When Alex Kreger and Linda Zaikovska-Daukste envisioned founding a design agency for digital services a decade ago, they stood at a crossroads of ambition and uncertainty. The financial services industry, vast and entrenched in tradition, seemed an unlikely playground for creativity. Yet, what began as a daring leap into uncharted territory evolved into UXDA, a transformative force in financial UX design, crafting innovative digital experiences for some of the world’s leading financial brands.

Could design, often seen as an afterthought or just decoration, truly revolutionize finance? The toughest markets need the softest touch. Confident in their beliefs, Alex and Linda embarked on a mission to demonstrate that human-centered design could play a pivotal role in the financial sector. Entering a market known for its cutthroat nature was a daunting challenge, but the UXDA founders were keen to introduce something completely new, aiming to transform financial services from the ground up.

This decision wasn’t made lightly. With years of experience designing digital experiences for complex startups, Alex and Linda honed their skills in turning ideas into reality. They specialized in creating brand-aligned digital strategies, developing UX approaches and managing large cross-departmental teams. Assured in their expertise, they felt ready to take on the challenge and make a meaningful impact in the financial industry.

A Bold Vision: Transforming Finance Through Design

Without bold vision, even the strongest brands risk fading into the past. Entering a fiercely competitive market known for its conservatism, UXDA’s founders took a calculated risk. Alex and Linda identified a critical issue plaguing financial brands—fragmented digital identities. Products, communications and strategies operated in silos, leaving customers disconnected. The solution? A cohesive digital journey that unified these disparate elements into a seamless financial brand experience.

From the outset, UXDA's founders chose a distinctive path. Unlike generalist design agencies that accept any clients across various industries, UXDA focused exclusively on the financial sector.

It’s uncommon for design agencies to say “no” to clients. However, despite a high number of requests─over 2,000 inquiries in 10 years — UXDA had to limit its annual workload to just a few financial institutions, and has said no to 674 prospects to ensure maximum quality and transformation for select clients.

Such an exclusive approach allowed UXDA to design digital service solutions that weren’t just functional but tailored to the unique challenges and opportunities of each client's brand. Today, UXDA has successfully completed over 150 projects across 28 different financial categories, ranging from mobile banking super apps to complex trading platforms.

Redefining the future starts with redesigning the user experience. Where others saw insurmountable complexity, UXDA saw potential. By collaborating with leading banking and Fintech brands in 37 countries, UXDA's unique financial UX design approach boosted adoption rates, enhanced user engagement and pioneered numerous financial UX innovations that set new industry standards.

UXDA's work transcends traditional design; it acts as a digital identity bridge, connecting users with financial brands. Such an exclusive and specialized UXDA approach resonated with clients and yielded outstanding results. Despite dealing with the complexities of financial products—some involving over 6,000 interface screens—UXDA has maintained an impressive 5.0 rating on Clutch and Google, turning challenges into opportunities.

Rejecting the Ordinary: A Tailored Design that Delivers Results

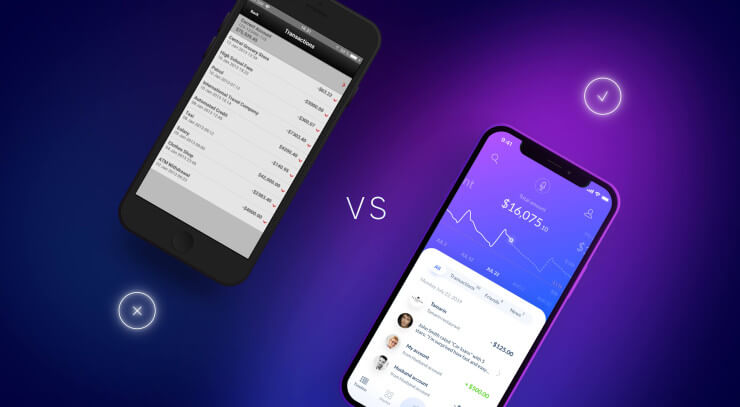

Digital finance is not about the numbers; it’s about relations. Showing a balance or transaction history is easy, but the true design is needed for a more complex task─creating a connection with the brand. That’s why in a world of cookie-cutter templates and one-size-fits-all solutions, UXDA takes a radically different approach.

Every design by UXDA is crafted from scratch, ensuring alignment with the client’s brand and strategic vision. By providing scalable solutions that evolve with businesses, UXDA encourages clients to stand out in a crowded market, infusing soul and authenticity into every financial product.

Such a tailored approach reduces the risk of digital products becoming generic platforms lost in a sea of sameness, because the greatest risk in digital finance is the fear of change. Using cookie-cutter designs may compromise a financial brand's uniqueness and effectiveness, thus failing to resonate with the audience.

UXDA's impact goes beyond aesthetics: its user-centric strategies drive measurable outcomes. Clients report significant improvements—50% increases in app adoption rates, 20-30% boosts in onboarding conversion and enhanced user retention and transaction completion metrics. By aligning business goals with user needs, UXDA delivers solutions that foster both immediate and sustainable growth.

Such focus ensures financial brands reduce the risk of missing out on substantial revenue growth and operational efficiencies that strengthen market positions. Instead of short-term standard solutions, the UXDA agency is focused on long-term success and the empowerment of financial brands in an evolving landscape.

Collaborating with the Best: Industry-Leading Expertise

To work with the best, you must think like the best. UXDA’s roster of clients includes some of the leading brands in finance, including Emirates NBD, Garanti BBVA Securities, Banorte, United Arab Bank, Bank of Jordan, SurePrep by Thomson Reuters, UNFCU, iGTB, Golden 1 and the GCash superapp, with its 90 million users. With over a decade of dedicated financial UX expertise, UXDA has mastered the nuances of the industry, enabling brands to navigate its complexities and unlock new opportunities.

By choosing depth over breadth, UXDA ensures its clients benefit from unparalleled expertise—a critical factor in transforming complex financial products into user-centric experiences. Dedicated solely to financial UX design, UXDA has achieved amazing results that enhance brands' digital identities. Serving top-tier clients, including Fortune 500 companies, brought industry-leading insights and practices to product design and strategic UX.

Often, clients choose UXDA because they specifically want to collaborate with thе agency, trusting its unmatched competence, proven expertise and exceptional results. Dozens of leading financial brands are confident that only UXDA team can deliver the transformative digital experiences needed to achieve their goals. With such a specialized expertise, UXDA clients gain the support to navigate complex industry challenges effectively. Only a design-driven approach to digital transformation can improve market positioning and strengthen competitive advantages.

The more you understand your users, the more they'll understand your value. What truly sets UXDA apart is its unique methodology and design philosophy. While many agencies adopt generic design processes, UXDA believes the financial industry requires a specialized approach. The UXDA team has developed a user-centered design process specifically tailored for finance, integrating 44 proven design methods and 8 unique frameworks.

By leveraging deep analytics and understanding user behavior, the UXDA team creates intuitive interfaces that exceed expectations. The UXDA methodology aligns financial psychology, user-centered design and data-driven decision-making with regulatory needs, empowering digital brands to lead in innovation and user satisfaction.

Such specialized expertise is needed to ensure the depth of the design of digital interactions with the service and brand. Expertise is critical to the digital transformation and positioning of a financial brand in the market, especially when it seeks to provide an exclusive digital experience that sets it apart from the competition.

Revolutionizing with Innovation: Pioneering Financial UX/UI

True innovation in finance isn't coded in algorithms; it's crafted in the customer's experience. Without forward-thinking design, any product can become outdated, causing a financial brand to lose relevance. The spotlight of innovation shines brightest on those who put users first, casting others into shadow. That’s why customer-centered innovation design is the lifeblood of UXDA.

From introducing the first banking superapp interface to pioneering AI banking and spatial banking, UXDA continually pushes the boundaries of what’s possible in financial service design. By merging cutting-edge tech with design, UXDA doesn't follow the future of finance—it creates it.

Innovation isn't just an option in digital finance—it's the key to staying ahead. The UXDA team draws continuous inspiration from outside the financial industry, enabling them to bring groundbreaking innovations and experiences to their clients. This approach blends fresh perspectives with familiarity, helping to modernize and elevate the financial product experience.

UXDA's innovative financial solutions have gained over 30 international accolades, including the world’s top three design awards—Red Dot, iF Design Award and A’ Design Award. UXDA ensures digital brands remain ahead of the curve. Refusing to settle for industry standards, UXDA pushes boundaries to deliver future-proof solutions.

In-House Excellence: A Team That Delivers Beyond Compare

The more voices you answer to, the less your own vision is heard. Conflicting interests and a diluted focus could compromise digital empowerment. To maintain a commitment to digital excellence and client success, UXDA maintains its independence. This allows them to focus on an extraordinary level of craftsmanship that sets them apart from other agencies.

Remaining independently owned and managed enables UXDA to stay true to its core values because agencies owned by everyone often stand for nothing. Unlike many agencies driven by different shareholder demands, UXDA prioritizes independence to empower financial brands with creativity and quality. With company executives actively involved in every project, UXDA ensures unwavering consistency and excellence.

As the independently owned and founder-led agency focusing solely on high-end, customized designs for a limited number of selected clients, the UXDA team is able to prioritize quality over quantity. Such an independent approach prevents a financial brand from becoming just another account in a large firm's portfolio, losing the personalized touch that empowers its digital advantage.

At the heart of UXDA’s unique approach is its in-house team of specialists. In an industry dominated by outsourcing, UXDA relies solely on a rigorously selected internal team with scientific grades and experience in finance, psychology, design and business. UXDA relies only on an in-house expert team to maintain consistency and foster deep expertise and collaborative effectiveness, while upholding a unified vision. This collaborative approach ensures clients the delivery of solutions that are swift, innovative and precise.

To build a dedicated in-house team comprised of seasoned UX experts, consultants, analysts, UI and motion designers with extensive experience in the finance sector, UXDA uses a rigorous hiring process, accepting only the top 1% of applicants and then investing up to two years in training new team members to ensure they meet and adhere to the highest in-house standards.

UXDA experts have become financial UX influencers with over 200 insightful publications, a financial UX podcast and groundbreaking design case studies that reach over a million financial professionals in 195 countries.

Key Principles of UXDA's Exclusive Digital Experience Branding

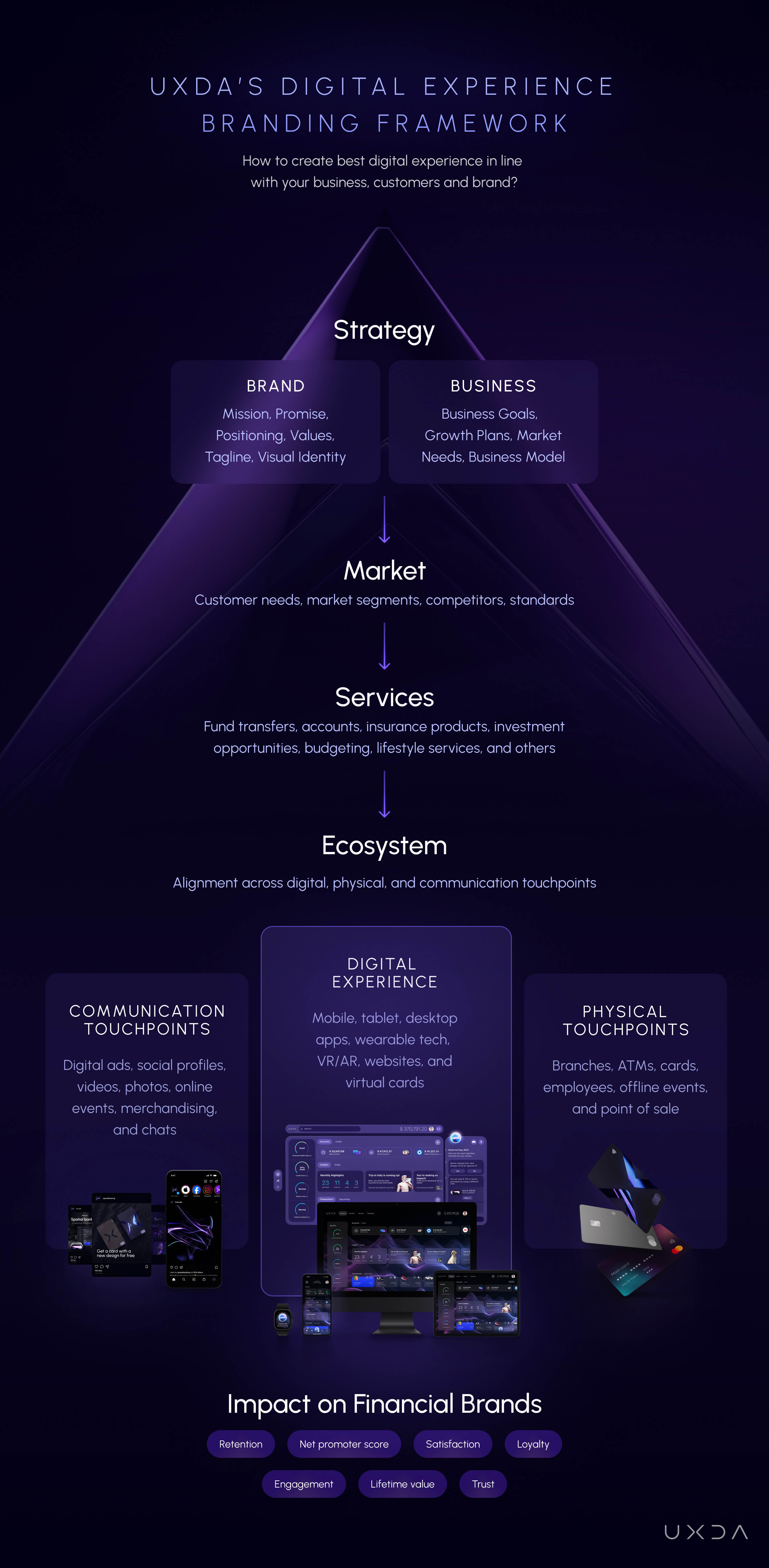

When a digital identity mirrors brand values, users stop being customers and start being believers. UXDA redefines financial services through a unique approach to digital experience branding, emphasizing user-centered strategies that make financial products more human-centric, accessible and emotionally engaging.

The main idea is to create a consistent digital identity that matches the philosophy, authenticity and values of a specific financial brand, through a digital service interface, a digital experience and digital communications. Here are key aspects of how UXDA transforms the digital identity:

1. Empathy-Driven Design

UXDA utilizes a strong emphasis on empathy to understand the real needs and emotions of users. The human-centered design process begins with observing and engaging with users to uncover insights into their behaviors, values and pain points. This approach allows financial services to be tailored to real-life contexts, ensuring relevance and emotional resonance.

2. Customer Experience as a Brand Differentiator

UXDA advocates that a financial brand's success is built on delivering exceptional digital experiences. By leveraging storytelling, personalized interactions and intuitive design, the agency creates memorable and consistent brand impressions across multiple touchpoints.

3. Behavioral and Psychological Insights

Leveraging user psychology, UXDA addresses cognitive biases and decision-making heuristics. This ensures that products are not only usable but also persuasive, influencing users' behaviors in ethical and beneficial ways.

4. Innovative UX Strategy

By blending brand strategy with UX methodologies, UXDA enables financial institutions to innovate while staying user-focused. UXDA's approach aligns customer needs with business goals to craft authentic products that distinguish the brand in a competitive market.

5. Digital Ecosystem Integration

UXDA emphasizes integrating various financial services into cohesive brand-driven digital ecosystems. This reduces brand identity fragmentation and simplifies user experiences, making a financial user journey more accessible and user-friendly.

By implementing these principles, UXDA transforms traditional financial services into digital experiences that resonate emotionally with users, making financial brands engaging, inclusive and forward-thinking.

A New Standard in Financial UX Design

UXDA's approach goes beyond traditional UX, positioning the company as a leader in creating comprehensive digital experiences for the financial sector. The agency expertise lies in designing user-centered digital experiences that anticipate business strategic future needs while ensuring seamless integration across every end-user touchpoint.

By combining business strategy, psychological insights and design excellence, UXDA designs financial ecosystems that are not only highly functional but also deeply aligned with the brand's identity, delivering consistent and impactful user experiences.

UXDA's holistic design approach evolves financial brands into cohesive, user-centered ecosystems, making financial services more accessible, empathetic and engaging. UXDA sets a new standard for what the financial industry can achieve, driving meaningful change and elevating the entire brand experience.

When digital finance embraces empathy, numbers transform into meaningful connections. By embracing complexity and staying committed to innovation and user-centered design, UXDA has managed to make a meaningful impact—not just for the agency's clients but for the millions of users who interact with the financial products developed by the agency.

By constantly exploring and innovating, you can find that the journey itself is the destination. The UXDA story is still unfolding, and the entire team is excited about what the future holds. The agency continues to explore new ways to innovate and improve, with the goal of improving the financial user experience.

UXDA used the power of bold vision and relentless innovation—a journey that proves design, when done right, can truly redefine the future of finance. Without their innovative edge, financial products risk falling behind, causing digital brands to miss advancements that provide competitive advantages. In a rapidly evolving digital world, innovation is key to empowerment and success.

Get UXDA Research-Based White Paper "How to Win the Hearts of Digital Customers":

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedin