In the past decade, the banking industry has experienced seismic shifts that few traditional bankers saw coming. As a banking UX strategist with over ten years of experience designing 150+ digital financial products, I’ve witnessed firsthand how rapidly customer expectations have evolved—and how unprepared many banks were for the scale of this change.

We’ve all lived through more Black Swans in recent years than our grandparents saw in a lifetime. Pandemic. War. Inflation. Economic crisis. Geopolitical crisis. Revolutions. Tech disruption. Mass migration to the cloud. Crypto hype. AI is rewriting entire industries overnight.

What used to happen once in half a century now happens every season. And still — many banks, teams, and leaders—try to make the world predictable again. Build plans. Control outcomes. Keep things stable. Most banking strategies still aim to survive uncertainty—not thrive on it. They build stronger walls instead of smarter systems.

The truth? Stability is fragile when the world is constantly shaken by Black Swans. And they will not disappear.

Concepts from Nassim Nicholas Taleb’s Black Swan theory help explain why digital transformation took many banks by surprise—and why another powerful wave, the AI revolution, is fast approaching.

A “Black Swan” event, as Taleb defines it, is characterized by rarity, extreme impact that is only explainable in hindsight. In other words, it’s an unexpected shock that changes the rules, leaving people scrambling to explain it after the fact.

Digitalization in banking has proven to be a kind of Black Swan: an underestimated, transformative force that has upended long-held assumptions in financial services. What began as gradual tech adoption suddenly accelerated into a revolution of mobile apps, Fintech startups and Big Tech platforms offering financial features. This digital revolution not only introduced new players and technologies—it completely rewired what customers expect from their banks.

Today’s banking customers, spoiled by the likes of Amazon, Apple and Google, demand seamless digital experiences, instantaneous service and personalization on a par with the best consumer techs out there. Traditional banks, once confident in branch-centric models, found themselves blindsided by this extreme impact event in customer behavior. In Taleb’s terms, many banks had been “the turkey before Thanksgiving”—blissfully extrapolating a stable hundreds-years-old past into the future—only to be jolted by an unforeseen reality.

In this article, we will explore why digitalization became a Black Swan event for banks, dramatically widening the gap between customer expectations and what the majority of banks deliver. We’ll also examine the upcoming AI revolution as the next potential Black Swan— another wave of unpredictable change poised to reshape banking in ways we can only partly imagine.

Drawing on my experience in digital customer experience design, alongside financial industry insights and Taleb’s theory, I’ll examine why banks were caught off guard, how they’ve responded (often inadequately) and what must change for them to thrive in an era of continuous disruption. In a world in which innovation—not tradition—has become the currency of success, understanding and embracing Black Swan forces is critical for any financial institution that hopes to survive and prosper.

The Black Swan Concept: Expecting the Unexpected

By nature, banks are built for financial stability. Risk aversion is in their DNA as the number one priority. That’s what makes them trustworthy. But this very foundation—designed to ensure reliability—has become their biggest weakness in the face of digital disruption.

Taleb’s Black Swan theory provides a useful lens to understand banking’s current upheaval. A Black Swan event has three key traits: it is an outlier (unexpected, outside regular predictions), it has a massive impact, and people concoct explanations for it after it happens, as if it were predictable.

The unique thing is that in banking today, we’re not dealing with a single Black Swan—we’re facing a whole flock. While digital-first experiences like Uber, Amazon and Netflix were redefining what “good service” meant—seamless, personalized and intuitive—most banks were still busy fine-tuning their Interactive Voice Response (IVR) menus. The shock didn’t come from the evolution of technology—it came from the realization that users were no longer comparing their bank to other banks. Instead, they were comparing it to the best experiences in their daily digital routine.

The birth of the internet, the 2008 financial crisis, the rise of smartphones and the Gen AI hype are classic Black Swans—events that experts failed to foresee yet, in hindsight, seemed obvious. Crucially, Taleb argues that humans (and institutions) are wired to misjudge risk by looking only at past experiences and known variation, which leaves us blind to rare game-changers. We build plans assuming that tomorrow will look a lot like yesterday—and we’re often wrong.

In the context of banking, decades of relative stability bred a false sense of security. That comfort led many banks to believe that digital would evolve gradually, giving them time to adapt. They expected linear change—like fewer people visiting branches and steady improvements to online banking. What they didn’t expect was an exponential shift that would flip the entire business model.

Some argue that digital transformation didn’t just happen overnight—there were warning signs. And that’s true. But for many banks, the real surprise was realizing that digital isn’t just a new alternative channel. It is a whole new business platform that requires full transformation of priorities and processes. In that sense, the digital revolution became a true Black Swan—not because no one predicted it, but because its timing, speed and impact broke through every conventional expectation.

As one analogy, consider how the media industry’s swift move from print newspapers to personalized news feeds took observers by surprise. The banking sector is now undergoing an equally shocking transition from localized branch services to instant global digital finance.

Taleb’s guidance for managing Black Swan events is not to attempt precise predictions, but to build robustness and adaptability in the face of uncertainty. For banks, this means shifting focus from forecasting every technological development to becoming truly future-ready—by adopting a tech-driven mindset, adjusting strategic priorities and evolving both operating models and organizational culture. The reality is that, prior to the 2010s, few banks had invested in developing an agile, innovation-oriented environment. So when the digital disruption arrived, many institutions were unprepared—a textbook example of a Black Swan blindsiding those who had assumed it would never happen.

Digitalization: Banking’s Unlikely Earthquake

For decades, traditional banks built their businesses around physical branches, paper-based processes and face-to-face service. Change was slow, incremental and firmly controlled from the top. Then came a seismic shift: the rise of smartphones, high-speed internet, cloud computing, crypto currencies and open APIs—followed closely by a wave of Fintech startups in the wake of the 2008 financial crisis.

Suddenly, banking was no longer constrained by geography or brick-and-mortar infrastructure. Customers could manage finances from the palm of their hand, and new competitors could reach users globally without a single physical branch.

The impact is dramatic: banking moves from local to global at the speed of light. Digital-first Fintech innovators armed with mobile apps and advanced tech began offering digital-native services that were more convenient, faster and often cheaper than what incumbent banks provide. Companies like PayPal, Chime, Square, Revolut, Nubank and Wise quickly scaled across borders, reaching millions of users through platforms—not branches.

For perspective, Revolut—founded in 2015—surpassed 60 million retail customers in 48 countries in a decade. That kind of growth would’ve been unimaginable for a single bank just a decade ago. This globalization of banking mirrors what happened in the media industry: just as streaming platforms and social media made content instantly accessible across the world, mobile banking has unlocked borderless finance—shifting competition from the bank across the street to digital players around the globe.

While some industry leaders talked about “digital transformation,” few anticipated how quickly consumers would embrace these new options. The smartphone, in particular, proved to be another Black Swan catalyst. In 2007, the iPhone debuted; by the early 2010s, mobile banking apps became mainstream. Today, digital banking penetration totally exceeded branch usage—with 77% of the U.S. population preferring digital channels for banking, eclipsing the old habit of visiting bank branches.

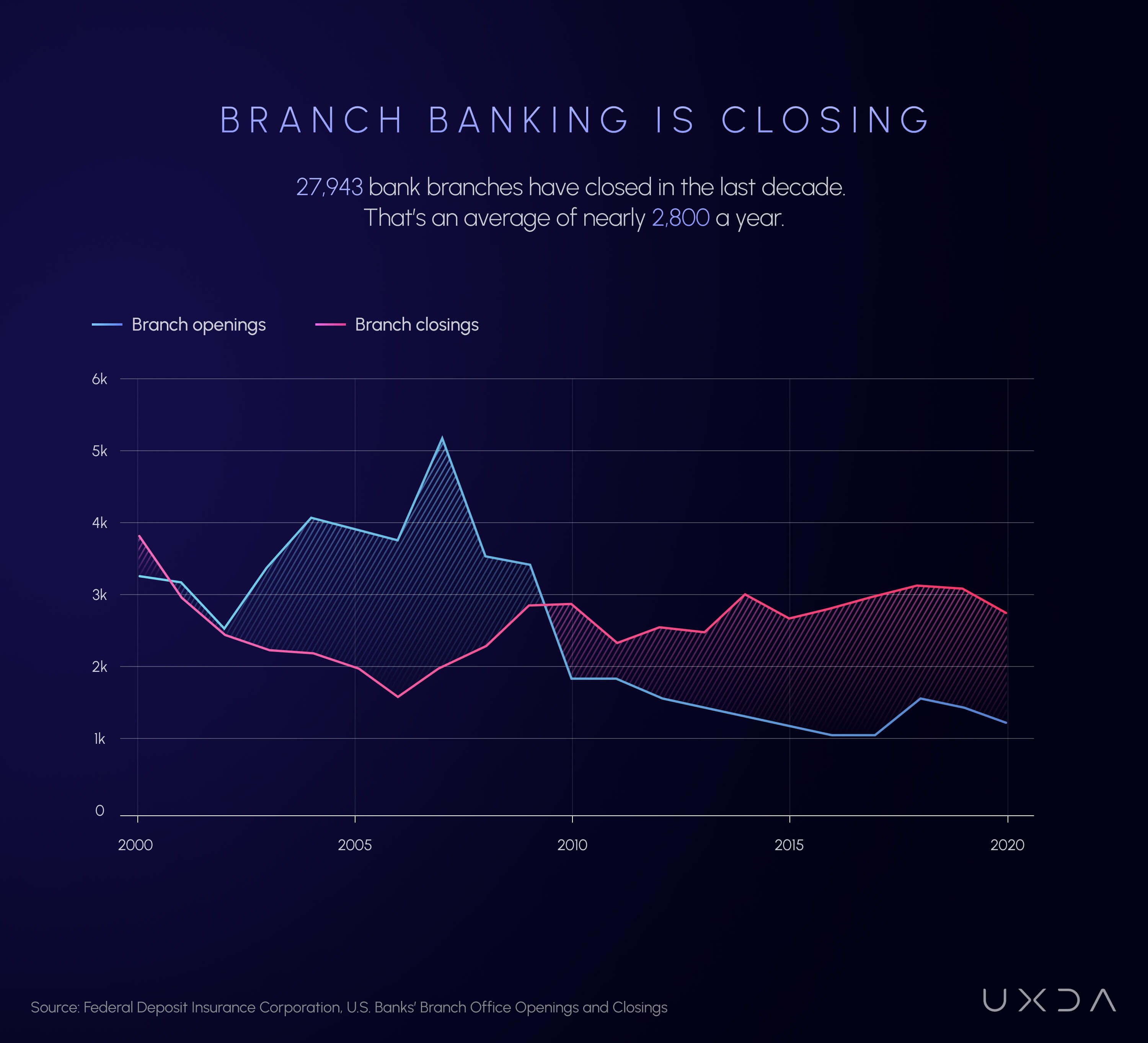

But many banks were slow to react. Designed in a pre-digital era and often led by executives who came up through the old system, banks kept expanding their physical networks even as mobile adoption skyrocketed, only to reverse course once they saw customers abandoning the branch for the app. In the U.S., banks added branches up through 2009, but by 2017 had shuttered nearly 7,700 locations—roughly 8% of all branches—as the industry belatedly reacted to the “bricks to clicks” shift. It’s a classic example of retrospective predictability: in hindsight, of course, widespread use of the internet and smartphones would reduce the need for branches, but before it happened, most banks didn’t act on that foresight.

From my vantage point working with banks worldwide, I saw firsthand how disbelief gave way to alarm. Perhaps the most profound impact of the digital revolution is how it reset customer expectations for financial services. Today’s customers compare their banking experience not just to other banks, but to the best digital experiences in any industry. Long-standing institutions suddenly realized that their competitive moat wasn't as deep as assumed. Customers were migrating to providers who prioritized digital experience and innovation—two things many traditional banks had long deprioritized.

If Uber, Netflix or Amazon can deliver personalized, instant user-friendly service, consumers naturally expect their banks to do the same. They don’t care if financial services are more complex behind the scenes—they judge the digital experience based on what they’ve come to expect elsewhere. In practice, this equates to on-demand access, intuitive interfaces, seamless omnichannel options and proactive, personalized support—every time, across every device. This is why we named it the Black Swan—the widening expectation gap between what customers want and what the majority of banks are able to deliver.

To bridge that gap, many financial institutions have launched apps, upgraded systems, hired design teams or acquired Fintechs. But despite these efforts, digital banking often still feels clunky, disconnected and frustrating. Why? Because these efforts are often superficial. Many banks are layering new interfaces over old systems and mindsets—treating digital as an alternative channel and not a full business transformation.

A redesigned app won’t fix a fragmented backend or outdated service processes. Acquiring a Fintech company doesn't automatically bring a culture of innovation. You can’t build the future by retrofitting the past.

Here’s what modern banking customers expect and where many banks are falling short:

- Anywhere, Anytime Access: Customers want to perform transactions or manage accounts whenever and wherever they choose. Frictionless full service in mobile app and online platforms is a baseline requirement. Remote financial activities—from opening an account to applying for a loan—are expected to be as simple as ordering a cab on an app.

- Speed and Convenience: Today’s customers expect things to happen instantly. According to Zendesk’s Customer Experience Trends report (2023), 72% of customers want service immediately, often through instant messaging or chatbots that can provide real-time answers. Whether it’s sending money, making a payment, checking a balance or resolving a problem, speed isn’t just appreciated—it’s expected to be the norm.

- Seamless Omnichannel Experience: Modern customers expect flexibility and consistency. They might start an interaction on a smartphone, continue on a tablet and finish on a laptop—without losing progress or having to start over. They expect a smooth, connected experience across all touchpoints based on the same UX principles. That means no UI fragmentation, no repeating themselves, no inconsistent information, no unnecessary friction in key flows and no dead ends. Whether it’s an app, website, social media channel or even a voice assistant, banks must meet customers where they are—and make the overall customer journey effortless.

- Personalization and Advice: Perhaps one of the biggest leaps in expectation comes from the AI-driven personalization users see in other apps (think: Netflix recommendations, Google’s personalized results, TikTok’s individual feed, or Chat GPT answers). Financial customers now expect their bank to know them, hear them and tailor financial services accordingly. According to McKinsey’s Next in Personalization Report (2021), 71% of consumers expect companies to deliver personalized interactions, and 76% percent get frustrated when this doesn’t happen. Customers don’t just want information—they want intelligent support. They expect their bank to flag unusual spending, recommend better savings options or even nudge them toward smarter financial decisions. In short, they want a financial partner, not just a transactional service.

- Effortless UX Design: Design and usability are no longer “nice-to-have” features—they are critical. Users demand brand-driven apps that are easy to navigate, visually appealing, error-free and authentic. If a Fintech app makes budgeting fun and simple with slick design, a clunky bank interface will seem unbearable in comparison. And the cost of bad UX is steep. Based on Financial Brands research (2025), 54% of users will consider switching providers after just four bad digital experiences. Clean navigation, responsive design and moments of delight—like micro-interactions or personalized visuals—are now essential for building trust and loyalty.

- Trust and Security—Delivered Quietly: In the digital realm, security is paramount – but customers expect it to be largely invisible. They want banks to protect their data and money with cutting-edge security like encryption, biometrics and fraud AI detection, while not burdening them with cumbersome processes. The goal is security with minimal friction, like biometric logins that are both safer and easier than passwords. Any breach of trust here—a hack or simply a confusing security step—can severely damage a bank’s reputation, given how much is at stake online.

It’s important to recognize that customer expectations aren’t standing still—they’re rising fast. The more digital services improve in general, the higher the bar for banks. Traditional banks must understand that today’s customers—especially younger, digital-native generations—expect something very different from what worked in the past. They have zero patience for outdated banking practices and assume everything should be as instantaneous as texting and as intuitive as swiping on a touchscreen. Digital changes banking customer expectations—fundamentally and irreversibly.

Digital disruption in banking was especially forced by the pandemic. COVID-19 became one more Black Swan for the financial industry. Accenture’s Global Banking Consumer Study (2020) reported that COVID-19 “advanced [banks’] digital strategies by up to five years in some cases,” as customers suddenly relied on online and mobile channels. What was once gradual adoption became a surge, validating our theory about an unpredictable external shock forcing banks to innovate overnight.

Before 2020, only 15% of consumers had used video calls with their bank. But after the pandemic, that number shifted dramatically—46% said they were open to using video advisory services instead of visiting a branch, according to Accenture. Additionally, according to the Bank for International Settlements report (2021), central banks observed a sharp shift from cash to contactless digital payments in 2020, actualizing CBDCs emission, which could become one more Black Swan for banks in the future.

In summary, modern digital services, globalization of tech, the mobilization of everyday life via smartphones and now the early phases of “AI-ization” (AI permeating daily services) have all combined to create a customer who expects smart, fast and personalized 24/7 banking. This customer is radically different from the branch-dependent account holder of the past. And this change happened quickly—largely catching banks off guard. How exactly did banks react to this? Let’s examine their responses and explore why those responses often haven’t been enough.

There has never been such a considerable gap between what digital consumers expect and what traditional banks offer. Fueled by the rise of e-commerce, social media and on-demand platforms, a new generation of users now expects seamless, personalized and instant financial services. For banks, this wasn’t a single catastrophic moment—it was a fast-moving, high-impact transformation—one that struck with all the force of a Black Swan.

The Growing Gap Between Customer Expectations and Bank Reality

It might seem paradoxical, but banks have invested heavily in “digital transformation” projects, rolled out new apps and features and even embraced trendy technologies. Yet customers often remain underwhelmed, if not outright dissatisfied. The crux of the issue is that many banks approached digitalization as a checklist of tech upgrades rather than a holistic, customer-driven reinvention of their service model. They deployed technology, but often without a clear purpose or understanding of customer needs, resulting in digital products that miss the mark. The outcome is a persistent experience gap—banks think they’re doing much better than their customers actually feel.

The consequences of this gap are severe. Customers have more alternatives than ever: not just other banks, but Fintech services, neo-banks and tech platforms. If a bank’s experience frustrates them, switching has become easier, thanks to digital account opening and portability of services.

Research data starkly underscores this disconnect. A recent comprehensive global study of customer experience (2025) by The Financial Brands (covering banking among other industries) found a 56-point gap in perception: 80% of business executives believed they delivered a great customer experience, while only 24% of customers agreed.

In banking specifically, this illusion of adequacy is common—many banks pat themselves on the back for offering a mobile app, assuming customers are now satisfied, whereas customers compare that experience to top-tier Fintech or Big Tech services and find it lacking. As a result, banks consistently overestimate the quality of their digital CX.

It’s telling that in the same study, nearly half of industry leaders (47%) admitted there’s a growing disconnect between their efforts and what customers actually experience, and roughly the same proportion believe this gap is widening over time. In other words, even bank executives are coming to realize that despite all the tech investments, they are falling further behind consumer expectations.

Why is the gap still growing? Several factors emerge:

Misdirected Digital Strategy

Banks often invest in technology for technology’s sake—launching a chatbot, for example, just to advertise they have AI innovation on board—without ensuring it truly solves a customer pain point. Indeed, research from The Financial Brand (2025) reveals that 63% of business leaders admitted they aren’t seeing meaningful customer experience improvements from their digital investments, and 43% said the benefits don’t even justify the costs. Those are startling admissions: it means a lot of digital transformation spend has been wasted on the wrong solutions.

The shiny new app or feature might function, but if it doesn’t make customers’ lives easier, it’s not moving the needle on satisfaction. A banking executive quoted in the same article noted that many organizations focus on the wrong metrics and fundamentally misunderstand what customers value. For example, a bank might brag about reducing branch wait times by two minutes (metric-driven), while customers actually wish they never had to visit a branch at all. What they truly value, instead, is full digital capability to open and manage an account.

Generic Experiences

As discussed, the heavy use of white-label platforms and copycat designs has led to a homogenization in banking apps. From one major bank to another, the interfaces often look and feel surprisingly similar and similarly underwhelming. When everyone offers basically the same generic online banking with poor UX, customers have no reason to be enthusiastic about financial brands. Worse, this sameness undermines brand identity.

Customers don’t feel a unique connection to a specific bank's brand if its digital experience is indistinguishable from others. Studies have shown that companies succeeding in digital CX are those solving real problems and building emotional connections with users—the kind of relationship in which customers “willingly pay premium prices” to maintain it. Unfortunately, many banks’ digital services today are forgettable utilities rather than beloved experiences, so they fail to inspire loyalty or excitement.

Slow Pace and Inertia

Customer expectations are evolving continuously and rapidly, but banks often move slowly. Lengthy IT development cycles, regulatory compliance hurdles and internal committees can delay the rollout of improvements by months or years. Meanwhile, consumer-tech companies deploy updates in weeks. This means banks are perpetually playing catch-up and often delivering features that feel late.

By the time a traditional bank launches a decent mobile budgeting tool, customers might have already moved on to a Fintech app that does it better. The innovation tempo mismatch keeps the gap wide open.

Cultural and Organizational Barriers

A deeper issue is that truly meeting customer expectations may require transformational change in how a bank operates, beyond just surface-level tech. It means breaking down product silos to offer a unified experience, empowering front-line teams to solve customer issues creatively and instilling a customer-centric mindset in every decision.

These cultural shifts are hard. Many banks still prioritize short-term sales targets or risk avoidance over customer experience excellence. A lack of genuine customer-centric culture “prevents employees from bringing service closer to customer expectations” and causes a persistent “culture gap” within banks. Essentially, even employees see the gap but are powerless to change it without support from leadership.

In summary, despite a flurry of digital initiatives, many banks still deliver a digital customer experience that falls short. A wide gap remains between what customers expect and what they get, and by many accounts that gap is growing. The digital revolution turned out to be a Black Swan that re-wrote the rules of customer engagement, and banks are still struggling to rewrite their playbooks accordingly.

Banks Caught Off Guard and Scrambling to Catch Up

When the digital wave hit, many banks entered reaction mode. They scrambled to modernize—launching in-house innovation labs, partnering with vendors, copying Fintech features, or acquiring startups—once they recognized the scale of the threat. And to their credit, most banks today do offer mobile apps and online platforms that look modern on the surface. So why is there still a problem?

But the real issue remains: despite all these efforts, there’s still a significant gap between what customers expect and what banks actually deliver. And evidence suggests that this gap isn’t shrinking—it’s actually widening.

Buying “Off-the-Shelf” Digital Solutions

One of the most common quick fixes banks turned to was buying ready-made digital banking platforms from third-party vendors. These white-label solutions promised a fast, low-effort way to launch mobile apps and online banking portals. In theory, it’s a fast route to offer modern features without years of in-house development.

Indeed, the market for off-the-shelf digital banking is booming and expected to grow over 10% annually through 2028 as financial institutions seek rapid go-to-market solutions, according to a report by Research and Markets (2023).

While off-the-shelf platforms offer speed, they come with significant trade-offs—most notably, sameness. If every bank uses the same templated app with a different logo, none truly stand out. Over-reliance on white-label vendor solutions can dilute a bank’s brand identity and result in a generic, forgettable user experience. The result is short-term speed at the expense of long-term differentiation and customer loyalty.

Launching “Innovation Labs"

Some banks invested in building internal digital design and development teams, or even separate innovation labs/powerhouses, to create better digital products. On the surface, this approach offers greater control, customization and alignment with the bank’s long-term vision—unlike white-label solutions. But in practice, many of these teams ran into a familiar roadblock: legacy culture and internal resistance.

I’ve often seen internal design teams propose customer-centric improvements, only to be overruled by siloed departments or conservative risk managers. Without C-level buy-in for a truly customer-first philosophy, internal teams can end up just adding incremental features rather than rethinking the experience. The result: despite having a mobile app, the bank’s offering remains clunky or outdated compared to nimbler Fintech apps or advanced competitors. In short, building a digital team is not easy, but empowering it to drive real change and innovations is even harder.

Copying Competitors

In an effort to keep pace, many banks opted to mimic successful competitors or Fintech features. If a Fintech app gained traction with a budgeting tool or peer-to-peer payments, banks would rush to launch a similar feature in their own app. While it’s wise to monitor market trends, simply copying competitors rarely leads to meaningful results.

Simply replicating a popular service’s interface and features will obviously not work because it fails to capture the underlying factors that made the original successful. Imitation without insight often leads to half-baked features that don’t quite integrate with the bank’s ecosystem or meet the real user need. True success comes when a bank understands why a Fintech feature resonates and adapts it in a way that fits their customers’ context and expectations.

Unfortunately, too often banks focus on superficial aspects—a cool UI design here, a chatbot there—without aligning the experience into a coherent, customer-centric journey. It becomes a game of catch-up: always a step behind what leading Fintechs were doing last year.

Partnering with or Acquiring Fintechs

Another approach was “When you can’t beat them, buy them.” Banks began partnering with Fintech companies for specific services, for instance, integrating a Fintech’s payment gateway or using a robo-advisor platform developed by a startup. Others went further to acquire Fintech startups outright, hoping to instantly import innovation and tech talent. From 2014 to 2024, 39 European banks acquired roughly 70 Fintech companies—often to protect their core business or accelerate innovation they struggled to produce internally.

According to the KPMG report (2022), major U.S. banks have made similar moves, and 2021 saw a global peak in bank-Fintech M&A. This strategy can bring new capabilities, but it’s not a silver bullet either. Merging a nimble Fintech into a big bank can smother the very agility that made the Fintech successful, due to cultural clashes or bureaucratic integration processes.

Some acquisitions end up as “trophy buys” that don’t fundamentally change the parent bank’s culture or user experience. Still, this route at least acknowledges that banks needed outside help to innovate, which is a step in the right direction when executed with a clear purpose. Next, an even more potent force is emerging—one that promises to raise the stakes further: the rise of artificial intelligence in banking.

The AI Revolution: Banking’s Next Black Swan

Just as banks are grappling with the fallout from one disruptive wave, another is cresting on the horizon. Artificial Intelligence (AI)—in particular, recent advances like generative AI—is poised to fundamentally alter banking. While this time banks are more aware that something big is coming, the specific impacts of AI could still surprise and overwhelm many institutions that aren’t prepared for its speed and scope.

AI is rapidly entering the scene—and it’s set to be the next major Black Swan for banking. But this one is different, because it's not just a shift in interface or delivery; it's a redefinition of value itself.

AI is changing the nature of interactions, trust, personalization, decision-making, planning and even financial advice. For the first time, machines aren’t just supporting banking—they're becoming bankers in many use cases. Customers will soon expect proactive financial coaching, hyper-contextual insights and instant resolutions—all delivered with a human-like touch.

And yet, most banks are nowhere near ready. They're either cautiously piloting large language models in sandboxes or blindly plugging them into chatbots with no broader strategic integration.

AI in banking is not entirely new; for years, banks have used AI or machine learning for things like fraud detection, credit scoring and basic chatbots. But we are now at an inflection point at which AI’s capabilities are improving exponentially and becoming more visible to consumers.

The launch of ChatGPT in late 2022, for example, served as a “Sputnik moment” for AI— suddenly millions of people experienced how conversational and creative AI could be. This has direct implications for customer service and banking advice. One can easily imagine AI-driven assistants handling the bulk of customer inquiries, performing transactions on voice command or offering tailored financial advice in real time. According to a 2019 Chatbot Report cited by the UMass Isenberg School of Management (2024), AI was expected to automate up to 90% of customer interactions in banking by 2022. While reality may not yet have reached that level, it indicates a strong push toward AI-driven service. Customers will soon expect their bank’s chatbot or voice assistant to be as competent as a human: available 24/7, instantly responsive and context-aware.

Beyond customer support, the personalization potential of AI is enormous. Banks sit on vast troves of customer data (e.g., transactions, financial histories, goals) that often go underutilized. AI can analyze this data to uncover patterns and make predictions far better than any manual process. This means truly proactive and individualized banking could become the norm. Imagine an AI notification that says, “You have a high balance in checking; shall I move $500 to your savings or investment account for better yield?” or one that dynamically adjusts your credit card’s rewards to match your spending habits this month.

AI could enable the bank to act like a personalized financial concierge, anticipating needs and optimizing finances for each user. This is the kind of deep user experience that would greatly delight customers—and it’s one that tech-savvy consumers may come to demand, especially if Fintech innovators or Big Tech offer it first.

Crucially, AI also promises huge efficiency gains for banks, which is a double-edged sword. On one hand, those banks that harness AI well could streamline operations and save enormous costs, potentially freeing up resources to reinvest in better services. Business Insider analysis estimated that AI could save the banking industry about $447 billion by 2023 and up to $1 trillion by 2030 through efficiencies and automation. These savings could mean lower fees, faster processing and improved profitability for forward-looking banks.

On the other hand, if a bank lags in AI adoption, it could find itself at a serious cost disadvantage or unable to offer the intelligent features customers expect. It’s no wonder that in a recent global survey of ABA Banking Journal (2025), eight in ten banking executives agreed that banks not embracing AI will fall behind competitors. According to Temenos survey (2025), 77% of financial institutions are investing in data analytics and AI-driven insights, highlighting that the race is on.

What makes the AI revolution a potential Black Swan is the element of surprise in how and who it benefits most. It’s not guaranteed that incumbent banks will be the ones to fully capitalize on AI. Tech giants like Google, Apple, X, Meta or Amazon, which have advanced AI capabilities and rich ecosystems, could extend deeper into finance, offering AI-powered financial products that outshine banks’ offerings. If these players layer superior AI-driven insights on top, they might deliver a financial experience that traditional banks simply can’t match with their outdated legacy systems.

Alternatively, new Fintech startups born with AI at their core might leapfrog the UX of both banks and earlier Fintechs. The unpredictable aspect is which specific use-case or provider will really take off with AI in banking. Will it be AI investment advisors that render human advisors obsolete? Will it be autonomous finance managers (“self-driving money” apps) that automatically handle your bills, saving and investments optimally? Or perhaps something like decentralized finance (DeFi) combined with AI agents negotiating the best interest rates across the world for you. These scenarios might sound far-fetched now, but Black Swan events often do… until they happen.

From the customer perspective, the AI era will push expectations even higher. Consumers will expect hyper-personalized, intelligent financial engagement seamlessly served in the background. Waiting days for a loan approval may become unacceptable when AI can underwrite credit in seconds using hundreds of data points. Needing to ask a banker for financial advice could seem quaint when an AI could monitor your financial health in real time and nudge you continuously.

In essence, banking could shift from a series of customer-initiated transactions to an AI-augmented smart banking service that proactively works in the background for customers. Banks that leverage AI to offer this kind of value will gain a strong competitive edge; those that don’t risk becoming irrelevant, as their services will seem “dumb” and inconvenient by comparison.

We should note that AI is not without pitfalls: concerns about privacy, biases and errors are significant. Regulators are likely to heavily scrutinize AI use in finance, and customers will need to trust these systems. But assuming these challenges can be managed, the transformative potential of AI in banking is enormous. It indeed represents a pivotal moment for the banking industry, comparable to how the internet revolution or mobile revolution were disruptive forces.

It may not be a total surprise that AI is coming and on everyone’s radar, but the winners and losers of the AI revolution, and the new business models it may spawn, could certainly qualify as Black Swan outcomes that defy conventional wisdom.

Bridging the Gap: Becoming Antifragile in the Face of Disruption

If there’s one lesson banks must learn from the past decade, it’s this: you cannot afford to be complacent or reactive in the face of transformative change. The Black Swan of digitalization taught us that merely doing business as usual—and making small tweaks—was not enough to meet a radical shift in customer expectations. The looming AI revolution will teach the same lesson even more forcefully.

The deepest disruption AI brings isn’t technological—it’s psychological. It will shatter long-standing beliefs about what a bank is and what role it plays in people’s lives. This is what Taleb warned about: systemic vulnerabilities hidden behind a facade of control. The legacy systems. The risk-averse culture. The overreliance on compliance and generic solutions to dictate design. These cracks will widen as AI scales. Customers won’t wait for slow movers. The platforms that can meet their emotional, cognitive and behavioral needs—intuitively and instantly—will win.

So, what can banks do to avoid being “the turkey” that gets blindsided? How can they, in Taleb’s terms, turn potential Black Swans white—or even benefit from them? Here are some strategies gleaned from both Black Swan theory and real-world experience designing digital banking solutions:

1. Cultivate an Antifragile Organization

Taleb introduces the idea of antifragility:systems that not only withstand shocks but actually get stronger from them. Banks need to move toward this mindset. That means embracing change and uncertainty as opportunities rather than threats.

For example, instead of dreading and fearing Fintech competition, an antifragile bank learns from it, perhaps by co-opting the best ideas or talent. It means having flexible technology infrastructure that can plug in new modules or third-party services quickly (via APIs and cloud platforms) rather than monolithic core systems that take ages to modify. It also means empowering cross-functional teams to experiment, fail fast and iterate—agile methodologies should replace slow waterfall projects.

Banks that set up venture arms or incubators to continuously scout and integrate new ideas are practicing antifragility by diversifying their bets on the future. In short, treat disruption as a chance to evolve, not a disaster to avoid at all costs.

2. Obsess Over Customer Experience (CX) and Needs

The ultimate North Star should be solving real customer problems and delivering value, not just implementing fancy tech. The Financial Brands research (2025) reminds us that the companies who succeed are those “solving real problems and building connections” with customers. This requires a deep customer-centric culture.

Banks should invest in researching customer pain points, gathering feedback and truly listening. Use techniques like customer journey mapping to identify friction points and eliminate them. More importantly, close the feedback loop: one study noted a significant “feedback gap” in which banks weren’t actually hearing the voice of the customer enough. That must change—continuously measure customer satisfaction (e.g., via Net Promoter Score, app ratings, etc.) and treat that as importantly as quarterly financials.

When designing new digital features, involve real users in testing and iterate based on their input. The goal is to narrow the expectation gap by exceeding those expectations—delighting users in ways they didn’t even anticipate, which is what true innovation does.

3. Differentiate, Don’t Just Digitize

It’s not sufficient to have a digital offering; it must be a remarkable offering that expresses your brand’s unique value. If every bank offers a similar app, the bank that wins will be the one that adds something distinctive—whether it’s a superior user interface, a signature feature or an emotionally resonant brand experience.

For instance, one bank might distinguish itself by being the “financial wellness” champion with AI-driven budgeting tools and human coaches on call, while another might be the “fastest and simplest” bank known for one-click features for everything.

The key is to avoid the trap of generic white-label sameness. Use design strategically to stand out; blending in is the last thing you want in a digital world of lookalike apps. Banks should leverage their data, expertise and trust advantages to craft experiences Fintechs can’t easily replicate. But doing so requires creativity and a willingness to break from industry norms.

4. Leverage AI Wisely and Ethically

To prepare for the AI revolution, banks should actively experiment with AI applications now—not just for cost savings internally but for customer-facing innovation. This might involve deploying advanced AI chatbots that actually resolve complex queries, using machine learning to personalize app dashboards for each user or offering AI-powered financial planning.

At the same time, banks must be mindful of the ethical implications. Responsible AI use—being transparent, avoiding bias in algorithms and safeguarding privacy—will be essential to maintain customer trust. Banks actually have an opportunity to be leaders in ethical AI, given their regulated nature and experience with risk management. If they can combine the efficiency and insight of AI with the reassurance of a trusted, ethical advisor, they could turn AI into a strength that plays to banks’ images of stability and reliability.

According to the ABA Banking Journey (2025) survey, training staff to work alongside AI as “augmented employees” is key to preserving the human touch—ensuring empathy and personal service remain, even as automation grows. The banks whose employees and AI systems collaborate effectively will deliver the best of both worlds to customers.

5. Proactive Risk Management and Resilience

By definition, Black Swans include extreme downside possibilities, so banks must continuously identify where they are vulnerable. This could mean stress-testing not just financial portfolios but business models, e.g., “What if in 5 years, 50% of our revenue erodes to Fintech competitors? How would we cope?” By running such scenarios, banks can plan strategic responses in advance, perhaps diversifying services or investing in certain capabilities now.

Cybersecurity is another critical area—as more banking goes digital and AI-driven, the risks of cyberattacks increase, and a major breach could be its own Black Swan. Investing in top-notch security and fail-safe systems (with redundancies and rapid recovery plans) is non-negotiable to survive shocks. Taleb’s notion of robustness applies here: banks should ensure that no single point of failure can bring them down and that they have buffers (e.g., capital, technology backups, etc.) for turbulent times. COVID-19 was a real-world test: those with robust digital channels thrived when branches shut their doors; those without them scrambled. The next shock might be different, but the principle stands: build resilience before you need it.

Ultimately, for banks to thrive in an unpredictable world, they must blend their traditional strengths—trust, scale and regulatory expertise—with a new mindset rooted in agility, adaptability and a willingness to evolve. It’s about becoming what one might call a “stable innovator”: solid and reliable at the core but flexible and inventive at the edges. Taleb would say it’s about avoiding being the complacent turkey and instead being the crafty fox that’s hard to catch off guard. For banks, this might mean adopting a continuous learning mindset: treat each new Fintech trend or AI development not as a threat to be squashed or a fad to ignore, but as a signal to adapt and improve your own offerings.

Conclusion: Don’t Be the Turkey

The Black Swans are already circling. The question is not whether another disruptive event will strike—it’s whether your institution will recognize the signs in time to adapt.

Banks that understand this shift—and are bold enough to reinvent from the inside out—won’t just survive; they’ll lead a new era of digital financial experiences defined by empathy, intelligence and trust.

The future is uncertain. Taleb taught us that those who embrace uncertainty—not as a risk, but as a design input—will thrive in a world shaped by the unpredictable. The challenge is not to predict the digital transformation of banking, which is obvious, but to fully grasp its disruptive potential and change in customers’ behaviors.

The banking industry’s journey over the last decade vividly illustrates the power of a Black Swan event. What started as a steady rise of digital technology turned into a whirlwind of change that fundamentally altered how consumers interact with money and their banks. Many banks, anchored in old paradigms, were caught by surprise, finding themselves outpaced by Fintech upstarts and tech giants in delivering the kind of digital experience customers now demand.

The gap between customer expectations and banks’ delivery, forged by the digital revolution, continues to challenge the industry. And just as banks begin to find their footing, another disruptive force—artificial intelligence—promises to rewrite the rules yet again, with the potential to be as shocking and transformative as the previous wave.

The narrative here, however, is not one of doom and gloom for traditional banks. It’s a call to action. Black Swan events, as Nassim Taleb reminds us, will always be part of our world. You often can’t predict exact changes, but you can prepare for them in how you build your organization, culture and business processes.

Banks that learn from the past, that embrace innovation and customer-centric design as core values, will find that they not only survive these disruptions but can excel in them. After all, the flipside of every disruption is opportunity: the chance to delight customers in new ways, to reach new markets and to operate more efficiently. We have already served some forward-thinking banks and credit unions that leverage digital tools to greatly improve customer satisfaction, proving that incumbents can adapt.

As we stand on the cusp of the AI revolution in banking, the real winners will be those who didn’t just digitize outdated processes, but completely reimagined banking for the digital—and now AI-driven—era from the ground up. They will be the banks that move as quickly as their customers do, maybe even anticipating needs before customers voice them. They will collaborate with Fintechs and tech firms when it makes sense, and differentiate when it counts. Most importantly, they will put the customer at the center of every strategy, using technology as a means to an end (better service), not an end itself.

In Taleb’s words, the successful banks will have avoided being the turkey—not blindsided by disruption, but strengthened by it. They’ll have embraced volatility, built resilience and adapted to whatever comes next. At its core, banking is still a business of trust and relationships. While those relationships may now unfold through screens and algorithms, they remain deeply human. By leveraging digitalization and AI to deepen personalization and treat customers as people—not just account numbers—banks can close the expectation gap. What once seemed like a Black Swan threat can become a once-in-a-generation opportunity to reimagine what banking truly means in the digital age.

The future of banking will belong to the bold: those willing to rewrite their playbooks—and perhaps even their business identities—in pursuit of relevance and excellence in a changed world. As we have seen, innovation, not tradition, is the new currency of success in banking. The Black Swans of digitalization and AI need not be feared. With the right mindset, banks can ride these wild waves and come out ahead of where they started. The task now is clear: close the gap, embrace the unpredictable, and design the future of banking that customers are already eagerly awaiting.

We’re at a critical juncture. Banks can either see digitalization and AI as threats or as transformative opportunities. But that requires more than just adopting new technologies. It requires rethinking the entire digital experience—starting with the customer, not the system.

From our work at UXDA, I can say this with confidence: true innovation happens when banks shift from transactional mindset to experience mindset… when digital strategy is driven not by what’s technically feasible, but by what’s emotionally meaningful.

This means:

- Designing ecosystems, not interfaces;

- Mapping emotional journeys, not user flows;

- Empowering internal teams to experiment and evolve; and most importantly:

- Treating technology not as a goal, but as a bridge to human connection.

Discover our clients' next-gen financial products & UX transformations in UXDA's latest showreel:

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedin