In today's digital age, customer experience (CX) has become crucial for businesses across all industries, including digital banking. With so many options available to consumers, it's more important than ever for banks to deliver a seamless, pleasant CX to stay competitive. In this article, we'll explore the key elements of a successful digital banking strategy and provide practical tips on staying ahead of the competition.

What is the digital banking strategy in CX?

Digital banking strategy in CX refers to the overall approach and plan that a bank adopts to improve the customer experience of its products and services. This can include a wide range of activities, such as conducting customer research to understand their needs and preferences, using design thinking and agile methodologies to iterate on and improve the design of products and services, implementing customer service and support systems, and using metrics and analytics to track and evaluate the effectiveness of the customer experience.

A successful digital banking strategy in CX can help a bank to differentiate itself from competitors, improve customer satisfaction and loyalty, and drive business growth and profitability. By focusing on the needs and expectations of its customers, a bank can create a customer experience that is convenient, easy, and satisfying, and that helps to grow revenue by building trust and long-term relationships with its customers.

The main difference is that incumbent enterprises apply customer-centricity in separate stages of their digital product development, but to realize the full potential of banking CX it should be integrated into the company core. This is what digital-first challengers are very focused on doing.

If a customer-centered banking strategy isn't one of the cornerstones of the financial company's values and culture, then the possibility of creating customer service that would attract customers like a magnet decreases dramatically. To help maximize the power of banking CX, I have compiled the top 5 strategies from digital-first challengers that have mastered outstanding CX implementation in banking.

However, there are a number of challenges that banks may face in trying to provide excellent CX in banking, including:

1. Legacy systems and technology

Many banks have complex and outdated systems and technology that can make it difficult to deliver a modern and seamless customer experience.

2. Siloed departments and processes

Banks often have siloed departments and processes that can make it difficult to provide a consistent and coherent banking CX across different channels and touchpoints.

3. Customer expectations and behaviors

Customers' expectations and behaviors are evolving rapidly, and banks need to keep up with these changes in order to provide a relevant and satisfying customer experience.

4. Security and compliance

Banks must ensure the security and compliance of their systems and processes in order to protect their customers' data and assets, and this can sometimes create friction in the customer experience.

5. Competition and innovation

Banks face intense competition from other financial institutions and fintech companies, and must continuously innovate and improve in order to stay ahead and provide a competitive banking CX.

Overall, providing excellent customer experience in banking is a complex and challenging task, and requires banks to overcome a variety of obstacles and challenges in order to succeed. By understanding and addressing these challenges, banks can create a customer experience that meets the evolving needs and expectations of their customers.

Five Digital Banking Strategy Drivers in CX

1. Empower Digital-First Business Approach Through Design Thinking

Digital-First Banking Strategy: to ensure a customer-centered digital transformation in banking industry, design thinking is perceived as a customer-centered business approach that's integrated into the company culture, inner processes and the development of products.

Outdated strategy: design is executed only as the user interface product part or as a visual tool for marketing purposes that helps to increase sales.

Companies that are admirably successful in the digital era, like Netflix, Apple and Facebook, understood a long time ago that design is so much more than just a pretty package. Design is the key behind successful digital products. I define user experience (UX) design as a methodology and ideology behind creating a financial brand that is truly user-centered.

Design is also the foundation of businesses leading the digital disruption. Why? Because they perceive design not as a package but as an approach.

That helps to integrate customer-centricity into every level of the company─starting from production to the way executives and employees think and act to create real value and benefit to the people using their products.

The seven steps of the Financial UX Design Methodology by UXDA

It's no wonder that client-centric companies are 60% more profitable compared to companies not focused on their users, according to Deloitte.

Progressively thinking successful financial brands understand this very clearly and are currently leveraging the power of digital CX over financial companies that haven't yet gotten there.

One of the core principles of financial companies that are eager to succeed on their digital goals would be to perceive design as a mindset or an ideology that puts the customer at the center of all business operations. It would inspire and push the financial company to constantly strive to make the world a better place for people to live in.

Using design as a process, not as a tool, allows us to maximize the full potential of a financial company and its digital products. It is a process that involves the whole team of the company in seeking and executing innovative ideas on how to better solve customer problems. It's an approach for creating demanded financial digital products that live up to the customer needs and expectations.

To use digital banking CX design as an accelerator of a financial company's success, there are five key aspects to focus on:

- transform a business model into one that puts the processes of user-centricity first;

- implement UX (user experience) expertise that will ensure the digital product brings true value to the customers;

- execute the right actions guided by UX experts who are able to impact in-depth processes of the financial company;

- have the correct criteria to evaluate the results your team is producing - whether the focus is on packaging or delivering exceptional experience;

- define and focus the authentic value your product will provide to the customers.

I'll further touch on each of these areas throughout the article.

2. Unite Digital Assets Into a Consistent Ecosystem

Digital-First Banking Strategy: Digital-first companies from the start have a vision how to grow a holistic ecosystem that leads to a smooth and intuitive banking CX.

Outdated strategy: Companies create multiple departments that develop products separately, thus increasing the chance of broken, fragmented customer experiences.

In the process of digital transformation in banking industry, incumbent enterprises usually complete each digitization project with a separate team of project managers and designers working on it, executing different visions and setting different goals not connected by the overall digital ecosystem. This causes high fragmentation within the customer experience. It might not harm the financial institution from the inside but will probably increase the customers’ frustration, digital friction and switching. This is because customers expect the brand experience to be a connected, holistic flow, not separate fragments. Fragmentation breaks the customer experience by causing a lot of struggle and confusion.

To avoid this, digital-first team members work side-by-side to improve the banking customer experience that unites all of their products into a user-friendly ecosystem.

Creating and developing a consistent digital ecosystem is the way to ensure a successful digital transformation in banking industry.

It establishes digital synergy through a smooth, connected flow of a delightful experience that the customers expect from their financial brand.

A complete UX/UI design system is a practical way to make this happen. It ensures that everyone working on the ecosystem products are on the same page and can easily develop consistent digital solutions in their specific field of responsibility. Most importantly, in this way the customer will be able to enjoy the end result as all banking products will have the same intuitive and user-friendly principles of functioning.

3. Make an Extra Step to Relate to the Customer Needs

Digital-First Banking Strategy: Challengers actively explore the needs, wants and feelings of users to base their digital banking strategy on that and hugely invest into the product user experience upgrade.

Outdated strategy: Incumbent enterprises often have the first-hand focus on their portfolio strategy, marketing strategy and product strategy.

The number of complaints about banking services in the UK alone exceeded 2 million in 2019 (Statista). This clearly demonstrates the importance of exploring, identifying and relating to the needs, wants and expectations of the customers.

Nevertheless, there are always some companies that might be eager to skip through the UX research process and get right to the product design as quickly as possible. This can lead to unpleasant consequences when the product gets launched but faces no demand or a lot of claims from dissatisfied customers.

The tricky part here is that often there is a disconnect between the businesses and end users' perceptions of the brand and the experience it provides. Some time ago, there was a study by Bain & Company, indicating that 80% of CEOs believe they deliver a superior experience, while only 8% of customers agree with that assumption. And, it's still true due to the cognitive bias.

A digital financial service that might seem nice and easy to use for financial product owners can be perceived as a nightmare from the customers’ viewpoint.

76% of consumers expect companies to understand their needs and expectations and deliver according to those, so it's crucial for the business to get to know their customers and start feeling their pain to address it. It's impossible to do that without user research that allows the creation of banking products that fully solve user problems in a manner that's quick and completely understandable.

We could call the financial UX research and engineering a “recipe” for a banking product that the customers would most likely love to use and recommend.

Digital-first challengers know that digital products created without proper user research often fail; you can’t address market needs if you are not aware of the user problems. That's why most Fintechs first find out the user’s context and then create the value proposition of their products based on the users’ needs. This is similar to an architectural firm that designs a skyscraper blueprint to secure its solidity and relevance before construction begins.

Digital-first companies know that only a single negative product experience can be enough to damage the way a brand is viewed in the eyes of the customers, forcing them to switch to another one, as 33% of Americans have stated. And, it takes 12 positive experiences to compensate for this one unresolved negative experience.

That's why they invest a lot of time and money in user research, data analysis, information architecture and product improvement. Before building the product, they do thorough user research and user experience engineering. They test the usability of the product before its launch and make several improvements. After the product is released, customer feedback is regularly collected from social networks, the App Store and Google Play, and leveraged to improve the product accordingly.

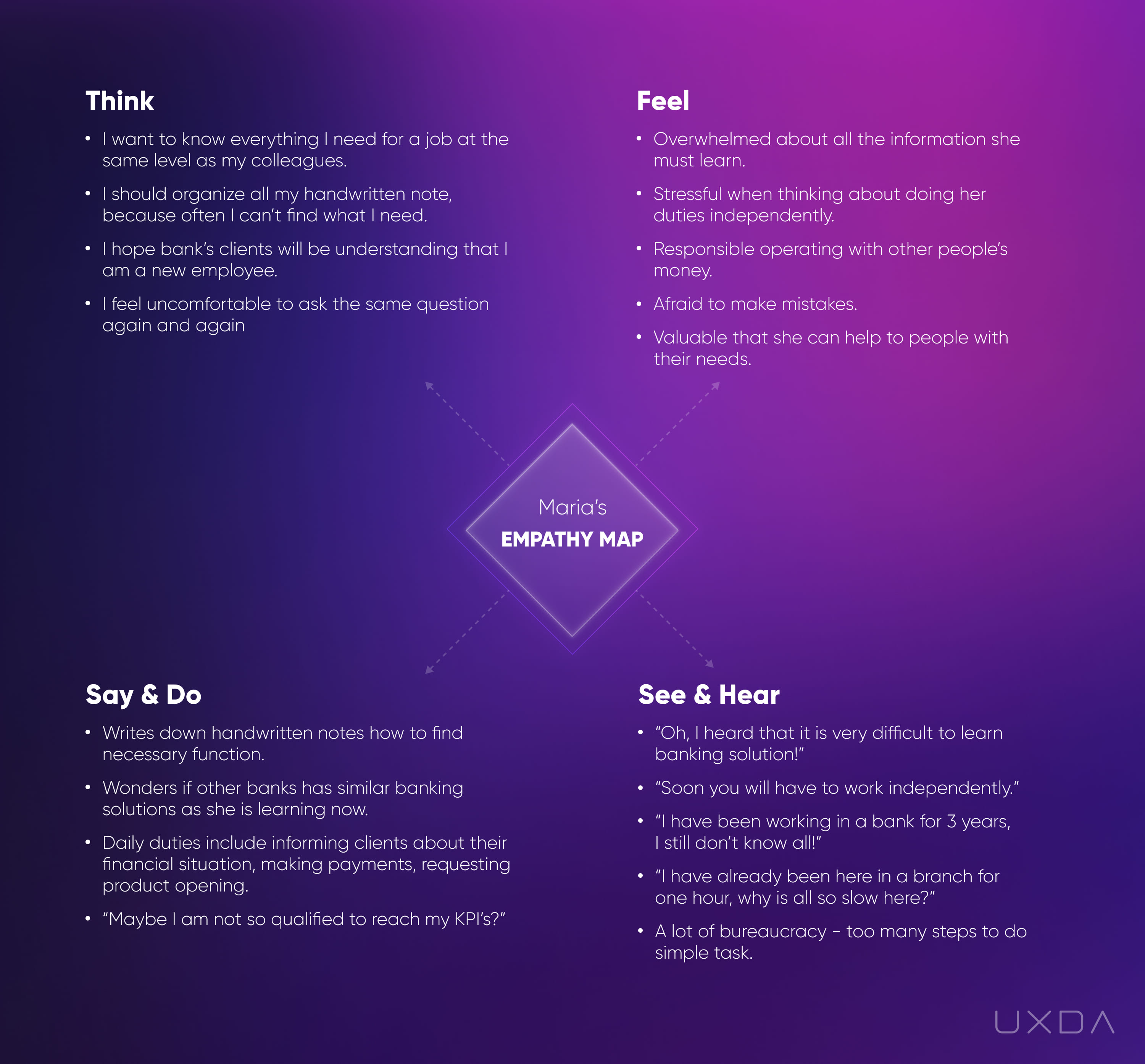

Incumbents might know their target audience, demographic data or user age group very well, but how about the users’ actual life stories, concerns and pain points? Do financial institutions know what their users’ stories are when it comes to their banking experience? Do bank employees and executives feel enough empathy toward customers' struggles?

User research provides huge value in the process of developing user-centered banking products. It not only helps to understand the motivation of people using your banking product, but also what kind of troubles your service may cause.

Customers using digital banking are real people with real-life stories, and they expect their issues to be heard. Going deep on analyzing customers─who they are, where they come from, their daily activities, other services they are using and what job they expect of your service is the foundation of creating customer-centered products.

Use an Empathy map to create delightful banking CX

Successful digital product or service design is created through a deep understanding of the end customers, attention to their needs and a well-organized design process.

4. Provide a Unique Value That's Adapted to the Future

Digital-First Banking Strategy: challenge everything to create an authentic value proposition that's based on the customer needs and the trends of the future.

Outdated strategy: protect themselves by relying on bureaucracy and legacy.

79% of customers in the United States are certain that brands should demonstrate understanding and care toward their customers, according to Wunderman’s research, and 89% are willing to engage with businesses that not only show care but go above and beyond that.

Successful companies relate and adapt to the changing customer value according to the development of the industry they are in. The victories of the past don't mean anything for those who fail in adapting to the future. Blockbuster, Kodak or Nokia were so focused on their established revenue sources that they ignored consumer trend switches, and we all know what happened to them!

63% of consumers state that the best brands are the ones that exceed expectations throughout the customer journey, as conducted in a study by Wunderman. The best way to exceed expectations and show customers that the financial brand cares about them is by offering a true value and benefit that is tailored to the specific needs the customers face.

Unfortunately, very often, instead of delivering a specific value through a financial product, a template solution is created. There are quite a lot of inconvenient, faceless and boring products that have almost no benefit for the users. This is one of the reasons why the growth rate of challengers has been so rapid.

In an industry in which complexity and similarity have dominated for years, it's not so difficult to attract customer attention with a brand new level of banking customer experience, possibilities and personalization.

To create demanded digital products, it's essential to know the meaning of WHY the brand exists. What is the unique value that it brings to the people opening this particular banking app or the online bank? There are quite a few financial companies that have never actually thought about these kinds of questions, but there is a huge difference that it can make in gaining a market advantage. As Simon Sinek said, people don't buy what you do; they buy why you do it.

In the digital age, the one-size-fits-all approach doesn't work anymore as customers demand and are surrounded by a more personalized experience. That's why the majority of businesses (around 62%, according to a study by Walker) are investing in individual customer characteristics. “Needs, challenges, and future direction of an individual consumer can provide a lot of insight into what they want to see from the brand.”

Meanwhile, challengers craft unique solutions that evoke positive emotions in their customers. In fact, consumers who have an emotional connection with a brand have a 306% higher lifetime value, stay with a brand for an average of 5.1 years vs. 3.4 years and will recommend brands at a much higher rate (71% vs. 45%), according to Motista.

Challengers are authentic to save their businesses from the so-called “red ocean”. It's a concept from the book “Blue ocean strategy” by C. Kim and R. Mauborgne, that embodies a tight competition in an already existing market space VS the “blue ocean” that stands for authentic products that bring outstanding value in an uncontested market space.

They define the weak points of incumbent enterprises and address customers’ pains in a way that enriches their daily lives.

Digital-first companies are flexible and adapt to future rules, while incumbents often rely on past success. The new age requires the ability to adapt quickly, and the Covid-19 crisis is a clear example of it. Those who reacted bravely managed to keep their clients, while those who were stuck in protecting their legacy failed. The explosive growth of the challengers’ customer base depends on the ability to remove obsolete practices and adopt a new, customer-centered approach to doing business by adjusting to growing customer needs and digital tendencies.

The digital age is a time of authentic solutions. Banks can power up their brand advantage by crafting a unique digital banking experience that evokes positive emotions and leads to long-term loyalty. In order to do that, they need to think about what exactly makes their financial product valuable and unique to the users, and how it matters to the team involved in its creation.

At the level of value, the design approach helps banks to find the particular uniqueness of their products and brands─something that will definitely distinguish the brand and its digital products from the many others already offered by competitors.

Here are five digital banking CX strategy tips to define and create an exceptional value for the customers:

- if the product's functionality is not enough to ensure value and compete, seek ways to provide better usability;

- if all the competitors have the same functionality and usability, add aesthetics to inspire and “wow” your banking customers;

- if you need an even better competitive advantage, connect the product with the customer’s lifestyle by personalizing it;

- go even further by turning the financial product into a symbol of the customer's status (e.g., VIP, family, student, entrepreneur, millennial);

- finally, reach the peak of providing ultimate value through stating a mission with your financial brand that aims to make the world a better place and build a community around it.

The five levels of UXDA's Value Pyramid

Viewing a product from the perspective of user benefits allows you to set priorities aimed at creating long-term relationships with clients within a win-win framework.

5. Have a Customer-Centered Measurements and Process

Digital-First Banking Strategy: prioritize and evaluate the results based on customer satisfaction.

Outdated strategy: focus on the quantity of the deliverables and the speed of execution.

The goal is as important as the way we measure it. Instead of focusing on the number of interface screens designed per day, create an intuitive banking CX and think carefully about every element on each screen. The product quality should not be sacrificed for speed and quantity. This might seem like a win in the short term, but, in the long term, a support team may start to receive thousands of calls about similar struggles.

The proper outcome criteria define the level of value a product is able to provide for the users. It's not the number of screens that is important; it is the quality of the screens. Often, a clever and user-centered architecture of a digital product can significantly reduce the number of screens, while increasing user satisfaction.

Only the compliance of the financial product design with the key user scenarios can make it more understandable and enjoyable for the customers. Naturally, it requires an investment of more time and resources into analysis, research and UX architecture, but it's definitely worth it.

To ensure such a maximal adaptation, Fintech startups and challenger banks use an iterative process while designing and developing digital products. Iterations are usually performed as a cyclic process that includes ideating, rapid prototyping and testing multiple versions of each flow to ensure that the user needs are matched with the best quality solution. The process is repeated until the user problems are reduced to an acceptable level. This allows to make the most significant changes in the earliest stages of design, thus making the overall process more efficient and reducing excess costs.

This Agile approach could be also used by banks to ensure sharp user-centered focus in their digital products. Short iterations significantly reduce risks and failure rate. This is especially effective after the product launch in order to improve it based on users' feedback. Visual prototyping reduces the amount of written technical brief communication and misinterpretations, saving time, efforts and putting all of the team on the same page.

The Agile approach is not a technique but rather a digital age philosophy that defines the values and principles to guide teams in a liberal and democratic manner. That’s why it requires a special business culture empowered with a human-centered mindset that might be difficult to integrate into traditional banking bureaucracy.

The key performance indicators (KPIs) banks can focus on to measure the satisfaction of their customers and seek ways to improve it are:

- app ratings on Google Play and the App Store;

- reviews and feedback on social media platforms, forums and other sites;

- customer satisfaction and NPS (net promoter score) - how likely customers are to recommend this banking product;

- customer lifetime value (CLV) - helps to understand the value of investing in long-term relationships with the customers;

- reasons why most users contact the support center;

- retention and switch rate.

Reviews before and after of mobile banking CX transformation of the Bank of Jordan app

It's very important that banks are aware of these measurements and also act upon them. 79% of U.S. consumers state that brands have to show they care and understand their users in order to choose their services (Wunderman).

Long-lasting emotional connection with customers is formed when they gain support not only in the shape of words but also actions. Clients want to feel that their bank truly cares about them, takes into account their problems and solves them as quickly as possible.

Road to digital-empowered banking excellence

75% of banking customers report that a bank's performance falls short on their financial goals, according to a Segmint. The Qualtrics Banking Report found that customers ranked poor service as the number one reason they were leaving, but 56% of customers who have left say the bank could have changed their mind. And that is indeed true. With their huge resources, enormous amounts of collected data and impressive product variety, there are so many advantages that banks could offer to their customers. All it takes is transforming an outdated mindset and legacy into a power that trumps Fintechs with something they aren't able to compete with: expertise, stability and trust that's built over decades.

84% of customers expect to be treated like a person, not a number, according to Salesforce. If banks can turn their weak points into their main market advantages by using the power of UX, there's no need to worry about emerging finance companies. The place for customer-centered banks is secured in the future.

Additional answers that might be helpful:

What are the most important things in banking CX?

The five most important things in banking customer experience are:

1. Convenience

Customers want to be able to access their accounts and conduct financial transactions easily and quickly, without having to spend a lot of time or effort.

2. Trust

Customers want to trust their bank and feel confident that their money and personal information are safe and secure.

3. Transparency

Customers want to understand the fees, charges, and terms and conditions associated with their accounts and transactions, and feel that they are being treated fairly and transparently.

4. Personalization

Customers want their banking experience to be tailored to their individual needs and preferences, and want to feel that their bank knows and cares about them as an individual.

5. Support

Customers want to be able to get help and support when they need it, whether that is through online resources, phone support, or in-person assistance.

By focusing on these factors, banks can create a customer experience that is satisfying and effective for their customers.

Learn about gaps in the banking CX and how to avoid them >>

How can banks improve customer experience?

Banks can improve customer experience by taking a number of steps, such as:

1. Conducting customer research to understand their needs and preferences, and using this information to inform the design and development of products and services.

2. Using design thinking and agile methodologies to iterate on and improve the design of products and services, and to create a cohesive and coherent customer experience across different channels and touchpoints.

3. Implementing customer service and support systems that are convenient, responsive, and helpful, and that provide customers with the assistance they need when they need it.

4. Using data and analytics to track and evaluate the effectiveness of the customer experience, and to identify areas for improvement and optimization.

5. Investing in technology and innovation, and adopting new technologies and approaches that can improve the customer experience, such as artificial intelligence, blockchain, and biometric authentication.

Read more on how to improve banking customer experience >>

What are the main trends in digital banking CX?

According to UXDA experts TOP 10 digital banking customer experience trends are:

1. Expanding the Digital Perspective

2. Empowering an Experience-Based Inner Culture

3. Overcoming the Experience Gap

4. Enriching the Customer Experience in Finance With an Emotional Connection

5. Setting up Experience-Driven KPIs

6. Switching From IQ to EQ

7. Establishing Consistency Through Product Ecosystem

8. Providing a Contextual Financial Experience

9. Teaming up With Fintech and Technology Companies

10. Taking the Value of Financial Customer Experience to a New Level

Read more about banking CX trends >>

Get UXDA Research-Based White Paper "How to Win the Hearts of Digital Customers":

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedin