Design has emerged as a powerful driver of banking innovation and success in the ever-evolving financial services landscape. Beyond its traditional role of shaping financial products' visual appearance, design now plays a pivotal role in transforming organizations and propelling them toward new heights. How much does design maturity impact revenue, cost savings, time to market and company valuation?

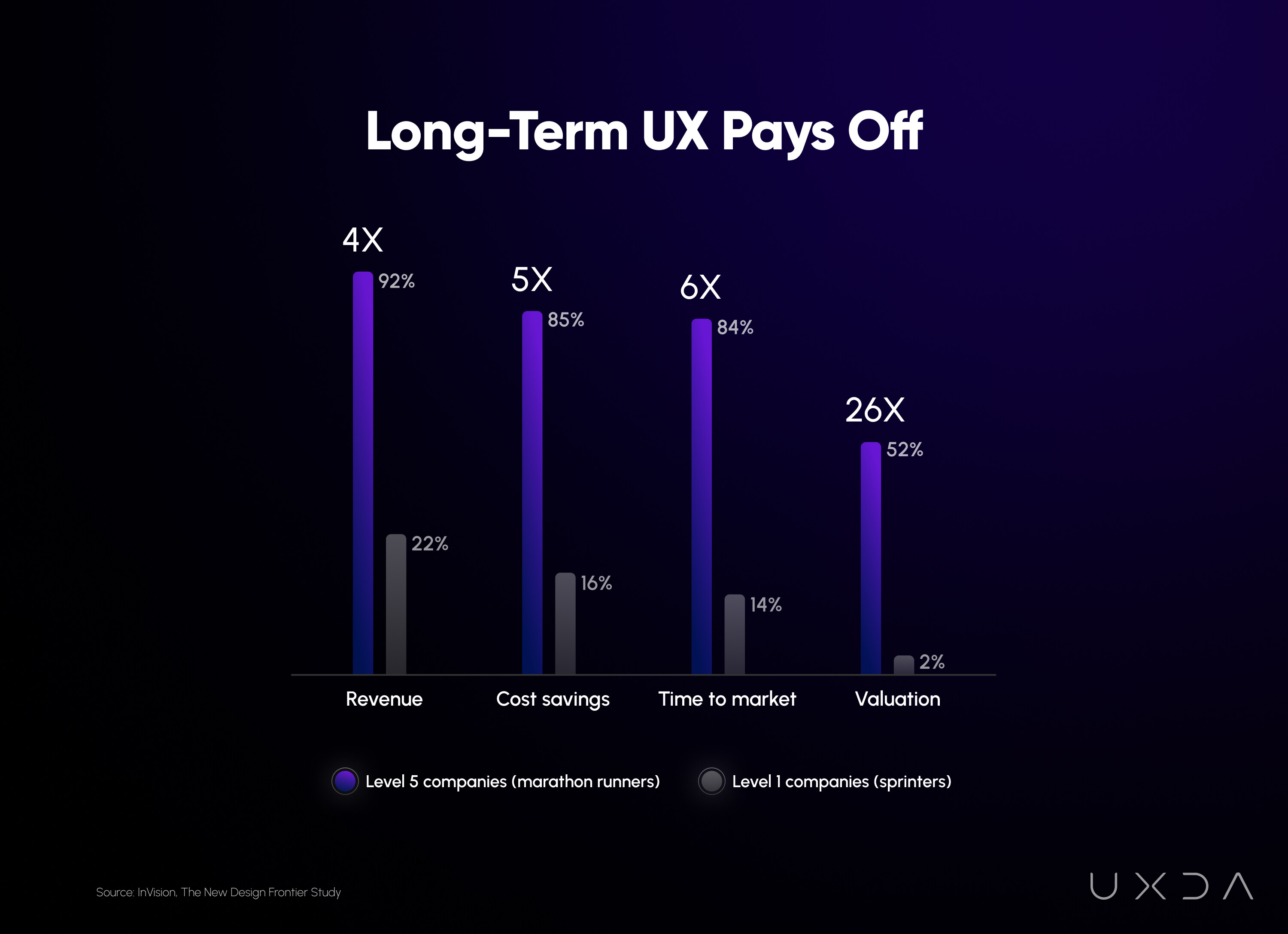

A study of 2,200 companies in 77 countries conducted by InVision showed a vast difference between companies that claim that their design team has had a proven impact on key business success indicators and companies that do not. It depends on the level of design maturity of the organization.

The number of mature companies with a noticeable design impact on revenue, cost savings and time to market is five times larger than immature companies - 87% versus 17%. And, in the case of evaluating the impact of design on company valuation, the difference is 26 times larger - 52% versus 2%.

We call the first-level companies - sprinters because they primarily focus on short-term design and minor user experience improvements. In contrast, 5th-level companies can be called marathon runners because they implement design and UX at the strategy level, pursuing long-term goals.

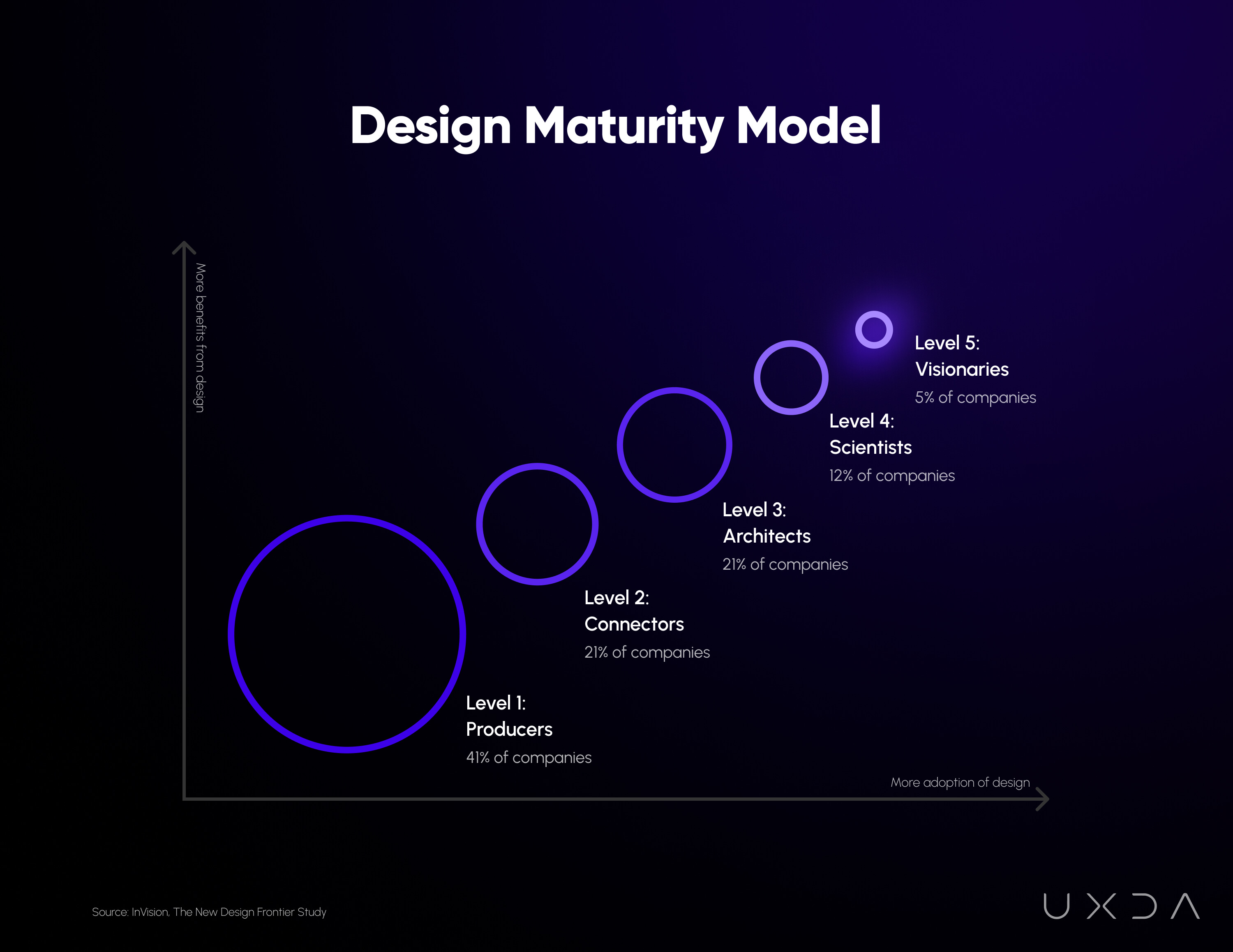

These numbers show how much more value long-term mature design practices can bring to a business. Perhaps one might think that, for as big a tech company as Apple is, it could be true but, for others, questionable. InVision surveyed 24 industries ranging from the financial industry to non-profit organizations. They found that the distribution of design maturity works in every industry and, on average, looks like this: 41% of companies are at the entry level of design maturity with only 5% at the highest, and the remaining 54% are somewhere in the middle.

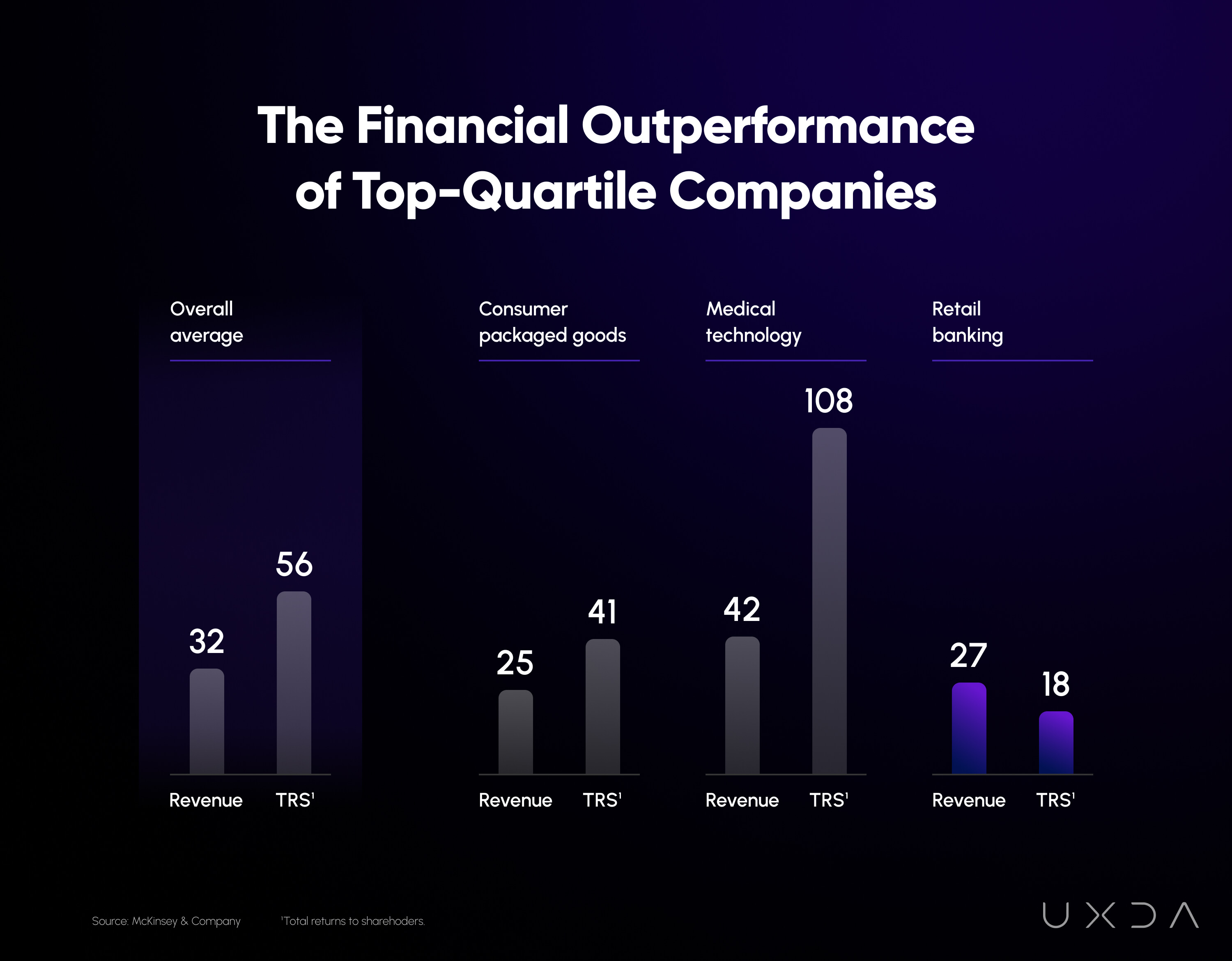

Another significant piece of evidence showing the design impact on business success was explored by McKinsey researchers, who tracked the design practices of 300 publicly listed companies over a five-year period in different countries and industries. Companies with advanced design approaches increased profits 2.5 times more - 10% growth versus 4%.

According to McKinsey, more than 40% of the companies surveyed do not talk to their end users during development. More than 50% admitted that they do not have a system for evaluating and setting goals for the results of the project teams. The drivers of a strong and consistent design environment identified in McKinsey's research require decisions and investments at the company's strategic level. Yet, seeing no connection between design and business goals, senior executives do not invest resources in design.

McKinsey’s findings show that top-quartile companies in design—and leading financial performers—excelled in four areas of design. And these four clusters of design actions showed the most correlation with improved financial performance:

- measuring and driving design performance with the same rigor as revenues

and costs; - breaking down internal walls between physical, digital and service design;

- making user-centric design everyone’s responsibility; and

- de-risking development by continually listening, testing and iterating with end users.

The McKinsey study further finds that top-quartile McKinsey Design Index (MDI) scorers increased their revenues and total returns to shareholders substantially faster than their industry counterparts did. In retail banking, the difference was 27% in revenue and 18% in TPS over a five-year period from 2013 to 2018.

Forrester research commissioned by Adobe also confirms design-led companies' business superiority because they have 1.5 times greater market share, competitive advantage and more satisfied and loyal clients than design laggards. Similar findings come from the Design Management Institute, which found that design-driven companies outperform S&P by 228% over ten years.

Risks of Low Design Maturity

Design maturity refers to the evolution of an organization's design capabilities and how well design is integrated into its processes, decision-making and strategy. The entry level of design maturity is characterized by a lack of strategic focus, ad hoc decision-making and a siloed approach to design.

From a financial product design point of view, offering a digital service without effective User Experience (UX) design is comparable to driving without shock absorbers. Such a car could move very fast, but passengers will feel very uncomfortable, and, on the first pit, the wheels of the car can fall off.

Offering such experiences to the public will cause significant damage to the brand's reputation. UX design of next-gen financial products focuses on the emotional response of consumers when engaging with a service. That's why staying at the entry level of design maturity instead of progressing to the highest one can expose any financial company to several dangers and limitations, including:

Low Competitiveness

Financial companies and banks at the first level of design maturity often lack a deep understanding of true user needs and market trends. This can result in missed opportunities to develop innovative products or services that could give them a competitive edge in the future market. Design can help these companies differentiate themselves from their competitors, attract new customers and increase market share.

Inefficient Product Development

Without a mature design process, product development may become inefficient and riddled with costly iterations and rework. Inadequate consideration of user experience and design implications can lead to financial products that do not meet customer expectations, requiring costly fixes post-launch.

Poor Customer Experience

Financial companies with a low design-maturity level may prioritize short-term profitability or cut costs over customer needs, leading to products or services that do not resonate with their target audience. Such digital services are difficult to use and end up frustrating customers. This lack of customer-centricity can negatively impact customer satisfaction and loyalty, increasing customer churn and lost revenue.

Brand Dilution

Inadequate design focus can lead to inconsistency across the digital product ecosystem, brand and messages in different channels and touchpoints. This fragmentation can dilute the financial brand identity and reduce marketing efficiency, thereby weakening its market position.

Talent Gap

Top design talent is often attracted to organizations that prioritize design and offer opportunities for creative expression. In addition, employees who are not involved in the design process are less invested in the company's products and services, which reduces their productivity. Such a company with a low level of design maturity could struggle to attract and retain skilled talent.

Reactive Decision-Making

Without a strategic approach to design, the financial company or bank may find itself blindly reacting to market trends rather than proactively finding solutions that empower business development. This reactive decision-making can hinder long-term planning and growth.

Reduced Banking Innovation

Financial organizations at the initial level of design maturity often struggle to foster a culture of innovation and creativity. This stifles the generation of new ideas and limits the company's ability to develop breakthrough products or services that adopt the latest banking innovations.

Wasted Resources

Inefficient design processes and unreasonable product revisions lead to higher development costs. Financial companies that lack a strategic approach to design are more likely to waste resources on projects that do not meet their users' needs and do not align with the company's overall goals and brand identity.

Limited Buy-In

Without a mature design strategy, other departments may not fully appreciate the value of design, leading to a lack of buy-in and collaboration. In-house competition and a siloed approach can hinder the integration of result-driven design thinking across the organization, reducing its ability to effectively find and implement innovative solutions.

Risk of Disruption

In today's rapidly evolving digital landscape, financial companies and banks that don't see design as a strategic advantage risk being squeezed out by more design-savvy competitors that adapt faster, better and more efficiently to digital customer requirements and market trends.

Maturing design capabilities can help financial companies and banks overcome these dangers and gain a competitive advantage in the market.

Components and Benefits of Design Maturity

Design-mature financial companies establish a user-centric culture throughout an organization, making it a shared responsibility and mindset across departments. They approach their product development like a marathon, not a sprint, securing long-term UX design.

It requires a cultural shift that fosters a deeper understanding and appreciation for user needs and experiences, leading to better products, services and customer satisfaction. You can explore key ideas on how designers could switch their organizations to long-term UX in an insightful talk by UXDA's Account Executive & UX Architect, Santa Paegle, in Chili Labs Product Design Meetup:

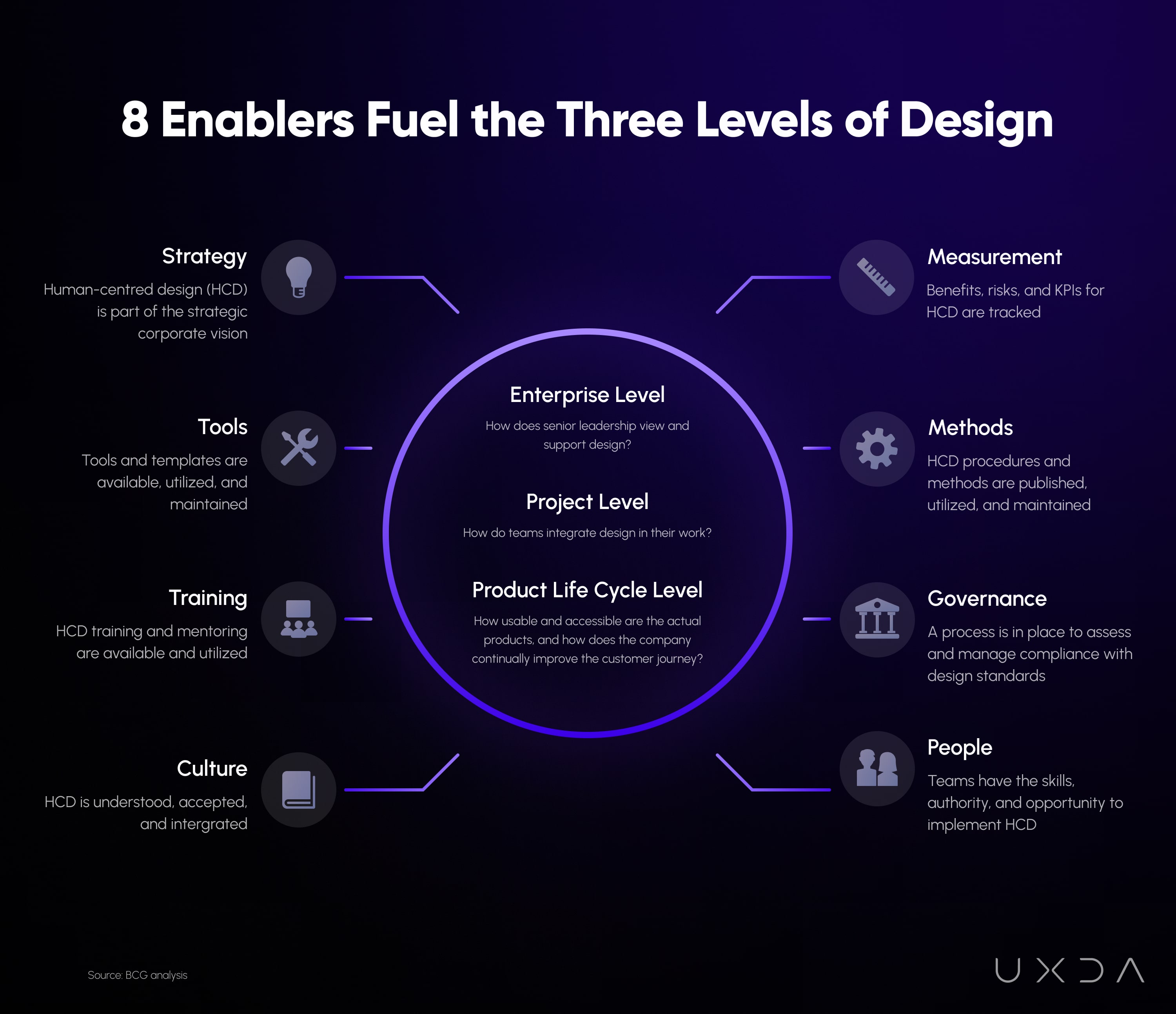

According to BCG, there are eight key elements that influence the design maturity of an organization: strategy, culture, measurement, methods, tools, governance, people and training.

Design prioritization across companies helps to create a competitive advantage in the market, enabling the financial company to differentiate itself by delivering an exceptional user experience. This increases customer loyalty, fosters positive word-of-mouth and gains a distinct market position.

Another important benefit is the ability to make more informed strategic choices for decision-makers in a company. When the management team considers a user's needs and feedback, it influences product development, business direction and resource allocation. Decision-making based on user insights results in products and services that better meet customer expectations.

All of this encourages a culture of innovation. Only by understanding user pain points, desires and aspirations can financial organizations identify new opportunities for product or service improvements. Digital product design and UX professionals can provide valuable insights and collaborate with other departments in financial organizations to develop innovative solutions that resonate with users and drive business growth.

Deloitte data shows that organizations with high levels of design maturity are 6 times more likely to change their design quickly, 5 times more likely to manage change effectively, 4.9 times more likely to develop talent, 4 times more likely to successfully sustain legacy operations and pioneer new ones and 3 times more likely to develop new products that disrupt markets.

You might think that such mature design companies probably have a huge design department to achieve these benefits. Surprisingly, the opposite is true, according to the InVision study. Design-mature companies, on average, have two times fewer designers than low-maturity organizations, 15 versus 30.

There could be several reasons for this inefficiency and more design staff in immature companies. Most business units do not collaborate with designers or participate in the design processes, making it difficult to make and implement design decisions. Instead of prioritizing financial innovation and strategic product improvements, designers are overwhelmed by the chaotic processing of many small tasks. The business team does not have the data to make quick and informed design decisions, which leads to wasted time and reduces work efficiency.

9 Steps to Increase Design Maturity

So what exactly separates the most design-mature companies from the least mature, and how do they empower business with design? Of course, it depends on the role design plays in a company.

In entry-level design maturity, the work and responsibility of designers is limited to their computer screens. The design focus is on the short-term goal of how to make a product or package prettier. Design is on the periphery of the business; its role in the company is unrelated to key business processes. Designers' suggestions and ideas often carry little weight in a company, and there is a disconnect between what product designers create and what developers build.

In companies with the highest design maturity, design is an element of the company's business strategy. Product design here aims to solve business and customer problems. This mindset creates a long-term competitive advantage by designing exceptional service to customers, not just improving a product or packaging's appearance. Therefore, the responsibility and influence of designers is much wider, and their activities are directly related to strategic processes. Product design is at the heart of the business. All departments and executives, and not just designers, are actively involved in the design process.

Results of Forrester research commissioned by Adobe shows that 86% of design-led firms often or always involve design teams in digital CX strategy, while 41% of design laggards do it occasionally, on ad hoc basis, or rarely.

As we see, the only way to shift financial organization to the highest design maturity level is to move design from the periphery to the center of business. This path is possible only through collaboration, integration and exploration. And, while we're exploring this in steps, there's no strict sequence but rather working together on each step simultaneously.

Unite Team Around Design

Immature companies focus mainly on the visible aspects of design, such as digital product screens, advertising design and other marketing assets. To progress, financial companies must collaborate in raising design value and impact across teams, establish a user research program and emphasize that the design goes beyond visuals.

By integrating more user research and collaboration in the digital ecosystem design, financial companies can bridge the gap between designers and developers. Incorporating rapid sketching, joint sessions, stakeholder participation and shared usage of design tools is essential for an efficient design process.

Step 1. Join forces

Encourage a culture of collaboration and break down silos between designers and other departments, such as marketing, engineering and product management. Organize design training sessions and workshops that bring together teams from different departments to collaborate on solving real business challenges using design thinking methods, fostering a shared understanding of design principles and methodologies. This helps align various departments toward a common design language and approach.

By involving stakeholders from different disciplines in strategic discussions, design specialists can gain insights, gather diverse perspectives and align design efforts with business goals to create a seamless user experience. In turn, working in cross-functional teams helps foster a shared understanding of user needs and helps to integrate product design considerations into the overall business strategy.

Step 2. Influence with design

Encourage designers and UX architects to be design evangelists within the organization. Share knowledge and insights through internal blogs, presentations and newsletters to raise awareness about the value of design among all employees.

Advocate for the value of design at the strategic level. This involves educating senior leadership about the impact of design on customer experience, brand perception and overall business outcomes. Sharing case studies, research and success stories from other companies can help illustrate the benefits of investing in design.

When communicating design ideas to the strategic level, frame them in business terms that highlight benefits. Focus on how design initiatives can improve customer satisfaction, increase conversion rates, drive revenue, reduce support costs and strengthen the brand image. Translate design concepts into tangible benefits for the company.

Step 3. Bring design to the boardroom

Seek sponsorship from top executives who believe in the value of design. Having influential advocates for design at the strategic level can accelerate the integration of design thinking in the company's DNA.

Design and UX specialists should actively engage with executives, educate them about the value of design and demonstrate how it aligns with the organization's goals and objectives. By securing leadership buy-in, design specialists can ensure that design is given the necessary attention and resources at the strategic level.

Foster a design-driven culture within the financial organization. Encourage and reward employees for embracing design thinking principles and user-centered approaches. When design becomes an integral part of the company culture, it naturally finds its way into strategic planning.

To drive change facilitation, seek external expertise for breakthroughs. Partnering with UX design agencies and consultants, such as UXDA, will help to challenge traditional thinking and foster banking innovation. External perspectives bring fresh insights, accelerating the design maturity process.

Turn Design Into a System

Establish design systems with dedicated team members, including designers, engineers and product managers, focused on scaling systematic approaches. Emphasize design across the business with daily standups, clear roles, design briefs and formalized processes for design operations.

Step 4. Plan and think big

To foster banking innovation, prioritize significant achievements over minor ones. Focus on big wins to drive substantial progress. Set long-term design goals that align with the company's vision. These goals can be related to digital ecosystem development, user experience improvements and design process enhancements. Regularly track progress and report on achievements.

Encourage the management team to explore various design scenarios and user-centered solutions when formulating new business strategies. Incorporate design thinking methodologies into the strategic planning process, and allocate appropriate budgets for design initiatives to demonstrate the potential return on investment (ROI) for design improvements.

Step 5. Formalize consistency

Placing design at the strategy level helps ensure consistent user experiences across different touchpoints and channels. When design is considered from the outset of the strategy, it becomes embedded in the entire product development lifecycle. This consistency builds trust and familiarity with users, reducing friction and enhancing their overall experience with the organization's offerings.

Implement design governance processes to ensure consistency and quality across all design outputs. This can involve design reviews, style guides, the brand's visual identity and language and design system maintenance to maintain coherence in branding and user experience.

Step 6. Measure impact

Establish Key Performance Indicators (KPIs) specifically for the design team, tracking metrics such as design process efficiency, design team performance and design-to-development handoff effectiveness. These KPIs help quantify design contributions and progress.

Also, establish KPIs to measure the impact of design on the company's success. These KPIs would include customer satisfaction ratings, user engagement metrics, retention rates, usability rates and financial brand perception studies. Present these metrics at the strategic level to demonstrate the value of design.

Develop a design performance dashboard that tracks key design metrics and presents them in a visually compelling way. This dashboard can be shared with the strategic team and other stakeholders to inform them about the impact of design efforts.

Focus Design on Business Growth

Empower business growth with routines for hypothesis development, testing, research and analysis. Foster strong partnerships with developers, product managers and data analysts to make design a powerful tool for learning and decision-making. Implement data-driven approaches across the financial organization, integrating ideation, experiments and analytics.

Step 7. Clarify the context

Designers should take time to understand the company's overall business strategy and objectives. This includes understanding the target market, competition and the long-term goals of the organization. Aligning design efforts with the broader business strategy ensures that design decisions support the financial company's growth and success.

Conduct user research and involve stakeholders in the process. Present user insights and pain points to the strategic team, making a strong case for how design improvements can directly address customer needs and desires.

Also, conduct regular competitive analysis from a design perspective. Present findings to the strategic team, illustrating how design-driven financial innovations can help the company gain a competitive edge in the market. A strong user experience (UX) design strategy enables companies to differentiate themselves by delivering exceptional user experiences.

Step 8. Detect opportunities

By understanding user pain points, desires and aspirations, organizations can identify new opportunities for product or service improvements. Design professionals can use these insights and collaborate with other departments to develop innovative solutions that resonate with users and drive business growth.

Test and validate concepts before full-scale implementation. User feedback and data insights can inform strategic decision-making and lead to better products or services. Use analytics to measure the impact of design changes and communicate the results to the leadership team.

Stay up-to-date with the latest design trends, tools and methodologies. Embrace continuous learning and improvement to ensure that the design team remains at the forefront of industry best practices.

Step 9. Inspire with success

Highlight design success stories and celebrate the positive impact of design-driven projects within the organization. Recognition at company-wide events or meetings can increase the visibility and importance of design efforts.

Schedule regular design review meetings with senior executives to showcase ongoing design projects and collect their feedback. These sessions demonstrate the progress and value of design initiatives.

Create periodic design impact reports that demonstrate the tangible outcomes of design initiatives. These reports can highlight how design improvements have contributed to revenue growth, customer satisfaction and operational efficiencies.

Design Your Next Big Thing

Elevating design from the business periphery to the core strategy level allows an organization to bring the highest value to the financial company and its customers. Instead of thousands of minor changes, design-mature companies are focused on long-term impact and building the next big thing. They have a user-centered design approach integrated into their company DNA.

Design has transcended its conventional boundaries and emerged as a catalyst for business excellence. Design tools allow us to explore user needs, expectations and pain points, detect trends and foresight research to assess product market fit and deliver a unified digital strategy across all platforms.

From boardroom decisions to product discovery and customer experiences, design-driven innovation could empower financial organizations and banks to thrive in a rapidly changing world and discover the next big business opportunity, similar to Apple. By harnessing the power of design thinking, exploration and technology, financial brands can unlock their full potential and lead the way in shaping the future of the financial industry.

Get UXDA Research-Based White Paper "How to Win the Hearts of Digital Customers":

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedin