Can your financial brand get more from design than just a standard interface for digital services? Absolutely! Design determines what kind of experience and emotions customers will have when interacting digitally with your financial brand and how satisfied they will be. But without aligning your financial service with the actual brand and business strategy, it is impossible to get the most out of your design initiatives.

There is a Gap in Financial Experience

Leading tech companies embed their competitive edge in digital products, setting the stage for success from the start. However, traditional financial firms face a challenge here, especially when adopting white-label digital solutions. Aligning them with their unique business essence and customer needs is tough.

A recent Salesforce study revealed a significant shift in customer preferences in the financial sector. In 2023, 25% of customers switched banks, and over a third switched their insurers and wealth managers. 51% cited the desire for a better digital experience as the main reason for switching.

In finance, digital transformation is essential for shaping the future of financial brands. But how can you align digital experience with brand identity, goals and customer needs?

To answer, we need to agree on a few things:

- It's not about how the financial industry adopts digital, but about how digital technology sculpts financial companies.

- It's not about attracting customers through digital channels, but about going digital to serve your customers.

- It's not about additional convenience through digital, but about the primary way to perform financial tasks.

Thus, digital is not a channel for delivering financial services; it has become a product that is in demand for customers.

Weaknesses in the design approach used by financial companies limit their ability to ensure the best digital experience to gain a competitive advantage in the market.

Because of these weaknesses, there is a huge gap between customer expectations and the digital offering. To bridge this gap, design must become more than just a tool for drawing service screens; it must be taken beyond the screen to achieve business goals, as shown in a study of 2,200 companies in 77 countries conducted by Invision. The design impact on revenue, cost savings and time-to-market could be five times larger - 87% versus the usual 17%, resulting in 26 times growth in company valuation. And the key to this is integrating a brand strategy into financial services design.

Digital Strategy in Financial Services Provides a Bridge to Customer Satisfaction

A digital strategy in financial services refers to a comprehensive plan that outlines how financial institutions leverage digital technologies to enhance customer experiences, achieve their business objectives, and stay competitive in the rapidly evolving digital landscape. This strategy encompasses various elements, including purpose and values, brand identity, target market, business model, service range, technology adoption, data utilization, customer engagement, and operational efficiency.

Imagine the process of designing a bridge over a stormy river instead of blindly jumping into unknown waters. So how exactly can we build a bridge to cross the gap between digital offerings and the customer experience in finance? Essentially, it will be nice to have a specific framework to strategically design the best digital solution that will achieve business goals and satisfy customer needs while enhancing digital customer satisfaction in banking.

Similar to bridge construction, a strategic design framework must have certain characteristics to ensure success:

Clear Direction

If you want to cross a wide, fast-flowing river, you need to choose the right location for a bridge. It should be connected to the existing infrastructure to ensure a clear and safe path to the final destination. A well-defined digital strategy in financial services outlines the direction, goals and objectives, ensuring that every design decision aligns with the intended business destination. This will allow your team to work cohesively toward a common goal, increasing efficiency and minimizing wasted effort and resources.

Risk Mitigation

Building any bridge involves careful planning to account for factors like the river's depth, currents and geological conditions. Similarly, a strategic product design approach anticipates competitive context, potential pitfalls and challenges in the digital landscape, allowing for proactive risk mitigation. By addressing issues and pitfalls early, you avoid costly redesigns and post-launch problems.

Efficiency and Optimization

Constructing a bridge requires precise measurements, materials and engineering expertise. Likewise, a UX design approach defines the right tools, technologies and methodologies to create a digital financial product efficiently. Efficiency leads to cost savings and faster time-to-market, offering you a competitive edge.

User Centricity

A well-designed bridge considers the needs of pedestrians or vehicles, ensuring a safe and comfortable journey. In digital product design, a digital strategy incorporates user research and insights, ensuring that the final product meets users’ expectations and needs. Satisfied users lead to higher adoption rates, increased loyalty and positive word-of-mouth.

Consistency and Scalability

A bridge is built with uniform materials and design principles to maintain structural integrity. In digital product design, compliance with business strategy establishes a consistent design system, ensuring that your product maintains its quality as it scales and evolves. Scalability allows your product to adapt to changing market conditions and growing user expectations.

Measurable Success

When constructing a bridge, you set milestones and conduct inspections to ensure it meets safety and performance standards. Similarly, a digital product design relies on business key performance indicators (KPIs) to measure the impact on customer experience. You should be able to track progress, make data-driven improvements and demonstrate return on investment (ROI).

Adaptation to Change

A bridge can withstand environmental changes, such as rising water levels or shifting terrain. A strategy implementation in design approach anticipates shifts in user behavior, technology trends and market dynamics, constantly raising company adaptability. As a result, your product remains relevant and resilient over time.

Just as a well-constructed bridge ensures a safe and efficient journey across a challenging river, implementing a strategy into digital product design provides a clear path with minimal risks and enhanced efficiency, ultimately leading to a more secure and rewarding business journey in the digital realm.

This is definitely not the easiest task to perform. But with a clear and refined digital design approach, we could determine exactly what needs to be done and how to align financial service design with business strategy. And this is the perfect moment to introduce the UXDA Digital Strategy Pyramid.

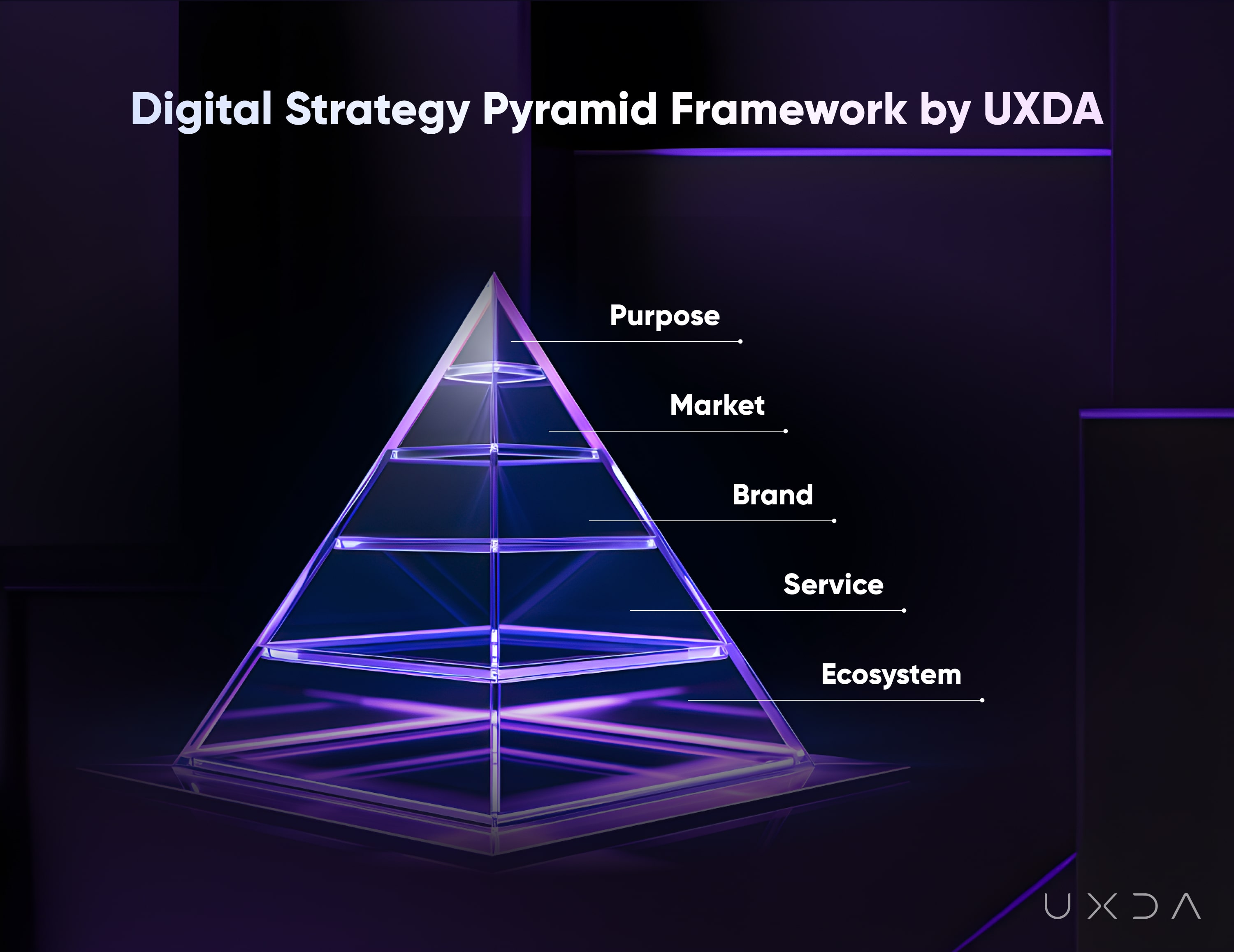

Digital Strategy Pyramid Framework by UXDA

The Digital Strategy Pyramid framework is used by UXDA’s digital experience consultants as a part of our financial UX design methodology. It is an easy-to-use and intuitive five-level hierarchy, in which each level is shaped by the previous one, ensuring that the financial product design is fully informed and determined by the financial service digital strategy.

The financial industry is witnessing a seismic shift in consumer expectations. And digital experience consultants can help the company most effectively realize its purpose.

Let's delve into each level and examine how it applies to financial UX design.

Let's delve into each level and examine how it applies to financial UX design.

1. Purpose

We start with the Purpose level, encompassing a company's “why?” through vision, mission, values, goals and its commitment to providing value to customers and society. This level sets the foundation for all business decisions, including design, ensuring they align with the overarching goals.

As Simon Sinek said, money is like fuel. Cars need fuel to drive, but the purpose of the car is not to get more fuel; it simply uses fuel to move people from point A to point B. Business is the same. The purpose of business is not to make money; it’s to serve a more significant meaning or cause, building or providing something.

A clear sense of purpose extends beyond short-term goals and instant challenges, giving direction through a bigger picture of a business and social landscape. It's fueled by passion and dreams, driving us to make tangible efforts for meaningful results in our businesses and lives.

For financial companies, this may be related to improving people's lives through simplifying financial transactions, facilitating financial management, improving wealth, providing financial support and education, friendly fees, etc.

Despite the convenience of traditional banking services, customers have grown disillusioned with a system that often appears opaque, profit-driven and disconnected from their values and needs. This disconnect between banks and their customers is a glaring issue. While the digital era has provided an opportunity for a banking revolution, most institutions have merely transplanted their traditional services onto digital platforms. This has left customers yearning for more of a purpose.

According to Havas’ global Meaningful Brands® 2019 research, meaningful brands that are viewed as making the world a better place outperform the stock market by 134%. Accenture Strategy’s global survey of nearly 30,000 consumers found that 52% of respondents have indicated that they prefer brands that believe in something greater than just the products and services they sell. This is also confirmed by a study by New Paradigm Strategy Group & Fortune, which found that 64% of the US population believes that the company’s primary goal should be to “make the world a better place.”

Imagine a financial service designed not only to be functional but also to be used as a vehicle for fulfilling a profound purpose. Consider a bank that views its role as more than just a profit generator but, rather, as a catalyst for positive change in the lives of its customers and society as a whole. Banking product design should be rooted in a clear and resonant business purpose.

2. Market

The next level of the pyramid is the Market level, involving understanding the target audience, customers’ profiles, expectations, needs, usage contexts and pain points.

According to a Salesforce study, 66% of customers expect companies to understand their needs and expectations. So, the financial executives need to have a clear understanding of who their customers are and what they want in order to develop a purpose-driven digital strategy that resonates with them. Deep insights into the customer base are crucial for tailoring design to meet specific customer requirements.

For a financial company, this may include such users as people who struggle with managing finances or people who need reliable service to build their financial well-being, etc.

3. Brand

The third level of the pyramid is the Brand, which involves defining the company's brand identity and determining how it can be authentically communicated to customers based on Purpose and Market insights. This includes brand guidelines and visual language, as well as the channels and methods through which the brand will be communicated.

Stackla research found that 86% of consumers say authenticity is important when deciding what brands they like and support, but 57% of consumers think that fewer than half of brands resonate as authentic.

Company executives need to ensure that the brand authenticity reflects the purpose and values and resonates with its target audience. Product design in this stage plays a crucial role in consistently conveying the brand's essence, ensuring consistency and differentiating it from its competitors. A study by McKinsey demonstrates that a consistent brand experience can increase customer satisfaction by 20%, leading to greater brand loyalty, and a Lucidpress State of Brand Consistency Report found that consistent branding can increase revenue by 33%.

For a financial company, this translates into creating a brand that is innovative, trustworthy, and reliable and design authentic visual communication activities that are relevant to the target market.

4. Service

The fourth level relies on the aspect of Service. This stage involves making crucial determinations regarding the range of services a company will offer in order to fulfill its Purpose within the target Market in line with the Brand identity.

According to Zendesk research, 81% of customers will make another purchase following a positive customer service experience while 61% would switch to a competitor, after one negative experience.

In the banking context, these encompass essential services, such as fund transfers, deposit accounts, credit accounts, insurance products, investment opportunities and various other financial instruments, including services that facilitate financial management and budgeting.

5. Ecosystem

The final level of the pyramid is the Ecosystem, which includes all the digital products and elements needed to interact with customers. It is the main infrastructure and support that enables the company to function and serve its customers. This includes things like mobile and online banking, as well as the internal systems and processes that support these services.

According to Forrester, the key challenges to delivering a good CX are internal struggles: the lack of a cohesive strategy across teams (48%) and silos of various CX operations and functions across the organization (38%). At the same time, a Wunderman Thompson study shows that ensuring a seamless experience through all channels is a top priority for 42% of consumers.

Financial companies need to ensure that their digital ecosystems provide a consistent and frictionless experience to its customers and employees across all touchpoints. A cohesive and user-centric digital ecosystem is crucial for retaining customers and creating a competitive advantage in the modern world.

Putting the Digital Strategy Pyramid into Practice

Implementing a strategic approach to design in modern companies is essential for staying ahead in the digital age. The Digital Strategy Pyramid framework offers a simple and structured path to empowering this integration, ensuring that design decisions are aligned with the company's purpose, market insights, brand identity, service specifics and ecosystem consistency. For example, Apple's success is due to showing meticulous attention to design potential that results in the best digital competitive advantage in the world, driving customer loyalty and growth worldwide. Let's take a closer look at the drivers to their success.

Apple case study

Apple's digital strategy revolves around creating a seamless and integrated ecosystem of hardware and software that simplifies technology for its diverse customer base. This approach helps them fulfill their purpose of enriching people's lives through technology, making it more accessible and enjoyable.

1. Purpose

Apple's purpose is to unleash, support and inspire creativity in people. They implement innovations to empower individuals, redefine possibilities and challenge conventions. From education to healthcare, from creative arts to business, Apple’s purpose is to set new standards and inspire others to push boundaries. Apple aspires to be a catalyst for implementing positive global change. Apple’s design-driven innovative approach is not about making things look nice; it's about harnessing the power of design to fulfill a revolutionary purpose.

2. Market

Apple users are at the heart of everything they do. Apple designs products with empathy, seeking to understand their customers’ desires, challenges and dreams. Apple’s primary customers are those who value a delightful and innovative user experience and need simple but powerful digital solutions to move their creativity to the next level. Apple customers seek high-quality, well-designed devices and services for various purposes, including communication, work, entertainment and creativity. Customers’ pain points that Apple addresses include compatibility issues, complex user interfaces and a lack of seamless integration among devices.

3. Brand

Apple's brand is synonymous with innovation and sophistication. Their visual language incorporates these elements through a sleek user interface, reinforcing the brand's premium image. Apple believes in creating a brand that last, reduces environmental impact and provide enduring value to its customers. It's a purpose-driven commitment to sustainability and responsible design. Apple's brand philosophy is to create intuitive, aesthetically pleasing, functional products. That’s why the design approach is critical to Apple’s brand identity.

4. Services

Apple’s design-driven innovations have a ripple effect across industries. To simplify and improve the user experience wherever they go, Apple introduced multiple innovations, such as the first graphical user interface with a mouse, reimagining the music experience, inventing buttonless mobile computing and moving toward spatial mixed reality. All the services Apple provides are focused on its primary mission to unleash and support everyone’s creativity on the go without the need to learn any technology. And they are constantly expanding their services in accordance with their purpose.

5. Ecosystem

Design at Apple is not a superficial layer; it's the driving force behind their disruptive innovations. Apple’s products are designed to remove barriers, to make technology more accessible and to enhance the way people connect, create and communicate. Apple's ecosystem seamlessly integrates services with its devices, creating a unified user experience that benefits users with a consistent design language and user flow.

To deliver services according to its purpose, Apple designed a range of innovative products such as MacBook, iMac, Mac, iPad, iPhone, AppleWatch, AirPods, Apple TV and Apple Vision Pro. The consistent design of those products is informed by the upper levels of the Digital Strategy Pyramid, creating a digital ecosystem through the AppStore, iTunes and iCloud to simultaneously provide a synergistic, frictionless and delightful user experience across all devices. Apple uses design as a vehicle for positive impact, creating products and experiences that elevate the human spirit and transform how we interact with technology.

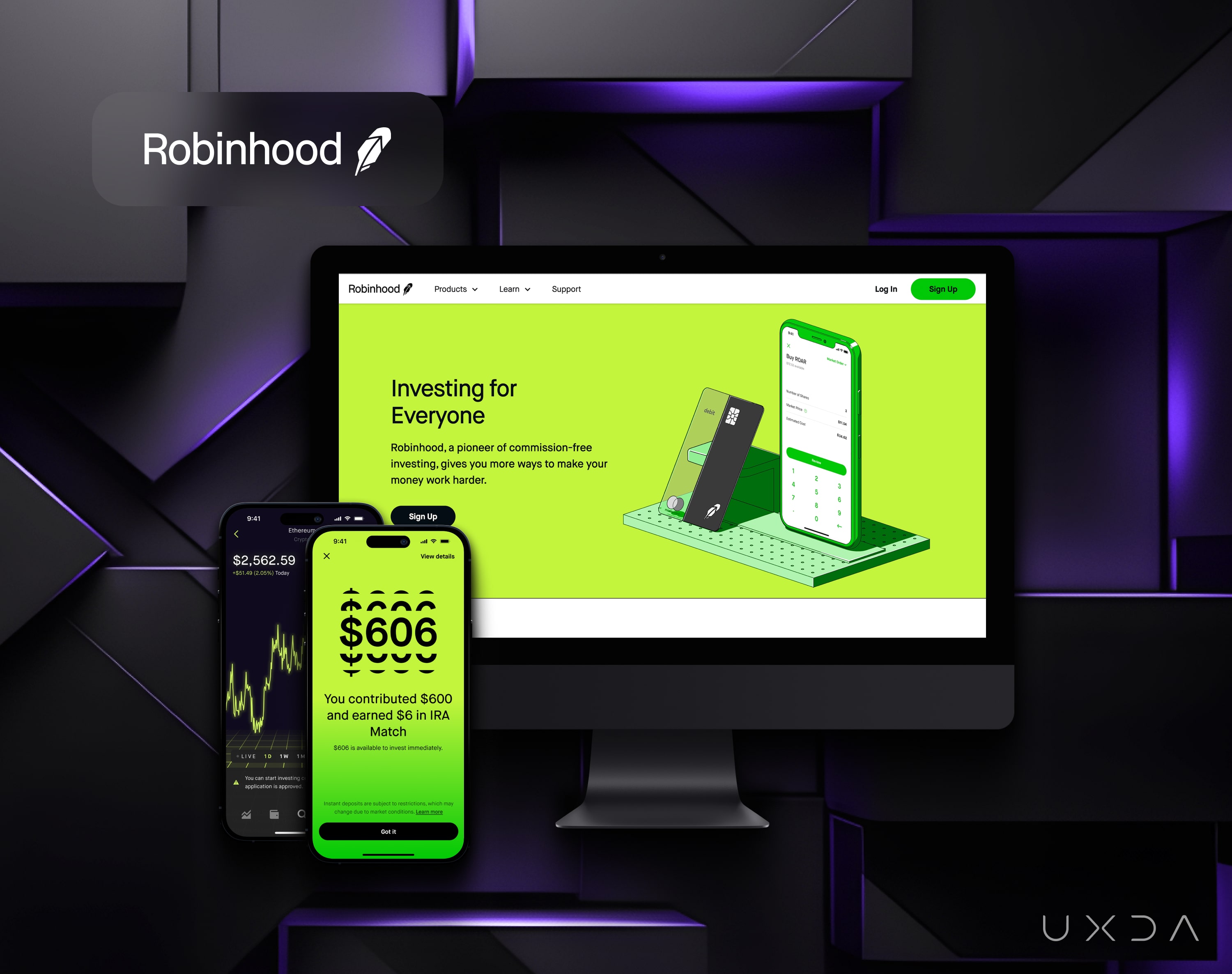

Robinhood case study

Robinhood's digital strategy revolves around its purpose of democratizing finance, catering to the needs of retail investors and aligning its brand identity with simplicity and accessibility.

1. Purpose

The purpose of Robinhood is to democratize finance and make investing accessible to everyone. Robinhood's values include simplicity, accessibility and empowerment. They make investing approachable to novice investors by removing friction from investment experience.

2. Market

Robinhood's primary customers are typically retail investors, including millennials and first-time investors who are seeking a user-friendly platform to invest in stocks, ETFs, options and cryptocurrencies. They need an intuitive, low-cost platform for trading and investing.

3. Brand

Robinhood's brand identity is informed by their purpose to make investing more inclusive and is connected to the needs of their target audience. The brand identity impacts the digital design by emphasizing clean and intuitive design, clear language and easy navigation.

4. Services

Robinhood addresses their customers’ needs and pain points by offering commission-free trading and leveraging technology to simplify the investing process. They also offer fractional shares, making it easier for customers to invest with smaller amounts of money.

5. Ecosystem

Robinhood delivers its services through its mobile app and website. The digital products are designed for ease of use, with intuitive navigation, real-time data updates and a straightforward account setup process. The mobile app has light design and reduced complexity, optimized for on-the-go investing, while the web platform caters to more advanced traders.

Revolut case study

Revolut's digital strategy revolves around creating a banking super app that addresses customers’ financial and lifestyle needs.

1. Purpose

Revolut's purpose is to simplify all things money by providing a comprehensive financial and lifestyle platform that empowers customers to take control of their finances and improve their overall quality of life. Revolut's value proposition includes convenience, cost-effectiveness, transparency and a wide range of services.

2. Market

Revolut's primary customers include tech-savvy individuals, frequent travelers, young professionals, families and businesses seeking a single platform for both financial and lifestyle management. Customers need a convenient and cost-effective solution for banking, trading, savings and lifestyle services, all in one place.

3. Brand

Revolut's brand identity is tech-forward and customer-centric, aiming to be an all-encompassing financial and lifestyle hub. Its visual identity is informed by their mission to simplify and enhance their customers' lives.

4. Services

Revolut improves their customers’ lives by offering a wide range of financial services, including banking, trading, savings, charity donations, gift cards, insurance and lifestyle amenities like concierge, trip booking and airport lounge access. This comprehensive approach helps customers save time and money while enjoying a more convenient lifestyle.

5. Ecosystem

Revolut delivers its services primarily through its mobile app and website. The design of their app emphasizes simplicity, ease of use and seamless navigation between financial and lifestyle services. The app's design characteristics include a clean and intuitive interface, real-time transaction updates and personalization features that enhance user engagement.

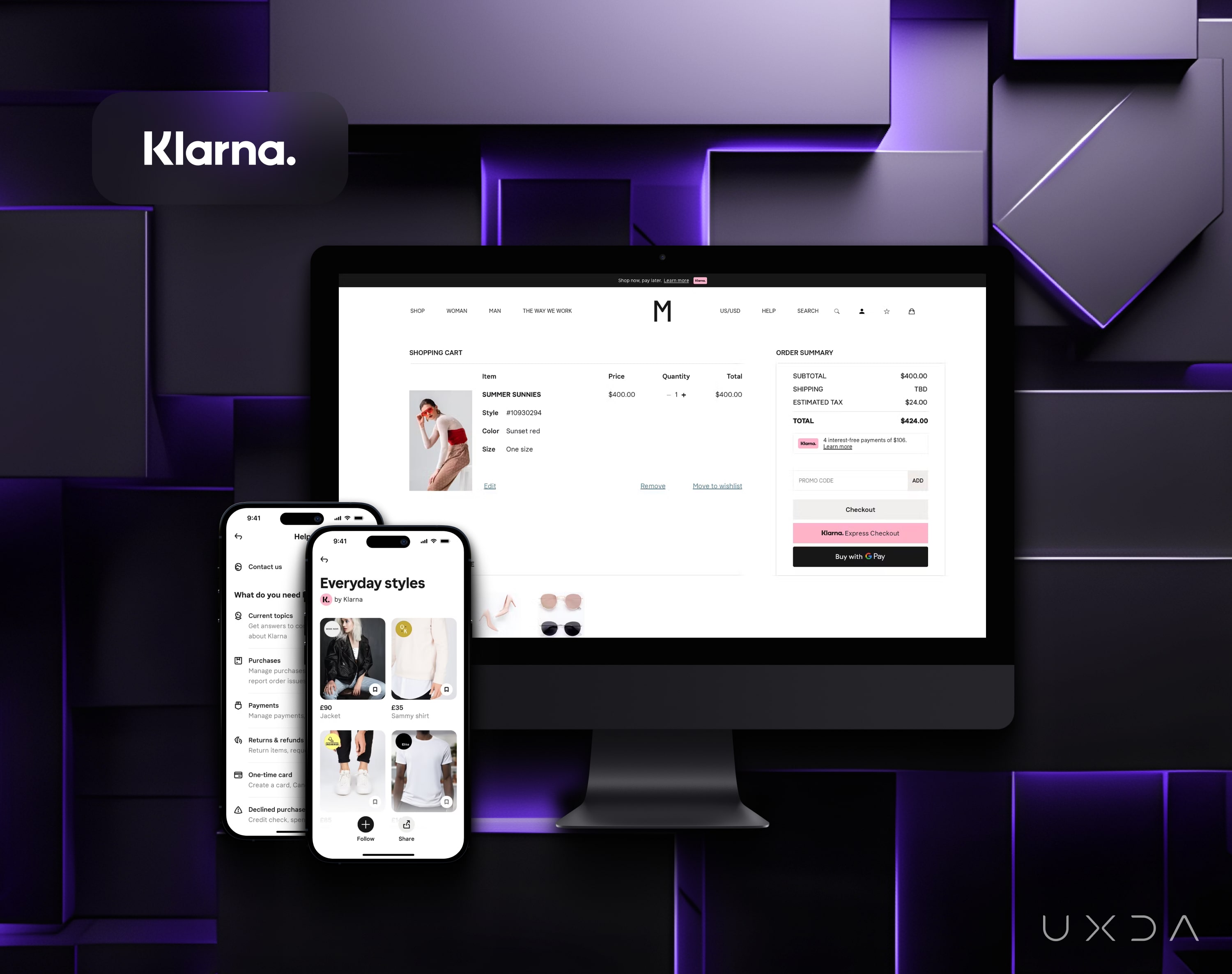

Klarna case study

Klarna's digital strategy is centered on simplifying the online shopping and payment process, aligning with their purpose of making buying easier.

1. Purpose

Klarna's purpose is to "simplify buying." The company exists to make online shopping and payments smoother and more convenient. Klarna improves people's lives by providing a seamless and secure payment solution that enhances the online shopping experience, reducing friction in the checkout process and offering flexible payment options.

2. Market

Klarna's primary customers include online shoppers, e-commerce merchants and retailers looking to improve their online checkout process. Customers seek a hassle-free and secure online shopping experience with flexible payment options and a smooth checkout process.

3. Brand

Klarna's brand identity aligns with its purpose by positioning itself as a customer-centric payment solution that simplifies online shopping. Klarna's visual language focuses on a user-friendly interface, emphasizing simplicity and ease of use.

4. Services

Klarna offers services such as "Pay Later," "Pay Now" and "Slice It," allowing customers to choose flexible payment options at the point of purchase. Klarna differentiates itself by providing a simplified and streamlined checkout process with a variety of payment options, including installment plans.

5. Ecosystem

Klarna delivers its services through its mobile app, website and integrations with e-commerce merchants. The digital channels are characterized by a clean and intuitive interface, seamless integration with partner websites and features like real-time payment notifications.

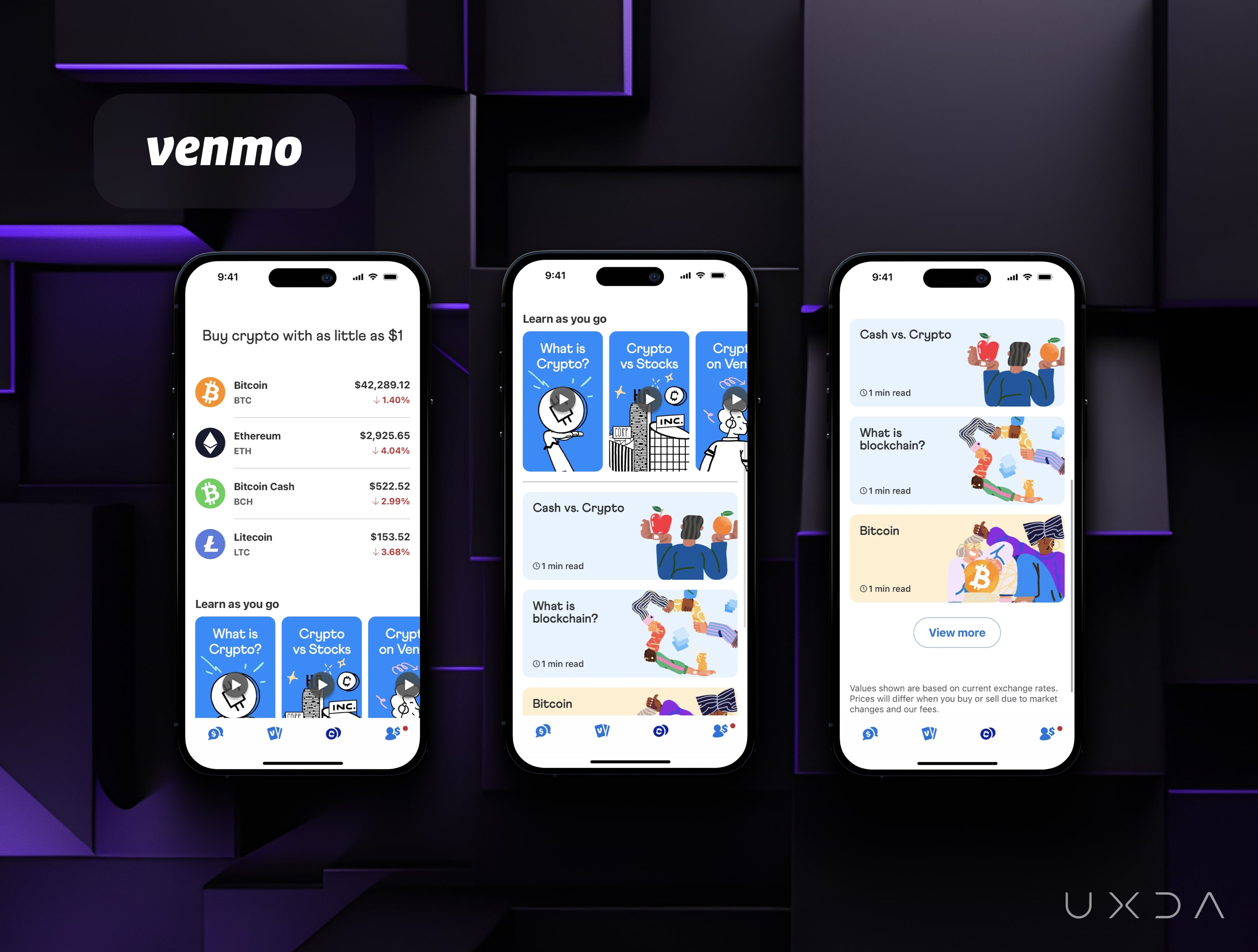

Venmo case study

Venmo's digital strategy revolves around creating a social payment platform, aligning with its purpose of simplifying and enhancing peer-to-peer payments.

1. Purpose

Venmo's purpose is to simplify and enhance peer-to-peer payments. The company exists to provide a convenient and social way for people to send and receive money. Venmo values ease of use, social engagement and financial inclusion, aiming to make money transactions more accessible and enjoyable.

2. Market

Venmo's primary customers are millennials and younger generations who seek a user-friendly, social and mobile payment solution. Customers need a simple and efficient way to split expenses, share payments and engage socially. Traditional payment methods, such as checks or bank transfers, are cumbersome and lack the social dimension that Venmo offers.

3. Brand

Venmo's brand identity is informed by their mission to create a social, easy and enjoyable payment experience. Venmo's product design focuses on a user-friendly, mobile-first interface with features like emojis and payment descriptions that promote social engagement.

4. Services

Venmo provides services for sending and receiving money, splitting bills and sharing payment activities with friends. Users can link their bank accounts or debit/credit cards for transactions. Venmo differentiates itself by integrating social interactions into payments, allowing users to add notes, emojis and comments to their transactions.

5. Ecosystem

Venmo primarily delivers its services through its mobile app, available on both iOS and Android platforms. The app design prioritizes a user-friendly and social experience. The digital products prioritize simplicity, security and social interaction.

Why Do Financial Brands Fail to Align Design with a Digital Strategy?

Aligning a digital product design with a digital strategy can be a complex endeavor, as it involves bridging the creative and strategic aspects of a company. Following are key challenges that can arise during this alignment process:

Differing Timelines

A digital strategy often requires long-term planning, while a digital product design may operate on shorter development cycles. Balancing these differing timelines can be challenging, as design iterations may be needed even after the digital strategy is set.

Budget Constraints

Allocating resources for design can be a struggle when business leaders prioritize other areas, such as marketing or infrastructure. Convincing stakeholders to invest and grow design maturity can be a challenge, especially if they don't immediately see its impact on the bottom line.

Changing Business Priorities

Business goals and priorities can shift rapidly due to market dynamics, competitive pressures or external factors like economic conditions. This can lead to conflicts when design efforts are well underway, causing design teams to pivot quickly.

Lack of Alignment Among Teams

Ensuring that design teams, product teams and business units share a common understanding of the overarching strategy is crucial. Misalignment among these groups can lead to inconsistent execution and wasted efforts.

Limited User Centricity

Sometimes, business strategies may focus too heavily on financial goals and not enough on user needs and preferences. Balancing these priorities is essential for creating products that resonate with customers.

Resistance to Change

A company’s existing culture, processes and workflows may not be conducive to incorporating design thinking into every phase of product development. Overcoming resistance to change and promoting a design-centric culture can be challenging.

Communication Gaps

Effective communication among design teams and business strategists is crucial. Misunderstandings or a lack of clarity about objectives and constraints can lead to design decisions that don't align with the intended strategy.

Resource Allocation

Deciding how much time, effort and talent should be devoted to design within the broader resource allocation can be tricky. It often involves trade-offs with other critical functions like engineering, marketing and customer support.

Scalability

As businesses grow, maintaining design consistency and quality across multiple products, platforms or regions becomes challenging. Scaling design processes while preserving the original strategic intent can be demanding.

Competing Stakeholder Interests

Different stakeholders, from executives to customers and investors, may involve conflicting interests and expectations. Balancing these interests while adhering to the core business strategy can be a juggling act.

Overcoming these challenges requires a collaborative approach in which design teams work closely with business leaders, engage in ongoing communication, adapt to changing circumstances and advocate for the value of design in achieving strategic goals. It's a dynamic process that requires continuous effort and a commitment to aligning design and business strategy effectively.

Key Takeaway: Strategy-Driven Design is Central to Digital Customer Satisfaction

The financial industry's future is inextricably tied to a digital transformation. It's not merely about adopting technology; it's about reimagining financial services through digital products to serve and satisfy customers effectively.

Digital services are no longer secondary to financial products; they have become products in themselves. Customer satisfaction hinges on how thoughtfully and effectively these digital experiences are designed.

To bridge the gap between customer expectations and digital offerings, design must be integrated with a strategic approach. It's not just about designing screens; it's about designing a path that aligns with business goals. It sets the tone for how customers perceive and interact with your financial brand digitally.

Customer satisfaction in the financial industry hinges on the thoughtfulness and success of digital design. Financial executives should recognize that digital services themselves have become the products for which customers come, making design integration with strategy imperative. And the UXDA Digital Strategy Pyramid framework offers a structured approach to aligning digital product design with strategy in the financial industry.

Starting with a clear business Purpose, financial executives should define their business vision, mission, values and goals. Choosing the target audience and understanding their context, needs and pain points at the Market level is crucial. This informs the Brand level, at which the company defines its identity that resonates with customers and creates a value proposition, visual language and communication strategy. The Services offering must align with the Purpose and Market needs, while the digital product combined into a consistent Ecosystem should ensure a user-centric experience in delivering these services.

By embracing the Digital Strategy Pyramid design framework, the digital experience consultancy team of UXDA helps to align digital product design with the financial brand’s goals and purpose, delivering financial UX that resonate with customers and drive long-term success in the ever-evolving digital landscape.

Get UXDA Research-Based White Paper "How to Win the Hearts of Digital Customers":

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedin