The Metaverse will become the next global milestone after the digital transformation in the next few decades and the first spatial computer Vision Pro by Apple is evidence that the largest corporations are making key bets here. It is, in fact, the transition of the internet from a two-dimensional experience into a multi-dimensional one, which will require a significant creative effort. This new world will lead to the fast development of a creative economy. The main task for financial services is to bridge the online and offline financial experience that will merge real and virtual assets. And, this is already happening.

What is the Metaverse, and How Does it Bring the Creative Economy to the Forefront?

After Facebook was renamed Meta in the fall of 2021, the whole world started talking about the development of the metaverse. But, in the spring of 2022, the hype began to wane, and the global focus of attention was taken over by the war and the global energy crisis. Of course, it is still very early to talk about a full-fledged metaverse, but the metaverse user experience is already available and is sure to create a new economy within the next decade.

The metaverse is an interconnected collective virtual space of digitally enhanced surroundings that use virtual reality (VR) and augmented reality (AR) to provide consumers with a variety of immersive experiences as a digital extension of the real world. It is an independent virtual economy enabled by digital currencies, non fungible tokens (NFTs) and other digital assets.

The metaverse will evolve as a digital universe for personal, business and financial interactions that will merge real and virtual assets.

According to Citibank experts' forecast, the metaverse will become the next iteration of the internet, or Web 3.0. Such an “Open Metaverse” would be community-owned, community-governed and a freely operable version that would ensure privacy. Users will access a host of use cases, including commerce, art, media, advertising, healthcare and social collaboration. It will be accessible via personal computers, game consoles, smartphones and VR and AR headsets. Using this broad definition, the total addressable market for the metaverse could be between $8 trillion and $13 trillion by 2030, with the total metaverse users numbering around five billion.

If these predictions come true, the metaverse will create the third largest economy in the world in terms of GDP after the United States and China.

The key to the development of the metaverse and the new digital reality is creativity, which will drive the global economy of the digital age. It will transform the metaverse into an alternative world that captures the imagination and attracts billions of people.

Creativity is the essential foundation of human nature. Without creativity, it is impossible to imagine the development of the individual, society and humanity. For the first time in history, with the advent of digital technology, and later the metaverse, the creative economy moves to the forefront and gets the recognition it deserves.

A creative economy, according to Wikipedia, is based on people employing their creative imagination to increase the value of an idea. John Howkins wrote a book in 2001 to describe economic systems in which value is based on innovative creative characteristics rather than traditional resources, such as land, labor and capital. Unlike creative industries, which are limited to specific sectors, the term "creative economy" refers to creativity throughout the economic system.

The main question is how this new world will operate and on what principles it will be built. Technologies of the metaverse will not only be able to bring financial services to a new technological level, but will force a rethinking of finance by expanding the process, objects and subjects of transactions.

The Creative Economy is Already Making Millions for its Adepts

Millions of people are already creating the metaverse today. Despite there being only 30 million VR headsets in use, at the moment the most popular metaverse predecessors are online games, such as Fortnite, Roblox and Minecraft, with half a billion total users.

Fortnite is an online battle game of the virtual world with many experiences. A Travis Scott Fortnite concert during COVID lockdown in 2020 had 27.7 million unique attendees, far more than a typical concert venue can accommodate. Scott raked in roughly $20 million from Fortnite for the five digital concerts, each lasted 10 minutes.

Another example, and one of the most successful players in the metaverse world, is Roblox. Founded in 2004, the platform has 47 million daily active users globally and 9.5 million developers building out user-created worlds and games.

The Sandbox is the largest virtual world in terms of transaction volumes, with 65,000 transactions in virtual land totaling $350 million in 2021. The same year, Decentraland became the second largest, user-owned, Ethereum-based virtual world with 21,000 real estate transactions worth $110 million, raising virtual real estate prices by 700%. The most expensive real estate plot in Decentraland was Fashion Street Estate, sold for $2.42 million. In August 2022, Decentraland announced its plans to launch the world’s first metaverse ATM. The Transak metaverse ATM by Decentraland is the world’s first fiat-to-crypto ATM. The initiative aims to help users easily buy MANA and other cryptocurrencies.

Global businesses, such as PwC, JP Morgan, HSBC, and Samsung, have already snatched up plots of virtual land, which they intend to develop for a variety of purposes. DBS became the first Asian bank to partner with The Sandbox to launch DBS BetterWorld to demonstrate how the metaverse can be used as a force for good. And, even such a future-driven city as Dubai announced its Metaverse Strategy to become one of the world’s top 10 metaverse economies as well as a global hub for the metaverse community and creative economy.

From 40% to 65% of 1,004 consumers questioned by PwC in 2022 expected from the metaverse the ability to explore new places virtually; interact with health providers, customer service agents and familiar brands; attend courses/training; play video games; engage in entertainment experiences; discover and interact with new brands; explore job opportunities; interact with work colleagues; buy and sell physical products; create content for others to engage with; buy and sell digital products; use a digital wallet; and meet new people.

Digital art NFT sales volume hit $25 billion in 2021, but is the traditional economy ready for this? We've all heard about the NFT art piece called “Everydays: the First 5000 Days,” by the artist known as Beeple, that set a record for digital artwork in a $69 million sale at Christie’s in 2021.

“Everydays: the First 5000 Days” is a collage of all the images that the artist known as Beeple has been posting online every day since 2007; via Christie’s

But hardly anyone has heard of crypto-artist Ilya Borisov, from Europe, who in the same 2021 became one of the most famous generative artists in the world, selling 3,557 NFT paintings for 8.7 million euros and now can't pay his utilities because his bank account was arrested six months ago by the police. He could face up to 12 years in prison due to his enormous income that cannot be explained by state officials other than as "money laundering on a large scale" despite the fact that he's paid taxes on it.

In a creative economy, artists, designers, and digital developers who profit from every sale and resale of the digital assets they create will become the new multimillionaires. The expansion of objects available for digital monetization will result in anyone being able to create value in the metaverse─total democratization of finance. Crypto artists and crypto investors create enormous wealth in months, but it seems that the potential of new technologies are still too unexpected and suspicious to be accepted by the traditional economic system.

Integration with traditional financial institutions is a significant issue in the metaverse development. Fiat money, and thus conventional financial institutions, will link digital assets and cryptocurrencies to real-world economics. Therefore, the speed of development of the creative economy depends on how accessible and user-friendly financial services will be in the metaverse.

Without this integration, the first pioneers of the metaverse are more like outlaws. Unfortunately, today we see that tax and banking services lack competence, experience and regulations for dealing with crypto wealth.

Traditional Business Executives are Also Preparing for the Metaverse

Gartner expects that, by 2026, 25% of people will spend at least one hour a day in the metaverse for work, shopping, education, social media and/or entertainment. According to the McKinsey forecast, the metaverse may generate up to $5 trillion in value by 2030.

Accenture report “Technology Vision 2022: Meet Me in the Metaverse” indicates that 98% of executives believe continuous technological advances are becoming more reliable than economic, political or social trends in predicting their organization’s long-term strategy. Seventy-one percent of global executives state that the metaverse will positively impact their organizations, with 42% believing it will be a breakthrough or transformational.

Technologies of the metaverse are already available and being used right now. In 2018, the Chinese news agency, Xinhua, unveiled a virtual newsroom with an AI news anchor who can deliver breaking news to audiences 24 hours a day.

In PwC’s "2022 US Metaverse Survey" of over 1,000 US business leaders, 50% call the metaverse exciting, and 66% of company leaders report that they’ve moved beyond the metaverse experimentation by building proofs of concept, testing use cases and even generating revenue from the metaverse. Eighty-two percent of executives expect the metaverse to become a part of their business activities within three years.

According to PwC research, more and more companies are hiring talent focused on the metaverse and digital assets, along with investing in metaverse-associated technology. Almost half of the respondents believe hiring people with skills in metaverse-related areas is a top priority for capitalizing on the upcoming metaverse trend. Forty-one percent prioritize investing in relevant technology, 40% are ready to research customers to define potential use cases, and 39% are upskilling staff in emerging technology.

Financial Services Need a Future -Forward Mindset in the Metaverse

Financial services in the metaverse will become the glue for the upcoming creative economy bridging within real and virtual assets. And the main issue is a lack of future-forward mindset that is needed to develop competence and deliver customer experience required by the growing creative economy. The growth points for financial services could include:

1. Development of Digital Competencies

Improve the financial company's in-house digital metaverse competency by adding IT and metaverse experts or consultants to the team. Find the one who has a passion for it and can lead it. Try the metaverse experience for yourself, learn about new technology, forecast the metaverse impact on your business, and generate appropriate digital and customer experience strategies.

2. Implementation of Disruptive Inner Culture

Financial brands can keep up with digital innovations if they adopt a flexible disruptive culture. This way of thinking and operating allows us to step out of the box and adapt to any new technology and customer trends. Each employee in such a culture is open-minded to constantly reinventing the customer experience, bringing it to a new level and offering a solution that's way more usable and enjoyable than any other alternative on the market.

3. Tracking Customer Expectations

To be ready to adapt, it's essential to constantly monitor and detect changes in customers' digital behavior and have the technological resources to adapt quickly and efficiently. By staying alert to rising changes in customers' needs, the companies should be able to prepare in advance and react in time, thereby expanding their digital solution to new platforms and providing customer-demanded solutions.

4. Attention to an Existing Experience

It's important to remember that many financial brands are focused on upcoming digital trends in a rush for an outstanding competitive advantage. But first, we must ensure that the existing service is well thought out and executed to keep users safe from friction and frustration. Using the example of the European NFT artist, it didn't take innovative technology to serve a legal client worth $10 million, just a bit more competence and attention. Often you can do a lot to improve the customer experience and become human-centered even before adopting innovative technologies.

5. Revision of Business Legacy

People's habits and outdated ways of thinking often prevent them from seeing new possibilities. In financial services, it makes sense to practice an experience-centered mindset throughout the entire organization with the courage to challenge the legacy mentality. This will organically make the financial brand team focus on serving customers and be open to adopting digital innovations demanded by the new generation of consumers.

Design is Here to Help

To create solutions in the metaverse, we need to develop VR/AR technology, but the main success factor is still all about the user experience. First, we need to explore VR/AR environment to understand how it affects user expectations, needs and behavior in the metaverse.

Overstepping the Limitations of the Screen

Compared to the desktop or mobile experience, volumetric VR/AR design is not limited by the screen size. Although it might be tempting to display all possible information at once, this wouldn’t be a great idea as it could cause cognitive overload and frustrate the user. In the case of VR/AR banking design, it’s especially important to remember that the main criterion for quality is simplicity.

A Perfect Match Between Realities

Both virtual and augmented reality should relate to the experience in the real world. Properly structured VR design should reduce the painful effect of a mismatch caused by the difference between the eyes’ tracked movement in virtual reality and the feeling we perceive from physical reality through our other senses.

Ensuring a Smooth In-Depth Experience

One of the most significant challenges of VR/AR banking design is user interface transition from two-dimensional (2D) to three-dimensional (3D) interactions. This requires deep adaptation of UX/UI design principles and methods for the depth of volumed space.

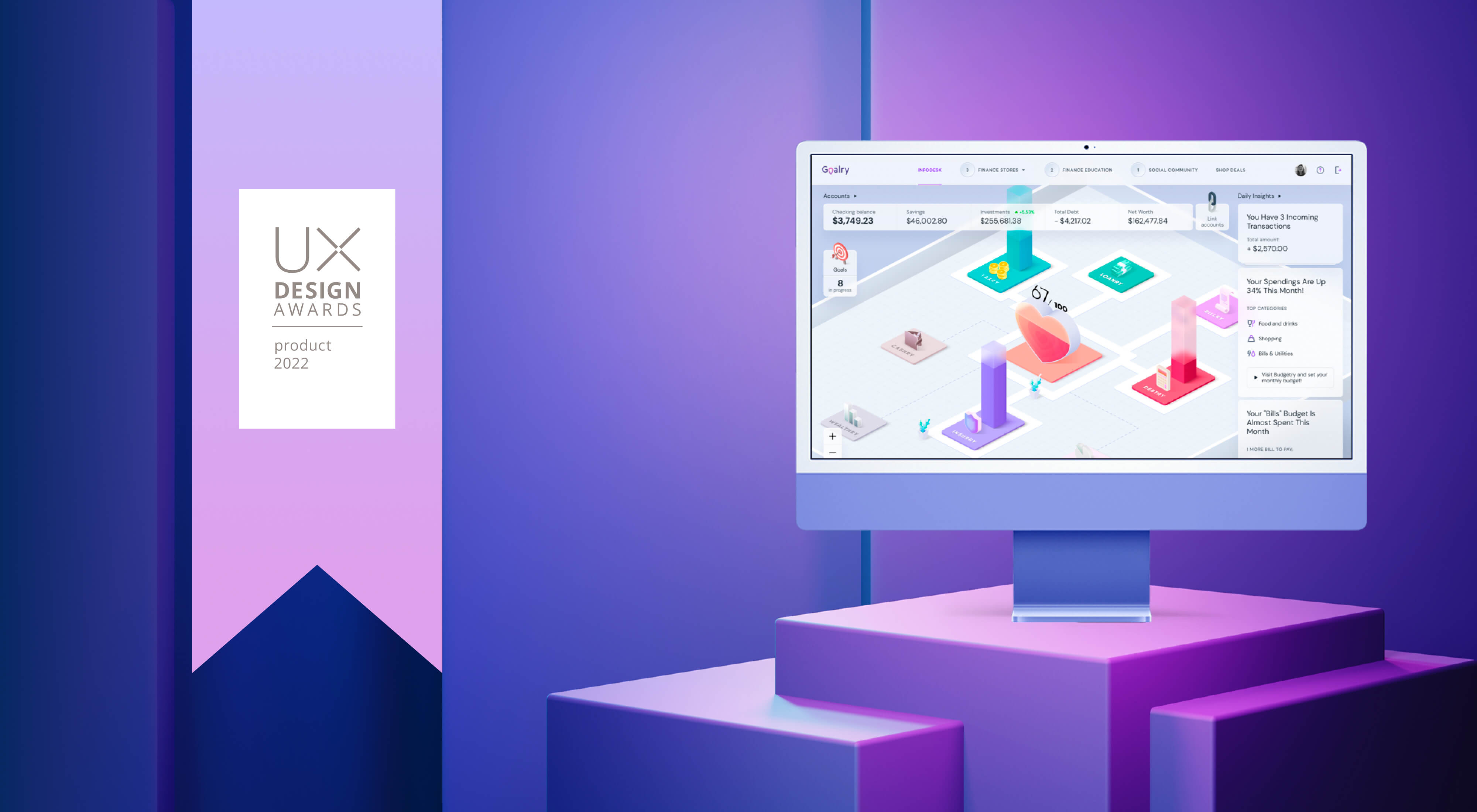

An example of creating the volumetric spatial design of financial services can be the Californian Fintech startup Goalry, developed in our agency. This innovative design stands out among the flat template financial solutions dominating the market, but its potential is marked by such famous international design awards as If Design Awards, and UX Design Awards.

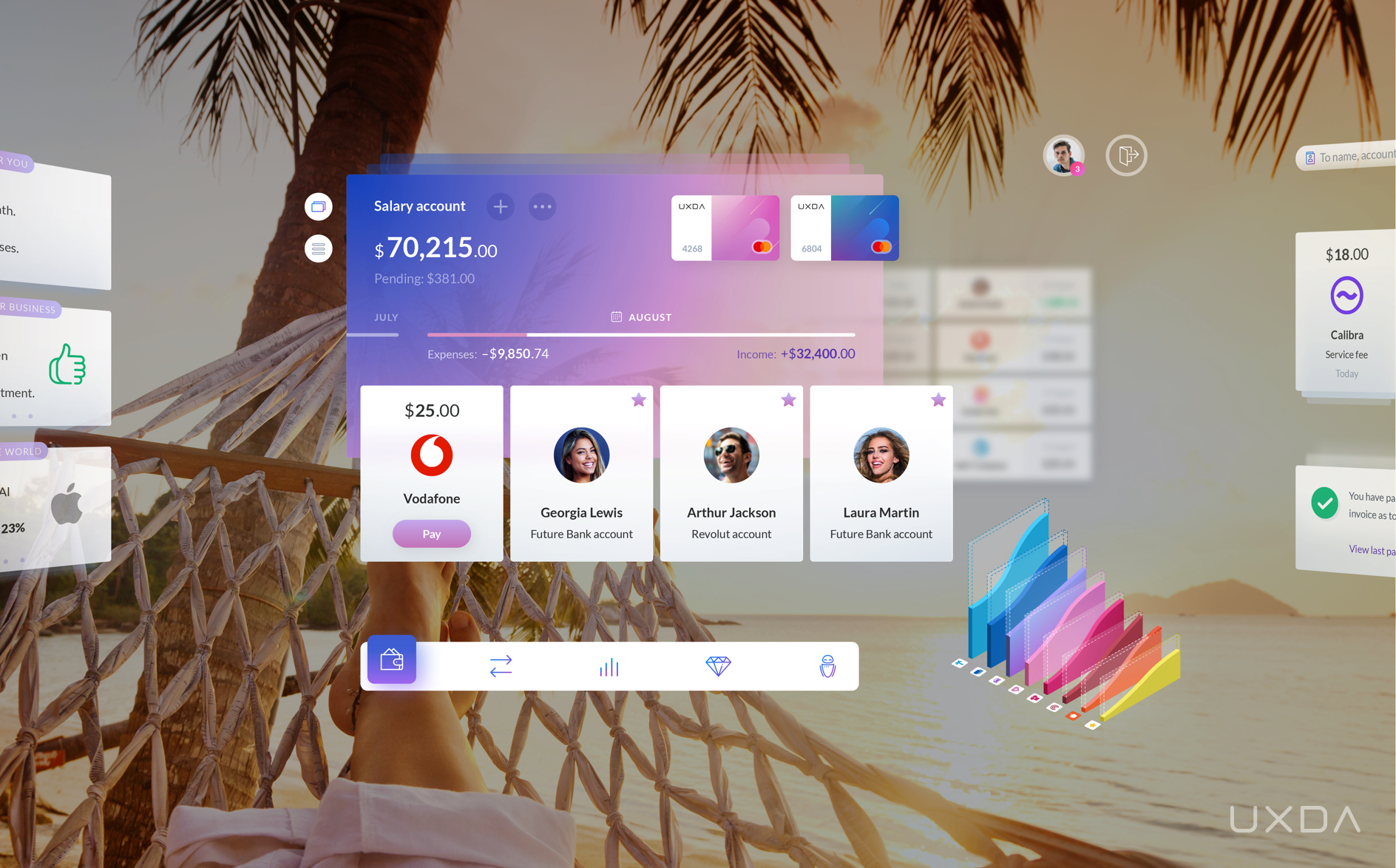

Also the team of UXDA made an attempt to adapt the banking for the full use in the metaverse. As a result, we published a case-study Metaverse Banking VR / AR Design Concept of the Future.

Conclusion

All industries are now experiencing a digital transformation. Digital services are shaping consumer needs and behavior through digital channels. Such digitalization has created a new paradigm in which emotions and experience dominate economic relationships.

Consumers are hungry for engaging experiences. As a result, the creative economy has become the main value driver in the modern world.

In the creative economy, people don’t just buy and sell products, services or features. They value the experiences and emotions behind them. In the metaverse, people will pay large sums for intangible items that provide special meaning and offer relevant experiences.

According to a Dimension Data study, 84% of companies have increased their revenue by adopting a customer-centered approach. A McKinsey study shows that customer experience leaders increase company revenues by 10-15%, have higher customer satisfaction scores, reduce service costs by 10-20% and increase employee satisfaction.

According to Deloitte, the creative economy is likely to be a key driver of economic growth over the long term, so there is no doubt about the role of financial services in this development. Today we already see the active participation of Fintech in the metaverse technologies and other digital innovations supporting the creative economy development.

To prepare for the upcoming metaverse, financial brands need to not only hire new talent and adopt new technologies but also establish an experience-driven mindset to serve a new generation of consumers in a changing environment. And the main question is, what kind of customer experience can financial services offer today to earn their place in the metaverse of tomorrow?

Get UXDA Research-Based White Paper "How to Win the Hearts of Digital Customers":

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedin