Growth in financial services has long been driven by product innovation, regulatory advantage and balance sheet strength. But as these differentiators converge and customer expectations soar, a less obvious — yet increasingly critical — growth driver has emerged: Digital Customer Experience (DCX).

While many financial institutions still treat digital as an alternative delivery channel or a digital marketing cost center, this mindset underestimates its full potential — and the hidden risks. Poorly designed digital customer experiences silently erode trust, create invisible churn and stall organic growth. Every frustrating form, delayed response or confusing interface chips away at customer loyalty and brand value — often without a complaint ever being voiced.

At the same time, forward-thinking institutions are turning their digital channels into key growth drivers. They understand that digital doesn’t just support users—it shapes their experience, influences their actions and determines whether they stay or leave in the future. These financial institutions know that the digital experience is now the most powerful, scalable and emotionally impactful part of their customer journey that shouldn't be underestimated.

Only 3 % of U.S. companies are truly customer-obsessed. They’re racing ahead with 41 % faster revenue growth, 49 % higher profits and 51% better customer retention according to Forrester’s 2024 US Customer Experience Index. And 2024 Bank Customer Experience Survey by FICO shows that 62% of respondents believe customer experience is as important as a bank’s products or services, and 26% think it’s even more important.

This article explores ten key growth drivers that are directly affected by digital product, digital service, and digital communication design. Together, they illustrate why digital customer experience in finance should no longer sit in the background of growth strategy but, rather, at its very core.

1. New Customer Acquisition through Frictionless Journeys

Today’s customers expect immediacy, simplicity and relevance right on their phones. A well-designed digital onboarding journey — intuitive, fast and personalized — significantly reduces acquisition barriers. Whether opening an account, applying for a loan or starting an investment, the smoother the digital process, the more likely potential customers will convert. Moreover, digital channels often serve as the first point of interaction, forming critical first impressions. And of course, the need for a fully digital service is not up for debate.

According to a survey published on Lightico, digital onboarding has proven highly effective, reducing onboarding time by up to 67%, increasing completion rates by 25% and lowering touchpoints by 60%. Despite these clear advantages, many financial services still rely on manual data entry and redundant information collection, which slow down the process and increase the risk of errors. As a result, a study by Signicat revealed that 68% of customers abandon financial service applications due to cumbersome and lengthy onboarding processes. This underscores the critical need for financial institutions to simplify digital experiences; failure to do so risks losing valuable customers.

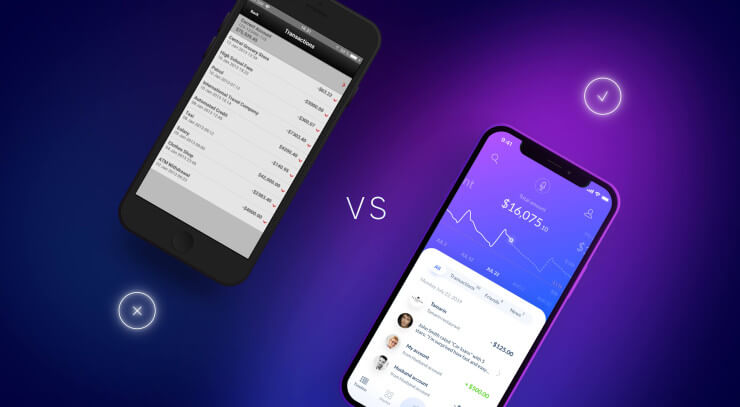

2. A Distinctive, Differentiated Brand in a Sea of Sameness

In a crowded market, many financial brands look and feel indistinguishable. But a thoughtfully crafted digital experience can become a powerful brand signature. Visual storytelling, microinteractions, tone of voice and personalized design patterns can all signal uniqueness. Institutions that embed their values and identity into every click and scroll ensure their brand leaves a lasting imprint — even before a customer speaks to a human. UXDA has helped global financial brands enhance their digital experience, enabling them to stand out visually and drive long-term growth in a competitive market.

A study by Motista found that emotionally connected customers are incredibly valuable: they deliver 306% higher lifetime value, stay loyal for 5.1 years on average (compared to 3.4 years) and are far more likely to recommend the brand — 71% versus just 45%.

3. Authentic and Dopamine-Driven UX

The most effective digital financial experiences use principles from behavioral psychology to keep users engaged. UXDA’s Dopamine Banking approach takes this a step further by focusing on emotional connection and the important role financial services play in users’ lives. Features like goal trackers, gamified savings and real-time investment updates create systems that reward progress and offer small, satisfying boosts. This turns occasional users into loyal ones. When financial platforms focus on emotions and motivation, and show clear progress, they help users form habits that lead to healthy financial behavior, thereby building long-term engagement and loyalty.

Financial institutions that not only provide valuable features but also engage users with positive digital experiences are leading the market. In fact, research by Paula Bitrián and et. al. shows that incorporating gamified elements into financial apps can increase user involvement by 54% and improve saving habits by 22%. This demonstrates how creating emotional engagement and interactive experiences can truly transform the customer journey.

4. “Wow” Moments That Lead to Organic Recommendations

Every customer interaction is a chance to create a “wow” moment — whether it’s instant approval, smart financial advice or timely, personalized notifications. These emotional highs leave lasting impressions, turning users into loyal promoters. When embedded naturally into the experience, they fuel word-of-mouth — one of the most powerful and cost-effective ways to drive growth.

The 2025 Zendesk research underscores the urgency for financial institutions to integrate emotions into their digital experiences. It reveals that banks that consistently optimize customer experience grow 3.2 times faster than those that don't. The research also highlights how delivering unexpected delights, such as instant approvals or personalized financial advice, creates memorable moments that customers are eager to share. At UXDA, we've seen how natural “wow” moments shape users’ perception of a bank — building loyalty, engagement and a deeper sense of trust and collaboration.

5. Increased Cross-Selling Opportunities through Intelligent UX

A digitally mature experience uses data to predict and present the right offerings at the right time. With smart UI design and contextual elements, customers can seamlessly transition from one product to another — from a savings account to a personal loan, insurance plan or investment product. This approach enhances cross-sell rates naturally without being pushy, creating a relevant, uninterrupted journey.

This becomes obvious when seeing statistics of advanced personalization strategies that drive 20-30% increases in cross-selling success rates while simultaneously improving customer satisfaction. Users value contextual, actionable advice that helps improve their financial well-being. According to NTT DATA Global Study 2021, 49% of consumers expect their financial institutions to anticipate and suggest products or services that they may need or find useful.

6. Scalable Personalization That Builds Loyalty

Digital channels are scalable by nature, but personalization is what makes them truly powerful. When financial services cater to individual needs, preferences and life stages, users feel understood and valued. AI-driven personalization in dashboards, notifications and offerings allows institutions to create tailored experiences for each user, at scale. This strengthens customer relationships and makes it more difficult for users to switch providers.

Based on recent research, banks that use AI-powered personalization engines see a 14.2% increase in digital customer acquisition. By training AI to understand and respond to human emotions, banks can make interactions feel more personal and not robotic. Done right, personalization goes beyond marketing — it enhances everyday interactions and supports customers in improving their financial well-being.

7. Continuous and Proactive Experience Management

Customers often leave not because of major issues, but because of the accumulation of small frictions. By creating an empathetic digital experience that actively identifies and removes these frictions through testing, analytics and user feedback, financial institutions can significantly increase customer lifetime value. Designing digital platforms as living products with continuous improvements helps reduce churn and keeps customers engaged and satisfied.

Global statistics reveal that poor customer experience is causing banks to lose 20% of their customers — often because they overlook what truly matters to users. At UXDA, we’ve seen this firsthand. By gathering and analyzing user feedback, we ensure that our designs align with both user needs and business objectives. For example, user feedback from Private Wealth Systems highlights the direct impact of usability testing on customer satisfaction, proving that involving users in the development process significantly enhances their experience.

8. Building Trust in a Remote-First Financial World

In a world in which face-to-face interactions are limited, trust must be built digitally. Transparent processes, clear error handling, empathetic microcopy and secure-feeling interfaces all foster a sense of safety. A well-designed experience conveys competence and care — two essential pillars of trust in finance. According to a McKinsey & Company report, 60% of customers trust their primary bank to help them navigate financial downturns, and that number jumps to over 80% among those highly satisfied with their bank’s digital experience. This trust is essential for fostering long-term relationships and positive reviews, which are key to sustainable growth.

Moreover, research from Frontiers in Psychology (2021) shows that attractive product designs can positively impact consumer behavior, but true customer trust goes beyond aesthetics. It’s rooted in smooth, intuitive experiences, in which every interaction feels natural and easy.

9. Faster Innovation Cycles Enabled by Modular Digital Design

An agile, well-architected digital experience enables financial institutions to test, learn and iterate far faster than legacy systems. With modular digital infrastructure and decoupled experience design, new features, services and experiments can be deployed quickly and with minimal risk. This flexibility allows institutions to respond rapidly to user behavior, market trends and competitor actions — giving them a key advantage in a market increasingly shaped by Fintech disruptors.

Furthermore, agile methodologies and modular infrastructure drive innovation, reduce operational risks and help financial institutions stay competitive. According to The Financial Brand, over half of firms using experimentation-led strategies report revenue growth of 10% or higher.

10. Lower Operational Costs through Self-Service Optimization

A seamless digital experience takes the pressure off of costly human support channels. When users can easily complete tasks — from onboarding to resolving issues — on their own, efficiency goes up and service costs go down. Smart digital customer experience (DCX) design does more than delight users; it simplifies complexity and automates routine interactions. Well-crafted self-service portals, intuitive chatbot flows and predictive UX reduce call center volume and increase first-contact resolution — freeing up staff to focus on high-value, human interactions.

According to a McKinsey & Company report, enabling customers to use intuitive and helpful self-service tools can significantly reduce call and message volumes to contact centers — allowing financial institutions to optimize team workloads and operational footprints.

Conclusion: DCX Is the Future Growth Engine Financial Institutions Can't Ignore

Digital customer experience is no longer an extra part of traditional growth strategies — it is the strategy. In an era in which every swipe, tap and scroll shapes perception, trust and loyalty, financial institutions are no longer judged solely by their products or rates but, rather, by the quality of the journeys they create.

From customer acquisition to advocacy and operational efficiency to innovation, the digital experience connects all critical pillars. Financial institutions that invest in emotionally resonant, context-aware and continuously evolving experiences aren't just keeping up — they are redefining what finance feels like.

Success in this new era won’t come from the biggest balance sheet or the oldest brand, but from those who turn their vision into digital moments that engage and move people. They make complexity feel simple, decisions feel confident and interactions feel human.

To future-proof their growth, modern financial companies must embed digital experience design at the heart of their strategic roadmap — not just in their apps and websites, but in the way they think, operate and evolve. To thrive, financial leaders must stop thinking of DCX as a channel or a feature — and start seeing it as the embodiment of their culture, their strategy and their future.

Discover our clients' next-gen financial products & UX transformations in UXDA's latest showreel:

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedin