Garanti BBVA Securities, one of Turkey’s leading brokerage firms and a part of Garanti BBVA, the country’s second-largest private bank, set out to revolutionize its investing platform, eTrader. This ambitious transformation involved moving away from third-party vendors and a restrictive white-label solution to create a distinctive, fully personalized digital product ecosystem for both novice and experienced investors. This shift also aimed to unify the mobile and web platforms, offering a seamless experience that empowers users and solidifies Garanti BBVA Securities' brand as a market leader.

Client: Local Leader with Global Expertise from BBVA

Garanti BBVA Securities (Garanti Yatırım Menkul Kıymetler A.Ş.) is one of the leading brokerage firms in Turkey’s financial market. It operates as a subsidiary of Garanti BBVA, Turkey’s second-largest private bank, majority owned (85.97%) by Banco Bilbao Vizcaya Argentaria S.A. (BBVA). BBVA is one of the world’s largest financial institutions, with a strong brand and well-established reputation. Recognized for five consecutive years as a leader in digital banking by "The Forrester Digital Experience Review," BBVA places user-centricity at the core of its operations.

With a wide distribution network, advanced technological infrastructure, strong brand image, experienced staff and innovative approach, Garanti BBVA Securities provides comprehensive brokerage and investment banking services to investors across domestic and international markets.

Its online trading platform, eTrader, enables investors to manage investments in equities, futures, warrants and options, monitor the market and access advanced analysis tools and reports through web and mobile applications. Investing services are exclusively available to Garanti BBVA bank clients, ensuring a complete suite of financial services.

Garanti BBVA Securities was recently honored as the “Most Innovative Brokerage Firm” at the Annual Global Economics Awards 2024. This award highlights the company’s market leadership and dedication to offering innovative investment tools and strategies to best serve their users' needs.

Challenge: Evolve from a White-Label to a Tailored Investment Experience

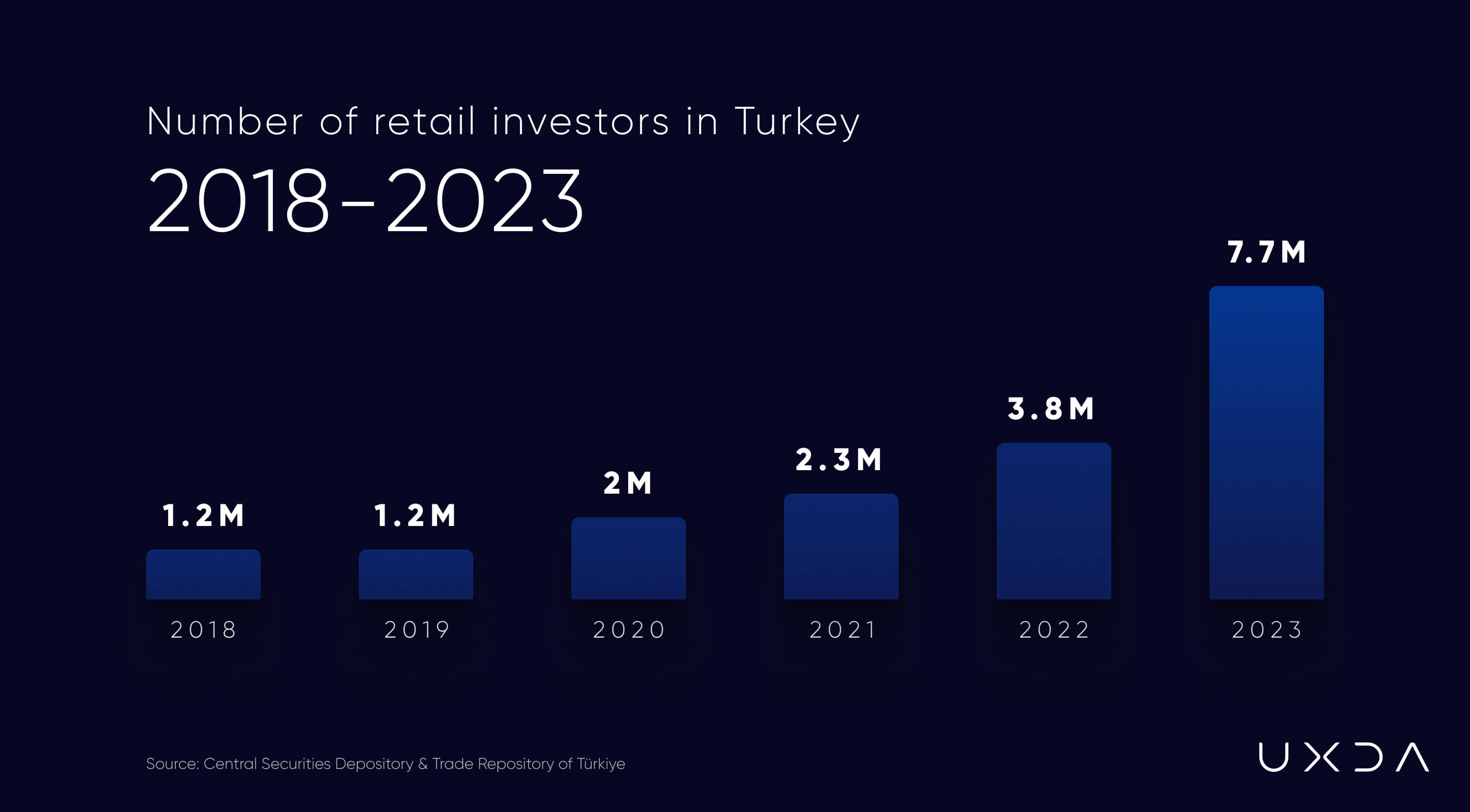

In the wake of COVID-19 and surging inflation, reaching 61.4% in October 2023, Turkey saw a significant increase in retail investors aiming to protect their money against inflation and grow capital. It grew from 1.2 million in 2020 to over 8 million by 2023, with a high percentage of younger demographics. This surge presented an unprecedented opportunity for Garanti BBVA Securities to expand its user base, but it also revealed critical gaps in its existing digital experience.

The eTrader platform, a white-label solution, had numerous limitations. It restricted the ability to introduce new features demanded by users and required by the business. It lacked synchronization between the mobile and web platforms, leading to inconsistent user experiences and hindering efficient investment management across channels. Moreover, the platform primarily catered to experienced investors and restricted the ability to personalize user experience, notifications and offers based on various investor types and their needs. With 52% of investors seeking more portfolio personalization over the next five years, according to Schwab research, and 83% of consumers believing that a seamless user experience across all devices is essential, Garanti BBVA Securities recognized the urgency to innovate and differentiate itself in a competitive market already saturated with similar third-party solutions.

The eTrader platform, a white-label solution, had numerous limitations. It restricted the ability to introduce new features demanded by users and required by the business. It lacked synchronization between the mobile and web platforms, leading to inconsistent user experiences and hindering efficient investment management across channels. Moreover, the platform primarily catered to experienced investors and restricted the ability to personalize user experience, notifications and offers based on various investor types and their needs. With 52% of investors seeking more portfolio personalization over the next five years, according to Schwab research, and 83% of consumers believing that a seamless user experience across all devices is essential, Garanti BBVA Securities recognized the urgency to innovate and differentiate itself in a competitive market already saturated with similar third-party solutions.

Garanti BBVA Securities aimed to move beyond third-party solutions by setting a new standard for investment experience in the Turkish market. The challenge was to transform eTrader into a highly personalized, user-centered platform that delivers seamless and outstanding digital experiences for both novice and experienced investors. The main goal was to strengthen the brand by attracting new users, enhancing loyalty and achieving greater market differentiation.

After consulting with five UX agencies, Garanti BBVA Securities chose UXDA as its strategic UX/UI partner for its proven expertise in designing complex financial ecosystems. This collaboration aimed to transform the product ecosystem, delivering a differentiated, high-value experience that meets the demands of a rapidly evolving market.

Together, we identified the key aspects to address in the digital experience transformation:

- Adapt to diverse investor needs to ensure the product caters to the expectations of both experienced and novice investors by balancing advanced functionality with simplicity.

- Shift from white-label to a brand-driven in-house solution to overcome vendor limitations and have more flexibility to personalize, innovate and respond to changing market and user demands.

- Ensure consistent brand experience across the product digital ecosystem, including the mobile app and the web solution.

- Implement new functionalities to provide a cohesive and efficient investing experience that strengthens the brand’s competitive edge without overwhelming and frustrating its users.

Solution: Tailor-Made Digital Platform for Diverse Investors

Garanti BBVA Securities recognized a critical gap in the Turkish market: many investment providers relied on similar third-party solutions that failed to meet the expectations of increasingly diverse and demanding users. Leveraging UXDA's strategic UX design approach, Garanti BBVA Securities embarked on a journey to create a seamless and personalized digital ecosystem that caters to various investors' unique preferences. This evolution not only empowers users to make confident investment decisions but also positions Garanti BBVA Securities as a user-centered, innovative leader redefining the investment experience in Turkey.

Key outcomes of the eTrader transformation:

- Enhanced user engagement and retention: Advanced customization options and seamless navigation empower users to personalize their experiences according to their individual preferences and goals. It improves user engagement for both novice and experienced investors, increases satisfaction, fosters long-term loyalty and drives higher retention rates and brand affinity.

- Strengthened brand and market positioning: By aligning with BBVA’s brand identity and design aesthetics, Garanti BBVA Securities integrates the product into the global BBVA ecosystem and brand identity. This alignment reinforces user trust and familiarity, strengthening its leadership in Turkey's investment market.

- Market differentiation via rich investment and education tools: The product leverages Garanti BBVA Securities' 29 years of industry expertise to offer a broad range of investment analysis tools and research resources, positioning itself as a comprehensive investment platform. Furthermore, the Academy section provides tailored educational resources, empowering novice investors to grow their confidence and engage more actively with Garanti BBVA Securities’ services.

- Efficiency through cross-platform consistency: Consistent design, functionality and user experiences across mobile, web and tablet platforms ensure seamless product usage across multiple devices. This synchronization not only ensures a cohesive experience but also streamlines future updates and innovations, keeping the platform competitive and agile.

In September 2024, Garanti BBVA Securities launched the reimagined eTrader app, with a newly designed web platform soon to follow. This milestone marks a pivotal moment in their commitment to provide a world-class, personalized investment experience tailored to the evolving needs of their diverse user base. By establishing a strong foundation for innovation and differentiation, Garanti BBVA Securities has positioned itself as a trailblazer in the Turkish investment landscape.

Tufan Akça, Capital Markets Product Management Of The Mobile and Web Trading Applications, states:

"As Garanti BBVA, we are highly satisfied with our collaboration with UXDA during the design process of our eTrader stock trading application. The team's deep expertise in user experience (UX) and design approach have added significant value to our project. Their meticulous attention to creating a user-friendly, aesthetically pleasing, and functional interface has had a positive impact on the final version of our application. Throughout the project, their professionalism, flexibility, and solution-oriented approach further strengthened our partnership. The UXDA team successfully simplified complex financial processes, making the application accessible to new and experienced users. For all these reasons, we would like to express our sincere gratitude to the UXDA team."

Approach: Transforming eTrader Through User-Centered Design and Brand Alignment

Garanti BBVA Securities’ strategy is to provide an innovative investment product that goes beyond standard white-label brokerage services, catering to the unique needs of today’s investors. With a strong focus on personalization and user-centered design, Garanti BBVA Securities aims to become the preferred investment platform for those investors seeking a seamless, informed and tailored investment experience.

To bring this vision to life, UXDA optimized the user journey and enhanced UX/UI to meet and exceed the expectations of a broad audience─from novice to experienced investors. This transformation included the implementation of new functionality and the creation of the new Academy section from scratch, carefully balancing simplicity with the advanced tools required for comprehensive investment analysis. We aimed to emphasize transparency, ease of use and personalization to empower users to achieve their financial goals while driving engagement, retention and informed decision-making.

Research as a Foundation for User-Centered Design

Garanti BBVA Securities consistently prioritizes user needs in product development, regularly gathering insights to refine and enhance their offerings. With a recent influx of new investors entering the market, Garanti BBVA Securities recognized the need to deepen its understanding of its diverse audience and emerging trends. By partnering with UXDA, the main task was to design a product that builds meaningful connections, addresses varied user needs and strengthens long-term relationships. UXDA’s expertise in financial products and its proven UX strategy was instrumental in identifying local trends and user expectations, guiding essential design choices for the platform. We explored the Turkish investment market and conducted extensive research to tailor the eTrader experience to the unique needs of Turkish investors.

Our research revealed distinct patterns: experienced investors who engage with the market daily, track even minor price changes and rely on market reports rather than advisors. Meanwhile, less experienced investors—forming the majority—prefer social trading, following other traders on platforms like X and Telegram to stay updated on market sentiment and trends.

Stakeholder interviews with Garanti BBVA Securities' Product, Support and Analytics teams highlighted that users primarily choose eTrader for its strong association with Garanti BBVA, a brand recognized for its security and trustworthiness. Users expect an intuitive and secure investing platform with essential analytics tools and a wide range of functionality.

To overcome language barriers with users, we partnered with local experts to interview eight investors of varying experience levels. These interviews found that users check the app frequently throughout the day, even during work hours, to monitor market changes. Users strongly desired to deepen their investment knowledge and chart analysis skills to make informed market decisions. The interviews also confirmed the critical importance of the watchlist feature, which allows users to track their preferred stocks and make timely investment decisions.

Boosting Investor Confidence with Improved Information Architecture

The eTrader app was designed to make users feel understood and empowered to achieve their financial goals. For novice investors, the platform offers a safe, approachable environment where they can easily learn and monitor their portfolios. Meanwhile, experienced traders benefit from advanced analysis tools to evaluate data before making critical financial decisions. Our objective was to create a product that adapts to the needs of diverse users, strengthening Garanti BBVA Securities' commitment to providing meaningful investment experiences.

Intuitive information architecture was our focus in the design process to enable users to navigate and interpret complex data effortlessly. UXDA’s strategic UX approach focused on user-centered design principles, allowing us to quickly identify areas for improvement through usability testing of wireframes and design screens. Our iterative process emphasized balancing simplicity for beginners with robust functionality for experienced investors, ultimately creating a seamless experience that fosters confidence and supports informed investment decisions for all user levels.

Elevating the Investment Overview for a Tailored Next-Gen Experience

Through user interviews, we discovered that eTrader users' key activities are reviewing portfolio performance, tracking watchlists and receiving price and news alerts. These insights guided the design of the app's dashboard, ensuring that key metrics, such as total portfolio value, daily performance and real-time updates on dividends, stock price alerts and order execution, are prominently displayed. We created an intuitive user experience that not only meets users’ needs but also enhances engagement and retention, making the app a valuable part of users’ daily investment routines.

Recognizing the importance of watchlists in users' decision-making, we introduced a quick-access feature to buy or sell directly from the watchlist, empowering users to respond swiftly to market changes and make investment decisions without extra steps. This ensures users can act quickly and confidently in the fast-paced investment landscape.

As 66% of consumers indicate they will stop engaging with a brand if their experience isn't personalized, we focused our design strategy on allowing users to customize the dashboard to suit their diverse needs. This was especially important for users who check the app daily to monitor the market. Users can select which modules to display, hide and arrange a sequence according to their investment focus. Additionally, users can personalize the Watchlist by renaming it, selecting a preferred view type, adjusting symbol order and customizing data display settings. This flexibility ensures the app adapts to each investor's unique preferences, fostering long-term engagement and enhancing user loyalty by providing an experience that evolves with each user’s preferences.

To further enhance personalization and accessibility, we included dark and light themes, allowing users to choose the interface that best suits their environment and comfort level.

The bottom menu provides seamless access to essential activities, such as viewing market information, managing portfolios and orders and exploring additional resources, like analytical tools, market research and educational resources to support investment decisions.

Enhancing Symbol Analysis for Trading Efficiency

Garanti BBVA Securities aimed to enhance eTrader's symbol analysis by integrating more market and analysis data while ensuring the interface remained user-friendly for both novice and experienced traders. Our challenge was to present detailed information without overwhelming users, so information structure was essential. We kept the symbol details structure using multiple tabs—covering overall information, fundamental analysis, price data, broker activities and other data—allowing users to explore data step-by-step. This structure helps users easily find the information they need while maintaining clarity.

To support novice traders, we introduced expandable guidance on the symbol analysis page, offering essential context without cluttering the interface. This feature empowers new users to build analytical skills and make informed decisions over time.

Additionally, we added a dedicated Notes section to help users track their investment strategies, insights and goals in one easily accessible place.

UXDA’s approach strengthens Garanti BBVA Securities' position as a leading provider of detailed data and analysis, offering a balanced experience that appeals to both experienced investors and those new to trading.

Strengthening Clarity and Confidence in Portfolio Management

The Portfolio section is essential for giving investors a comprehensive view of their investments. By strategically prioritizing key information, UXDA’s design ensures that users can easily assess value, performance, trade activities and portfolio composition in a structured way.

Customizable views—ranging from a detailed symbols list with Profit/Loss charts to a simplified symbols-only layout—ensure the platform meets diverse user needs, accommodating those who prefer in-depth analysis as well as those seeking simplicity.

The design flexibility not only improves user engagement but also empowers both novice and experienced investors to manage their portfolios confidently.

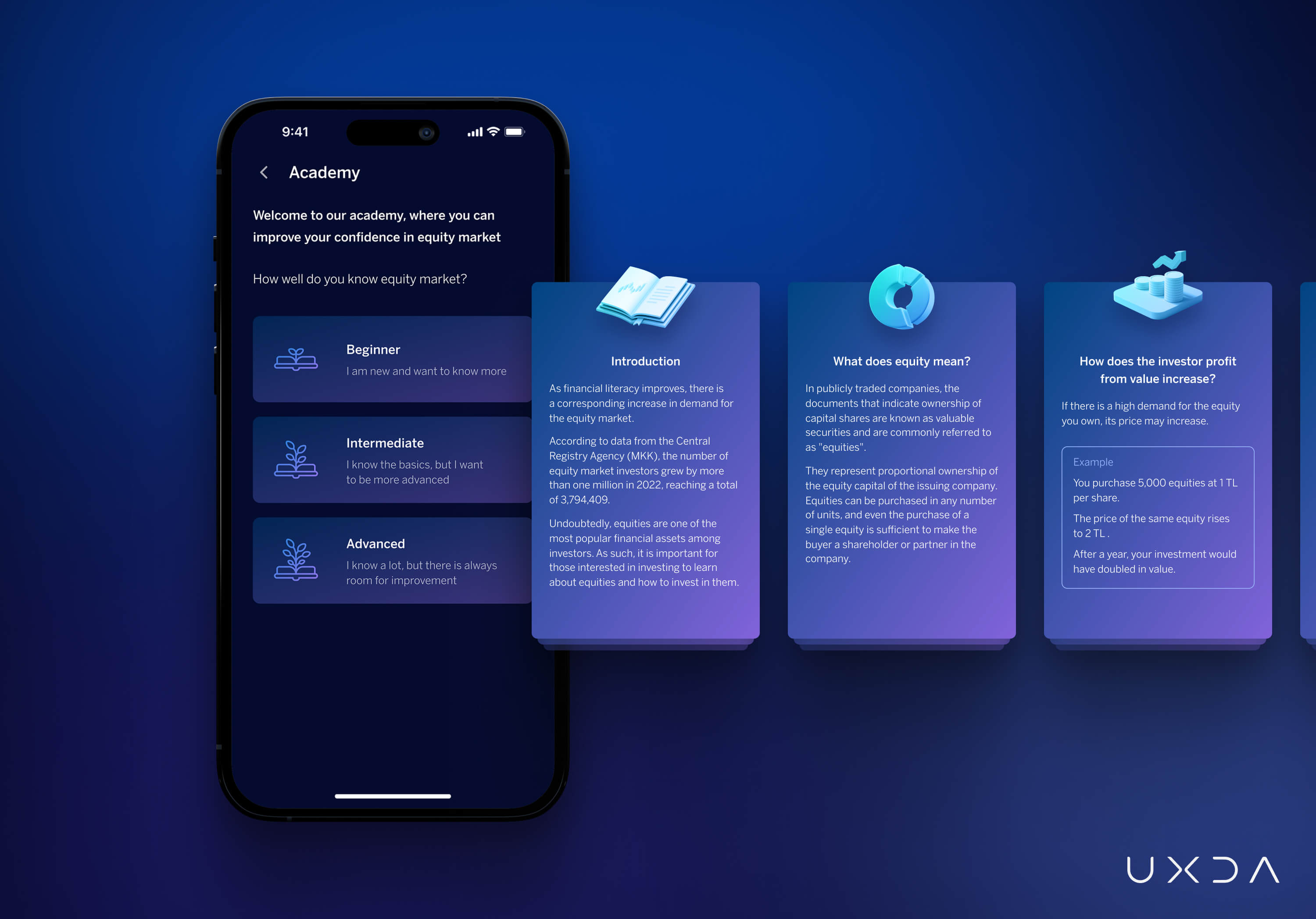

Building Confidence with Tailored Learning

Garanti BBVA Securities identified a growing interest among new investors in learning about investments but faced the challenge of simplifying complex financial topics. Collaborating closely, the UXDA team shared global best practices and facilitated brainstorming sessions to shape the vision for the newly introduced Academy section.

The Academy moves beyond lengthy explanations, offering concise, step-by-step content and visuals tailored to different knowledge levels. This dynamic, interactive approach simplifies learning, empowering novice investors to build confidence and track their progress.

In response to a trend of users relying on social media influencers for investment advice, which often lacks reliability—Garanti BBVA Securities aimed to position itself as a trustworthy and responsible source for financial education. The Academy not only makes investing more accessible and engaging but also reinforces the brand’s commitment to guiding users with accurate and dependable knowledge in a rapidly evolving economic landscape.

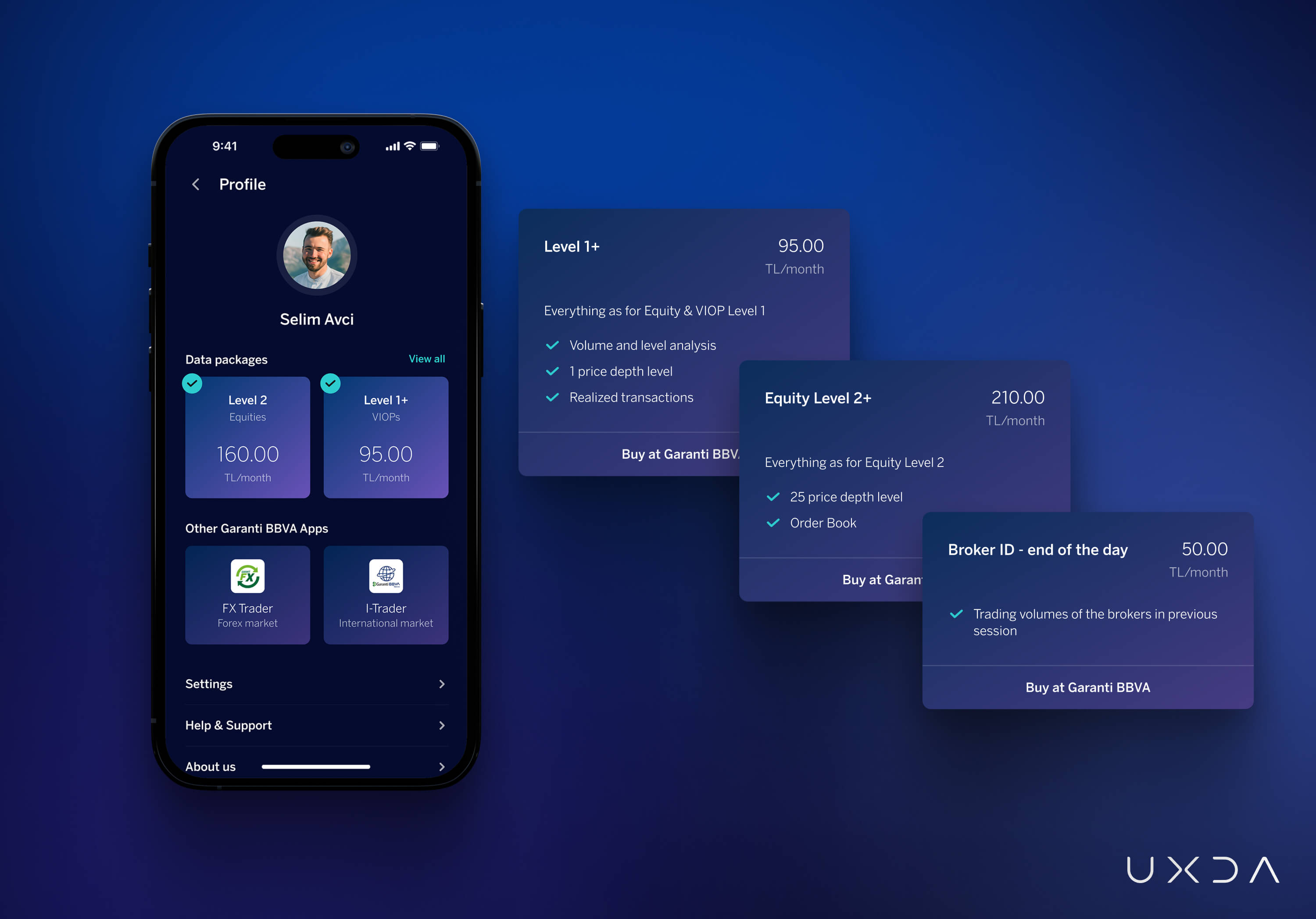

Streamlining Data Packages and Service Integration

Garanti BBVA Securities encountered challenges in helping users understand and manage their data packages. Many users struggled to manage active packages, explore options or differentiate between free and paid services. UXDA addressed this by redesigning the Profile section and introducing a dedicated space for package information. This solution simplifies package management, enabling users to easily view, compare and select the options that best meet their needs.

We integrated cross-links to Garanti BBVA Securities’ separate apps for Forex and international market investments into the Profile section. This strategic approach ensures users are informed about the full spectrum of Garanti BBVA Securities’ services while enabling seamless navigation among apps, fostering greater engagement with the brand's comprehensive investment ecosystem.

Aligning eTrader Design with BBVA's Brand

The challenge was integrating BBVA’s globally recognized and respected visual identity into the eTrader platform while ensuring it remained user-friendly, innovative and reflective of Garanti BBVA Securities’ local expertise. UXDA aimed to create a design that not only enhances brand recognition but also strengthens user trust and loyalty by conveying BBVA’s reputation as a trusted and innovative financial leader.

To address this, UXDA infused the design with BBVA’s brand of a dark blue palette and accent colors, reinforcing the platform’s connection to the global brand while evoking trust, stability and sophistication. Rounded shapes, calming tones and smooth animations were thoughtfully implemented to foster comfort and approachability. A matte glass effect added depth, offering a modern, spatial aesthetic that balanced realism and elegance.

The result is a cohesive design that aligns eTrader seamlessly with BBVA’s global brand identity, ensuring users feel part of a world-class financial network experience. UXDA’s strategic approach overcame the challenge of balancing global branding with local market needs, creating an intuitive platform that engages users, enhances trust and reinforces Garanti BBVA Securities’ position as a gateway to innovative financial solutions within the BBVA ecosystem.

Empowering Innovation Through Strong Team Collaboration

With over 150 digital financial products in its portfolio, UXDA understands that strong collaboration is essential to delivering innovative solutions and achieving rapid product launches. Our partnership with Garanti BBVA Securities illustrates this, as both teams worked strategically to create a personalized and delightful investment experience for diverse user types while accelerating the project's development.

Garanti BBVA Securities’ team was highly engaged throughout the project, providing crucial information and actively participating in design testing and iterations, which offered valuable insights and user context to validate design decisions. Their enthusiasm and determination to elevate the eTrader experience, combined with UXDA’s expertise in balancing functionality and innovations with user-friendliness, enabled the project to address even the most complex challenges.

To refine the critical order execution flow—arguably eTrader’s most essential and complex process—the main project owner traveled to UXDA’s Riga office. During workshops, we could iterate quickly and discuss practical solutions, best practices and innovative ideas. This in-person collaboration was invaluable and efficient, enabling real-time decision-making and ensuring a seamless alignment of the product vision, ultimately creating a more enhanced, seamless and effective solution not only to meet but exceed different users' expectations.

To support development, we provided detailed design documentation alongside the screens and ongoing guidance to ensure smooth design implementation. With design and development advancing in parallel, the project maintained momentum and ensured efficient resource utilization. Before the product launch, we thoroughly tested and reviewed the app to confirm it was fully ready from an experience standpoint to ensure a seamless experience from the first interaction with the new enhanced eTrader app.

Tevfik Kardelen, Unit Manager of Garanti BBVA Securities responsible for Digital Channels and Marketing, states:

"They are really focused on what they are doing. What I liked most about UXDA was that they brought new ideas. The outcomes are perfect, and we think we will disrupt the Turkish Capital Market industry with our new design."

Our collaborative efforts also extended across web and tablet platforms, where we provided clear guidance on unified omni-channel design and responsiveness principles for different development teams working on separate platform design implementations. This strategic cooperation not only accelerated the project timeline but also reinforced Garanti BBVA Securities’ innovative spirit, setting a new standard for personalized and user-centric investment platforms.

Deliverables

Strategic foundation:

- Stakeholder interviews

- Product strategy

- Contextual market analysis

- User interviews

- User personas through a JTBD framework

- Empathy map

- User journey map

- Scenarios red route map

- Information architecture

- Value storyboard

- User flow maps

- Wireframes

- Product experience movie

- Key design concept

UX/UI and motion design:

- UI design prototype for Android, iOS, Desktop and Tablet

- Product motion design

- Digital ecosystem UI design

- Responsive design

- Design library

Success facilitators:

- Design documentation

- Development support

- Product launch support

Takeaway: Global Brand, One Platform, Tailored Experiences for Every Investor

Recognizing the rapidly evolving user expectations and the growing demand for personalized experiences, Garanti BBVA Securities embarked on a transformative journey with eTrader. Transitioning from a restrictive white-label solution to an in-house, custom-built, digital product ecosystem empowered Garanti BBVA Securities to have deeper control over user engagement, actionable insights and the ability to innovate and personalize the experience, setting eTrader apart in a competitive market.

Collaborating closely with UXDA, Garanti BBVA Securities addressed the challenge of catering to a diverse investor base, while UXDA’s strategic UX approach allowed eTrader to serve new and experienced investors. By integrating stakeholder expertise, user insights and market research, we enhanced the eTrader experience so that new investors can see financial data in an understandable way to step into the trading world. At the same time, experienced investors can access advanced tools and detailed analytics, enabling them to maximize their investment strategies. This personalization ensured that eTrader meets users at every stage of their investment journey, aligning with Garanti BBVA Securities’ mission to deliver an exceptional investor experience.

To enhance personalization and consistent and seamless experience, UXDA designed a unified omni-channel ecosystem across Android and iOS mobile apps, as well as responsive desktop and tablet platforms. This cohesive approach enables users to switch effortlessly among devices while reinforcing Garanti BBVA Securities’ position as an innovative and trusted financial leader within their globally recognized BBVA brand network.

Tevfik Kardelen, Unit Manager of Garanti BBVA Securities responsible of Digital Channels and Marketing, states:

"Not only has UXDA executed their tasks well, but they've also provided top-notch recommendations to further elevate the solution. They communicate well and are highly reliable and professional. They impress with their exceptional design skills and dedication to the project's success."

Through innovative design and a highly collaborative partnership, UXDA helped Garanti BBVA Securities minimize development risks, streamline workflows and accelerate the product’s time to market. The result is a robust platform that strengthens Garanti BBVA Securities’ competitive edge and enhances BBVA’s global reputation while catering to the diverse needs of the Turkish market. This success highlights the transformative power of strategic UX design in driving innovation, achieving business goals and delivering meaningful user experiences that foster long-term brand loyalty and trust.

Discover our clients' next-gen financial products & UX transformations in UXDA's latest showreel.

Get UXDA Research-Based White Paper "How to Win the Hearts of Digital Customers":

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedin