepts every financial product owner should know and put into practice:

These principles not only enhance user experience but also ensure that products are efficient, engaging and aligned with business goals. Here are 15 essential design concepts every financial product owner should know and put into practice:

1. Design Thinking

Design thinking, introduced by Herbert A. Simon in 1969, is a human-centered, iterative approach to innovation that focuses on understanding how users think, feel and behave. This concept helps financial product owners empathize with users and develop innovative solutions that address real needs.

2. Jobs to Be Done (JTBD)

The JTBD framework, developed by Anthony Ulwick in the 1990s, focuses on the tasks users aim to accomplish rather than the features. The concept enables financial product owners to create solutions that fulfill user motivations and needs, thereby enhancing product relevance.

3. Mental Models

Introduced by Kenneth Craik in 1943, Mental models represent users' perceptions and interactions with a digital system. The concept helps financial product owners design intuitive interfaces that align with user expectations, ensuring a smoother digital experience.

4. User-Centered Design (UCD)

UCD, introduced in the 1980s by the legendary Donald Norman, prioritizes user needs through extensive research and testing. The concept ensures financial products are tailored to user requirements, improving satisfaction and usability.

5. Information Architecture (IA)

IA, first defined in the 1970s by architect Richard Saul Wurman, organizes and structures content for easy navigation. The concept ensures that the product is well-organized and meets user requirements, thereby enhancing user satisfaction and experience.

6. Usability

Usability, which gained prominence in the 1990s through Jakob Nielsen's work, measures a product's ease of use and efficiency. The concept ensures that financial products are user-friendly, reducing learning curves and enhancing adoption rates.

7. Empathy Map

The Empathy map, developed by Dave Gray, co-founder of XPLANE, visualizes what users say, think, feel and do. The concept enhances understanding of user experiences, leading to more empathetic and user-centered financial products.

8. Wireframing and Prototyping

Wireframing, a standard practice since the 1980s, involves creating preliminary versions of a product for testing. Initially used by video game designers, this concept now helps digital financial product owners test ideas and identify issues early, thereby saving time and resources.

9. Accessibility

Accessibility standards like WCAG, developed in the late 1990s by the World Wide Web Consortium (W3C), ensure products are usable by people with various abilities. This concept broadens the user base of financial products by enhancing accessibility and inclusivity.

10. User Journey Map (UJM)

The User journey map, invented by Chip Bell and Ron Zemke in the 1980s, is a visual representation of the user’s experience with a product. The concept helps financial product owners identify pain points and opportunities for improving the user experience.

11. Emotional Design

Emotional design, coined by Don Norman in 2004, focuses on creating products that evoke positive emotions. The concept increases engagement and satisfaction by making financial products emotionally resonant with users.

12. Data-Driven Design

Data-Driven Design leverages analytics and user feedback to inform design decisions. This critical concept helps understand what works best for users and continuously improves the product based on data insights by using user research tools.

13. Agile and Iterative Design

Agile methodologies, defined in the early 2000s by Ken Schwaber and Jeff Sutherland, enable rapid iteration and continuous improvement through regular testing, feedback loops and flexibility. This concept helps keep the product aligned with user needs and market changes.

14. Contextual Design

Contextual design, developed by Hugh Beyer and Karen Holtzblatt, examines how users interact with a product within their specific environment and workflows. The concept emphasizes capturing users' environments and activities to create designs that seamlessly integrate into their daily routines.

15. Affordance

Affordance, popularized by psychologist James J. Gibson in the 1970s, emphasizes designing products and interfaces to suggest their use intuitively. This concept helps build digital products that clearly indicate how they should be interacted with.

How Design Concepts Address Product Challenges

The design concepts mentioned above can significantly help banking product owners overcome their primary challenges. Here are a few examples of how each concept can be applied:

1. Balancing Stakeholder Expectations

- Design Thinking: This iterative approach involves stakeholders at each stage, fostering collaboration and ensuring that everyone’s needs are considered. It promotes transparency and consensus-building by validating ideas through prototypes and user feedback.

- User-Centered Design (UCD): By prioritizing the end-user, UCD ensures that user needs are the focal point, which can help align various stakeholder expectations with user satisfaction.

2. Prioritizing Features

- Jobs to Be Done (JTBD): Helps in identifying the most critical tasks users want to accomplish, ensuring that feature prioritization aligns with actual user needs rather than assumptions.

- Mental Models: Understanding how users think and interact with the system helps in prioritizing features that will be most intuitive and beneficial for them.

- Contextual Design: Designing with a focus on the actual product use environment helps evaluate solutions to ensure they are not only functional but also intuitive and aligned with user expectations.

3. Staying Updated with Industry Trends

- Design Thinking: Encourages continuous learning and adaptation while helping product owners stay abreast of industry trends and incorporating new insights into product development.

- Data-Driven Design: Using analytics and user feedback to make informed decisions ensures the product evolves with industry trends and user needs.

4. Ensuring Usability and User Experience

- Information Architecture (IA): Organizes content in a way that makes it easy for users to navigate and find information, enhancing overall usability.

- Usability: Emphasizing simplicity, efficiency, and satisfaction, it ensures that users can complete tasks with minimal effort and frustration.

- Affordance: Ensuring that design elements visibly indicate their function helps reduce the learning curve, enhance usability and minimize errors.

5. Technical Challenges

- Wireframing and Prototyping: These practices allow early testing of technical feasibility and usability, identifying potential issues before full-scale development.

- Agile and Iterative Design: This approach promotes regular testing and feedback loops, enabling quick adjustments to technical challenges as they arise.

6. Regulatory Compliance

- Accessibility: Ensuring products are accessible to all users helps meet certain regulatory requirements, such as those related to disability access.

- Design Thinking: Iterative testing and user feedback help ensure that products not only meet user needs but also comply with regulatory standards from the outset.

7. Managing the Product Backlog

- Information Architecture (IA): Helps in logically organizing and prioritizing backlog items, ensuring that the most valuable features are developed first.

- User Journey Map (UJM): Helps to align development priorities with actual users' needs.

8. Customer Satisfaction

- Empathy Map: Provides a deeper understanding of user emotions and behaviors, helping to design features that resonate with users and address their pain points.

- Emotional Design: Creating products that evoke positive emotions can lead to higher user satisfaction and loyalty, enhancing customer retention and satisfaction rates.

Conclusion

In an industry in which innovation and trust are paramount, financial product owners stand at the intersection of technology, user experience and business strategy. The 15 design concepts discussed here are more than just theoretical frameworks—they are essential tools for navigating the multifaceted challenges of modern finance. By mastering these principles, product owners can transform the user experience, ensuring their digital services are not only efficient and compliant but also deeply empathetic to user needs.

The future of financial products depends on a delicate balance: meeting stringent regulatory demands while pushing the boundaries of what technology can offer. As Artificial Intelligence, machine learning and blockchain continue to evolve, seamless integration of these innovations into existing infrastructures will distinguish the leaders of tomorrow. Design thinking, user-centered approaches and agile methodologies empower product owners to not only meet today's expectations but to also anticipate the demands of the future.

Ultimately, the strength of financial products lies in their ability to build and maintain trust. By prioritizing security, privacy and user satisfaction, financial product owners can create solutions that resonate emotionally with users and build lasting relationships. This approach not only strengthens a company's competitive edge but also ensures sustainable growth in an ever-changing market.

In embracing these design concepts, financial product owners are not just designing products—they are crafting the future of finance, shaping an industry that is resilient, innovative and, above all, human-centered. The journey is complex, but with the right design principles at their disposal, product owners can lead the charge in creating a more inclusive and trustworthy financial landscape.

Get UXDA Research-Based White Paper "How to Win the Hearts of Digital Customers":

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedin