In a dazzling showcase of innovation and design excellence, UXDA has clinched yet another Red Dot Award in the "Interface & User Experience Design" category for its transformative work on Liv X—the UAE’s first lifestyle-driven digital banking app, powered by Emirates NBD. This latest accolade cements UXDA’s reputation as a trailblazer in financial UX, setting new benchmarks for how banking apps can enrich and empower modern lifestyles.

UXDA’s aim was to take the Liv X journey from fragmented to seamless by reimagining banking for Gen Now. Faced with users juggling multiple apps to track expenses, explore offers and manage goals, UXDA’s strategic UX overhaul fused banking and lifestyle into one intuitive ecosystem.

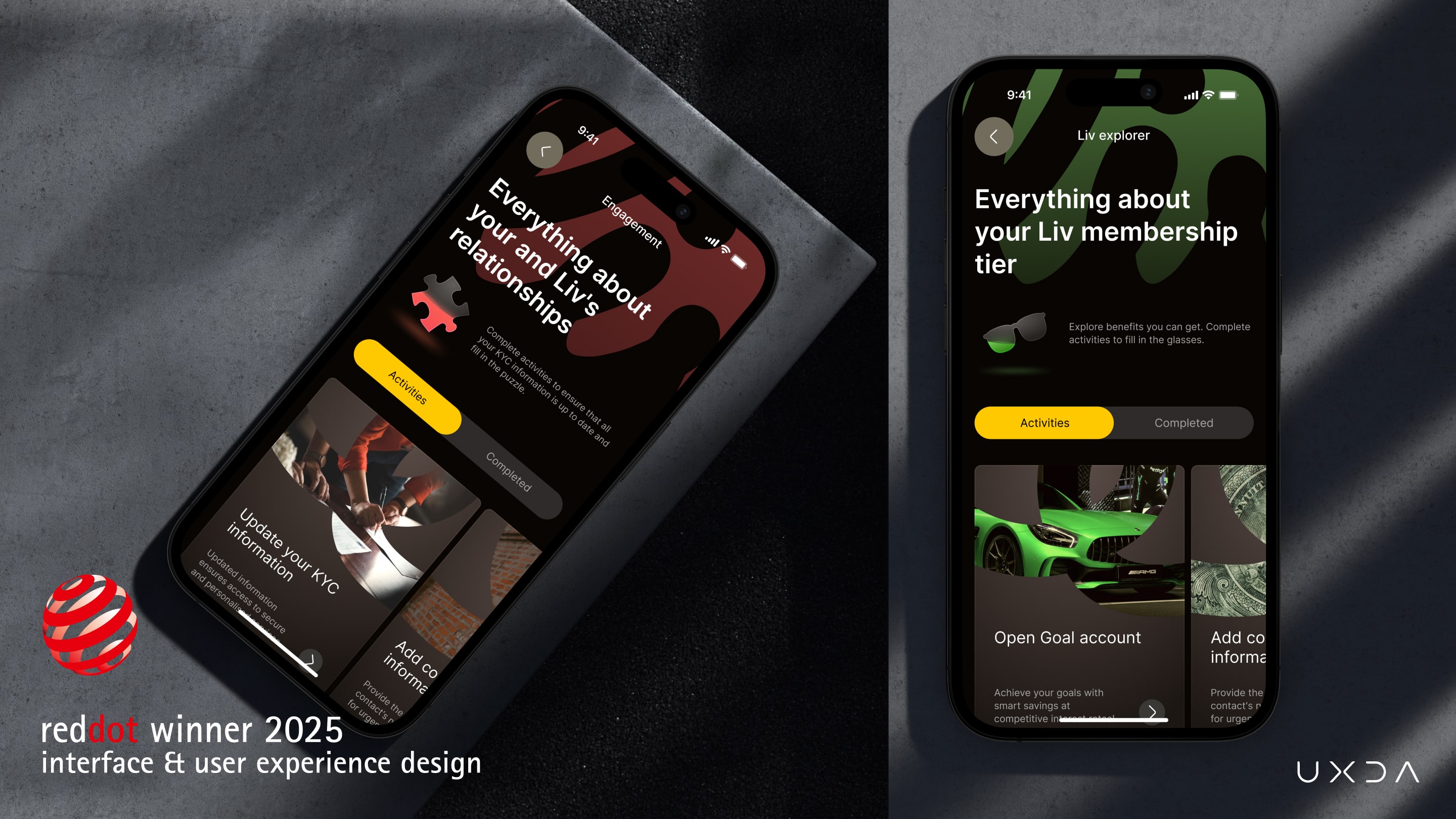

To deliver a visually striking and emotionally engaging journey that differentiates itself from all other banking brands, the app was inspired by high fashion, modern art and luxury design. With tailored themes and an emphasis on aesthetics, Liv X elevates digital banking into a bold expression of individuality and modern sophistication.

“With Liv X, we didn’t just design an app; we engineered a holistic digital experience that resonates with the UAE’s dynamic spirit,” said Alex Kreger, CEO and Founder of UXDA. “Winning the Red Dot Award again is a testament to our team’s relentless pursuit of perfection and our commitment to reshaping financial services for the future.”

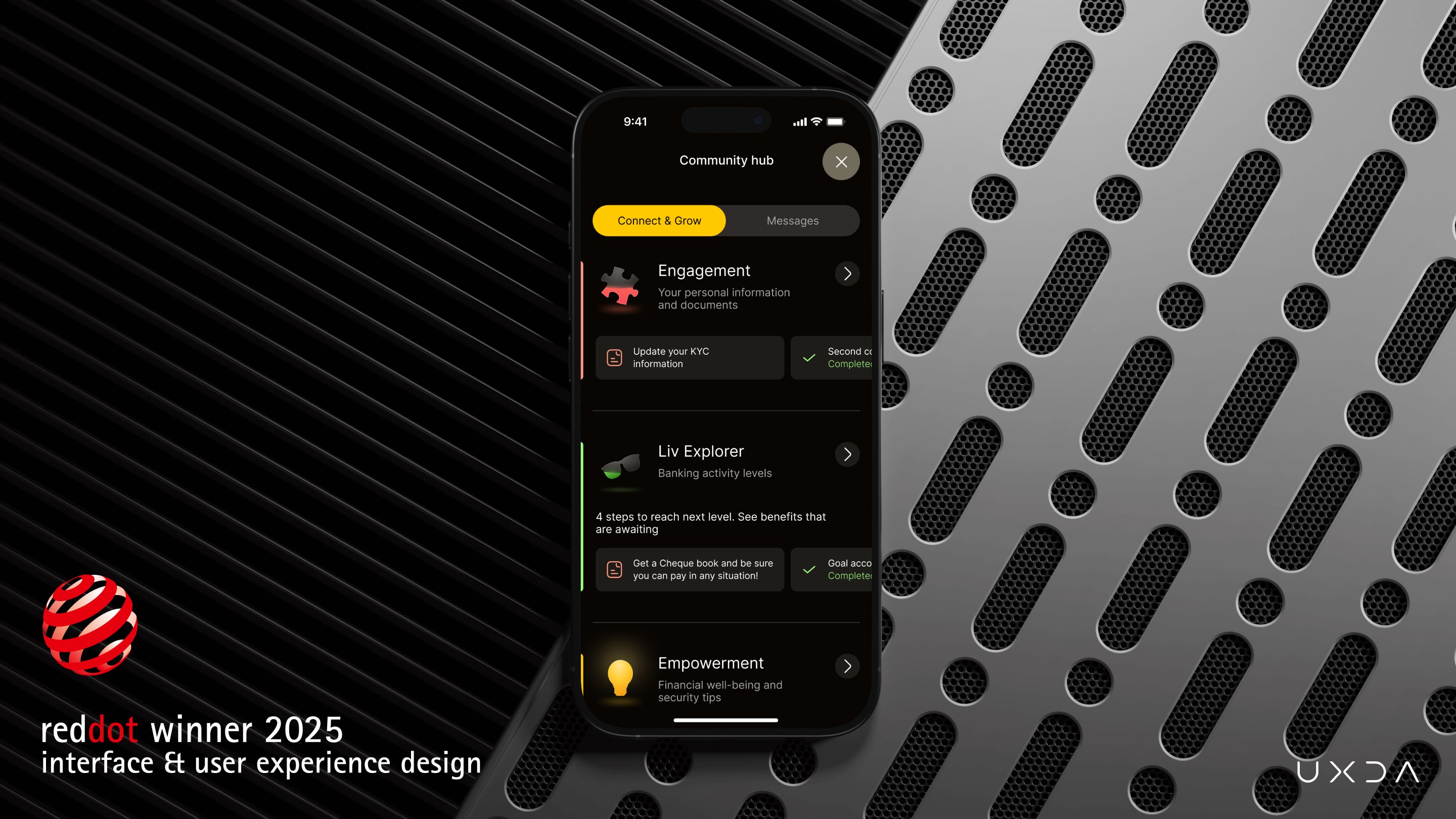

At the heart of Liv X lies the bold “Liv Ahead” proposition—an ethos of forward-thinking design and user empowerment. UXDA infused UAE’s futuristic lifestyle with AI-driven banking insights, gamification and deep personalization. Users can effortlessly split bills, set savings streaks and unlock tailored lifestyle perks, all within a slick, cohesive interface. The innovative Community Hub fosters meaningful engagement, turning routine banking tasks into vibrant social experiences.

“Financial services are evolving beyond transactions; they’re about forging emotional connections,” reflected Linda Zaikovska-Daukste, COO and Co‑Founder of UXDA. “Liv X embodies this shift by putting the user at the center—anticipating needs, celebrating milestones and nurturing a sense of belonging through a fashion-inspired app experience. As banks compete on more than just rates, design becomes the ultimate differentiator.”

The Red Dot jury praised Liv X for its exceptional clarity, brand authenticity and visual impact, recognizing UXDA’s ability to translate complex banking features and ambitious brand identity into an accessible, delightful journey. Beyond creating a beautiful interface, UXDA’s strategic UX design approach helps shape the entire digital ecosystem—ensuring every touchpoint reflects a cohesive visual philosophy, emotional depth and user-centric innovation that sets the foundation for long-term product growth.

Since its inception in 1955, the Red Dot Award has stood as the gold standard of design excellence, attracting submissions from industry giants and emerging talents alike. Earning a Red Dot is a public commitment that the brand treats product design and user experience as mission‑critical—investing money, talent and time to innovate and push beyond just “good enough.” That's why the world's largest brands, such as Apple, Bang & Olufsen, Sony, Dyson, Bose, LG, Samsung, Philips, Lenovo and many others place the Red Dot seal in their advertising and on the packaging of their products after winning as a mark of excellence.

Previous winners also include premium designs by Lamborghini, Ferrari, Mercedes-Benz, BMW, Porsche, Maserati, Bulgari and thousands of others. For banks and Fintechs, this seal of approval signals to investors, partners and end‑ users that their products are not merely functional but are paragons of innovation and user advocacy.

This victory holds profound implications for the financial services industry. As consumers—especially affluent, tech-savvy demographics in MENAT—demand seamless, personalized, future-driven experiences, banks must transcend a legacy approach to stay relevant. Liv X’s Red Dot Award demonstrates that innovative UX is not merely an aesthetic choice but a strategic imperative, driving user loyalty, brand differentiation and market leadership.

With over half a million loyal customers already onboard, Emirates NBD’s Liv Digital Bank, powered by UXDA’s award‑winning design, is poised to redefine the standards of digital finance. As the sector grapples with digital disruption, UXDA’s Liv X serves as a blueprint for banks worldwide: fuse lifestyle and finance, harness intelligent personalization and craft experiences that captivate both hearts and minds.

Developing a visual identity that truly resonates with users’ lifestyles is one thing—but the real challenge lies in scaling it and weaving it seamlessly throughout your entire digital ecosystem and brand communications. Achieving a unified brand image and a consistent, frictionless customer journey across every touchpoint is no small feat. Yet that’s exactly what UXDA accomplished with Liv Digital Bank—integrating an authentic digital brand visual language, expanding the ecosystem with an immersive spatial banking experience for Gen Now users and creating the Liv Lite app tailored specifically for children.

Established a decade ago with a deep focus on digital financial services design, the UXDA agency designed over 150 complex products for leading banks and Fintechs in 39 countries around the world. What sets UXDA apart is its human-centric design philosophy powered by scientific insights. Every iteration begins with immersive user research—conducting stakeholder interviews, real-world observations, mapping emotional journeys and analyzing behavior patterns.

UXDA Dopamine Banking approach blends service design, top UI trends and behavioral psychology to craft interactions that emotionally connect financial brands with users. As pioneers of harnessing AI in the design of next-gen financial services, UXDA tailors experiences that anticipate user needs before they even surface. This end‑to‑end approach—from strategic vision to pixel‑perfect prototypes—ensures each solution is not just visually striking but deeply resonant with target audiences.

Discover our clients' next-gen financial products & UX transformations in UXDA's latest showreel:

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedin