Every financial brand is constantly seeking ways to maximize the success of their company and products. Spending 15 years in business, creating hundreds of different kinds of digital banking products and studying their growth, I have extracted a straightforward formula that explains what determines the success rate and customer engagement of any digital financial product. This formula is the foundation of the Financial UX Design methodology developed by UXDA. It uncovers 4 aspects that should be applied to increase the success potential of a digital banking product and improve digital customer engagement in banking.

Listen to this article in audio format:

What is Customer Engagement in Banking and Why is it so Important

Customer engagement in banking refers to the interactions and relationships between a financial brand and its customers that cultivate a sense of loyalty, involvement, and investment in the bank's products and services. It is a measure of how involved and committed customers are to the financial brand and how much effort they are ready to put into their relationship with the financial company.

In banking, customer engagement takes many forms, including online and mobile banking, in-person branch visits, customer service interactions, feedback and reviews, social media engagement, and loyalty programs. These interactions should be designed to create a positive customer experience, that builds trust and foster a sense of connection with the bank.

Engaged customers are more likely to stay loyal, provide feedback, and recommend the bank to others. Therefore, customer engagement is an important metric for banks to monitor and optimize. By improving customer engagement, banks can increase customer retention, revenue, brand perception, and overall customer satisfaction.

Customer engagement is important for:

1. Customers retention

Engaged customers are more likely to stay with a bank over the long-term. When customers are engaged, they feel valued and invested in the relationship with the bank. This leads to increased loyalty and retention.

2. Revenue

Engaged customers tend to spend more and use more services than disengaged customers. This can lead to increased revenue for the bank.

3. Brand perception

Customers who are engaged with a bank tend to have a more positive perception of the brand. This can lead to increased word-of-mouth marketing, referrals and NPS (Net Promoter Score) rate.

4. Customer feedback

Engaged customers are more likely to provide feedback to the bank, which can help the bank to improve its products and services. This can lead to a better overall experience for all customers.

5. Competitive advantage

Banks that have high levels of customer engagement may have a competitive advantage over banks that do not. This is because engaged customers tend to be more loyal and less likely to switch to a competitor.

Customer Engagement Improvement Depends on Customer Experience

Improving customer engagement in banking is a complex task, that requires a holistic approach. Basic customer engagement strategies in banking include providing excellent customer service, utilizing digital platforms, offering personalized communication, providing rewards and incentives, conducting surveys and listening to feedback, educating customers, and being transparent:

1. Enhance customer service

Providing excellent customer service can be one of the most effective ways to engage customers in banking. Train your staff to be friendly, knowledgeable, and attentive to customer needs.

2. Utilize digital platforms

Many customers are now using digital platforms to access banking services. Therefore, banks should invest in creating user-friendly digital platforms to make it easy for customers to access services, such as online banking, mobile banking, and chatbots.

3. Provide personalized communication

Customers appreciate personalized communication, whether through email, phone, or other channels. Use customer data to personalize communications and offer relevant products and services that meet their specific needs.

4. Offer rewards and incentives

Customers enjoy being rewarded for their loyalty. Offer rewards and incentives, such as cashback, discounts, or loyalty points to encourage customers to engage more with the bank.

5. Conduct surveys and listen to feedback

Conduct regular surveys to obtain customer feedback on the bank's products and services. This information can help banks to understand the needs and preferences of their customers, and to make necessary changes to improve customer engagement.

6. Educate customers

Educating customers on the services and products offered by the bank can help them to fully utilize the available services. By doing so, customers will feel more engaged and informed.

7. Be transparent

Transparency in banking is crucial to building trust and improving customer engagement. Banks should be transparent in their fees, charges, and the terms and conditions of their products and services.

All of this requires deep focus on customers, their needs, expectations and pain points. Nowadays almost everybody is doing their best to integrate customer-centricity into their products and services. So, why are so many financial companies struggle at their customer engagement?

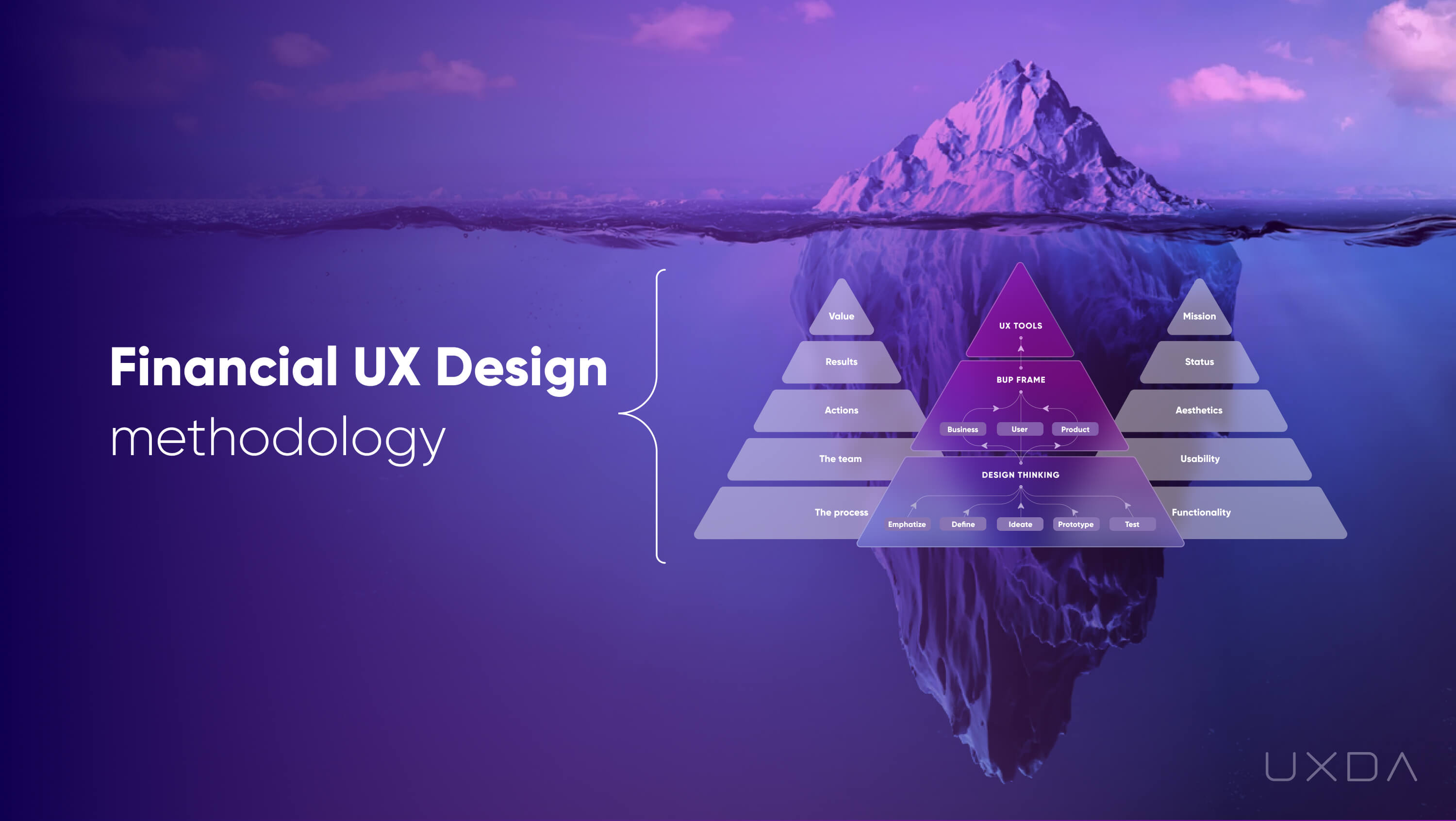

Many are convinced that, to attract digital customers, it is enough to ensure a standard financial service through the digital channels. But to create truly successful modern banking service, it is only the tip of the huge iceberg we have under the water. This iceberg consists of a thorough system with many crucial elements that impact digital customer experience and digital customer engagement in banking. And to deal with this iceberg, we use the methodology of financial user experience (UX) design.

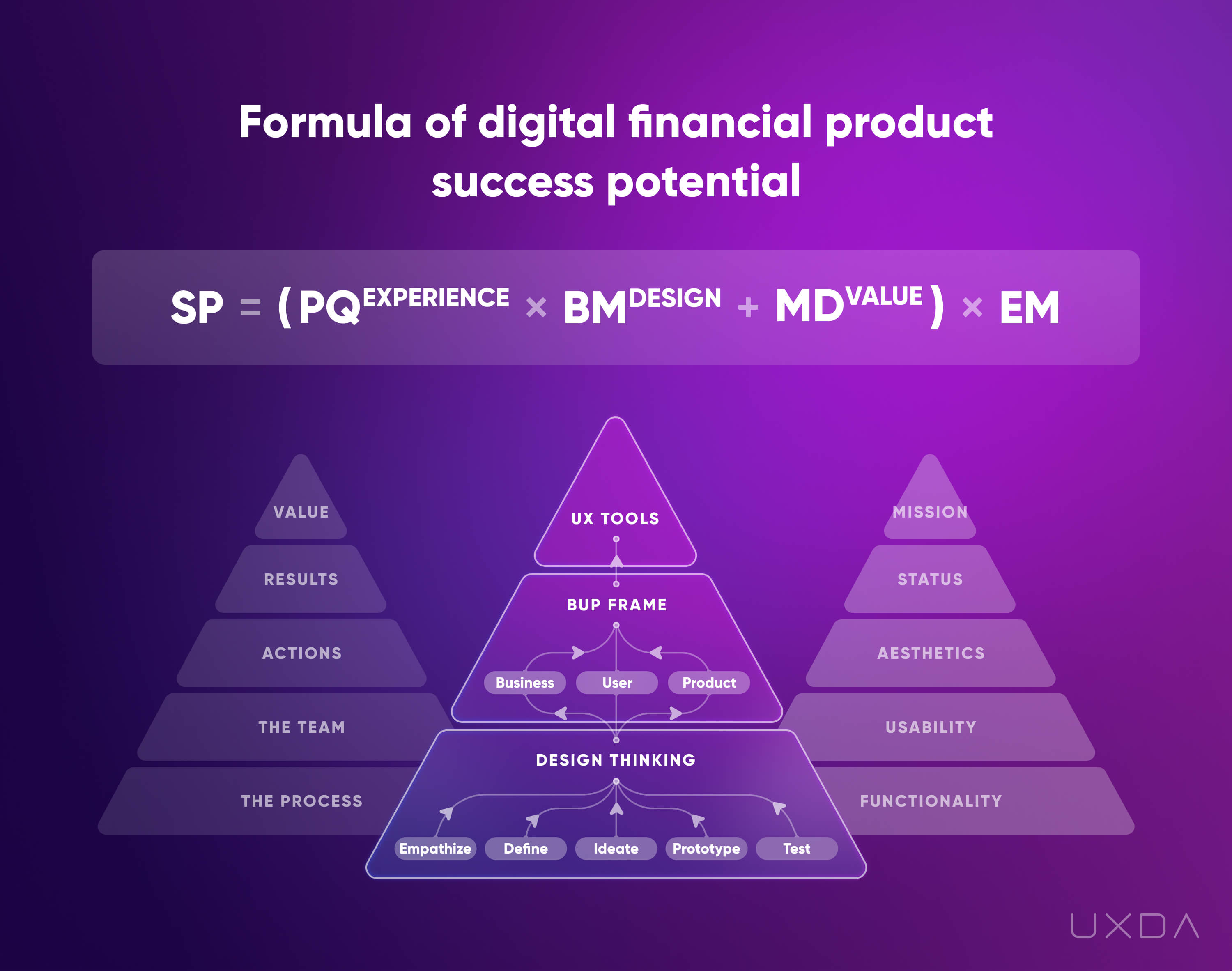

Unfortunately, many companies still aren't aware of this and lose millions on unsuccessful digital customer engagement improvement. That's why we guide our followers through the four main components of UXDA's Financial UX Design methodology: the Product Value Pyramid, Design Pyramid the Experience Pyramid, and Purpose-Driven Mindset. In this article, I demonstrate simple formula that allows to integrate all 4 key aspects of financial user experience into the core of а business thus helping to improve digital customer engagement in banking.

Rethinking The Outdated Business Formula

To better understand how to improve customer engagement in banking, let's first explore the main components that define the performance of any business.

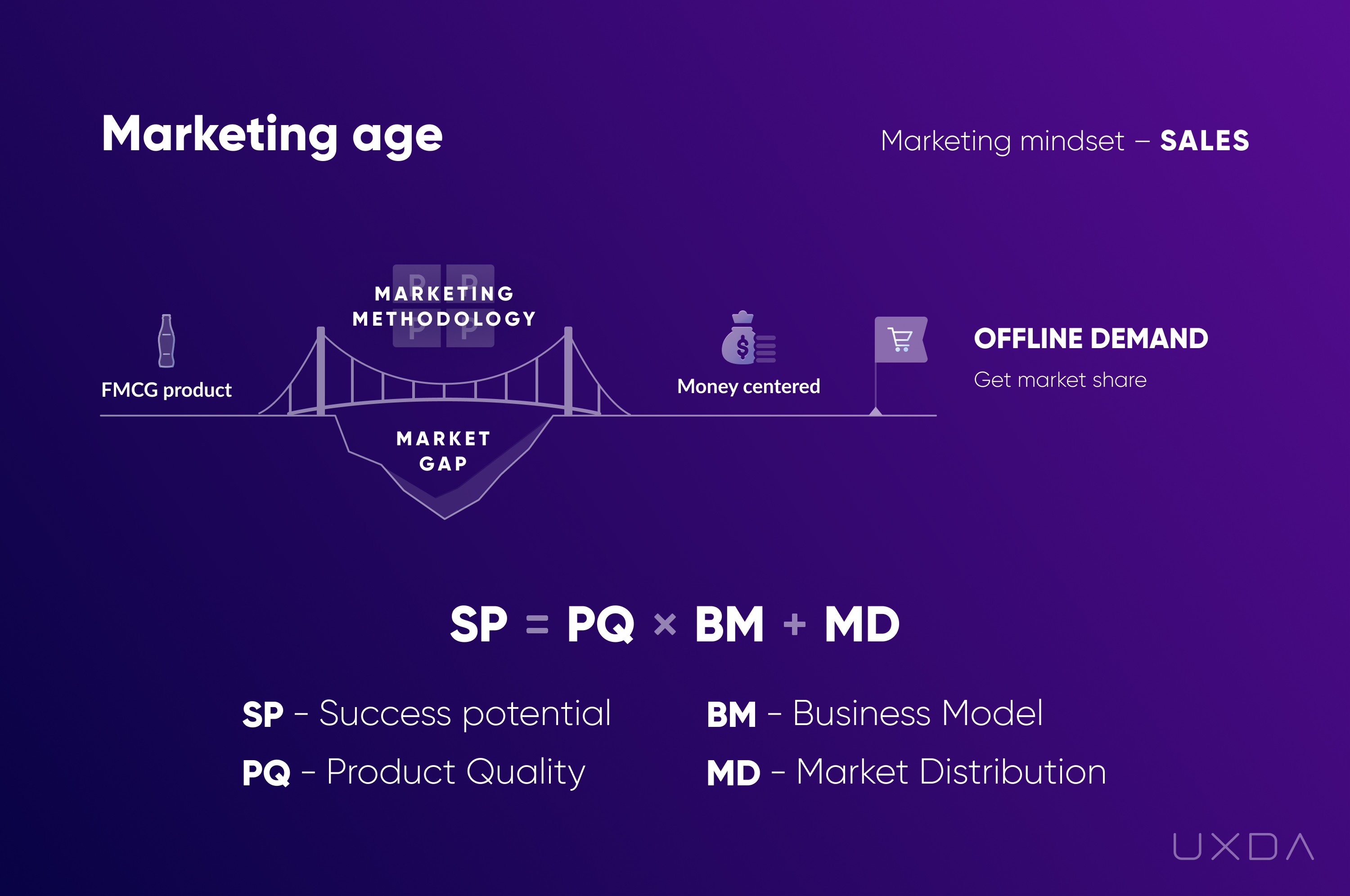

Product Quality (PQ)

This represents what the product has to offer to the customers. It's the end product or service that is exchanged with consumers for resources. Here it's important to make the quality of the product match the expectations of the customers in order to ensure demand. So, we name it Product Quality (PQ).

Business Model (BM)

Simplified, it's the way that a company operates─the organization model and manufacturing process of a product or service, principles and system that determine the functioning of a business, its internal and external operations. We will call it the Business Model (BM).

Market Distribution (DM)

Tools and actions the company uses to market the product to the customers. It's the distribution of the information about the product in the external environment, to increase market awareness and generate consumer interest in the service or product. Let's call it Market Distribution (DM).

There's a multiplication sign between the product quality and the business model because these elements closely affect each other. In the case of an ineffective business structure, the likelihood of creating and developing a quality product is sharply reduced. In turn, a poor-quality product can demotivate employees and complicate operations with a large number of complaints, which will reduce the efficiency of business processes.

Success in the Marketing Age

Not so long ago, in the so-called marketing age when the main goal was to make profit, this formula provided a clear understanding of how to make a business successful.

Do you have a quality product, well-established business processes, but no sales? Look at distribution channels, positioning strategies and competitors. Find out how to raise the MD, and the business will go up. Or, for example, is everything alright with the distribution and quality of the product, but there is no profit? Look at your BM; you probably have bottlenecks somewhere─production lags behind sales, delay with the component supplies, etc.

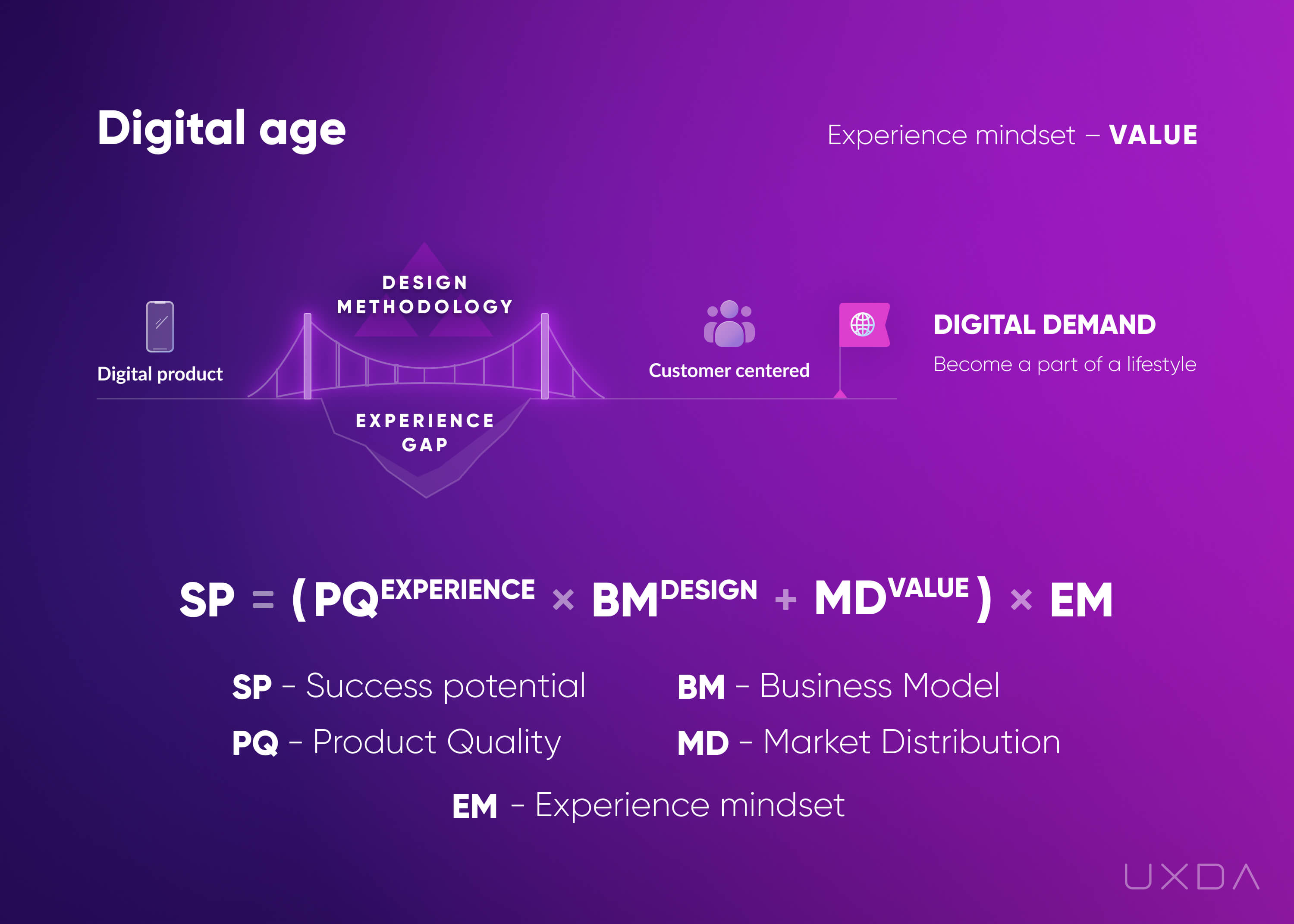

UX Formula to Improve Customer Engagement in Banking

In the digital age, everything is changed. Today, the development of digital technology affects the basic principles of consumption, customer engagement and, therefore, the rules of business. Despite the fact that basic business components have remained the same, new elements must be taken into account. These elements affect efficiency but, at the same time expand the formula to new success opportunities.

The scale in which a business integrates all of these additional elements defines the success potential of the financial company and its digital financial products.

So, when it comes to the digital age, I define the business success potential by the following formula (in the brackets): product quality raised to the power of experience times business model raised to the power of design plus market distribution raised to the power of value (brackets closed), multiplied by the experience mindset.

At first glance, it may look a little complicated, but actually it's a quite clear and easy-to-use framework.

The rate of each component can be estimated by a value from zero to 5, taking, as a basis, the relevant characteristics of leaders and outsiders in the related industry.

To increase the success potential of its customers, the UXDA team uses this formula as the basis for our Financial UX Design methodology, which we have developed over the past 15 years. The key components of this methodology (i,e., Purpose-Driven Mindset, Experience Pyramid, Design Pyramid, Value Pyramid), and practical examples of its use, have already been published on the UXDA blog. While we take a closer look at the formula, I will tell you which of the components of our methodology should be used to increase a particular formula parameter.

Success Potential

What is meant by success potential in this formula? This is the ability of a business to efficiently produce and deliver to the market a product or service that will be in such high demand that it will ultimately generate a positive financial flow in the long term.

On a utility level, this is the potential of a business to create and exchange something for the resources necessary for its existence and growth. And what does it depend on?

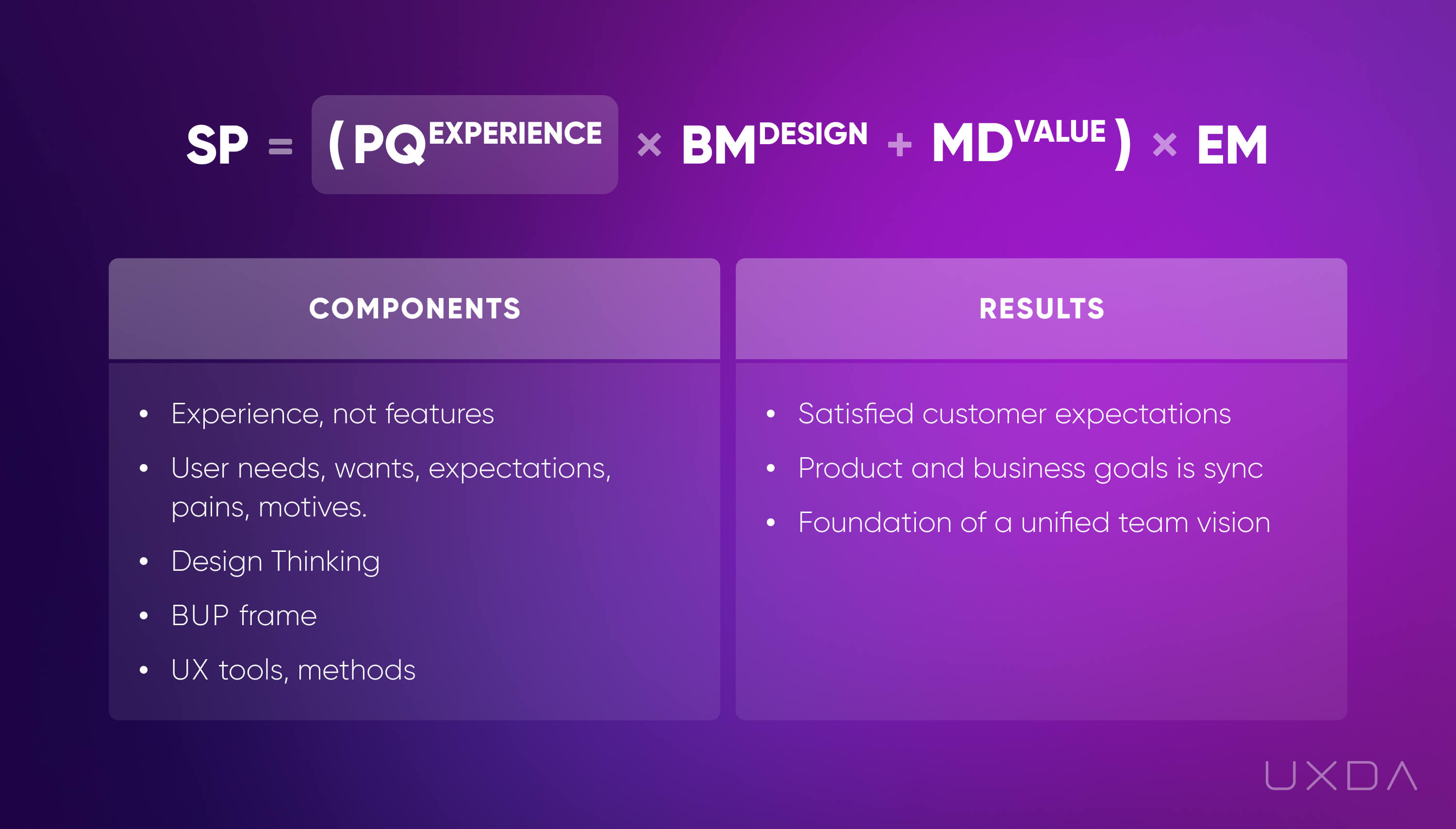

Product Quality Raised to the Power of Experience

First of all, it depends on the business offer to its end customers, i.e. product or service. In our formula, we call it the Product Quality.

This means that the main focus is not on product features but on what kind of experience the financial product offers to the customers.

The better the experience, the higher the chance for the financial product's success.

I think everyone will agree that the quality of a product or service significantly affects demand in the long term. But, in the digital age, it's not only about the characteristics of the product or service, but primarily about the whole experience we provide to the customer. This means that if you want to increase the success rate of the product, you must purposefully create a delightful customer experience. By increasing the degree of experience, you could significantly increase the chances of success.

For example, imagine a company that produces a high-quality and well-made product focused on the user's problem, but it has low demand. This may be due to the fact that the experience of using this product does not meet the expectations and needs of the user. At the same time, a similar, maybe even not so well-developed, product takes into account the context of user experience and offers a simple and clear solution for which users are willing to pay double the price.

In order to create a great experience, we need to take into account the user's needs, wants, expectations, pains, and motives for using the financial product. When working with our clients who utilize the UXDA's Financial UX Design methodology, we do this through the components of the Experience pyramid─the Design Thinking approach, brand, user, product frame (BUP), and different UX tools and methods.

Our workflow is created to design financial product through the customer perspective. This approach can be used to make any product or service customer-centered. It is focused on achieving maximum customer satisfaction according to the specific business goals and taking into account the capabilities of the financial product.

This component of the formula results in a product that lives up to the customer expectations and wouldn't get rejected.

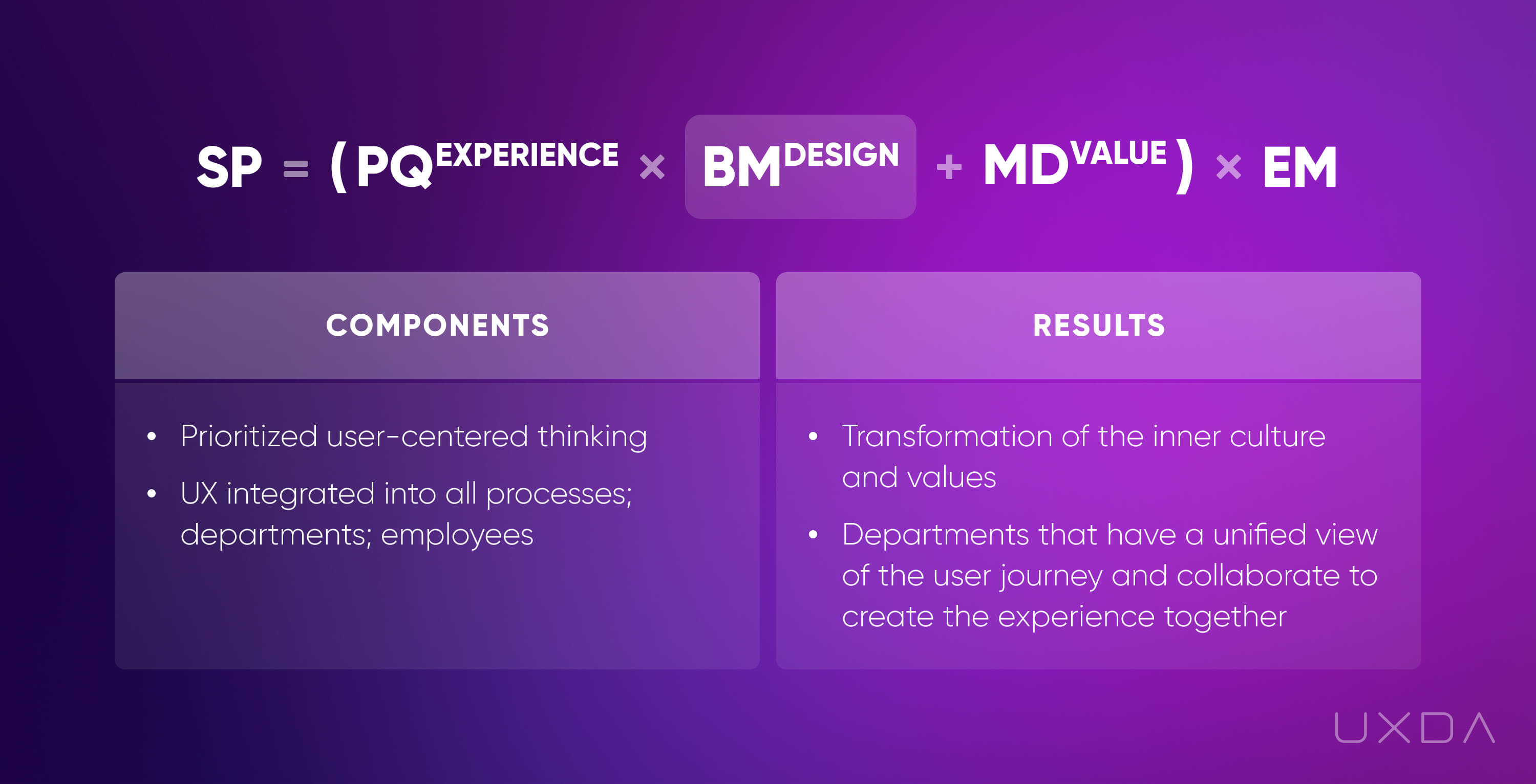

Business Model Raised to the Next Level with the Power of Design

The second parameter of the formula is the business model. The business model determines not only the type of business, but also the basic principles of its functioning, development strategy and organization features. That is, everything that determines the production of a product or service and the implementation of business goals.

Of course, an effectively built and well-functioning business has a very high chance of success. Working with banks, I see huge organizations with precise functioning rules.

Competitiveness in the digital banking industry requires more flexibility and switching focus from bureaucratic legacy to providing demanded value to customers. To increase the focus on customer satisfaction and accordingly ensure long-term success in the market, financial companies should integrate design thinking at all levels of the business.

That is why we place design as a degree that impacts the success of a business model. In this case, we are not talking about the visual aspect of design, but about a generalized design approach to create and develop human-centered business at all operational aspects and in business culture. This approach allows us to ensure business adaptation to modern market realities, which will significantly increase its effectiveness. We discuss design integration in more detail in the Design Pyramid article.

For example, banks, whose well-established and regulated business models have been proven for decades, today are surprised to see the super-fast rise of Fintech companies whose business models use the design approach as fuel for disruptive innovation.

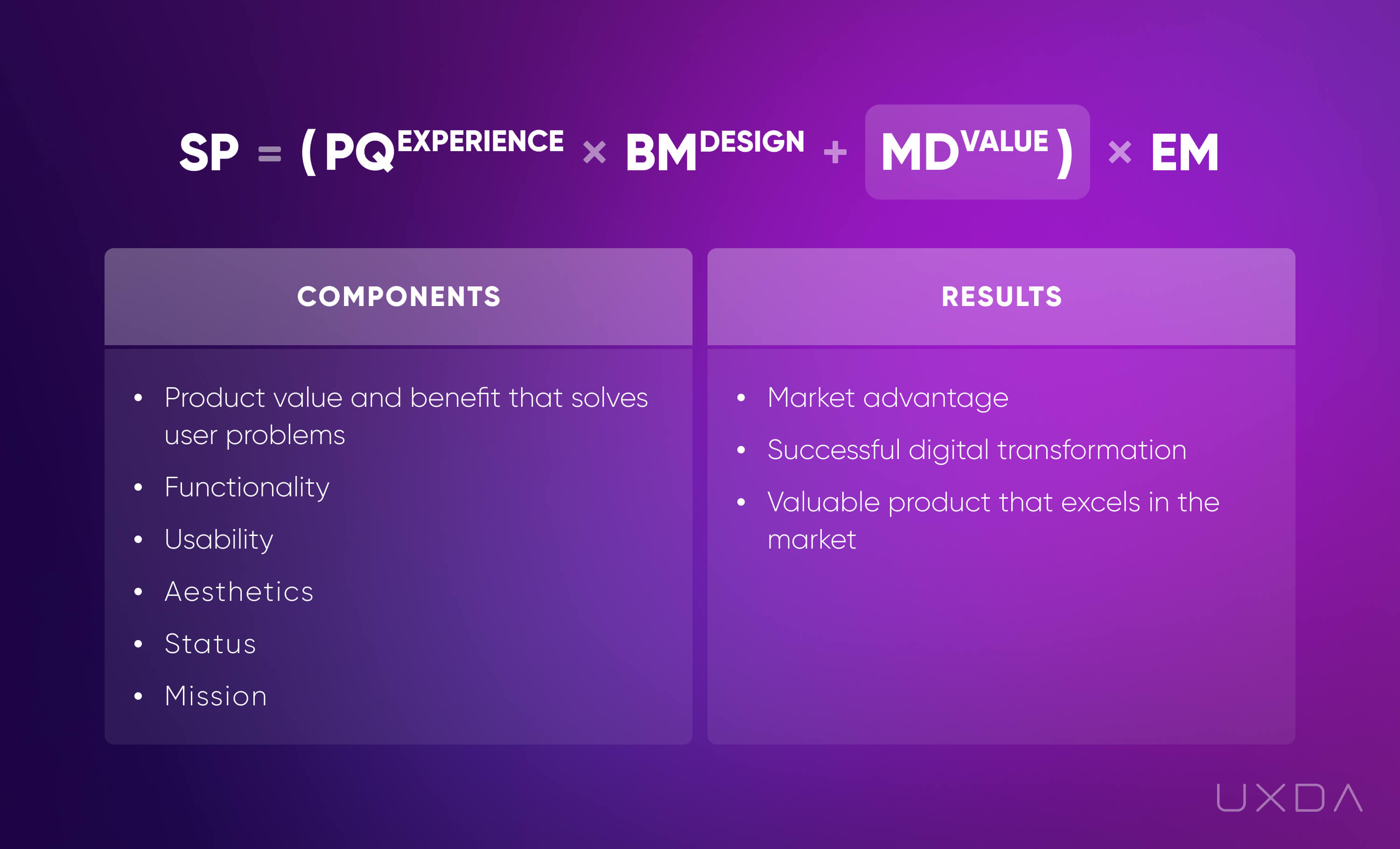

Market Distribution That's Powered by Value

The third component of the formula are the operations of the business with the outside world or, rather, market distribution. In the market distribution term, I include both the chosen market niche with a positioning strategy and the activity of promoting and delivering information about a product or service to customers or potential partners of the company.

In the so-called marketing age, it was enough to boost the marketing budget to reach more people and convince them to buy the product. But, today, it no longer works like that. We have the network effect, and anyone is able to post a bad or a good review on the internet. This determines whether a person will trust you enough to buy your product or quickly learn from his or her peers that it's just a pretty advertisement.

For the market distribution, the success multiplier is the value provided to the customers. It's possible to create that if, besides basic functionality, the product also provides pleasant usability and aesthetics that cause positive emotions─status or personalization according to the specific needs of different audiences and the possibility to create a feeling of being a part of a bigger mission that has an impact on the world, like Tesla does.

In the Value pyramid, we explore these five levels in great depth. Their development is associated with the competitive expansion on the market. Involving a higher level of value creates significant competitive advantages and increases the return on efforts aimed at market distribution. In general, this is a question about why your business exists and what value and benefit it brings to the customers.

At the same time, we are adding, but not multiplying, market distribution rate to the formula, since, even with a zero distribution, business success still can be achieved─in particular, with handcrafted products or boutiques, which are organically promoted by word of mouth without the participation of business owners. In this case, this is due to the outstanding quality of the service/product and the competent organization of the business.

For example, a large enterprise that has existed on the market for a long time for sure has a clear positioning of its products, well-established distribution channels and huge budgets for promotion, but this potential could not work to the maximum if the value provided to customers is at a basic functional level. However, if the value level is raised significantly higher toward the client, you will see a sharp increase in support and new opportunities for business development.

Just imagine a business that offers a special experience for a certain segment of consumers or, even better, implements a socially responsible mission. This could lead to creating community support around it. Members of such communities usually recommend products, defend the interests of the company and help develop its business, as this becomes part of their lifestyle.

The Experience (Purpose-Driven) Mindset

The final and fourth element in the framework of this formula is associated with our thinking. Thinking is a filter through which we perceive the world around us and the basis for which we set goals and make decisions. Instead of an outdated mindset focused only on sales, we should implement a mindset that is focused on creating value for customers. This is the only way to survive in the age of digital disruption.

In this kind of mindset, we view the customers as our friends or family members, aiming to help them with the financial products the best way we can.

Since the format of our thinking directly impacts the organization’s culture, strategy, priorities and the configuration of the product, the principles of our business and the plan for market promotion depend on this. Therefore, thinking becomes a crucial factor for the whole formula. The success scope of all of the three previous components depends on it.

To ensure the organization's success in the future, a sharp focus on customers’ expectations and behavior is critical. It is your customers’ needs, perceptions and experiences that play a key role in the digital economy. Don’t try to manipulate them. Use empathy to become really useful to your customers, and they will provide an unexpected power for the growth of your business.

The customers of today expect a more ethical, responsible, and honest attitude from their financial institution, as well as attention to their needs. Only this kind of attitude can ensure long-term success under conditions of digital transparency, total socialization, globalization, the disappearance of intermediaries, low market barriers, high competition, and changes in consumer values. This type of thinking differs from the usual mindset of consumers as a resource used for business development. We call it the “Experience mindset or the Purpose-Driven mindset.” You can learn more about the experience mindset and diagnose the level of its development in your organization by reading our article.

Experience mindset is a form of perception and action that meets the requirements of the digital era and is maximally human-centered. Thus, a possible way to improve the quality of all the components of our formula at the same time is to integrate the Experience mindset into the company's culture. The UXDA team practice of conducting multiple workshops on the development of the experience mindset shows that such a transformation is possible only through external facilitation due to the high inertia of the cultural legacy.

Expected Results

Let's have some fun and play with numbers. Let's take two companies, Samsung and Apple, which operate in the consumer electronics market, and try to evaluate their performance using our formula. This is not a serious business analysis but rather a framework performance test.

We can put all 5s at the level of basic elements, because these companies represent the benchmark of efficiency in our world, are passionate about the quality of their products and are genius marketers.

In my opinion, Apple's main difference is that they strive to provide the best user experience in everything they do, and their army of fans confirms this, so we will give one more point for experience. And, unlike Samsung, they don't just promote their products; they globally promote the idea to "unleash your creativity," thus instilling powerful emotional value in their customers, so they get 5 points for value.

The last difference is the mindset. I'm not sure everyone would call Apple the global benchmark of a customer-centered company, but many can agree they are very good in this regard, and Samsung is a step below, in my opinion. Therefore, in terms of experience mindset, I gave Apple a four and Samsung a three. Time for the math.

Success potential of Apple: (5^4 x 5^5 + 5^5) x 4 = 7.8 million

Success potential of Samsung: (5^4 x 5^4 + 5^2) x 3 = 1.2 million

So, our final calculation shows that Apple's potential is almost seven times higher. Let's check the numbers. As of December 2023, Samsung has a market cap of $366 billion, and Apple has a market cap of $3 trillion—eight times as much!

While it isn't perfect, this formula shows the power of customer-centricity and customer experience. And just imagine what the purpose-driven business potential is for the banking industry, which isn't exactly spoiled by excellent product design and a human-centered attitude. I think it's time to humanize the financial industry.

You may ask if this formula passed the test in real business and what results it provided. We discovered positive impact of this formula among dozens of large and medium-sized businesses in various industries. For several years, we executed the Financial UX Design methodology based on this formula with 70+ clients, as well as our own company. Using this formula in the development of the UXDA agency ensured incredible results for us personally, as well as for our clients.

Building its business on this formula, UXDA has become the world's leading financial UX design agency in only four years. We received great recognition from banks, financial companies and Fintech startups from 27 countries, which is demonstrated by many awards, client testimonials and an high customer engagement with an NPS (Net Promoter Score) rate of 81. We started from scratch without investment funds, and, in a couple of years, the agency’s income exceeded one million euros, which usually takes much more time and resources for design firms. And all of this without having a geographical advantage through locating offices in Silicon Valley, New York or London.

In full accordance with the formula described here, the key priorities of our team are the best experience for our customers, the highest quality of service and a clear and transparent business model that uses design thinking at all levels. This allows the UXDA team to design services that provide maximum value to end users, which, in turn, forms a stable basis for the success of our customers who rely on the described formula.

The UXDA team is extremely passionate about designing human-centered financial products and proud of our achieved results. We are grateful to more than 70 financial institutions for the chance to perform and prove our methodology, knowledge and skills. Nevertheless, we aim even further by making humanization of the whole financial industry our mission. As a result, this led to 300,000 followers and a queue of customers, with almost no advertising budget.

I am sharing this formula with you to show the components that, in my opinion, have a key impact on business success in the digital world─a world in which the impact of customers on business has grown tremendously. These are dramatic changes to business rules that cannot be ignored in any industry.

Although ten years ago this success formula could succeed with only a product, business and market, in modern times, it’s unthinkable without multipliers of experience, design, value and mindset. This is the only way to adapt to the expectations of customers, gain their trust and skyrocket the business’s chances of success.

Get UXDA Research-Based White Paper "How to Win the Hearts of Digital Customers":

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedin