Today’s Fintech disruptors and neobanks are igniting our brains’ reward centers with flashy visuals, gamified challenges and social interactivity that practically beg us to keep coming back for more. This is the effect of “Dopamine Banking,” where finance meets emotions and entertainment, and every tap of your smartphone is engineered to delight and reward. It ultimately changes how we think about financial services. Buckle up, because the future of finance just got exhilarating.

Traditional banking often struggles to capture and maintain customer engagement. Their digital service feels purely transactional, lacking the emotional connection that builds loyalty and trust. The routine nature of digital banking, including boring interface design, complex language, confusing navigation, hidden fees and formal attitude, can feel tedious and uninspiring, further reducing the desire for meaningful interactions with financial brands. This gap in engagement and recognition highlights the customers’ expectations for a more dynamic and modern digital banking experience.

Banks invest many resources into research, security and basic digital service functionality—only to follow up with so-called “Lean Designs,” which are little more than colorized, clickable prototypes. Where’s the brand identity? Where’s the authenticity, the cutting-edge aesthetics or the refined UX that we know customers crave from a premium digital service?

To address this gap, Fintech companies and neobanks have transformed the financial services landscape by launching apps that break away from traditional banking approaches. These platforms are not only distinguished by their vibrant, authentic and eye-catching interface designs but also by their innovative approach to customer engagement. Today, clients expect more than a basic straightforward financial service. They want an immersive digital experience that delights, supports, educates and rewards.

Using gamification, reward programs, community-building initiatives and influencer collaborations, digital brands establish deeper connections with their customers. Beyond pure functionality, these platforms blend education, entertainment and lifestyle perks into their offerings, aiming to create a sense of excitement and loyalty that goes well beyond the usual banking relationship. This new model prioritizes interactive and emotionally resonant touchpoints and can be named “Dopamine Banking.”

The Dopamine Banking concept goes beyond traditionally straightforward transactions and accounts, leveraging Dopamine Design principles, cutting-edge technology and insights from neuroscience and neuromarketing to create digital experiences that are genuinely engaging, emotionally rewarding and conducive to long-term financial health.

The Neuroscience Behind Dopamine Design

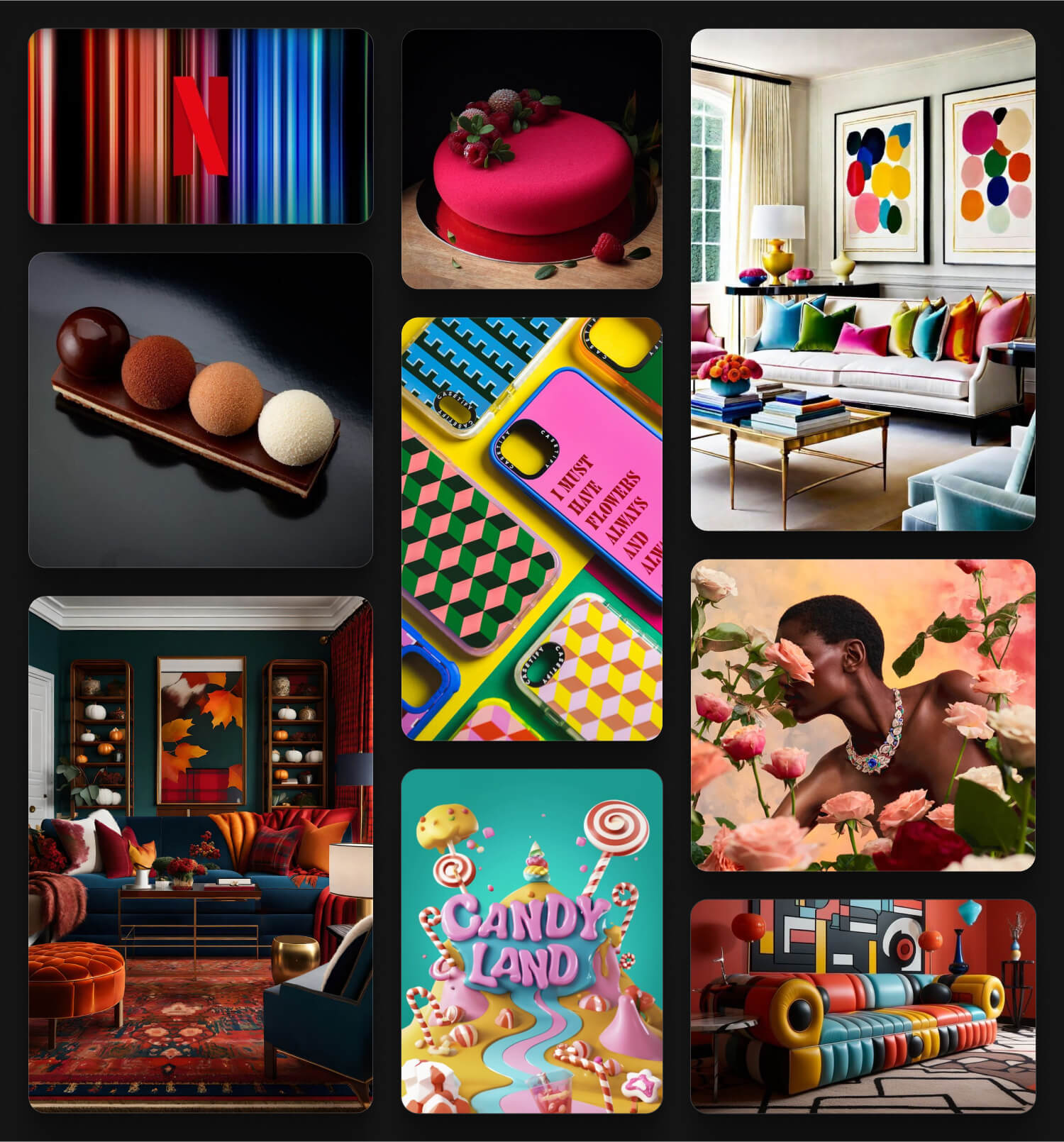

In creating Dopamine Banking, a special role is played by Dopamine Design. As the name suggests, it is used to create a little happiness boost in the brain using bright colors, playful shapes and patterns that evokes a sense of energy and excitement. The goal? To make people feel good, which is something that is sorely lacking in our stressful lives.

Dopamine Design: Creating Emotional Connections

Dopamine Design is an approach that leverages insights from neuroscience—specifically how the brain’s reward system is triggered—to create more engaging and emotional user experiences. It is a bold, hyper-visual approach designed to grab attention in an instant by leveraging bright colors, bold fonts and patterns that trigger the brain’s reward system—much like the rush we get from social media feeds. It arose as a response to our swipe-driven, digital culture, where decisions happen in milliseconds, forcing brands to stand out visually rather than appeal to slower, more reflective consumer habits.

By shooting straight for instant gratification, Dopamine Design departs from the muted, Lean Design approach of minimalism and functionality and embraces an aesthetic that is fast, fun and all about emotional impact and entertainment.

Research from neurobiologists Semir Zeki and Tomohiro Ishizu uncovered that aesthetically pleasing art activates the same reward center in our brains as romantic love. And while dopamine often gets the spotlight for activating pleasure responses, it’s only one part of a more intricate “neurochemical cocktail.”

Dopamine plays a vital role in reward and movement regulation in the brain. When applied to product design and marketing, this understanding helps designers build experiences that spark motivation, curiosity, and emotional gratification.

Dopamine, often called the “feel-good” neurotransmitter, is released by the brain in response to rewarding or pleasurable activities, but the story is more nuanced. Neurologically, dopamine does not simply generate pleasure; it motivates us to pursue rewards and engage in goal-directed behaviors. Alongside it, serotonin helps keep our mood in balance, oxytocin promotes comfort and connection, norepinephrine spurs excitement, and endorphins induce an overall sense of well-being.

A visually pleasing environment can also amplify associated perceptions—so much so that enjoying your meal could feel more indulgent in the vibrant and pleasing surroundings and servings. This interplay, known as cross-modal perception, has been a key area of study at Oxford’s Crossmodal Research Lab. Scientists there have consistently found that our brain weaves together information from multiple senses in ways that can intensify how we taste, touch and even hear.

Dopamine Design Principles

Within the broader field of neuromarketing, Dopamine Design focuses on shaping touchpoints—such as visuals, micro-interactions, feedback loops, and gamified elements—to elicit positive emotional responses. Below is a universal “Dopamine Design” framework—adaptable to digital products, physical environments, branding, marketing campaigns and more. The idea is to spark joy, user engagement and positive emotional responses by weaving neuroscience insights into every step of the creative design process:

1. Bold, Vibrant Color Palettes

Why It Works: Bright or saturated hues tap directly into our emotional centers, generating excitement and optimism.

How to Apply:

- In Digital Products: Use high-contrast, energizing colors for call-to-action buttons or progress indicators.

- In Physical Spaces: Highlight key areas (like entrances or focal points) with bold color accents.

2. Focal Accents

Why It Works: Unexpected or whimsical design elements trigger curiosity and awaken our innate sense of fun.

How to Apply:

- In User Interfaces: Incorporate eye-catching icon shapes or unique micro-animations.

- In Product Packaging: Use geometric or organic patterns that stand out on the shelf.

3. Multi-Sensory Engagement

Why It Works: Combining visual, auditory or tactile cues amplifies the overall experience, leveraging cross-modal perception to enhance pleasure.

How to Apply:

- In Apps and Games: Add subtle sound effects or haptic feedback for key interactions.

- In Retail Environments: Offer textural variety (e.g., plush seating, smooth countertops) and ambient music to enrich the atmosphere.

4. Personalization

Why It Works: Items, themes or prompts that evoke personal associations, memories or milestones deliver emotional comfort and a feel-good factor.

How to Apply:

- In Branding/Marketing: Reference cultural touchstones, popular nostalgia or personalized messages for specific audience segments.

- In Product Design: Let users customize elements—colors, layouts or settings—to evoke a sense of ownership and familiarity.

5. Thoughtful Use of Light

Why It Works: Properly balanced light—whether real or artificial—can lift mood, reduce stress and enhance focus.

How to Apply:

- In App Design: Incorporate light/dark modes and soft gradients that mimic natural lighting shifts.

- In Physical Spaces: Layer different types of lighting (e.g., task, ambient, accent) to keep the environment interesting and welcoming.

6. Functional Whimsy

Why It Works: Quirky, playful elements in everyday interactions spark micro-moments of delight, triggering positive associations that make people want to return or re-engage.

How to Apply:

- In UX/UI: Surprise users with playful iconography, Easter eggs or custom animations.

- In Product Packaging: Integrate a hidden message or amusing detail that rewards closer inspection.

7. Balance and Harmony

Why It Works: While boldness captures attention, too many stimuli can overwhelm. A sense of cohesion keeps the experience joyous rather than chaotic.

How to Apply:

- In Visual Layouts: Maintain consistent spacing, typography or color palettes to anchor vibrant elements.

- In Experiences: Blend playful features with moments of calm, ensuring users have room to breathe and process.

By merging bold aesthetics, playful interactions and personal relevance, Dopamine Design ensures that users feel both excited and emotionally connected—whether they’re opening an app, walking into a branch or unboxing a product. When done ethically and thoughtfully, these principles motivate positive engagement, build loyalty and transform mundane interactions into memorable, uplifting experiences.

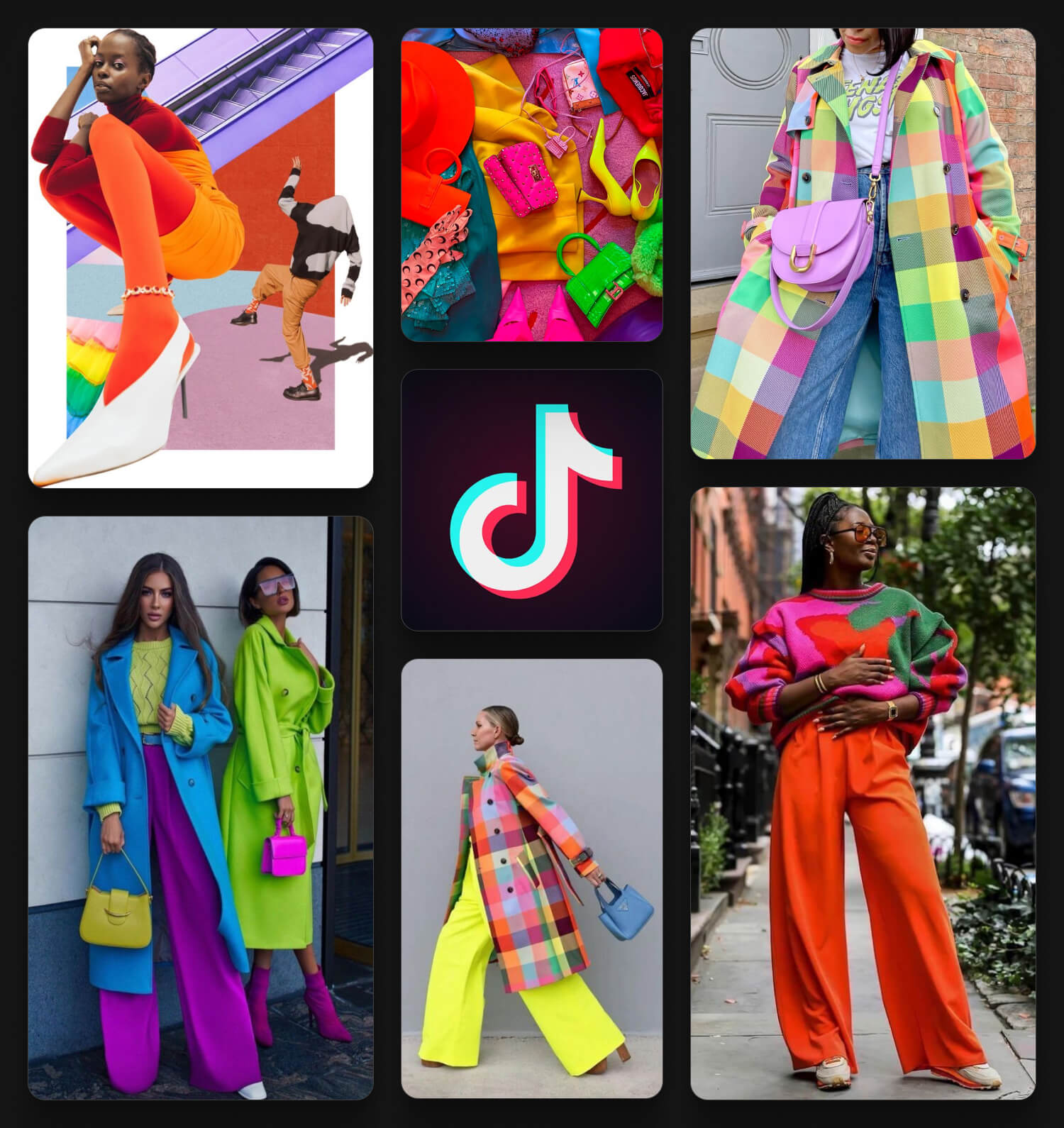

For example, TikTok’s famous "dopamine dressing" trend is about using clothes that boost your mood. The same principles applied to dopamine decor encourages decorating spaces with an emphasis on personal pleasure rather than prescribed aesthetics.

What Is Dopamine Banking and Why we Need It

For the past 10 years, UXDA has been applying neuromarketing to banking to change the way people interact with financial services. Our approach, Dopamine Banking, uses Dopamine Design to make banking not only more efficient and user-friendly but also more rewarding and emotionally resonant.

At its core, Dopamine Banking is the practice of designing financial products and services that elicit positive emotional responses in users as opposed to Lean Design that prioritizes functionality, simplicity and efficiency, stripping away non-essential elements to provide users with a clear and utilitarian experience.

Rather than viewing a banking app as merely a digital ledger, Dopamine Banking treats financial services as a gateway for personal and financial empowerment, entertainment and social connection. The idea is to produce a “wow” factor: interactions with the bank’s digital ecosystem should feel intuitive, satisfying and even inspiring, encouraging users to return regularly and engage more deeply.

Lack of Dopamine in Banking

Lean Design in financial services is a massively adopted functionality-focused approach whereby high-fidelity wireframes serve as the final design deliverable, emphasizing clarity, usability and compliance over aesthetics or emotional engagement.

By adopting a lean, bootstrapped process, it enables rapid iteration and cost efficiency. However, it could sacrifice emotional connection and creative flexibility, resulting in designs that are reliable but may lack connection to brand identity and the engaging or memorable qualities of visually expressive design methods.

Of course, high-fidelity wireframes are a critical tool in product development. They help teams visualize layouts, user journeys and informational hierarchies. However, they are meant to be just a step in the design workflow—not the final expression of it. Somewhere along the line, the distinction has blurred in many banking products, resulting in an uninspired UI that fails to truly resonate with users. What once felt like careful placeholders are now treated as the final look and feel.

The problem with massively used Lean Design in finance is that digital-first customers nowadays demand the same emotionally rich experiences from their digital bank that they get from gaming, social media or e-commerce, and they can easily switch providers. Neobanks, Fintech startups and tech giants are all vying to offer frictionless, delightful financial solutions. Emphasizing emotional engagement sets their brands apart.

Lean Design works best for functionality-driven platforms in which clarity and speed are paramount, while Dopamine Design is ideal for competitive environments that demand emotional resonance and brand differentiation. This is because a dopamine-fueled positive user journey increases retention, cross-sell opportunities and overall lifetime value.

In industries like financial services, balancing the two approaches becomes essential, as the stakes include both user trust and the ability to stand out in a crowded market. The choice reflects not just a design strategy but a broader statement about how a business values and interacts with its users. Each financial institution has (or at least claims to have) its own identity, values and story. Where is the transformation of those unique selling points into bold visual language, modern aesthetics and distinctive digital interactions?

Releasing Dopamine in Finance

A banking product’s UI and the whole customer journey itself should be a strong extension of the brand—conveying trust, stability and an emotional connection. Every part and touchpoint should remind users they’re using this particular bank’s service. But if a user can’t differentiate one bank’s services and apps from another by look or feel, there’s a massive gap in brand reinforcement.

Dopamine Banking differs from traditional banking in its fundamental approach to user engagement, emotional resonance and the overall role of financial services in people’s lives. Traditional banking historically operates as a utilitarian function, e.g., deposit money, pay bills, take out loans. It focuses on efficiency, reliability and compliance, offering stable but largely impersonal interactions. In contrast, Dopamine Banking reimagines these interactions through a human-centered and emotionally intelligent lens.

A brand that helps users build healthy money habits is not just about selling a product—it’s empowering customers to improve their lives and create a loyal user base and positive word of mouth. Modern users can easily switch providers; a dopamine-fueled positive user journey increases retention, cross-sell opportunities and overall lifetime value critical in a subscription era.

The “dopamine” in Dopamine Banking references one of the brain’s primary neurotransmitters associated with motivation, learning and reward. When we encounter something positive—such as receiving a personalized tip that helps us save money or seeing an attractive and interactive dashboard that tracks our financial health—we get a small boost of dopamine.

Over time, these positive micro-experiences can help transform the traditional banking relationship into a long-term, trust-based partnership that feels more like navigating a personalized financial companion than dealing with a faceless digital service. After all, everything in the world revolves around happiness, and a seamless banking interaction can be one of the small joyful moments in a user’s day.

How Dopamine Banking Benefits Stakeholders

Dopamine Design leverages visually appealing interfaces, interactive elements and rewards to create memorable and enjoyable user experiences. This approach connects deeply with brand identity and seeks to build long-term user loyalty through delight and positive reinforcement.

At its essence, Dopamine Banking introduces innovative strategies that benefit multiple stakeholders in the banking ecosystem by improving engagement, financial behavior and overall satisfaction.

- Customers: They enjoy streamlined banking experiences, gain financial confidence and feel in control, ultimately making better financial decisions. This makes customers feel more related to the product, reinforcing its value in their lives.

- Banks: By focusing on long-term user engagement and loyalty, banks can improve retention, strengthen and differentiate their brand, opening avenues for cross-selling and upselling more relevant, beneficial services.

- Society: If Dopamine Banking encourages better financial habits at scale—such as increased savings, more prudent spending and greater investment in education and health—then it can have a positive macroeconomic impact as well. Individuals become more financially secure while economies grow more robustly.

Dopamine Design Implementation in Digital Banking

A Dopamine Design approach to digital banking can seamlessly blend human-centered psychology, neuroscientific insights and emotional design practices to make financial interactions feel both rewarding and trusted.

Dopamine Banking can reinforce positive behavior and create a sustainable cycle of motivation and well-being through “little moments of happiness.” By celebrating small accomplishments, people associate even minor progress with reward, building resilience and a positive self-image in the long term.

This approach combats stress and burnout by cultivating a habit of mindfulness and gratitude, ensuring that sustainable happiness in general comes from everyday moments rather than being deferred to distant, larger goals.

At UXDA, we use the power of Dopamine Design every day to ignite emotions, captivate users, and elevate their financial journey. Explore our recent cases of Dopamine infusion in fintech and banking app design:

Liv X Digital Banking

Liv X digital banking by Emirates NBD is the first digital-only lifestyle banking app in the United Arab Emirates (UAE), blending fashion-forward design with vibrant energy. Its sleek, trendy look and gamification features, like progress tracking, inject positive energy, aligning with users’ aspirations and making finance feel exciting. Explore case study here.

CRDB Retail Banking App

CRDB Bank, Tanzania's leading commercial bank, SimBanking app blends neomorphism, neon lights, and dynamic movement. This design sparks excitement, energizes users, and connects them to a modern, tech-driven world, making finance feel vibrant and full of possibilities. Explore case study here.

Liv Lite Banking for Kids

Liv Lite, the kids’ banking app from UAE, builds an emotional connection through its simple, engaging design. With an energetic style and an in-app buddy, it fosters trust and curiosity, helping young users make confident financial decisions while staying relevant to their life stage. Explore case study here.

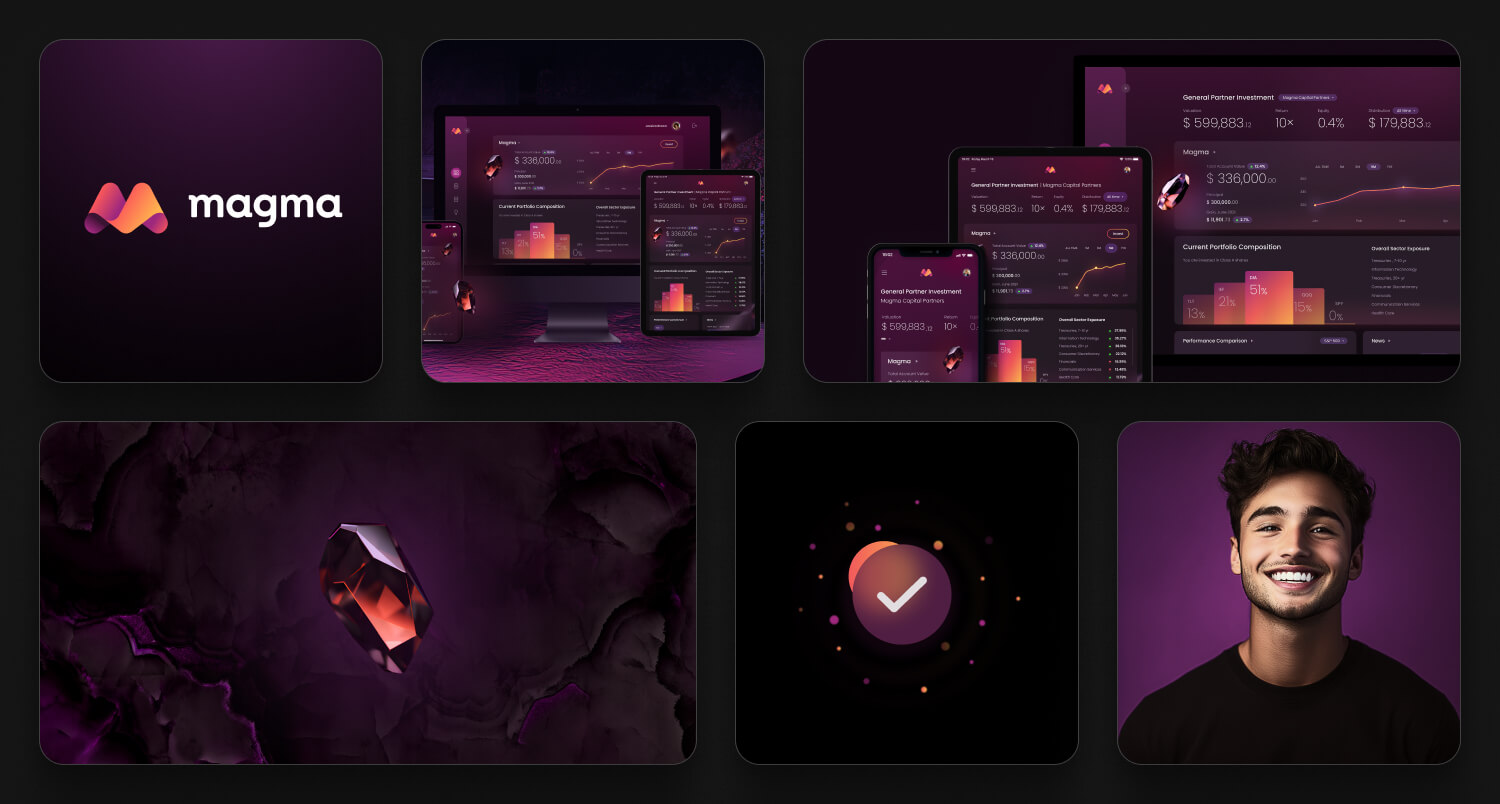

Magma Hedge Fund Platform

Magma hedge fund solution, combines bold design with a premium aesthetic that speaks to the luxurious lifestyle of millennial high-net-worth investors. The crystal, as the design core element, adds exclusivity, sophistication, and status, strengthening the brand connection. Explore case study here.

my.t money Banking SuperApp

my.t money SuperApp by Mauritius Telecom, the largest telecom company in Mauritius, delivers a gamified experience with features like the Circle of Fortune, rewards, bright colors, and real-time updates. Its playful and vibrant identity keeps users engaged and excited at every touchpoint. Explore case study here.

Bineo Digital Banking

Bineo by Banorte, Mexico's first 100% digital bank, fills users' digital banking journey with relevant insights, vibrant confirmations, and playful micro-animations. It's optimistic, cheerful tone resonates with users, transforming banking into a dynamic and enjoyable experience. Explore case study here.

Bank of Jordan Banking App

The Bank of Jordan, the leading bank in Jordania, mobile banking app makes managing money feel energizing and motivating, bringing a fresh, vibrant experience to every transaction. With bold colors and cultural touches, it creates a strong connection, making banking not just practical, but truly engaging. Explore case study here.

Traditionally, digital banking is seen as utilitarian, with many consumers finding it stressful or confusing. By employing Dopamine Design, UXDA transforms key touchpoints into opportunities for emotional satisfaction, motivation, and loyalty. Applying neuromarketing to finance ensures that each step of the digital banking journey resonates with the user’s innate desire for progress and reward. The result is a stronger user-product bond, increased engagement, and, ultimately, a more positive relationship with money management.

Dopamine Banking aligns financial tasks with the user’s emotional and neurological triggers, turning everyday banking actions into confidence-building, gratifying experiences. This is the power of neuromarketing in banking—crafting financial experiences that meet both functional needs and deeply rooted emotional drivers.

Dopamine production is greatly stimulated by vivid aesthetics, as well as when we anticipate positive outcomes, get insights, learn from feedback and achieve incremental goals. To design Dopamine Banking, we at UXDA are using the following strategic UX principles:

1. From Transactions to Transformations

Traditional finance often focuses on functional efficiency and compliance. However, next-gen financial services demand user experiences that feel transformative rather than purely transactional. By concentrating on emotional engagement, personalized design and customer well-being, a strategic UX approach can effectively “inject” dopamine into financial user journeys.

Building Dopamine Moments

- Reframing Mundane Tasks: Instead of a standard “Pay Bill” form, add contextual one-tap prepared payments based on payment history, which will notify users about upcoming payments and allow them to pay quickly and with ease.

- Delight with Design: Incorporate visually-pleasing graphics, playful typography or soothing micro-animations at key steps in the user flow. For instance, a colorful confirmation message following each deposit or a quick celebratory icon animation at login can spark mini dopamine hits that leave users feeling uplifted.

Why it Matters

- Shifts Perception of Banking: Financial services stop being viewed as a stressful obligation and instead become a supportive, motivating partner in users’ lives.

- Drives Customer Retention: When users derive emotional satisfaction (dopamine releases) from their financial interactions, they’re more inclined to stay loyal.

2. Emotional Connection Through Human-Centered Design

In traditional banking, interfaces tend to be purely functional and emotionally neutral. Dopamine Banking intentionally uses delightful design elements, friendly language and relatable metaphors that connect with users on a human level, creating an emotionally resonant environment. Strategic UX methodology is deeply rooted in human-centered design, uncovering not just what users do but why they do it. This involves qualitative research, empathy mapping and behavioral insights.

Building Dopamine Moments

- Empathy-Driven Features: By mapping customers’ emotional highs and lows—such as the anxiety of impending bills or the joy of meeting a savings goal—designers can embed “moments of delight” in their transactions (e.g., tiny rewards, celebratory animations, helpful tips).

- Nudges and Micro-Wins: Human-centered design pinpoints critical points in the user journey to prompt a small, uplifting action—whether that’s tracking spending daily or reaching the next milestone.

Why it Matters

- User Trust and Loyalty: When interfaces anticipate needs and show empathy, customers feel understood and supported. This sense of connection fuels a subtle but powerful release of dopamine and fosters a deeper bond with the brand.

- Human-Related: A strong narrative framework around money management transforms financial tasks into a story of personal growth—an approach that intrinsically motivates users and encourages them to develop good habits.

3. Strategic UX Alignment with Brand Vision

Rather than tacking on “cool features,” strategic UX focuses on aligning the user experience with the brand’s core vision and promise. This ensures a cohesive feel across every digital channel, from web platforms to mobile apps and even emerging interfaces like voice or wearables. Also, traditional banking often feels like a necessity devoid of encouragement. Dopamine Banking positions a financial brand as a supportive partner, framing financial tasks as steps toward personal growth rather than burdens, ultimately instilling a sense of empowerment in the user.

Building Dopamine Moments

- Consistent Brand Experience: Your brand’s tone, visual style and messaging should be seamlessly integrated across web, mobile, wearables and even voice assistants. Consistency reinforces brand trust—crucial for dopamine triggers related to safety and familiarity.

- Value Proposition as an Emotional Hook: If a financial brand’s message is “empowering financial freedom,” every user journey is designed to reinforce that empowerment, triggering satisfaction and motivation each time users sense progress.

Why it Matters

- Differentiation in a Crowded Market: Next-gen consumers expect fluid, brand-aligned experiences. Strategic UX helps a financial brand stand out in a marketplace filled with commoditized apps and features.

- Emotional Cohesion: A well-aligned UX approach ensures that each touchpoint reaffirms the brand’s personality, instilling confidence and generating delight at every step.

4. Personalization and Predictive Guidance

While traditional banks provide generic interfaces and processes, Dopamine Banking uses data and AI to tailor the experience. It anticipates user needs, providing timely tips, nudges and shortcuts aligned with individual goals and habits. A hallmark of Dopamine Banking is anticipating user needs and providing relevant guidance before they even ask. Strategic UX in banking emphasizes the power of data and AI to deliver hyper-personalized interactions.

Building Dopamine Moments

- “Right Place, Right Time” Recommendations: Knowing users are paid bi-weekly, the app might nudge them to allocate a portion to savings immediately, celebrating each successful deposit with a small on-screen animation or reward.

- Adaptive Dashboards: Interfaces that rearrange themselves based on user behavior trigger dopamine through a sense of personal relevance—people love feeling like the product “gets them.” For instance, if a customer regularly transfers money to family on Fridays, surface a quick action card every Friday morning.

Why it Matters

- Boosts Engagement: Personalized tools keep users interested; when the interface speaks directly to their circumstances, it feels like a genuine financial coach.

- Creates Positive Habit Loops: Small successes in money management—reinforced by micro-rewards—form new habits that strengthen overall financial wellness.

5. Gamification Done Responsibly

Traditional banking rarely acknowledges user achievements beyond completing transactions. Dopamine Banking celebrates small victories—such as saving a set amount each month—triggering dopamine releases that reinforce good financial behaviors. UXDA’s strategic UX approach integrates gamification as a purposeful enhancer of user motivation rather than as a gimmick. Gamification can transform mundane tasks—like categorizing expenses—into engaging mini-challenges.

Building Dopamine Moments

- Reward Mechanisms: Rather than trivial badges, tie recognition to genuinely beneficial financial behaviors (e.g., maintaining an emergency fund for three consecutive months).

- Financial Health Score: Provide real-time updates on users' financial health. Offers perks—like discounts or premium advice—when users maintain streaks or hit savings targets. Each micro-achievement fuels the dopamine cycle, encouraging ongoing efforts.

Why it Matters

- Encourages Financial Literacy: Gamification can nudge users to explore unfamiliar features—like investing or saving instruments—in a low-pressure, enjoyable way.

- Builds Long-Term Engagement: By weaving dopamine-releasing milestones into everyday banking, people become more active and loyal participants in the product ecosystem.

6. Visual Storytelling and Emotional Engagement

Instead of relying on dense statements and jargon, Dopamine Banking employs intuitive visuals, progress bars and interactive narratives. Strategic UX design often leans on visual storytelling to demystify complex financial processes. Instead of abstract statements, users see rich, interactive visuals that track their progress or illustrate “what-if” scenarios.

Building Dopamine Moments

- Progress Bars and Dynamic Charts: Watching savings grow or debt decrease in real time can be inherently satisfying. It taps into the human love of measurable growth, triggering a mini dopamine boost with each update.

- Actionable Narratives: Rather than reading jargon-laden text, users experience guided journeys—“Here’s how your mortgage balance improves if you pay an extra 200 dollars monthly.”

Why it Matters

- User Empowerment: Emotional engagement through visuals helps users feel in control of their financial journey. A sense of mastery releases dopamine and fosters a positive feedback loop.

- Better Decision-Making: Clear, visual narratives reduce the cognitive overload often associated with finances, allowing people to make quicker, more confident choices.

7. Ongoing Improvement and Experimentation

Traditional banking systems often remain unchanged for long periods. Strategic UX in Dopamine Banking advocates a test-and-learn culture—iteratively refining the user interface based on analytics, user testing and real user feedback. This bottom-up approach invites creative ideas from across the organization.

Building Dopamine Moments

- Frequent Updates: Each new enhancement or micro-feature can re-engage users, prompting them to revisit the platform, discover improvements and feel like they’re part of an evolving experience.

- Collaborative Feedback Loops: When users see their suggestions implemented in the product, they experience a sense of influence and ownership—sparking positive emotions and loyalty.

Why it Matters

- Keeps Experiences Fresh: Continuous iteration prevents user fatigue. There’s always something new or improved to explore, leading to consistent engagement.

- Builds Authentic Brand Relationships: Users sense that the brand values their input, reinforcing trust and long-term emotional commitment.

8. Community-Driven Engagement

Dopamine Banking can build a sense of brand community by integrating social elements into the financial experience. Users can see how others save or invest, presented in an inspiring and positive light. This taps into the human desire for connection and shared achievement, creating a sense of belonging and friendly competition. Social affirmation—whether through peer comparisons, chatbot suggestions or advisor tips—reinforces user success and builds trust in the system.

Building Dopamine Moments

- Community Benchmarks: Anonymous comparisons—such as “You’ve saved more than 75% of people in your age group!”—create pride and a sense of achievement. Frame it in a positive, encouraging way—never shame.

- Personalized Coaching: Timely advice from chatbots or community advisors, framed as expert guidance, feels like individualized support, sparking mini-boosts of dopamine.

Why it Matters

- Encourages Engagement: Social features and affirmations inspire users to interact more with the platform, fostering regular use.

- Builds Trust and Motivation: Validation from others, even in virtual form, reinforces positive financial behaviors and keeps users striving toward their goals.

9. Intuitive Navigation and Architecture

An intuitive interface that aligns with users’ mental models simplifies financial tasks and enhances satisfaction. By reducing cognitive load and frustration, users can focus on their goals without unnecessary effort. A design that “just works” resonates with the brain’s reward system, delivering subtle dopamine hits through seamless navigation and clarity.

Building Dopamine Moments

- Streamlined Navigation: Logical menu structures and accessible features ensure users quickly find what they need, reducing friction and improving efficiency. Use progressive disclosure (revealing features gradually) to keep new users motivated.

- Guiding Tips: Subtle, contextual guidance—such as tooltips or prompts—helps users understand options and make informed choices without feeling overwhelmed. Offer bite-sized tips or explanations when users need them most.

Why it Matters

- Enhances Usability: Clear, user-centered design removes barriers to interaction, making the platform approachable and satisfying. Reducing friction at the outset sets the stage for future positive interactions.

- Builds Confidence: Guiding tips empower users to explore new features with confidence, building a sense of control and mastery.

10. Collaborative Growth and Feedback

Traditional banking is often a "take it or leave it" business. Digital banking has all the tools necessary to invite users to create the best possible service. This feeling of importance is a powerful trigger for positive neurotransmitters. Dopamine Banking embraces user feedback to create a continuously evolving platform that makes users feel connected. Incorporating user suggestions builds a sense of collaboration and ownership.

Building Dopamine Moments

- Next Feature Polls: Inviting users to vote on upcoming features makes them feel directly involved in shaping the platform, enhancing their sense of ownership and engagement.

- Instant Experience Evaluation: Requests for experience evaluation and feedback regarding their interactions with the app spark interest in improvement and care for users.

Why it Matters

- Strengthens Loyalty: Users feel heard and involved, building a deeper bond with the brand.

- Sparks Motivation: Seeing tangible evidence of service improvement reinforces commitment to support the brand.

However, it’s important to note that we need to use Dopamine Banking in an ethical way and remember to make financial services not only dopamine-releasing but also dopamine-friendly. It is crucial to sustain engagement with healthy money habits without triggering the excessive impulse purchasing that many people with ADHD, especially women, experience. Dopamine Banking is not just about the moments of happiness here and now but also about feeling happy in the long term by preventing the loss of thousands as a result of ADHD impulsivity.

Creating positive “dopamine hits” while also building helpful guardrails—like customised budgeting tools, visual and color-coded spreadsheets, saving pots with personal images and timely spending notifications—can curb impulsive behaviors and keep finances front of mind in a non-overwhelming way. These methods nurture a reward-based approach to managing money that still feels exciting but remains focused on stability, ultimately reducing financial anxiety and preventing the high-interest debt traps that often follow disorganised spending.

Dopamine Banking Examples from Famous Fintech Brands

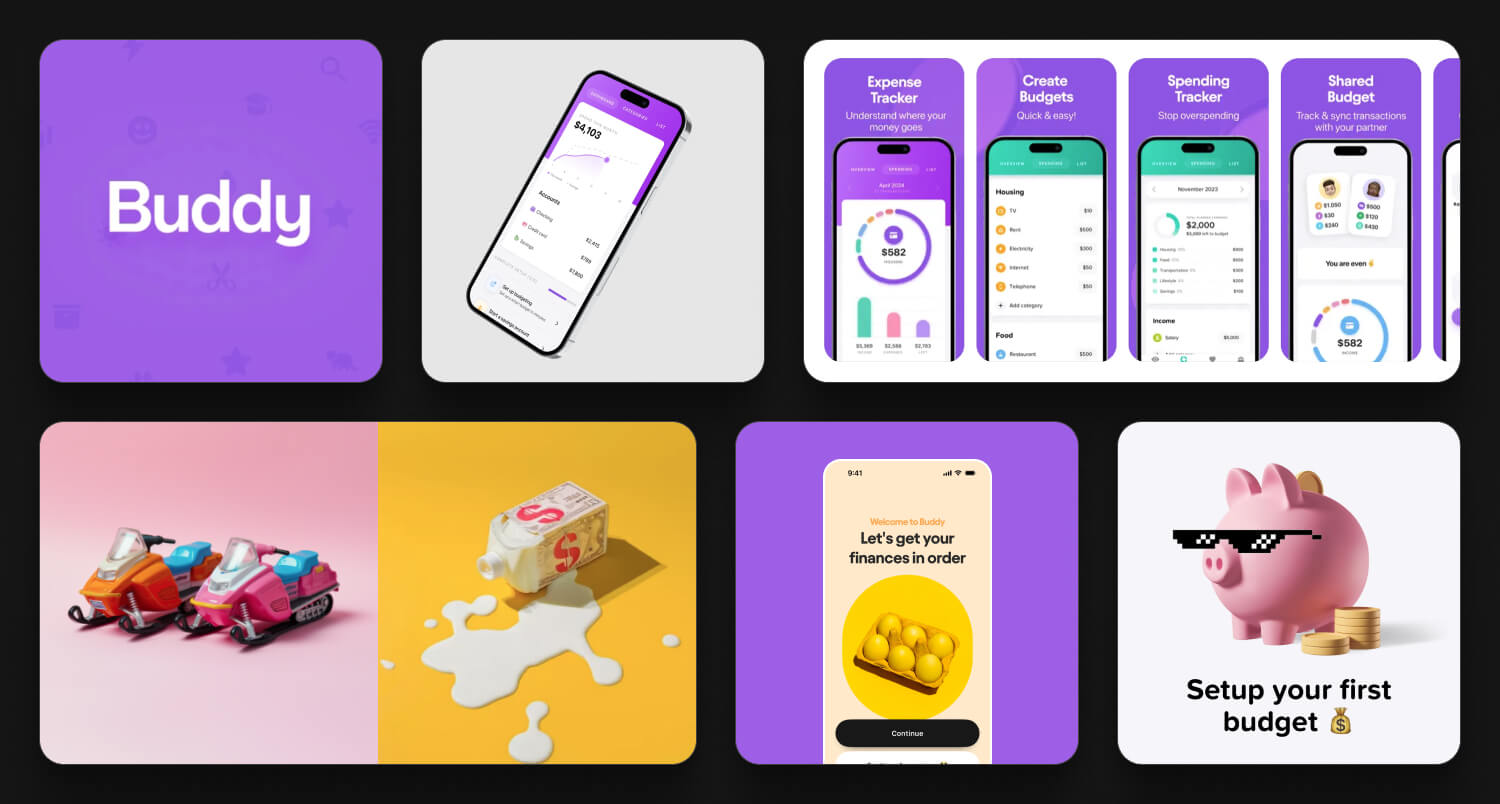

Buddy

A visually-driven budgeting app that helps users track expenses, set budgets and monitor their financial health collaboratively. It’s designed to make financial planning easy, intuitive and even social.

How it uses Dopamine Banking principles

- Bright, Visual Design: The app uses colorful charts and graphs to make financial data more engaging and less intimidating.

- Gamification: Features like budget streaks and visual progress tracking create micro-rewards that encourage consistent budgeting.

- Collaborative Features: Sharing budgets with friends or family fosters a sense of community, adding emotional engagement to financial planning.

- Goal-Driven Interface: Users can set and monitor goals with instant feedback, sparking dopamine as they see tangible progress.

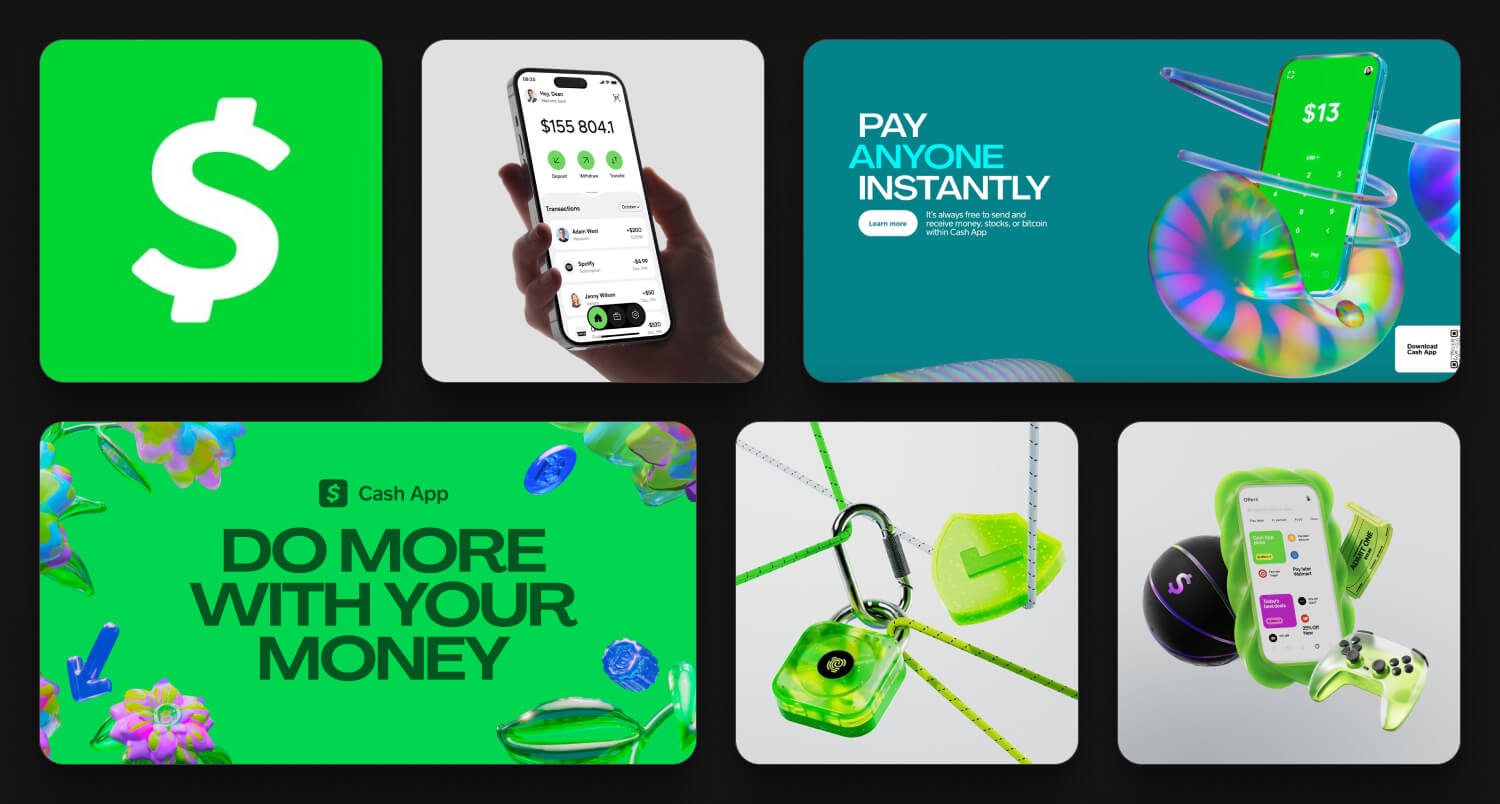

Cash App

The Cash App combines banking, payments and investing into a seamless platform, offering features like peer-to-peer payments, Bitcoin trading and cashback rewards.

How it uses Dopamine Banking principles

- Instant Gratification: Real-time notifications for transactions and rewards provide immediate feedback and satisfaction.

- Rewards and Incentives: Users can earn Bitcoin and cashback perks, triggering the brain’s reward center with tangible benefits.

- Bold, Modern Interface: The sleek design and colorful visuals make financial interactions feel exciting and user-friendly.

- Community Engagement: Promotions and giveaways add a layer of gamified excitement to the platform.

Cleo

An AI-powered budgeting app that makes managing money approachable with a humorous, conversational interface. It provides spending insights, budgeting tools and savings challenges.

How it uses Dopamine Banking principles

- Humorous, Conversational Tone: Cleo’s AI uses witty and playful messaging to make financial advice feel lighthearted and engaging.

- Gamified Challenges: Users can participate in savings challenges and track progress, providing a sense of achievement and motivation.

- Instant Feedback: Spending breakdowns and budgeting insights are delivered dynamically, providing users with real-time rewards for their actions.

- Interactive Experience: The chatbot-style interface makes budgeting feel more personal and fun.

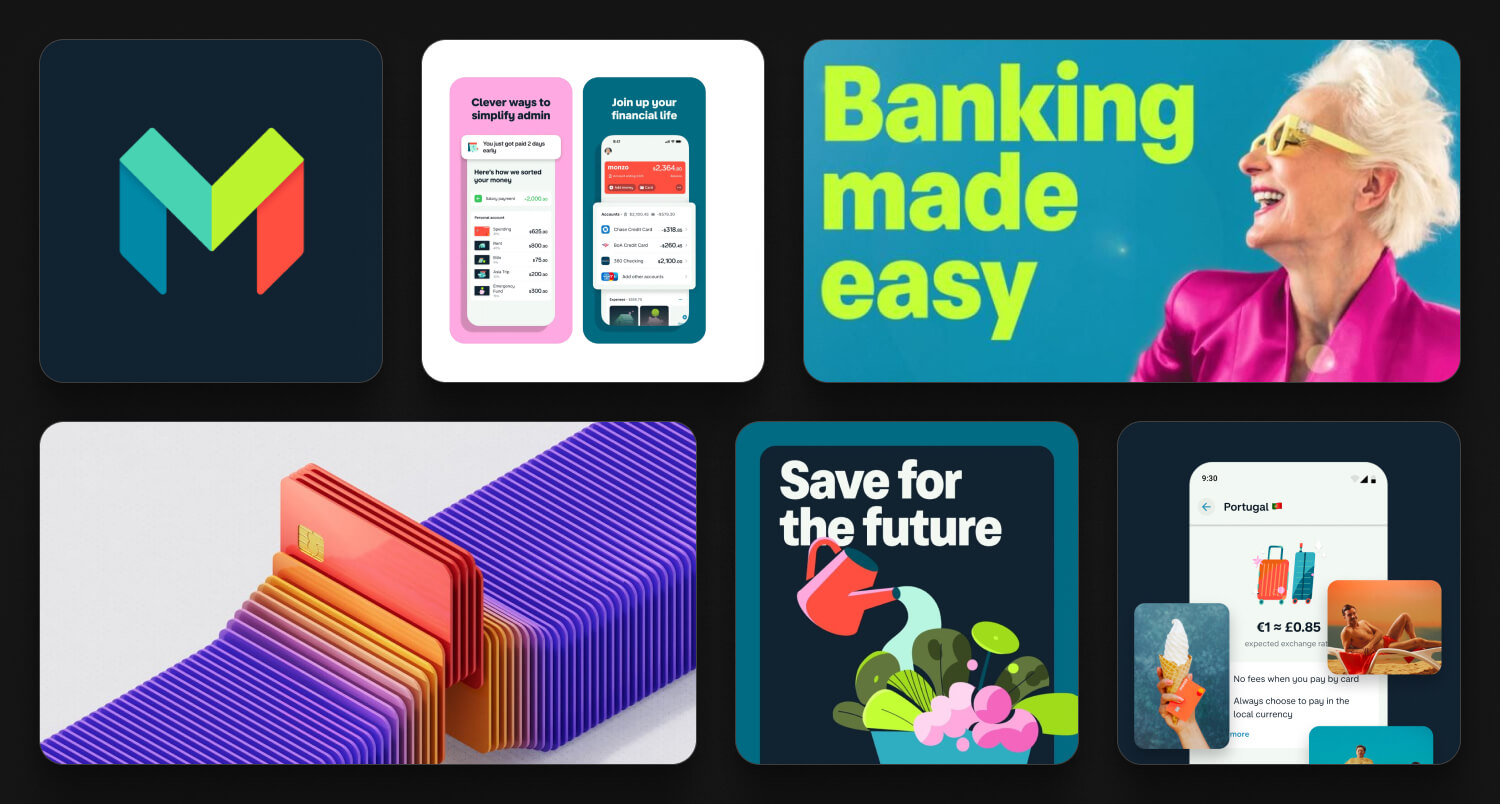

Monzo

Monzo is a neobank offering a full range of banking services, known for its user-friendly design, real-time insights and innovative savings features.

How it uses Dopamine Banking principles

- Real-Time Notifications: Instant spending alerts and updates offer a sense of control and immediate feedback.

- Customizable Savings Pots: Visually-distinct savings goals with progress tracking make achieving financial targets feel tangible and rewarding.

- Playful Design: Bright colors, friendly animations and lighthearted micro-interactions enhance emotional engagement.

- Emotional Touchpoints: Spending summaries and personalized insights create a sense of support, turning routine banking into a positive experience.

In Conclusion: Let's Bring Happiness to Finance

A strategic UX approach to a financial brand’s digital experience is not just about making interfaces easy to navigate; it’s about consciously creating positive emotional moments at each touchpoint. By aligning product design, brand communication and behavioral nudges with neuroscience-based insights, we can build an environment in which users actually look forward to managing their finances.

Dopamine Banking emerges when these carefully orchestrated design decisions fuse into a holistic ecosystem of trust, delight and ongoing engagement. The result? Customers who not only manage their finances easily and effectively but also feel more moments of happiness in their financial lives. This will make them advocates for your financial brand because, ultimately, you’re offering them more than a transactional service; you’re offering a personalized, motivating companion that helps them live their best financial life.

Dopamine Banking isn’t just about making finance more “fun and nice.” It represents a fundamental shift in how financial services engage with customers, transforming the experience from routine transactions into an empowering, emotionally-resonant journey. This approach, pioneered by UXDA, focuses on building a human-centered, brand-aligned digital ecosystem that not only meets users’ functional needs but also speaks to their hopes, feelings and aspirations.

By applying empathy-driven research and behavioral insights, UX designers can uncover not just what people do with their money, but why, identifying pain points, emotional stressors and natural high points in their financial lives. This human-centered philosophy creates an opportunity for “dopamine moments”—small instances of satisfaction and happiness that encourage users to return more frequently, trust the service more deeply and ultimately enjoy managing their finances.

UX design can influence dopamine release by carefully crafting interactions, feedback loops and visual elements that align with how our brains respond to incentives and learning. While designers can't directly "control" brain chemistry, they can use a variety of techniques to create environments in which users are more likely to experience positive reinforcement and sustained engagement:

- Research and User Discovery: Begin by conducting extensive user research. Map out the customer journey, identifying pain points and moments in which timely interventions could improve the experience.

- Technology Integration: Leverage AI, machine learning and predictive analytics to tailor interactions. Invest in back-end systems that can scale and adapt as user data grows. Consider microservice architectures for flexibility and iterative improvement.

- Cross-Functional Collaboration: Dopamine Banking isn’t the product of a single team. Involve UX designers, data analysts, product managers and compliance officers. A holistic, interdisciplinary approach ensures the resulting product is both engaging and responsible.

- Anticipation of Positive Outcomes: When a user opens their banking app and sees a well-designed, personalized home screen—perhaps a predictive shortcut to pay their upcoming utility bill or a prompt showing how close they are to a saving milestone—they anticipate a beneficial experience. This anticipation itself can trigger dopamine, making the interaction feel more rewarding.

- Incremental Progress and Learning: Neuroscience tells us that the brain responds positively to small “wins.” If a banking interface provides incremental feedback—celebrating when a user saves a set amount, reaches a credit score milestone or completes a financial literacy quiz—the user’s brain registers these events as achievements. Over time, these small hits of dopamine reinforce habits, turning sporadic users into loyal advocates.

- Personalization and Relevance: The more contextually relevant and personalized the banking experience, the more likely users are to find it meaningful. When the interface “knows” why you’ve opened it (e.g., to check your mortgage balance on payday), this relevance can strengthen the neural association between the banking app and a sense of efficiency and control—key factors for user satisfaction and habit formation.

- Emotions and Aesthetics: Beautiful, clean and vibrant interfaces do more than catch the eye; they can actually prime the brain for a positive emotional response. The color palette, iconography and micro-animations should help stimulate the reward centers, creating a subtle “feel-good” effect that all tie back to the core brand identity. This consistency across the interface not only boosts memorability but also ensures emotional comfort. When everything looks and feels “on brand,” users subconsciously associate this harmony with reliability and trustworthiness.

- Intuitive Architecture: A clear, logical navigation reflecting users' mental model about the service reduces cognitive load and frustration. When people can find what they need without hunting through submenus or rethinking their actions, they experience subtle but consistent hits of positive reinforcement—essentially, the app “just works.” Aligning with users’ mental models in this context resonates strongly with our brains' seeking system.

- Social Connection: Seeing how other similar users save or invest—framed positively—can create a sense of community and shared achievement. Social affirmation taps into our reward systems, especially when users feel they’re succeeding alongside their peers. Expert tips, chatbot suggestions or advisor recommendations appearing at the right moment can feel like personal coaching sessions. Validation from others (even virtual personas) can elicit small dopamine rewards.

- User Involvement: Continuously improving the product interface based on user feedback ensures that interactions remain fresh and relevant. Responding to user suggestions creates a sense of collaboration and belonging, which will boost user satisfaction. In addition, showing users their financial growth over months or years, with visual representations of how they’ve improved, can induce a sense of pride and long-term motivation—a potent driver of dopamine release related to goal pursuit.

In a world in which neobanks, Fintech startups and tech giants compete fiercely, offering only speed and convenience is no longer enough. Consumers can easily move to a competing service at just the slightest frustration. A strategically designed, emotionally intelligent experience creates deeper ties. It transforms an app from a financial tool into a long-term partner, guiding users and empowering them to feel optimistic about their financial future and a bit happier overall. Dopamine design is about creating little moments of happiness, and if financial services are crafted with this in mind, customers will experience a more delightful, meaningful and valuable interaction in their lives. Customers who find joy and value in their banking experiences are far more likely to recommend the service to friends and family.

Dopamine Banking represents a bold shift from traditional notions of finance-as-utility to finance-as-experience. Grounded in behavioral science and neuroscience, it acknowledges that successful financial habits stem not only from rational incentives but also from emotional engagement. By designing financial products that continually delight, educate and empower users, banks can create a virtuous cycle: customers learn to trust and enjoy their digital financial tools, leading them toward sustained financial well-being and a happier life, while financial brands benefit from deeper relationships and robust growth.

Get UXDA Research-Based White Paper "How to Win the Hearts of Digital Customers":

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedin