In the UAE (United Arab Emirates), where future-driven innovation is a way of life, Emirates NBD conquered an ultimate challenge. When this Dubai-based banking powerhouse faced the relentless demands of an increasingly digital world, the bank knew it needed more than just incremental change—it needed a bold transformation. Emirates NBD challenged the UXDA team to increase digital ROI by designing a seamless, highly personalized digital experience that goes beyond traditional banking and meets the high expectations of Dubai’s tech-savvy population. This case study delves into how the strategic UX approach transformed Emirates NBD’s digital ecosystem, setting a new standard of excellence for digital banking worldwide and solidifying the Emirates NBD brand’s position as a leader in the Middle East financial industry.

Client Profile:

Leading Powerhouse of Middle East Banking

Emirates NBD, Dubai's government-owned bank, is the leading financial services brand in the UAE and one of the leading banking groups in MENAT with $235 billion in assets. Currently, more than 30,000 people, representing more than 90 nationalities, are employed by Emirates NBD, making it one of the UAE's largest and most culturally diversified employers.

Emirates NBD holds a dominant market position as one of the biggest financial groups in the Middle East. With a presence in 13 countries and serving over 20 million customers, Emirates NBD is a significant player in the global digital banking industry. The bank is ranked 85th globally in The Banker’s list of the World’s Top 1,000 Banks for 2023.

Emirates NBD, the first National Bank established in Dubai and the UAE, offers a full spectrum of financial services—from retail and corporate banking to wealth management. Emirates NBD Group further enhances its market presence through subsidiaries like Emirates Islamic Bank, a Shari’ah-compliant franchise, and Liv Bank, a digital-only lifestyle bank. Emirates NBD is recognized as a pioneer in UAE banking, consistently leading the region in adopting and integrating cutting-edge technologies.

Emirates NBD is one of the first banks in the region to integrate the Microsoft Sustainability Manager into its ESG strategy. The bank is also a principal partner of COP28, emphasizing Emirates’ commitment to the UAE’s Year of Sustainability. A key component of its digital strategy also includes the launch of the SustainTech Accelerator program, which will support global green Fintech in creating innovative, sustainably focused financing solutions.

The bank has received multiple awards for its innovations, such as Global Finance World’s Best Bank in the UAE, Euromoney Market Leader in Digital Solutions and Euromoney Award for Excellence 2024 as the Middle East's Best Bank for Wealth Management. By continually refining its services and digital products to provide a personalized banking experience, Emirates NBD has built strong customer loyalty and satisfaction.

Challenge:

Increasing Emirates NBD’s Digital Ecosystem ROI Through Strategic UX

As the rapid evolution of digital financial services continues to disrupt the banking sector, institutions like Emirates NBD face the challenge of integrating these innovations within legacy frameworks while driving growth. In Dubai’s competitive landscape—where high standards of service and innovation are the norm—customers demand digital experiences that are not only seamless and intuitive but also deeply personalized.

Emirates NBD recognized that to maintain its leadership, it needed to shift from a traditional banking model to a digital-driven one that offers exceptional user experiences, enhancing customer satisfaction and, ultimately, driving higher ROI. This strategic pivot was essential to meet the expectations of Dubai’s tech-savvy population and to set new benchmarks for digital banking excellence.

Recognizing this, Chief Digital Officer Pedro Sousa Cardoso approached UXDA to make a bold move to completely revamp the user experience and the bank’s digital ecosystem. Mr. Cardoso leads the bank's digital transformation, directing cross-functional business and engineering teams to create a digital experience that enables the bank to realize its vision of becoming the most innovative financial institution.

The Emirates NBD team had ambitious goals to increase their digital ecosystem ROI: triple the app store rating, increase the number of active users and lay the foundation for future digital expansion. These initiatives underscore Emirates NBD’s commitment to leveraging UX to drive business success, ensuring that every digital touchpoint delivers strategic value and strengthens the bank’s competitive positioning.

To realize goals, Emirates NBD required a UX strategy aligned with its customer-centric digital ecosystem vision, brand values and long-term business strategy. The bank sought to overhaul its digital channels, beginning with the mobile app and expanding across its entire digital suite, ensuring every customer interaction was optimized for both engagement and efficiency.

The collaboration with UXDA, a strategic UX design agency 100% focused on financial products, played a critical role in this transformation. With a focus on maximizing the digital ecosystem’s ROI, UXDA brought innovative solutions that bridged the gap between cutting-edge technology and legacy systems. This partnership aimed not only to enhance the user experience but also to empower a customer-first mindset, culture and approach within Emirates NBD’s digital strategy, ensuring the bank remained at the forefront of digital banking in Dubai.

Defragmenting the User Experience

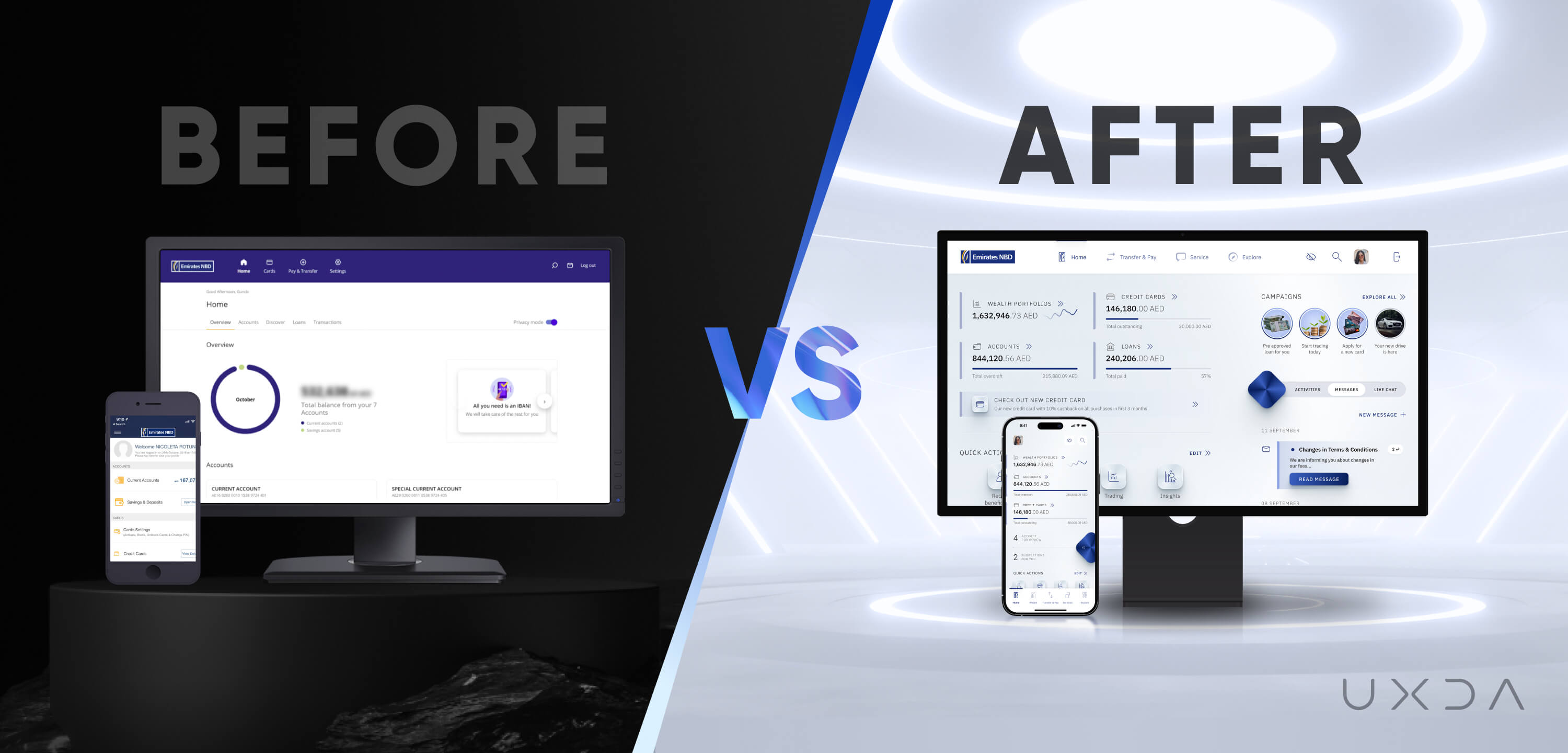

For most banks in the region, it is standard practice to create separate apps for different products. Therefore, Emirates NBD had several apps for its products and services, such as mobile banking, investing and deals with offers. However, this approach added friction to the customer journey, leading to user frustration.

The bank made a strategic decision to remove this fragmentation. We consolidated all services into one seamless application, building a new user journey experience that is user-centered, intuitive and aligned with the bank's broader goals. By offering a unified platform, Emirates NBD could more effectively promote its full range of services, empower cross-selling opportunities and ensure the digital transformation aligned with the bank's long-term objectives.

Overcoming the Complexities of a Large Corporation

In large retail banks, processes and decision-making are strictly structured and regulated, creating additional difficulties for any project. Adjusting or integrating even a minor detail often requires approval from multiple departments, resulting in huge delays. Additionally, ensuring a flexible and innovation-supportive culture can be difficult when internal teams and external UX partners start collaborating.

Despite this, Emirates NBD set an ambitious goal to launch the first version of the new ENBD X App in just six months… and did it!

To achieve this goal, the bank needed a strategic partner that could navigate these complexities effectively. UXDA’s extensive experience in large-scale digital transformations and our exceptional flexibility, planning, communication and prioritization skills were crucial in overcoming these hurdles.

To achieve this goal, the bank needed a strategic partner that could navigate these complexities effectively. UXDA’s extensive experience in large-scale digital transformations and our exceptional flexibility, planning, communication and prioritization skills were crucial in overcoming these hurdles.

Considering Emirates NBD's goals and unique cultural and organizational needs, we tailored our design processes to facilitate a streamlined and efficient project execution. Such flexibility ensured that teams were synchronized and focused, optimizing task management and resource allocation. As a result, decision-making was accelerated, the ambitious launch timeline was met, and the foundation was laid for effective planning and execution of future product enhancements in the roadmap.

Aligning Innovation with Infrastructure

As demand for digital financial products grows, there's a noticeable gap between what the market offers and what users expect. This gap presents a substantial opportunity to differentiate and remain competitive through innovation and personalization in a rapidly growing market. However, the path to seizing this opportunity is often obstructed by rigid regulations, complex processes and outdated legacy systems. Financial institutions struggle with integrating new technologies into existing legacy systems, which often slows down innovation, complicates the customer experience and lowers the bank's market competitiveness.

So, another key challenge was to align the new UX/UI system and standards with the bank's existing backend. To address this, the UXDA team maintained continuous communication, exploring both the technical opportunities and the limitations posed by the bank's current infrastructure. This collaborative approach and our previous experience allowed us to identify the best possible solutions, even when confronted with significant technical constraints.

By working closely with the Emirates NBD team, we successfully navigated these challenges, balancing the need for cutting-edge innovation with the practical realities of the bank's extensive infrastructure. The result is a solution that not only meets modern industry standards but also aligns with Dubai's exceptional lifestyle and sky-high service expectations, positioning Emirates NBD as a leader in the digital banking landscape.

Empowering a Culture of Innovation

Emirates NBD understood that a successful digital transformation requires more than just technological and design upgrades—it also necessitates a cultural shift toward digital innovation and design thinking within the organization. The bank set out to implement a culture in which creative thinking and experimentation were encouraged, enabling teams to push the boundaries of what was possible in digital banking.

UXDA supported the cultural transformation by guiding the adoption of agile methodologies and design thinking practices. This shift not only accelerated the development process but also empowered employees to take ownership of their creativity, driving continuous innovation. By embedding this culture of innovation across the organization, Emirates NBD ensured that its digital ecosystem would remain dynamic and resilient, capable of evolving with the rapidly changing customer expectations.

Implementing Scalable Architecture

As Emirates NBD pursued its digital transformation, one critical challenge was ensuring that its new digital products could scale effectively as the bank grew. The digital solutions needed to accommodate increasing numbers of services without compromising performance or customer experience. To address this, UXDA collaborated with the bank to implement a scalable architecture that could support future growth.

This approach not only prepared the bank for future expansion but also ensured that new features could be integrated seamlessly without disrupting existing services. The result was a robust digital infrastructure capable of adapting to market demands, ensuring long-term sustainability and ROI.

Personalizing the Customer Experience

With the growing demand for personalized services in the banking sector, Emirates NBD sought to differentiate itself by offering highly tailored digital experiences to its customers. The challenge was to leverage user data and advanced algorithms to deliver personalized content and services that would resonate with individual customers.

UXDA implemented personalization strategies that included dynamic content, personalized product recommendations and tailored communication. This personalized approach not only improved customer satisfaction but also drove higher conversion rates and deeper customer loyalty, contributing significantly to the overall ROI.

Solution:

Implementing the Highest Dubai Standards in Digital Banking

People in Dubai aspire to live life to the fullest, expecting excellence in everything they consume or use. Emirates NBD aimed to create a distinctive user experience by infusing its digital offerings with an aesthetic, innovative spirit and unique experiences that define Dubai. The UXDA team did everything possible to carefully convey the uniqueness and values of the legendary brand into the digital space.

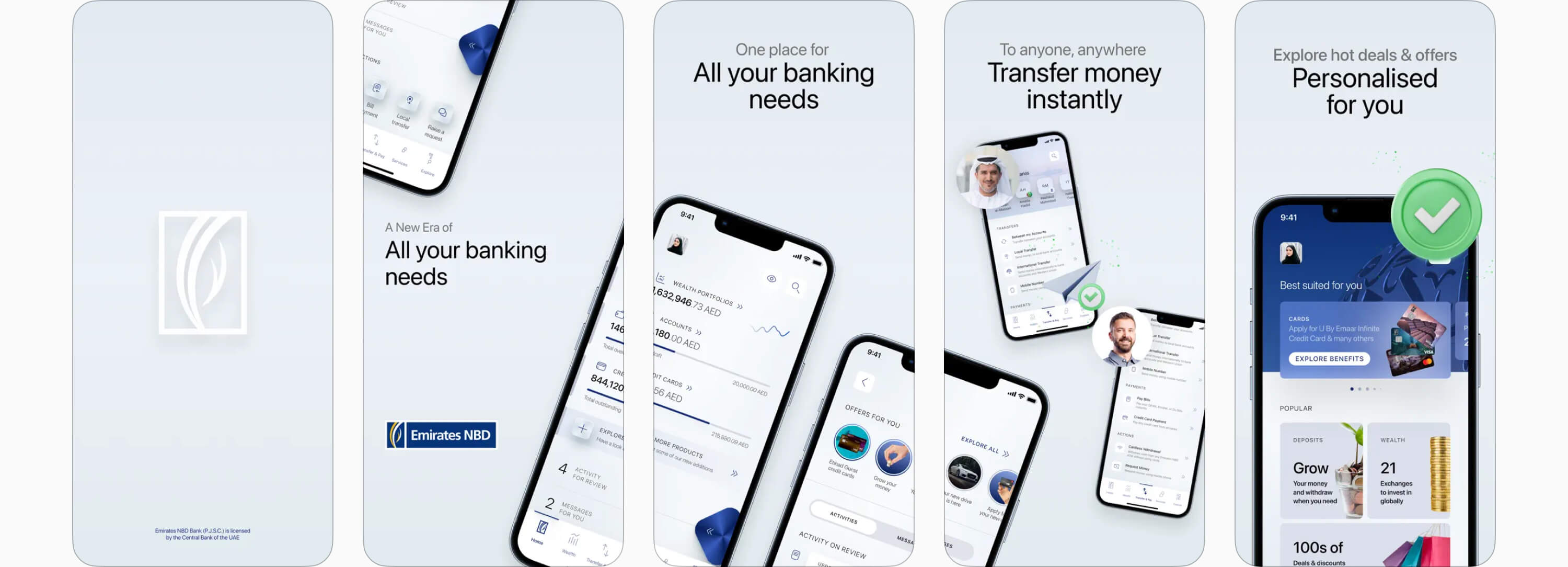

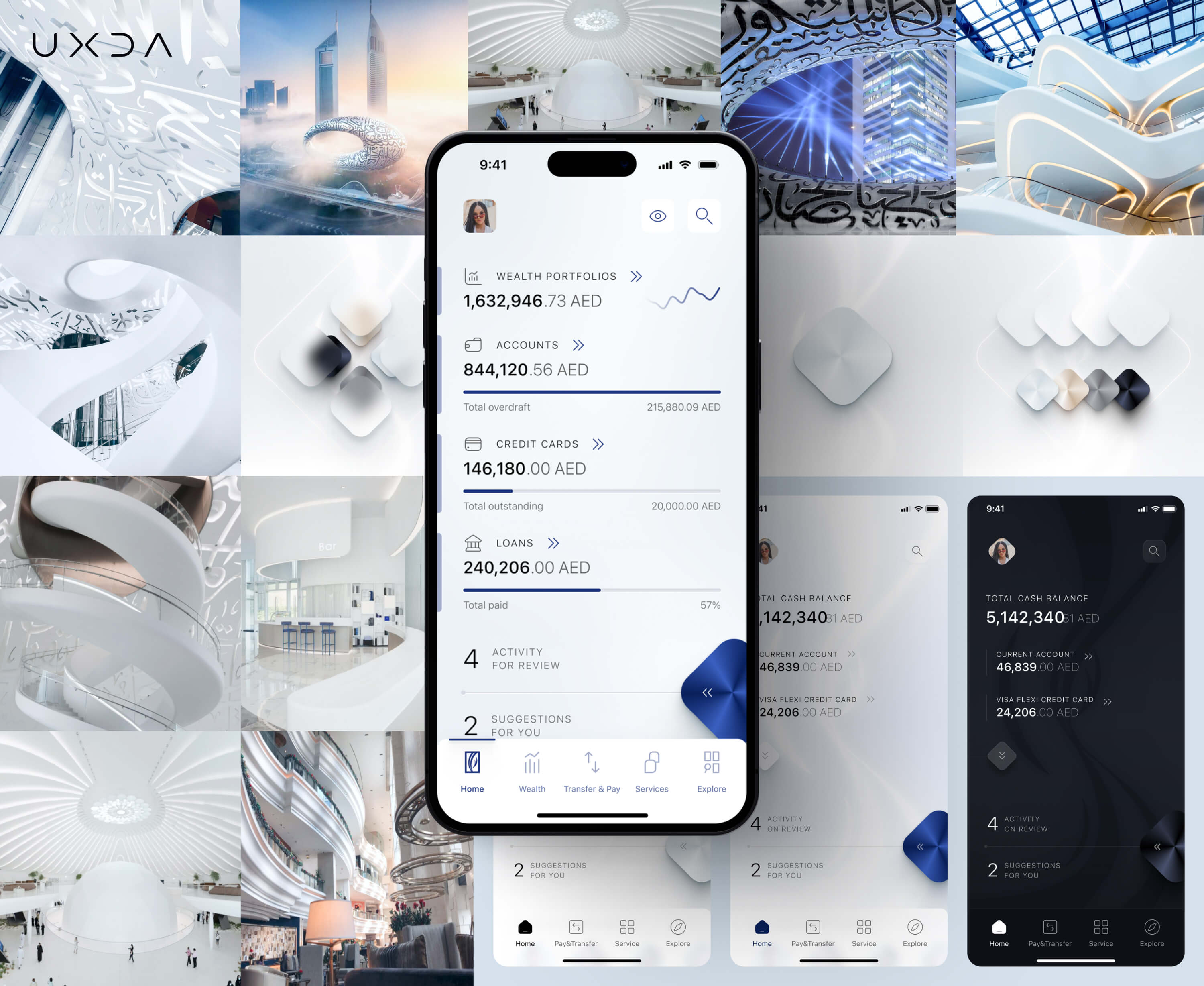

The UXDA team provided a UX strategy and UI design that empowered a new digital ecosystem, primarily the banking app, with a premium look and feel, aligning it with the daily excellence people in Dubai feel. Inspired by the renowned bank's brand and the majestic city architecture, the ENBD X App seamlessly integrates into users' routines. More than just a digital tool, this app is a one-stop banking and wealth management solution that provides a valuable extension of the luxury and innovation that characterizes Dubai living.

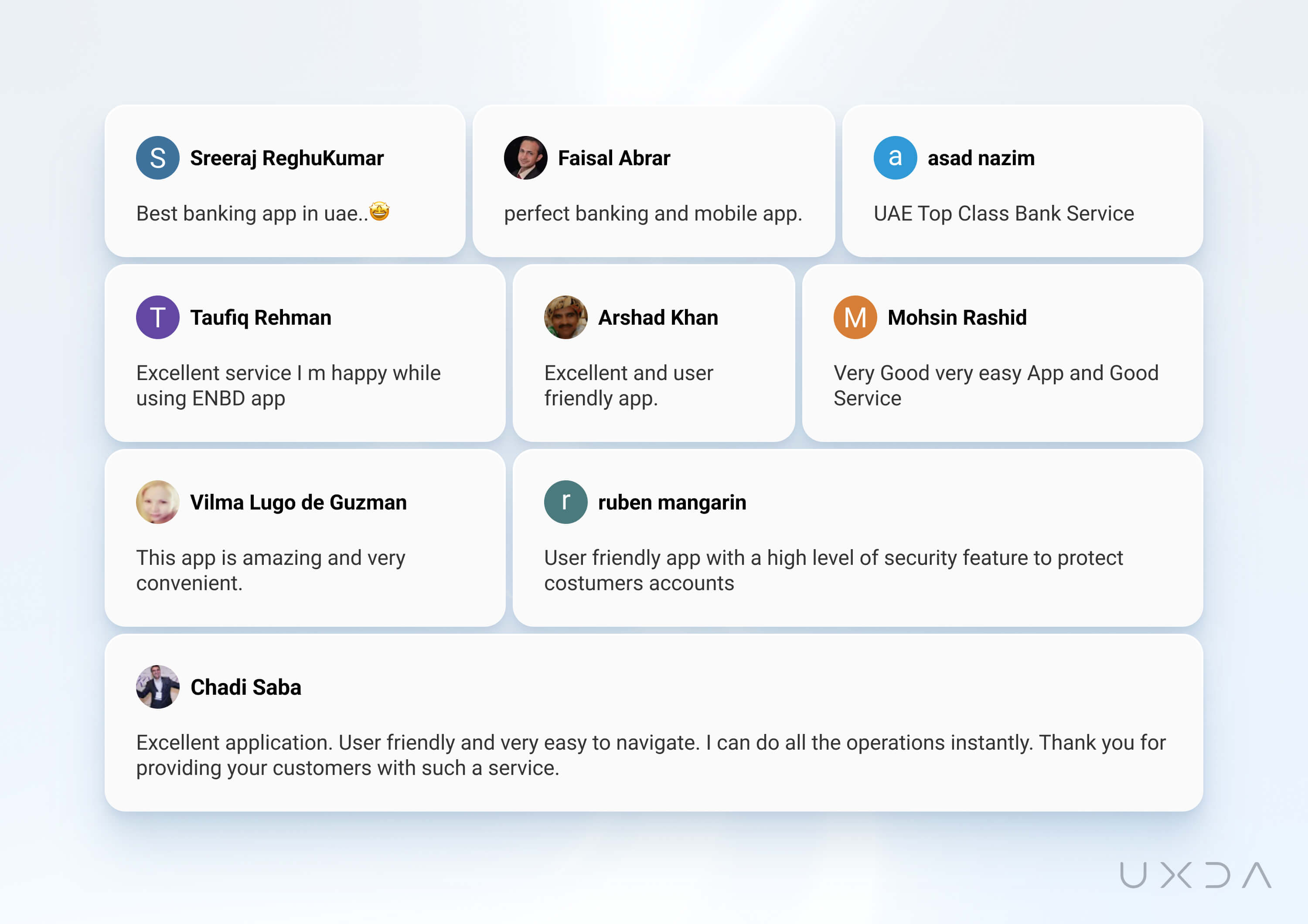

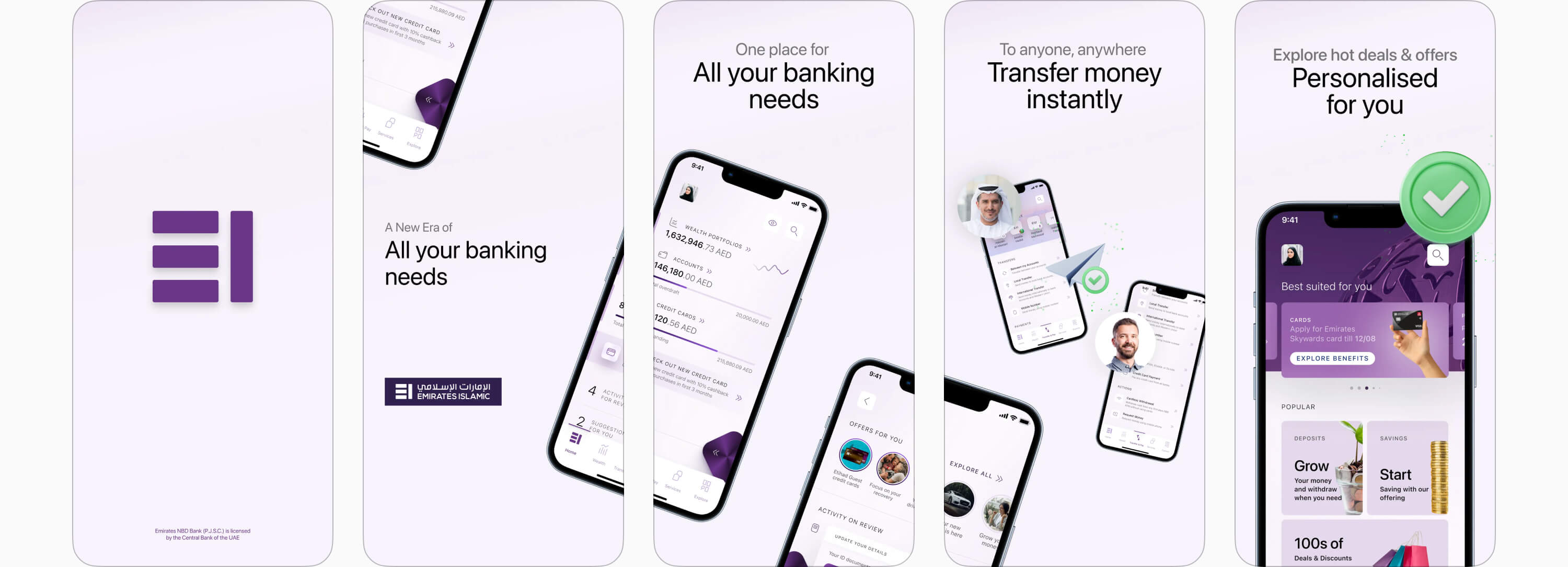

After cooperating with UXDA and launching the new ENBD X App, the Emirates NBD bank received numerous positive reviews and high ratings on both the App Store and Google Play, achieving a rating of 4.7. This tripled the previous app's rating (3.4 points growth) and marked an ambitious accomplishment.

ENBD X has also quickly earned a number of awards and conquered industry recognition, including the Excellence in Mobile Banking Award by Finnovex Magazine, Best Mobile Banking Application – UAE Award by Global Business Outlook, Most Innovative Retail Banking App – UAE Award by Global Banking and Finance Review and Best Mobile Banking App in UAE Award by the International Finance Magazine.

Pedro Sousa Cardoso, CDO, Retail Banking and Wealth Management, states:

“ENBD X sets a new standard of excellence for mobile banking in the region and beyond and is designed to provide customers with a truly enriching banking experience. As a front-runner in digital banking innovation in the MENAT region, Emirates NBD strives to provide its customers with all the information, tools and access they need to fulfill all their everyday banking needs at their fingertips.”

This was made possible by a well-established UX strategy to build a highly personalized and seamless experience continuously. By moving users to a digital service, we focused on the users' needs to manage all their finances within one app. The app provides personalized offers, real-time updates and direct communication with the bank, ensuring that users are informed and engaged.

Digitalizing the user journey across almost all banking interactions provides more than 200 banking services digitally, resulting in 50% more activity, both logins and transactions, compared to the previous app version. Daily app improvements to grow the adoption rate among its 20 million Emirates NBD customer base never stop.

Key differentiators:

- Unified finance and wealth management: Integrating wealth management with everyday banking offers users a holistic overview of all financial matters, creating a more cohesive and efficient digital experience.

- Proactive financial guidance and communication: The app proactively notifies users about important financial matters and tailored offers, reinforcing the bank's commitment to their financial well-being. This approach adds a human touch to the user-bank relationship, making customers feel valued and supported.

- Self-service hub: The app empowers users with a full suite of self-service options, allowing them to apply for products, track and review requests, and access support without the need to visit a branch or contact customer service.

- Personalized offers: Users receive tailored financial opportunities directly through the app, enabling them to maximize their partnership with the bank and achieve their financial goals more effectively.

A well-defined UX strategy with careful project planning and management were essential for helping the Emirates NBD team achieve their ambitious goal for the first beta release of the ENBD X App within an extremely short timeframe of six months. The launch of the new ENBD X app couldn't have come at a better time: it served as a wonderful gift to the bank and its customers to celebrate Emirates NBD's 60th anniversary. And this marked the beginning of Emirates NBD’s most ambitious digital reinvention journey.

The beta release covered the most crucial user journeys and was available for testing by a small group of users. Involving users in the app creation and testing process strengthened their relationships with the brand and fostered a sense of belonging. Based on the feedback we received, we made necessary improvements and continued working on future releases to enhance other user journeys.

Such a phased launch approach allowed the bank to continue refining the remaining user experiences without losing momentum. This approach ensured that Emirates NBD stayed ahead of the curve with an innovative solution, creating a digital advantage in the market.

Being user-centered, the Emirates NBD team continually listened to users and worked on improvements. The ultimate result was to make the ENBD X app the preferred choice for managing finances and investments in the region, elevating the holistic digital banking experience to new heights.

The established trust between Emirates NBD and UXDA has already led to over two years of continuous cooperation. As a dedicated UX/UI partner, UXDA focuses on enhancing the bank’s digital brand, design language, product ecosystem, user experience and customer-centric approach. UXDA created a base for a unified digital ecosystem that includes a mobile app, responsive online banking and Tablet X design, ensuring a consistent, seamless experience across all devices.

Additionally, we adapted the new design system to other Emirates NBD Group products like Emirates Islamic, ensuring that all users receive the same exceptional service, user experience and feeling.

At UXDA, we frequently assist clients with visual communication for marketing and digital platforms, ensuring a consistent product and brand experience across various environments. Our motion designers had the unique opportunity to create a product video showcased on one of Dubai's largest digital billboards─an 840m² display along the busy Al Safa Road highway. Before its launch, this prominent showcase introduced the new ENBD X App, effectively engaging and connecting with a broad audience.

This comprehensive approach highlights Emirates NBD's dedication to user-centered design, innovation and premium digital service, aiming to be the best bank in the region. By seamlessly blending aesthetics with the user experience, the bank adds significant value to its offerings, ensuring that each interaction not only meets but exceeds user expectations.

The launch of the ENBD X app following a digital ecosystem transformation became a cornerstone in Emirates NBD's broader strategy to future-proof the bank against industry disruptions and position it as a leader in the evolving digital financial landscape. These initiatives lay the foundation for sustainable growth and innovation, ensuring that Emirates NBD remains ahead of the curve in meeting the demands of tomorrow's customers.

As the digital landscape evolves, Emirates NBD remains at the forefront, continuously improving and setting new standards in the industry. The banking sector can certainly anticipate more groundbreaking updates from Emirates NBD.

Approach:

Emphasizing the Customer Experience and Embracing the Brand in Modern Banking

To elevate the user experience, we involved employees from five key bank departments, who shared valuable insights regarding users’ behaviors, struggles and the product. Additionally, we interviewed users from three segments to comprehensively understand their daily lives, financial management habits, challenges and expectations. Users were enthusiastic about participating in the app improvement process.

User Research and Planning for an Enhanced Digital Banking Experience

The user interviews revealed crucial insights on diverse needs within each segment. Thus, retail banking customers primarily focus on transactional operations and seek good deals. In contrast, private banking clients expect a high level of personalized service─from dedicated relationship managers and effortless access to overview their finances through digital platforms. To validate UX/UI decisions, we mapped out the user journey, explored opportunities for the experience enhancement and prioritized scenarios for all user segments based on the gathered insights.

In such large-scale projects, UXDA's capabilities and previous experience with over 150 financial products worldwide were essential while working across multiple platforms and implementing new features, which required careful prioritization, meticulous planning and efficient resource allocation.

To create a more personalized experience, we collaborated closely with the Emirates NBD team, exploring a wide range of ideas, analyzing industry best practices and drawing inspiration from global trends beyond the banking sector. The project involved over 20 professionals, including product owners, designers, developers and project managers, who engaged in regular calls, check-ins and brainstorming sessions to bring the product vision to life.

The competitive spirit and drive for excellence that defines Dubai, a city known for its 300+ Guinness World Records titles, were also evident in the Emirates NBD team. Their commitment to innovation and excellence drove the design process. Together, we explored many design iterations, created various design directions for the app and reviewed multiple versions of new functionalities or data displays to achieve an exceptional final result. Our brainstorming sessions were dynamic, with real-time updates and refinements during calls with the client.

A particularly memorable moment for Lead UX Architect Inese and Lead UI Designer Dmitry was one of their visits to Dubai, where they were stuck in the Dubai Mall because of heavy rains and flooding that day in April 2024. A recorded 24-hour rainfall was equivalent to what the desert city typically expects in a year and a half. They couldn't get to their hotel that day, but despite this, they held a workshop with the Emirates NBD team the next day to discuss and generate new ideas for further product enhancements. Even under extreme circumstances, the UXDA team found ways to meet, connect and push things forward.

Allowing Users to Keep a Hand on the Pulse of Their Finances

Only a product that excels in personalization, transparency and accountability can provide a significant competitive advantage. User trust is a financial institution's most valuable asset, and maintaining it is one of its most significant challenges. Ensuring digital services are secure and transparent in data handling and service delivery is vital for fostering long-term relationships with users. This trust is a critical factor UXDA prioritizes in every project, as any misstep in user experience or design can undermine users' confidence and damage the client’s reputation.

Emirates NBD believes that making users feel valued is key to building and maintaining trust, deepening customer relationships and enhancing user engagement. So, the UXDA team aimed to infuse humanity into the product by promoting open and proactive communication between the bank and its users while ensuring users feel secure using the product. We took inspiration from proactive communication found in non-banking services that most users are already familiar with, such as event suggestions, updates on friends' activities and news feeds on social media platforms like Facebook or Instagram. We adopted a similar social feed pattern for banking. This empowered users to stay on track with updates, news and important information while reinforcing that the bank genuinely cares about them.

A focus on information architecture ensures users can quickly access a comprehensive financial overview via the dashboard. The Communication Hub section provides deeper insights, informing users about crucial actions and updates. For example, users can view pending money requests, receive notifications, be reminded of upcoming payments for better financial planning or discover new credit card offers tailored to their preferences and spending habits. This proactive communication from the bank ensures users stay on top of their finances while reinforcing the bank’s commitment to their well-being and strengthening long-term relationships with the brand.

Self-Service Hub: Enhancing User Experience and Bank Efficiency

Do you remember the last time you had a financial task and needed to contact your bank? Or when you submitted a request but haven't received an update for a long time? Perhaps you had to plan a visit to the branch to apply for a new product or update an existing product. These common struggles highlight the need to enhance the user experience across all banking interactions.

To bring greater transparency and independence and empower users to access support from the bank at any time, together with the Emirates NBD team, we integrated the idea of a Self-service Hub within the app. The core value of this hub is its simplicity in finding the services users need or receiving relevant suggestions, ensuring efficiency by completing their tasks. Whether requesting a card replacement, ordering a new checkbook or obtaining an authenticated account reference letter, the hub simplifies the process by breaking it down into remotely manageable steps. This approach prevents users from feeling overwhelmed, giving them confidence and control over their inquiries while saving them precious time.

Additionally, the Self-service Hub empowers users to track and manage their pending requests, allowing them to follow up if needed. This feature not only boosts customer satisfaction and loyalty by providing greater transparency and control but also enhances the bank’s operational efficiency. By minimizing the need for direct customer support, the Self-Service Hub helps reduce operational costs, as users can independently handle and review all information related to their requests.

A Unified User Experience as a Market Differentiator

Many individuals are focused on growing and protecting their wealth in the Middle East. Previously, Emirates NBD users faced challenges efficiently managing and overseeing their investments. They often had to spend additional time communicating with advisors or relationship managers to obtain up-to-date or detailed information about their investment performance and opportunities. This process led to frustration for users and placed a significant time burden on the bank’s client managers, who were tasked with providing this information.

To create a more seamless and holistic experience, the UXDA and Emirates NBD project team integrated wealth and investment management features directly into the everyday banking app, where users can invest in and trade over 11,000 global and local ETFs and equities. This empowers users to monitor their investments and make decisions independently.

This innovation significantly strengthens Emirates NBD’s position in wealth management and premium services. As a result, the bank can reduce the time required to answer routine inquiries, allowing client managers to focus on delivering more personalized service to priority and private segment users. This helps to strengthen trust and engage users in broader financial transactions with the bank.

Emirates NBD offers a wide variety of exclusive deals and benefits. Previously, users had to switch between different apps or check the website to view special offers or financial-related benefits with the bank. To unify the experience and strengthen users' relationships with the bank, we integrated these exclusive deals and offers into the mobile banking app, making them easily accessible alongside other banking services. By providing personalized suggestions for relevant offers, the app enhances convenience.

Through deals and offers, the marketplace establishes a stronger emotional connection and loyalty to the brand, allowing users to maximize their savings using more than 1,000 personalized exclusive deals in such categories as travel, shopping, dining and e-commerce. As a result, users appreciate the added value of their relationship with Emirates NBD, reinforcing the bank's market differentiation through a unified and user-centric experience.

Designing Dubai's Future Banking Experience

With its well-established brand and vision, Emirates NBD aspires to be a leading innovator and to become recognized as a sophisticated, premium financial service provider and a digital trailblazer in the region. This ambition added an additional challenge to our design process by ensuring that the new interface seamlessly balances the bank's brand and heritage with its forward-looking vision.

The UXDA story behind the vision for user interface design began with inspiration from the people of Dubai, who seek experiences beyond the ordinary in a city renowned for its world-class marvels and achievements─whether it's the breathtaking view from the 148th floor of the Burj Khalifa, the panoramic sights from the world's largest frame or playing tennis atop the Burj Al Arab. So the UXDA team believed that Emirates NBD’s digital banking services for Dubai and global residents should be just as exceptional.

To convey a futuristic banking app mood, we captured Dubai's dynamic and aspirational spirit. Our mood board included ever-changing desert dunes, which symbolize flexibility, mesmerizing natural beauty and the city's ambitious pace in constructing new landmarks and architectural advancements. This led us to a seamless fusion of modernity with a touch of Arabic motifs in the background to reflect Emirates’ ethos.

We iterated and explored various design directions to ensure alignment between user perceptions and visual patterns with Emirates NBD's brand identity. To achieve a sophisticated, elegant and futuristic aesthetic, UXDA designers balanced contrast, scale, visual hierarchy and functional element placement.

As a result, the minimalist design combines textures of glass, metal and concrete to reflect Dubai's skyscrapers, bringing the spirit of the future-driven city into the bank's digital space. The design achieved a luxurious appearance by emphasizing ample white space and crisp typography while enhancing usability through functionality.

Inspired by the rhombus in Emirates NBD's brand book and the diamond shape it represents, we ensured this element played a vital role in the design. The diamond, enhanced with a metallic effect, adds a touch of sophistication and a premium feel to the user experience while attracting users' attention to the latest updates and personalized content.

These enhancements, in conjunction with a personalized user experience, position Emirates NBD as not only a step ahead in the market but also highlight the brand's distinctiveness and individuality. The refined design of the ENBD X app was not just about aesthetics; it was a purposeful move to increase customer retention through an intuitive, highly personalized experience that drives higher transaction volumes and deepens users' relationships with the bank.

A crucial aspect of the design process was aligning and refining the existing design system that underpins Emirates NBD’s entire digital ecosystem. This required thorough consideration of how any modifications to components would impact all related digital product designs. Close collaboration with the Emirates NBD team, who managed the design system, allowed UXDA to evolve it into a cohesive new design language. This strategic approach mitigated the risks of inconsistency, provided standardized and reusable components and established guidelines that streamlined development, fostered effective collaboration and supported scalable growth across platforms.

Additionally, UXDA integrated motion design into the prototypes, defining how all design elements should move. This not only conveyed the intended user experience but also provided development teams with precise instructions for dynamic interactions, ensuring a fluid and cohesive experience through smooth microinteractions.

Balancing Project Trade-offs

Balancing speed and quality is a significant challenge in large-scale projects like this one. Tight time constraints often limit opportunities for extensive workshops to refine ideas tailored to specific user contexts. To address this challenge, the UXDA team prioritized tasks with Emirates NBD, focusing on key screens and app flows for the initial app launch. The UXDA team lead also allocated additional internal resources as needed, maintaining flexibility throughout the process.

As is common with existing product enhancements, we sometimes need to test and iterate multiple times due to technical limitations of the bank's legacy system to find the best solution. While immediate changes weren’t always feasible, our goal remained steadfast: support Emirates NBD in aligning the mobile app and online banking with its new vision. Many ideas and iterations were set aside for future product updates, recognizing that product improvement is an ongoing journey.

Based on our designs, the internal product team at Emirates NBD and UXDA worked on various app and desktop flow screens in parallel. This collaborative approach and careful planning ensured efficient task prioritization and the use of time and resources to launch mobile and desktop versions of the product as soon as possible.

The close cooperation, marked by meeting ambitious launch deadlines, laid the groundwork for a long-term collaboration to ensure continuous product experience improvements. These efforts have strengthened Emirates NBD's brand and deepened its connection with users.

The launch of the ENBD X app serves as a cornerstone in Emirates NBD's broader strategy to future-proof the bank against industry disruptions and position it as a leader in the evolving digital financial landscape. This initiative establishes a strong foundation for sustainable growth and innovation, ensuring that Emirates NBD stays ahead of the curve in meeting the demands of tomorrow's customers.

Project Milestones

- Discovery and Assessment: Conducted stakeholder workshops and user research to understand Emirates NBD’s business goals, customer needs and legacy system constraints.

- Strategic Vision Development: Crafted a comprehensive UX strategy aligned with business objectives and mapped out a digital ecosystem for a cohesive user experience.

- Design and Prototyping: Developed wireframes, prototypes and high-fidelity designs, validated through user testing to ensure they meet users’ needs.

- Legacy System Integration: Assessed technical feasibility and supported backend development to ensure seamless integration of the new designs with existing systems.

- Implementation and Launch: Collaborated closely with Emirates NBD to implement, test and launch the new designs across the digital ecosystem with a phased approach.

- Post-Launch Optimization: Gathered user feedback and utilized data analytics for iterative refinements, scaling the new UX design across all digital channels.

- Ongoing Support: Assistance in continuous innovation to ensure the ecosystem evolves with changing user needs and emerging trends.

Takeaway:

Align User Expectations with Business Goals Through a Strategic UX Approach

Today, users interact with various digital products across industries, setting high standards for user experiences. This is especially true in environments like Dubai, where exceptional service is the default. In banking, there remains a gap between user expectations and what the market currently offers, primarily due to a lack of next-gen digital solutions tailored to user needs and contexts. Any bank failing to address these market shifts risks not only losing a competitive advantage but also diminishing market position.

Emirates NBD has ambitious goals regarding their digital ecosystem and has invested significant funds into this groundbreaking transformation. Strategic UX design implementation by UXDA was meticulously aligned with Emirates NBD's long-term objectives, ensuring that the bank not only enhanced its digital capabilities but also mitigated risks associated with data security, regulatory compliance and operational continuity. This approach safeguarded the bank's reputation while delivering innovation at scale. These digital initiatives play an important role in the bank's active preparation for future expansion in this region and in other countries of the Middle East or globally.

In 2023, Emirates NBD reported record financial results: profit surges 65% to AED 21.5 billion on asset growth, a stable low-cost funding base, increased transaction volumes and substantial impaired loan recoveries. ENBD X was launched in 2022 starting Emirates NBD’s full digital ecosystem revamp and this new digital strategy, in line with impressive efforts to consistently improve the customer experience across the digital ecosystem, have obviously delivered a positive ROI. Emirates NBD addressed this challenge by cooperating with UXDA as a strategic digital experience partner, helping to integrate diverse financial services into a holistic, personalized digital experience, significantly boosting customer engagement and satisfaction.

One of the main challenges in redesigning existing banking products and the user experience is overcoming limitations posed by the current bank's legacy systems, especially when mobile apps and desktop solutions operate on different platforms. A strategic UX approach requires close collaboration among teams, iterative testing and user feedback collecting to balance solutions that address user needs overcoming technical constraints. This approach ensured continuous improvement and seamless integration of new features, aligning the product with both user expectations and the bank’s strategic objectives.

This digital journey didn't end with the new app launch; this is only the beginning. Emirates NBD's commitment to ongoing innovation and improvement ensures that its digital banking experience evolves alongside customer expectations and technological advancements. By actively listening to user feedback, the bank continuously refines its roadmap and prioritizes enhancements that align with its long-term business strategy.

By redesigning the app, ensuring responsive design across multiple channels and adapting the new design language and UX strategy for online and Islamic banking, Emirates NBD established a robust digital product ecosystem. Unlike other banks that mainly focus on improving their mobile app experience, leaving other platforms outdated, Emirates NBD implements a consistent next-gen digital experience across all products, mitigating reputational risks associated with friction caused by fragmentation. This holistic approach strengthens its brand’s position as a market leader.

Despite being a large and well-established bank, Emirates NBD operates with the agility of a Fintech company, ready to make improvements, implement them quickly, test and update─and do it all in short iterations. This commitment to agility and user focus underscores the bank’s priority of providing the best possible customer experience in the shortest time. By embracing a continuous improvement mindset, there is no "final version"—the product will always evolve and improve.

Emirates NBD serves as a prime example of how powerful strategic UX, user-centered design and innovation can shape the future of digital banking. Successfully led by Mr. Cardoso, Emirates NBD’s digital ecosystem transformation delivered substantial strategic value, enhancing the bank's competitive positioning in the Middle East while driving operational leverage through scalable digital solutions that align with long-term growth objectives.

By prioritizing personalization, collaboration and continuous refinement, Emirates NBD, together with trusted UX/UI partner UXDA, has elevated its brand and set a new standard for excellence in customer experience. This alignment ensures the bank remains resilient and competitive, positioning itself for sustained growth and leadership in the digital financial landscape.

Discover our clients' next-gen financial products & UX transformations in UXDA's latest showreel.

Get UXDA Research-Based White Paper "How to Win the Hearts of Digital Customers":

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedin