Leading the way in digital banking requires bold decisions and a clear focus on brand identity. CRDB Bank, a leading financial institution in Tanzania, recognized the need to transform its outdated mobile app into a cutting-edge solution for the future. By partnering with UXDA, CRDB not only modernized its app but also reinforced its reputation as the bank of tomorrow. Explore this case study to see how UXDA's expertise and strategic UX approach ensured long-term success, strengthening CRDB's brand consistency and reshaping Tanzania’s banking landscape.

Client: “The Bank that Listens” Pioneers Banking Innovations in Tanzania

CRDB Bank is Tanzania's largest commercial bank, holding nearly 25% of the country's total market assets. Since day one, it has been redefining industry standards with top-notch services and forward-thinking solutions. Named Tanzania's Best Bank four years in a row by Global Finance, this accolade underscores the bank's dedication to growth and digital innovation.

True to its tagline, “The bank that listens,” CRDB Bank introduced a groundbreaking digital tool that uses QR codes to collect customer feedback. This innovation has made it faster and easier to understand customer needs, helping the bank respond swiftly and effectively.

CRDB Bank has a history of being first. In 2011, it launched SimBanking, Tanzania's first mobile banking app, putting everyday banking services in the hands of its customers. It also pioneered agency banking in 2013, now boasting over 20,000 agents and 250 branches. In 2022, the bank launched self-account onboarding, allowing customers to open accounts without visiting a branch. This feature alone brought in 68% of new customers last year, pushing the bank's total customer base past 4 million.

With a vision to transform lives and unlock Tanzania's economic potential, CRDB Bank is committed to staying ahead. It’s shaping the future of digital banking in Tanzania with secure, innovative and customer-centered experiences that set new benchmarks in the industry.

Challenge: Reimagine the Brand's Digital Identity with a Future-Focused Product Experience

CRDB recognized a gap between its strategic vision and its outdated digital presence. The existing digital experience no longer reflected the bank's ambition to be a trusted, cutting-edge financial partner. To bridge this gap, the challenge was clear: deliver a next-gen user experience that not only met but exceeded customer expectations.

Transitioning from legacy products is never easy—it’s a bold move into uncharted territory that demands a delicate balance between innovation and usability. CRDB needed to ensure that the new features and solutions truly addressed customer needs, without adding complexity to operations or risking the trust they had built over the years.

To tackle this transformation, CRDB partnered with UXDA, a leading UX agency renowned for redefining digital experiences in the financial world. With a track record of designing over 150 next-gen banking and Fintech solutions across 37 countries, UXDA was the perfect fit to bring CRDB’s vision to life.

The UXDA mission in this project was ambitious: to reinvent the CRDB brand's digital identity with a forward-thinking product experience, minimizing risks while turning their strategic vision into reality.

Solution: Redefining CRDB Bank's Digital Future

UXDA’s collaboration with CRDB Bank delivered a visionary design concept that set the stage for upcoming digital success. By turning long-term goals into clear, actionable steps, we empowered the CRDB team with a roadmap to achieve digital excellence.

Elevating the Brand's Digital Identity and UX Standards

To help CRDB stand out in the competitive digital banking landscape, UXDA crafted a full redesign of the SimBanking app. The new app integrates world-class UX/UI practices and a cutting-edge design interface, perfectly embodying the bank's mission to provide an innovative banking experience and extend its brand beyond local market competitors. A newly integrated loan section and biometric authentication set a new standard in the Tanzanian market, providing a world-class banking experience.

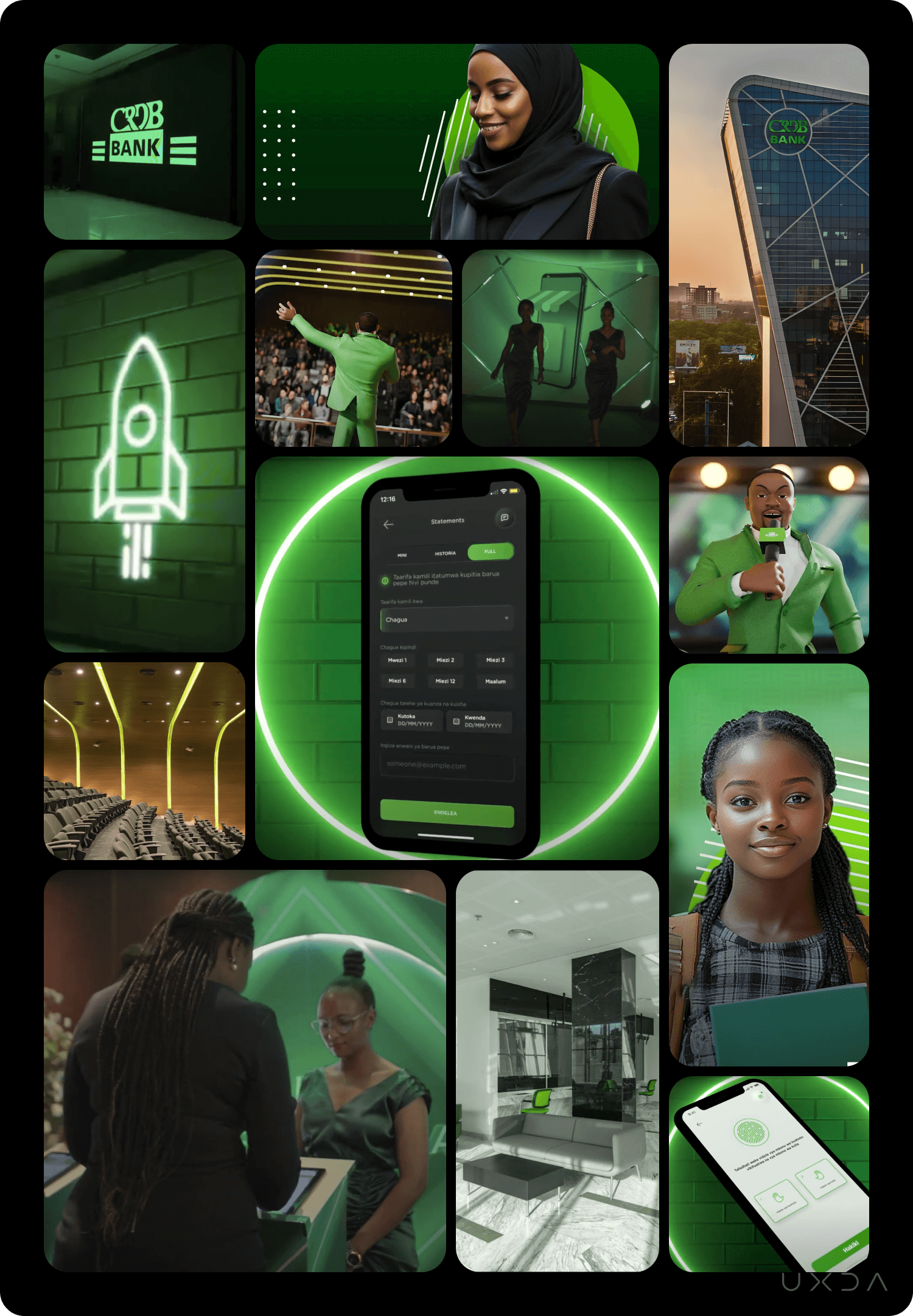

To demonstrate its forward-thinking approach and to highlight the uniqueness and authenticity of its brand in the market, the bank agreed to an innovative aesthetic. The design introduced a bold aesthetic with neon green highlights on a sleek dark background, accented by dynamic lighting effects. This fresh visual identity redefined how banking apps are perceived in the region, breaking away from generic, uninspired designs. The result? A modern, high-tech feel that instantly differentiated CRDB from its competitors.

Brand Activation Through Design Consistency

The redesigned app received accolades not only from CRDB customers but also within the industry. Following its launch, the app was recognized at the Digital Tanzanian Awards as the “Best Banking App” of 2021. This accolade complemented CRDB's nominations for “Best Innovative Bank” and 'Bank of the Year,” highlighting CRDB brand's significant achievements in the banking sector.

To achieve such recognition, the bank took the design language of the app a step further and elevated it to the level of brand identity, integrating the new visual language across all customer touchpoints, both online and offline. By using these design elements in its marketing communications, the bank not only conveys an energetic, innovative image but also provides a consistent experience throughout the customer journey, activating powerful resonance with the brand.

Facilitating the Revolution of Tanzania's Digital Banking

The redesigned SimBanking app has revolutionized how banking is done in Tanzania. By digitizing 70% of processes, CRDB empowered customers with self-service options and reduced reliance on branches. This transformation contributed to a rise in digital financial inclusion—from 65% in 2017 to 76% by 2023.

We are continuously reviewing our offerings to best respond to the changing needs of our customers, and this app is developed entirely based on customer feedback. It is about leveraging world-class technology to deliver the future of banking today.

Abdulmajid Nsekela (Bank’s Managing Director and Group CEO)

CRDB also led the way in operational transparency, clearly displaying transaction fees—a first in the region. This bold move not only earned customer trust but also set a new standard for accountability in the banking sector, inspiring other institutions to follow suit.

A Lasting Impact

Three years after its launch, the new SimBanking app remains the gold standard for mobile banking in Tanzania and a case study for innovation across Africa. CRDB’s success continues to influence financial institutions looking to embrace user-centricity and transparency. Other banks in Africa regularly cite CRDB's case when engaging with UXDA as potential clients.

The SimBanking app’s redesign isn’t just a tech upgrade—it’s a blueprint for how a bold visual identity and strategic UX approach can redefine a bank’s presence, transform customer experiences and shape industry trends for years to come.

Approach: Brand-Driven Design for Next-Gen Digital Banking

To showcase CRDB Bank as an industry innovator, UXDA crafted a digital banking app that truly resonates with Tanzanian consumers. By enhancing intuitive navigation and expanding self-service features, we ensured that essential financial services are accessible anytime, anywhere—building trust and establishing long-term relationships.

Empathy at the Heart of Design

Creating a strong brand in digital banking requires a powerful emotional connection. And this is impossible without understanding the key pain points and expectations of users. In-depth UX research helped us to understand CRDB's customers and develop deep empathy for them within the project team.

Our process included a detailed analysis of the Tanzanian market and competitor benchmarking. We assessed CRDB’s app features, identifying opportunities for improvement.

Our UX research led to creating user personas that addressed real challenges with effective UX/UI solutions. We worked closely with CRDB Bank’s team to validate customers' profiles and key activities. Collaborative validation with CRDB’s team ensured our design addressed users' specific needs. Our research uncovered:

- Frustration with fees: Users’ frustration with banks obscuring service fees eroded trust and loyalty. We recommended prominently displaying actual fees within the app to rebuild trust.

- Complex navigation: To address complex navigation challenges in the mobile app, we switched from a hamburger menu to a bottom navigation bar, delivering a smoother, more intuitive and universally accessible user experience.

- Need to visit the branch: Users found it inconvenient to visit bank branches for tasks like applying for loans or opening additional accounts, often requiring a significant amount of time. We collaborated with the CRDB team to enhance self-service capabilities by digitizing the account opening process within the mobile app.

A Bold, Future-Focused Visual Identity

To empower CRDB Bank’s visual identity and position the app as a future-driven digital extension of its brand, UXDA designers thoroughly reviewed the bank’s brand book, guidelines and marketing assets. We incorporated the bank’s primary color as a central theme of a bold and cohesive app experience that reinforces CRDB's identity.

Additionally, UXDA introduced a unique "еnergy circle" element to symbolize continuous movement and progress, embodying the bank’s forward-thinking vision and adaptability. This visual asset has become a defining feature of the app and a cornerstone of the bank’s brand identity, maintaining its recognition as a leader in the financial landscape.

The UXDA team aligned the bank’s commitment to innovation and user-centricity with a seamless and consistent digital brand experience. By designing both dark and light modes, we ensured the app caters to diverse user preferences and enhances accessibility.

We incorporated neomorphic design elements to give the app a futuristic edge—using lighting, shadows and rounded shapes to create a tactile, immersive experience. We also prioritized trust and security to boost user engagement.

Seamless and Accessible Banking

We have enhanced user convenience through reviewing in-app navigation and incorporating a “Loans” tab within the app. By digitizing the loan application process and providing an overview of existing loans, customers can seamlessly manage their finances, reducing the need to visit bank branches and ultimately lowering the associated costs of coming to the branch.

To ensure a fast and reliable banking experience, we had to carefully evaluate every UI element and interaction, taking into account regional network speeds and connection coverage. We focused on creating a lightweight design that minimized loading times and increased responsiveness, ensuring a seamless experience for users regardless of their network conditions.

Driving Success Through Strategic Collaboration

The success of the redesigned app comes from the strong partnership between CRDB and UXDA. Together, we worked with a visionary, goal-driven team eager to challenge market norms and turn bold ideas into real-world solutions.

Through this partnership, the bank team embraced the app’s visual style and design to align their efforts and create a unified brand identity. Together, we built a strong foundation for ongoing innovation, setting CRDB Bank up for lasting success in the competitive world of digital banking.

The SimBanking app design set a gold standard in the market, receiving positive feedback and serving as a benchmark for design excellence that competitors aspire to achieve. The outstanding results inspired the bank's team, boosting their confidence and driving their commitment to continued innovation.

UXDA Deliverables

- Stakeholders’ interviews

- Product strategy

- Product audit

- Contextual market analysis

- User personas through a JTBD framework

- Empathy map

- User journey map

- Scenarios in red route map

- Information architecture

- Wireframes

- Key design concept

- UI design prototype

- Product motion design

- Development support

Takeaway: Build Your Banking App as a Powerful Brand Ambassador

A banking app is no longer just a self-service tool; it’s a dynamic channel for showcasing a bank’s identity and values. When done right, it delivers a unique, engaging experience that resonates with customers and reinforces brand loyalty.

To achieve this, banks need a cohesive visual communication strategy that integrates their apps into a powerful brand identity. Every touchpoint—digital services, branches, websites, marketing campaigns, social media and customer interactions—should work together to tell the same compelling brand's story. This consistency builds trust and loyalty by highlighting the bank’s personality to strengthen its position as a reliable financial partner.

CRDB Bank's initiative demonstrates that achieving market leadership involves navigating inherent risks and uncertainties. By partnering with UXDA, they embraced bold innovation to tackle user pain points and reimagine familiar experiences. The result? A user-friendly, impactful app that not only simplified banking but also elevated the bank’s reputation as a market leader.

Through a brand-driven digital experience transformation, CRDB Bank strengthened its market position and reinforced its role as a pioneer and innovator setting new standards for banking in Tanzania. Our collaboration improved brand perception and increased interest in the bank's services, ultimately driving user satisfaction and loyalty. CRDB Bank's journey proves that blending creativity with user-focused solutions can set new standards for digital banking, inspiring others to follow suit.

Discover our clients' next-gen financial products & UX transformations in UXDA's latest showreel.

Get UXDA Research-Based White Paper "How to Win the Hearts of Digital Customers":

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedin