Beneath the surface of every large retail bank lies a truth rarely voiced in boardrooms but whispered in team huddles: genuine digital transformation cannot succeed on in-house talent and legacy alone. While product teams brim with bold ideas—AI-driven analytics, intuitive dashboards, brand’s digital leadership—their proposals repeatedly collide with an immutable executive belief: “We can do this ourselves in the best way possible.”

What if a bank’s “digital transformation” isn’t a transformation at all, but a placebo for pride in the past? Every day we talk to product teams overflowing with ideas about customer-centric innovation, AI integration, seamless onboarding, dream-level CX… and the execution mantra silences them: “We’ll build it ourselves.”

The result? Years of lag, mounting product debt, an exodus of rock stars and customers fleeing to the nearest Fintech.

There is a silent struggle in financial product design that reveals a deeper truth: it's not just about technology or resources—it's about mindset. Many banks operate within invisible walls built from legacy patterns, risk aversion and the illusion of control. These barriers prevent them from seeing beyond internal limitations, even when the world outside is shifting faster than ever.

Here’s the reality we tiptoe around: in-house ≠ in-shape.

The unspoken reality is that even the most passionate and capable bank employees cannot shoulder the full weight of digital transformation alone. In today’s rapidly evolving landscape, agility, personalization and trust aren’t delivered through legacy pride—they emerge through bold collaboration, digital-native approach and open-minded strategies. Today, you don’t need one more internal task force—you need special forces.

Why This Matters for the Future

When financial services are defined by digital-first impressions, banks that fail to evolve will forfeit their role as trusted financial services, advisors and partners. The coming decade will see customer loyalty hinge on proactive guidance, seamless omnichannel digital experiences and transparent AI-powered insights.

In such conditions, any financial brand needs a bold product vision that can create a competitive difference—not an average risk-free option that copies solutions from 10 years ago.

That’s why addressing product development blind spots today is essential to maintaining market share against agile Fintech disruptors and advanced digital competitors, protecting brand reputation by preempting outages and compliance missteps and securing growth capital through customer-centered innovation and operational efficiency.

An otherwise insular approach creates long-term risks and threats:

- Chronic Customer Attrition

Without rapid innovation, customers migrate to Fintech alternatives offering superior UX, leading to sustained revenue decline. - Escalating Technical Debt

Skewed priorities toward Band-Aid fixes bloat legacy systems, resulting in skyrocketing maintenance costs and increased risk of outages. - Talent Drain and Cultural Stagnation

High-performing employees depart for environments that enable continuous learning and experimentation, eroding institutional knowledge. - Regulatory and Security Vulnerabilities

Outdated toolchains and siloed compliance processes heighten the likelihood of data breaches or non-compliance fines. - Competitive Irrelevance

As peers leverage AI and personalization to set new industry benchmarks, insular banks risk becoming commoditized service providers.

To truly transform, banks must confront five uncomfortable realities—blind spots that quietly erode their potential while competitors leap ahead. These aren’t just operational gaps; they’re strategic risks born from outdated assumptions. Recognizing and addressing them is the first step toward unlocking the agility and innovation of today's market demands. Let's explore them in detail below.

From Blind Spots to Breakthroughs: Reframing the Path to Digital Excellence

World-class customer experiences, adaptive architecture and AI-driven intelligence require a blend of internal dedication and external specialization. It’s not a weakness to seek help—it’s a competitive advantage.

By acknowledging this uncomfortable truth and reshaping outdated procurement and budgeting mindsets, banks can transform their most critical blind spots into engines of innovation. This shift not only accelerates delivery and reduces long-term costs—it also empowers internal teams, strengthens customer loyalty and ensures long-term relevance in a market that won’t wait.

It’s not about outsourcing control. It’s about outpacing stagnation—and building the kind of financial future that customers, teams and shareholders can believe in. And hiring a team of “special forces” to do it may be the best solution.

1. Dismantling the Myth of In-House Mastery

Senior leadership often assumes that decades of institutional knowledge equate to cutting-edge capability. Yet years spent patching monolithic architectures, navigating vendor contracts and prioritizing incremental fixes leave little room for the deep specialization required by today’s AI, UX and data-science disciplines. As a result:

- Skill gaps widen: Teams lack experience with modern design systems and machine-learning toolkits.

- Innovation fatigue sets in: Repeated failed pilots erode morale, and best practices drift out of sight.

Progressive employees see this mismatch clearly—yet every request for outside expertise is met with “Why outsource what we can build ourselves?”

Strategy: Spotlight Specialist Gaps with Data

- Internal “Skills Audit” Workshops: Host cross-team sessions in which designers, developers and data scientists catalog tool-and-tech proficiency. Identify concrete areas, e.g., “no team member has shipped an AI-powered recommendation engine,” to highlight specialization shortfalls.

- Benchmark Exercises: Assign small sub-teams to recreate a leading Fintech UI using only internal methods. Document time spent, roadblocks encountered and quality of the results. Share these findings with executives to illustrate the need for deep-dive expertise that accelerates progress.

- External-vs-Internal UX Audit: Commission a UX agency to run a UX audit on a flagship app while your in-house team performs the same audit in parallel. Compare the two findings and present the delta in effort, depth and actionable insights to leadership. Nothing uncovers capability gaps faster than watching an outside team expose critical issues the internal review missed entirely.

2. Exposing the False Economy of DIY Innovation

Cost-cutting is the usual refrain when outsourcing budgets are proposed, but insisting on purely in-house delivery often backfires:

- Longer timelines: Recruiting or up-skilling staff takes months, delaying time-to-market.

- Technical debt accumulation: As teams get stretched to cover unfamiliar domains, they introduce workarounds that bloat future maintenance costs.

- Opportunity cost: While internal resources tinker with prototypes, competitors deploy polished features to paying customers.

What looks like thrift today becomes an expensive drag on growth tomorrow.

Strategy: Translate Time and Debt into Dollars

- Total Cost of Delay (CoD) Analysis: Determine how an internal build defers revenue from new users versus a faster, better outsourced pilot. Express both scenarios in projected fees, reduced churn or increased efficiency.

- Technical Debt Ledger: Maintain a living “debt register” that logs hacks, workarounds and patch jobs arising from forced DIY. Assign estimated remediation costs—developers’ hours, system-downtime risk—and present quarterly summaries to finance.

- Opportunity-Cost Dashboard: Build a simple scoreboard that contrasts internal sprint outputs (features completed per quarter) against those of peer banks or Fintech partners. Evaluate how slower cadence erodes competitive parity.

3. Stop Confusing Loyalty with Leadership

Your internal team is committed—no question. But commitment ≠ cutting-edge. Compare one bank’s lifetime of projects to a specialist crew like UXDA, which has:

- Designed 150+ financial products end-to-end—retail, wealth, SME, crypto… you name it.

- Served 39 countries, absorbing regulatory nuance, cultural habits and UI conventions you won’t learn from a single-market backlog.

- Tested and refined thousands of patterns, widgets and AI-driven flows and then distilled them into playbooks that shaved months off delivery.

- Competes daily on the open market, so speed, innovation and measurable ROI are survival skills, not workshop slogans.

Internal passion is priceless, but it can’t match the focused repetition and cross-market pattern-matching that a purpose-built UX strike force develops by solving the same category of problems hundreds of times.

In-house people bring institutional memory; leading UX agency brings a proven, global competitive edge. Blend them and you get loyalty + leadership—the only mix that wins in the next decade of digital banking.

Strategy: Inject Proven Expertise and Accelerate the Curve

- Industry Benchmark: Ask your product team to capture UX patterns and KPIs (e.g., task-completion rate, NPS, time-to-resolution) from the ten highest-rated banking and Fintech apps. Take your app and score every flow side-by-side with market leaders.

- Best-Practice Gap Audit: Commission the UX agency for a heuristic-plus-analytics UX audit of your app to detect its performance compared to best practices in the industry, flag missing standards, features and flows and translate every gap into business opportunities.

- Concept Reboot Lab: After the audit, embed the agency in a two-week sprint to craft a future-state prototype: UI design concept. Pair your internal designers with an agency for live knowledge transfer.

4. Framing Outsourcing as a Strategic Accelerator

Forward-thinking organizations recognize that targeted partnerships can accelerate innovation without eroding internal culture:

- On-demand talent pools bring UX researchers, AI engineers and accessibility specialists who’ve solved similar challenges as Fintech leaders.

- Rapid knowledge transfer occurs through collaborative sprints and embedded coaching, elevating in-house capabilities long after the external team departs.

- Objective audits of customer journeys and tech stacks uncover hidden friction points that internal teams may normalize.

By framing outsourcing as a strategic accelerator and not a last resort, banks can harness peak expertise while preserving their core identity.

Strategy: Pilot Partnerships with Embedded ROI

- Micro-Consulting Sprints: Contract a UX agency for a few-week design sprint on a high-visibility micro-feature (e.g., onboarding flow). Require a deliverable that includes user-test videos, clickable prototypes and actionable insights. Present these outcomes directly to executives.

- Knowledge-Transfer Mandates: Structure any external engagement to include formal “teach-back” sessions, documentation and lunch-and-learn workshops. After the agency departs, the internal team should be able to replicate key processes—turning each partnership into a multiplier of in-house capability.

- “Innovation Credit” Budget Line: Propose a small, dedicated fund earmarked exclusively for specialist partnerships. Frame it as an insurance policy: if the bank encounters a blocker that internal teams can’t clear without an agency, this fund can be tapped immediately, avoiding project stalls.

5. Overcoming Executive Skepticism with Tangible Proof

Shifting a decades-old mindset requires more than persuasive decks—it demands tangible proof:

- Quantify hidden costs: Map current backlogs, technical-debt tickets and time-to-hire metrics. Translate delays into dollar‐and‐cent terms to reveal the true expense of going it alone.

- Elevate success stories: Highlight case studies from peer institutions that combined in-house teams with specialized agencies to launch high-impact features in weeks, not quarters.

Once executives see concrete returns—and hear praise from internal teams—they become champions rather than gatekeepers.

Strategy: Align Outsourcing with Business Outcomes

- C-Suite Reality Sprint: Invite key decision-makers to a half-day, hands-on workshop to walk through benchmark data and gap-audit highlights, see unfiltered user-testing clips so executives feel the friction firsthand and co-ideate a future-state digital strategy.

- Milestone-Linked Funding Gates: Redesign budget approvals so that each tranche is unlocked only after predefined success metrics are met (e.g., “If the external sprint improves task success rate by 20%, release next budget phase”). This ties executive risk appetite directly to measurable progress.

- Showcasing of Peer Success Stories: Curate brief case studies from comparable companies or regulated industries that have outsourced product design. Highlight headline results (e.g., conversion lifts, NPS improvements, compliance efficiencies) to normalize the approach and reduce perceived risk.

By systematically exposing capability gaps, quantifying hidden costs and delivering unmistakable early wins through targeted external engagement, bank teams can shift executive mindsets from “we can do it ourselves” to “we must blend our strengths with world-class experts.” This inside-out approach not only unblocks stalled projects but lays the groundwork for a cultural evolution, one in which innovation becomes a collaborative, data-driven and business-aligned endeavor.

Case Studies from UXDA Clients

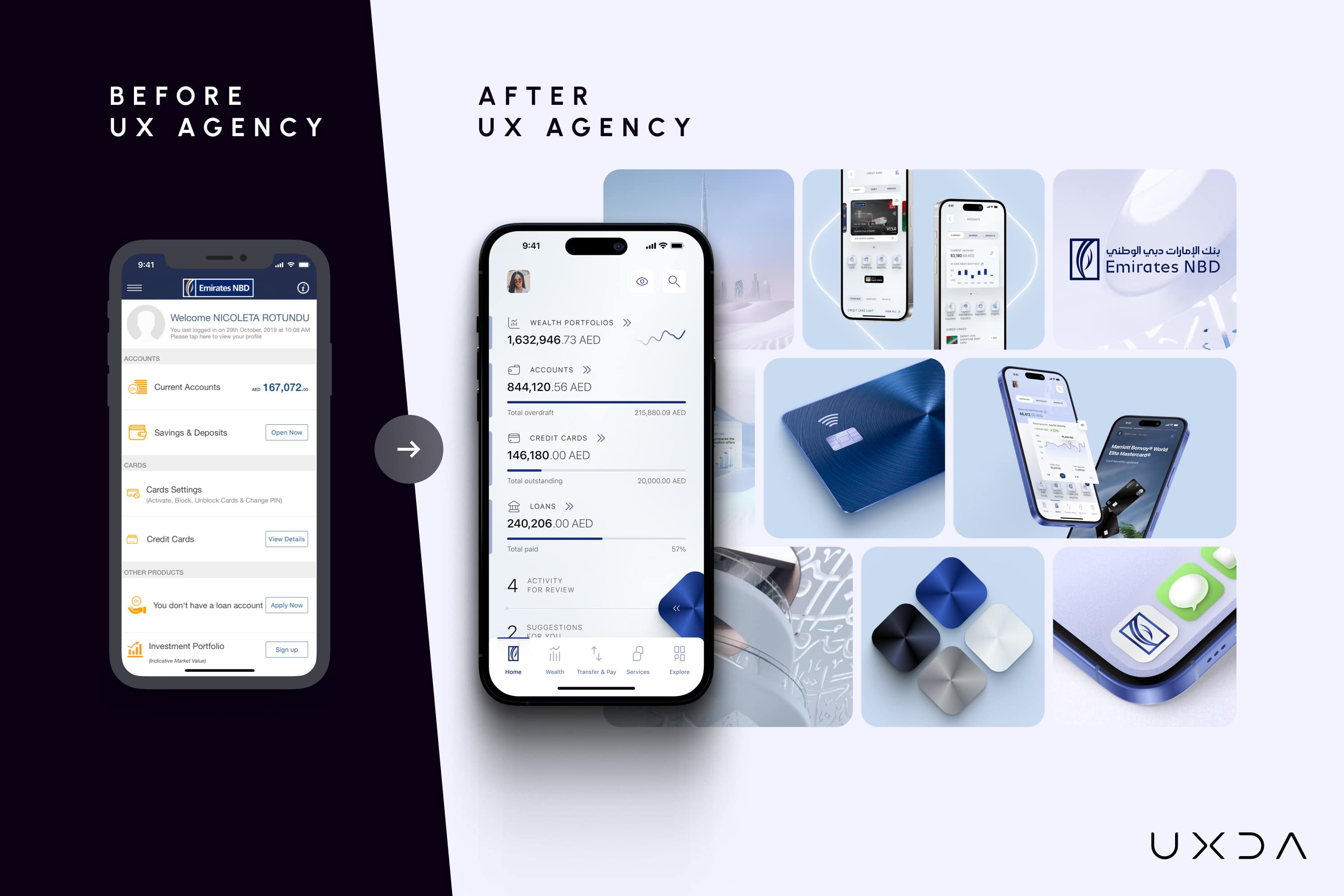

Emirates NBD – The Day Pride Met Pragmatism

After multiple in-house revamps that were stuck in a 3-star App Store store rating, Dubai’s flagship bank made a brave and bold call: pull the plug on incremental fixes and hand the entire digital ecosystem to an outside agency based in Europe. Partnering with UXDA, the bank set an audacious six-month deadline and met it—collapsing several fragmented apps into one digital ecosystem experience.

This grew the app rating to 4.7, lifting digital activity by 50 percent while scooping a string of “Best Mobile Banking App” awards. That calculated leap turned a legacy champion into the region’s benchmark for premium, ROI-driven digital banking.

BKT – Albania’s Centenarian Reinvents Itself

Nearing its 100th anniversary, BKT had the courage to admit its mobile journey felt like an Excel spreadsheet, and had the ambition to transform it into the most innovative banking service in the country. Partnering with UXDA, the bank rebuilt every flow around friendly self-service budgeting and soft new visuals, slashing branch dependence and shifting brand perception from bureaucratic and outdated to innovative and future-led.

The result: soaring loyalty, reduced support costs and repeat recognition as “Best Bank in Albania,” proof that a venerable institution can outpace Fintechs when it chooses the right product design ally.

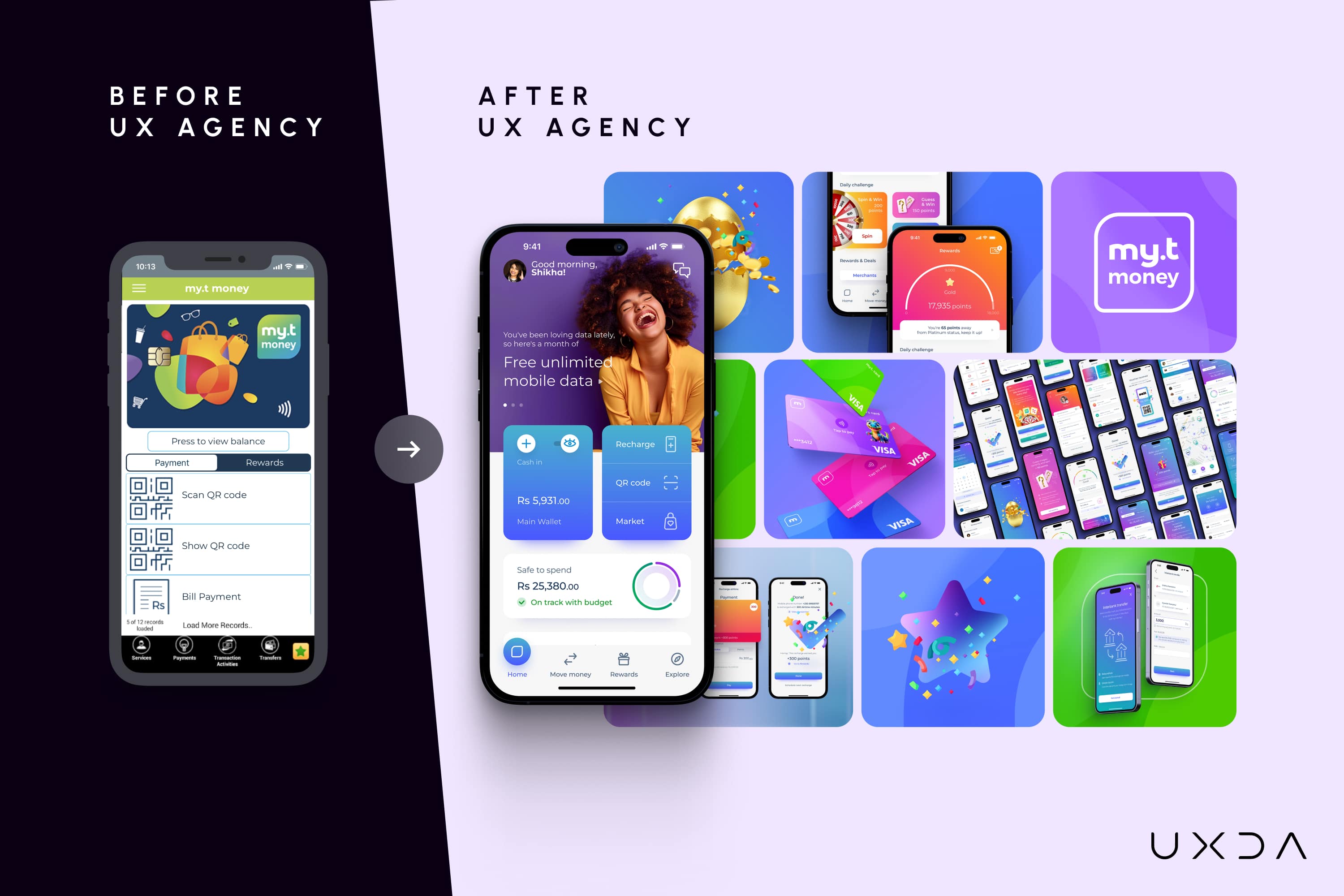

my.t money – Mauritius’ First Super App

Mauritius Telecom wanted more than a payment wallet; it wanted to modernize a nation by providing remote access for key financial services for everyone. They didn't limit themselves to the progress the internal team had made with the first version of the app; they hired an outsourced agency to take it much further.

Handing over the reins to UXDA, Mauritius Telecom relaunched my.t money as the islands’ first financial-lifestyle Super App—complete digital onboarding, budgeting, micro-loans, even chit-funds—wrapped in playful gamification. The wager paid off: 300,000 users, 200 partners and a new revenue engine that positioned MT as a future digital bank rather than a utilities provider.

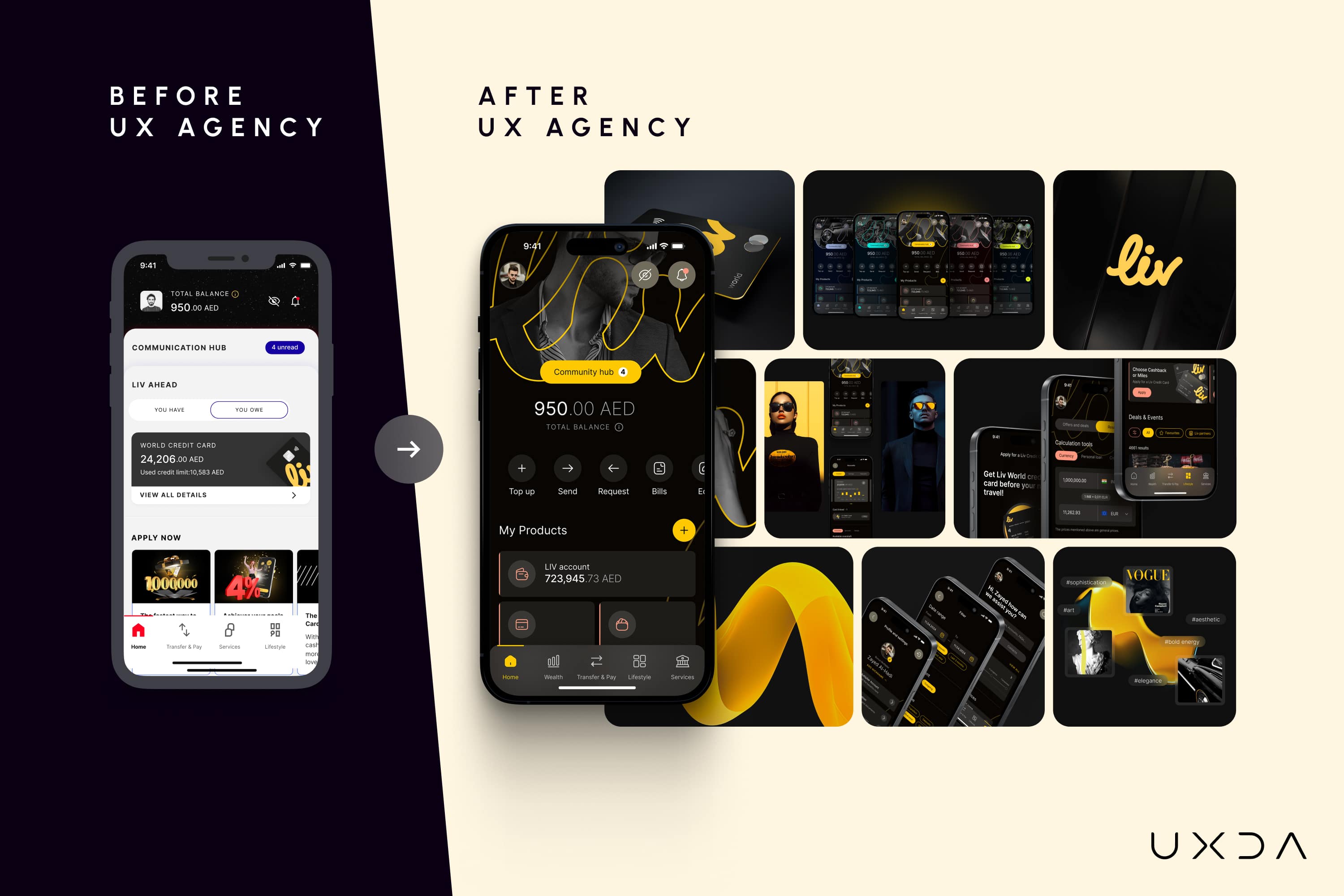

Liv X – Banking Ahead for Gen Now and Gen Alpha

Emirates NBD’s lifestyle offshoot, Liv X, has gained proven traction and success in the UAE market. But to build on this success, Liv Digital Bank didn’t just refresh the app; it hired UXDA to architect an entire family ecosystem: Liv X for millennials, a Vision-Pro spatial prototype and Liv Lite for children ages 8-18.

Delivered under brutal deadlines, the suite aligned with the “Liv Ahead” rebrand, earned multiple awards and opened a pipeline of lifelong customers by teaching money skills to kids in a game-rich environment—an audacious bet that banking design can win loyalty before a customer even turns eighteen.

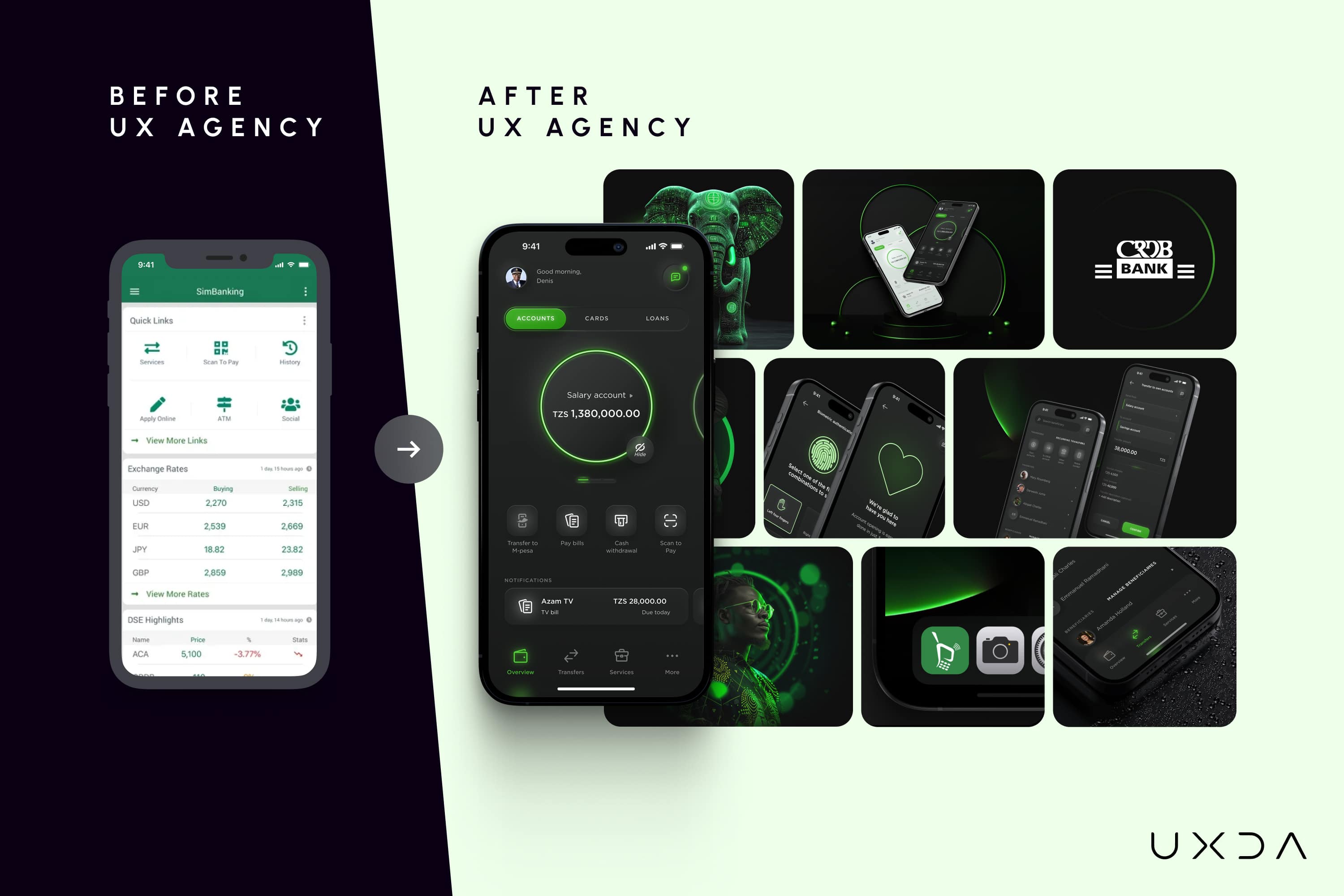

CRDB – Tanzania’s Neon Trailblazer

It took vision and honesty from the CRDB team to recognize that their app no longer met evolving customer expectations and their product team needed help, but this decision opened the door for them to digitally dominate the Tanzanian market. To make a new app UX that matches its “Bank That Listens” mantra, Tanzania’s biggest bank engaged UXDA to rethink SimBanking from the logo outward.

The new neon-on-dark identity, biometric onboarding and fee transparency digitized 70 percent of processes, won “Best Banking App” nationally and pushed financial-inclusion metrics across the country—so convincingly that rival African banks now cite CRDB’s case when briefing their own vendors.

Garanti BBVA Securities – eTrader 2.0

To break free from the limitations of a standard trading solution and offer their clients a unique experience, Turkey’s leading brokerage, Garanti BBVA Securities—a part of Garanti BBVA, the country’s second-largest private bank—bravely dumped its restrictive white-label trading stack after consulting five agencies and choosing UXDA.

Together we built a brand-aligned, cross-channel eTrader that seamlessly integrates BBVA’s globally recognized visual identity while reflecting Garanti BBVA Securities’ local expertise. The platform lets novices learn in-app and power users personalize dashboards. It launched in September 2024, immediately earning the “Most Innovative Brokerage Firm” accolade. The project proves that opting for a specialist partner can turn a commodity platform into a market-differentiating, innovative investing experience under a strong and trusted financial brand.

Afterthought: Unlocking Digital Potential Using Experts

Think of your in-house design team as diligent family physicians. They know the “patient” intimately—every screen, every button, every workflow. They can handle routine check-ups: tweaking a button here, adjusting a label there, treating minor usability “colds” with quick fixes and general best practices.

But when the patient faces a high-stakes heart condition—say, a complete UX overhaul, a mission-critical AI personalization engine, brand-driven revamp or an enterprise-wide accessibility transformation—you wouldn’t settle for a generalist. You’d call in the world’s leading cardiac surgeon. That’s what a best-in-class financial UX agency brings:

- Specialized Diagnostic Tools: While the family doctor relies on standard checklists, the heart surgeon wields advanced imaging (e.g., deep user research, behavioral analytics) to pinpoint hidden defects in the user journey.

- Precision Execution: The family doctor might prescribe lifestyle tweaks (“add more microcopy here”), but the cardiac surgeon performs targeted interventions—redesigning core architectures, orchestrating complex component migrations or stitching in new AI-driven features with surgical accuracy.

- Risk Management and Recovery Plans: A family doctor handles general aftercare; if complications arise, they refer you to a specialist. A heart surgeon, by contrast, designs comprehensive pre- and post-op protocols—detailed launch plans, rollback strategies and continuous monitoring—to ensure the “patient” not only survives but thrives.

If you're serious about the future of your services, it's essential to allocate sufficient funding. As a point of reference, architects typically charge 10–15% of a building’s construction budget for design work. For complex digital projects, this percentage can be even higher.

Consider the case of designing a comprehensive digital banking platform—encompassing mobile apps, desktop banking, CRM systems, and more. Building such a system can cost tens or even hundreds of millions, and the design phase alone minimally requires hundreds of thousands of dollars. In the case of a full digital banking ecosystem, the design budget can easily exceed one million.

Can it be done for less? Technically, yes—but the result will likely be a generic, copy-paste solution that fails to differentiate your brand. In the long term, this leads to poor user engagement and a steady outflow of customers to competitors offering superior digital experiences.

In short, in-house designers should keep your platform healthy day-to-day. But for life-or-death operations—those transformative projects that redefine your digital brand—it pays to enlist the top “cardiac surgeon” of UX. Their deep expertise, specialized tools and rigorous protocols turn high-risk procedures into success stories, unlocking performance and reliability that mere generalists simply can’t achieve.

Discover our clients' next-gen financial products & UX transformations in UXDA's latest showreel:

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedin