More and more companies from different industries are evolving from a product-based marketing mindset to one focused on the customers' experience. This is because in an experience economy of the digital age people don’t buy products or services but the experiences and emotions behind them.

What is Customer Experience in the Insurance Industry

Customer experience in the insurance industry refers to the overall perception and interactions that customers have with an insurance company, from the time they first learn about the company and its products, to the time they make a purchase and receive ongoing support and service. In the insurance industry, customer experience is typically influenced by factors such as the clarity and simplicity of the company's products and services, the ease and convenience of the purchasing process, and the quality and responsiveness of customer support. A positive customer experience can help insurance companies build trust and loyalty with their customers, while a negative customer experience can lead to customer dissatisfaction and churn.

Unfortunately, the insurance industry is not exactly associated with the most positive emotions from the customer's point of view. It is long overdue for insurers to tackle their deep-rooted negative image, by adding soul and breathing life into their product, services and operations in general. Global digitalization and pandemics deeply impacted the insurance industry, due to changes in the customers' behavior. This led to the rapid emergence of new service providers - insurtech, which operate on relatively different principles.

Insurtech, short for insurance technology, refers to the use of technology to innovate and improve the way insurance products and services are designed, delivered, and managed. This can involve the use of digital tools and platforms to make the insurance process more efficient and convenient, as well as the use of data and analytics to personalize and improve the customer experience. Insurtech companies often use a variety of technologies, such as artificial intelligence, machine learning, and the Internet of Things, to create new insurance products and services, and to automate and streamline various aspects of the insurance process. The goal of insurtech is to make insurance more accessible, affordable, and relevant for consumers and businesses.

In this article, we try to observe what are the main insurance customer experience trends, and how customer-centered UX design could help not only to switch negative emotions to positive ones, but also ensure the best value for digital customers.

Article's Key Takeaways

- The insurance industry is transforming from “detect and repair” to “predict and prevent”.

- To remain relevant in the future, insurers first of all need to foster a transformation culture and customer excellence culture to position towards delivering value to customers and solving their real problems.

- Technology should be used to increase the value of service delivery, because technology is a means, not a target.

- Incumbent insurance should follow insurtechs in adopting an experience mindset and embracing opportunities from disruptive technologies—instead of viewing them as a threat—point the way to next-generation capabilities.

- Leveraging opportunities of digital technologies and developing appropriate contextual ecosystem strategies (embedded insurance) will enable insurers to make a larger impact on customers' daily lives.

- Digital becomes a huge part of the insurance experience, thus making UX design investment a key competitive advantage in the brand strategy.

Insurance Industry is Still at the Early Stage of Digitalisation

The insurance industry has been handling the Covid-19 crisis relatively well. As reported by the Allianz Global Insurance Report 2021, in 2020 global premium income fell by only 2.1%.

Some regions, especially Asia, will almost seamlessly have resumed their pre-crisis development as early as 2021. The recovery elsewhere will be much more uncertain. Western Europe will lag behind, but nevertheless still experience growth - with total premium income up by 1.2%.

Overall, 2021 was an opening shot for a strong decade. Globally, average growth of over 5% over the next 10 years appears possible, driven by higher risk awareness, the pivot to sustainability and the further rise of Emerging Markets.

Thanks to the current abundance of information, individual consumers are more aware of what is happening around them and the potential risks. Therefore, there has been a significant increase in demand for better insurance coverage, new products and socially responsible initiatives.

According to EY 2021 Global Insurance Outlook, disruption caused by the COVID-19 pandemic represents a huge opportunity for insurers to remake their purpose into meaningful action and create value for individuals and society.

Although the silver agers generation is considered the biggest customer group of insurance, the industry is increasing contact with the younger generations as growing interest in life, health and other insurance products can be observed among younger generations. The Allianz survey found that millennials and Gen-Z expressed more interest in increasing their insurance coverage than their elder peers.

Younger consumers are used to a clear and seamless digital experience - starting from social networking, music streaming and e-commerce services to challenger's mobile banking. Insurance customers are not an exception. However, the industry is struggling to address these expectations, since 60% of insurers admit the lack of customer experience strategy in their organization, as identified in a recent report from IBM Institute of Business Value.

While the insurance industry has been reacting to changes in behavior of economic agents by developing and offering some specific insurance products, it is still lagging behind in delivering those products to customers with the convenience and ease that mobile technologies can provide.

As McKinsey & Company points out, many insurers are modernizing their technology stacks but are at an early stage of the digitalization journey.

Top 5 Digital Insurance Customer Experience Trends 2022

1. Omnichannel Insurance Experience Becomes Standard

Due to the Covid-19 pandemic, customers are embracing digital interactions more than ever before and insurance is no exception. The main issue is that today's insurance customers tend to have a fragmented multichannel experience.

In practice, that means there are different isolated communication/service channels. For example, if a customer starts a claim submission process by phone call and then wants to finish it through the web Client Portal, he/she has to submit certain information again. The channels are not linked. Therefore, there is an increasing demand for more integrated and holistic experiences that provide a single, connected experience flow and information consistency across a combination of different channels, depending on customer's needs and preferences.

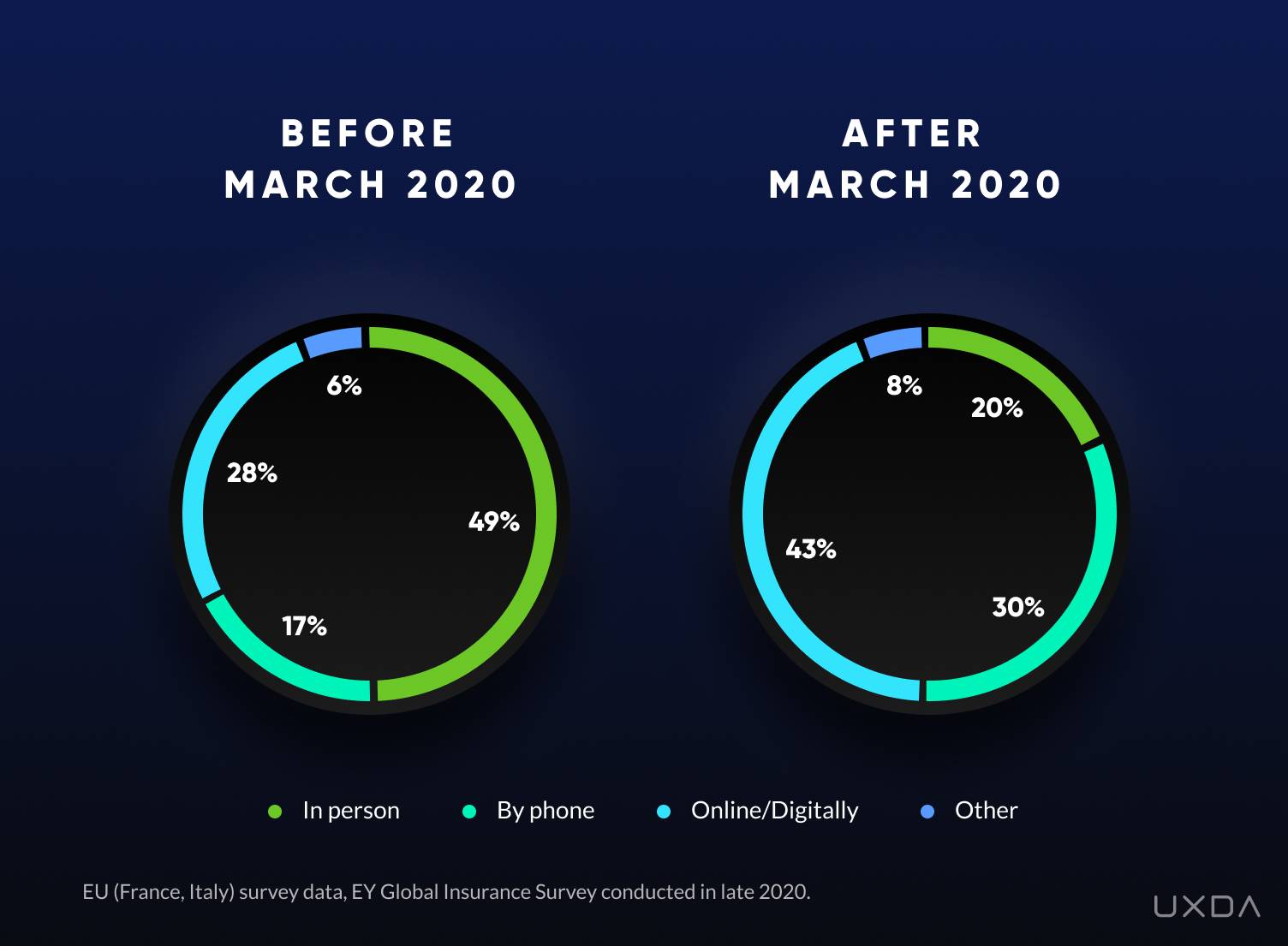

According to findings from the EY Global Insurance Consumer Survey, in times of COVID-19, in EU markets, only 28% of consumers used to favor digital contact with their agents before COVID-19, increasing to a whopping 43% during the pandemic.

Nevertheless, it is worth examining this phenomenon closer. We interviewed insurance users about their experience with insurance to get insights into their habits, behavior and struggles related to it. The interviews revealed that users prefer different types of channels for different tasks.

“[..] I would like to use more digital tools to manage insurance related tasks on my own, but at the same time I need to be able to contact a human being to discuss any questions or problems that I might have.”

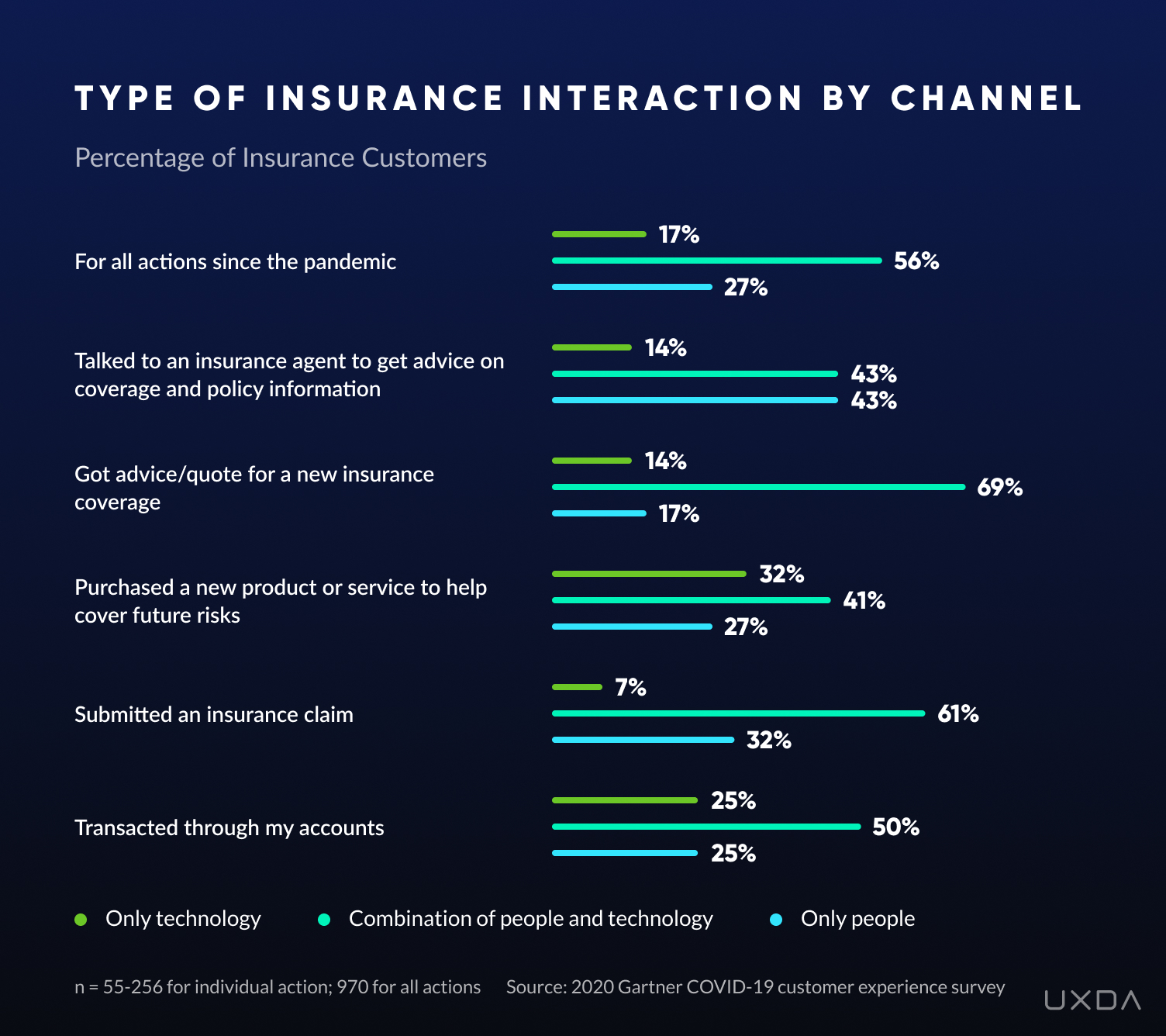

Users expect comprehensive digital tools, while at the same time they want to have an option to have human interaction, whenever needed. This is also confirmed by a Gartner Covid-19 customer experience survey which found that people and technology combinations were most often used for all transaction types.

Hybrid interactions will be predominant in the future. Insurers must address this by building a unified channel system taking into consideration customer-facing channels, as well as employee-facing channels to provide holistic customer experiences. This is important not only for onboarding tasks, such as getting advice or a quote for new coverage, but also for ongoing engagement and management of existing insurance policies.

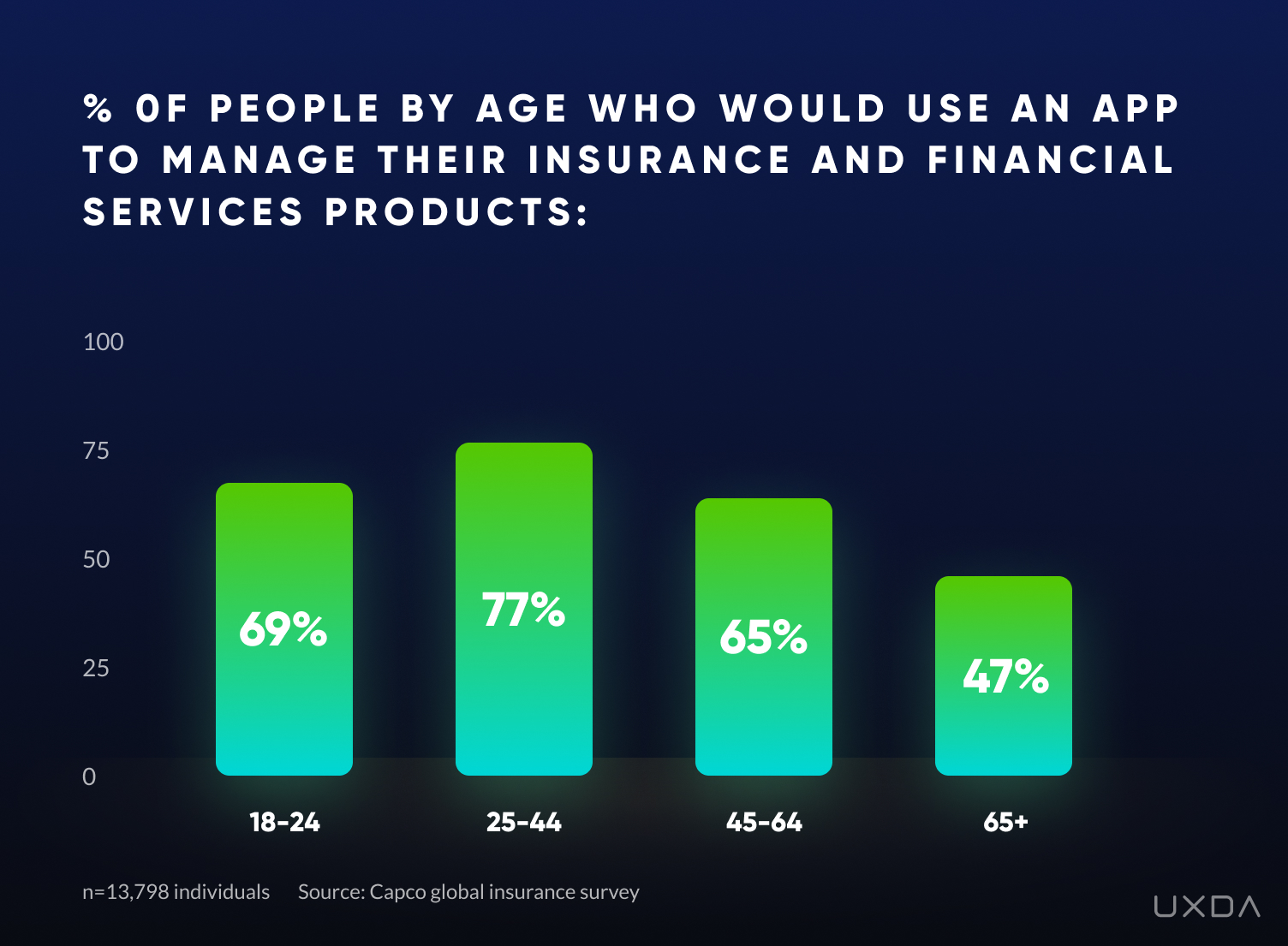

Less than half of insurance customers surveyed by Capco have multiple policies with the same provider. In the UK, which is a very mature insurance market, this figure falls to 24%. Consequently there is a relatively strong interest among customers to use a digital tool that gives better visibility of all financial products (bank accounts, pensions, insurance policies), in addition to receiving personalized insights.

As one of the digital insurance customer experience trends 2022 omnichannel might be a competitive differentiator for insurers today. However, in the near future, it will become a default requirement for insurers to remain relevant for customers.

2. Simplicity and Speed in Insurance Experience Become Key Benefits

In terms of customer experience, insurance is placed in an extremely sensitive area. This is because the key quality assessment by customers occurs at the moment of greatest emotional vulnerability and tension, when an accident occurs. The most common friction points are complicated contracts and poor claims experience. That's why many customers view their insurance experience in a rather bad light.

According to EY 2021 Global Insurance Outlook, customers report lack of understanding, confidence and trust in insurance. Sixty three percent of customers do not understand the extent of their life insurance coverage and 50% are not confident that they will receive benefits consistent with their coverage. This is also reflected by a widespread perception that insurers often try to find different pretexts and arguments to avoid paying insurance indemnity, instead of actually serving their customers. Such unethical practice definitely is a recipe for CX disaster.

Tasks in the onboarding stage, in particular, represent an opportunity to improve the insurance customer experience and ensure better clarity for customers and confidence in insurance. For instance, as customers still value human interactions, remote video-call consultations with a human can make a difference, even if it is not in-person. Innovations in this stage of customer experience will be especially relevant in markets that rely heavily on brokers and agents, such as Belgium.

During our user interviews, insurance customers indicated that one of the most frustrating and time consuming aspects of their experience is whether insurers heavily rely on physical paperwork processes.

“My mailbox explodes from the amount of documents I receive from some of the insurers. Even if I extend the coverage period of an existing policy, they still send paper documents and I have to spend hours to review if the conditions haven't been changed. And then, of course, send back the documents by mail. It is hell!”

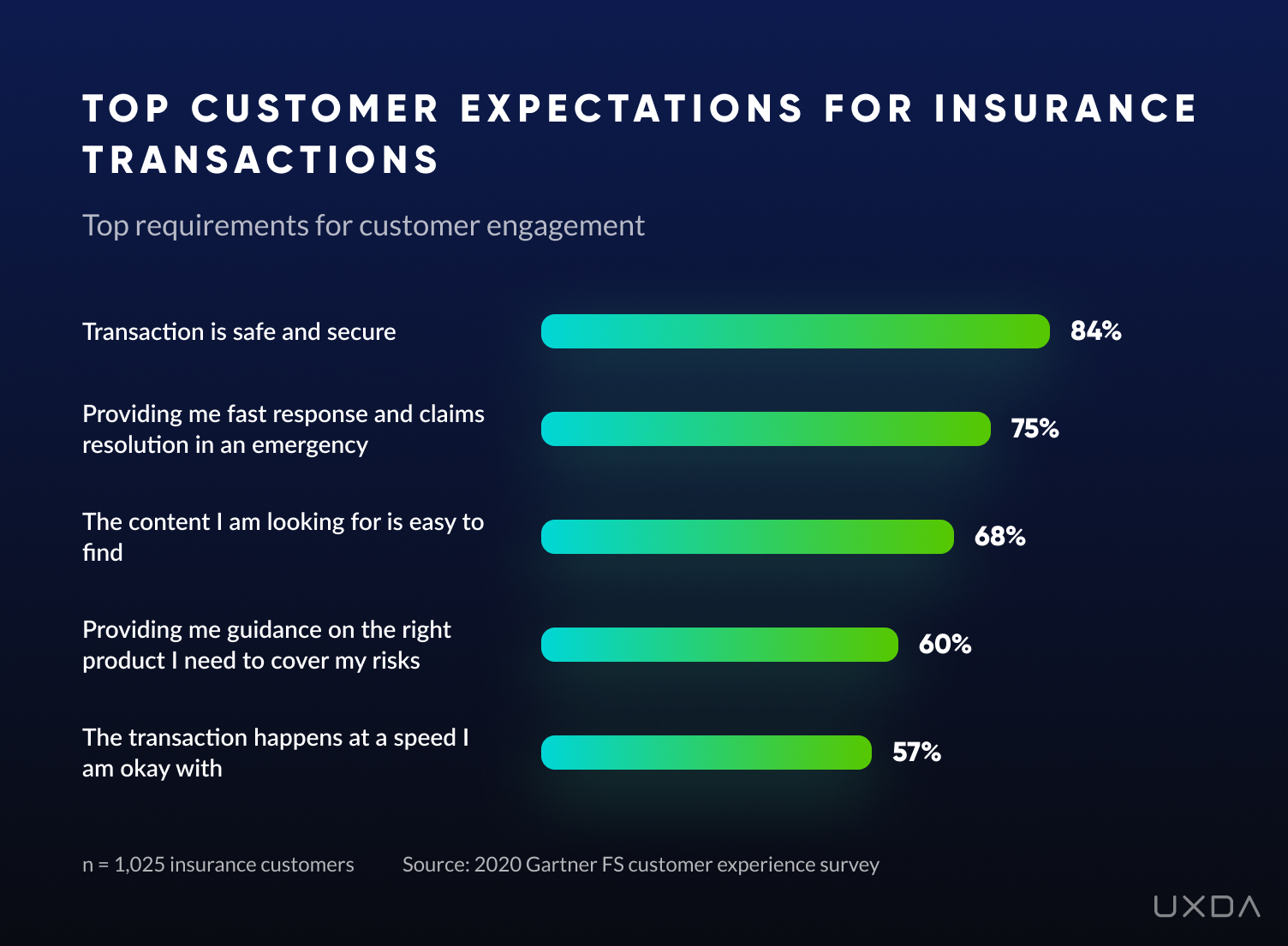

Customers seeking simplicity are switching to insurers that eliminate frictions and save time. The 2020 Gartner FS Customer Experience Survey found that two out of top five insurance customer requirements are related to speed:

To keep up with customers' speed requirement, insurers will need to integrate digital channels with back-end systems, automate manual steps and upgrade third-party processes to ensure faster digital processing. The importance of simplicity and speed will only increase as digital behavior grows and consumer expectations, shaped by digital services from different industries, rise.

A good example is insurtech company Lemonade, that created what they call 'Policy 2.0' - a radically simplified, modernized, and digitized insurance policy. This makes it easier for their customers to understand terms and conditions of their policies. Furthermore, they promise a hassle-free claim submission process and world record worthy instant payments - three seconds.

3. Customers Demand Embedded Insurance Experience

Insurance is something that most individual customers don't use on a daily basis (most of them actually hope they will not need to use it at all). However, when they do use it, "insurance interactions are almost as likely to produce a negative outcome as a positive one” as found by Gartner research:

- 42% resulted in a positive outcome (increasing business with the provider)

- 41% resulted in a negative outcome (decreasing business with the provider)

- 17% were passive (no action taken)

This affirms why so many users describe their relationship with insurers as a love-hate relationship. To make it a more-love-less-hate relationship and drive loyalty, insurers will need to create new touch points and find meaningful ways to engage more with customers, by adding value to the relationship through proactive, personalized and contextualized experiences, thus providing a positive impact.

Creating new touch points to engage with customers entails expansion beyond corporate walls and reinventing business models beyond insurance to build an embedded customer experience of the future.

Embedded insurance can be bought where there are customers and from brands they trust. It can become a feature of the product, rather than something that is purchased separately. According to PYMNTS.COM research of 3,551 U.S. consumers, 70% of digital bank customers would be highly interested in at least one type of bank-embedded offer based on their transactions history.

Insurance will become more present in consumers' everyday lives, due to the reach of technology empowered ecosystems in which companies collaborate to offer different complementary services in mutually beneficial ways. This includes win-win partnerships for insurtechs, insurers, non-insurers and, ultimately, for consumers. For example, Tesla already includes car insurance when customers purchase it.

Insurers can either be one of many participants in such an ecosystem or be an orchestrator of it. The latter is a much more difficult role to take on but also presents a greater opportunity to make a larger impact on experiences that consumers encounter on a daily basis. This role entails a thorough rethinking of insurance business and redesigning the customer experience away from a product logic toward a holistic service approach. Good partnership management is critical for ecosystem business.

Delivering a customer experience that encompasses not only insurance related aspects but also other daily life aspects, with an aim of making users feel safe and taken care of, results in an untapped potential for growth.

Accenture found out that 84% of insurers identify ecosystems as an important part of their strategies, while only 5% have what is needed to run an ecosystem-dependent business.

The Three Main Shortfalls are:

- lack of appropriate ecosystem strategies;

- scarcity of the specific interdisciplinary skills and lack of necessary organizational structures and cultures;

- insufficient technology architectures.

Providing an embedded insurance experience largely depends on the ability to gather and analyze data for useful insights. Technology-intensive ecosystems can be a great source of diverse data points, especially because the potential of creatively developed ecosystems present opportunities for insurers to pair omnichannel networks with customer intelligence, analytics, IoT, AI, AR, blockchain and other emerging technologies.

This allows them to create more personalized and dynamic customer engagements. This includes interaction with customers at the right time and with the right message, hyper-personalized offers, personalized support at risk mitigation, proactive servicing, event-based processing, decision automation, etc.

4. Digitalization Will Improve CX in an Underserved SMEs Category

Just like individual customers, commercial insurance customers have been affected by the Covid-19 pandemic. There has been a surge in products, such as insurance against business interruption, coverage of business expenses in case of forced closure, protection against liability incurred from employees and consumers catching a disease in their place of business.

Historically, commercial insurers have focused on serving retail and large corporate customers because of greater premiums, as reported by Insurtech Insights. This has left SMEs (small and medium-sized enterprises) under-served, despite the fact that they comprise the vast majority of businesses in the UK, Europe and North America.

As Renuka Sridhar, General Manager of Insurance at Wipro has pointed out “small commercial insurance customers, usually a subset of the personal lines insurance consumer class, expect the same digital experiences from their insurance providers that they receive from personal lines insurance companies”.

Digital channels earned high marks for 24/7 availability, ease of updating information for insurers, and search capabilities. However, only 32% of insurance executives say digital channels are effective in securing sales because they lack personalized advice capabilities, according to Capgemini World Insurance Report 2021.

Insurance customers who are looking for sophisticated and customized products, are waiting for detailed personalized advice from brokers, which is a major challenge for the digital development of insurance. At the moment, SMEs did not see an appreciable difference in the convenience offered by agents and brokers, digital channels or direct channels.

Given the developments of data analytics and automation, in the future insurers will be able to serve SMEs more profitably compared to today and offer SMEs a similar experience as that of personal line insurance. The role of agents and brokers will grow into dealing with complex and specialized cases.

However, to accommodate this change of role of agents and brokers, insurers will need to extensively upgrade their back-office tools to increase the efficiency and user experience of their teams. As reported by Capgemini World Insurance Report 2021, agents and brokers want to ramp up their digital engagement capabilities, and about 44% said they need support from their insurers.

5. Digitalization Increases the Role of Customer-Centred Design

Global digitalization and pandemics drive significant changes in customer behavior. The development of the digital ecosystems lowers the threshold of entry and leads to the emergence of new players and increased competition on the market. The ability to provide customers with the greatest value becomes the main competitive advantage.

McKinsey & Company analysis of 2000 global insurtechs reveals “rapid growth, evolving product focus, and a growing crop of innovative opportunities”. The strongest insurtech presence has been felt in marketing and distribution. Increasing innovation is also evident in operational aspects, such as policy servicing (especially in life), claims (especially in auto), and back-office functions and operations (especially in health).

In terms of product categories, 66% of insurtechs operate within P&C lines of business (led by auto insurance), while 18% and 16% focus on health insurance and life insurance, respectively. Around 47% of insurtechs launched between 2000 and 2020 focused on personal lines, with the number that operate in commercial lines increasing in recent years. Insurtech companies design digital products with the consumer at the center, providing industry disruptive service.

It requires having empathy for what customers are going through when they are interacting with an insurance company. There are two key touchpoints in the insurance customer journey - purchase experience and claims experience.

When buying insurance, customers are increasingly looking for personalized and customized solutions.

Sixty nine percent of consumers would share significant data on their health, exercise and driving habits, in exchange for lower prices from their insurers, and 66% would also share significant data for personalized services to prevent injury and loss, as reported by Accenture's global Insurance Consumer Study.

Besides personalized coverage plans, more important is that customers want to feel the insurer understands their pains and concerns, that they can rely on their insurer as a trustworthy partner and that the insurer will be there for them to help overcome problems in case of an accident. In other words, customers expect empathy and human-touch from their insurance providers.

That leads to the second occasion when people contact insurers - claims experience - which is one of the most important, if not the most important touchpoint in the insurance customer journey. This is because it is often related to emotionally charged unfortunate or tragic accidents. At these moments, customers are especially sensitive to how they are treated, how their requests are handled, what they have to put up with and consequently form most of their opinion about the insurer.

Digital product interfaces have become an important determinant of customer experience.

Only when insurers empathically recognize specifics of different customer touch points and address them, is it possible to design an intuitive and caring customer experience for their users. The best way to achieve that empathy level is through insurance UX research and using findings of it to design and build a customer-centric insurance UX / CX.

It is important not to underestimate the significance of customer-centricity, as customer experience is starting to overtake price and product as brand advantages. The Capgemini report shows that 8 in 10 consumers are willing to pay more for a better customer experience. Good service often leads to repeated purchases and recommendations to friends and family.

Insights From Best Insurtech Companies to Implement Customer Experience Trends in Insurance

Clark

Personal digital insurance broker that stores all insurances in one place (irrespective of provider).

- Not in the service of a single insurance company, but in the service of customers.

- Support with claim submission to respective insurers.

- Provides personal consultations with insurance professionals.

- Requires power of attorney from customers to represent them.

Lemonade

Digital-only insurer with web and mobile platform.

- Chatbot-powered conversational policy purchase process.

- Renters insurance.

- Car insurance based on driving habits.

- Accepted by a major mortgage lender.

- Helps to easily switch from other insurers to Lemonade.

- AI claim review and instant payment (for simple cases).

- Donates unclaimed premiums to causes chosen by users.

Metromile

Leading pay-per-mile car insurance in the US (acquired by Lemonade in Nov, 2021).

- Rate is based on the user's driving habits.

- Uses a telematics device that plugs into the car's diagnostics port, as well as driver’s mobile phone to get data on car usage.

- AI assisted claim review system.

- Access to a nearby repair shop, rentals and everything you need to get back on the road in case of accident.

So-sure

Phone and home content insurance management (with plans to add other insurance products).

- AI driven object recognition allows users to take a snapshot of objects, receive insurance estimates within seconds and get insured.

- Engages customers by making insurance social and offering payback.

Luko

Digital home and real estate insurance app offering prevention, comprehensive coverage, maintenance and repair.

- Damage assessment by expert through video call.

- Access to free services to fix damages and network of certified artisans to get advice through video calls to help with minor repairs.

- Partnership with Netatmo smart home devices and offers a discount to insurance, if security solutions are used.

- Donates unclaimed premiums to causes chosen by users.

Beam Dental

Digital-first, preventive-focused dental insurance.

- Electric brush connects to an app to help track and improve brushing habits.

- Gamified teeth care turns good brushing habits into rewards and savings.

- Nearby dentist search.

Vitality

World’s largest behavioral platform linked to financial services that encourages behavior-change to make people healthier.

- Positive effects on insurers and society by addressing 3 key areas – nutrition, physical activity and preventive screening.

- The platform includes a network of the largest insurance companies.

- Tailored health insurance solutions, based on individual risk factors and preferences.

- Rewards for engagement with the program.

- Access to a network of providers of services.

Alan

Digital health insurance super-app offering personalised healthcare and wellbeing (B2B2C).

- Modular insurance builder - small companies can subscribe in a few clicks; big companies can tweak every single parameter to build the right insurance package for them.

- A complete interface to manage health insurance both for employers and employees.

- See nearby doctors and their average fee, book appointments, chat and video consultations with a doctor, get a free meditation app subscription, and others.

Thimble

On-demand business insurance platform made to serve small businesses, self-employed and freelancers.

- Buy a policy online, in the app, or over the phone in minutes.

- Coverage by hours, days, months or years.

- Flexible payment options.

- Possible to modify, pause, or cancel policy instantly.

- No direct claim handling process, since they are handled by underwriting partners.

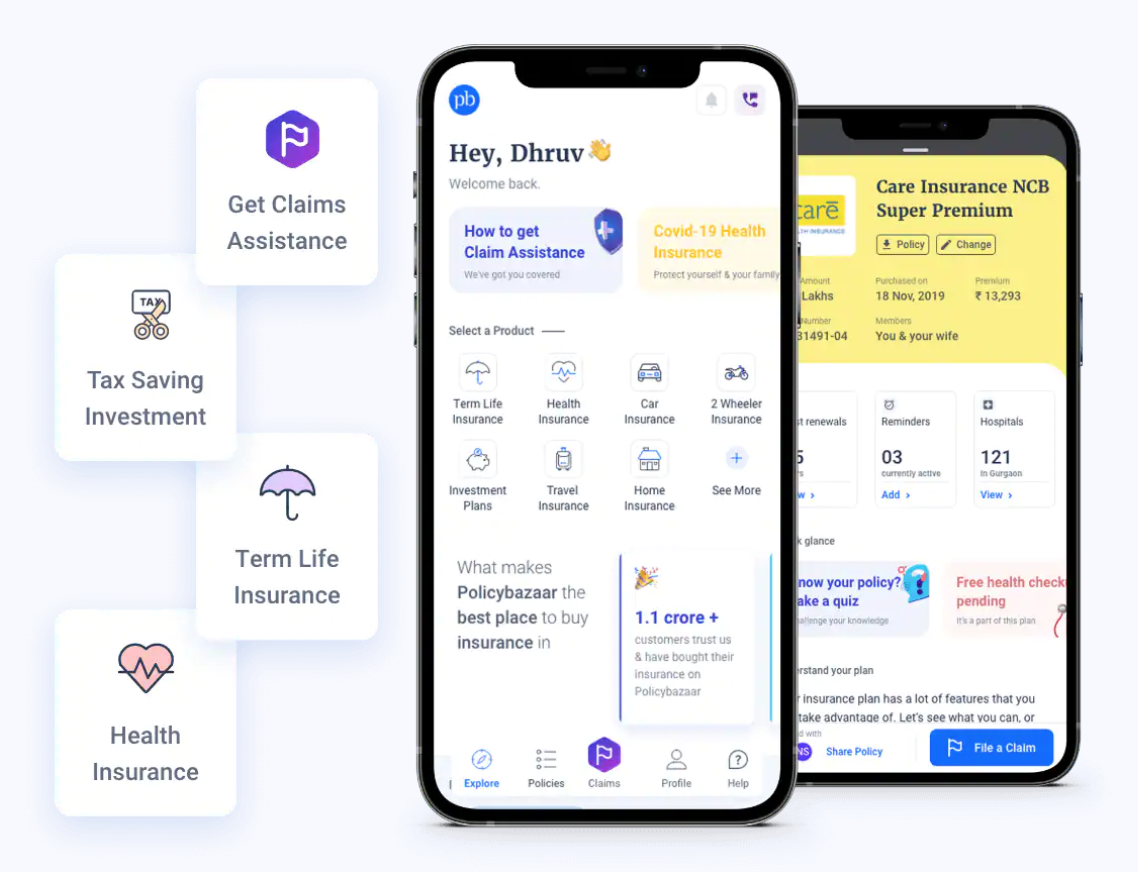

Policybazaar

Personal digital insurance broker. India’s largest insurance comparison app (web and mobile) allows users to buy, store, share and track all insurance policies online.

- Claim assistance - step-by-step information for each provider.

- Hospital locator and cashless partner garage locator.

- Gamifying insurance education.

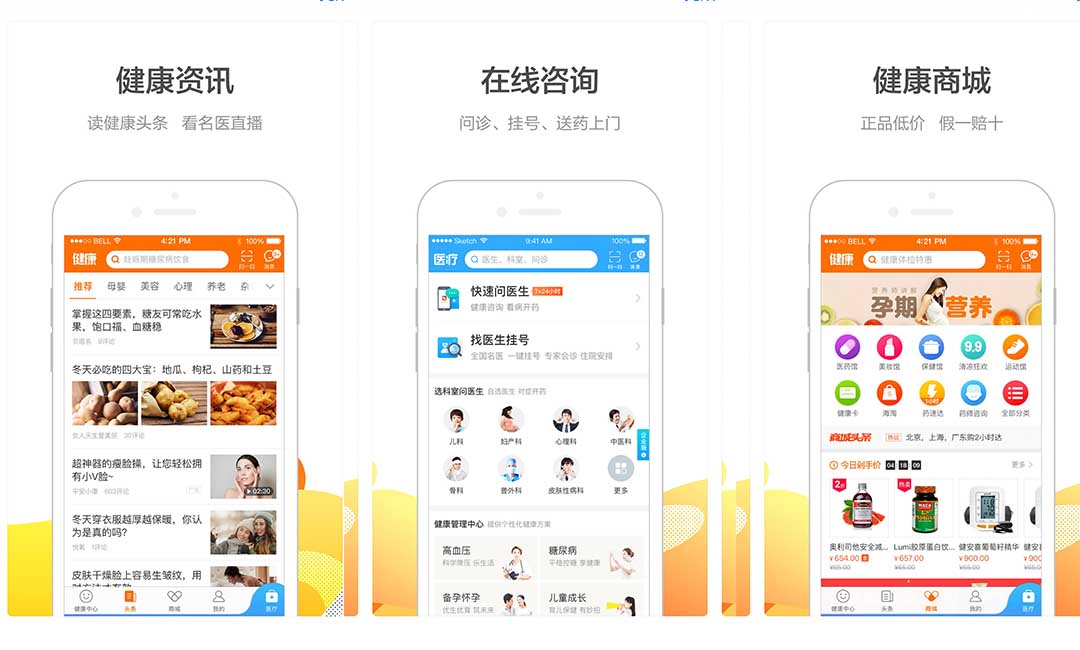

Ping An

Looking beyond insurance, and developing comprehensive technology and finance ecosystems. Serves online and offline retail customers through several spin-off companies.

- A comprehensive healthcare ecosystem that includes government, patients, medical service providers, social and commercial health insurers and technology.

- Generates strategic synergies of health care services that can be provided efficiently and tailored for different segments.

- Provides each segment with relevant smart tools for enhanced operations.

How to Build a Successful Human-Centred Insurance Experience

There are several key steps that insurance companies can take to build a successful human-centred insurance experience. One important step is to clearly define and understand the needs, preferences, and expectations of the target customers, and to design products and services that meet those needs in a simple and convenient way. This can involve conducting research and gathering feedback from customers, as well as collaborating with other stakeholders such as brokers and agents.

Another key step is to provide a seamless and intuitive purchasing experience, using digital tools and platforms to make it easy for customers to find, compare, and purchase insurance products, or even better, provide an embedded insurance service. Third, insurance companies should focus on providing high-quality customer support and service, with responsive and knowledgeable teams available to care about customers in case of insurance claim.

The insurance industry as a whole is facing a challenging customer experience task - to change the widespread negative perception about it.

In order to win the hearts and loyalty of digital customers and remain relevant in the future, insurers must first foster a transformation culture and customer excellence culture to position towards delivering value to customers and solving their real problems.

This will allow them to evolve from “detect and repair” to “predict and prevent”. It also implies making use of possibilities that emerging technologies bring. However it is not possible to overemphasize that technology itself is not a goal, it is only a tool to increase the value of human-centered product delivery.

Developing or participating in embedded insurance ecosystems will prove to be an effective way for insurers to stand out with their products, not only by providing great customer experience but also by evoking the feeling that their products and services help customers to live their best life every day.

There are many different insurance products that are available. It is crucial to understand the peculiarities and details of the insurance customer journey for each particular product, when embarking on the quest to humanize insurance.

This involves upgrading service channels, tackling legacy systems, leaving behind inefficient processes, changing company culture and shifting mindsets. For many incumbent insurers, it might mean tearing apart everything or at least seriously and thoroughly reconsidering the way things are done before starting to build a holistic insurance customer experience from scratch. It can be scary, but it has tremendous potential. If you look at it that way, it becomes liberating.

The main idea that insurtechs embrace is to leverage technology but remain “human,” by offering greater customer-centricity thus driving better outcomes. Some of the technologies and approaches that can be seen in different insurtech companies and will develop more in the future are:

- AI and automation for predictive analytics and proactiveness - faster claims, policy administration and risk assessment.

- Use of IoT to obtain data, prevent losses, reduce risk and offer better rates.

- Subscription-based models.

- Hyper-personalized products.

- Mainstreaming blockchain for smart contracts.

- Omnichannel distribution and embedded insurance.

- Mobile apps become the main point of contact between both parties for any transaction.

- Video call consultations with AR enabled features.

- Peer-2-peer or social insurance.

Incumbent insurers find it extremely difficult to adopt new technology, synchronize work of different teams towards digital age requirements and shift their corporate culture to an experience mindset. Therefore, incumbent insurers are partnering with insurtechs to gain access to relatively faster technology adoption by agile teams. Some incumbents are even starting their own tech divisions in the form of incubators or tech focused R&D entities, such as Munich Re’s Innovation LAB.

Relationships between insurtechs and incumbent insurers can be described as both - foes and friends. It all depends on the mindsets of the companies. The truth is that, in most cases, neither of them can have a successful and fruitful growth without partnering with the other party. Insurtechs often don't have capacity to underwrite all the risks, so they need to be backed up by any of the large, incumbent insurance companies.

Such partnerships are excellent soil for building contextual ecosystems that reinvent business models beyond insurance and will create an everyday customer experience in the insurance industry of the future.

Get UXDA Research-Based White Paper "How to Win the Hearts of Digital Customers":

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedin