Digital solutions based on empathy and customer needs achieve better results and have competitive advantages. That's why design thinking implementation has outstanding potential to make digital products in the banking sector customer-centered. UXDA has used the design thinking process and tools to develop over 100 digital financial products in 36 countries. By applying design thinking to the user experience in banking, we create more intuitive, user-friendly, and effective financial products that better implement business strategies in line with the needs of customers.

What is the Definition and Role of Design Thinking in the Banking Sector

Design thinking in banking sector is a creative problem-solving approach that focuses on the customer's needs. In the context of banking, design thinking can be used to create financial products, services, and experiences that are more user-friendly and effective. This can help banks and fintechs to better serve their customers and differentiate themselves in a competitive market.

Additionally, using design thinking can help banks and other financial companies to identify and solve problems in new and innovative ways, leading to improved efficiency. Design thinking has become increasingly important in the banking sector as a way to improve customer experience and create innovative solutions to complex problems. In this context, the main role of design thinking is to help banks understand the needs, behaviors, and pain points of their customers, and then use that understanding to develop new products, services, and experiences that better meet those needs.

Some specific ways in which design thinking is being used in the banking sector are:

1. Customer empathy

Such design thinking methodologies as user research, journey mapping, and key personas, help banks to gain a deeper understanding of their customers and their needs. This helps design products and services that are more user-friendly, intuitive, and tailored to financial customers' needs.

2. Ideation and prototyping

Design thinking encourages companies to generate ideas and then prototype and test those ideas with customers. This approach helps financial organizations identify innovative solutions to complex problems and quickly validate those solutions with real customers.

3. Collaboration and co-creation

Design thinking encourages collaboration across different departments and stakeholders within the bank, as well as with external partners such as fintech startups and customers themselves. This collaborative approach helps to overcome in-house silos and leads to more innovative solutions that better meet the needs of all stakeholders.

Design thinking in banking involves empathy for the user, the ability to define problems and create ideas, prototyping and testing, and iteration. Potential benefits of using design thinking in banking include:

Improved customer experience

By putting the needs and preferences of customers at the center of the design process, banks can create products and services that are more user-friendly and effective.

Increased efficiency

Design thinking can help banks identify and eliminate unnecessary steps and processes, streamlining operations and making them more efficient.

Increased innovation

The iterative nature of design thinking allows banks to quickly test and refine new ideas, increasing the likelihood of developing successful, innovative products and services.

Improved risk management

By actively seeking out diverse perspectives and testing and iterating on new ideas, banks can mitigate the risk of introducing faulty products or services to the market.

Enhanced teamwork and collaboration

Design thinking encourages collaboration and co-creation among team members, fostering a culture of innovation and cooperation within the organization.

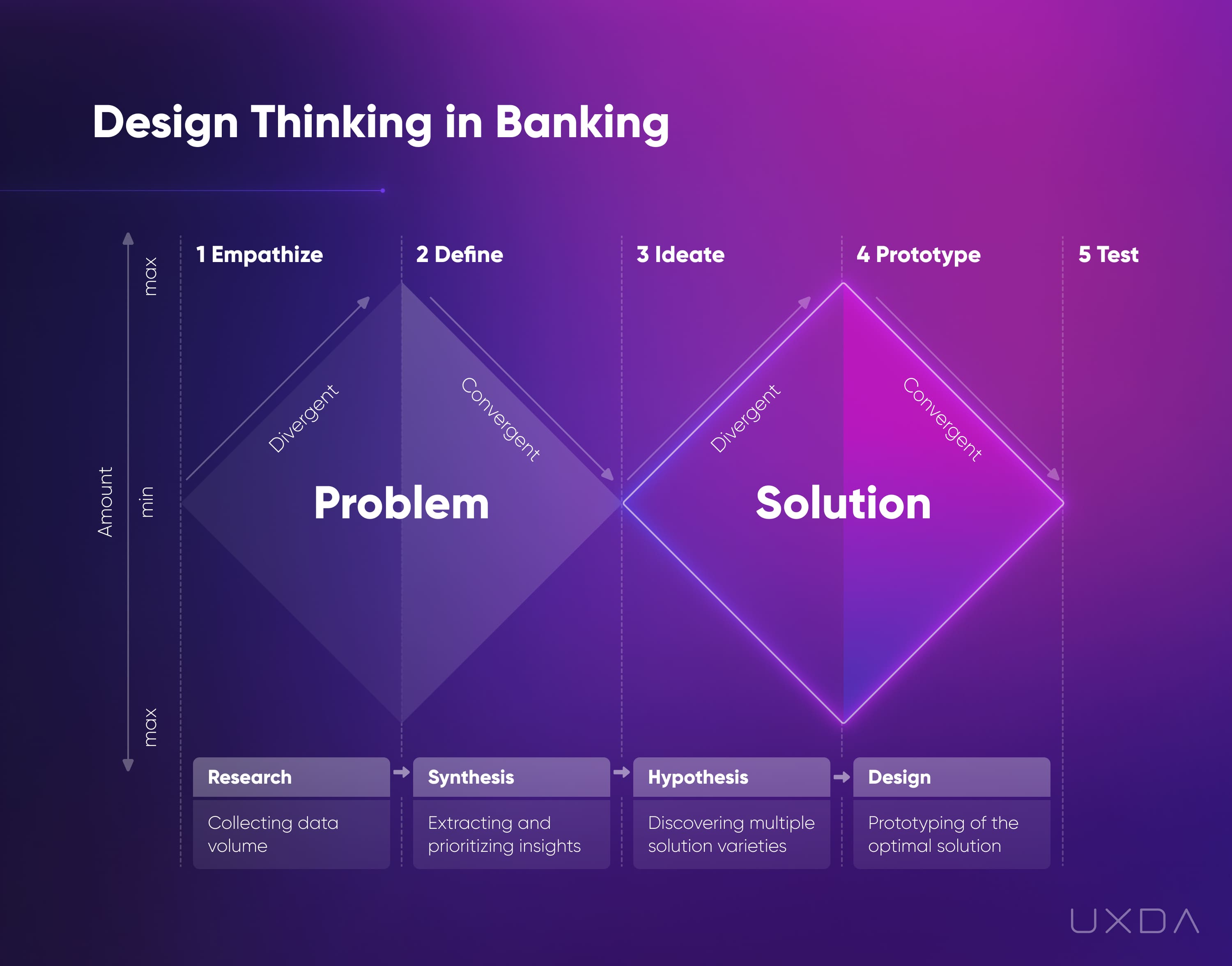

Design thinking in banking used to architect digital financial products in 5 steps: Empathize, Define, Ideate, Prototype, Test. But it's not that easy, let's explain it through the Double Diamond model. The first diamond is known as Problem. It collects data through divergence and prioritizes key insights through convergence. The second diamond is about Solution and starts from diverging all possible solutions based on extracted insights and converging all into a prototype, which, at the end, is tested and delivered according to previously defined criteria.

Proven process of design based product development

What is the Process and Main Specifics of Design Thinking in Banking

Let’s explore each stage of design thinking in banking:

1. Empathize Digital Banking Users

At the Empathize stage, we collect a large amount of data about business goals, customer needs and pain points, and product features, thus researching the wire context around the product. Our aim is to feel and emphasize with the problem we are trying to solve. To achieve this, we need to step into the shoes of the customer and business owner.

2. Define Core User Problems and Value

At the Define stage, we analyze and synthesize collected data to define the core problems and prioritize key data. The main purpose is to understand what value we could bring to customers and why they would prefer it over other solutions. To achieve this, we need to approach data analysis from these different angles: business, psychology, user behavior, competitors, marketing, technology, etc.

3. Ideate Digital Banking Solution

At the Ideate stage, we start to generate multiple hypotheses about what our solution could be. Our main goal is to uncover the best way to solve the previously defined problems. To achieve this, we need to step out of the box and create dozens of potential solutions.

4. Prototype Digital Banking Product

At the Prototype stage, we take dozens of previously generated ideas about how our end solution could look and work, moving toward designing the final version. We check all the solutions based on previously generated user scenarios, business goals, etc. at the Synthesis stage. In this way, we narrow down multiple solutions into one or more that are delivered as visual prototypes and could be tested by users and business owners.

5. Test Banking Prototype

The final Test stage is needed to ensure that our visual prototype provides the needed solution according to the previously defined problem. If it is not, we then return to the first stage and repeat the process.

Some specifics of design thinking in the banking industry include:

User-centered approach

Design thinking in banking puts the needs and expectations of users at the center of the design process, and focuses on creating solutions that are tailored to their unique preferences.

Collaboration and co-creation

Design thinking in banking involves collaboration and co-creation with users and other stakeholders, such as bank employees, business partners, and regulators, to ensure that solutions are well-aligned with their needs and objectives.

Rapid iteration and experimentation

Design thinking in banking encourages rapid iteration and experimentation, and encourages designers to try out new ideas and approaches, and to refine and improve them based on feedback and user testing.

Data-informed decision making

Design thinking in banking leverages data and analytics to inform and guide the design process, and to make better decisions about which solutions to pursue and how to improve them.

Focus on customer experience

Design thinking in banking focuses on enhancing the overall customer experience, and aims to create solutions that are easy to use, convenient, transparent, and pleasant to users.

Continuous learning and improvement

Design thinking in banking encourages a culture of continuous learning and improvement, and encourages designers to regularly seek feedback from users, and to use that feedback to make ongoing improvements to their solutions.

Design Thinking in Finance Determines Success in Digital Age

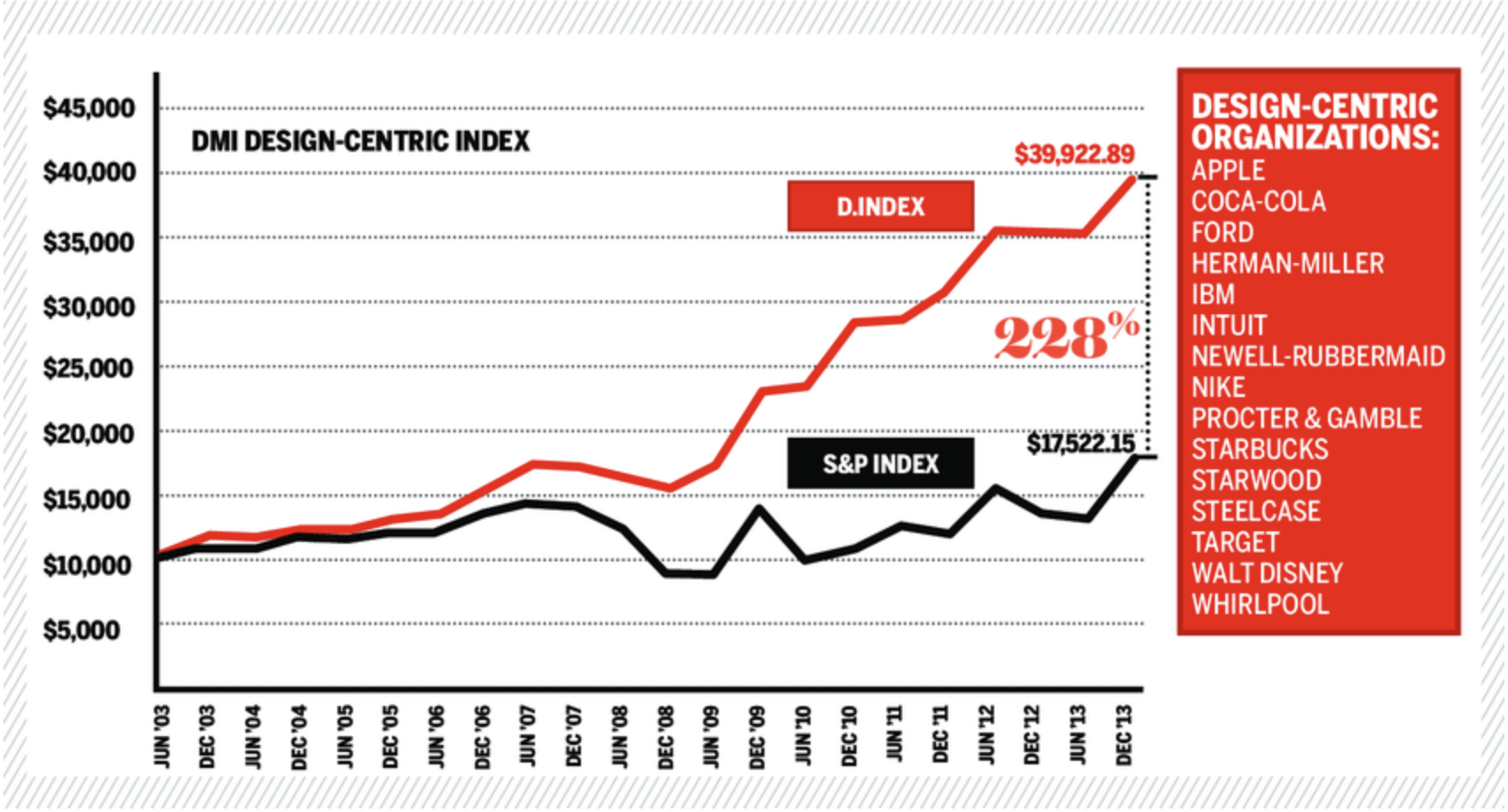

Design and design thinking have never before played a more influential role in determining the success of any business in any industry. This fact is well supported by the Design Value Index (DVI), a summary of the market performance of 15 design-driven companies including Apple, IBM, Nike, and SAP. Those companies share a high level of design strategy implementation across their organizations. Their executives practice design in everyday work, and they have design positions at the management levels. Design-driven companies outperformed the S&P 500 by 211%.

The finance industry has experienced a turbulent period of Fintech disruption in recent years. In fact, 75% of the finance sector companies surveyed by KPMG stated that changing customer needs is the key area where disruptive Fintech companies have been challenging the traditional finance businesses. Although customers' needs are the basis for any business, in today’s competitive and customer-centric landscape, businesses must understand the customer on a much deeper level to come up with more innovative solutions. It is at this point that design thinking in finance comes in.

In its essence, design thinking in banking is a customer-centered process for solving problems. It includes understanding people’s needs, defining their challenges, brainstorming solutions, and then prototyping and testing the solutions. Through design thinking, teams and individuals combine what is desired and needed by the user with what is technologically feasible under the circumstances and viable for the business.

Banks acknowledge the importance of design thinking in financial services and look for ways to transform their organizations. BBVA has trained 1,000 design thinking experts to educate their employees to apply this approach on a daily basis. Capital One has developed “Capital One 360 Café”, a hybrid bank/coffee shop branch where the bank’s employees can freely speak with their customers to understand customer banking experiences. In addition, many banks worldwide have acquired Fintech companies, creating accelerators to attract them.

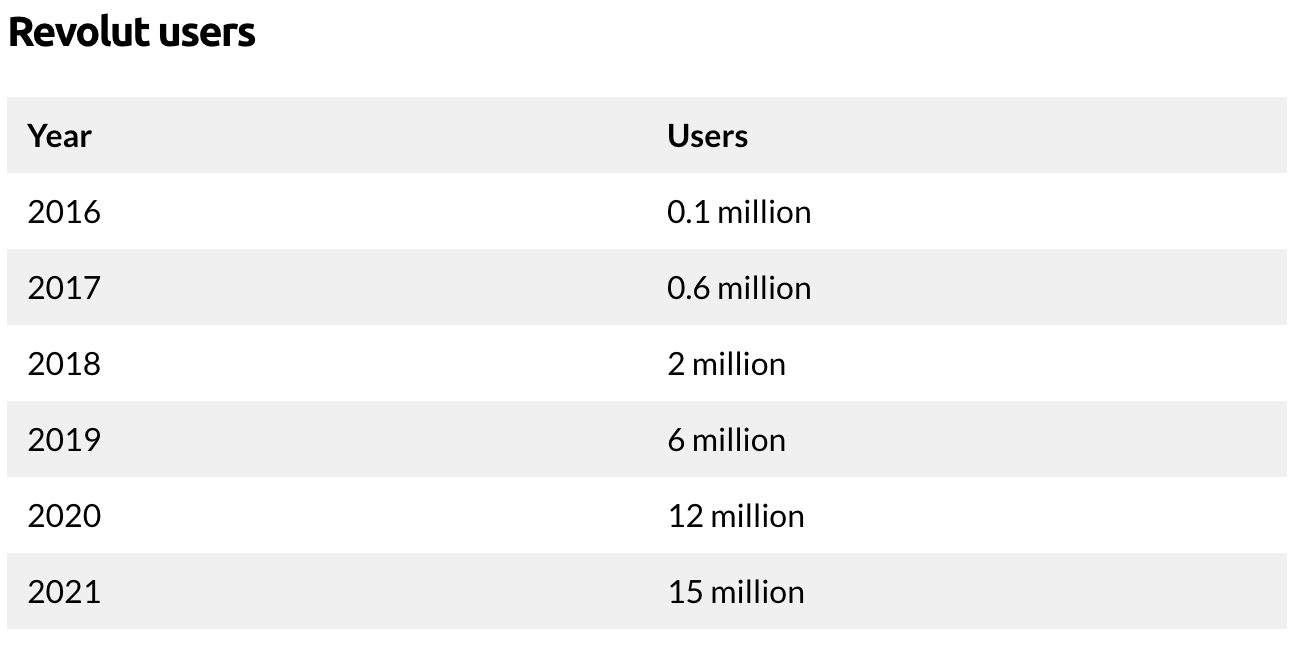

Yet, Fintech companies are becoming more popular among customers who are switching their current accounts from banks to Fintech organizations. For example, in only the first 3-year period, Revolut acquired more than 1 million users, from which 250 thousand were active users and by 2021 they hit the mark of 15 million users.

Other Fintech companies are following a similar trend, with design thinking characteristics as a means to understand users, and continuously testing of products emerging as core advantages.

Main Challenges of Design Thinking in Banking

There are several challenges to implementing design thinking in the banking industry. One of the main challenges is the fact that the banking industry is highly regulated, which can make it difficult to innovate and try out new ideas.

Many banks are large organizations with long-established processes and ways of doing things, which can make it difficult to change the culture and mindset to one that is more focused on design thinking. Finally, the nature of the banking industry itself can make it difficult to implement design thinking, as it is a highly complex and risk-averse industry that requires a high level of accuracy and attention to detail.

Resistance to change

Many banks have traditional and entrenched processes and systems that may be resistant to change. Implementing design thinking requires a shift in mindset and culture, which can be challenging for employees and managers.

Lack of design expertise

Many banks may not have a strong design team or the necessary skills and expertise to effectively implement design thinking. This can lead to a lack of understanding of the principles and practices of design thinking, and hinder its successful implementation.

Limited resources

Implementing design thinking often requires significant resources, such as training and development for employees, and investment in new tools and technologies. Many banks may face budget constraints and may be unable to allocate the necessary resources for a successful implementation.

Regulatory constraints

The banking industry is heavily regulated, and any changes to processes and systems must comply with strict regulations. This can limit the scope and flexibility of design thinking, and make it challenging to implement breakthrough solutions.

Customer resistance

Design thinking involves engaging with customers and understanding their needs and preferences. However, customers may be resistant to change and may not be open to new ideas and approaches. This can make it difficult to gather valuable customer insights and implement effective solutions.

How to Implement Design Thinking to Transform Banking Services

To use design thinking to transform banking services, use the following steps:

1. Understand the needs and wants of customers

Conduct user research and empathy mapping to understand the pain points and unmet needs of customers in their banking experience.

2. Generate ideas to solve problems

Use brainstorming and other ideation techniques to generate a range of possible solutions to the identified problems.

3. Prototype and test solutions

Create physical or digital prototypes of the solutions and test them with users to gather feedback and refine the design.

4. Implement and iterate

Based on the feedback from user testing, implement the solutions and continue to iterate and improve them based on ongoing feedback and user testing.

5. Communicate and educate

Communicate the changes and improvements to customers and educate them on how to use the new services.

By following these steps, design thinking can help to transform banking services into more user-centered and effective solutions that meet the needs of customers.

What Banking Experts Say About the Implementation of Design Thinking

To identify the path for successful implementation of design thinking in finance, we talked with experts from leading banks and Fintech companies in Northern Europe:

Get Ready That Declaring "Customer-Centricity" is not Enough

Experts from banks and Fintech companies agree that understanding the customer is the core of every business. In fact, customer-centricity is well-communicated among employees in banks. Yet, differences exist in how people in both types of organizations perceive customer-centricity. Fintech companies “step into customer shoes” and examine the customer on a deeper level to find new ways to disrupt existing financial services. Banks concentrate on how to maintain current services for their large base of customers.

Design-driven organizations are engaging with their customers to find out what they really think and what values they hold. For example, by approaching customers in a local bank branch and having a talk with them about their banking experience.

Yet, it is the management which usually sets the tone defining how deeply the company needs to understand the customer. Instead, bringing the customer in at all levels of the company can be an advantage. For instance, Jeff Bezos leaves one seat free at the boardroom and encourages the meeting attendees to imagine that it is taken by their customer - “the most important person in the room”.

Another common practice for raising customer-centricity in a company is field experience - have top/middle management spend a day per month working with people who work with customers on a daily basis. That's a way for management to truly understand their customer.

Moreover, a company can involve all employees to understand the customer on a deeper level. Every day, companies receive complaints and feedback from their customers. Why involve only customer support to answer them? Create a support deck where each employee receives one complaint to which a reply needs to be given. That way all employees become more aware of their customer, and feel responsible in their daily routines. Remember, customer-centricity is a special way to think and act, not just talk.

Don't Miss out on Specific Goals

Setting common goals and visions is easier in smaller organizations such as Fintech companies. Banks have many departments and teams which concentrate on various targets. In fact, lack of focus on defined problems and poor definition of challenges are the key obstacles of integrating design thinking process in international banks.

Defining goals is a crucial part in tackling any challenge. It is important to get them right to create a focus on the given problem. From a design thinking perspective, the goal can be defined as a problem statement which summarises ‘who is the customer’ and ‘what are the customer’s needs’ - in other words “the challenge”.

For example, Mark is a 25-year old Millennial who doesn't like to follow his daily finances. He needs a way to save up money from daily spending, while not taking too much attention from his routine. The first part describes the customer, and the second part elaborates on the need the customer is facing.

However, the goal formulation is not the problem, but the way it is communicated across departments and teams. In larger organizations, it is common to set goals with a top-bottom approach, excluding the opinion of regular employees.

Make a point of setting united goals by hearing the opinion of your employees. Traditional culture should learn from Fintech how to “hear” customers, employees and partners. This critical step can make the employees more engaged in the company by involving them in the goal-setting process. Encourage bottom-top and lateral as well as top-bottom communication across your organization.

Ensure Customers' Presence in Daily Routine

While large organizations such as banks spend a considerable amount of time organizing work between their departments, Fintech companies have budgetary and time constraints which motivate them to act quickly. Quick action includes brainstorming ideas and testing them as soon as possible to learn from mistakes. But there’s more to it than that.

The majority of specialists from various organizations have stated that only some customer-oriented departments, such as R&D and marketing, use design thinking. Fintech companies practice ideation more than traditional organizations, as they need to be flexible about what customers truly need to disrupt existing financial products. Due to the presence of extensive legacy systems, a large portion of bank employee time must be devoted to operational functions which are not related to the customer. Therefore, customer-centricity is more common in Fintech companies where the roles of the employees are more customer-centred.

Although banks encourage employees to participate in product brainstorming and testing sessions, the participation is low as it is not relevant to people who perform operational roles. Therefore, it is important to find a way to relate the work of all employees to customer-related challenges.

The example and attitude shown by management towards employees results in employees adopting a similar approach in their interaction with customers and customers’ challenges. If management doesn't listen and respect other people’s opinions and feelings, the employees do the same.

As discussed in the first obstacle, it is important to bring all employees in to solve customer complaints and raise the customer's presence in the organization. Yet, it is even more crucial to involve all employees in developing solutions to those complaints.

A good practice is to involve employees in a project-based activity that contributes to meeting a certain challenge. Create a team of 5-7 people from various departments (including operational departments) and hand them a customer-related challenge. Not only will employees sense a higher level of the customer's presence in their work, they will also have a more interesting, and more rewarding, work experience that complements their daily routine. That can help to develop change-orientated culture in any organization.

Encourage Experimentation Culture

As discussed above, ideation and rapid prototyping is practiced early on in design-driven companies. The rapid process helps validate ideas quickly, then move on with new ones and those with high chance of success. Yet, prototyping is not practiced actively in banks. While the obvious explanation is the lack of customer-centricity among employees performing operational roles, another important aspect is concern over experimentation.

As banks want to maintain the trust of their large customer base, experimenting with new ideas is not as common as in Fintech companies. Startups see that discrepancy as a market advantage that allows them to deliver new products, updates, and customer satisfaction faster and more consistently.

Employees in banks are accustomed to a routine which excludes time for additional activities, such as working on new ideas that will improve results of their core work. Management failing to find time for employee participation in design activities is one of the key obstacles various international banks faced when attempting design thinking implementation in banking.

It is a common practice to build up a strong business case to initiate a project in banks and other large organizations. Therefore, testing is practiced only in the later stages of the project, increasing chances that the work invested might be for nothing. Many Fintech companies use short iterations and cycle times, and companies test ideas frequently to understand whether there is value in pursuing further development.

Yet, it is important to remember that the prototype of an idea does not need to be a perfect solution. Create simple prototypes of your ideas and test them among a subset of your customers to get rapid feedback. For example, if you want to develop a new concept for your mobile application, create three of your most important scenarios in a clickable prototype, then go in to the streets and perform "Guerilla testing" with people that you meet. In a matter of days, you will have tested an idea without risking your existing customer base.

Another question that arises is how to encourage customer-centric and innovative design thinking behavior from employees across a large and diverse organization. One of the best ways is to continue the work that many banks worldwide have already begun - innovation hubs. Retain the innovation hubs and encourage your employees to test their ideas there. Have representatives from innovation hubs in each department of your organization to provide guidance on experimenting with new ideas.

Alternatively, adopt another practice that is common among many international banks - develop independent units which focus on specific goals by embracing their own working culture. For example, Citibank launched its Fintech unit to work as an independent startup of 40 people tasked with developing mobile-first solutions for improved customer banking experiences.

Wrap-Up

Successful implementation of any innovative methodology depends on the culture of the organization. Most banks have been established for decades. Fintech companies have been founded just recently, allowing them to build their organizations from zero. Out of necessity, Fintech companies have been required to implement processes which reliably lead to the most effective solutions in the shortest time span, in order to survive in the market.

Although Fintech companies appear to be more aware of using design thinking in banking, banks have started many initiatives to transform their organizations. Innovation hubs, internal UX workshops, design support teams, and independent design units are only some of the initiatives taken to change the way how they think. But whether that will transform the established culture of their organizations is a question of time.

Additional answers that might be helpful:

What is the mindset required for design thinking?

Today, customers have dozens of new alternatives every year due to low entry barriers and open banking. That's why, in order to survive in the digital age, financial brands are required to adopt design thinking to make business customer-centered. And this requires from a new generation of bankers to bring their mindset in line with the design thinking approach.

The mindset required for design thinking involves empathy, curiosity, creativity, and collaboration. It requires understanding and empathizing with the needs and wants of users, as well as being open to new ideas and approaches to finding solutions to complex problems. In order to be successful at design thinking, you need to be willing to challenge assumptions, think outside the box, and embrace uncertainty and experimentation.

There are five key attitudes that need to be implemented with the aim to make the team mindset customer-centered and shift the business toward Design Thinking.

Serve Instead of Sell

Emotions Over Information

Solution Instead of Features

Disruption Over Protection

Create Flow, Avoid Fragmentation

What are design thinking tools?

Design thinking tools are methods, techniques, and frameworks that help designers and innovators apply the design thinking process to a particular problem or challenge in banking industry. These tools help designers to better understand the needs and wants of users, generate creative solutions, and iterate on their ideas to develop the most effective and impactful solutions.

Some common design thinking tools include:

Empathy mapping

A technique for understanding and empathizing with users, by mapping out their thoughts, feelings, and behaviors.

User personas

Fictional characters that represent the different types of users that a product or service is designed for.

Prototyping

The process of creating a model of a product or service to test and refine its design.

User testing

The practice of collecting feedback from real users to inform and improve the design of a product or service.

Customer journey mapping

A visual representation of the steps that a user takes to interact with a product or service, from their first touchpoint to the final outcome.

What is the role of design thinking in the banking sector?

Design thinking is a popular approach used by many companies to improve their digital services. Such companies as Google, IBM, Amazon, Apple, Tesla use design thinking to better understand the needs and preferences of their customers and to develop digital services that are user-friendly, intuitive, and effective.

In the banking sector, design thinking is used to improve the user experience by identifying and addressing the needs and challenges of bank customers. This could involve conducting user research to understand their needs and preferences, developing user-centered solutions, and testing and refining those solutions through prototyping and feedback. By applying design thinking to the user experience in banking, financial institutions can create products that are more likely to be successful and meet the needs of their customers.

Read more about UXDA's 7 steps to improve banking experience >>

UXDA MATRIX FOR DESIGN THINKING IMPLEMENTATION

Get UXDA Research-Based White Paper "How to Win the Hearts of Digital Customers":

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedin