What is the most valuable thing in any company that can be built and developed over 20 years, but can be destroyed in five minutes? It is brand reputation. To meet the demands of the digital economy, we need to adapt financial services design and market strategy based on new market rules and a human-centered approach.

The customer previously evaluated the financial institutions by how quickly operations were performed in the branch. Today, we need to ensure that customers have digital accessibility, which includes the user experience from the online bank, the attractiveness of the mobile app and the connection with third-party platforms or stores.

This is not all. Values are especially important to a new generation of customers, which means the FI position on social issues and their attitude towards customers and employees. Any communication by the FI could impact brand reputation, including the bank's reaction to comments on Twitter or reviews in the App Store.

Ethics and responsibility contribute to the best customer and employees experience, assuring the highest profitability in the digital economy. However, to make these initiatives effective, we must examine the financial services design from the perspectives of sustainability and customer experience.

How does financial brand reputation relate to financial services design?

A financial brand's reputation determines how a company, product or service is perceived by its customers, stakeholders and the market as a whole. It is a set of experiences, ideas and emotions related to a product and customer service. It is what a potential customer expects or an existing customer experiences when buying and using a company's product or service, as well as when receiving after-sales service. This includes everything from the quality of a brand's service to the company's attitude towards its customers and employees, which is consciously or unconsciously expressed through publicly available media.

A great brand reputation builds consumer trust and confidence in the product or service it provides. The brand is, therefore, the most valuable asset of any mature organization and reputational damage is a key risk factor for business leaders around the world. According to a Deloitte study, 88% of executives perceive reputational risk as a key business challenge.

Many people think that branding starts with developing a logo, but this is not correct. A brand's reputation is built on its relevance, which resonates with consumers and creates an emotional connection that differentiates that brand's product or service offering from competitors. A striking design or other visual elements are just one of almost a hundred ways to convey this meaning to consumers. Apple, Nike and other well-known brands convey this meaning not through a beautiful brand logo, but through the broad context associated with it and use a UX design approach in their brand strategy.

Brand reputation is built through the unique experience that a company provides to its customers. Customers construct an overall image of the product, service and company, which eventually evolves into a familiar and attractive brand.

However, we all understand that a strong brand is not built only after the sales process, when the consumer has purchased the product or service, but well before that process. The buying cycle can be defined by four customer states: I know; I want; I believe; I buy.

At each stage, a brand can create a unique experience through different communication elements and channels accordingly:

- Introduce the brand (social networks, blog, video blog, conferences, advertising, competitions, media opinions, etc.)

- Inspire with the brand (brand philosophy and values, product benefits, tips for solving customer problems, research, usage reviews, product reviews, performance demonstrations, knowledge and experience sharing, etc.)

- Demonstrate the brand (customer testimonials, international recognition, long-term business, customer recommendations, demand indicators, brand achievements and innovations, etc.)

- Delivering a quality brand service (finding the best solution, personalized service, pleasant user experience, product or service meeting customer expectations, thorough support service, post-purchase communication etc.)

If a brand is about value differentiation, then it means that for a brand to be strong, it has to fit the company's value structure. After all, a business with values that are close and understandable to customers attracts them, while one with unacceptable values repels them. According to the Edelman Trust Barometer, 81% of consumers worldwide say they cannot trust a brand, if it does not do what is right. It could even become the deal breaker.

The market paradigm has changed

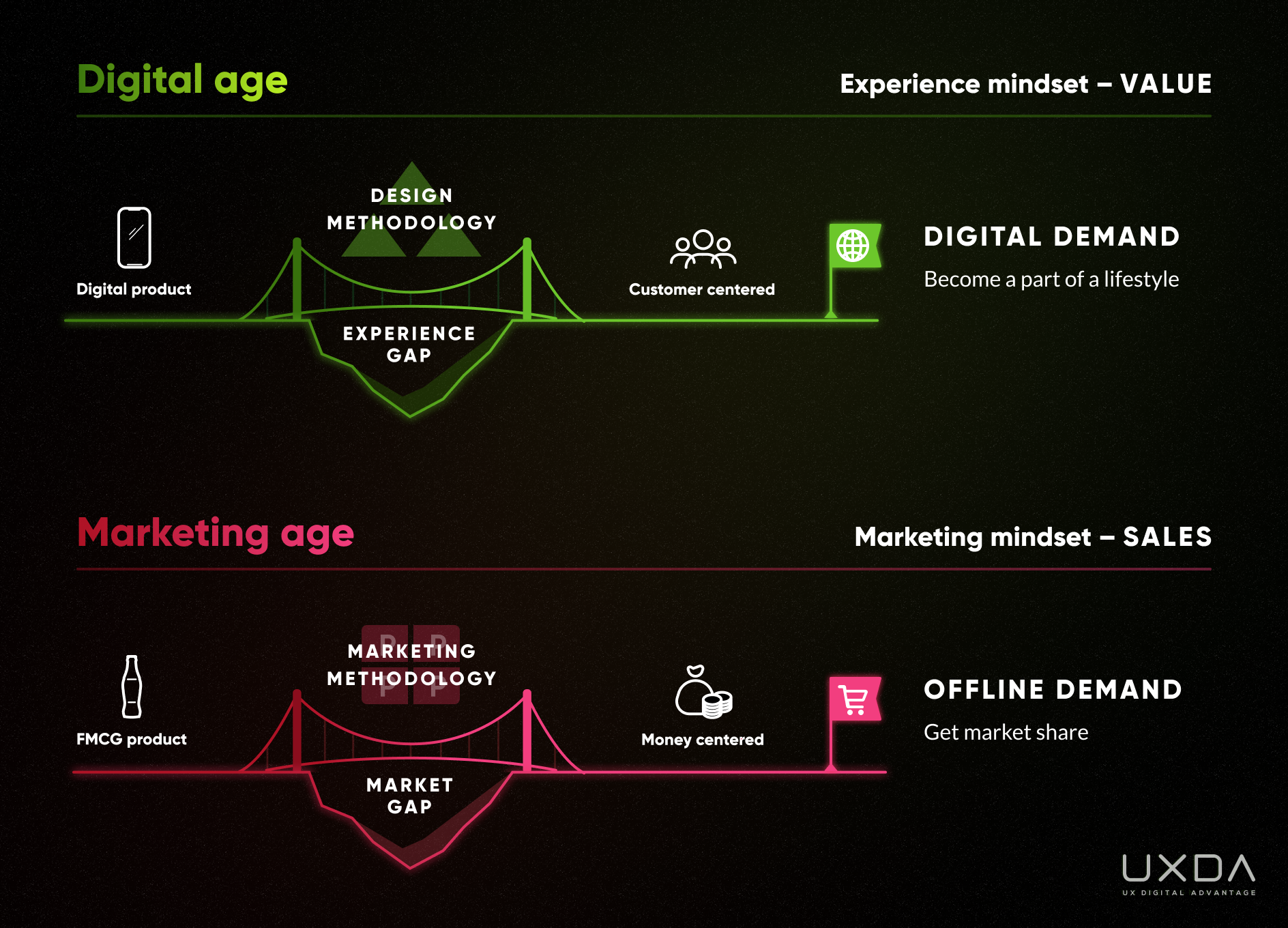

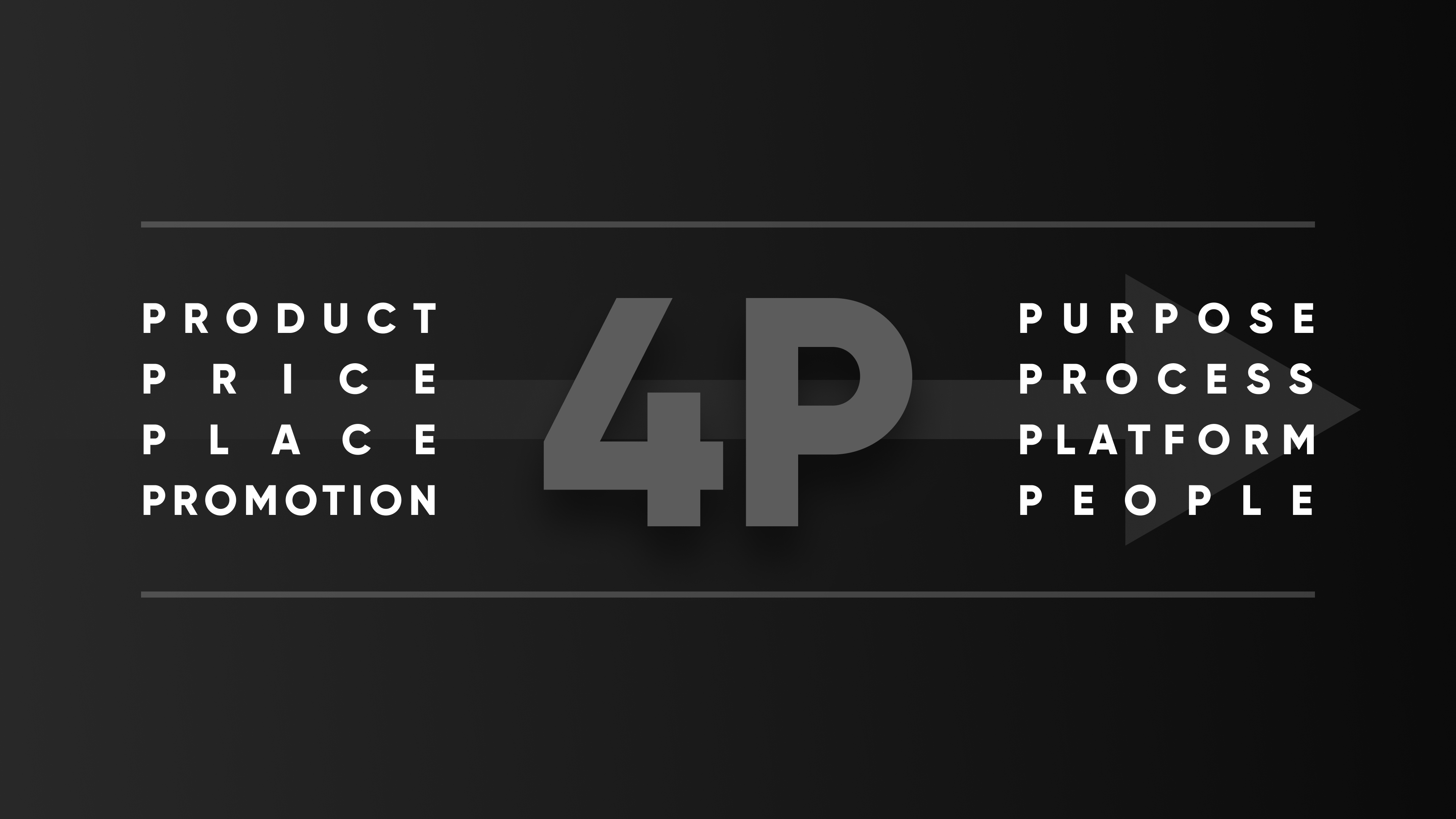

The 4P marketing approach - Product, Price, Place, Promotion - has helped to create successful brand strategies for more than 50 years. It is for good reason. One of the key challenges of that time was to find effective ways to sell millions of FMCG products in a world of intense competition, distribution barriers and expensive advertising. To bridge this gap, 4P marketing became the key to the company's success.

Today, 87% of shoppers start their research on digital channels, before making a purchase in a physical store or online, according to Salesforce research. Global digitalization has changed consumer behavior, which leads to new marketing requirements for brands.

Which financial services design will the customers choose? It will be the one that will effectively solves their problems in the easiest, fastest and most enjoyable way. What was effective for companies to close the market gap a few decades ago has now become a waste of time and money, due to digital transformation and challenges. For digital products, the market gap can't be bridged through advertising, but primarily by making the product itself an important part of the customer's lifestyle and experience through the power of design.

Creating a meaningful and strong connection with customers through digital channels is becoming a key advantage in modern brand success, even in conservative industries, like finance. That is why in the digital age, the 4P model evolved from Product, Price, Place, Promotion to Purpose, Process, Platform, People.

Purpose defines the Product

The product today is becoming, or is fully associated with a digital presence. Even offline financial products or services will not succeed, if not presented through digital channels. Every service provider has its own website and online service has become a part of everyday life. Digital banking penetration has exceeded branch visits, with 75.1% of bank account users using digital channels.

More than three million apps are already available on the App Store and Google Play. Each of them is competing for users, continually raising the bar of user expectations. According to Statista, there are 21,000 Fintech startups in the world, as well as 90,000 banks worldwide (profiled at LinkedIn) that are rapidly digitizing themselves. Mobile apps today clearly have become the most important element of business.

In such a changing digital age, the product cannot remain traditionally constant. It must change with consumer demands and needs on a monthly basis. The key that defines a product is the purpose of the company and the essence of the value that is offered to consumers. The company must now constantly modify the product to adapt to market demands and to continue to realize the purpose.

The right question is not "What is our product?", but "What product will best serve the company's purpose today?".

For example, when it comes to Apple products, we all know Apple smartphones, computers and watches. However, an Apple product is an ecosystem based on the App Store and iTunes. Some time ago, Apple TV and iTags were added to the Apple products. These products are all interconnected and are aligned with the company's Purpose. In 10 years, Apple's range of products and services will probably change, but the promise and Purpose will remain the same: to empower the customer's creativity.

By leveraging digital technology, business can serve its Purpose more effectively, even on a global scale. For example, products and services made in some small towns could find customers in other parts of the world using digital technologies. This also happens in the financial industry with global challengers appearing, such as Revolut.

Process outcompetes the Price

In the past, price determined whether a product would be in demand. A well-designed pricing policy allowed companies to attract buyers and secure profits. Unfortunately, this often provoked ethical dilemmas, with customers who didn’t get what they were promised and employees who were forced to comply with the plan at any price.

The shift to process means a greater focus on customer and employee experience. User experience metrics, such as customer satisfaction, Net Promoter Score (NPS), repeat purchases and positive feedback become key performance indicators. This does not mean that profit is no longer important today. It is just no longer the company's main purpose. It just takes its natural place. Profit is the company's "fuel", as Simon Sinek says.

If a company manages to create demanded value for its customers, there will be plenty of profit-fuel for the journey ahead.

Even the ultra-low price of a product or service won't protect it from negative reviews on social media, if the product isn't good enough to meet customers' needs or solve their problems. That is why the process which helps deliver the best customer experience has become so important. It requires an experience that customers will be willing to pay more for, recommend to their friends and remain loyal to the brand.

Platform replaces the Place

Previously, product place was logistics, because the only way for customers to buy your product was to take up enough shelf space in supermarket chains. Everything now depends on digital platforms.

Modern businesses can sell and serve all over the world, taking orders and communicating with customers through digital platforms. They can deliver service right to the customer's hands, at the exact moment it is needed. They can even create their own global platform.

Without digital presence, there is no trade or service in the digital age. The next explosive digital expansion is with the development of the Metaverse.

It will no longer be about the best place on the shelf, it will be about the best place on the customer's screen.

People become more powerful than Promotions

Promotions were always the main driver of sales. The more promotions, the more sales. It is now just not enough and sometimes it is even dangerous to the company. For example, if a product is actively promoted and, due to its poor quality, it causes a series of negative reactions on social networks.

In the digital age, more than ever, people need human touch. They want companies and brands to act in a sustainable, inclusive and socially responsible way.

Consumers demand respect for themselves, for society and for the world in which we live.

In the digital world, it is not the media but people themselves who have become the main source of advertising or anti-advertising. This is happening because social networks are taking over the media. We often study reviews and video reviews of a product or service, before deciding on a purchase. We often even buy something we hadn't even planned, because we noticed it on Facebook, YouTube or TikTok.

This applies not only to people as customers, but also to employees of the company. A passionate team gets the company more results than any expensive advertising. That's why passionate people are the main driving force behind any digital product.

To better explain this approach, let's take something outside the financial industry, and even outside the digital. Let's say we have a café that sells pastries - delicious cakes. Using the old 4P model, you can improve the product by creating new recipes, or finding new outlets in shops or restaurants, or changing prices to beat the competition, and, of course, create advertising campaigns.

If we move to the new 4P model, we define the objective from the start, for example, to create inspiration in people's lives through cakes. In this case, cakes are no longer a product. Our product is the emotions associated with desserts. We no longer have to limit ourselves to the café. We can sell exclusive cakes online and deliver them to other cities.

We can define our product as workshops and broadcast them on YouTube and social networks, or create training courses around the world. We can deliver a set of ingredients with a recipe for making cakes at home. We can create a community of cake lovers or even create a special cake mobile app.

The configuration of the product will influence the choice of platforms through which we build, deliver and support our purpose. Accordingly, we will design the process that will best help the company's team to deliver their product to people.

Human-centered sustainability becomes the key trend

To match these 4P digital requirements mentioned above, modern financial services design focus on customers and invest all funds to build cutting-edge digital solutions that meet new requirements. Business efforts should now be focused on matching human needs and values that ensures financial brand sustainability. All involved parties should benefit in the long run as a result.

Sustainable banking is a trending strategy that emphasizes social responsibility and environmental sustainability. This type of banking is focused on conducting business in accordance with the Environmental, Social and Governance (ESG) criteria. Investopedia defines sustainable ESG criteria as a set of standards for a company’s operations that socially conscious investors use to screen potential investments.

Environmental criteria consider how a company performs as a steward of nature. Social criteria examine how it manages relationships with employees, suppliers, customers and the communities where it operates. Governance deals with a company’s leadership, executive pay, audits, internal controls and shareholder rights. Cone Communications research has found that 64% of millennials won’t take a job from a company that doesn’t have strong corporate social responsibility practices.

According to KMPG data, 80% of the TOP 100 companies in 52 countries now report on sustainability. For example, Deloitte research of banks in Nigeria shows that 95% of respondent banks have implemented environmental and social initiatives in the last three years. A total of 83% of these companies have realized both non-financial and financial benefits from sustainable banking, including revenue growth.

Satya Nadella, CEO of Microsoft, believes that the social contract of any corporation or enterprise is to create profitable solutions to overcome the challenges of people and the planet. He says that tech does owe something back to society. You can’t have a core business model that is not aligned with the world and then do ESG (environmental, social, and governance). That’s not really doing anybody any good.

Reduction of the carbon footprint and ensuring green workflow is extremely important for the survival of humanity. The main factor will be total digitalization of the financial industry. Based on research commissioned by Mobiquity conducted in 2021 with 300 C-Suites at banks in the UK, Germany and Netherlands, 80% of banking executives in the Netherlands and 72% of UK executives recognize the positive contribution digital can have to sustainability.

The experience economy is taking us much further than the digital economy

NFT sales volume has surged to $2.5 billion, but do banks serve this market? Crypto artists as well as crypto investors create huge wealth in months, but also have troubles with its use and legitimization in traditional services. This is only the beginning of a truly digital economy, the Metaverse is coming. Is the financial industry ready for this challenge?

CryptoPunk 7523 by Larva Labs, sold on Sotheby's for 11,754,000 USD

Pandemics brought the fully digital economy closer with incredible speed. Everyone is talking about cashless transactions, e-wallets, embedded finance, online shopping, decentralized crypto currencies, blockchain, NFTs and the Metaverse. New Fintech challengers are launching every month, with offers that we previously weren't able to imagine. However, if we look deeper, we can find something extremely interesting.

We used to call the previous age industrial, since the industrial approach was the main driver of development and the creation of consumer value. Today, all industries are undergoing digital transformation, and digital services are shaping consumer needs and behavior through digital channels. That is why we call it the digital economy.

Digital helps to understand the nature of the changes around us, but hides its essence. Cryptocurrency is an excellent example. Few people understand the difference and purpose of each coin. For example, Dodge coins were created for the sake of a "Doge" internet meme joke. Unlike Bitcoin, which is designed to be scarce and resistant to inflation, Dogecoin was created to be abundant. There are about 130 billion DOGE circulating, with miners producing another 10,000 every minute. Nevertheless, they have liquidity and are in demand from investors. The market cap for this joke is $ 22 billion at the start of 2022.

How can we explain all the strange phenomena, such as overcapitalization of joke cryptocurrencies, startups without sales and crowdfunding experiments that confuse the older generation? It's very simple. This is not about the emergence of a digital economy, but about an economy of experience. The essence of the changes is that digital created a new paradigm, where the economic relations are formed by experience. It takes the attention and emotions of consumers to the forefront. Experience becomes the determining factor of value in the modern world.

In an experience economy, people don’t buy and sell products, services, or features, but the experiences and emotions behind them.

We see that, in the digital age, financial interest is fueled by hype. Of course, this influence existed before. However, in the context of global social networks and instant information exchange, it became dominant. Digital banking plays a key role in the experience economy, since it enables global funding, stock trading and purchases from ordinary people.

Imagine someone on the other side of the planet who does not understand investments. However, after watching YouTube and TikTok, she/he downloads an investment app and buys crypto. Millions want to take part in the hype. Another example is: a teenager comes up with a bright idea, creates an NFT art collection, attracts everyone's attention and sales, thus becoming a millionaire and famous artist in a month.

In the experience economy powered by digital tech, experience can be directly converted into money.

It’s not only about crypto stuff. Take the example of someone who lives in a small town with a fantastic sense of humor. In the past, he would have had almost no chance to become famous, except to amuse his family. He now publishes videos on Youtube and attracts an audience of millions, without leaving his house. He became a wealthy standup blogger.

Ordinary people now have easy access to amazing opportunities. The main question is do they have an interesting experience to offer the world? Everyone can publish books without publishing houses, produce goods without factories and provide services without companies. All they need is a smartphone and a bank account.

This can also be applied to business. In the global experience economy, emotions play a key role. As a result, the largest companies in the digital age are focused on creating unique, innovative, rewarding and emotional experiences.

Billionaire Elon Musk is not just a brilliant visionary, engineer and entrepreneur who creates innovative products. He is a genius of hype who knows exactly how to impact people, which perfectly fits into the experience economy. His tweet about a Shiba Inu puppy resulted in this cryptocurrency growth. 7M% growth of the Shiba Inu crypto coin turned a guy who invested $8000 a year ago into a billionaire. Musk tweets are so powerful, that they drove stock market and crypto market prices not only up, but also down.

It may seem that money simply has no value in the experience economy. However, that is not true. It is because the consumer's psychology has changed. In the modern economy, the value and power of experience greatly surpasses money. This often generates unexpected and hard to explain outcomes.

How could financial services design better adapt to the new economy and generate experience that will attract demand, or even better, provoke hype? It requires an experience that goes beyond the usual and stands out from the noise of millions of one-day products.

Prepare your financial services design for the experience economy

FIs executives often say “show me the money.” This is obvious, since normal business should be economically successful, especially in the financial industry. However, sometimes the traditional approach to optimizing conversions or copying competitor digital functions can provide short-term benefits, but it does not affect the underlying source of product or company success in the experience economy.

If someone puts Tesla wheels or a dashboard screen on an old wreck, this vehicle will not turn into a Tesla. It will not be able to offer that special experience and the core value that Tesla provides through technology, design, service and brand ecosystem. We could invest heavily to copy Tesla, but we will not be able to copy their core value and strategy to achieve the same results.

Unfortunately, this approach is still widely used in the financial services design. FIs often put energy in the wrong direction. They do this by looking at competitors and copying what the competitor has. This turns digital products into Frankenstein solutions that complicate the user flow.

This could be one of the reasons why customers still see the financial services design as soulless and focused only on making a profit. Only a unique brand strategy and product value will win customers' hearts and create a long-term digital advantage.

Here are 20 tips financial services design can adapt to the experience economy:

- Integrating Feedback Collection: Actively gather and respond to customer feedback to continuously improve services.

- Managing Brand Reputation: Monitor and enhance how the brand is perceived online and offline.

- Increasing Social Network Activity: Engage with customers on social media to enhance visibility and service perception.

- Following and Setting Trends: Stay ahead of financial trends and possibly set new ones through innovation.

- Leveraging Influence Marketing: Partner with influencers to reach broader audiences.

- Ensuring Digital Authenticity: Maintain transparency and authenticity in digital interactions.

- Building Community: Create spaces for customers to interact, share experiences, and offer support.

- Adopting a Purpose-Driven Strategy: Align services with broader societal goals or causes.

- Emphasize Personalization: Customize services to individual customer needs and preferences.

- Leverage Technology: Use AI and machine learning for better customer insights and service delivery.

- Enhance Accessibility: Make services accessible across various devices and platforms.

- Focus on User Experience (UX): Design intuitive and seamless customer interfaces.

- Incorporate Financial Education: Provide resources to help customers make informed decisions.

- Implement Ecosystem Strategies: Ensure a consistent experience across all customer touchpoints.

- Prioritize Security and Trust: Strengthen data protection and privacy measures.

- Embrace Sustainability: Develop eco-friendly products and promote social responsibility.

- Foster Community Engagement: Create platforms for customer interaction and feedback.

- Innovate Continuously: Stay ahead with new features, products, and services that meet evolving customer expectations.

- Regular CX Monitoring: Continuously track and analyze customer experiences to identify improvement areas.

- Research and Implement Best Practices: Stay informed about industry innovations and customer service enhancements, integrating these insights into your offerings.

You need to look for your own path and your source of strength. We believe that this source lies in creating awesome customer experiences through a holistic customer-centered approach. As we say when designing financial services at UXDA, we need to add soul to the product to establish human-centered sustainability for the financial brand.

Get UXDA Research-Based White Paper "How to Win the Hearts of Digital Customers":

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedin