As Bill Gates said, “Banking is necessary, banks are not.” And that's true. Digital financial technology are all about improving the lives of the users and Fintech disruption in the banking industry already happens. Let's find out how it started and what banks can do.

How and Why Did the Fintech Disruption in Banking Start?

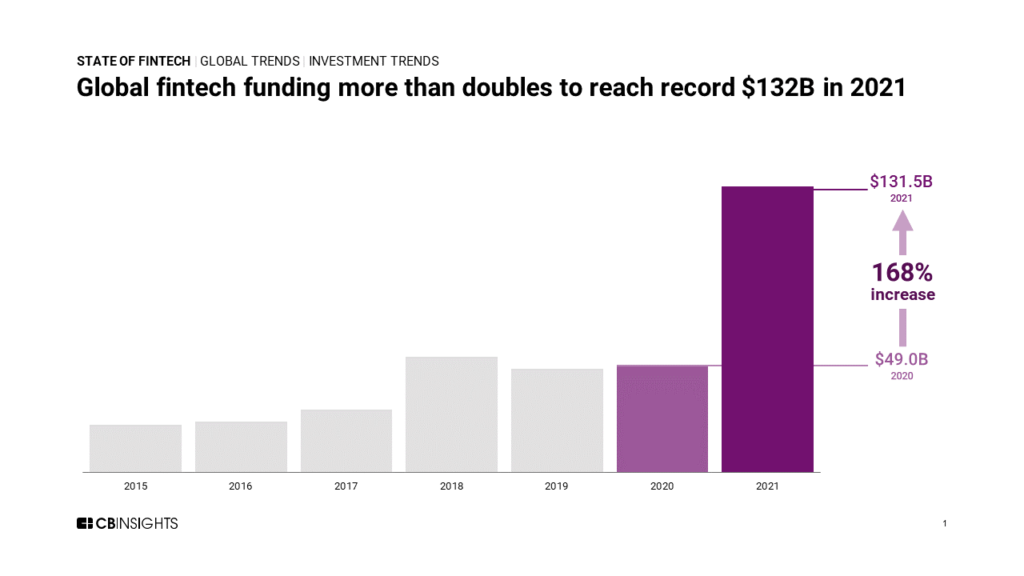

In 2021, global fintech funding reached $132 billion USD according to CB Insights.

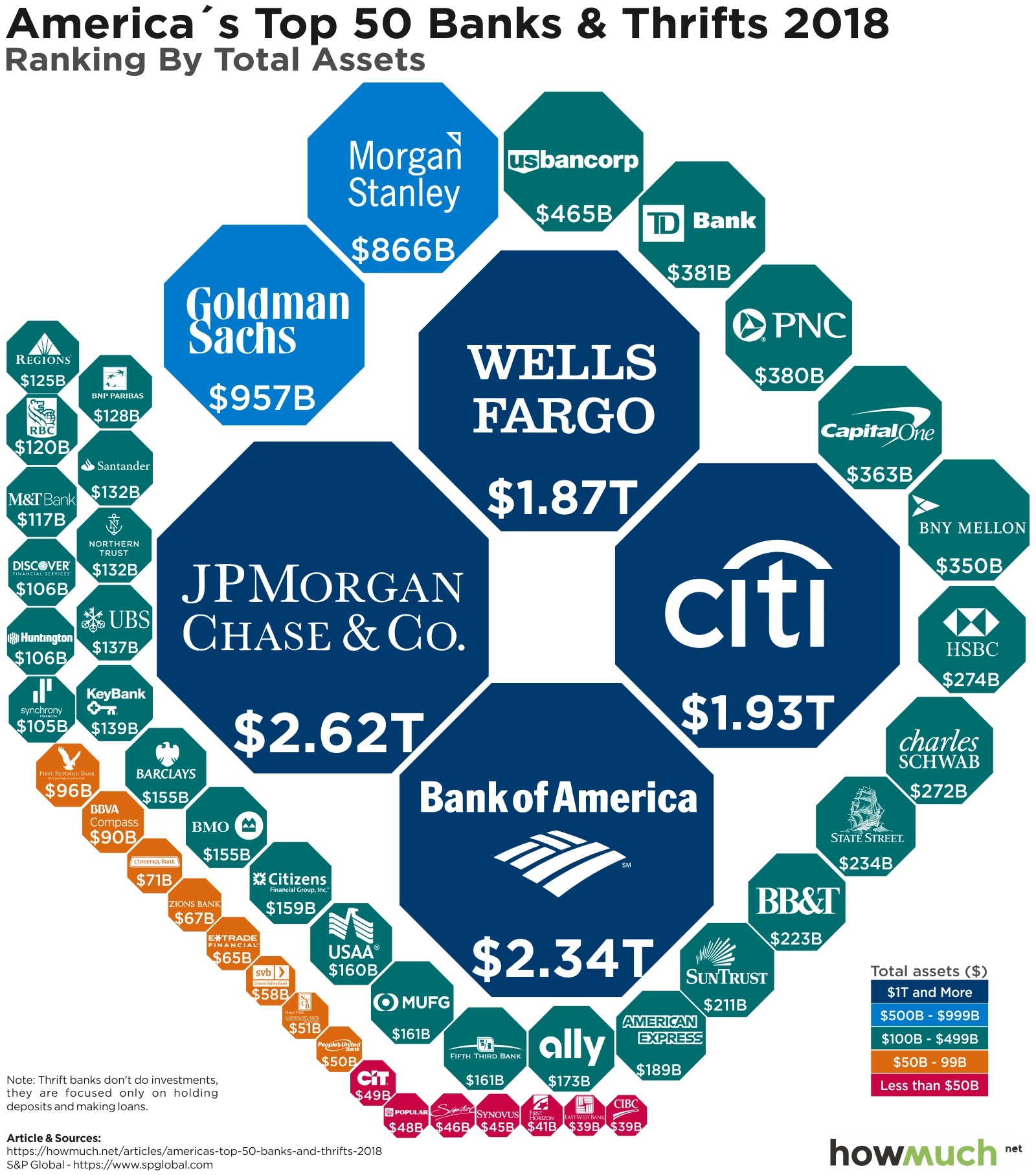

From the first sight, with the biggest banks controlling nearly $17 trillion in assets, $132 billion of Fintech industry looks like peanuts.

We have to consider that retail banks spend $30 billion annually on digital transformation, which is not so impressive compared to Fintech’s $132 billion.

It's self evident that the Fintech disruption in banking industry is in full swing and this trend is growing stronger and entering all the financial sectors. Traditional banks and financial sectors have been playing catch-up with very little change over the past 20 years. Bank managers are hesitant to embrace change and new technologies into the banking industry. Some may disagree, saying that banks have come a long way over the years, but, in reality, all improvements were made in favor of a banking profit and not the customers.

Traditional banks and financial sectors have been playing catch-up with very little change over the past 20 years. Bank managers are hesitant to embrace change and new technologies into the banking industry. Some may disagree, saying that banks have come a long way over the years, but, in reality, all improvements were made in favor of a banking profit and not the customers.

UXDA Matrix to establish customer-centered business

Online banking has reduced the need for regular visits to bank branches. This has changed how we perceive banking services but not the banking model itself.

Online banking probably wouldn’t happen if accountants didn’t notice that the costs of maintaining an online banking system are much less than that of the branches.

Transitioning to online was a strategic and beneficial move for banks. Unfortunately, just because you are on the web doesn’t mean you nail it. On the other hand, Fintechs secure the clients better than any bank with a suitable and efficient online strategy.

First of all, the Fintech disruption in banking started during the last financial crisis in 2008. Previous finance sector employees who lost their jobs weren't ready to give up on finance. They teamed up with IT professionals and started creating Fintech startups that were solving people’s problems instead of banking problems.

Due to the economic crisis, the trust in traditional banks was damaged, and everyone was eager to save and manage their money. This was a huge opportunity for the digital industry, and new user-centered financial services started booming.

Secondly, we are living in the digital age, which opened up countless opportunities for the financial industry. If you look at 2022 most valuable brands, you will see five tech giants. The digital age requires an absolutely new approach and mindset─one that's 100% user-centered.

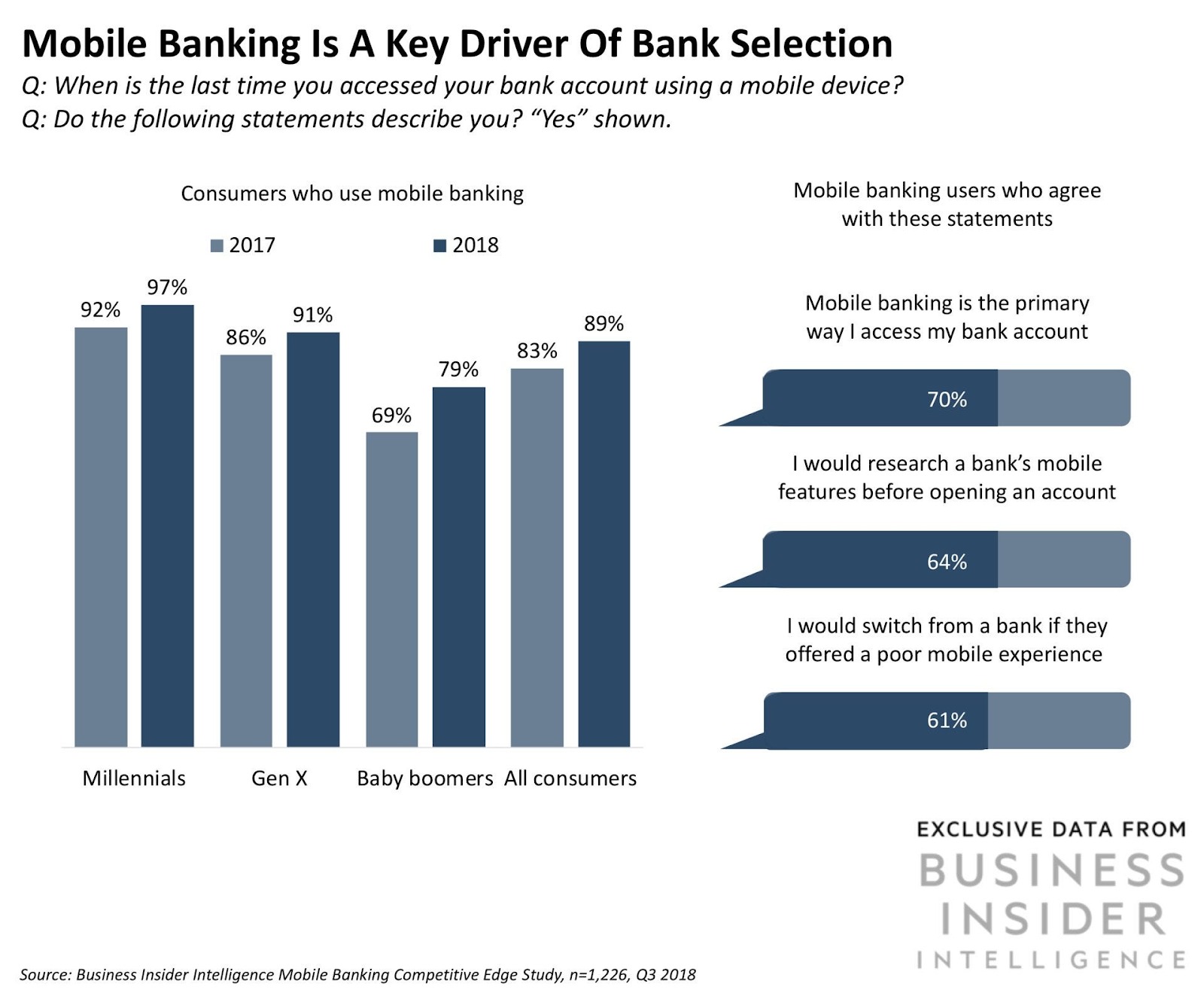

Mobile banking eliminates market entry barriers, which creates a demand for financial services regardless of location. Today, 89% of all consumers use mobile banking, according to a Business Insider Intelligence study, and Fintech is providing a solution to banking customers, enabling them to compete with the “big” banks.

How Fintech Won Over Their Customers

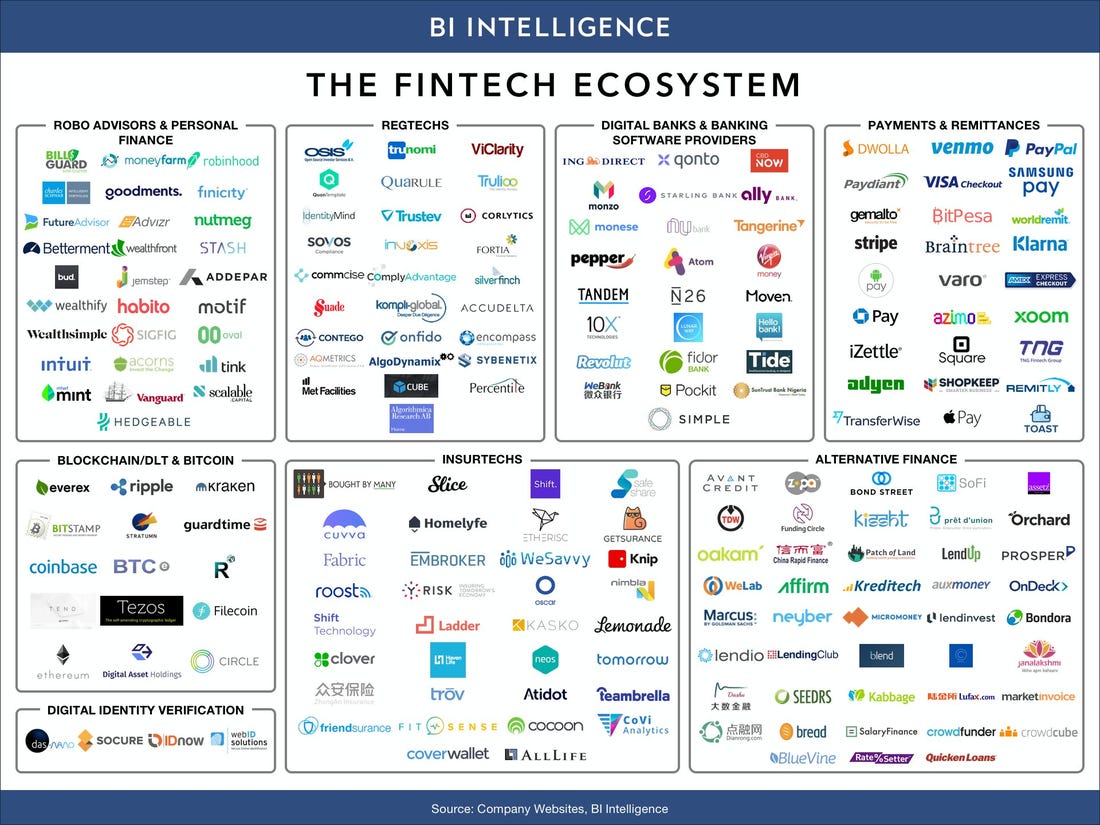

The Fintech disruption in banking brought us better finance management tools, mobile payments, crowdfunding, fast loans, peer-to-peer lending, and even Insurtech solutions (Insurance technology). All of this was done by brilliant minds that came together, understood the significance of Design thinking and created services in an environment where banks struggled. Fintech innovators understand the real struggle customers face when they have to perform banking services.

Fintech startups understand that splitting banking services and mastering at least one of them will grant them recognition and maximum customer satisfaction. This is where banks have failed with their online services. There are so many that are overly complex and extremely confusing comparing with friendly Fintech and Insurtech UI design. Some Fintechs and Insurtechs have a design vision that traditional financial institutions lack, and that vision is about delightful user experience.

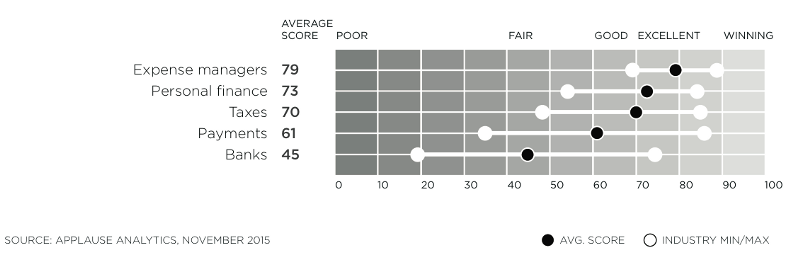

App quality index score of the nearly 6,500 finance apps in Google Play and Apple App Store by industries, as rated by their U.S. customers

Fintech and Insurtech owners see digital service through the eyes of the customers. They choose to be all about the customer and create digital products they would want to use themselves. Using the principles of Dopamine Design, they integrate aesthetics and usability into their products, strengthening the emotional connection with users. We call this approach Dopamine Banking.

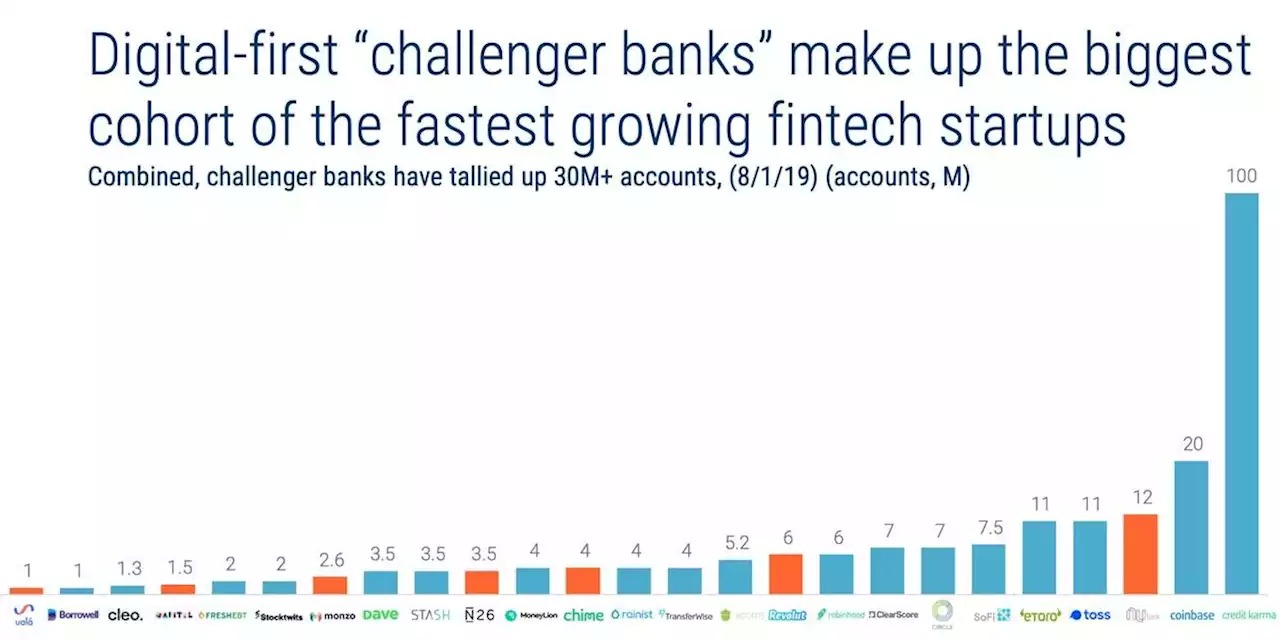

Banks, on the other hand, focus on better loans, fees and branch locations, but users value comfort, accessibility and simplicity. This is how crowdfunding and fast loans became so popular. It is easier to start a Kickstarter campaign and receive the necessary product funding than go to a bank branch and ask for a loan. The same scenario happens with digital-only neobanks, which have secured millions of customers in a few recent years.

More and more customers are choosing Fintech products, and banks are losing customers. It’s because such banks believe they already have well-composed products, so why would they need to change anything?

The same thing has happened with fast loans, personal finance management tools and Insurtech services. Almost all online banking services have personal finance management tools, but have you found them or even tried to use them? Probably not since you didn’t even know they existed, and, even if you tried to use them, you would probably stop because of their complexity. Then there is the Mint success story about how a simply perfect Fintech design helped build a personal finance management tool. Mint does only what's needed in a simple, beautiful and pleasant way.

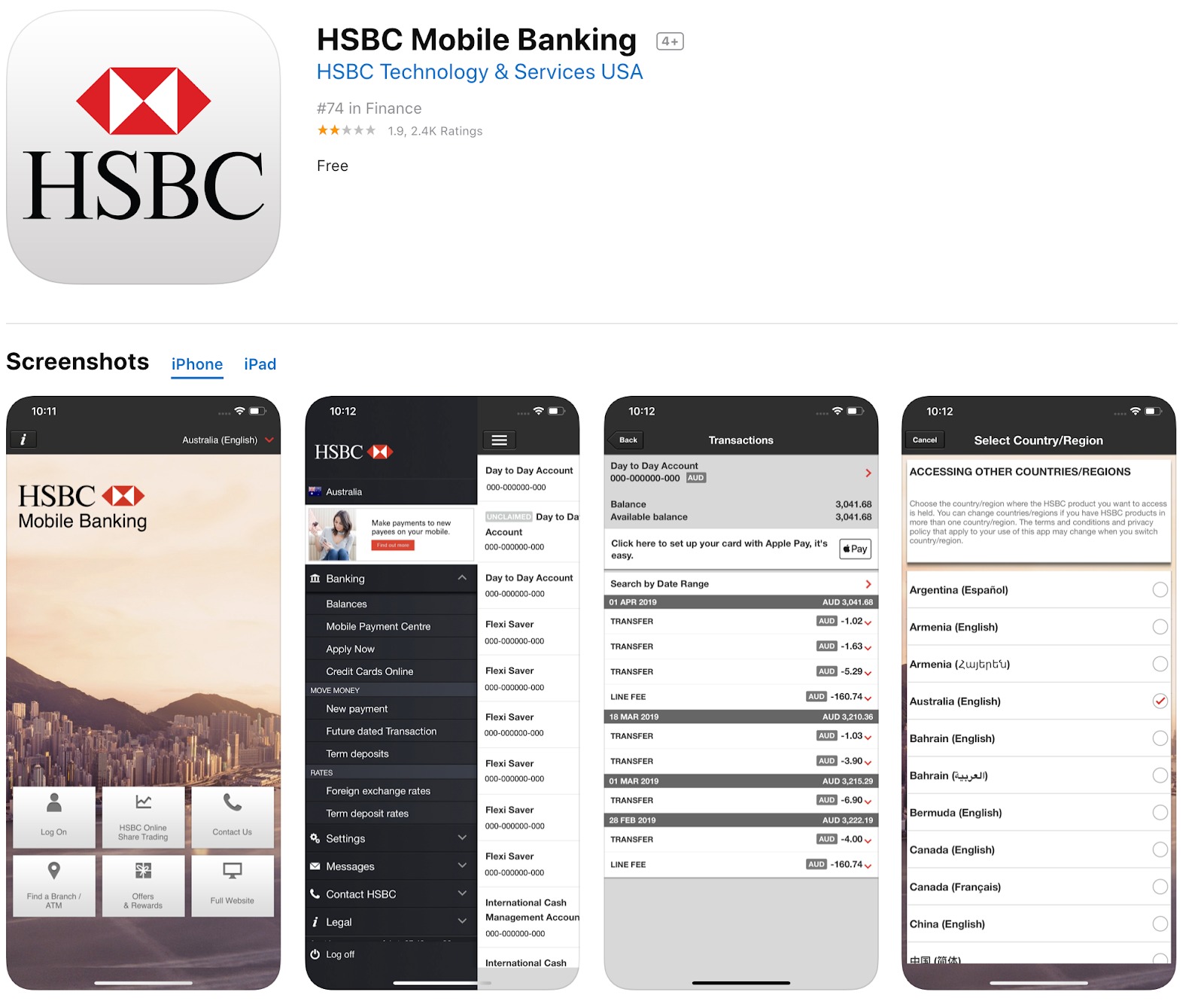

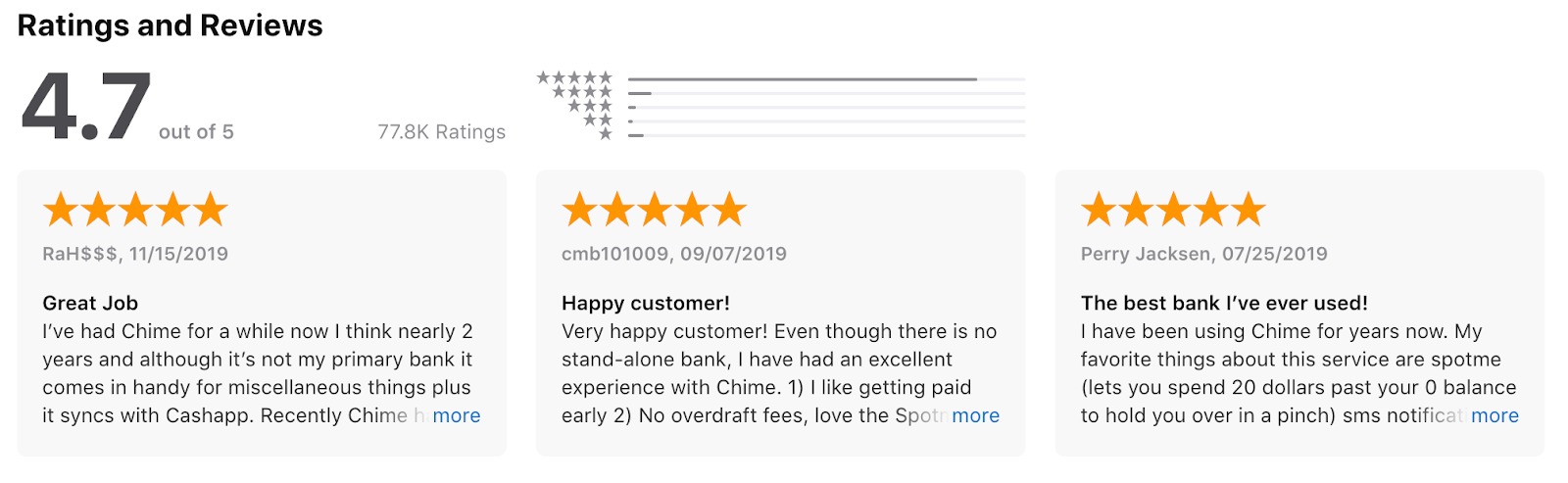

All we need is to open the App Store to find out how digital customers compare traditional banks with digital-only ones.

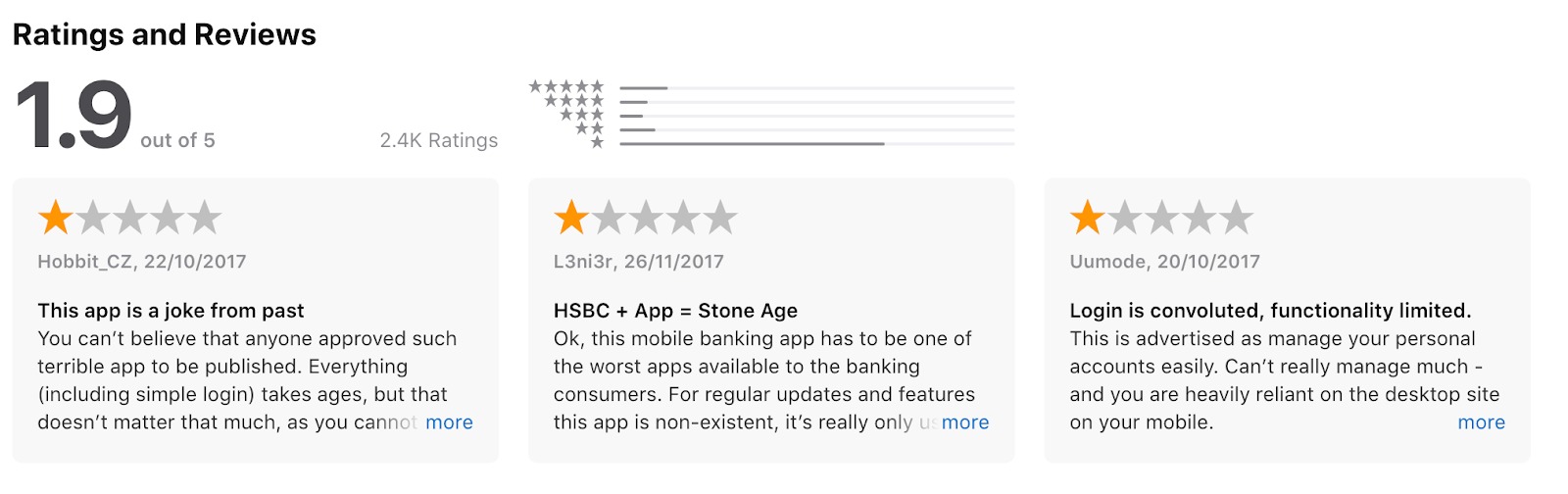

HSBC Ratings and Reviews:

Chime app Ratings and Reviews:

In recent years, we’ve seen a revolutionary shift in the activity of banking users. Ninety-one percent of users prefer mobile banking over going to a branch, according to Citi Mobile Banking Study. Capgemini research shows that 68% of consumers say they are currently using a checking or savings account from a challenger bank or are likely to in the next three years. The three main reasons to switch to Fintech services are lower costs (70% of respondents), ease of use (68%) and faster service (54%).

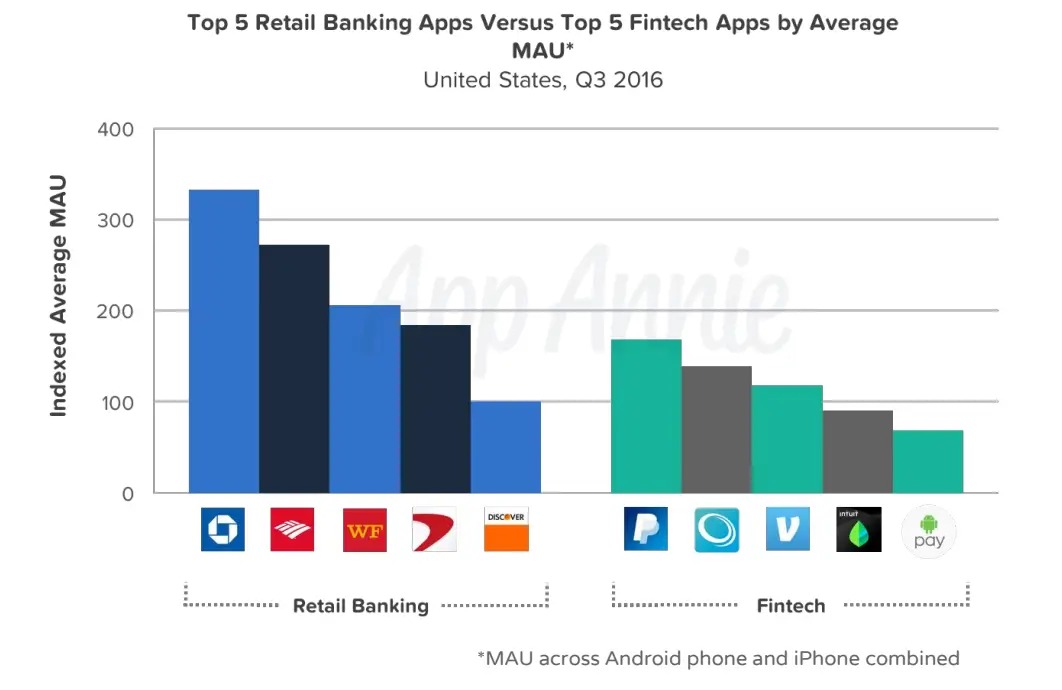

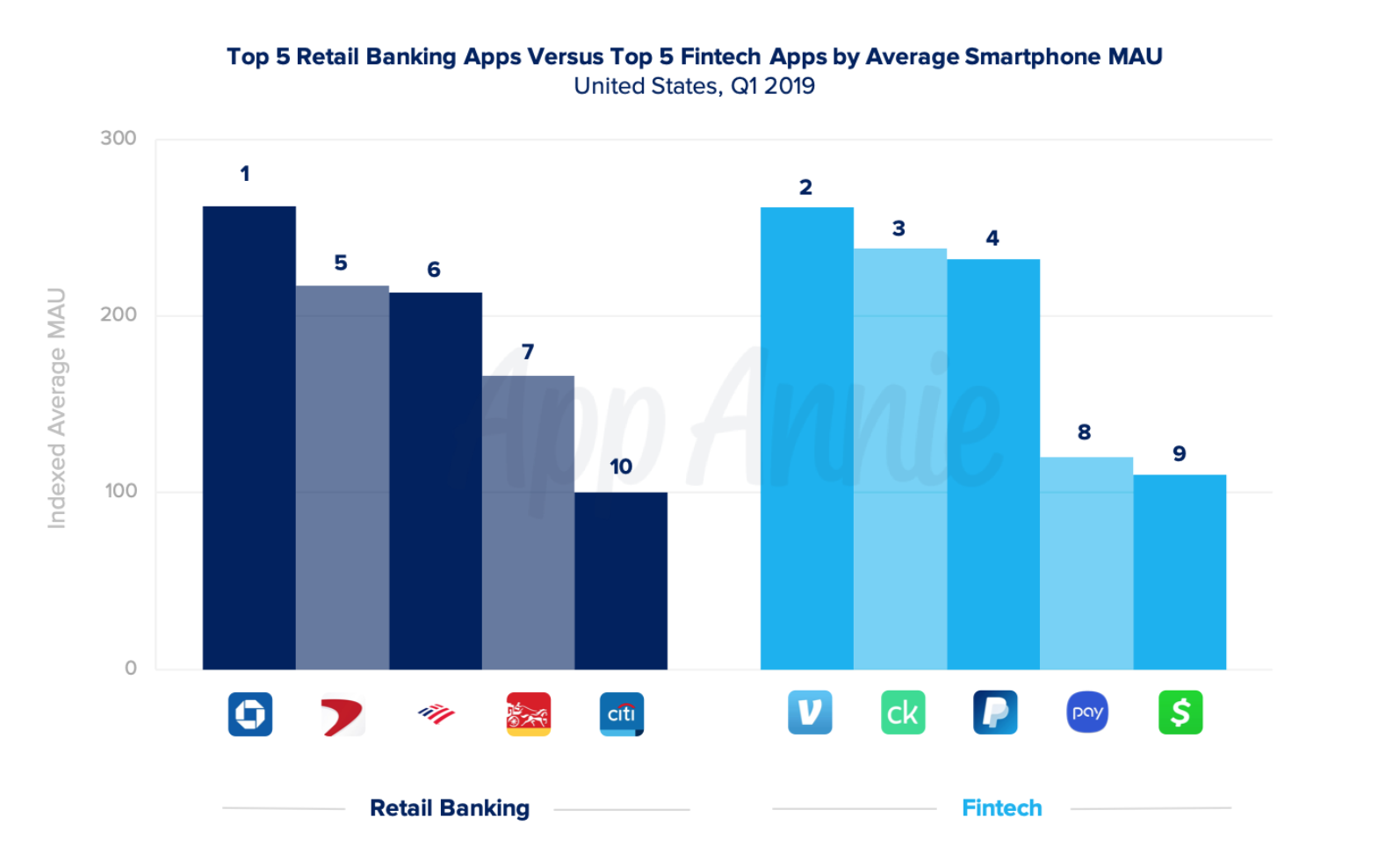

All of the aforementioned statistics show that Fintech design and UX (user experience) helps to disrupt traditional banking. If we compare the Monthly Users Activity (MUA) rate in top banking and Fintech apps, we will see drastic changes between 2016 and 2019. According to App Annie, it took only three years to put Fintech on the same level as multi-billion dollar banks.

What Can Banks and the Finance Industry Do?

For some customers, banks can be difficult, but, without them, life would be brutal. Banks are not going to go bankrupt or disappear, but almost everyone agrees that they need to embrace change. The majority of established banks already have platforms to deliver new services—the challenge is about the implementation of customer experience design in banking.

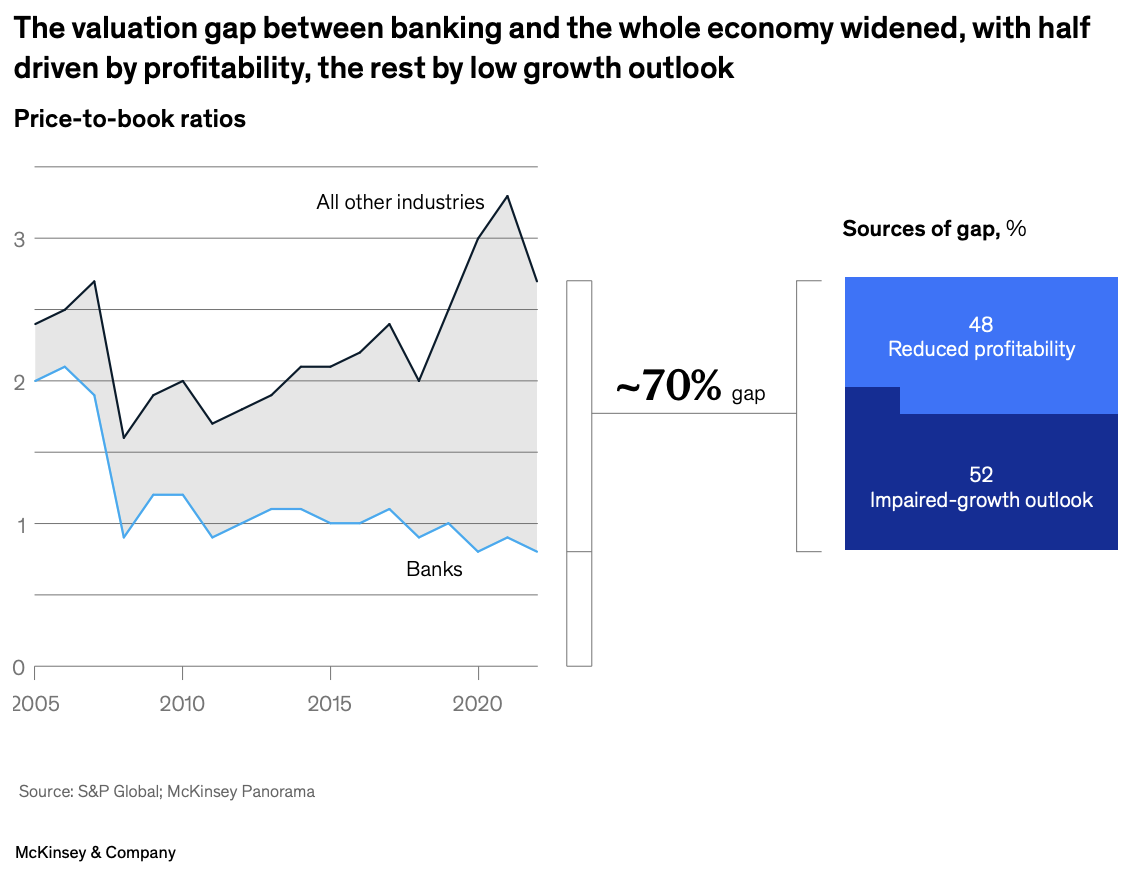

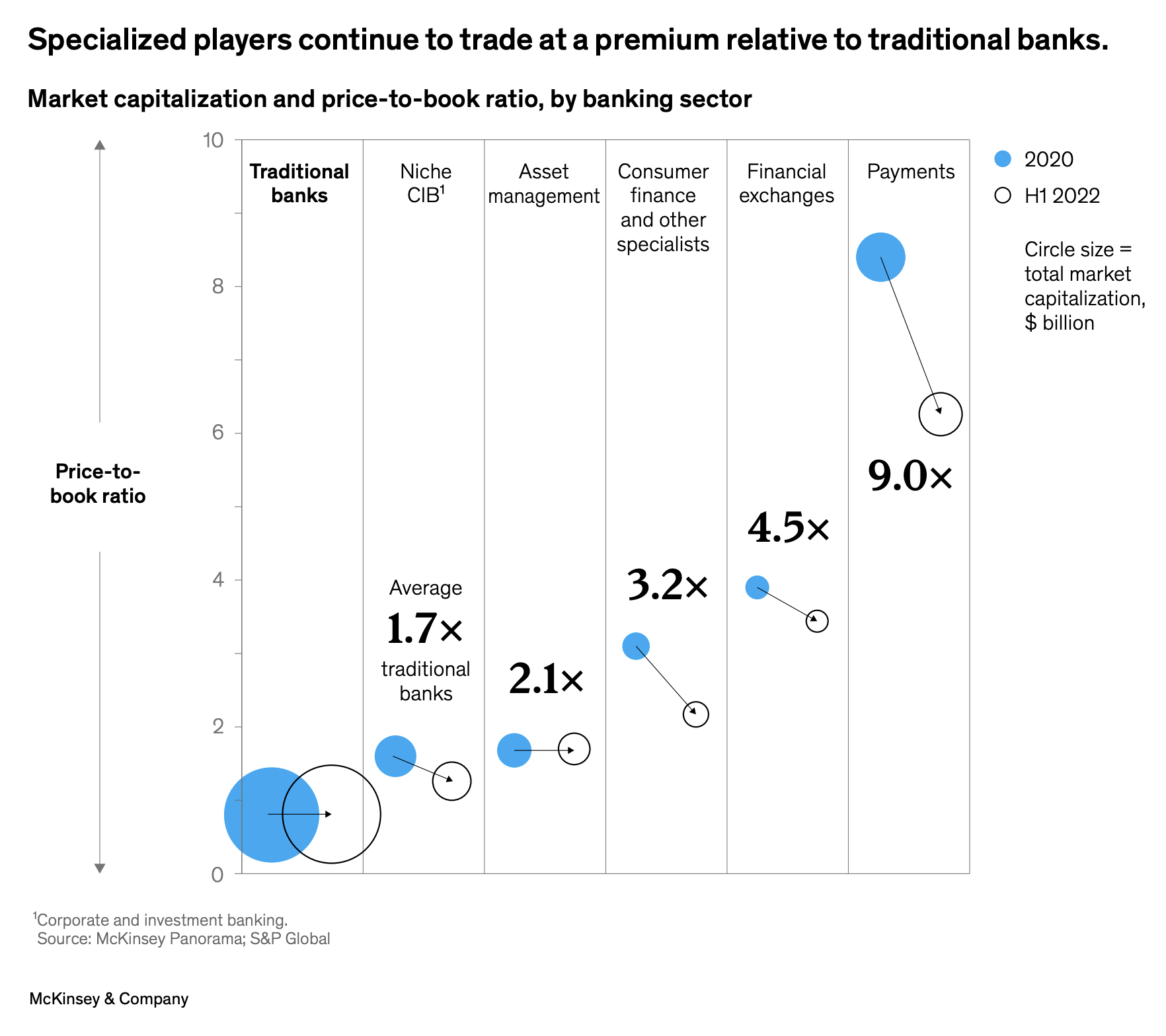

According to McKinsey Global Banking Annual Review 2022 there is a 70% valuation gap between banking and other sectors. And only about half of the valuation gap is a reflection of the banking industry’s low profitability, the other half reflects the expected lack of future growth, demonstrated by banks’ low P/E ratios. Banks have P/Es of about 13, compared with an average of 20 for other sectors—and the discount has been growing. Banks lack systematic growth perspectives for the sector overall, leading investors to discount the sector, which lacks the growth premium observed in other industries.

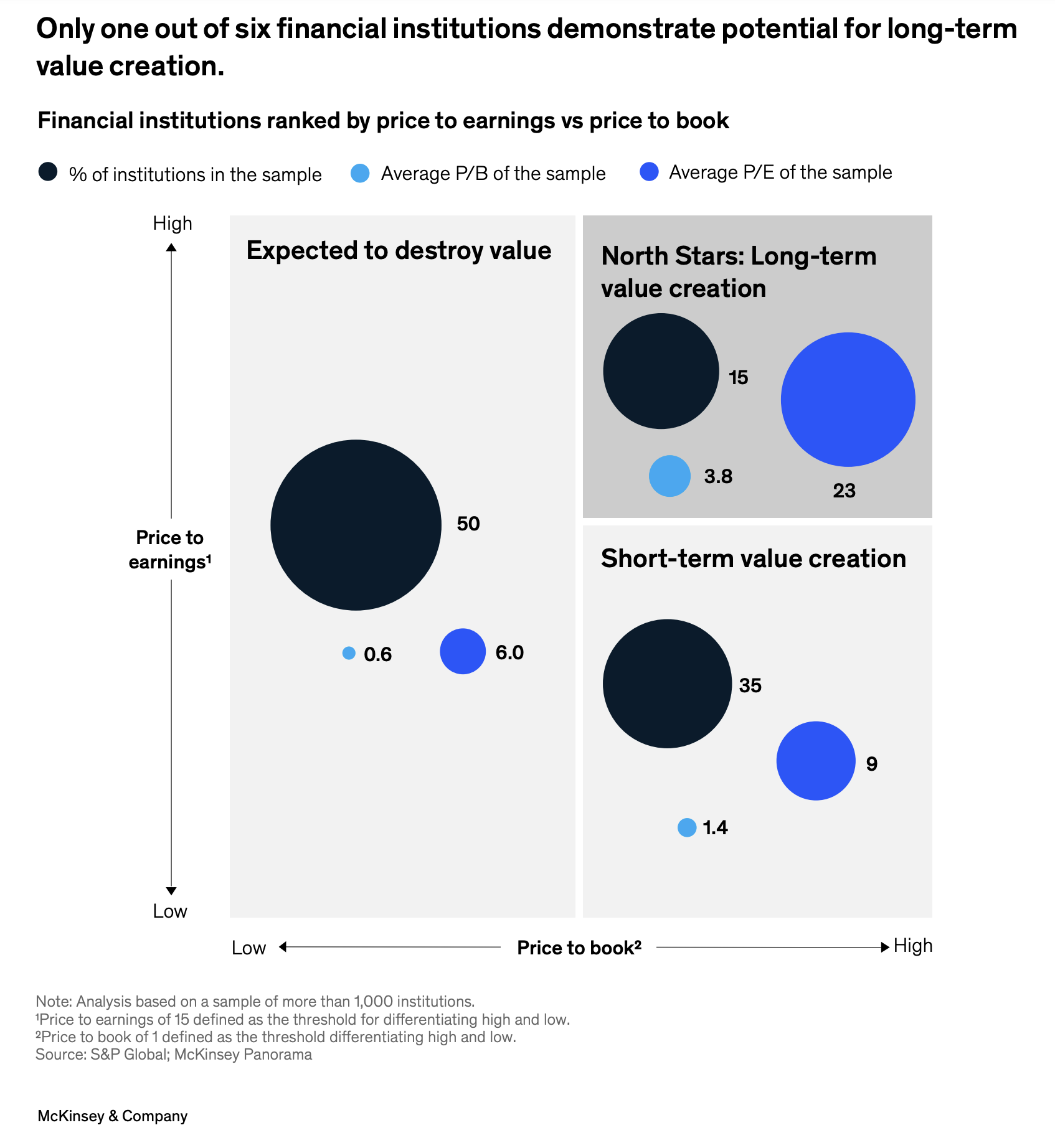

Only banks with long-term value creation (North Stars) perform well in terms of both high returns today and future growth. Their high P/Es imply high expectations for long-term growth, while their high price-to-book ratios (P/Bs) reflect risk-adjusted short-term profitability. These banks are a relative rarity: globally, only about 15 percent of banks qualify as a North Star. Their valuations are two to five times higher than others.

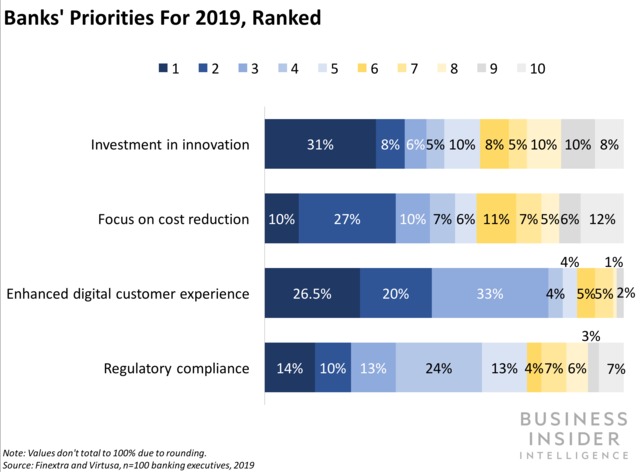

Shifting from product-centered thinking into a more customer-centered service design approach is established as the main priority by 79% of respondents from a survey by Finextra & Virtusa of over 100 banking executives throughout North America, Europe and the Asia Pacific region.

Digital customer experience improvement challenges traditional banking operating models and culture. It requires a customer-centered approach to deliver financial services that customers would welcome using banking technology.

Today’s digital customers have higher expectations than ever. To be successful, financial companies need to be more innovative to attract and retain customers through highly relevant and personalized experiences across multiple channels. One of the best ways to do this is to integrate Design thinking, not only in the processes but also in the culture of the institution.

Fintech specialization allows to provide better customer-centricity and increases value to customers and the valuation of a company. The McKinsey analysis here shows that well-valued specialist players and fintechs are—not surprisingly—active in banking products that generate profits, including deposits, payments, and consumer finance. This was still true after the market correction in 2022, which did not change the order or magnitude of difference.

New financial technology ensures customers with the freedom to switch financial service more quickly than ever, and this only speeds up with open banking initiatives. It is the job of the banks themselves to unlock added services and ultimately put the customers firmly at the center of what they do. Having great online services targeted toward the user is a positive step toward achieving this goal.

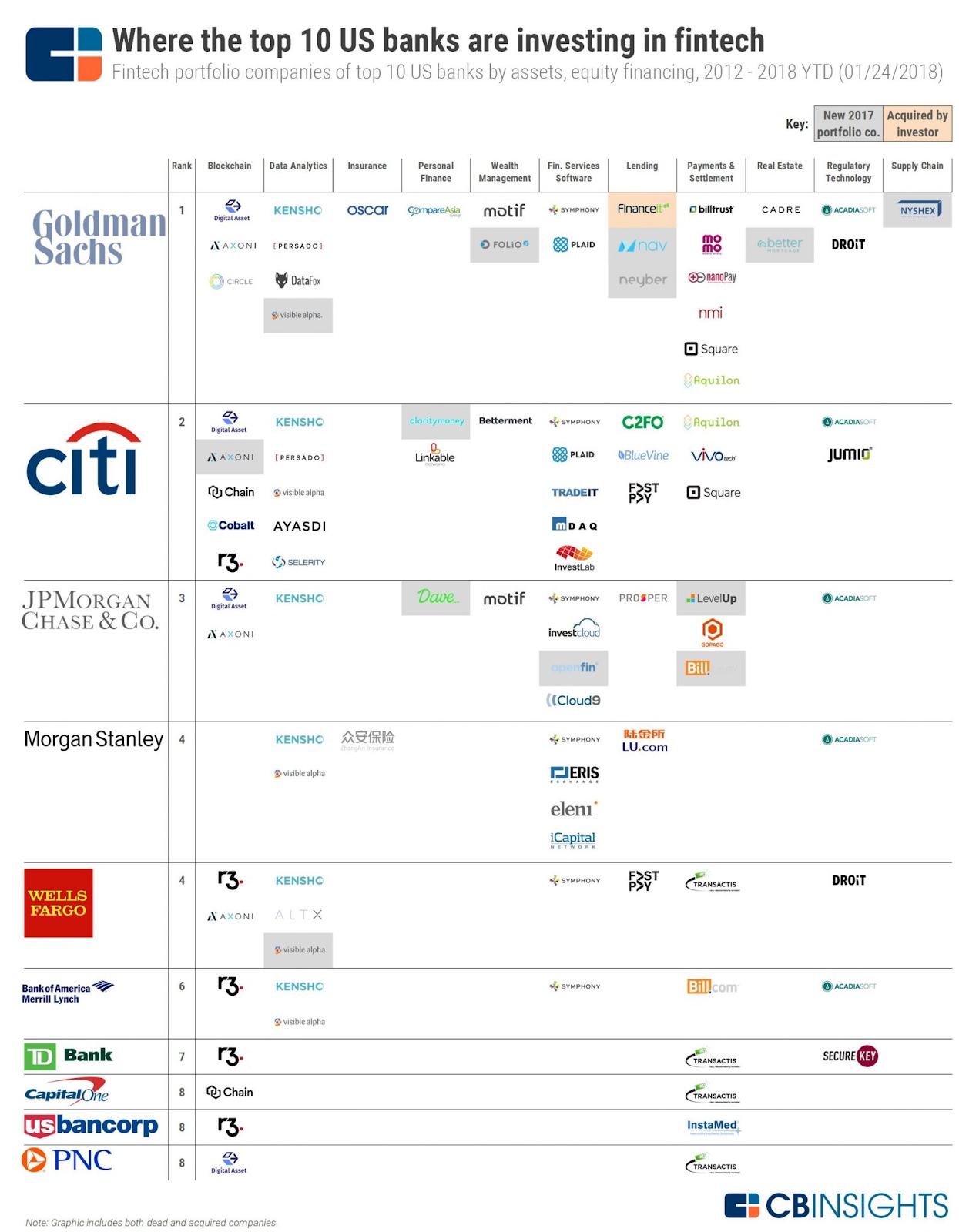

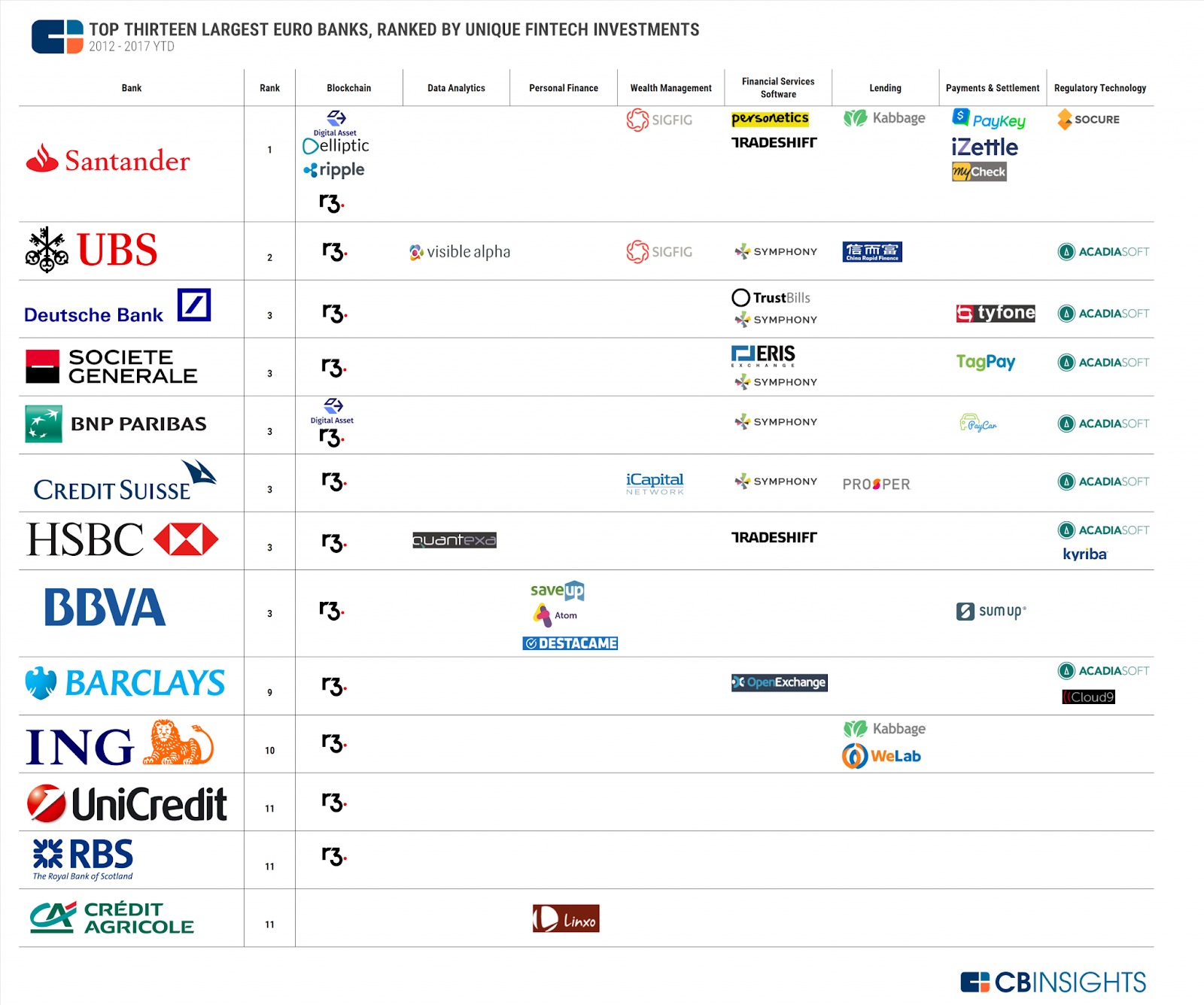

We see that more and more traditional financial companies such as banks are collaborating with Fintech and Insurtech firms, integrating them into their own ecosystems. This is a great approach to stimulate innovation and implement Fintech and Insurtech UX design.

To reach customers’ expectations successfully, advanced banks creating long-term digital strategies by looking outside of the traditional banking industry. They collaborate with Fintech startup owners, UX experts, banking user experience design professionals and researchers who have an understanding of customers’ needs and expectations and create amazing Fintech design solutions.

This strategy, mixed with flexible product innovation provides a key for success in the digital banking industry and enables banks to compete with the Fintech disruptors in the future banking marketplace.

Five CX Tactics for a Digital Breakthrough

Get UXDA Research-Based White Paper "How to Win the Hearts of Digital Customers":

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedin