Financial institutions often chase after groundbreaking functionalities that promise to rapidly set them apart from competitors, attract tech-savvy customers and generate instant media buzz. This is especially common in unstable markets, in which short-term interests prevail over long-term ones. Companies obsessively copy features, buy them and invent them, but sustainable product success lies in aligning digital service with a deeper strategic vision. Vision rooted in a clear brand promises an emotional connection with customers. In this article, we’ll explore why a feature-first approach in digital banking may harm your brand.

In today’s hyper-competitive financial industry, the allure of a “killer feature” can be irresistible. It promises instant differentiation, captures the attention of tech-savvy customers and often garners media coverage for being “innovative” or “revolutionary.”

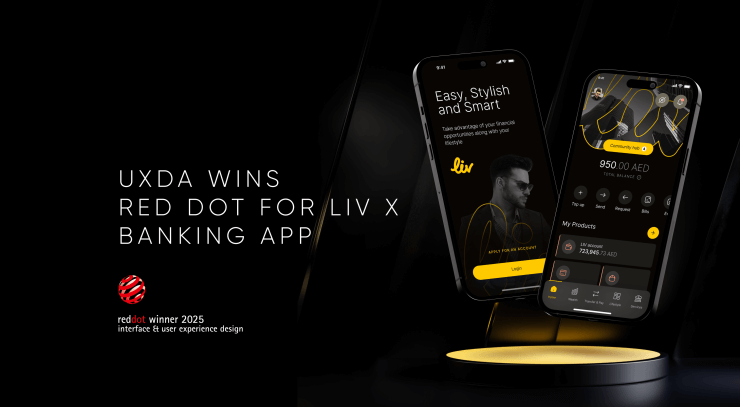

However, as tempting as it is to bet everything on implementing game-changing features, a feature-first approach can undermine your brand in the long run. The UXDA team’s experience consulting with financial institutions around the world has shown that true power belongs to companies that strategically harness product features as an extension of something far more profound: a clear brand promise and an emotional connection with customers.

In essence, this “features first, branding second” approach stands in opposition to the other one that begins with strategic business clarity and brand identity before designing the product features. Below is an examination of each approach, the drawbacks of the first, the reasons why many financial companies adopt it and how they can transition to the second approach for greater long-term benefit.

The Illusion of the “Killer Feature”

Many financial institutions default to the features-first approach due to a historical focus on technical innovation, regulatory requirements and risk management. There is often a perception that financial products are defined primarily by numbers and rates—interest rates, fees, terms—rather than by customer experience or brand storytelling. Additionally, the organizational structure of large banks and insurance companies may be siloed, with the product department working independently from marketing or branding teams.

Usually features-first product development begins by defining specific features, such as new savings accounts, loans with certain interest rates or retirement products with fixed or variable returns. Afterwards, these features are assembled into a cohesive product offering. Branding is then added as a finishing touch, including a name, logo and visual identity. Finally, the company establishes business processes like customer onboarding, compliance, marketing and revenue models to support the product.

Features-first financial institutions often hunt for a single, highly touted killer-feature—like advanced personalization algorithms, lightning-fast payments or robo-advisors with predictive analytics—as the gateway to sustainable success. Although these functionalities can indeed generate initial buzz, relying solely on a feature-first approach is precarious because:

- Features Can Be Copied: If your technology is your only competitive advantage, the likelihood is high that a rival will replicate or improve upon it within months. The Fintech market is littered with examples of imitators who neutralized first-mover advantage.

- Rapid Technological Obsolescence: Technological advancements accelerate at breakneck speed. Today’s “must-have” feature can easily become tomorrow’s afterthought, rendering your expensive, feature-centric strategy obsolete.

- Feature Overload Confuses Customers: An excessive focus on cramming every possible function into a single digital product can overwhelm users, making the customer experience feel like an exercise in software navigation rather than a true financial partnership.

- Lack of Alignment with a Business Strategy: When features define the product without broader strategic context, there is a risk of misalignment with the company’s core mission and long-term goals.

- Weak Brand Identity: Adding a logo at the end fails to create a cohesive brand experience. Customers often struggle to distinguish these products from competitors offering similar feature sets.

- Limited Focus on Customer Needs: A features-first approach might over-prioritize the “technical” aspects of a product rather than addressing real consumer pain points and desires. As a result, the product may fail to generate significant customer engagement or loyalty.

- Missed Opportunities for Differentiation: Because the brand identity is an afterthought, companies often miss the chance to tell a unique story or create an emotional connection—key differentiators in a crowded financial marketplace.

The Power of Brand Connection

While innovative features generate short-term excitement, a strong brand ignites long-term loyalty. Building a powerful brand goes far beyond logos, color palettes or tagline slogans. It’s about a relationship—an emotional bond between your company and its audience. In a world in which multiple apps can deliver nearly identical functionalities, people increasingly choose brands that stand for something meaningful and align with their personal or professional values.

Brand-first financial companies primarily define their purpose, marketplace goals and business strategy to differentiate themselves, using customer journey mapping and user research to prove this vision. They build a brand that aligns with core values and resonates with their target audience. With strategy and brand in place, digital experiences are designed to reflect the brand’s promise and address customer needs. Relevant features are integrated into a cohesive user experience, with marketing and distribution strategies reinforcing the brand’s value and integrity.

There are clear benefits of adopting the brand-first approach:

- Enhanced Market Differentiation: When a product is born out of a clear brand strategy, it naturally stands out in a crowded financial landscape.

- Deeper Customer Loyalty and Retention: Customers who connect with an authentic brand experience tend to remain loyal, reducing churn and amplifying word-of-mouth marketing.

- Flexible, Scalable Growth: With strategy and brand guiding product innovation, companies can more easily expand their offerings without diluting brand value.

- Long-Term Profitability and Sustainability: Products aligned to well-researched customer needs and strong brand identity are more likely to generate sustainable revenue and adapt over time.

- Humanizing the Financial Experience: Financial services—be they banking, lending or wealth management—are intrinsically emotional. Money is tied to people’s aspirations, security and sense of well-being. A brand that communicates empathy, trust and reliability will resonate on a deeper, more enduring level than a brand that leads purely with its features.

- Differentiation That Endures: Competitors can mimic or clone your features, but they cannot easily replicate the emotional resonance and cultural impact of a well-established brand. Whether it’s through a commitment to empowering underbanked communities or delivering “financial freedom” at every stage of life, a brand identity, if communicated consistently, becomes part of a bank’s or Fintech’s DNA—difficult to steal or duplicate.

- Brand Trust Fuels Adoption: When customers trust a brand, they’re more inclined to explore and adopt new offerings. This makes rolling out updated functionalities far simpler, as the brand equity built over time lowers the psychological barrier to trying new tools or services.

Marrying Features with Brand Promise

A brand-first approach in banking ensures holistic alignment, in which the product aligns with the overall business strategy and meets customer expectations. This strengthens brand value by making the product a direct reflection of the brand, resulting in trust and loyalty. Focusing on customer needs leads to customer-centric development, optimizing product features to deliver genuine value rather than just basic functionality.

To be clear, product features matter. Convenience, speed and personalization can undoubtedly win customers over. Yet these features should serve as proof points for a larger strategic narrative. In other words, you leverage functionality to demonstrate how you deliver on your brand promise, not the other way around.

Digital channels are often the primary channel in which modern consumers interact with financial services. Customers don’t just want a place to store or invest their money; they demand frictionless, intuitive and emotionally satisfying experiences. This heightened expectation in the digital space magnifies the importance of holistic brand building:

- Begin with Strategy: Start by defining your vision: What do you stand for? Whose problems are you solving? How do you want customers to feel every time they interact with your product or service? This strategic clarity sets the stage for deciding which features are relevant—and which merely distract from your mission.

- Stay Customer-Centric: Before adding new bells and whistles, ask yourself: Does this advance the brand’s promise, or does it just look good on a product roadmap? Prioritize features that amplify your identity and resonate with real customer needs.

- Integrate Brand at Every Touchpoint: Consistency is key. The brand promise must be evident from your homepage and mobile app interface to your customer service interactions. If your brand stands for “financial empowerment,” then your app design, tone of voice and educational resources should all reinforce that mission, with features that empower customers to take control of their finances.

Conclusion: Use Opportunity to Leave a Lasting Impression

While the first approach of designing financial products may meet short-term objectives—rapid product launches, quick feature rollouts—it often hinders true differentiation and long-term customer loyalty.

By prioritizing brand identity, overarching strategy and customer needs from the outset, financial institutions can create more meaningful digital products that not only fulfill compliance and operational requirements but also engage and delight customers. Shifting to a strategy-driven and brand-first mindset ultimately positions companies for sustainable success in an increasingly competitive financial ecosystem.

In the fast-evolving financial sector, longevity and loyalty hinge on how well you communicate who you are as a financial brand, not just what your product can do. As new technologies continue to disrupt the market, aligning your features with a deep and meaningful brand promise ensures you’ll remain relevant—and cherished—by the customers you’ve worked so hard to serve.

A seamless, user-friendly digital experience is not just a functional requirement—it’s an opportunity to leave a lasting impression. Every click, transition and alert can either strengthen or weaken the emotional bond you’ve built. Social media, brand communities and virtual events offer new ways for a brand to express its personality and engage with customers. These interactions build brand advocacy that extends far beyond any single feature’s allure.

Digital platforms allow you to instantly gather and analyze user behavior. Use this data to evolve both the brand expression and the product features, ensuring that new updates are always in harmony with your overarching promise.

To switch to the more holistic, brand-led approach, financial companies can:

- Revisit Their Core Mission and Values

Clarify what the business stands for and identify how it aims to serve and differentiate itself in the market. - Integrate Cross-Functional Teams Early

Instead of isolating product development from branding and marketing, create collaborative processes where these teams work together from the start. - Invest in Customer Research

Gather insights on consumer needs, preferences and emotional triggers to guide product design that is relevant and compelling. - Develop a Cohesive Brand Strategy

Shift resources and leadership focus toward creating a comprehensive brand identity, including the brand’s promise, personality and positioning. - Align Business Processes with Brand Values

Ensure that internal processes—compliance, customer service and operations—embody the brand promise at every touchpoint.

Discover our clients' next-gen financial products & UX transformations in UXDA's latest showreel:

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedin