After years of digital innovation, many financial apps still drown users in data—and miss what really matters: how people feel about their money. At UXDA, we see a radically different path: by applying neuroscience and neuromarketing, we’ve found that tapping into users’ emotional motivations can transform their entire financial journey. It’s not just about features and transactions—it’s about building trust, encouraging good habits and turning money management into something people actually feel good about.

Digital banking has undergone significant transformation over the past decade, yet many users still experience stress and confusion when managing their finances online. At UXDA, we believe design has the power to alleviate these pain points and spark genuine human connection. How can we use neuromarketing to apply neuroscience insights about the brain into making financial products both efficient and emotionally rewarding.

Research in consumer neuroscience by Kenning and Hubert (2008) indicates that subconscious, emotional factors strongly influence our decisions. In finance, these factors are magnified by everyone's subconscious fears about money, risk and loss. Leveraging neuromarketing principles allows digital banking and Fintech platforms to tap into users’ natural motivations, creating engaging, trust-building experiences that build meaningful financial well-being.

Why Neuroscience Matters in Finance

Managing money is often seen as a purely logical task based on numbers, rates and calculations. However, as Nobel laureate Daniel Kahneman demonstrated, emotions are inseparable from decision-making in finance. This connection is especially eye-opening in the realm of digital banking and Fintech product interfaces, where introducing elements of empathy and positive reinforcement can seem counterintuitive. In digital banking, small positive experiences—like celebrating a $5 savings—can have a surprisingly big impact. These “small wins” create momentum, helping users build healthy financial habits over time.

The problem is that users unconsciously develop everyday financial behaviors and decision-making patterns that can collide with cognitive biases, like loss aversion and mental accounting. They have ingrained ways of thinking about and handling money that can limit financial growth or lead to suboptimal choices. A “neuroscientific approach” recognizes these biases and works with them.

In many cases, these habits run headlong into loss aversion (Kahneman & Tversky, 1979) and mental accounting (Thaler, 1985), biases that lead users to feel outsized pain over small losses and compartmentalize money in ways that might not maximize their financial health. Instead of trying to eliminate these biases, a neuroscientific approach harnesses them for good—gently guiding users toward better decisions through well-timed nudges and simplified choices.

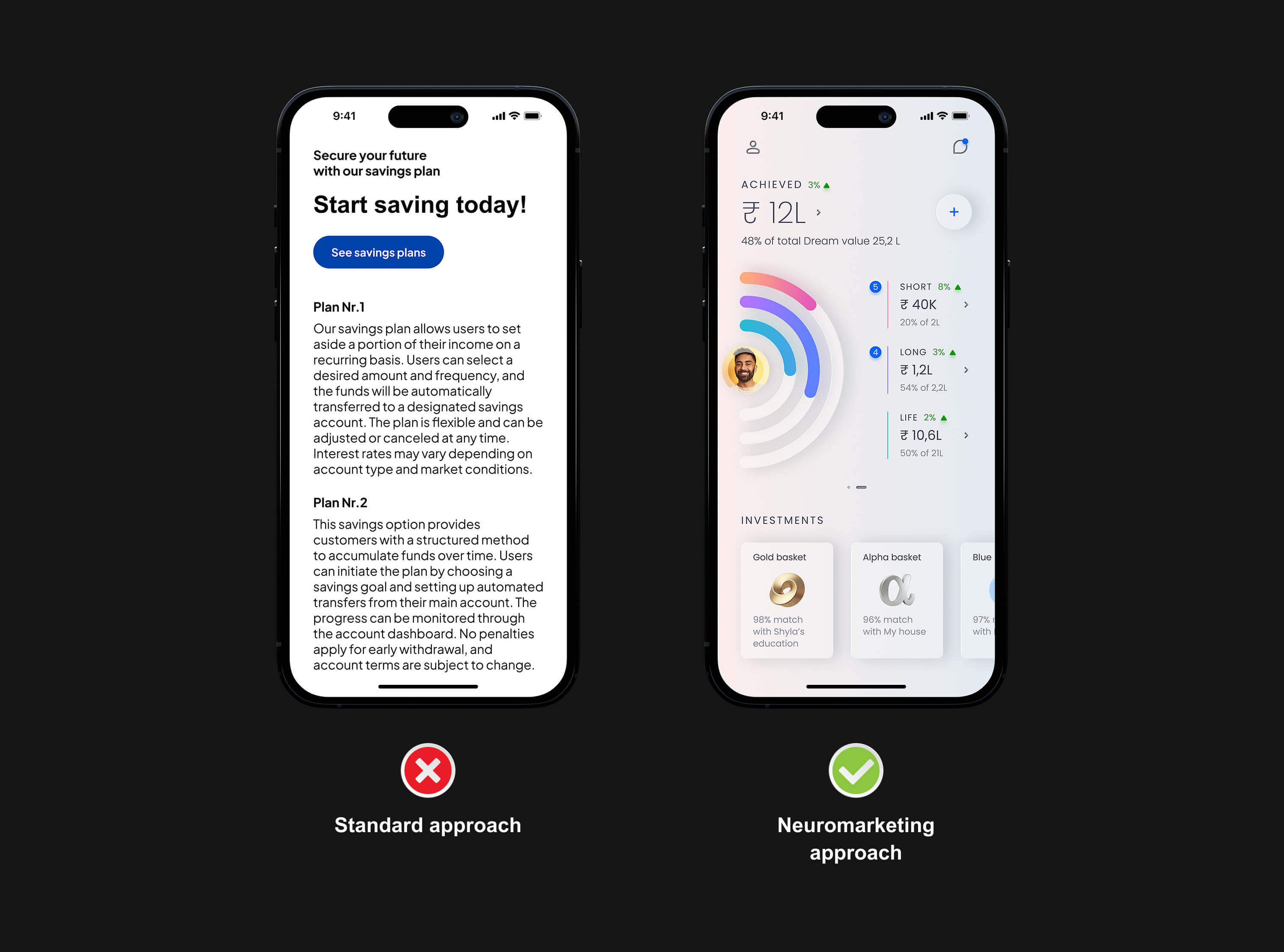

It is also counterintuitive to think that less information might actually benefit users. Financial institutions often believe in offering as much data as possible—detailed charts, extensive product catalogs and dense legalese—assuming it empowers customers. In practice, it actually does the opposite. When things get too complicated, people tune out. Research of Kenning and Hubert has shown that simplifying choices and providing clear, guided experiences actually builds trust and satisfaction. Clear, simple interfaces are far more effective than an overload of details. Neuroscience shows us that simplicity and clarity in digital interfaces can be far more persuasive and reassuring than an avalanche of facts.

Traditional financial services often focus on interest rates, fees or product comparisons, but they miss the emotional side of money management. This is where neuroscience bridges the gap. By understanding how the brain's reward system works—particularly the role of dopamine in shaping behavior—we can design financial products that provide immediate, positive reinforcement for good money habits.

Emotional Brand Connection

Another surprising insight is the role of emotional bonds in building long-term loyalty and trust (Plassmann, Ramsøy & Milosavljevic, 2012). While finance is often seen as cold and purely transactional, people are more likely to engage with digital financial platforms when there’s an emotional element involved. For example, instead of merely presenting numbers, we can incorporate storytelling into the user experience, transforming each financial action into a personal goal—such as saving for a vacation or a child's education—making the experience more relatable and motivating.

This approach aligns with Damasio’s (1994) claim that emotions are integral to rational thought. When users see their financial goals—like saving for a trip or paying off debt—apps suddenly feel more helpful and less stressful.

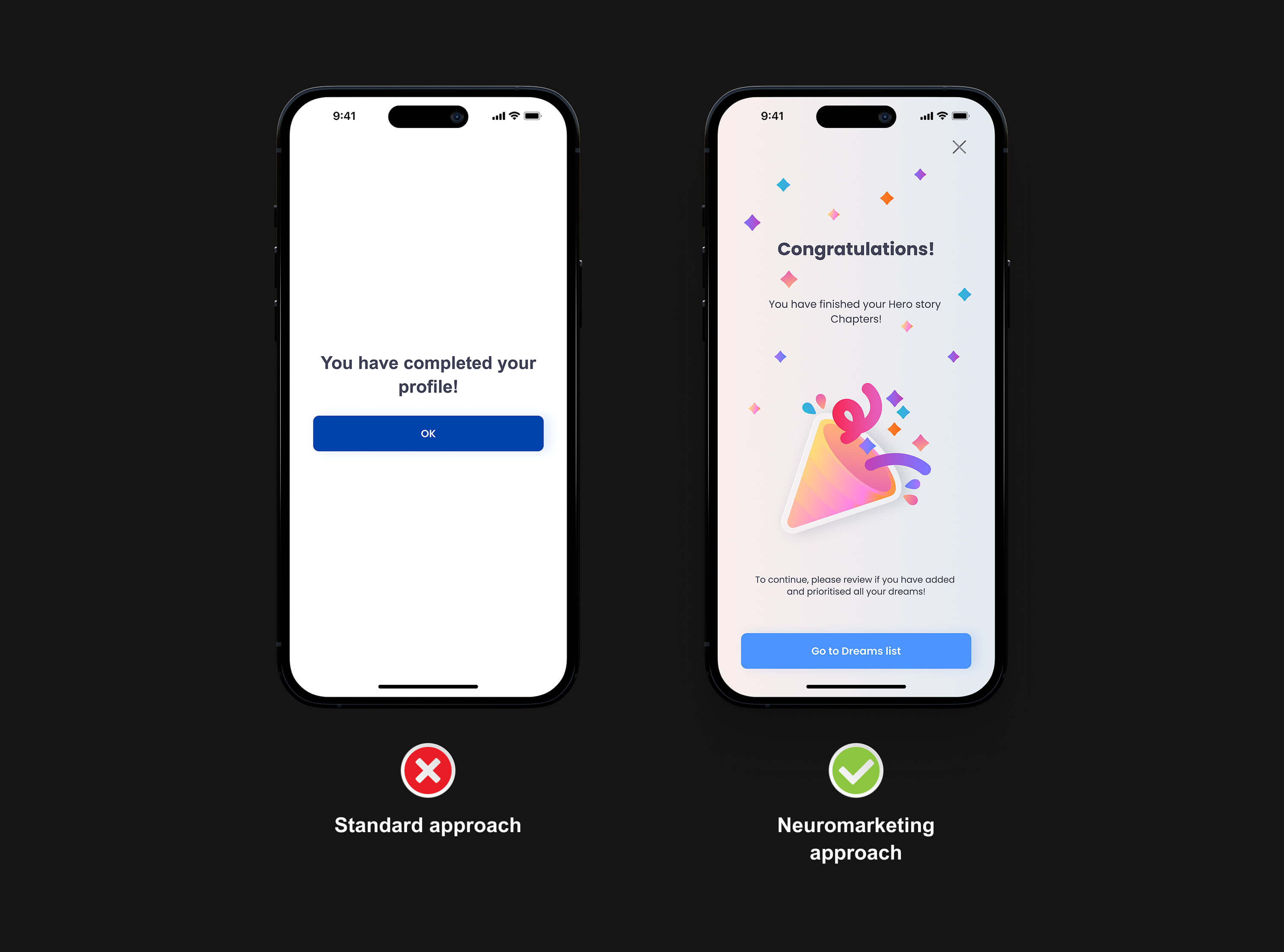

Dopamine design challenges the assumption that financial services, experiences and interfaces must be strictly formal, emotionally neutral and dry. Whenever a user meets a milestone—no matter how small—financial app interfaces could provide micro-celebrations, such as quick animations or congratulatory messages. Though it may seem trivial, these bursts of feedback release dopamine in the brain, reinforcing positive behaviors.

Extending this further, gamification features—like progress bars and streaks—tap into the brain’s inherent desire for completion and reward. Berns, McClure, Pagnoni and Montague (2001) observed how even predictable rewards can sustain engagement over time, particularly when layered into an interactive journey. By systematically applying these mechanisms, digital banking interfaces can transform mundane tasks—such as saving spare change—into satisfying, repeatable actions. One example is the Qapital app, which won users’ loyalty by turning saving into a fun, interactive experience through goal-setting, automation and reward-based features.

Neuromarketing for Simple and Delightful User Experience

Neuromarketing applies insights from neuroscience to shape design and communication strategies that tap into emotional drivers, habits and rewards. While it has gained traction in e-commerce and consumer apps, its influence in financial services is now accelerating. Money decisions are inherently emotional; people are driven not only by logical risk assessments but also by psychological factors like fear of loss, impulse rewards and habit loops. By tapping into these motivators, digital banking and Fintech platforms can become more engaging and less intimidating.

Using UXDA’s strategic UX framework, we turn brain science into simple design choices that build trust and make digital financial services feel clearer, friendlier and more human. For example, through the use of nudge theory (Thaler & Sunstein, 2008), we can guide users toward better decisions without being manipulative. Overloading users with too much data, like charts, graphs and jargon, can break trust and make decision-making harder. At UXDA, we use strategic UX to simplify things by replacing complexity with intuitive visuals, clear language and easy step-by-step flows. Simple design changes, such as curating product options and reducing clutter, empower users and help them avoid feeling overwhelmed.

In fact, sometimes less really is more. By using minimalistic dashboards or progress trackers, such as "You're 70% toward your debt-free goal," we help reduce anxiety and keep users engaged. Clear, goal-driven feedback gives users confidence and a sense of direction, which makes them more likely to return.

Long-term financial success depends on building consistent habits—like saving, managing debt and making informed spending choices. Neuroscientific research shows that small habit loops, reinforced by positive feedback, transition sporadic interactions into established routines (Berridge, 2007), insights often leveraged in neuromarketing strategies. At UXDA, we embed these loops into digital journeys, from timely prompts about upcoming bills to personalized tips on reducing unnecessary expenses.

The goal isn’t to manipulate but to empower. As users see real progress—whether it’s reducing their spending or contributing to savings—they build confidence, deepening their relationship with the platform. Over time, these small actions turn into lasting habits, transforming the banking app into a trusted financial companion.

UXDA’s Dopamine Banking: Applying Neuromarketing to Finance

UXDA applies neuromarketing principles to humanize the way people interact with financial services through our invented concept, Dopamine Banking. It uses a dopamine design to make banking not only more efficient and user-friendly but also more rewarding and emotionally resonant.

Below is an overview based on using dopamine design as a part of neuromarketing, along with how UXDA’s Dopamine Banking leverages these principles in financial services:

Below is an overview based on using dopamine design as a part of neuromarketing, along with how UXDA’s Dopamine Banking leverages these principles in financial services:

1. Emphasize Positive Reinforcement

What It Is:

Positive reinforcement focuses on rewarding desired behaviors so they become habit-forming. Neurologically, these small rewards trigger dopamine release, creating a sense of accomplishment and pleasure.

How to Apply in Financial UX:

- Micro-Celebrations: Add celebratory animations or messages after users meet savings or budgeting goals.

- Instant Feedback: Provide immediate confirmation (e.g., a “Success!” pop-up) to reinforce actions like bill payments or micro-savings.

Scientific Basis:

Berridge (2007) describes how dopamine drives “incentive salience,” meaning that positive feedback increases the likelihood of repeating the behavior.

2. Use Gamification to Drive Engagement

What It Is:

Gamification involves adding game elements—points, badges, streaks—to non-gaming environments. It exploits our innate desire for achievement and recognition, triggering motivational reward pathways.

How to Apply in Financial UX:

- Progress Bars and Milestones: Show users their progress toward earning rewards or cashback (e.g., “You’ve earned $20 cashback this month! Keep going to unlock more”), encouraging them to put in extra effort to level up.

- Challenges and Streaks: Introduce daily or weekly goals (e.g., “Save $5 each day”) that reward consistency.

Scientific Basis:

Berns et al. (2001) found that predictable rewards and goal tracking trigger dopamine release, which helps sustain ongoing engagement.

3. Personalize Experiences with Data-Driven Insights

What It Is:

Personalization tailors the user experience based on individual data—spending habits, savings goals—making the service more relevant and compelling.

How to Apply in Financial UX:

- Adaptive Dashboards: Show real-time spending patterns, custom budgeting tips and goal-setting reminders that reflect each user’s unique financial behavior.

- Contextual Notifications: Offer timely nudges (e.g., “Payday just arrived—want to set aside $50 for savings?”).

Scientific Basis:

Kenning and Hubert (2008) note that personalization increases emotional engagement, trust and user satisfaction.

4. Reduce Anxiety Through Emotional Framing

What It Is:

Money matters often spark stress or confusion. Emotional framing uses reassuring language and visuals to make financial tasks feel less intimidating and more approachable.

How to Apply in Financial UX:

- Friendly, Conversational Tone: Swap out formal jargon for relatable copy and guided tutorials. Instead of “Please complete the necessary verification process,” use “Let’s get you verified! Just a few quick steps.”

- Visual Storytelling: Transform raw numbers into meaningful journeys (e.g., “Your path to owning a home”) that resonate emotionally.

Scientific Basis:

Damasio (1994) highlights that emotions play a key role in decision-making, and by reducing financial anxiety, user trust and engagement can be significantly improved.

5. Leverage Loss Aversion and Mental Accounting

What It Is:

- Loss Aversion (Kahneman & Tversky, 1979): People dislike losing more than they like gaining a similar amount.

- Mental Accounting (Thaler, 1985): Individuals categorize money into “accounts” (e.g., rent, leisure) and treat each category differently.

How to Apply in Financial UX:

- “Savings First” Strategy: Encourage automatic transfers into savings upon paycheck arrival, framing it as “protecting your future.”

- Categorized Budgets: Present spending summaries by category (e.g., groceries, dining out) to align with how users naturally compartmentalize funds.

Scientific Basis:

Kahneman & Tversky (1979) and Thaler (1985) point out that these cognitive biases can be harnessed to motivate financially responsible decisions.

6. Simplify Complex Decisions with Choice Architecture

What It Is:

Choice architecture dictates how options are presented to guide better decisions. When too many choices exist, users may experience decision fatigue or paralysis.

How to Apply in Financial UX:

- Limited, Curated Options: When suggesting credit cards or investment portfolios, present a few well-explained alternatives.

- Smart Defaults: Preselect the most beneficial (or most popular) option for users who prefer a quick, low-effort decision.

Scientific Basis:

Kenning & Hubert (2008) demonstrate that minimizing cognitive load and simplifying decision-making processes significantly enhances user satisfaction and trust.

7. Encourage Habit Formation with Consistent Engagement

What It Is:

Habit formation involves regular cues, actions and rewards that become automatic over time. Financial apps can leverage habit loops to embed positive money management behaviors.

How to Apply in Financial UX:

- Recurring Savings Plans: Automate transfers to savings accounts, making consistent saving a default behavior.

- Regular Check-ins: Send gentle reminders (e.g., “Review your spending each Sunday”) to keep users mindful of their finances.

Scientific Basis:

Berridge (2007) emphasizes that when behaviors are consistently paired with immediate rewards, they reinforce neural pathways in the brain, making those habits stronger so they will endure over time.

8. Strengthen Emotional Brand Connection

What It Is:

An emotional brand connection goes beyond functional benefits to create a deeper relationship between the customer and the financial service. This fosters loyalty, trust and a sense of belonging.

How to Apply in Financial UX:

- Brand Storytelling: Weave an engaging brand narrative throughout the user journey, showing customers how the institution’s values align with their personal goals (e.g., sustainability, community support).

- Meaningful Touchpoints: Use friendly, personalized messages at key moments (e.g., congratulating users on their birthdays or celebrating savings milestones) to create a warm, human connection.

Scientific Basis:

Plassmann, Ramsøy & Milosavljevic (2012) indicate that strong brand cues can activate reward pathways, reinforcing emotional attachment.

9. Incorporate Dopamine Design

What It Is:

Dopamine design capitalizes on how the brain’s reward system releases dopamine in anticipation of positive outcomes. By designing interfaces that offer timely, meaningful rewards, financial apps can boost user motivation and engagement.

How to Apply in Financial UX:

- Small Wins and Feedback: Celebrate every small financial victory (even micro-savings of $1–2) with light animations or cheerful sounds.

- Progressive Challenges: Continuously update challenges and goals to maintain novelty, thereby sustaining the dopaminergic “reward anticipation.”

Scientific Basis:

Berridge (2007) highlights the link between dopamine release and the motivation to repeat rewarding activities, crucial for forming persistent behaviors.

10. Nudge Financial Health

What It Is:

Nudging (Thaler & Sunstein, 2008) involves subtly guiding people toward better choices without restricting their freedom. In finance, nudges can improve overall financial health by encouraging users to save more, spend responsibly or plan for the future.

How to Apply in Financial UX:

- Automatic Enrollment: Default users into higher savings or retirement contribution rates, while still allowing opt-outs.

- Timely Prompts: Send notifications at decision-critical moments (e.g., a nudge to invest a bonus rather than spend it) to capitalize on fresh capital influx.

Scientific Basis:

Thaler & Sunstein (2008) demonstrate that when designed ethically, nudges can guide individuals toward beneficial behaviors without compromising their autonomy.

Ethical Transparency in Neuromarketing

A common misconception about neuromarketing is that it's manipulative, but we believe that industry has to take a different approach. Transparency is key. We should use insights from neuroscience to make experiences better for users, not to trick them. Every little nudge, celebration or game-like feature should be clear, so users always know what's going on and why it matters to them.

As Plassmann et al. (2012) point out, this transparent approach is crucial in the financial sector, where trust is everything. By respecting privacy, providing clear opt-out options and avoiding hidden fees or misleading tactics, Fintech platforms should use neuromarketing to build trust instead of breaking it. This creates a relationship in which users feel supported and guided, not manipulated. To achieve this, it’s important to keep the following principles in mind:

- Informed Consent: Be transparent about data collection and usage.

- Avoid Manipulation: Design to empower users to make better financial decisions, not to exploit vulnerabilities.

- Data Privacy and Security: Protect sensitive financial information with robust safeguards.

- Respect Autonomy: Ensure nudges and dopamine-triggering elements are aligned with users’ best interests.

Conclusion

Adopting a neuromarketing approach in digital banking and Fintech challenges many long-held assumptions—that finance should be purely rational, that users need more data rather than less and that emotions have no place in “serious” financial decisions. However, research (Damasio, 1994; Kahneman & Tversky, 1979) consistently shows that human behavior is driven by a mix of cognitive biases, emotional responses and habitual patterns—not just logic and reason. Ignoring this human side can limit the effectiveness of even the most advanced financial tools.

By integrating emotional storytelling, dopamine-driven micro-rewards and nudge theory into a user-centered strategy, UXDA’s strategic UX redefines how people experience financial products. The real power lies in leveraging these counterintuitive insights—from celebrating even the smallest savings habits to simplifying choices—to empower users in building lasting financial well-being. When employed ethically and transparently, neuromarketing doesn’t trick users; it meets them where they are, helping them find confidence and joy in an area typically associated with stress and uncertainty. Here are the key neuromarketing strategies you can integrate into financial UX design:

- Reward System: Trigger dopamine release with immediate positive feedback and achievements.

- Emotional Resonance: Use storytelling, friendly design and visual cues to reduce anxiety and build trust.

- Personalization: Tailor insights to user behavior, fostering deeper engagement and loyalty.

- Cognitive Biases: Employ concepts like loss aversion and mental accounting to encourage responsible financial decisions.

- Choice Architecture: Simplify user decisions with clear, limited options and helpful defaults.

- Consistency and Habit Formation: Reinforce positive behaviors through regular reminders and automated tasks.

Through these strategies, companies can create user experiences that not only meet customers’ functional needs but also resonate emotionally—ultimately leading to greater satisfaction, trust and long-term loyalty.

Discover our clients' next-gen financial products & UX transformations in UXDA's latest showreel:

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedin