For anyone who knows how the banking back-office system looks like it would be a surprise that something of such complexity can win the Academy award of design - the IF Design Award. There’s a story behind every grand victory and we want to share it with you today.

This is a breakthrough success story about an extraordinary collaboration, or I would even say a partnership, that led to transforming a 15-year core banking solution into a revolutionary, award-winning business asset.

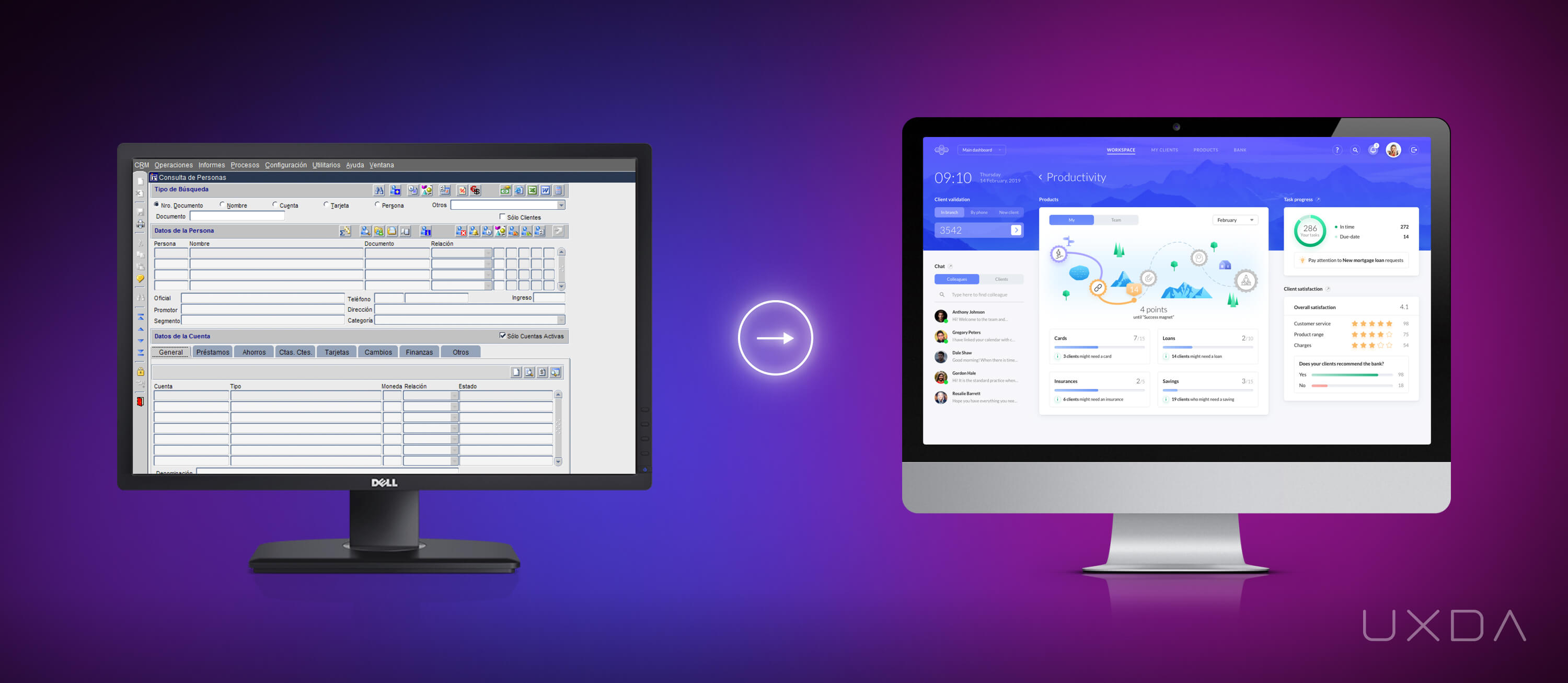

Outdated Core Banking System Design Ruins Everything

There's no secret that the majority of current banking back-office solutions are slow, complex, clumsy and leading the employees to mistakes instead of helping to avoid them.

The impact of an outdated banking back office system is much stronger than it seems at the outset. It drastically reduces the speed, quality and value customer service could provide.

Transforming a 15-year core banking solution into a revolutionary, award-winning business asset.

A progressively thinking banking software vendor company from Paraguay ITTI Digital, had spotted these pain points and embarked on a journey toward improving the beating heart of banking.

They turned to my team after trying to make their company user-centered on their own. They had heard a lot about user experience and Design thinking, but the efforts to make it work weren't successful.

There was something missing that they couldn't figure out. The team felt skeptical of the possibility of combining back-office functionality and security measures with user-centricity and delightful design.

ITTI Digital realized that it’s not only about interface design or product features, which is why they decided to trust the financial design approach developed by UXDA.

Customer-Centered Core Banking That Allows to Expand Globally

We had a 6 month long intense collaboration. The main challenge of ITTI Digital was to disrupt the banking industry by creating a never-before-seen core-banking solution 100% focused on the employees. After half a year, a brand new, industry-first core banking solution was born.

This transformation led to:

- a dramatic increase in banking's service speed, employee productivity, customer satisfaction;

- the learning curve of banking employees reduced from several weeks to a few hours;

- the potential for costly human errors significantly decreased;

- ITTI Digital gained the opportunity to expand in the global market.

The end result over-delivered on our expectations, not only because it proved the possibility to combine the complex functionality with user centricity in an enjoyable, beautiful and delightful design, but also because we became live witnesses of the huge mindset shift a user-centered thinking creates in our organization.

Hector Ojeda, ITTI Digital Innovation Manager

This core banking system received one of the world's most famous design prizes - the IF Design Award. It was awarded in the Service Design category alongside Apple that was recognized for its digital finance service design of the well-known Apple card.

The international jurors of 78 leading design experts from all over the world recognized this core banking solution UX/UI design for its exceptional transformation embodying a mission to inspire and lead the financial industry to a better future.

This core banking design is so much more than just an appearance; it transforms the daily routines of so many banking employees, as well as the service speed and convenience for the end users of the bank. This is really rewarding. Alex Kreger, CEO of UXDA

UXDA WINS THE WORLD-FAMOUS IF DESIGN AWARD

Of course, it took great courage to embark on this challenging journey. Most banks reveal they are very afraid of making such a huge and revolutionary shift, changing a structure that has been working for decades, but ITTI Digital is living proof that it's 100% worth it. And we are really proud of them!

Read the full step-by-step case study on the huge transformation we went through together with ITTI Digital.

Get UXDA Research-Based White Paper "How to Win the Hearts of Digital Customers":

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedin