The digital age has opened more opportunities than ever before for development and growth. This challenges the banks to adopt a new mindset, business approach and innovative technologies to take their services to the next level. Success in tackling digital banking customer experience challenges relies on customer trust and loyalty. How can you become a beloved digital brand that provides exceptional banking experience and establishes an emotional connection with your clients?

According to the 2023 BAI Banking Outlook, 44% of financial services leaders report their delivered digital banking customer experience is average. The most significant digital banking customer experience gaps are in onboarding, digital interaction, and account opening—three areas critical to the industry's success. Failure can have the following consequences: More over 55% of respondents said they would switch institutions for a better mobile banking app/digital capabilities, up from 47% the previous year. Meanwhile, the proportion of consumers who claimed their major financial services provider is a digital bank (one with no branches) has increased since last year. The biggest shift came from millennials, who increased from 22% to 34%.

What is Banking Experience and Why is it Crucial for any Financial Brand

Digital banking customer experience relates to a customer's feeling, emotions, cognitions, and behaviour when interacting with a bank or financial institution through digital channel. This involves all digital touchpoints with the bank, such as opening an account, applying for a loan or credit card, making a deposit or withdrawal, or communicating with customer support.

A positive banking experience is about providing exceptional customer service, accessible and easy-to-use services and products, and a seamless and frictionless experience across all channels. It is critical to understand and meet the needs and expectations of customers, as well as to continually provide a high quality of service.

Banking experience is critical for any financial brand since it affects customer satisfaction, loyalty, and, eventually, the brand's financial performance:

1. Customer satisfaction

It is critical to provide a great digital banking experience in order to generate customer satisfaction. Customers are more likely to be satisfied with a financial brand, its products, and services when they have a pleasant experience with it. Customers who are satisfied with a brand are more inclined to do business with it again and to refer it to others.

2. Increased customer loyalty

A pleasant banking experience boost customer loyalty. Customers are more likely to remain loyal to a company that meets their demands, provides a high level of service, and demonstrates a dedication to their satisfaction. Customers that are loyal to a brand are more likely to continue using its products and services in a longterm.

3. Competitive advantage

Providing a great banking customer experience is a crucial distinction for financial businesses in today's competitive economy. Consumers have more choices than ever before, and brands that prioritize customer experience are more likely to stand out and attract new customers.

4. Financial performance

A pleasant banking experience have a direct impact on a brand's financial performance. Customers who are satisfied and loyal to a brand are more inclined to use its products and services, which lead to higher revenue and profitability for the company.

Key Digital Banking Customer Experience Challenges

1. Customer Expectations are Constantly Growing

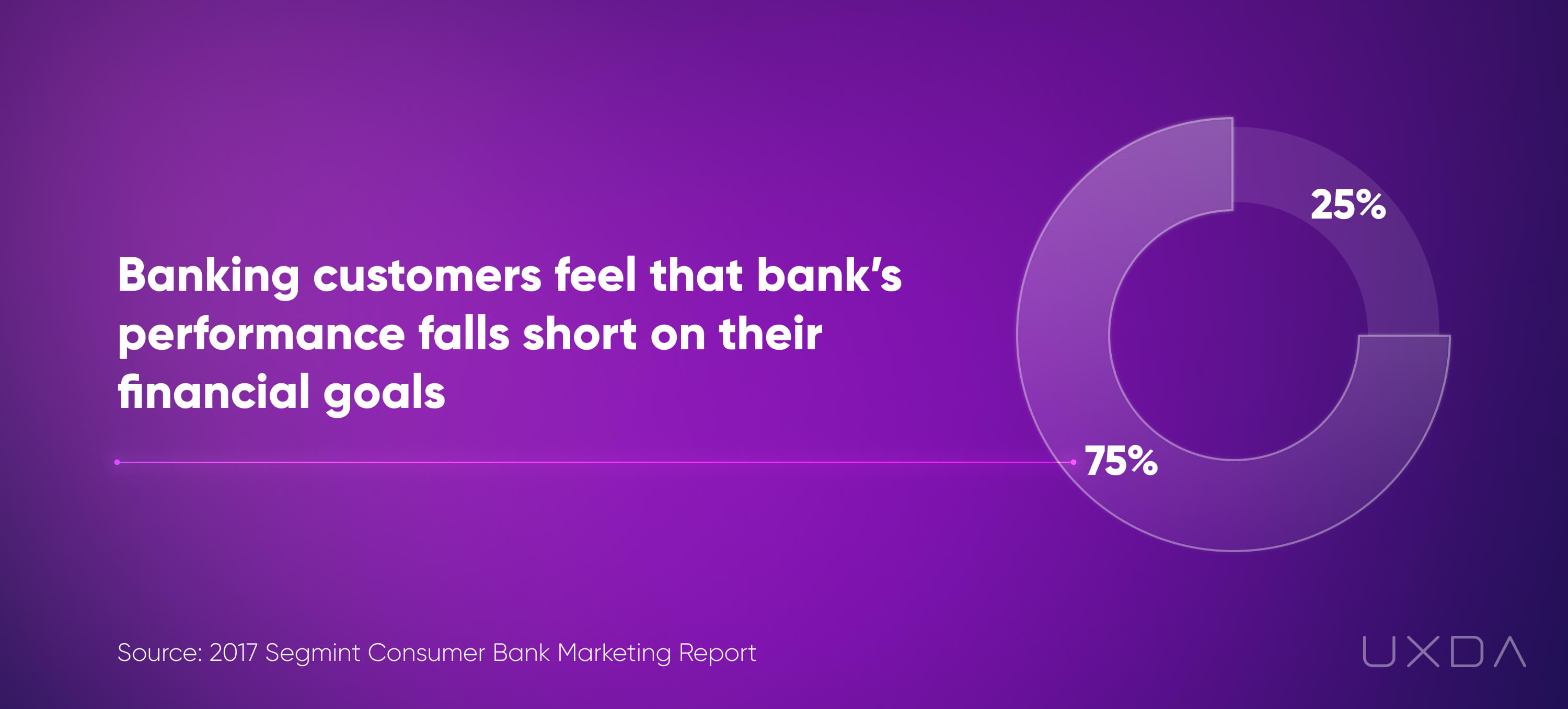

When it comes to banking, 75% of banking customers feel that their bank's performance falls short on their financial goals, according to a study by Segmint. And according to Statista, the number of complaints about banking services in the UK alone exceeded 2 million in 2019, while according to Esteban Kolsky research, only 1 out of 26 unhappy customers complain and the rest churn. Customers expect digital banking products to solve their problems and ease their everyday lives in a pleasant and enjoyable way. Also, 63% of consumers state that the best brands are the ones that exceed expectations throughout the customer experience journey, as conducted in a study by Wunderman.

Tackle it with banking experience design

Only 19% of companies have a team of CX specialists or customer experience consultants that help to bridge the gap between customer expectations and the businesses. Meanwhile, 69% of customers who plan to leave their bank say it was due to poor service rather than poor products, according to study by Temkin. So, the first step to becoming a financial brand that can deliver what the customer desires is to develop a strong team of either in-house or outsourced digital CX specialists who can become the user advocates within the organization. Their job is to integrate customer-centered values and mindsets throughout all levels of the organization, ensuring that the processes meet the customer needs. This can be greatly facilitated if the C-level executives are actively involved in increasing the brand's value through user-centered strategy and products.

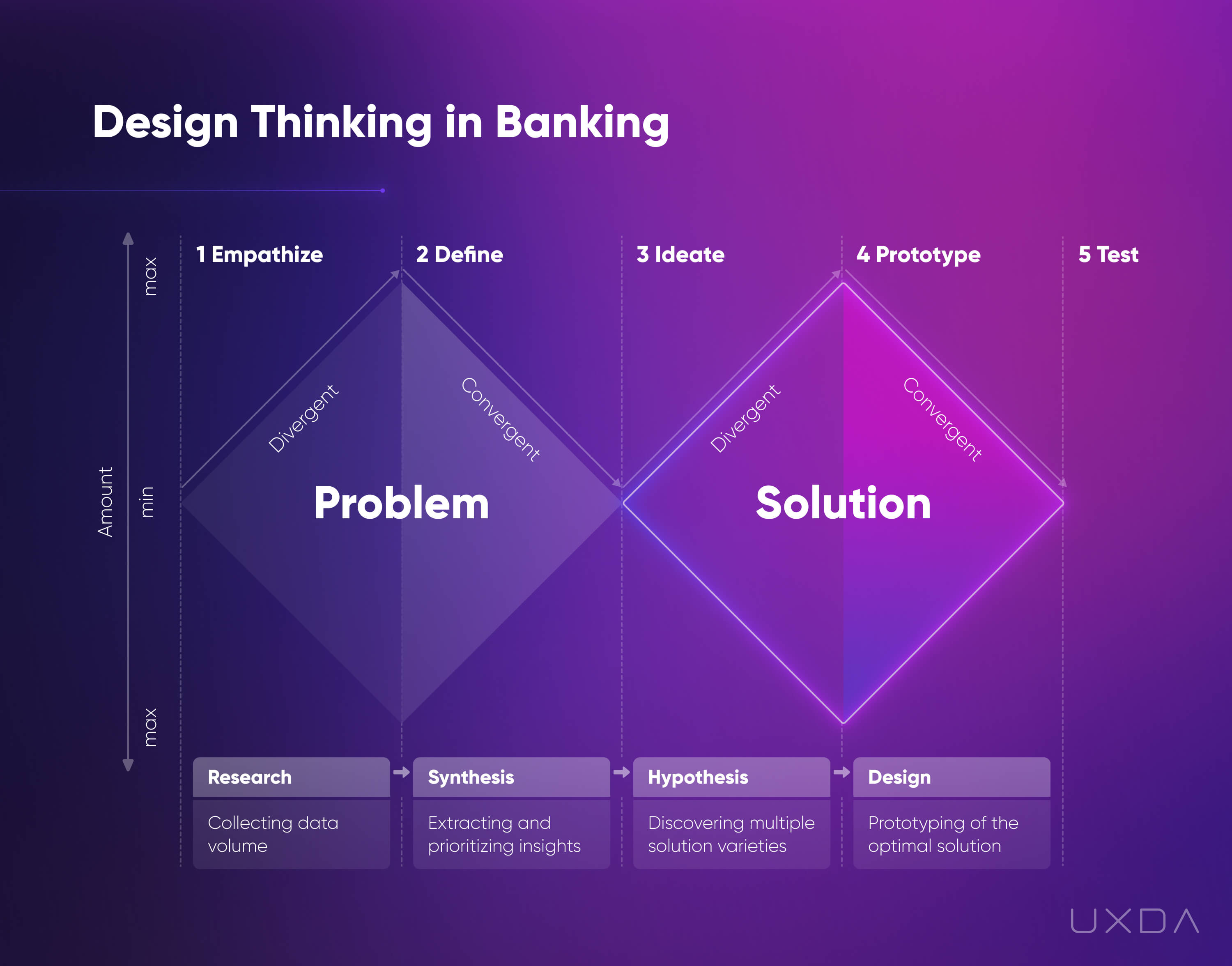

The CX team will make sure to integrate the design thinking approach deep into the operational and strategic processes of the company, ensuring that the digital CX solutions match the user needs and expectations.

UXDA's Double Diamond model of Design Thinking in Banking

Appropriate digital banking customer experience strategy

In order to create truly outstanding banking customer experience design that would wow the customers, the product development should be based on the market need.

From our experience, creating a product with the main focus on its features, marketing goals and profitability results in customer rejection and failure. At the same time, many financial companies believe this is the right approach to creating digital products. As stats show, 80% of CEOs believe they deliver a superior CX, while only 8% of customers agree with that, according to Bain & Company.

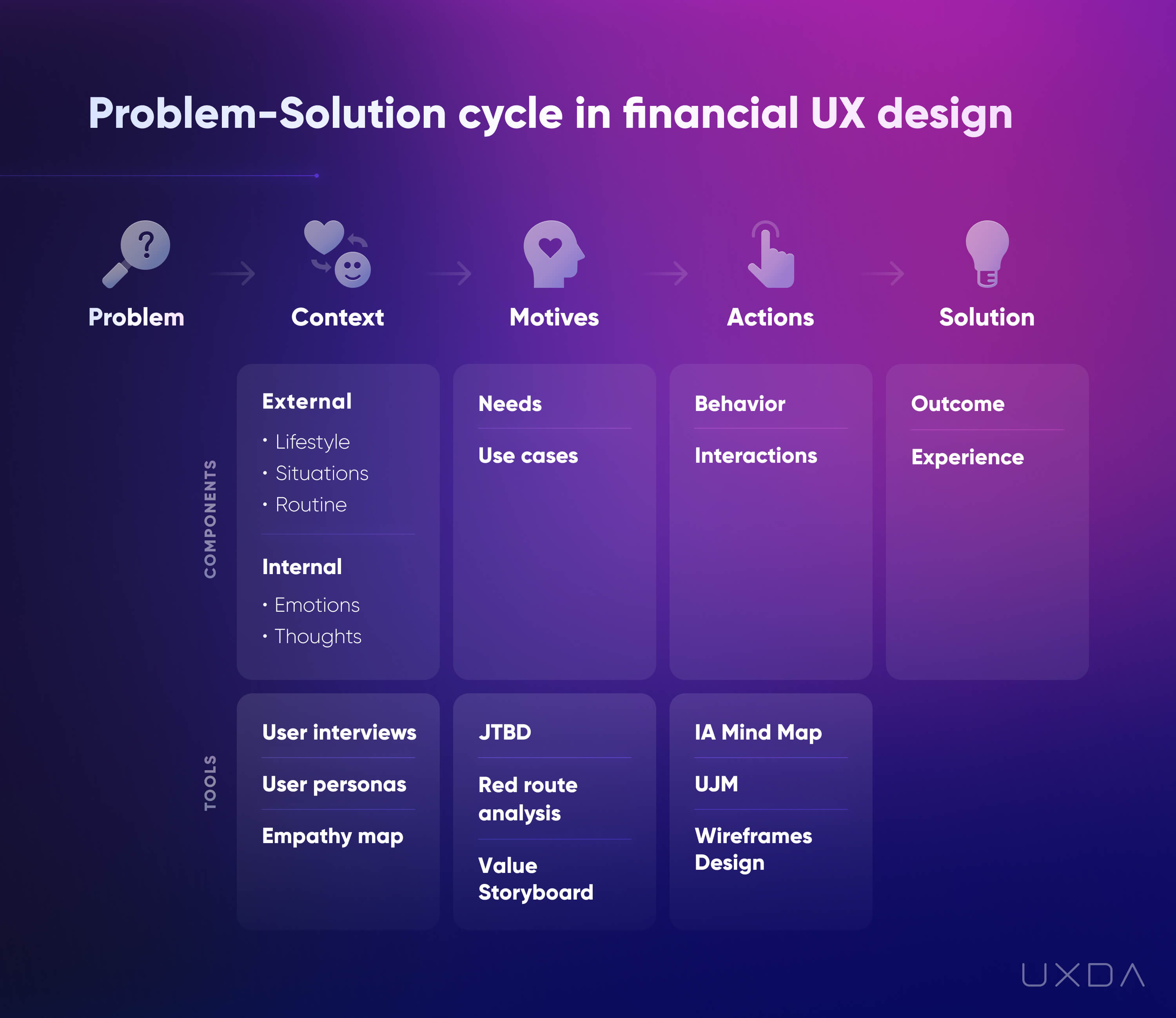

To create a financial product that customers will demand, love and be loyal to in the long term, it's critical to start with exploring their needs and wants through the human-centered Problem-Solution cycle.

In fact, 76% of consumers already expect companies to understand their needs, expectations and deliver according to those.

It's important to find out what “job” the users hire the product for. This is what defines the motivation to choose a specific product over other alternatives. This is so the newly developed solution wouldn't become a blind try to succeed, but would be tailored specifically to solve the pains and struggles users face.

A user will choose a solution according to his/her lifestyle, so it's important to take into account the audience for your product. For example, the daily routines of millennials and seniors would vary and have a different impact on their expectations. According to an Oracle report, 86% of customers are ready to pay more for a better CX, so this is the most effective way for the business to take care of profit in the long term.

Problem-solution cycle in financial service CX design

Components of CX research such as User Personas, Empathy Map and a Jobs-to-be-Done approach allow you to develop a clear understanding of what the exact audience for your product expects─the specific problems they seek solutions to and what makes them disappointed in the products already available on the market. This provides your team with the ability to create a digital financial solution that would address all of the most important user scenarios and deliver an exceptional banking CX, resulting in customer satisfaction with your financial brand.

2. Switching Brands Has Become the New Norm

In the digital age, customers are harder to impress and less forgiving. One negative product experience is enough to damage the way a brand is viewed in the eyes of the customers, forcing them to switch to another one, as 33% of Americans have stated.

Given the fact that it takes 12 positive customer experiences to compensate for one unresolved negative experience, financial products have to be on the top of their game to be appreciated by their clients.

Customers trust those financial brands that are able to ease their lives and generate positive emotions rather than complex solutions that cause them headaches. Open banking makes switching easier than ever before, as the number of customer-centered alternatives rises in the market.

Here are ten key aspects that can make customers loyal to a bank in the digital age:

- Customer service: Customers value excellent digital customer service, including frictionless digital products, fast response times, and knowledgeable support staff.

- Convenience: Customers appreciate digital banking services that are easy and convenient to use, such as mobile banking apps and online banking portals.

- Trustworthiness: Customers are more likely to remain loyal to a bank they trust, such as banks that are transparent about their policies and fees and provide secure access to their accounts.

- Competitive rates and fees: Customers value competitive interest rates, low fees, and other financial incentives, such as cashback rewards and loyalty programs.

- Personalization: Customers appreciate personalized banking services and offers that are tailored to their individual needs and preferences.

- Innovation: Customers are more likely to remain loyal to banks that are innovative and offer cutting-edge services, that looks and works according to latest digital requirements.

- Reputation: A bank's reputation can impact customer loyalty, including factors such as brand image, social networks or AppStore feedback, influencers reviews, and industry awards and recognition.

- Accessibility: Customers appreciate banks with an easy-to-use and modern digital offering, wide network of ATMs, 24/7 support.

- Communication: Customers value clear and transparent communication from their banks, including regular updates on account activity and timely notifications about important events or changes to policies.

- Social responsibility: Customers are increasingly interested in financial institutions that demonstrate social responsibility, environmental sustainability and purpose-driven business approach.

Tackle it with digital banking experience design

In the digital age, 89% of customers would switch to a competitor brand after receiving an unpleasant customer experience, according to Oracle.

Here, the key differentiating factor between companies that customers so easily abandon and brands that they stay loyal to is the value they receive. The better the value matches the customer expectations, the higher the chance that the brand will be chosen in the long term over other alternatives. A genuine value realized through a great CX design proves that the company cares about its customers and builds trust between the brand and its clients.

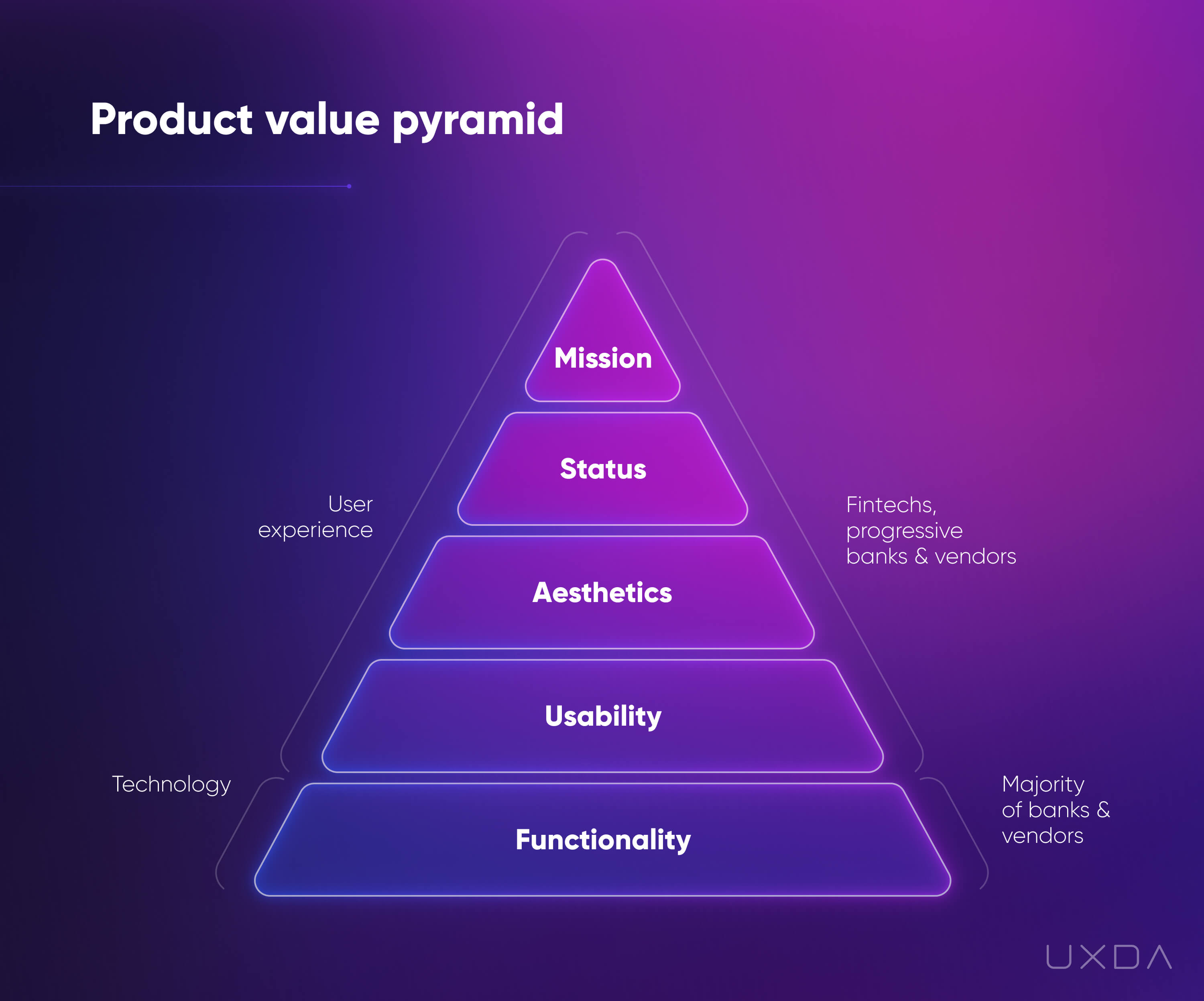

The unique value depends on 5 interconnected elements that should be integrated into the company's inner processes and product development: functionality; usability; aesthetics; status; mission.

UXDA's Product Value Pyramid

If functionality is not enough to conquer the rising market competition, then provide great usability. If there are competitors that provide both functionality and good usability, aesthetics should be added to make the product stand out. To gain an advantage over other alternatives, personalize the product, connecting it to your customers' lifestyles, make it a symbol of their status. Finally, if all of the previous levels are completed, move to the highest one─providing a mission that your company embodies.

Appropriate digital banking customer experience strategy

UXDA's financial CX design approach has the ability to eliminate a “bad experience” as a reason for switching brands by transforming it into a delightful one.

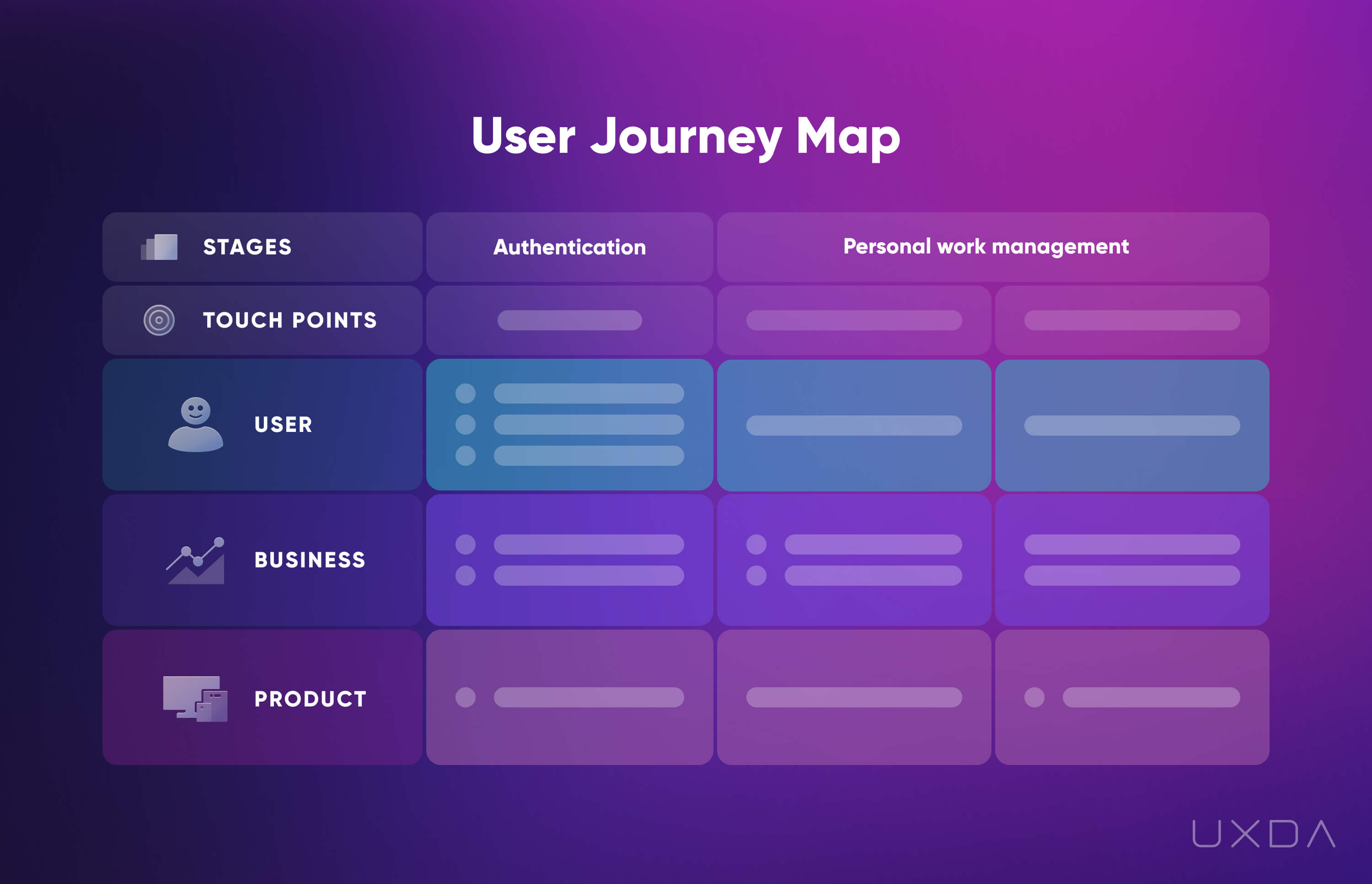

To create this outstanding digital customer experience in banking, start by mapping out your customer journey and identifying emotional reactions at every touchpoint within your digital solution. In this way you can find where you need to reduce friction that causes switching and transform pain points into “wow points.”

3. New Digital Platforms Transform Consumption

We are already accustomed to desktop, mobile and wearable (Apple Watch) products, but this is nothing compared to what the future holds.

Conversational services (e.g., Alexa and Google Home voice assistants), IoT (Internet of Things), VR/AR services (virtual and augmented reality, e.g. Oculus), Robots and Neuro services (neural interfaces, Neuralink currently developed by Elon Musk) are expected to become a part of our daily routines in the near future. According to the Futurum Research, consumers are expecting to further embrace new technologies by 2030: 80% say they expect delivery by drone, 81% expect to engage with chatbots, and 78% expect to use an augmented, virtual, or mixed reality app to see how a product will look.

Mixed Reality VR/AR Banking Design Concept by UXDA that was nominated for one of the world’s most prestigious design prizes─Red Dot Design Award 2020 final judging

Financial brands that will become the leaders of the future have already started to develop their digital competencies to be able to instantly adapt their service to any kind of digital platform. As Brett King, Founder of Moven, predicted: “The number one bank in the world will be a technology company.”

Tackle it with banking experience design

A bank can be sure to keep up with the technological innovations if it adopts a disruptive company culture. This agile way of thinking and operating allows it to be flexible and adapt to any new technology and customer trends. Such a company culture aims to transform the digital banking customer experience, bringing it to a new level and offering a solution that's way more pleasant and enjoyable than any other alternative on the market. This kind of brand provides an exceptional customer experience that's easily accessible throughout all of the platforms that people integrate into their lifestyles. Experience-driven businesses see almost 2x higher YoY growth in customer retention, repeat purchase rates, and customer lifetime value than other businesses, according to Adobe and Forrester research.

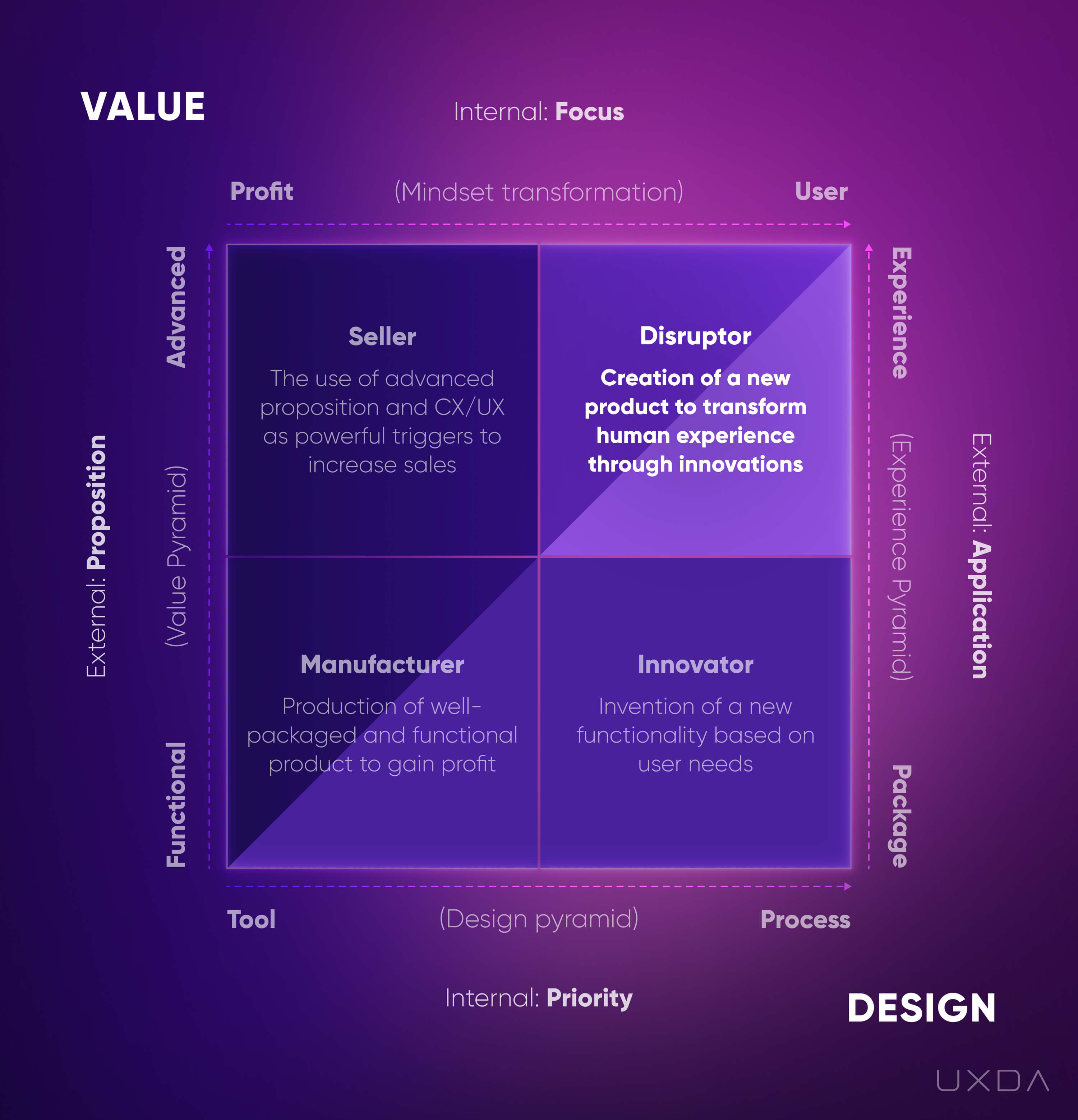

The Financial UX Matrix: Disruptor company culture

Progressive banks who will realize this and prepare such an experience working closely with banking customer experience consultants will become the pioneers of the new digital banking reality.

Appropriate banking customer experience strategy

The aim of a financial customer experience strategy is to constantly monitor and detect any change in the digital behavior of your customers and have the technological resources to adapt to it quickly and efficiently.

By staying alert to rising changes in customers' needs, you will be able to prepare in advance and react in time, thereby expanding your digital solution to new platforms in a way that's enjoyable for your customers.

Practice an experience-centered mindset throughout the entire financial organization and have the courage to challenge your legacy. This will organically make your business maximally flexible to adapt to any digital innovations demanded by your customers.

4. “Digital-First” Replaces Traditional Business Strategy

Research from an Arizent survey conducted with American Banker shows that many banks expect to cut their branch network in 2023 to suit clients' transition from in-person to digital service, particularly among global and national banks, continuing a trend that began during the pandemic. While the pace of closures may slow next year, more than one-third of banks stated they intend to reduce their branch footprint.

Brand marketing is also rapidly substituted by digital channels. It means that users get the overall impression of a financial brand primarily from the interaction with its digital service. If the digital customer experience in banking isn't satisfactory, the user’s trust and sympathy toward a company can be ruined. This is why it's very important to start viewing digital products as a representation of the whole financial brand.

According to IDG’s Digital Business Research establishing a digital business is top of mind, as 91% of organizations have adopted, or have plans to adopt, a “digital-first” business strategy.

Despite that, unfortunately, there are still a lot of incumbents that perceive digital solutions as alternative delivery channels. As data shows, 64% of digitally-active consumers use FinTech and have adopted the digital financial technology, according to the Ernst & Young Global FinTech Adoption Index based on a 27 thousand consumer survey. Meanwhile, Deloitte’s research shows that approximately 60% of bank customers worldwide use online and mobile banking more than twice a month, versus approximately 20% who prefer branches and contact centers with the same frequency. A recent Kearney survey of banking consumers reveals that more than 40% of consumers increased their use of mobile banking apps or websites during the COVID-19 pandemic. This demonstrates quite clearly that digital banking is no longer an alternative; it has become the main channel.

Tackle it with banking experience design

The digital age requires a brand new digital-first business strategy. IDG's study reveals that 67% of organizations mention better customer experience as the main objective for their digital business strategy.

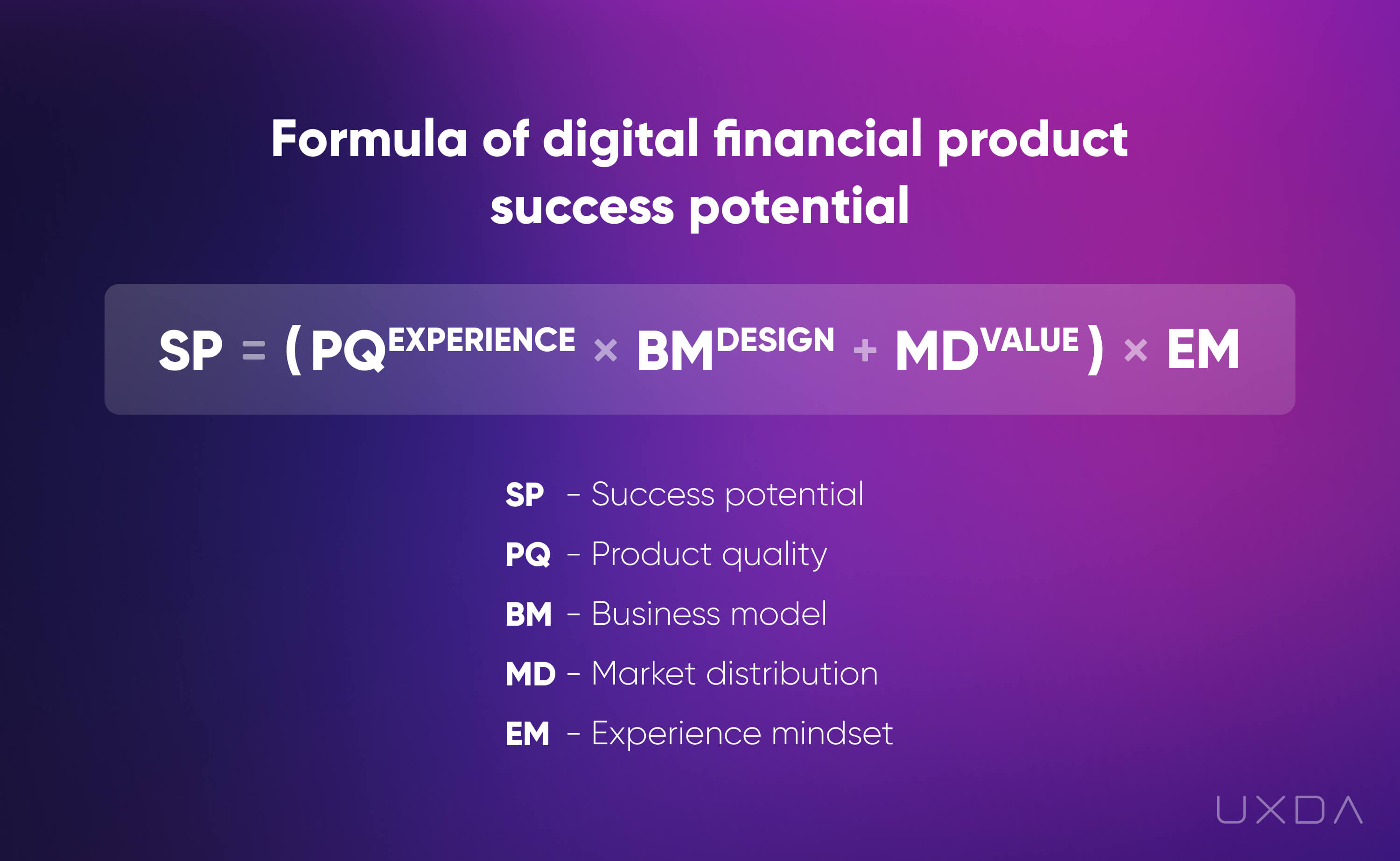

Only a decade ago, a product, business model and market distribution strategy were enough to ensure success. But, the requirements have changed. In order to communicate the brand value through digital channels, components such as experience, design, value and a user-oriented experience mindset should be adopted.

Financial UX Design methodology formula

Creating a beloved brand requires a focus on the digital customer experience your product provides, not on its features only. The better the digital banking experience, the higher the chances of becoming a trusted company that the customers will stay loyal to in the long term.

Design shouldn't be perceived as a package or marketing tool but an approach that puts the customer at the center of all business operations, allowing the approach to deliver up to expectations.

Marketing-motivated mass sales are becoming extinct. Everyone can now let the world know what hides under a pretty but empty product package through reviews and social networking. Currently, people choose those products that provide them value and ease their daily lives, not ones with a loud marketing campaign.

Finally, a beloved brand would always view its customers and all business processes through the prism of an experience mindset. It's a way of thinking that consists of serving the customers, providing an emotional experience, offering solutions instead of over featuring, disrupting the industry, and ensuring a smooth flow throughout the customer journey.

The essence of it is that you as a business owner or employee treat your customers as family or friend and strive to help them in any way possible. And financial success will come as a result, because customer experience leaders get 3 times greater return than CX laggards, according to Watermark Consulting research.

Customer Experience in Banking - Mindset Change

Appropriate banking experience strategy

To create a unique digital customer experience in banking that would make your brand beloved by your customers, start with a small audit of your current product, asking yourself the following questions:

- What is the essence of your brand and how can your digital products convey it?

- What is your digital strategy, and how can your digital products realize it?

- What are the habits, needs and lifestyles of your customers, and does your product meet them?

- What other alternatives are available on the market, and does your product offer a better customer experience and value to your customers?

- Is your product modern and aesthetically pleasing, or does it look outdated?

- Is your product intuitive and easy for your customers to use?

- Is your product gray and boring, or does it create a “wow” effect?

- Are your users proud of the product and perceive it as part of their lifestyle, or do they view it negatively?

Replies to these questions should demonstrate how your digital products communicate the brand value to the customers and stimulate ideas on how to improve it.

5. Big Techs Perform Emotional Disruption

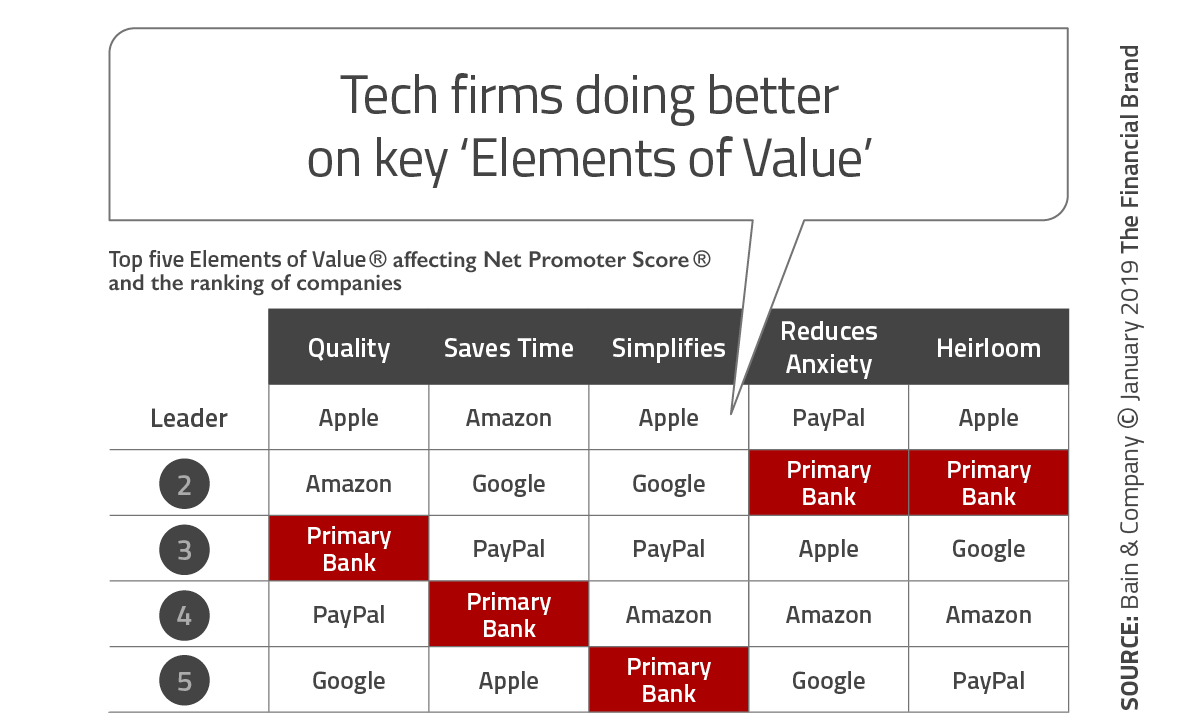

We are living in a world that's ruled by Big Tech companies. GAFA (Google, Amazon, Facebook, Apple) is already disrupting the financial industry in several ways, and we all know this is only the very beginning. Fifty-four percent of global respondents trust at least one big tech company more than banks in general, and 29% trust at least one tech company more than their own primary bank, according to a Bain & Company global survey.

One of the reasons why these tech giants have the support of so many customers is their ability to provide value and form an emotional connection. This could become a blind spot that financial companies aren't aware of.

Source: The Financial Brand

In the digital age, customers expect to receive not only a tailored and convenient usability but also positive emotions. As stats show, consumers who have an emotional connection with a brand have a 306% higher lifetime value, stay with a brand for an average of 5.1 years vs. 3.4 years, and will recommend brands at a much higher rate (71% vs. 45%), according to Motista.

It has never before been so important that the services we use daily make our lives better and create joy in the process. Despite this, there is still a myriad of complex banking products that are difficult to use.

Why would any customer choose a banking product that constantly causes anxiety, frustration and stress over a solution that is just as secure but also makes managing finances fun and enjoyable?

When customers compare their digital experiences, there's often quite a big gap between the usability and experience of Facebook or Instagram and their banking app. This causes disappointment because they have become accustomed to the Big Tech products that are smooth and enjoyable. Seventy-three percent of customers say that an extraordinary customer experience with one company raises their expectations of others, according to Salesforce. Why can't their banking customer experience be the same? This is the reason why the financial products developed by the Big Techs are predicted to dominate the solutions provided by the traditional players.

Meanwhile, there are finance companies that use this situation as an ideal growth opportunity and motivator in order to increase their digitization efforts. There are examples of well-known huge banks that have succeeded in creating a digital banking customer experience that surpasses the Fintech products in many ways and deliver exceptional service.

App Store rating of JPMorgan Chase & Co mobile app

We can read reviews on Google Play and the Apple Store that state the user’s overall excitement about the huge transformation the bank has undergone. These customers will most likely stay loyal because they see that their bank really does care about them and has made a big effort to create this pleasant experience for its customers. In fact, 79% of U.S. consumers state that brands have to show they care and understand their users in order to choose their services, according to Wunderman.

Tackle it with banking experience design

The human brain is not designed to budget. The irrational, unconscious emotions drive 80% of our behavior. This explains why it's difficult for many to manage their finances. Banks should take these stats into account and address people in a language that they understand─through emotions.

Enrich your digital banking products with designing customer experience that is so pleasant and enjoyable that it not only delivers up to customer needs but also creates an emotional connection with your brand.

Often, the banking industry is afraid of emotions, but, truth be told, this is one of the main ingredients of creating a long-term relationship with your customers.

Appropriate banking customer experience strategy

Our UXDA agency results proves that financial customer experience design is the most powerful and effective way to create an emotional connection between your brand and your customers through a digital product.

Beloved brands are built on positive customer experiences, and positive experiences are created through emotions.

Find out what users love about BigTech products and think about what you can use in your own product to make it more emotionally engaging. The goal isn't to copy the features of other products but rather get inspired by their “best practice” to stimulate ideas about how your solution could be improved.

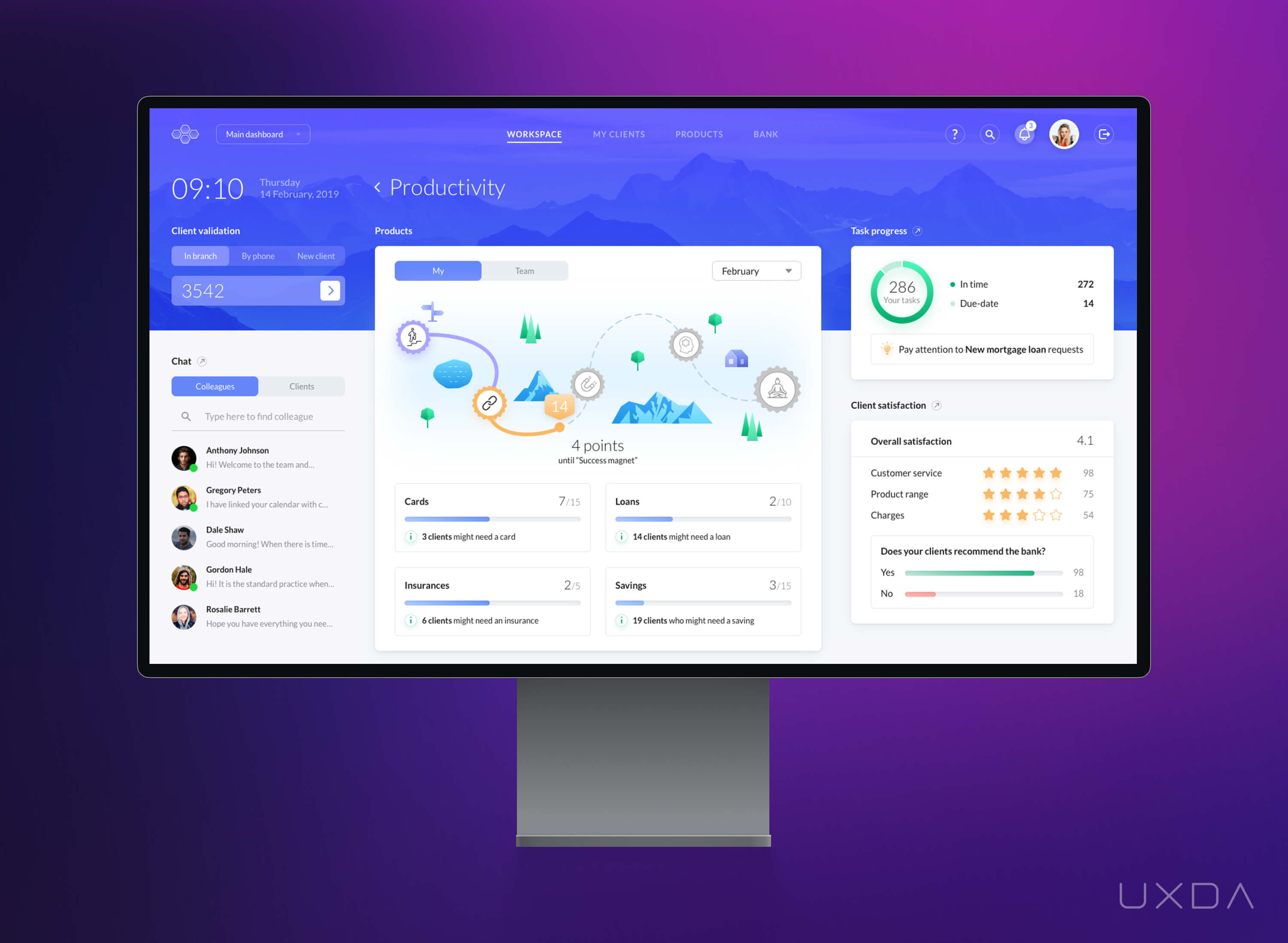

One of the ways progressive financial companies establish an emotional connection with their customers is by adding gaming elements, which generates fun and brings positive emotions to the banking customer experience.

Example of the use of gaming elements in a core banking solution designed by UXDA

The Key to Financial Brand Success Lies in the Customer's Hearts

Eighty-four percent of customers state they’re more likely to stick with a brand that treats them like a person, not a number, according to Salesforce. It's extremely important not only to think about marketing strategies but also about the integration of personalized, positive experiences that form emotional connections throughout the whole digital ecosystem of a brand. Ask yourself this: does your brand experience convey that the bank puts the customers first, cares about them, provides needed solutions and wants to help in any way possible?

There are several key steps that bank executives and managers can take to improve banking customer experience:

1. Understand customer needs and expectations

Bank executives and managers should make an effort to understand what their customers need and expect from their banking experience. This can involve gathering feedback through surveys, focus groups, or other means, and analyzing customer data to identify patterns and trends.

2. Create a customer-centric culture

Bank executives and managers should foster a culture that prioritizes the needs and preferences of customers. This can involve training employees to provide excellent customer service, developing processes that prioritize customer convenience and ease of use, and using customer feedback to inform decision-making.

3. Invest in technology

Bank executives and managers should invest in technology that enables them to provide fast, efficient, and personalized service to customers. This can include mobile banking apps, online banking portals, and other digital tools that make it easy for customers to interact with the bank.

4. Prioritize transparency and clear communication

Bank executives and managers should prioritize transparency and clear communication with customers. This can involve being upfront about product offerings and fees, providing clear and concise information to customers, and making it easy for customers to get in touch with customer service representatives.

5. Continuously monitor and improve customer experience

Bank executives and managers should continuously monitor and improve the customer experience in digital banking by gathering feedback, analyzing data, and making adjustments as needed. This can involve using customer feedback to identify pain points in the customer journey, testing new products and services, and implementing best practices from other industries.

Of course, there are several challenges that bank executives and managers may face when trying to improve banking customer experience. Let's name few of them:

1. Legacy systems and processes

Many banks have legacy systems and processes that can make it difficult to implement new technology or make changes to existing processes.

2. Regulation and compliance

Banks operate in a highly regulated environment, which can make it challenging to implement new products and services or make changes to existing processes.

3. Data privacy and security

Banks are responsible for safeguarding customer data, which can make it challenging to implement new technologies or processes that may pose a risk to customer data privacy and security.

4. Resistance to change

Some employees or stakeholders within the bank may be resistant to change, which can make it challenging to implement new processes or technologies.

5. Limited resources

Banks may have limited resources, including budget and staff, which can make it challenging to prioritize customer experience initiatives.

Despite these challenges, bank executives and managers who prioritize customer experience can make significant strides in improving the overall customer experience and building customer loyalty and advocacy.

It's not enough to create a nice banking app. It takes the integration of user centricity in the whole banking ecosystem─every product, every aspect of the business, every department and every employee━so that the whole organization is united in serving the customers and caring about them. In the digital world, this is the way to communicate to the world that the financial brand really does care about its customers and receive their love and loyalty in exchange.

Get UXDA Research-Based White Paper "How to Win the Hearts of Digital Customers":

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedin