The sudden crash of the Terra coins Luna and UST, ranked among the top 15 most valuable cryptocurrencies, has proven to be a very painful lesson for the financial world. People need trustworthy financial services that are stable and won't make people lose their entire life savings in 24 hours. But, for a financial product to guarantee trust, we need to understand why digital customers don't choose mainstream banking in the first place.

Sadly, trust is mostly based on the knowledge of your customer personas. If you haven't researched and invested in your clients, showing they are your first priority, then why would they trust you?

The Devastating Crash

Let's start off with what happened in the first place and why.

In just 72 hours, crypto tokens LUNA and UST dropped from being in the top 15 cryptocurrencies to being delisted from Binance, the largest crypto exchange site by market cap. Luna crashed due to its link to TerraUSD (UST), a stablecoin which was pegged to the US dollar. UST decoupled from the dollar earlier this week, which sent its price tumbling through the floor.

Even though Do Kwon, the owner of Terra, promises a bright return and asks the investors not to panic, it is still not known if the crypto giant will recover.

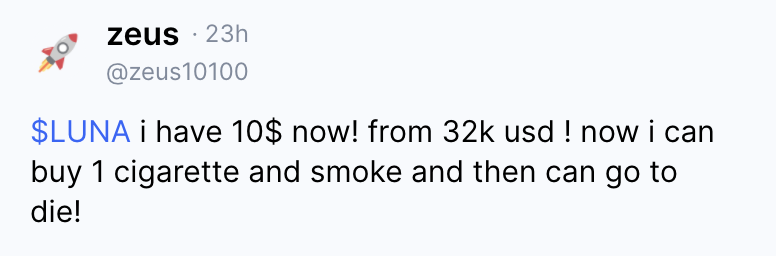

The highest value of one Luna token in the past few weeks was $119, but, as of May 12, it is worthless, having dropped to less than half a cent. Its market cap was more than $40 billion, but it has now dropped to almost zero. People all over the world are devastated. A big percentage of Luna believers had their life savings held in this cryptocurrency, and now they are left with nothing.

“Today I took a walk outside for the first time in the last few days. It's over. I lost everything I had. I need to clear my head so as not to harm myself.”

Many quotes like this are visible throughout the internet, like Twitter and social media, since people don't know how to cope with this situation.

Commentary section in Coin Market Cap shows devastation.

Luna and UST have wiped away billions in cryptocurrency value. As Fortis Digital's Boroughs said, the harm isn't done to Terra's ecosystem alone. Many people who were affected by Luna and UST would have sold out large portions of their crypto portfolios to recuperate some of their losses, thereby dragging the crypto market down with them, which affects almost everyone who's invested in any type of cryptocurrency.

Why Customers Choose Cryptocurrency

Let's look at some of the pain points customers experience in the financial world that make them turn away from defined banking systems and choose cryptocurrency investing instead.

Low Transaction Fees

One of the main reasons why cryptocurrency is so popular around the world is that it has very low transaction fees. When you use other forms of online payment methods, you'll frequently be charged a noticeable percentage of the transaction sum.

The Central Bank of Ireland states that, as of the year 2020, the total value of payment transactions had increased by 52% in 2020.

“During 2020, 2.14 billion payment transactions were recorded by Irish resident payment service providers (PSPs), a 12 per cent increase from 2019. This amounted to just over €7.58 trillion, representing a 52 per cent increase on the €4.97 trillion recorded during 2019. Payment transactions by non-MFIs include credit transfers, direct debits, payments made using cards, cheques, e-money transactions and over the counter deposits and withdrawals.”

Crypto Apps Don't Lack UX design

Although there are high risks in the world of cryptocurrency, one thing many crypto business owners can be applauded for is choosing UX design and putting their customers first.

For example, The Binance App won TWO iF Design Awards. The first award was for the Communication/Apps for Software category, while the second prize was awarded for the Binance Website for User Interface (UI) in the Interfaces for Digital Media category.

Sadly, there are many financial and banking products still operating on outdated UI and not giving UX design a chance to let their business thrive. But, can we imagine how big the business blow-up of banks could be if they chose to give UX design a try, accepted the methodology and put their digital customers first?

The Fear of Conspiracy Theories

Years ago, when cryptocurrency showed itself to be a big opportunity for any investor, conspiracy theories arose, and the motivation for investing was based on the statements that “the regular currencies like dollar or pound will soon die out and people will be left with nothing.” As a result, people wanted to make sure this would not happen to their savings.

Also, one of the reasons why people - not even understanding where all of the invisible money came from - started buying the first famous cryptocurrencies like Bitcoin etc., was the possibility of economic disaster due to a pandemic or the third world war.

As we see, a lot of time has passed, and there actually was a pandemic, but the regular currencies are still here. Thank God we have not yet experienced another global war, but, even if we did, it would not wipe out our all-too-well-known banking system or the currencies we have right now.

An Opportunity to Earn More

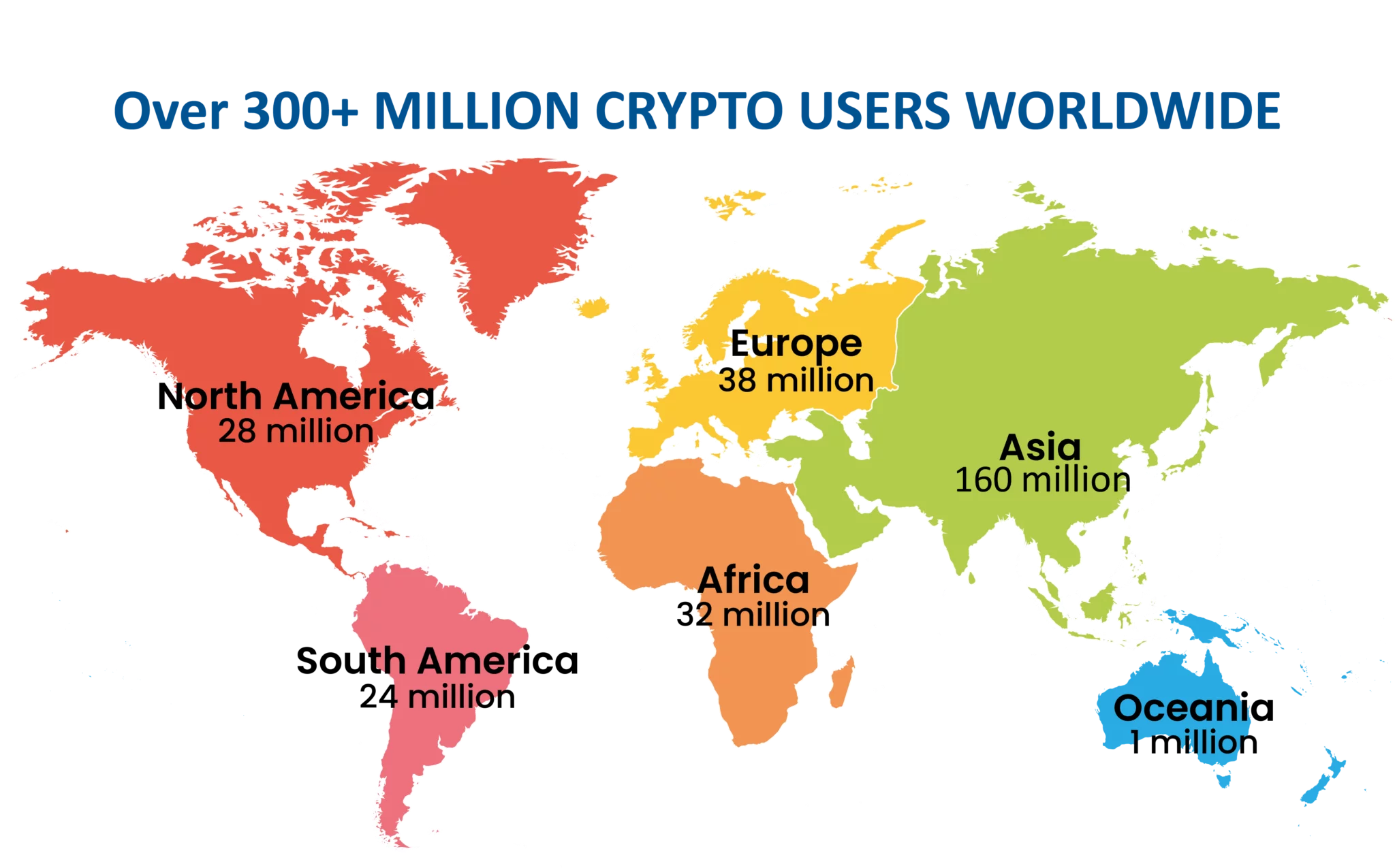

As of 2021, it is estimated that the global crypto ownership is rated at an average of 3.9%, with over 300 million crypto users worldwide. And, over 18,000 businesses are already accepting cryptocurrency payments.

Most of the crypto investors are there for the money. It is no doubt that, through thorough research, lack of fear and a pint of luck, you can earn huge amounts of money by trading cryptocurrencies.

There are high risks, however, especially with the small coins or new currencies that don't really have any proof of being a solid investment strategy. A lot of them are Ponzi schemes and other scams meant to defraud your funds. People need to be careful and dig into high-end research, or there's a big possibility of losing all of your money.

Why Customers Don't See Banks as a Reliable Alternative

The truth is, people are easily persuaded to choose a financial option that fits them best. The bank or Fintech product has to have a strategy based on customers’ emotions, demonstrating the importance of a customer-centric approach. The trouble starts when banks don't stay on the track of seeing their customers as their first priority, and they don't serve their needs.

Self-deception

Everyone has seen disappointing banking services in which even the bank clerks and employees ignore the bad customer reviews. They justify their behavior by believing that not all of the clients can be satisfied because everybody has their own quirks and wishes.

Although the view of this is understandable, it is as far from the truth. Yes, all clients can't be satisfied, but your particular audience CAN be shown the love they deserve. And, this calls for research, which is the number one strategy for UX design to be successfully applied to any financial product.

Read on how to brighten banking user experience with 7 winning strategies

The Lack of Trust

As we discussed before, the one thing people miss in this world is trustworthy and frictionless experiences when it comes to paying their bills, making investments or any other financial matter. But, trust can't be gained by not changing anything. People don't leave a service just because they are bored; they leave because they're upset about something.

But, it is possible to help with this. UX design is a proven way to gain back people's trust through digital service. We have to show customers they are the number one priority, because, without them, not a single financial product would exist.

Not Being Ready to Invest

Every great change comes with an even greater investment. Sadly, many banks and financial institutions aren't ready to invest in their customers because of their failure in seeing the big picture. The purpose-driven mindset is a shift in direction that few managers are willing to take.

It means changing the whole belief system from money-oriented to people-oriented, which isn't an easy thing to do. But, if we put the numbers together, we can see how this shift moves businesses from 5-digit net worth to 11-digit net worth, all because people don't buy things; they buy experiences, emotions and attitude. And if they feel validated, the jackpot has been hit.

Provide More Through UX Design Methodology

Customer and User Experience (CX/UX) refers to how people feel, think and act when they use financial services. The goal of UX engineering is to create a digital financial solution that is easy to use and fits consumers' needs with banking capabilities.

To succeed in the digital world, financial brands have to define the right goals, practice financial psychology, make financial UX more personalized and accept the UX challenge from the alternative UIs.

If banks added soul to their offerings, they would appear more genuine. Finance does not have to be as stiff as it may appear. Digital solutions, as we all know, will reinvent our experience and make it more human-centric. Challenger banks are fearless in demonstrating their commitment to their consumers.

See the 10 digital banking CX trends to make your business thrive.

People Want to Invest More

Even with all the negative aspects and risky features that the crypto world provides, people are ready to invest and be a part of that community because they feel accepted. They see their worth in being put first. They can feel the importance of a user-centered approach first-hand.

If people are ready to invest into the unknown, they will also be ready to invest in the calculated, risk-free financial platforms. We recommend that you shift out of the profit-first-based mindset of your business and instead consider putting the client front and center. As a result, profit will follow, because the ones increasing it - your clients - will follow. They will put faith in you seeing they're your first priority.

If you have the desire to include proper UX design tools and UX design technique into your mentality, you will simply find a way to do it.

We, at UXDA, with a 7-year long spotless reputation and worldwide recognition by big names like Forbes, Finovate, Banking Technology Awards, IF Design Award, etc., recommend financial UX Design for outstanding results, providing the greatest possible financial customer experience.

Get UXDA Research-Based White Paper "How to Win the Hearts of Digital Customers":

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedin