The identity of a bank in the modern era is inseparable from its digital presence. Customers no longer measure a bank by the magnificence of its buildings but by the quality of its digital product. The digital user experience (UX) is now the primary lens through which the majority of customers perceive the bank's brand, and it plays a critical role in shaping customer loyalty and trust.

Digital products are becoming the foundation of modern banks and their service offerings. Consequently, leading banks are making digital product design and user experience (UX) central to their strategy, brand identity, and profitability. In this article, we'll share insider information on why this is the case.

Digital Technology: Shifting Revenue Streams in Banking

Digital technologies have revolutionized the financial and banking industry in profound ways, fundamentally altering how banks operate, engage with customers and generate profits. This transformation has led to the emergence of new profit channels while challenging traditional revenue streams.

Automation, data analytics, cloud-based digital banking platforms, biometrics, open banking, blockchain, embedded banking, personalized services and other digital trends have all contributed to reshaping how banks operate and earn profits. As the industry evolves, banks that effectively harness these technologies will be poised to tap into new revenue streams, securing their profitability in an increasingly digital landscape.

Here's how these changes have occurred:

Automation and Efficiency

One of the most significant impacts of digital technologies on the financial industry is the automation of routine tasks and processes. Technologies like artificial intelligence (AI) and machine learning (ML) have enabled banks to streamline operations, reducing the need for human intervention in areas such as customer service, compliance and transaction processing. This automation leads to substantial cost savings, which directly boosts profitability by lowering operational expenses. For example, Accenture report states that integrating AI services into financial institutions will boost profits by 31% by 2035 directly increasing the ROI of digital banking.

Data-Driven Decision Making

The advent of big data analytics has given banks the ability to gather, analyze and leverage vast amounts of customer data. This data-driven approach allows banks to offer more personalized services, target customers with specific products and predict customer needs with greater accuracy. By understanding customer behavior and preferences, banks can create tailored marketing campaigns, optimize pricing strategies and improve customer retention rates, all of which contribute to higher profits. McKinsey research supports this, revealing that 71% of consumers expect personalized interactions, with 76% feeling frustrated when these expectations are not met.

Rise of Digital Banking and Fintech

Digital banking platforms and Fintech companies have reshaped the competitive landscape, offering innovative digital products and services that challenge traditional banking models by taking advantage of the absence of interest rates. These digital-first platforms operate with lower overhead costs than brick-and-mortar banks, enabling them to offer competitive rates, attracting cost-conscious customers. As a result, traditional banks have had to develop their digital offerings, shifting focus from physical branches to mobile apps and online services. A McKinsey research states that over the last 15 years, mobile has become the dominant retail banking channel, and its share continues to grow. This shift has opened up new profit channels, such as mobile banking fees, subscription-based services and partnerships with Fintechs.

Fee-Based and Subscription Services

With the decline in interest rate margins due to regulatory changes and low-interest-rate environments, banks have increasingly turned to fee-based services as a source of revenue. Digital technologies have facilitated the introduction of various value-added services, such as robo-advisors, premium account features and personalized financial planning tools, which banks can offer on a subscription basis. These services provide a steady stream of income independent of traditional loan and interest income, diversifying banks' profit channels. For example, Subscription Economy Index research data shows that companies embracing subscription-based models grew by 400% on average over the past 8.5 years.

Blockchain and Cryptocurrencies

Blockchain technology and the rise of cryptocurrencies have introduced entirely new ways of conducting transactions, managing assets and raising capital. Blockchain’s decentralized nature offers greater transparency, security and efficiency in transactions, particularly in areas like cross-border payments and smart contracts. Banks and financial institutions that adopt blockchain technology can reduce transaction costs, increase transaction speed and offer new services such as digital asset custody and cryptocurrency trading, creating new revenue streams. According to a report by Juniper Research, blockchain deployments could help banks save up to $27 billion on cross-border settlement transactions by 2030, reducing costs by more than 11%.

Digital Payments and Wallets

The widespread adoption of digital payments and mobile wallets has revolutionized the way money is transferred and managed. Technologies like Near Field Communication (NFC), Quick Response (QR) codes and mobile payment apps have made it easier for consumers to make purchases without cash or cards, transfer money and pay bills electronically. Banks have capitalized on this trend by developing their digital payment solutions or partnering with tech companies. These payment platforms generate revenue through transaction fees, merchant services and data monetization, providing a lucrative profit channel that complements traditional banking services. This conclusion is supported by an NFC Forum study, which found that 39% of respondents ranked NFC contactless payments as the most convenient method, followed by QR codes at 28% and contactless cards at 20%.

Embedded Finance

Embedded finance is another emerging trend in which financial services are integrated into non-financial platforms, such as e-commerce websites, ride-sharing apps or social media platforms. This integration allows banks to reach customers where they already are, offering services like lending, insurance or payments within these platforms. The ability to embed financial services into a broader ecosystem creates new profit opportunities, as banks can tap into new customer segments and revenue streams that were previously inaccessible. This conclusion is supported by McKinsey research, which reveals that, by 2030, the embedded finance market in Europe could surpass €100 billion and account for 10%-15% of banking revenue pools.

Customer-Centric Models and Personalization

Digital technologies have enabled banks to adopt a more customer-centric approach, focusing on delivering personalized experiences that meet the unique needs of each customer. AI and ML algorithms analyze customer data to offer personalized product recommendations, financial advice and customized solutions. For example, Medallia research reveals 61% of respondents are inclined to spend more with a company that provides a personalized experience. This shift toward personalization not only improves customer satisfaction and loyalty but also increases the likelihood of cross-selling and upselling, thereby enhancing profitability.

Regulatory Technology (RegTech)

RegTech, or regulatory technology, refers to the use of digital tools to help banks comply with complex regulatory requirements more efficiently. By automating compliance processes, such as anti-money laundering (AML) checks, fraud detection and risk management, banks can reduce the costs associated with regulatory compliance, according to a KPMG report. This efficiency leads to lower operating costs and reduces the risk of penalties and fines, ultimately protecting and potentially increasing profits.

Open Banking and API Economy

Open banking, driven by regulations like PSD2 in Europe, allows third-party developers to build applications and services around financial institutions. Through the use of APIs (Application Programming Interfaces), banks can share data securely with Fintech companies and other third parties, enabling innovation, collaboration and revenue increase. These aspirations are reflected in McKinsey research, which reveals that 44% of banks expect to decrease costs by more than 10% through their API efforts, and 31% anticipate increasing revenues by over 10%. Open banking has opened up new profit channels for banks by allowing them to offer banking-as-a-service (BaaS), charging fees for API usage and creating new business models based on data sharing and partnerships.

Product Design: Embracing New Face of Banking

The traditional image of a bank as a grand Main Street building is rapidly fading. Banks are undergoing a transformation that redefines their role and perception, shifting to digital platforms accessible via smartphones, tablets and computers. This evolution, driven by technology and changing customer expectations for convenience, has made digital platforms the primary point of contact. As a result, ease, efficiency and functionality are now the core elements defining a bank’s brand and business.

Customers today perceive a bank’s brand primarily through their digital experience. Instead of recalling a branch visit or a conversation with a bank teller, they think of the app they use to check balances, transfer funds or pay bills. The quality of this digital interaction shapes their view of the bank’s reliability, innovation and customer focus. A seamless, intuitive digital experience boosts satisfaction and loyalty, while a frustrating interface can push customers toward competitors.

The product design and digital UX are the new face of banking. It is where the brand lives and, through this interface, customers judge the bank's competence and trustworthiness. In a world where Fintech companies, with no physical branches, are gaining ground by offering superior digital experiences, traditional banks are compelled to prioritize their digital offerings. The digital product is not just an extension of the bank’s services; it is the bank itself. The quality of the digital experience—its speed, security, ease of use and personalization—directly influences how customers feel about the bank as a whole.

This paradigm shift means that a bank's success is increasingly tied to its digital strategy. A bank’s digital product must not only be functional but also engaging, intuitive and responsive to customer needs. The interface design, ease of navigation, personalization of services and seamless integration of features all contribute to the overall customer experience. In this sense, the digital UX has become the main touchpoint through which the bank’s brand is communicated and experienced.

Product design has emerged as the most important factor impacting profit in modern banking due to several key reasons, all tied to the evolving landscape of the financial industry and customer expectations:

- Shift in Customer Expectations. Modern customers demand seamless, intuitive and personalized experiences across all digital platforms, including banking. With the rise of Fintech startups offering user-friendly, innovative solutions, traditional banks are under pressure to match or exceed these standards. Customers now expect banking products that are easy to use, accessible on multiple devices and tailored to their individual needs. A well-designed product that meets these expectations leads to higher customer satisfaction, loyalty, and retention which directly impacts a bank’s profitability.

- Increased Competition from Fintechs. The financial industry has seen an increase of Fintech companies that focus heavily on user-centric design, offering niche services that cater to specific customer pain points. These companies often have the advantage of agility, allowing them to innovate and iterate quickly. To compete, traditional banks must prioritize product design to attract and retain customers who might otherwise be drawn to more innovative alternatives. A strong focus on design can differentiate a bank’s offerings, making them more appealing and competitive in a crowded market.

- Digital Transformation and Efficiency. As banks undergo digital transformation, product design becomes crucial in ensuring that digital services are not only functional but also intuitive and efficient. Well-designed products streamline operations, reduce the need for extensive customer support and minimize errors, leading to cost savings and higher profit margins. For example, a well-designed mobile banking app can reduce the load on physical branches and call centers by allowing customers to complete transactions and access services independently.

- Enhanced User Engagement and Cross-Selling Opportunities. A well-designed banking product enhances user engagement by making it easier for customers to interact with their accounts, explore new services and manage their finances. Increased engagement opens up opportunities for cross-selling additional services, such as loans, insurance or investment products, which can significantly boost a bank’s revenue. Effective product design also leverages data to personalize these offers, increasing the likelihood of conversion and customer satisfaction.

- Trust and Security. In banking, trust is paramount. A product that is poorly designed, difficult to navigate or perceived as insecure can erode customer trust, leading to attrition and a negative impact on profits. Conversely, a product designed with robust security features, clear communication and a user-friendly interface fosters trust and encourages customers to engage more deeply with the bank’s services. Trustworthy products lead to long-term customer relationships, which are more profitable over time.

- Customer Acquisition and Retention. Customer acquisition costs in banking are high, making it crucial for profitability. A well-designed product reduces churn by providing a positive user experience, making customers more likely to stay with the bank and less likely to switch to competitors. This is supported by a ConsumerAffairs report, which notes that 82% of bank customers cite their financial institution’s online and mobile platforms as a key reason for staying with their current bank. Additionally, an attractive and user-friendly product is more likely to attract new customers, expanding the bank’s market share and revenue base.

- Regulatory Compliance and Risk Management. Product design also plays a critical role in ensuring that banking products comply with regulatory requirements and manage risk effectively. A product that is designed with compliance in mind reduces the risk of costly fines and legal challenges. Moreover, well-designed products can incorporate features that help customers manage their own financial risks, such as budgeting tools or alerts for unusual account activity, which can reduce the bank’s exposure to bad debt and fraud.

- Brand Differentiation and Loyalty. In a market where many banking products offer similar features, UX and product design becomes a key differentiator. A product that provides an exceptional user experience can enhance the bank’s brand reputation and foster customer loyalty. Loyal customers are not only more profitable in the long run but also act as advocates, bringing in new customers through word-of-mouth and positive reviews.

- Scalability and Adaptability. Well-designed banking products are built with scalability and adaptability in mind, enabling banks to quickly respond to market changes and customer demands. In today’s fast-paced digital environment, the ability to rapidly scale services and adapt to new technologies or regulations is crucial for maintaining profitability. A product that is designed to be flexible and scalable can easily incorporate new features, expand to serve more customers and integrate with emerging technologies, all of which contribute to sustained profit growth. Moreover, scalable products can be deployed across multiple markets or regions with minimal modification, maximizing revenue potential.

- Data-Driven Insights and Continuous Improvement. Modern banking products, when designed effectively, collect and utilize customer data to provide actionable insights that drive continuous improvement. A product with built-in analytics capabilities allows banks to monitor user behavior, identify pain points and track the performance of different features. This data-driven approach enables banks to make informed decisions about product updates, new feature rollouts and overall service enhancements. By continuously refining products based on real user feedback, banks can keep their offerings relevant and competitive, which not only enhances customer satisfaction but also ensures that the products remain profitable over time. This iterative process of improvement, supported by a strong design foundation, is key to sustaining long-term profitability in a rapidly evolving market.

Digital Pitfalls: Crucial Factors that Impact Profitability

The impact of product design on profits can significantly decrease without the support of several critical factors that ensure the design's effectiveness and sustainability. A supportive ecosystem includes high-quality technical implementation, accessible customer support, continuous improvement, a customer-centric culture, design maturity, user research, cross-functional collaboration and strategic alignment.

Without this, even the best-designed products can fall short of their potential, leading to diminished customer satisfaction, reduced engagement and, ultimately, lower profits. Ensuring these elements are in place is essential for leveraging design as a key driver of profitability in the modern banking industry.

Here’s why each of these additional factors is essential:

High-Quality Technical Implementation

First and foremost, effective product design depends on a robust technical implementation as its foundation. If a digital banking product is poorly executed—featuring slow load times, frequent bugs or security vulnerabilities—the user experience will suffer. Customers are likely to abandon a product that does not function reliably, regardless of how well-designed the interface may be. Technical implementation ensures that the design translates into a seamless, efficient and secure user experience, which is crucial for retaining customers and driving profits.

Read more on how a poor launch can sink a banking app

Accessible and Effective Customer Support

No matter how well a product is designed, customers will occasionally encounter issues or have questions. Accessible and effective customer support is vital in these situations. If customers do not receive timely and helpful support when they face problems, their overall experience with the product will deteriorate, leading to frustration and possibly churn. Customer support bridges the gap between the design intent and real-world user experience, ensuring that customers can continue to use and enjoy the product even when issues arise. Without it, the positive impact of good design is undermined by unresolved problems and poor service experiences.

Read more on why reputation matters

Continuous Development and Improvement of the Product

The digital landscape is constantly evolving, with customer expectations and technological capabilities advancing rapidly. Continuous development and improvement of the product are necessary to keep pace with these changes. A product that remains static, even if initially well-designed, will eventually become outdated and less competitive. Regular updates, feature enhancements and iterations based on user feedback are essential to maintaining the relevance and effectiveness of the design. Without ongoing development, a product can quickly fall behind competitors, diminishing its impact on profits.

Read more on the urgent need to keep modernizing

Customer-Centric Culture and Mindset

A customer-centric culture ensures that every aspect of the product, from design to support, is aligned with the needs and preferences of the users. Without this mindset, even a well-designed product may fail to resonate with customers if it doesn’t truly address their pain points or expectations. A focus on the customer helps ensure that design decisions are made with the end-user in mind, leading to higher satisfaction and loyalty. If a bank lacks this culture, it risks creating products that are out of touch with what customers actually want, reducing the effectiveness of the design and its impact on profitability.

Read more on customer-centric banking culture

Design Maturity

Design maturity refers to an organization’s ability to effectively integrate design into its overall strategy and operations. It encompasses having the right processes, tools and expertise to support high-quality design work. Without design maturity, even good design practices may be inconsistently applied, poorly executed or not fully integrated into the broader business strategy. Design maturity ensures that design is not an afterthought but a core component of the product development process, driving innovation and user satisfaction. Without it, the influence of good design on profits may be sporadic and limited.

Read more on how design maturity impacts profits

User Research and Data-Driven Insights

Understanding user behavior, preferences and pain points is crucial for creating effective designs. User research and data-driven insights guide the design process, ensuring that the product truly meets the needs of its target audience. Without this research, design decisions may be based on assumptions rather than evidence, leading to a product that fails to engage users or address their actual needs. Data-driven insights also allow for continuous product optimization, enhancing its relevance and effectiveness over time. Without these insights, the impact of design on profitability is likely to diminish as the product fails to connect with its users.

Read more on user research methods

Cross-Functional Collaboration

Product design does not exist in a vacuum; it requires collaboration across various functions within an organization, including development, marketing, customer service and compliance. Without strong cross-functional collaboration, the design may not be fully aligned with technical capabilities, regulatory requirements or market positioning. This misalignment can result in a product that, despite being visually appealing or conceptually sound, fails to deliver the intended value to customers or the business. Effective collaboration ensures that the design is feasible, compliant and market-ready, thereby maximizing its positive impact on profits.

Read more on the role of DesignOps in banking

Strategic Alignment

For product design to have a lasting impact on profits, it must be strategically aligned with the organization’s broader business goals. Design decisions should support the bank’s objectives, whether it’s growing market share, enhancing customer satisfaction or driving innovation. If design efforts are disconnected from the overall strategy, the resulting product may fail to achieve the desired business outcomes. Strategic alignment ensures that design directly supports business goals and enhances profitability, delivering value to both the company and its customers.

Read more on mastering a strategic design framework

Scalability and Flexibility

Scalability refers to a product's ability to handle growth—whether in terms of user numbers, transaction volumes or feature expansion—without compromising performance or user experience. Flexibility is about the product's ability to adapt to changing market conditions, customer needs and technological advancements. Without scalability, even a well-designed product can become sluggish, unreliable or obsolete as demand increases. Similarly, without flexibility, a product might struggle to incorporate new features, integrate with other systems or adapt to regulatory changes. Scalability and flexibility are important for sustainable digital strategy and ensure that a product can grow and evolve with the business, maintaining its relevance and effectiveness, both crucial for sustaining profitability.

Read more on why customers struggle with digital banking

Robust Testing and Quality Assurance

Thorough testing and quality assurance (QA) processes are essential to ensure that the product functions as intended and provides a seamless user experience. This includes testing for usability, security, performance under load and compatibility across different devices and platforms. Even the most well-conceived product design can fail if it has bugs, security vulnerabilities or performance issues that degrade the user experience. Robust QA processes help identify and fix these issues before the product reaches the customer, ensuring that the design's intended value is fully realized. Without strong testing and QA, the product's design impact is compromised, leading to user frustration, higher support costs and potential loss of customers, all of which negatively affect profitability.

Read more on how to fix banking friction with a UX audit

Digital Advantage: Design is the New Currency in Banking

Financial apps today are focusing narrowly on functionality, with banks and Fintech companies assuming that offering features like transfers, bill payments and budgeting tools will ensure customer satisfaction. However, this approach narrows a crucial component: the user's emotional experience. According to a PwC survey, 59% of consumers feel that companies have lost touch with the human element of customer experience.

Emotional design goes beyond mere aesthetics; it’s about creating a connection with users. A McKinsey study found that banks offering emotionally engaging customer experiences experienced a 15% increase in cross-selling success and a 20% reduction in churn rates. By focusing on emotional design, banks can transform routine tasks into delightful experiences, fostering loyalty and satisfaction.

Investing in user-centered design and emotional engagement yields significant returns. According to a report by the Design Management Institute, companies that embraced design thinking outperformed the S&P 500 by 211% over a ten-year period. This approach not only enhances user experience but also drives business growth through innovation and differentiation.

Contrary to the prevailing wisdom, the most successful financial apps aren't merely feature-rich—they're emotionally engaging. Emotional design isn't fluff; it's a necessity. A study by Forrester reveals that 80% of respondents would spend more with a brand when they experience positive emotions. It’s time for financial apps to transform from mere utilities into experiences that resonate emotionally with users.

Banks are criticized for their lack of empathy, with many users finding their interactions with banks to be cold, frustrating and impersonal. A Forrester study reveals that 53% of customers consider banking to be more transactional than relational. This is a significant problem because, at its core, banking is about trust and relationships.

To address this empathy deficit, banks must adopt a user-centered product approach. This starts with thoroughly understanding the needs, desires and pain points of users through comprehensive research. Observing and engaging with users in their natural environments reveals insights that structured surveys and focus groups can’t, offering a deeper understanding of customer satisfaction with a product. For instance, why might a user prefer a mobile banking app over a traditional branch visit? What challenges do they encounter when trying to complete a transaction online?

Once these insights are gathered, they must be converted into actionable design principles. The Define stage of the design thinking process emphasizes framing the right problem to identify the most effective solution. By focusing on the user's perspective, banks can redefine their challenges, leading to more innovative solutions.

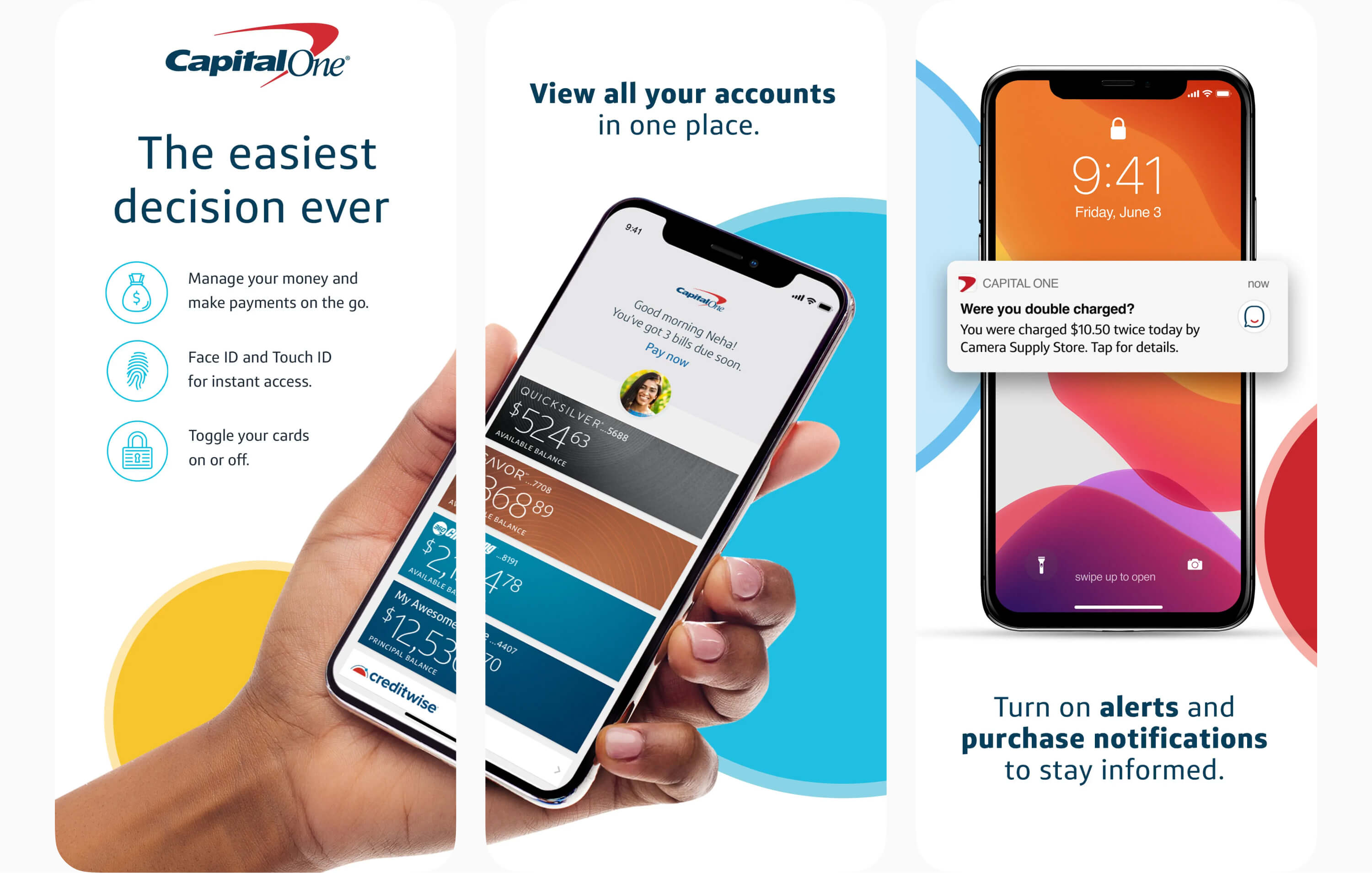

A great example of integrating empathy into a digital financial product is Capital One, which revamped its mobile app with a strong focus on user experience. They introduced features like personalized insights into spending habits and seamless integration with other financial tools. This approach led to a 20% increase in mobile app engagement within the first year of the redesign.

The future of banking will belong to those who are bold enough to rethink and redesign. It’s time for banks to move beyond the transactional and embrace the relational, transforming their interfaces to serve and delight users equally. The revolution in finance is not just about advancing technology; it's about putting the human experience at the forefront of financial product design.

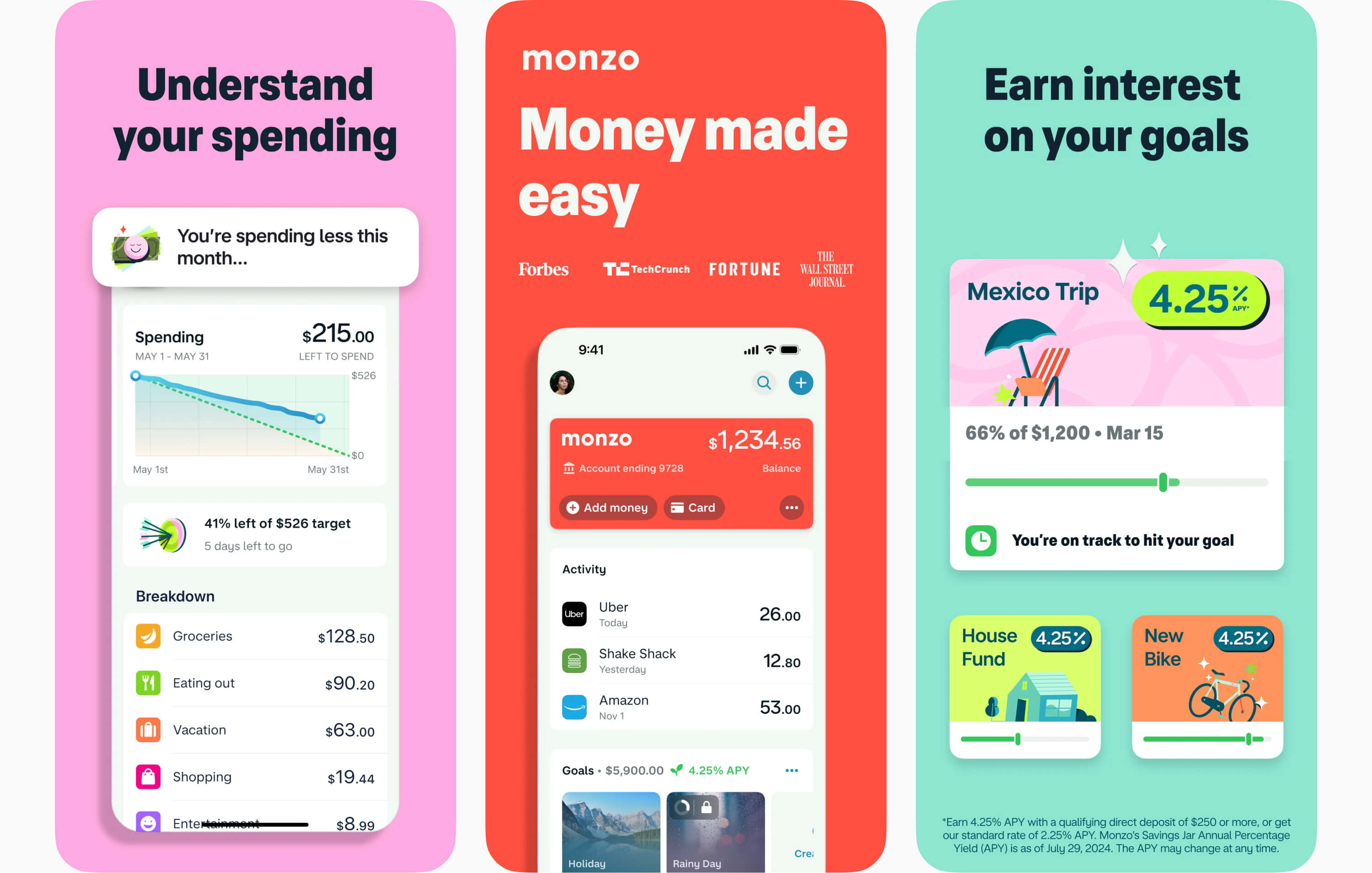

A perfect example of emotional design is the Monzo Bank mobile app, which employs friendly language, engaging visuals and intuitive interfaces to make banking feel less like a chore and more like a personalized service. Monzo's approach has not only attracted a massive user base but also fostered a community of loyal customers who act as brand advocates.

Here are the top 10 UX design principles that can transform financial apps into user-centric digital powerhouses:

1. Embrace Emotional Design: Beyond Functionality

Imagine your financial app as a trusted companion rather than just a tool. Users should feel understood, valued and cared for. Emotional design involves employing colors, typography and micro-interactions to create a warm and engaging environment. For instance, Monzo uses playful animations and personalized greetings to make users feel welcomed and appreciated every time they open the app.

2. Simplify Complexity: The Zen of Finance

Financial matters are inherently complex, but your app shouldn’t be. Strive for simplicity in both design and functionality. For example, Robinhood has simplified the complexities of stock trading into an intuitive and easy-to-use interface that even beginners can navigate effortlessly. Simplicity is not just about aesthetics; it's about ensuring clarity and ease of use.

3. Personalize the Experience: Tailored to Perfection

One-size-fits-all approaches are outdated. Personalization is a key for relevance. Utilize AI and machine learning to tailor content, notifications and advice to individual users. For instance, the personal finance app Clarity Money offers personalized insights and recommendations based on the user's spending habits, creating a uniquely tailored experience for each user.

4. Create Trust: Transparency is Gold

Trust is fundamental in financial services. To foster it, design for transparency by providing clear, concise information and straightforward navigation. Highlight security features prominently and provide explanations for complex processes. A study by Accenture found that 18% of customers switched providers due to a lack of trust. Effective trust-building can be achieved through clean, uncluttered interfaces and straightforward language.

5. Foster Engagement: Keep the Conversation Going

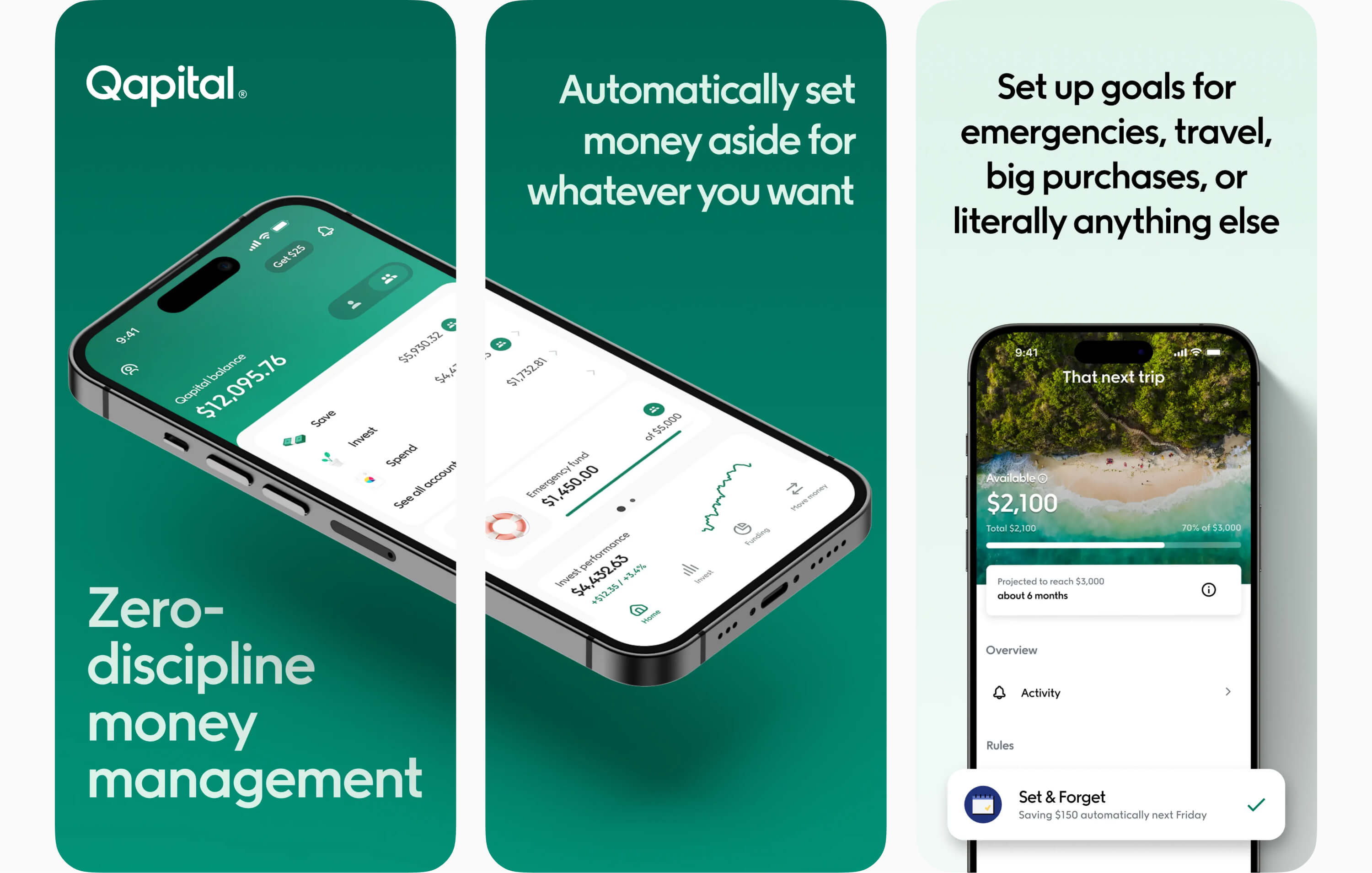

Engagement is an ongoing conversation, not just a one-time event. To keep users actively involved, incorporate gamification and interactive features. For example, the app Qapital uses goal-setting and reward systems to make saving money a fun and interactive experience. This continual engagement helps build habits that are crucial for fostering long-term loyalty.

6. Design for Accessibility: Inclusion by Design

Accessibility isn't an option; it's a requirement. Design your app to be usable by everyone, including those with disabilities. This includes using clear and readable fonts, providing text-to-speech options and ensuring color contrasts meet accessibility standards. For example, Apple's financial app, Apple Card, integrates these principles effectively, delivering an inclusive experience for all users.

7. Iterate Based on Feedback: The Agile Approach

Your users are your best critics. Implement a feedback loop in which user input directly shapes design improvements. Regularly update your app based on this feedback to meet evolving user needs. For instance, Spotify continuously refines its app using real-time user feedback, setting a standard for responsive design.

8. Prioritize Security: Peace of Mind

Security should be woven into the fabric of your app's UX. Ensure that security measures are visible and understandable. Use biometric authentication and provide users with control over their security settings. For instance, Revolut offers real-time transaction alerts and easy-to-access security features, giving users peace of mind.

9. Facilitate Learning: Educate and Empower

Financial literacy is low; your app can change that. Integrate educational resources and tools to empower users to make informed decisions and improve their financial well-being. Acorns does this exceptionally well by providing educational content that helps users understand investing basics, making the app both a tool and a learning platform.

10. Design for Delight: Surprise and Enjoyment

Delight is the secret sauce of exceptional UX. Small, unexpected moments of joy can transform the user experience. Think of incorporating delightful animations, playful interactions and rewarding feedback. The budgeting app YNAB (You Need A Budget) delights users with its fun, quirky interface and rewarding progress tracking, turning budgeting into an enjoyable experience.

Best Practices: Strategic Product Design Examples

The good news is that some financial companies are already adopting these UX design principles, elevating financial experience to new heights. Here are some standout examples and best practices in the banking industry where institutions have leveraged unique UX design principles to create hype, transform user experiences and increase ROI:

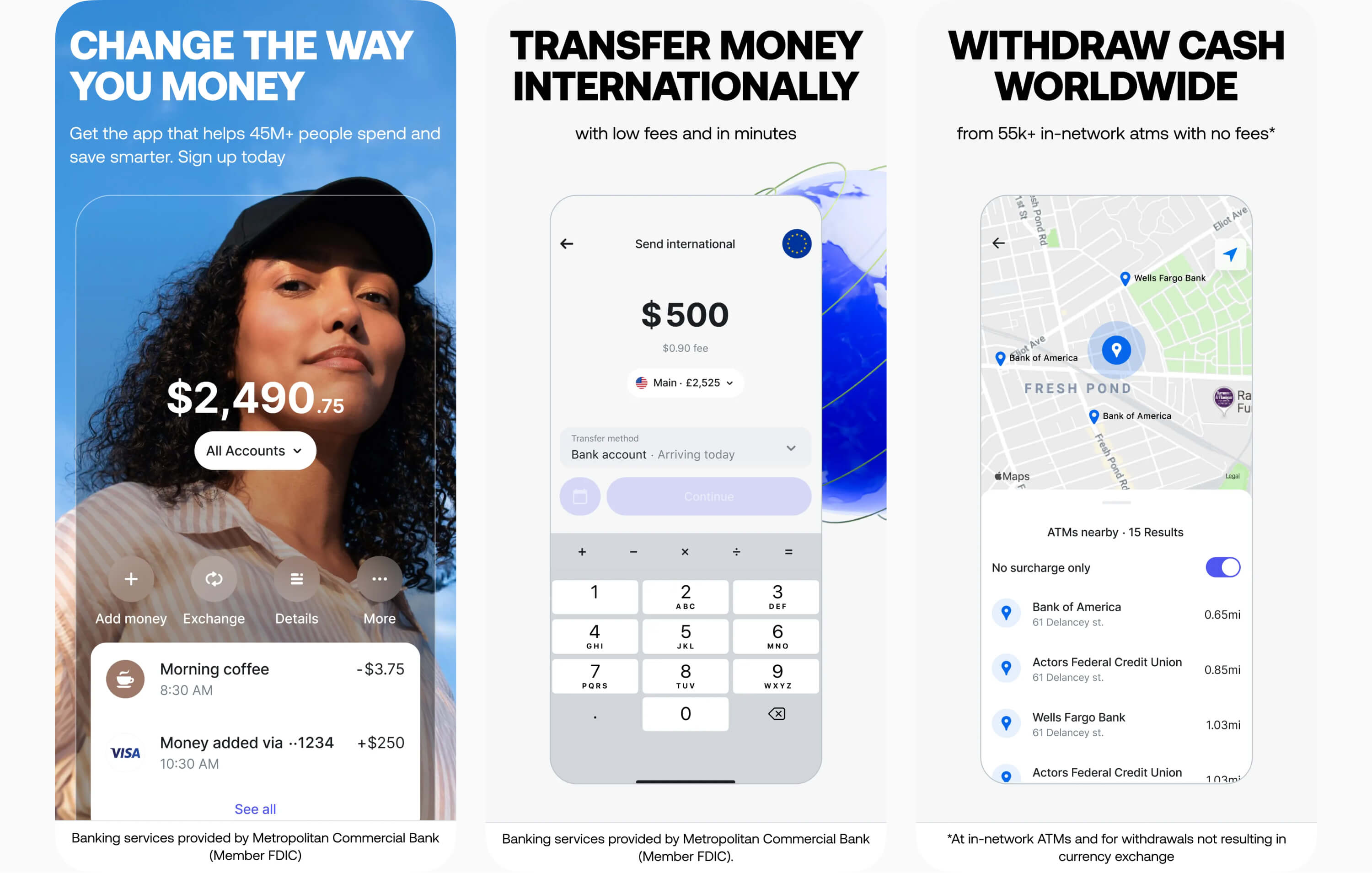

Revolut: Real-Time Notifications and Control

Revolut has revolutionized the banking experience with its real-time transaction notifications and extensive security features. Users receive instant alerts for every transaction, enjoying peace of mind and control over their finances. Additionally, the app allows users to freeze and unfreeze their cards instantly, set spending limits and enable location-based security, making it a powerful tool for managing and protecting their finances.

Monzo: In-App Community and Transparency

Monzo has created a unique community environment within its app by integrating a forum in which users can discuss features, share feedback and even vote on upcoming features. This level of transparency and user involvement in product development strengthens loyalty and fosters a sense of community. Additionally, Monzo provides detailed transaction breakdowns and instant notifications, enabling users to easily track their spending in real-time.

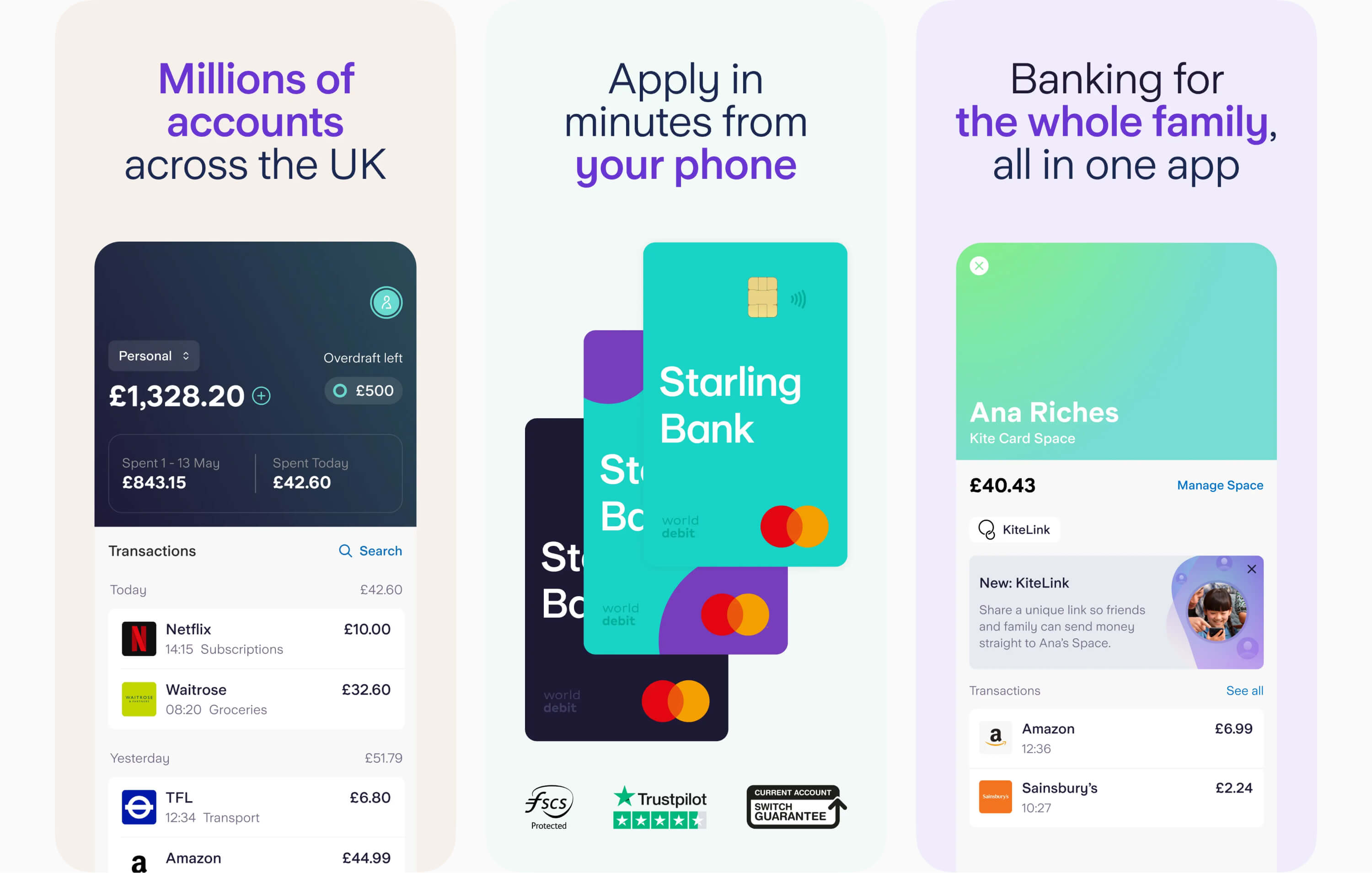

Starling Bank: Seamless Integration and Versatility

Starling Bank has focused on creating a versatile and integrative platform. Its marketplace enables users to link their accounts with various financial services and tools, from investment platforms to insurance providers. This seamless integration offers users a holistic view of their finances and enhances the app’s utility beyond traditional banking.

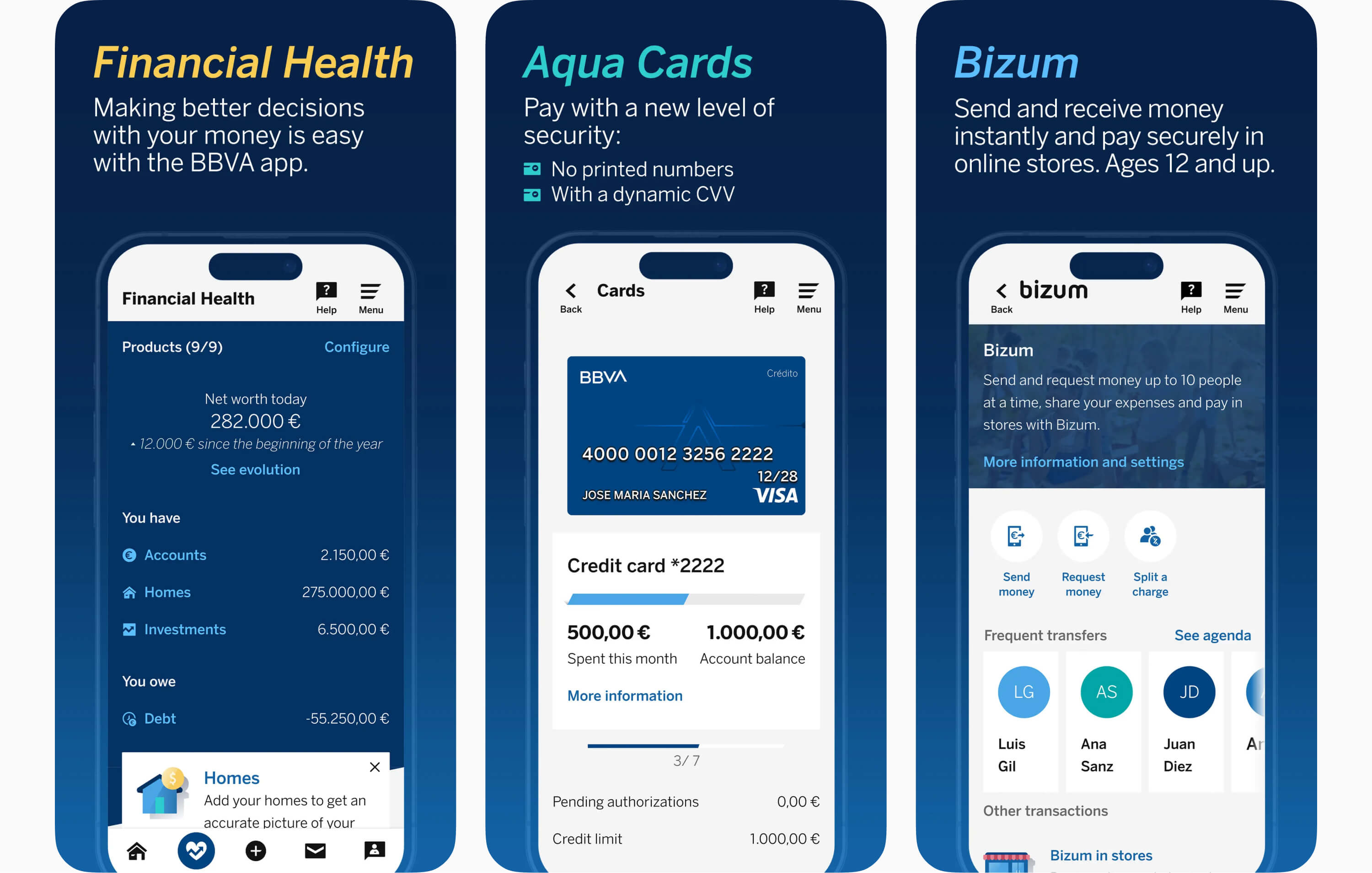

BBVA: Gamification and Financial Health Tools

BBVA has incorporated gamification elements into its app to boost user engagement and promote better financial habits. The app offers a financial health tool, “Bconomy,” that provides users with scores and insights into their financial behavior, along with personalized advice for improvement. These elements make financial management more interactive and empowering, helping users make informed decisions.

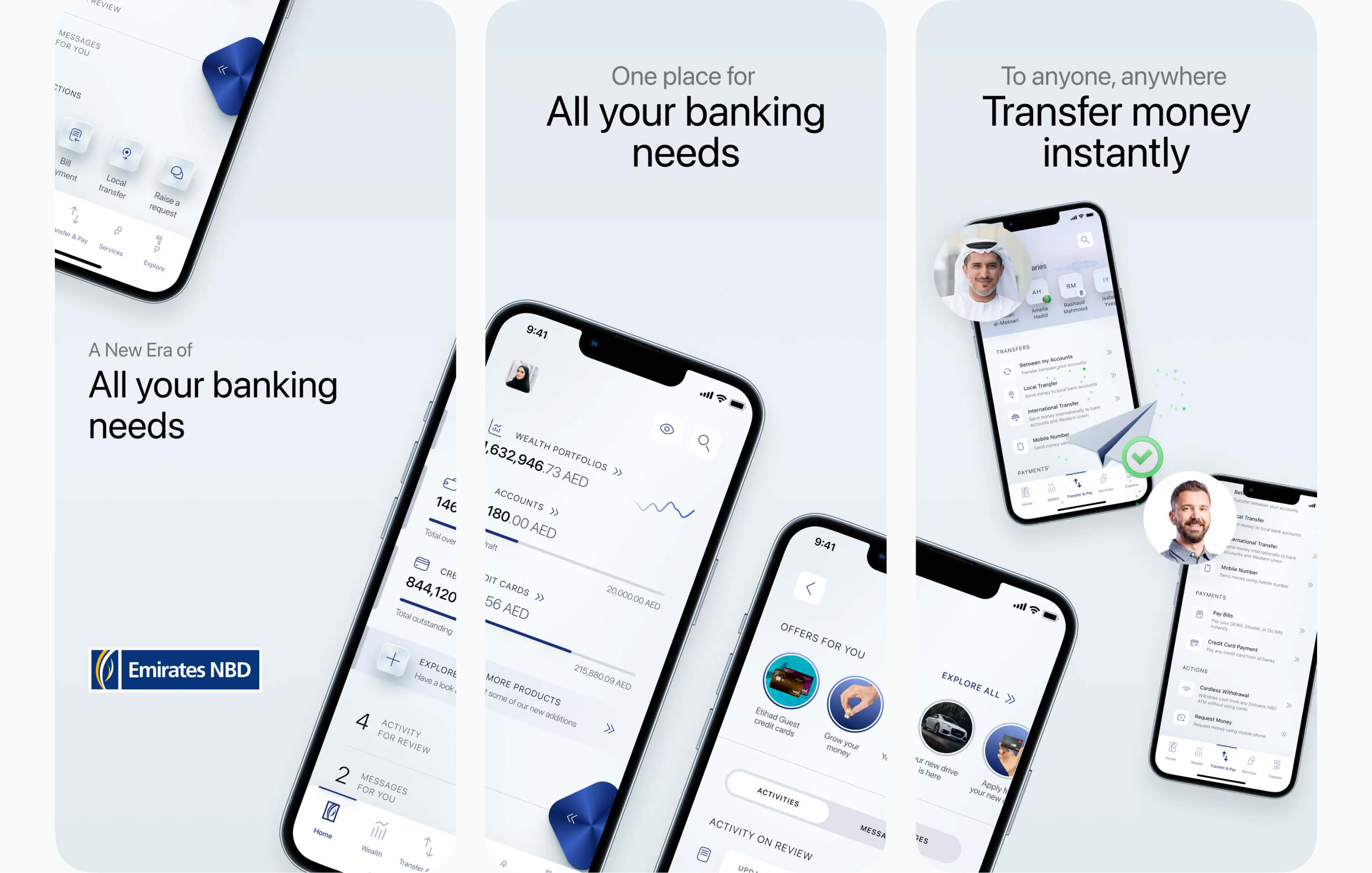

ENBD X: Premium Digital Banking Experience

ENBD X by Emirates NBD sets a new standard for digital banking in the MENAT region, reflecting the luxury and innovation of Dubai. The app combines everyday banking with wealth management in a sleek, user-friendly platform. With 200+ banking features including personalized financial insights, a self-service hub and proactive communication, ENBD X enhances the user experience, making it a preferred choice for managing finances and investments.

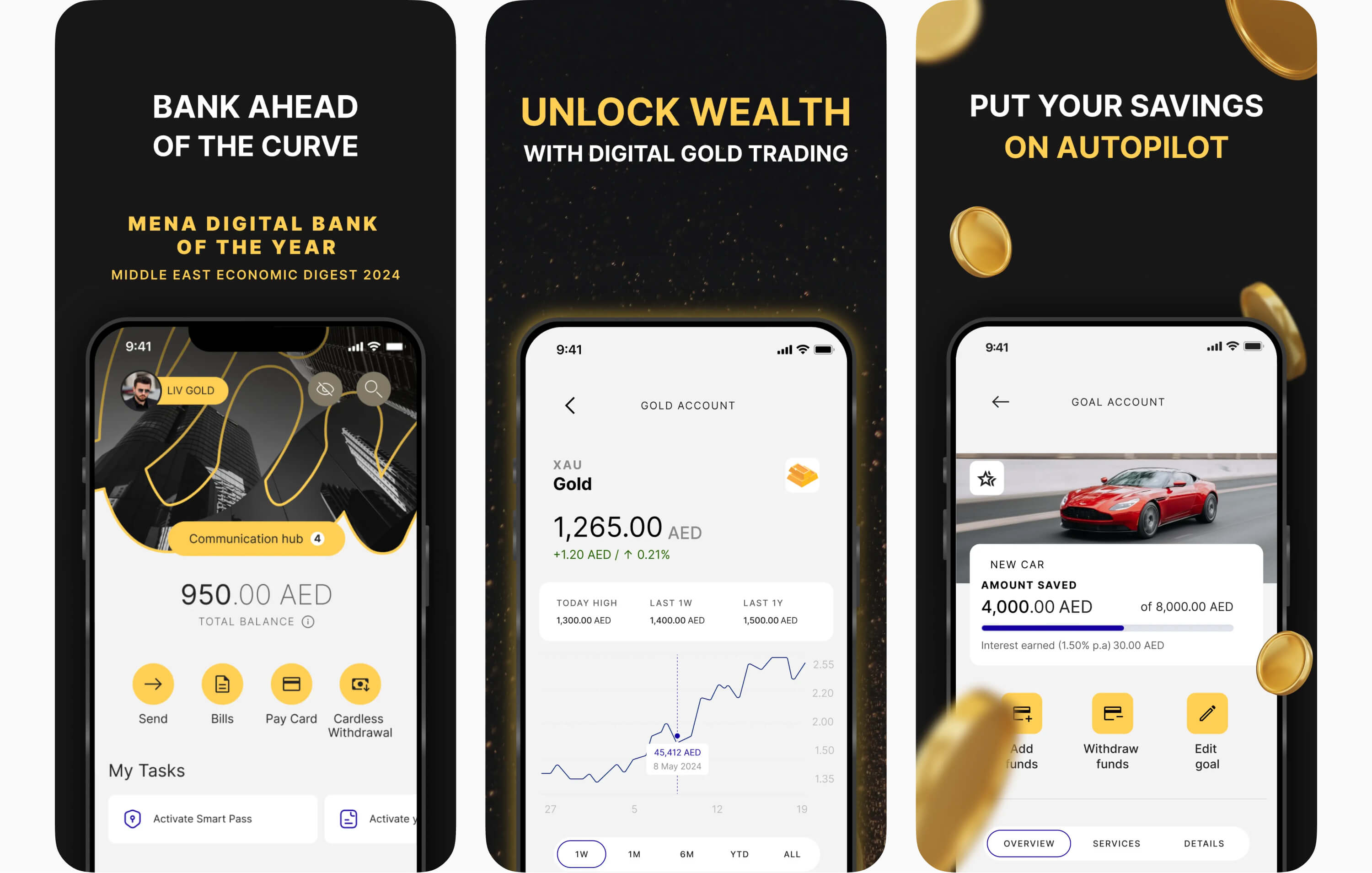

Liv by Emirates NBD: Millennial-Focused Banking

Liv Digital Bank, another product from Emirates NBD, is tailored specifically for millennials. It features a vibrant, social media-like interface that makes banking feel less formal and more engaging. Liv X app allows users to open accounts in minutes, track their spending visually and even split bills with friends effortlessly. The app’s social and interactive design has made it a favorite among younger users.

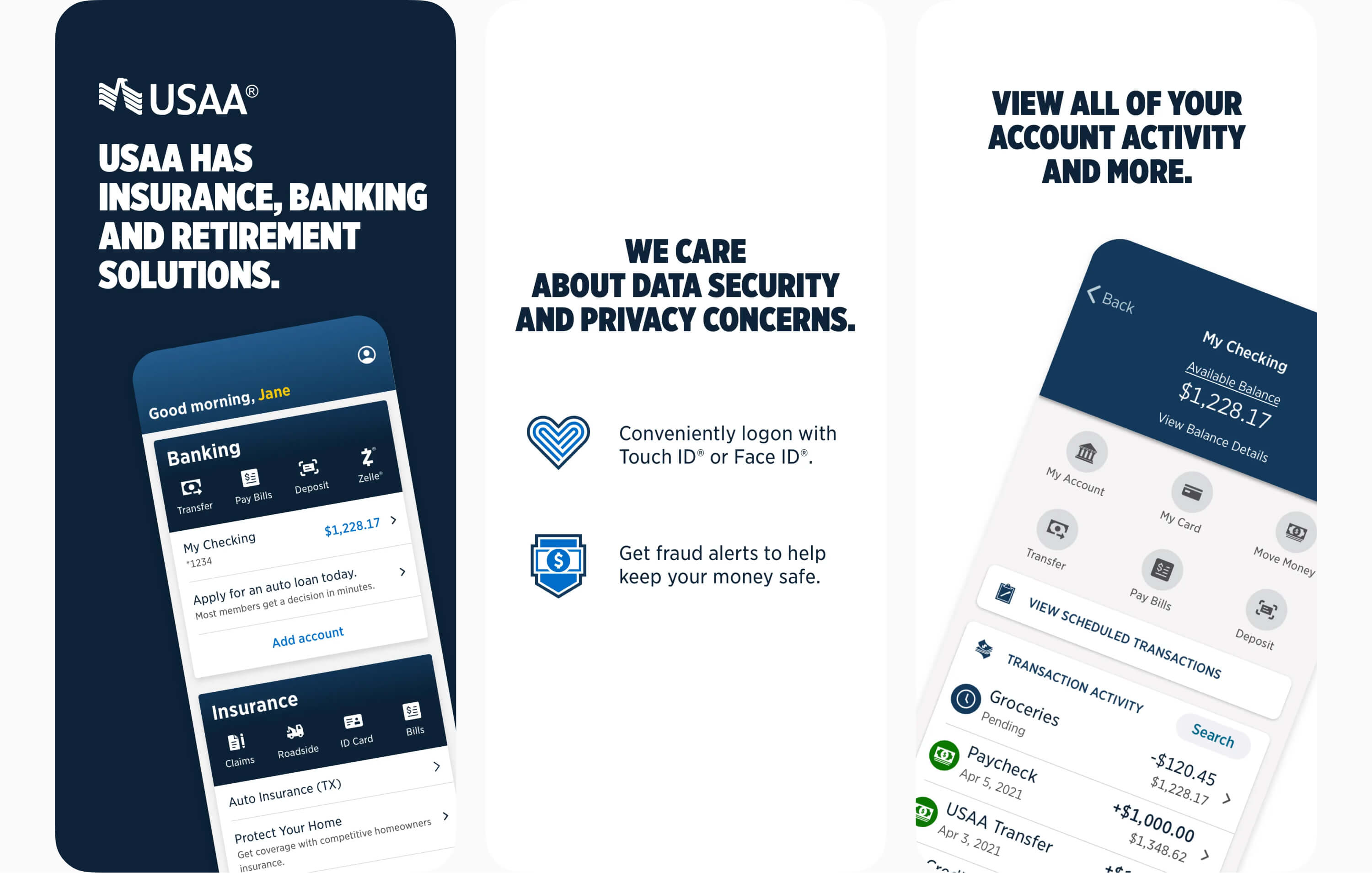

USAA: Voice and Biometric Authentication

USAA has been a pioneer in implementing advanced authentication methods, such as voice and biometric recognition. These features enhance security while also providing a seamless and convenient user experience. The app’s design integrates these security measures without compromising usability, making it both safe and user-friendly.

Capital One: Eno Virtual Assistant

Capital One has introduced Eno, a virtual assistant powered by AI that helps users manage their finances. Eno provides real-time updates, alerts and personalized insights and even helps users track their spending and manage their accounts via text message. This level of interaction and support makes financial management more accessible and intuitive.

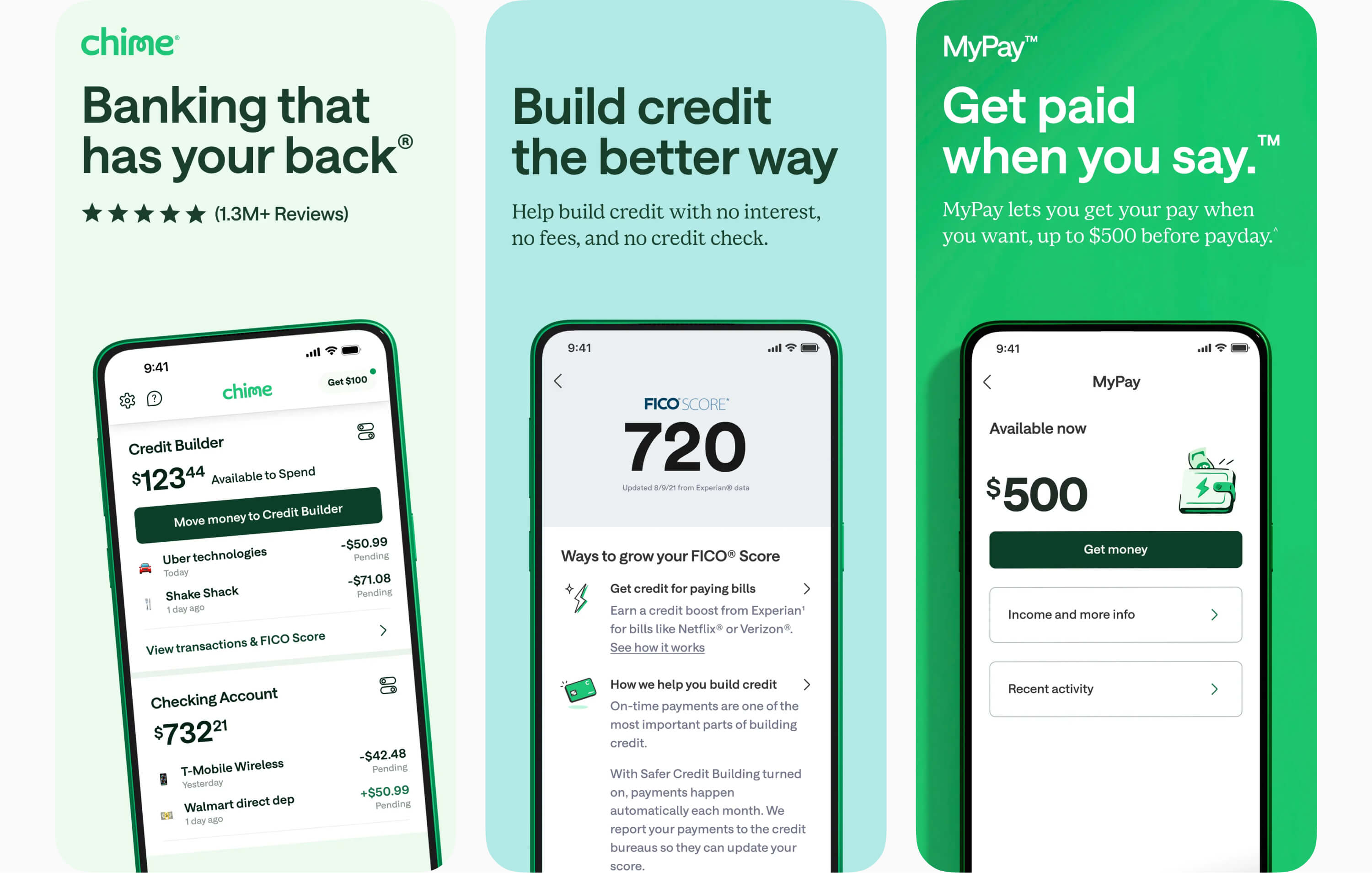

Chime: Automated Savings and Early Paydays

Chime has gained attention with features like automated savings and early access to paychecks. The app automatically rounds up transactions to the nearest dollar and transfers the difference to a savings account, making saving effortless. Additionally, Chime offers early direct deposit, giving users access to their paychecks up to two days early.

Qapital: Goal-Oriented Saving and Expense Tracking

Qapital has built its brand around goal-oriented saving and comprehensive expense tracking. Users can set financial goals and automatically allocate funds toward them in 15+ different ways. This focus on goals and tracking makes financial management more proactive and personalized.

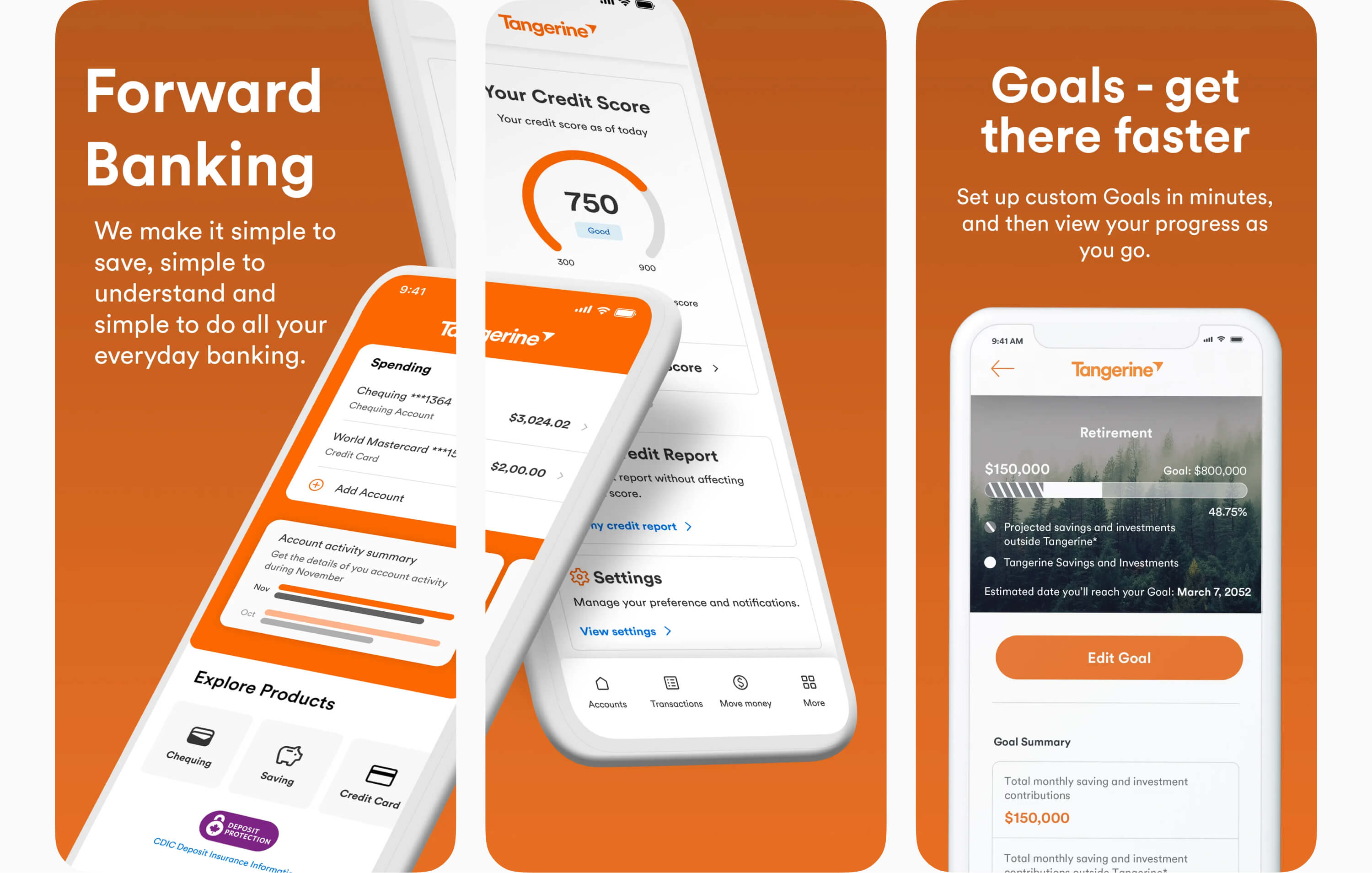

Tangerine: Personalized Financial Insights and Recommendations

Tangerine offers a feature that provides users with personalized financial insights and recommendations based on their spending habits. This feature helps users make better financial decisions and manage their money more effectively, significantly enhancing the overall user experience.

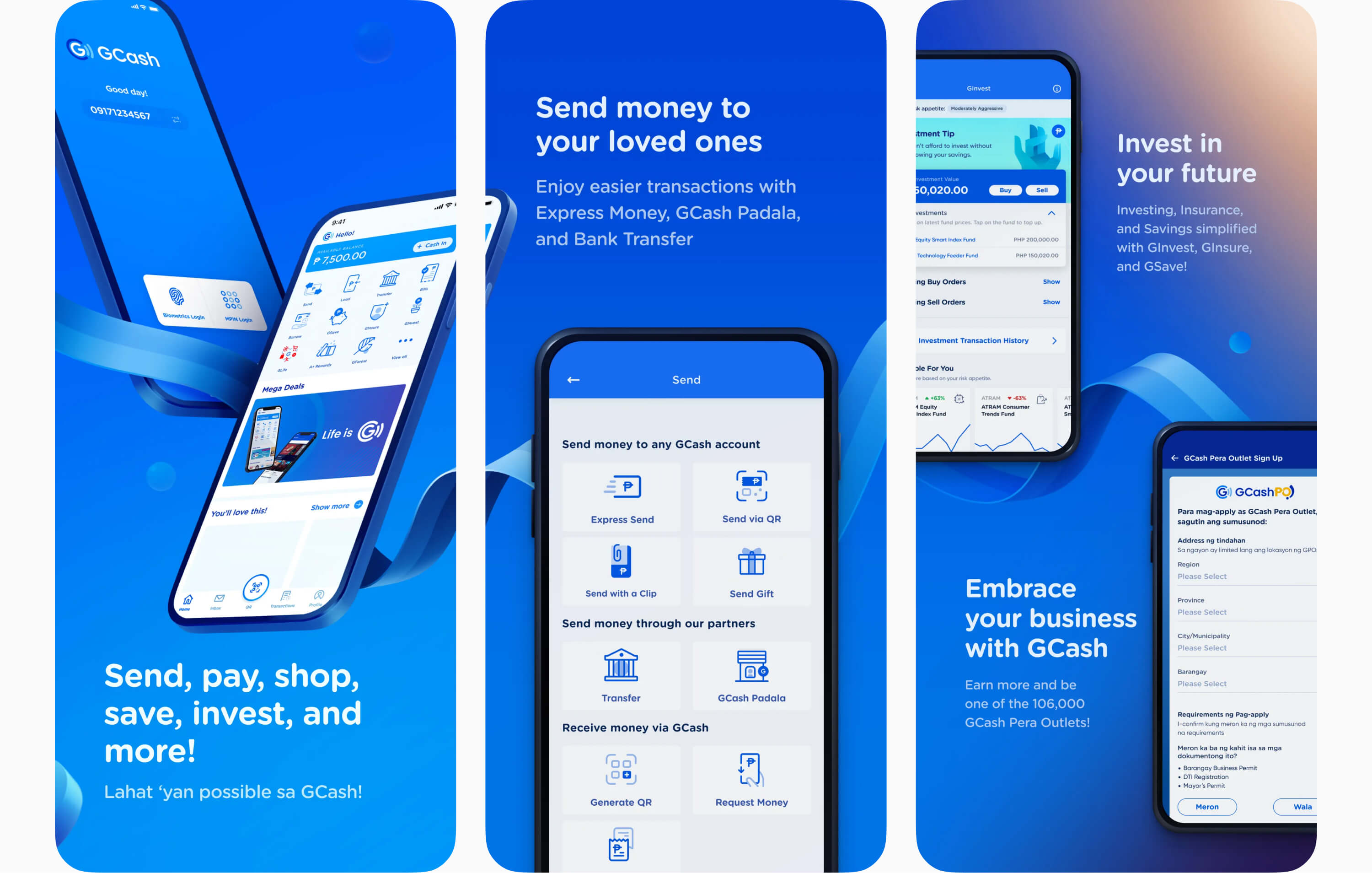

Gcash: Inclusive Digitalisation of Finance in Philippines

Gcash has transformed from a simple e-wallet into a comprehensive financial super app in Southeast Asia. It combines payments, savings, investments, insurance and lending in one platform. The super app’s user-friendly design and accessibility have empowered 90 million Filipinos to participate in the digital economy, especially in regions with limited access to traditional banking services.

bineo: Making Digital Banking Safe

bineo, launched by Banorte, is Mexico’s first licensed fully digital bank, designed with a deep understanding of local cultural and financial practices. The app features intuitive navigation and personalized financial tools, such as its "Pockets" savings feature, which aligns with the traditional Mexican habit of saving money physically. By focusing on customer-centric design, bineo ensures that users can easily manage their finances, set savings goals and track their progress in licensed banking services provided by Mexico’s largest banking group.

myt.money: Lifestyle Support and Financial Innovation

myt.money has evolved into a comprehensive financial and lifestyle super app designed to modernize banking in Mauritius. The app integrates a wide range of services, including payments, savings, investments, insurance and more, alongside everyday lifestyle needs like bill payments and ticket bookings. Its intuitive design and personalized financial insights empower users to seamlessly manage both their finances and daily activities, making it an essential tool for the modern Mauritian user.

Conclusion: Strategic Product Design Pays Dividends

Taking into account the shift from physical branches to digital platforms and the changing dynamics of the banking industry, product design and user experience (UX) are poised to become the main factors driving bank profitability in the future for several interconnected reasons.

First and foremost, as banks continue to operate primarily through digital channels, the user experience will be the most direct and impactful touchpoint between the bank and its customers. Unlike in the past, where a bank's physical presence, customer service at branches and personal relationships with bank staff played a central role in building trust and loyalty, these elements are now largely replaced by the digital interface. This makes UX the key factor in customer satisfaction, loyalty and, ultimately, retention. A well-designed, user-friendly digital product encourages customers to engage more frequently and deeply with the bank’s services, increasing the lifetime value of each customer.

Moreover, in a landscape where financial services are increasingly commoditized, and where numerous Fintech startups and digital-only banks are offering similar financial products, the differentiation factor will be the quality of the user experience. Banks that invest in superior product design and UX will stand out in a crowded market. They will attract not only tech-savvy customers who demand seamless digital interactions but also those who may otherwise be drawn to Fintech competitors. This differentiation will be crucial in driving customer acquisition and retention, both of which are critical for profitability.

Additionally, a superior UX directly influences operational efficiency and cost reduction. A well-designed digital product minimizes the need for extensive customer support, reduces the occurrence of errors and streamlines processes such as onboarding, account management and transaction handling. This operational efficiency translates into lower costs for the bank, which, combined with higher customer satisfaction and retention, leads to improved profitability.

The personalization capabilities offered by advanced product design and UX also play a significant role in enhancing profitability. By leveraging data analytics and AI, banks can tailor their offerings to meet individual customer needs, creating more personalized and relevant financial experiences. This not only increases the likelihood of cross-selling and up-selling but also enhances customer loyalty, as customers feel that their bank understands and anticipates their needs. Personalized services delivered through a well-designed UX create additional revenue streams and strengthen the relationship between the bank and its customers.

Furthermore, as banking becomes more embedded in everyday digital ecosystems—integrating with e-commerce platforms, social media and other online services—the user experience will be crucial in determining how seamlessly a bank can fit into these ecosystems. Banks that can offer a frictionless experience across various digital touchpoints will be better positioned to capture value in these integrated environments, thereby increasing their profitability.

Finally, in a future where technology continues to evolve rapidly, banks that prioritize product design and UX will be better equipped to adapt to new technologies and customer expectations. The ability to quickly iterate and improve digital products based on user feedback and technological advancements will be a key competitive advantage. This agility will allow banks to continuously enhance their services, maintain customer engagement and stay ahead of competitors, all of which are essential for long-term profitability.

As the banking industry becomes increasingly digital, product design and UX are not just important—they are central to a bank’s ability to generate profit. These factors determine how effectively a bank can attract, engage and retain customers, manage operational costs, differentiate itself in a competitive market and adapt to future technological changes. Banks that excel in product design and UX will be the ones that thrive in the digital age, turning these elements into the main drivers of their profitability and digital ROI.

Get UXDA Research-Based White Paper "How to Win the Hearts of Digital Customers":

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedin