In the digital age, where there's an app for everything and almost everyone is able to build one, banks are losing their power over customers. FinTechs are smashing the banks' monopoly by substituting the financial headache with a pleasant customer experience in banking. Discover 5 powerful strategies on how to improve the banking customer experience.

According to Fenergo estimates “poor customer experience” is costing financial institutions $10 billion in revenue per year. According to Fenergo research 36% of financial institutions have lost customers due to inefficient or slow onboarding, and 81% believe poor data management lengthens onboarding and negatively affects customer experience.

How do you encourage users to not only rank your app with 5 stars in the Apple Store and Google Play but also gain their loyalty and trust? It's no secret that the digital customer experience today is what differentiates demanded financial brands. The main struggle is keeping up by creating a digital banking customer experience that WOWs.

Download Improving the customer experience in banking - PDF.

The digital revolution has changed the rules of the game we all play. If you don't adapt, you will probably lose. What was efficient to reach demand a few decades ago has now become a waste of time and money. This is especially true if we are facing any kind of crisis, like with the COVID-19 pandemic we have all been battling.

Over a period of 10 years, the UXDA team has tested and put into practice more than 100 UX design methods and techniques while designing 100+ financial products from 36 countries. Based on the results and insights gained, I’ve extracted five crucial factors that can help any financial company, bank or FinTech improve and deliver an exceptional banking customer experience.

Poor banking customer experience can lead to problems for the customer and the financial company. For the customer, poor customer experience can lead to frustration, confusion, and dissatisfaction, which can ultimately result in them switching to a different financial brand. This can lead to a loss of business and revenue for the company. Additionally, poor customer experience can also lead to negative word-of-mouth and online reviews, which can damage the financial brand's reputation and make it harder to attract new customers.

What Is Banking Customer Experience

Banking customer experience refers to customer interactions with their bank, typically including online and mobile banking services, visiting a physical branch, or speaking with customer service representatives. The digital banking customer experience (digital banking CX) consists of all the emotions, thoughts and behavior of a customer triggered in using a digital banking service. A banking customer experience is generated by all digital products and brand ecosystems, including previous customer engagements and future expectations.

The goal of improving customer experience in banking is to make banking services as convenient, efficient, and pleasant as possible for the customer. This can be achieved through various means, such as offering an appropriate range of services and features, providing clear and helpful information and assistance, and ensuring that the customer's interactions with the bank are smooth and hassle-free. Make sure that banking customer experience aligns with brand identity and business strategy. At the same time, remember that in the digital age, brand reputation is no longer a guarantee of loyalty and can be instantly damaged by a problem with a mobile application caused by poor CX / UX design since the customer experience is a highly dynamic process.

5 Tips on How to Improve Customer Experience in Banking

For a focused digital banking customer experience design, it is necessary to make the digital product fully customer-centered, ensuring that the user needs are met at each touchpoint, thus building a deep emotional connection with the brand. So, that's why I would like to describe 5 ways in which you can improve digital CX in financial services:

1. Establish Experience Mindset

In many countries throughout the previous century, large banks were basically monopolists because they had a very strong and stable market share. Strong barriers of the financial services market entry, loyal customers and the absence of worthwhile alternatives ensured they would retain their strong positions for decades.

However, the development of digital technology is disrupting all the industries. What has been proven to work for decades, like traditional marketing and products, has stopped working. The world is making new demands on businesses, and banking is no exception.

Today, customers have dozens of new alternatives every year due to low entry barriers and open banking. That's why, in order to survive in the digital age, financial brands are required to adopt an absolutely new way of thinking and operating a business.

Social networks, information transparency and demand for sustainability challenge businesses to put the people first by becoming customer-centered and deliver experiences instead of manipulating customers to reap profits.

That's why the future of the banking industry depends entirely on how the new generation of bankers can bring their mindset in line with the digital age to provide the best possible banking customer experience.

There are five key attitudes that can be integrated into a company's DNA with the aim to make the team mindset purpose-driven and shift the business culture toward success in the digital age.

Serve Instead of Sell

The “sell” priority is all about focusing on marketing and looking at people as numbers behind conversion. Design, in this case, is only about using attractive packaging to sell more, and UX is just one more tool to manipulate user behavior.

To focus the business team on customer needs, feelings and behaviors, we need to prioritize "Serve." In this case, conversion became just a metric to evaluate product clarity, because the main aim is to provide real benefit for the customer. And, a lot of customers will appreciate it, using the digital space to express their gratitude and attract more users.

Emotions Over Information

People often forget information but remember experiences, and those are created from emotions. That's why information should be integrated into a context of usage. It should become an organic part of the banking user experience that is based on emotions, because emotions are the main language to communicate with the customers and understand their needs and expectations.

Solution Instead of Features

Don't make your users have to think about how to use hundreds of offered features. Instead, provide them with an easy to use solution. According to psychology experiments, too many options can cause decision paralysis. Users don't come to you for the hundreds of options you can offer. They have a specific problem and goal in mind that your financial product has to help to achieve.

Disruption Over Protection

Traditional banks and other well-established businesses are focused on protecting their legacy and maintaining the corporate image. That's why change comes slowly and painfully.

Instead of thinking about how to protect their products from the digital challenge and prevent customers from leaving, banks have to figure out how to stop self-deception and disrupt themselves and their competitors. In the experience age, self-disruption is the only way to provide meaningful and pleasant products for users.

Create Flow, Avoid Fragmentation

It is a common mistake to view services and products as separate parts. But, the human brain perceives experiences holistically - as a whole entity. Customers see the product as a continuous experience flow, even lasting for years.

Transition to the same thinking is the only way for businesses to ensure a delightful user journey. We need to detect links among user needs, emotions, behavior and service features, design and strategy.

Separation of service elements by different departments caused by organizational silos fills the customer experience with friction. We need to defragment business and ensure a frictionless flow that makes service pleasant.

Read more about the experience mindset

2. Focus on the Unique Product Value Proposition

Finance companies that actively implement the work principles of the purpose-driven mindset aim to bring maximum value to the user. In exchange, the customer gladly rewards the company with loyalty and supports its development by recommending their services.

The central question in the creation of any financial product is WHY it is needed. What exactly makes the product valuable and unique to the users? What problems will it solve, and what benefits will it provide? By not treating all of these questions with dignity, the financial company is risking its product quickly sinking into the “red ocean” of competition.

There are concrete product growth stages that depend on the level of competition and the demand from the customers. Understanding these stages helps to define and create the perfect match between the financial product's value proposition and the market demand, leading to success.

The competition is what requires finance entrepreneurs to step out of the box and identify customers’ expectations. The bigger the competition, the greater the need for market advantage to conquer the competitors.

If financial product functionality is not enough to compete, provide usability. If all the competitors have the same functionality and usability, add aesthetics. If you need even more of an advantage, connect the product with the customer’s lifestyle by personalizing it and making it a symbol of their status. And, finally, you can go even further and state the mission to deliver the ultimate value that will change the world and gain followers who look up to you.

Targeting the unique Product Value proposition through Mission, Status, Aesthetics and Usability help to maximize the needs of users through customer-centered product design.

Modern banks have already provided their customers with basic service functionality. Innovations in the digital banking industry have moved from the Functionality stage to the Usability and Aesthetics stages to create an emotional bond with customers.

Despite that, there are still many traditional banks that struggle with Usability. Meanwhile, progressive FinTechs are quickly climbing up the ladder, reaching the Status stage by personalizing and providing digital financial services that are enjoyable, attractive and serve the needs of specific audiences.

Read more about creating the Value

3. Integrate the Design Approach Across All Levels

By focusing on the usability, aesthetics and status of the product, you can engage digital users, but this is not enough. To ensure a long-term market need for your product, it is necessary to integrate customer-centricity into all levels and processes of the company, putting the user at the forefront.

In many cases, incorrect design integration in the process of product creation leads to harmful consequences. It's like in construction: a skyscraper can't stand without a well-thought-out and grounded architectural plan. The financial product with amateur UX will lack demand in the market, could be rejected by the users, often exceeds the development budget or doesn't even get launched at all.

There are five mutually connected areas in which the design approach can be integrated to ensure the best possible customer experience in the long term.

In general, these five areas match the main elements of business development. When you have a solid business idea, you need to create a business model by defining the key Processes that will help you reach your desired goal. Here you can make a design approach empowering fuel in all of your financial business processes.

In the next step, you need a Team of specialists who are qualified to execute your idea. At this point, make sure to add financial UX design expertise from people who have mastered digital products in finance.

When you have found professionals who match your challenge, you need them to take the right Actions that move you closer to product realization. Accelerate design impact by defining results-driven actions.

To be sure you are moving in the right direction, you have to evaluate the Results your team is producing. You should measure the quality of design by the way it serves your customers.

In the end, if all of the previous steps have been accomplished successfully, you can grasp the unique Value your financial product will provide to the customers, turning the digital product into a success story.

Read more about realizing the power of Design

4. Use the Proper Banking CX Methodology

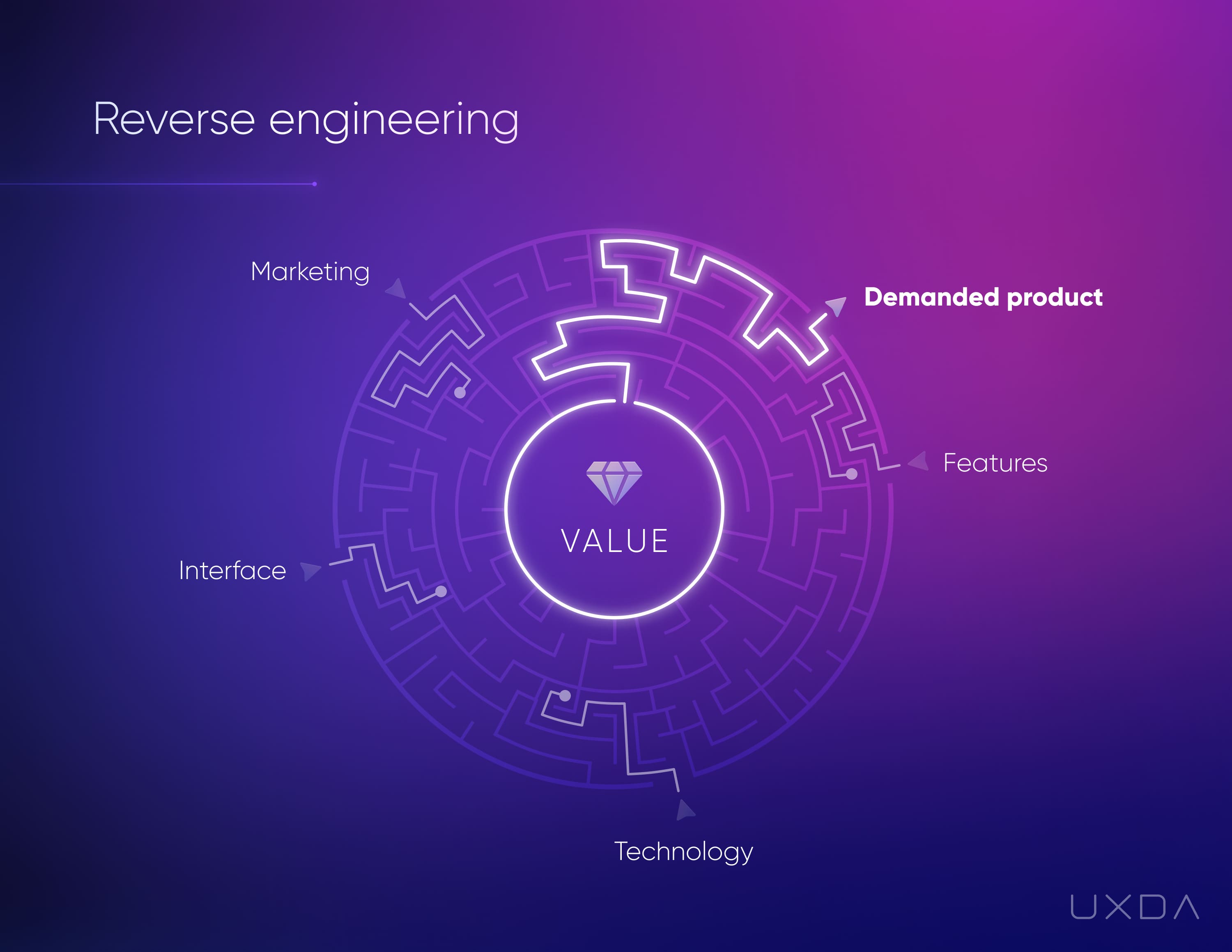

As a typical business delivery starts with Process and ends with Value to customer, then the easiest way to design the best possible digital experience is to do it in reverse. We should start with defining the ultimate Value for the customer and only then move on to an action plan.

We can compare reverse engineering to a maze that has multiple entrances and only one exit. The entrances are different types of product configuration, functionality, and features, and the exit is the high demand and success in the market.

Usually, entrepreneurs try to guess which configuration they should develop to gain success. They look around to identify what products are trending, code a lot of features to impress customers and finally pack all this into a vibrant design to grab attention. Then they spend tons of money on advertising to convince consumers that they need this.

In reverse engineering, you significantly reduce uncertainty by starting from the maze exit and moving to the correct entry point. In this case, the exit of the maze is the point at which the product is highly demanded because of the value it provides to customers. By using the CX / UX design approach, we are exploring the value that's significant to customers and putting the focus of the product and the entire business on the needs of customers.

Though CX and UX design is trending today, only a few financial product experts are capable of successfully translating it into architecture and the user interface of a particular product because it requires knowledge in human psychology, behavior and design arts. Perhaps this explains why most of the financial solutions around us still look outdated and amateur, despite the multiple designers involved in the product development teams.

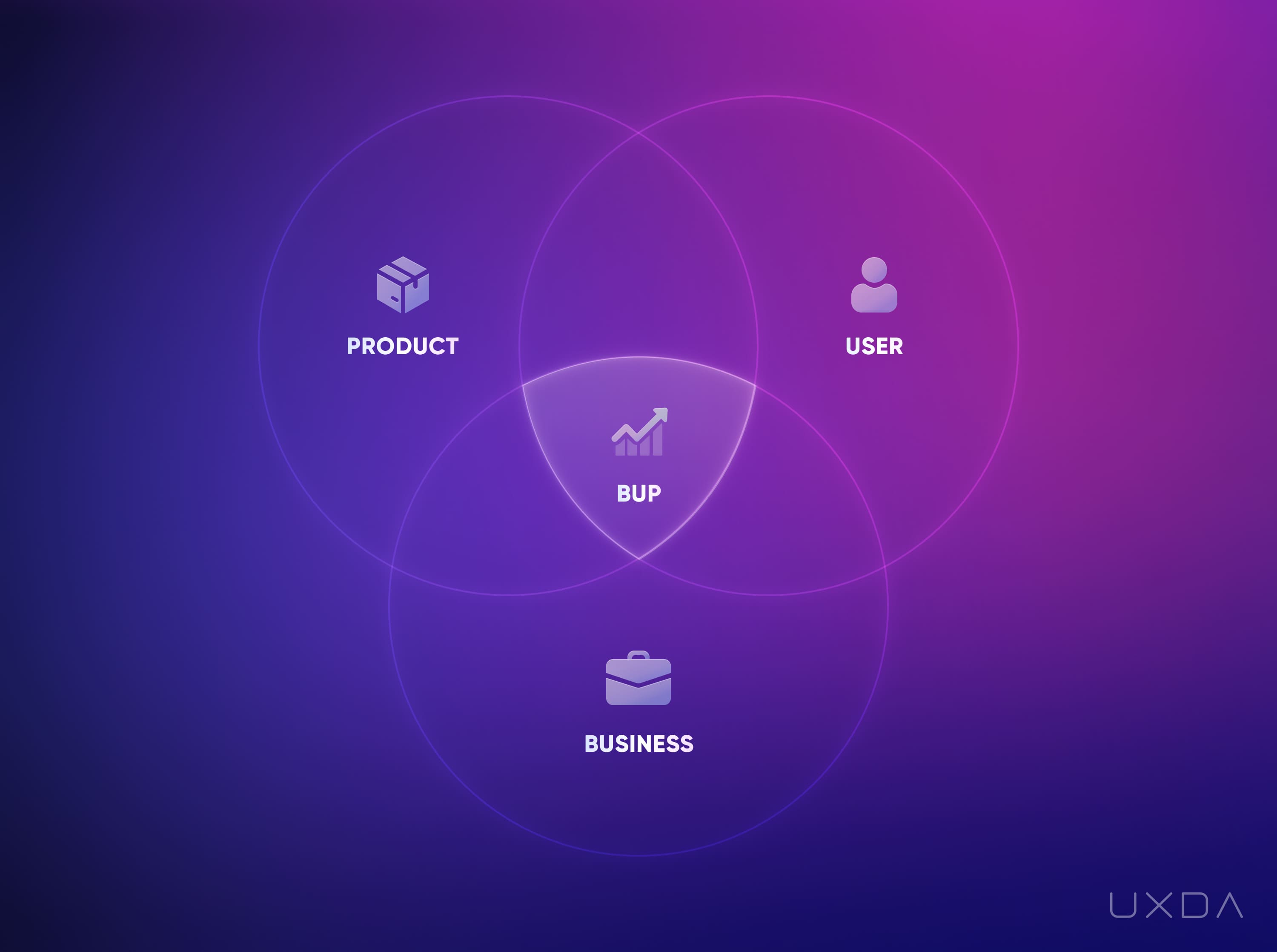

Designing a customer-centered financial product that's based on the value for users consists of three key elements: Design thinking, Business/User/Product frame and UX design tools.

Design thinking is the basis of Financial UX Methodology. It provides a methodical, iterative approach to explore and serve the key user needs through its five stages - Empathize, Define, Ideate, Prototype and Test.

Read more about Design thinking in banking

To ensure overall success, we have to implement all five parts of the Design thinking process through a Business, User and Product perspective. This way, we find, define and materialize the maximum value and gains for each of them.

Finally, UX design tools provide the best way to execute the whole process of Design thinking and the BUP approach, ensuring effective results-based financial product transformation.

Read more about Financial UX Methodology

5. Explore the Problem-Solution Cycle of Your Customers

At this point, you might feel like you have enough powerful knowledge to go straight to addressing your customer problems with your financial solution. This is a common mistake many finance entrepreneurs make.

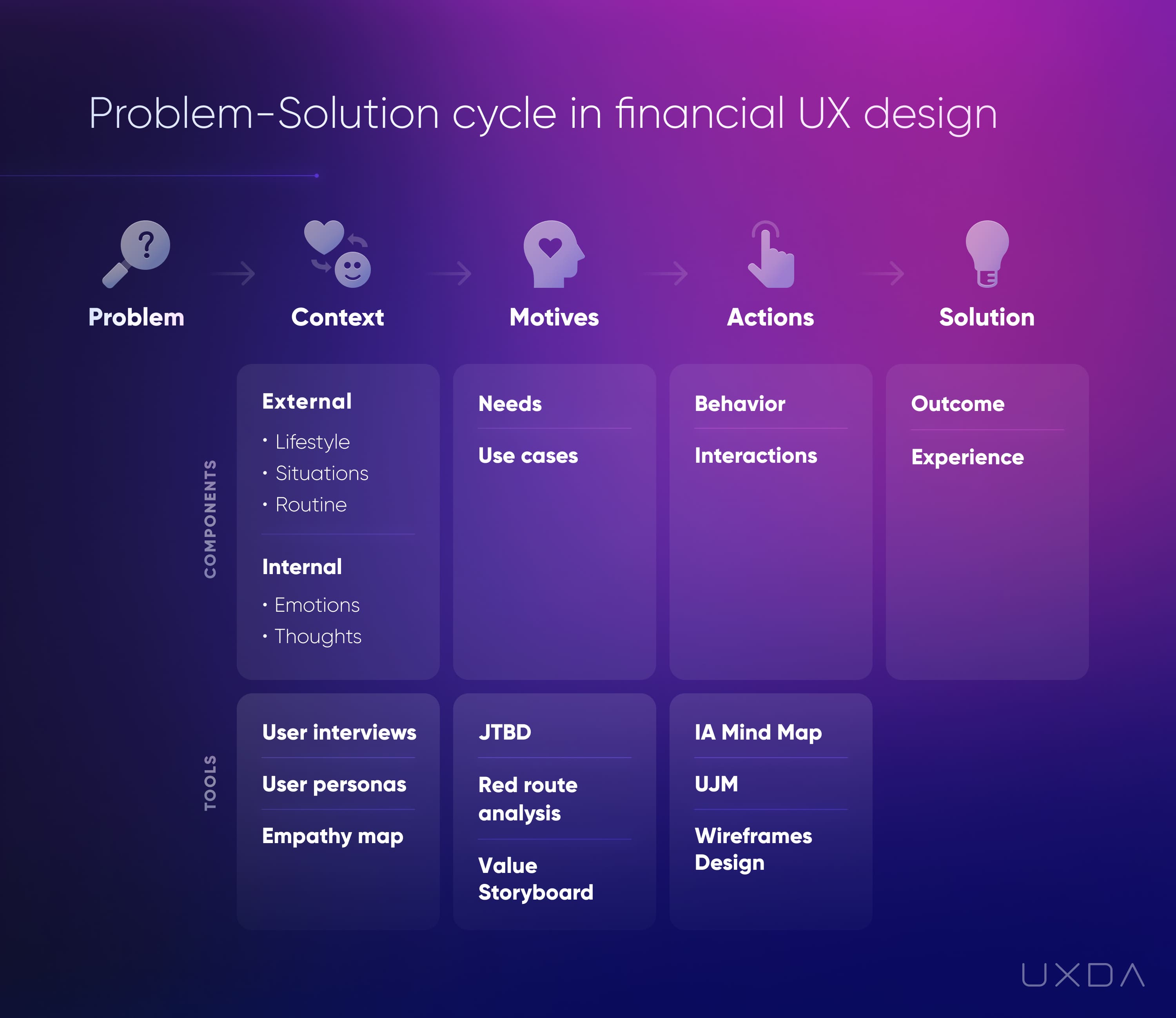

Yes, it all starts with a good solution to an important problem. But, between the problem and the solution, there are three crucial conditions that differentiate whether or not a product will match real users’ needs.

To create a demanded digital financial product that will be loved by the customers, we start with the problem.

To clearly define the problem and the tasks, we explore the problem-solution cycle's impact on the banking customer experience by creating user personas and defining their jobs to be done.

Throughout this process, we crystallize the context in which the problem takes place, the motives of the users that dictate the actions and the people it will take to apply the right solution.

During this process, Financial UX Design Methodology and such UX tools as an Empathy map, Red Route Map, UJM, user flows, wireframes, UI design and testing are used.

Read more about the Problem-Solution Cycle

Experience More Than Just a Digital Transformation

You can perceive this article as a cheat sheet for finance companies to create a customer experience that can conquer the market amid the growing competition.

- Establish a customer experience mindset

- Focus on the unique product value proposition

- Integrate the CX design approach across all levels

- Use the proper customer experience methodology

- Explore the problem-solution cycle of your customers

However, all your efforts will be meaningless if you are doing this only for the sake of digitalization instead of creating a valuable emotional connection with your customers by adding soul to your digital product.

How Purpose-Driven Banking and FinTech Create Exceptional Products

You see, we believe that digital transformation is pointless if it doesn't transform the digital banking customer experience. We use UX / CX design and digital technology to transform an awful user experience into an unforgettable one that makes users happy and solves their problems.

Additional answers that might be helpful:

What are the main challenges in improving the banking customer experience?

There are several challenges and struggles that banks may face in trying to improve their customer experience. One of the main challenges is the need to balance the often-competing goals of providing a high level of service and convenience for customers while also ensuring the security and integrity of the customer's financial information. This can require significant investment in technology and security measures, as well as careful management and coordination of various teams and departments within the bank.

Another challenge is keeping pace with changing customer expectations and behavior. As technology and the broader market continue to evolve, customers may come to expect new features and services from their bank. The bank will need to adapt to these changing expectations to remain competitive. Finally, there may also be regulatory and compliance issues that need to be taken into account when improving customer experience, which can add complexity and cost to the process.

Explore 20 tips to improve financial products UX/UI >>

How to create an excellent banking customer experience strategy?

To create a great customer experience strategy, banks should start by conducting a thorough analysis of their current customer experience, including gathering customer feedback and conducting market research. This will help the bank understand the strengths and weaknesses of its current customer experience and the opportunities and challenges they face in the market.

Based on this analysis, the bank should then develop a clear and specific customer experience strategy that outlines the specific goals and objectives that the bank wants to achieve, as well as the specific actions and initiatives that the bank will undertake to achieve those goals. This strategy should be aligned with the bank's overall business objectives and consider the unique needs and preferences of the bank's customers.

Once the customer experience strategy has been developed, the bank should then implement that strategy through a series of specific initiatives and programs. This may include investing in new technology, training staff, and implementing new processes and systems to improve the customer experience.

It is also crucial for the bank to regularly monitor and evaluate its customer experience strategy’s effectiveness and make adjustments based on customer feedback and other data. This will help the bank ensure that its customer experience strategy remains relevant and practical.

Check out 5 banking CX strategy drivers >>

What are the main benefits of an excellent banking customer experience?

There are many advantages that an excellent banking customer experience can provide for both the bank and its customers. Some of the main advantages include:

Increased customer satisfaction and loyalty

By providing a high-quality customer experience, banks can improve customer satisfaction and increase the likelihood that customers will continue to use their services and recommend them to others. This can lead to increased customer retention and loyalty, which can translate into long-term benefits for the bank, such as lower marketing costs and higher revenue.

Improved reputation and competitiveness

A great customer experience can also help improve the bank's reputation and make it more competitive in the market. Customers with positive experiences with the bank are more likely to share their experiences with others, which can lead to positive word-of-mouth and online reviews. This can help the bank attract new customers and differentiate itself from competitors.

Increased efficiency and cost savings

By focusing on the customer experience, banks can also improve the efficiency of their operations, leading to cost savings and increased profitability. For example, by providing more convenient and self-service options, banks can reduce the need for costly in-person interactions, and by providing clear and helpful information, banks can reduce the need for expensive customer service calls.

Greater compliance and risk management

Focusing on customer experience can also help banks better manage compliance and risk issues. By providing clear and concise information and obtaining proper customer consent, banks can reduce the risk of non-compliance and ensure that they are meeting their regulatory obligations. This can help protect the bank and its customers from potential legal and financial risks.

Overall, a great banking customer experience can provide a wide range of benefits for both the bank and its customers, and is an important part of any successful banking strategy.

Read more about five banking CX insights >>

It's not about technology or marketing, and it's not about trends and looking cool. It is always all about people.

I encourage you to put people first. You will experience a huge transformation happening within your financial organization, as well as outside of it, as the demand for your financial products, loyalty and support from your customers will start rapidly growing.

Get UXDA Research-Based White Paper "How to Win the Hearts of Digital Customers":

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedin