Magma Capital Funds, a Chicago-based private hedge fund investment manager hired UXDA to design a next-gen investment platform, Magma, for high-net-worth individuals. The aim was to create a quantitative hedge fund product to simplify and enhance the investment experience with cutting-edge technologies. The team has incorporated machine learning and artificial intelligence technology into the core of its back-end, and they needed an equally advanced client dashboard.

Client: Young Entrepreneur Challenges Hedge Fund Standards During COVID-19

Magma Capital Funds, led by CEO Gershie Vann, aims to transform the hedge fund investing experience by drawing inspiration from successful hedge fund founders, such as Ray Dalio. Gershie realized that there is a significant gap in digitalization and digital-native user experiences in hedge fund services. Leveraging Vann's entrepreneurial background and expertise in macroeconomics and finance, the company seeks to address the lack of clarity and control by traditional hedge fund managers.

Despite the COVID-19 lockdown, Magma Capital Funds started its digital hedge fund development in 2020. The Magma team focused on designing an exclusive highly technological and personalized hedge fund investment experience for its clients. Service is available only to a narrow circle of HNWIs (high net-worth individuals) who are personally approached by the CEO. This is essentially a small, elite club.

One of Magma's current investor groups consists of elite sportsmen, such as NBA and NFL players. They constantly work hard and don't have time to think about their financial future after early retirement. While players are earning millions of dollars each year, many of them fail to invest their money wisely, leading to financial difficulties later in life.

The needs and expectations of wealthy people at this level are shaped by the luxurious quality of service. Therefore, Magma Capital Funds was seeking innovative product solutions capable of providing an appropriate level of service to clients who trust their millions to the fund.

Challenge: Match Investment Experience to the Digitally-Native Elite Expectations

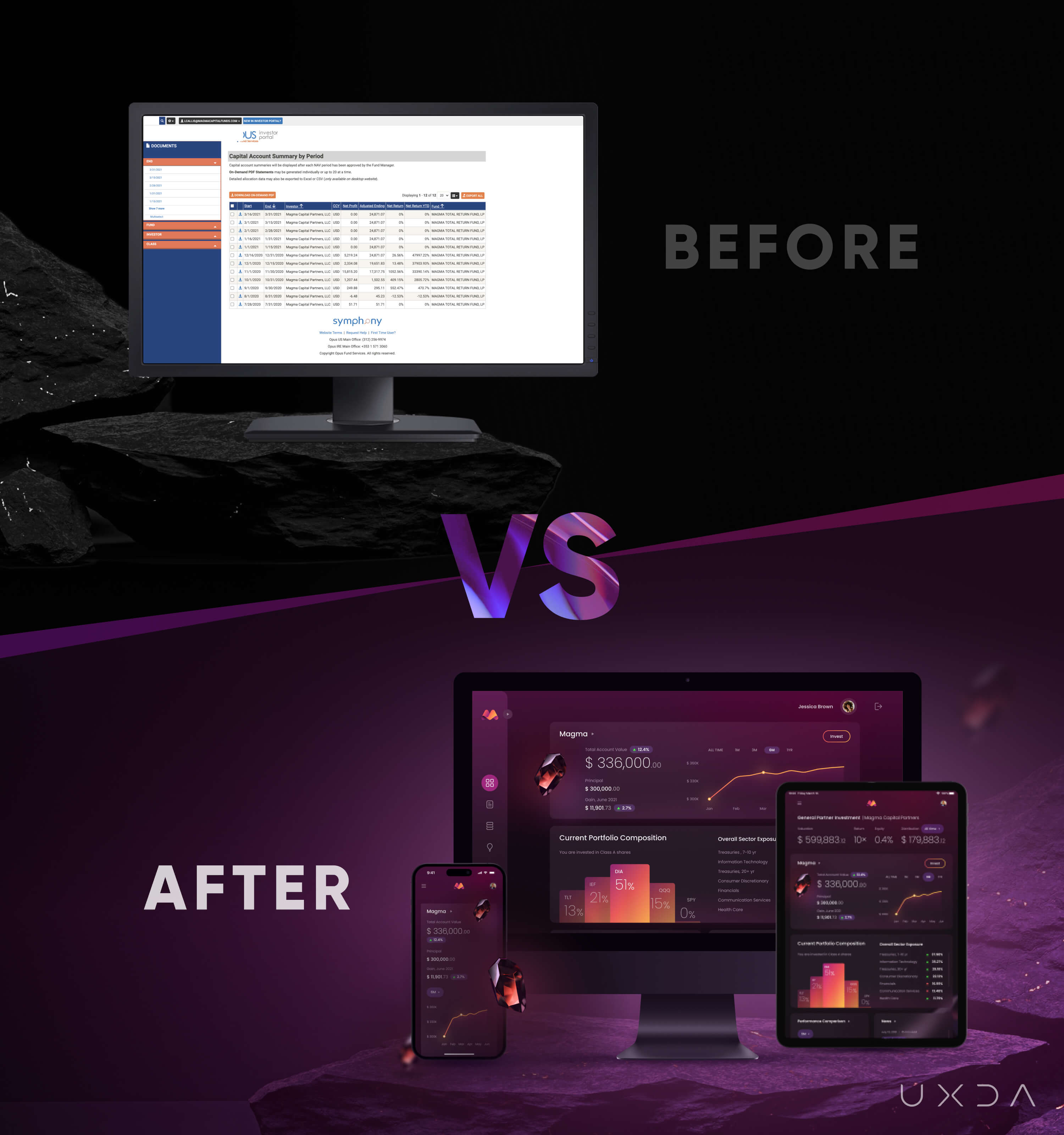

Magma Capital Fund's challenge was to invent a digitally-driven customer-focused solution that makes the abstract concept of investment real and clear to digitally-native users. They needed a Magma product to wow the new generation of HNWI investors with luxury aesthetics and a simple and fully digitized onboarding experience while empowering them with a sense of control, sophistication and affiliation.

Furthermore, the company was seeking solutions to the barriers to HNWI maintenance: the time-consuming paper-based registration process and the inability to view and control their investments digitally from anywhere at any time. The experience of investing in this next generation hedge fund aimed to eliminate the problems common to relationships between classic hedge fund managers and their investors that are associated with a lack of transparency, communication restrictions and secret investment strategies not explained to clients.

To reach the desired user experience and technological advantage, Magma Capital Funds was seeking a financial UX design agency capable of helping them innovate the experience. They approached UXDA with a specific vision of a new user experience concept. Given that the objective was to develop an encouraging product with a fresh approach and digitize paper-based procedures, it was crucial for the CEO, Gershie Vann, to ensure that the design agency they were partnering with had the expertise in the financial industry as well as in the optimization of the product and the simplification of the processes.

Solution: Exclusive 24/7 Access to a Digital Investment Club

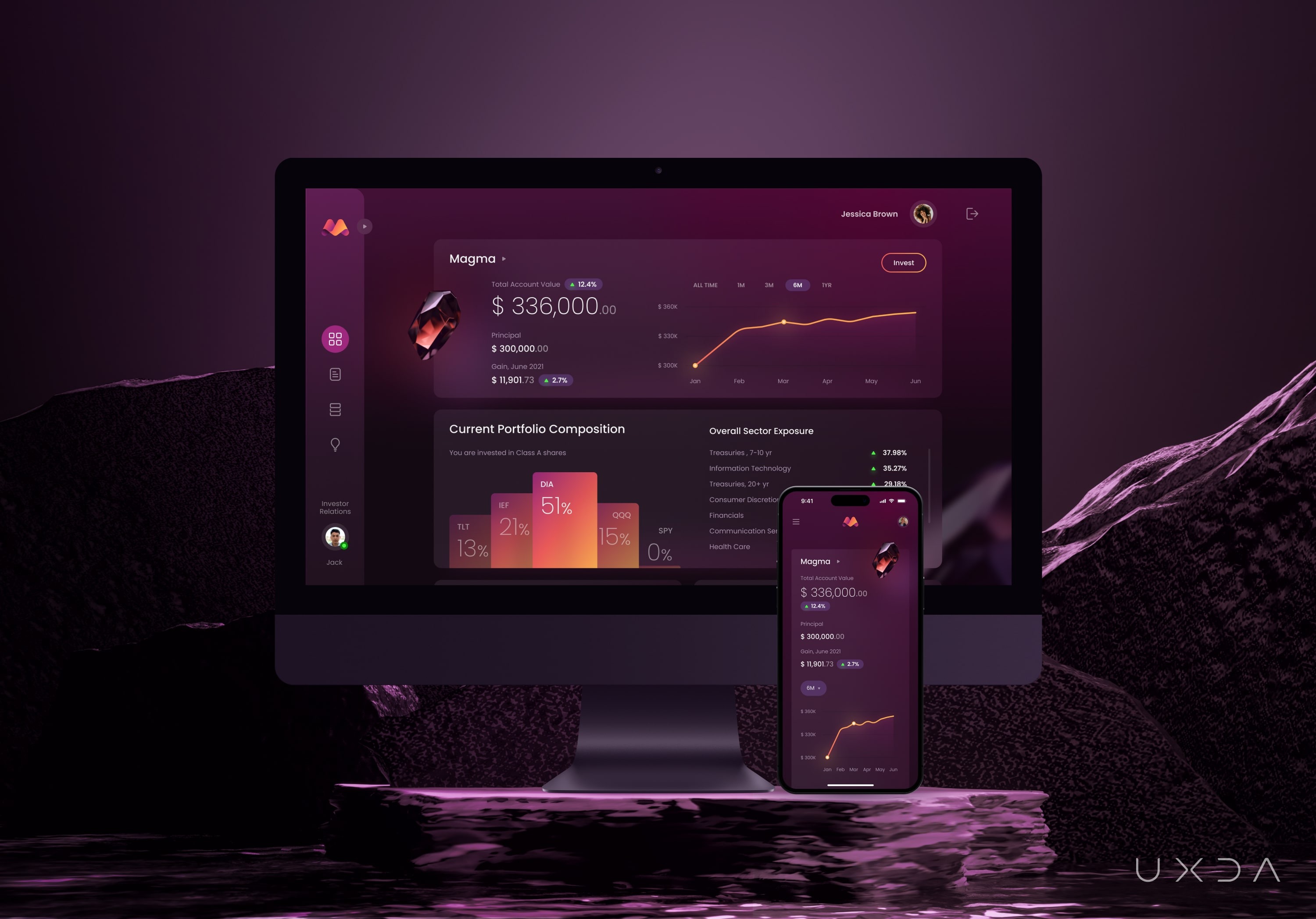

At the core of the investment product Magma are the complex algorithms based on AI and machine learning that allow the deployment of market volatility for the benefit of investors. Therefore, the client portal reflects this digital advantage but, at the same time, does not slide into a faceless and templated financial interface. The authentic visual and functional experience fuels the Magma brand with the feel of an exclusive, elite club in a digital dimension.

Unlike incumbent funds, Magma's product is tackling the distrust issue by providing 24/7 access to critical information and shining the light on the current situation with the user's investments. A completely digital solution provides a straightforward and comprehensible long-term investment overview, thus offering a constant feel of control and understanding. Furthermore, the new experience empowers successful individuals to reach their goals and be more confident about their future financial well-being.

UXDA ensured a customer-centered and premium design that simplifies the investors' experience. This enables the Magma platform to efficiently transmit a personalized approach and cultivate the relationships between the brand and its clients through a service that suits HNWI investors' high-end personalized lifestyle. The platform's design amplifies the brand reputability and trustworthiness and makes the investments more tangible for the customers. This digital product communicates AI and machine learning tech capabilities in an easy-to-understand and engaging way in line with Magma's brand value.

Despite active digitalization in the financial sphere, many hedge fund investors still receive tons of physical paperwork and frequent calls if they want to join and get updates from the hedge fund investing service. In contrast, Magma was poised to become one of the first next-gen hedge funds that makes the investment experience fully digital by digitizing the onboarding process, enabling electronic document signing (using DocuSign) and providing digital access to investors' portfolios.

However, Magma Capital Funds acknowledges the continued importance of maintaining a balance between the digital experience and personalized human-touch relationships.

Approach: Intuitive Architecture with Tailor-Made Premium Aesthetics

During the project, we interviewed Magma investors and discovered that they expect a simple and insightful service. The standards and expectations of the new generation of HNWIs are different from what the industry is used to. They are not ready to spend time on meetings, phone conversations and filling out paperwork.

UXDA came up with an intuitive architecture and user flows that provide the users with the necessary information to get an instant financial data overview. Our UX solution also aids users in efficiently navigating the platform and accessing information that is not readily accessible with other hedge fund portals.

Magma's UX design was then empowered by a visual design that gives investors a luxurious feeling of an elite investment club, with tailor-made premium aesthetics and limited access. The platform enables investors to maintain connection and control over their funds from any place at any time.

During the exploration of design concept directions, we came up with an idea centered around crystals. Magma Capital Funds planned to expand its services and offer various products on a unified platform, so we envisioned incorporating crystals with distinct designs that would carry the prestigious, personalized feeling and convey the visual identity of each product. Our approach involved emphasizing the brand and aligning with user expectations through unique design and attention to detail. The client was genuinely thrilled and excited about Magma's concept accompanied by the aesthetics, crystals, fonts and feelings it evokes.

Onboarding

One of the most significant transformations from the industry standards Magma has implemented is their onboarding process. Magma Capital Funds' CEO recognized UXDA's ability to simplify complex procedures and effectively used it to transform the onboarding flow. It took us a month to carefully examine 300 pages of onboarding documents, along with structurizing them and building a digital flow in parallel. We managed to digitize the process that previously took several days to complete, resulting in an unmatched and much quicker online onboarding experience.

The new onboarding flow features a straightforward, guided process that can be accomplished within a single day. The streamlined onboarding experience involves collecting and verifying personal and investor information, signing agreements and choosing an investment subscription. The integration of DocuSign technology has played a pivotal role in making the process more efficient for Magma Capital Funds and enabling investors to complete the entire process digitally, ensuring faster, safer and more accessible onboarding from any location.

Dashboard

Magma's dashboard provides users with information on the portfolio’s current state and past performance. By providing a clear interface, insights into their current investment strategy and portfolio composition, Magma helps users feel more confident, in control of their investments and informed about their overall financial well-being. Moreover, it emotionally connects the investors to the brand and the product they have trusted.

Magma Capital Funds' goal is to deliver above-average returns to investors by utilizing AI and machine-learning-powered investment strategies. To reassure investors, Magma provides a performance comparison between its quantitative fund strategies and the industry-standard 60/40 portfolio. Moreover, it serves to further reinforce the platform's commitment to delivering superior investment returns to its investors.

Magma promotes autonomy and a degree of independence, which is empowered by the ability of the investors to have certain control over their money. They can invest additional money by themselves at any time, which will then be processed and allocated to the fund by their manager. Magma's commitment to investor autonomy differentiates it from other investment options.

At the same time, Magma ensures clients feel the human presence and receive tailored support when it's required, facilitating communication between investors and their designated relationship managers through a convenient chat service or phone call. Furthermore, to increase the financial market awareness of the investors, they can familiarize themselves with relevant news from their new investment world.

Fund performance

Investors can get a more detailed overview of how their portfolio has fared over the entire duration of their relationship with Magma and how they have reached current heights. It lets investors assess whether they are meeting their financial goals and builds the ground for understanding the market performance, tendency of the investment strategy and potential outcomes.

The ability to create an online request for fund withdrawals eliminates the need for investors to spend time scheduling calls with their manager. Additionally, online withdrawal requests can help speed up the withdrawal process, allowing investors to access their funds more quickly.

Performance comparison

As Magma's goal is to empower investors to become more autonomous, it facilitates this aim by providing an investment simulator. By entering estimated investment and withdrawal amounts for the upcoming years, users can obtain an estimated level of return from their hedge fund investments and gain an approximate understanding of the financial contribution that Magma could provide in their lives, thus allowing them to evaluate the potential of their future financial well-being.

UXDA Deliverables

- Stakeholder’s interviews

- Contextual market research

- User personas through a JTBD framework

- User journey map

- Information architecture

- User flow maps

- Key design concept

- UI design prototype

- Design system

Takeaway: The Courage to Make Things Different Under Conservative Pressure

The traditional world of hedge fund investing is known for its high risks and requires an analytical approach with careful decision-making, which is what makes it so conservative. To create an innovative product in the conservative hedge fund industry, you need courage and a progressive mindset. Only by challenging the status quo could Magma Capital Funds unlock potential opportunities and build a successful next-gen investment experience.

Magma Capital Funds' strategy to develop an innovative value proposition required the project team to implement reasoning from key principles: rethink traditional industry processes, implement sophisticated digital technologies and use customer-centered digital product design methods. As the user experience plays a pivotal role in the adoption and success of any technological advancement, an advanced and well-thought out product design is essential.

A high-tech and complex system infrastructure requires an equally modern and innovative client interface, like the foundation, infrastructure, walls and interior of one building. Therefore, the capabilities of AI technology in products should empower a user experience that meets the modern standards of innovative digital solutions based on customer needs and expectations.

Discover our clients' next-gen financial products & UX transformations in UXDA's latest showreel.

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedin