What is the banking industry and how is it affected by design?

The banking industry is defined by all the offline and online infrastructure that handles money (cash and cashless), credit, transfers and hundreds of other financial transactions or services.

Today, we all see global digital transformation in banking that digitizes the banking industry. Bank customers prefer to use mobile banking or desktop solutions and minimize their time visiting bank branches. Thousands of branches are closed, and millions of bankers will lose their jobs in the banking industry in the next decade.

The financial industry actively switches to digital products and is disrupted by Fintech solutions. The Fintech industry provides a modern service for banking customers based on the latest technology in the banking industry. Fintech uses User-Centered Design and a UX approach to deliver the best possible solutions for users worldwide.

The banking sector must integrate a design approach and user centricity deep into its operational and strategy model to compete with Fintech for the digital future.

Check out the best articles by UXDA about the banking industry and the power of design.

Procurement Practices as a Hidden Risk to Banking Digital Experience

Effective procurement is crucial for digital banking success. While some teams focus solely on cost, others prioritize strategic expertise and quality, leading to stronger, more impactful products. Explore the key factors that make the difference.

Why Feature-First Digital Banking Strategies Could Break Brand Trust

Financial companies obsessively copy features, buy them and invent them, but sustainable product success lies in aligning digital service with a deeper strategic vision. Vision rooted in a clear brand promises an emotional connection with customers.

7 Ultimate Digital Banking Trends Shaping Financial Brands UX

In a world in which anyone can download a banking app, just being digital is no longer a differentiator. The real challenge now is building a brand's digital experience that goes beyond basic functionality—an experience that bridges the financial brand with customers’ values, emotions and long-term aspirations.

Customer Confusion in Banking App Is an Experience Design Failure

When banking executives face costly digital transformation, they often wonder why customers complain about their "intuitive" services. The real issue isn't the users but the complex and unintuitive interfaces they navigate.

Future Banking Trends: Enable Next-Gen Financial UX

Future Banking Trends include technologies such as Generative AI, the metaverse, the blockchain, embedded banking, DeFi with CBDCs, and open banking which are creating the next-gen financial UX.

Musk’s Global Bank Ambition for X: Tackling UX Challenges Head-On

Knowing Elon Musk's large-scale approach, his intention to turn X into a bank could have disruptive consequences for the banking industry. However, the conflict between the existing UX patterns of a social network and the implementation of financial functions can complicate the transformation.

Surviving Digital Disruption Through UX-Driven Banking Innovation

As the usage of physical cash diminishes and digital consumption skyrockets, traditional banks are undergoing a seismic shift to adapt to changing customer preferences. Digital transformation is reshaping industries and consumer behaviors, and the banking sector stands at a crossroads, poised to redefine our financial experiences in unprecedented ways.

CBDC Banking Could Disrupt Banks and “Steal” Their Funds

The Central Bank Digital Currencies (CBDCs) could start a new age in banking by impacting the financial customer experience and, as a result, disrupting the traditional business model. Will this CBDC trend be a threat or bailout for the industry, and how can UX design help banks to prepare for it?

How UX Can Help Banks Navigate the Digital Transformation Maze

Why are 78% of companies failing to achieve their digitalization goals? The digital transformation in banking must consider one key thing to succeed.

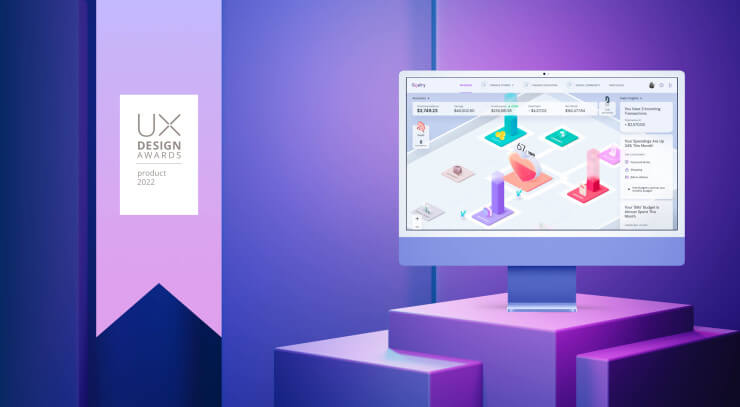

UXDA Wins the Prestigious UX Design Award 2022

UXDA team's work has been awarded by the global design competition for excellent experiences - The UX Design Awards 2022.

Financial Services In The Metaverse: The Glue For A Creative Economy

The metaverse will become the next global milestone after the digital transformation in the next few decades.

- 1

- …

- 3