Today there are thousands of digital financial services, but have you ever thought why majority of people are bad at understanding and planning their finances? Why is their debt almost as big as their pay check? Why are they so reckless with their money after a payday?

Answer is simple — according to Nobel laureate Daniel Kahneman humans are economically irrational. And it’s perfectly normal, because economics is not in human nature. Human brain is lazy on doing calculations and remembering numbers. Even simplest finance planning can cause it lots of work, stress and bad emotions. Doing so brains creates defence mechanism to protect itself and chooses not to behave positively towards money management.

It`s all because of our brains.

Why are financial services complicated from a user centered perspective?

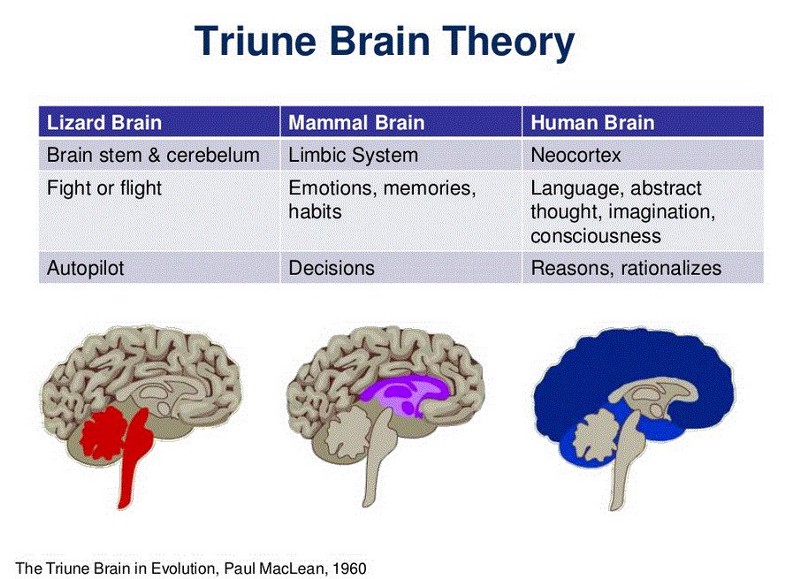

In 1960 the American physician and neuroscientist Paul D. MacLean formulated his triune brain model of the evolution of the vertebrate forebrain and behavior. The triune brain consists of the reptilian complex (Lizard Brain), the paleomammalian complex (Mammal Brain), and the neomammalian complex (Human Brain), viewed as structures sequentially added to the forebrain in the course of evolution.

Our irrational unconscious, emotions, habits drive 80% of our behaviour. And this is exactly what Lizard and Mammal brain is responsible for. Rational thinking happens in Neocortex — brain part that has smallest impact on our routine comparing to other parts. Make a guess where the concept of finance live in? Of course, in our brain youngest part.

Financial services and money have artificially evolved over the time and don't lie in our ancient brains as good as other human instincts. And as you know, humans behave more towards instincts than logic. This is why most of us fail to behave logically and rationally towards finance management. And not just finance management, in this category fall everything else that has evolved around money — taxes, funds, savings and other financial solutions.

Artificially generated value

Think about whole concept — someone prints famous historical person face or object on a piece of paper with a different number and tells you a value of that. Then you can exchange this piece of paper for some goods and services. Then there are checks. I write down on a piece of paper that I am turning this many numbers of value over to get something. One bounced check teaches you the flaws of this system. As technology progressed now we have plastic cards that hold these numbers of a piece of papers we don’t even have anymore. We don’t even see easily how many numbers we are having by looking at this piece of plastic. And this will go even further, soon we will pay without taking anything from our wallets.

No wonder that we spend without much thinking because we are not acknowledging how much we are owning at the moment. No one tells us that. Except in that embarrassing moment when your card is rejected. How am I supposed to remember all my transactions and current balance after doing tens of transactions a day? Now that is a bad experience for me (and I'm sure you can relate with me here). Some can argue here, that now we have mobile banking available, but how many of us just use them due to multistep complexity, just to check balance and transaction history.

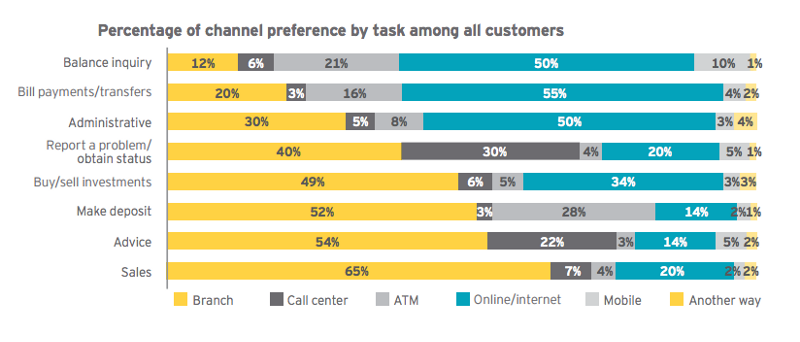

Source: Ernst & Young

Complexity of existing financial service

We have banks and financial institutions that help us. Now we have such innovative financial services as new payment methods, bitcoins, mobile payments, new ultra safe transactions via blockchains and many others. But why we still suck at managing and understanding finances? All those complex terms — subsidized/unsubsidized loans, running balance, available balance, interest rates, compounding, stocks, bonds, mutual funds. Why am I supposed to know what all that means, I just want to buy nice stuff and not run out of money.

I go to the bar grab one beer, pay with a plastic card, it’s just one beer. Right? Then I grab another one, it’s just a second beer. Then I call for shots and next morning with shaking hands, log in to the online bank to see and say — okay next time I`ll be more careful with my expenses. And we all know what happens next Friday — "Hey everybody, beers on me." Don't you visit bars? I bet it happens with you in shopping centers.

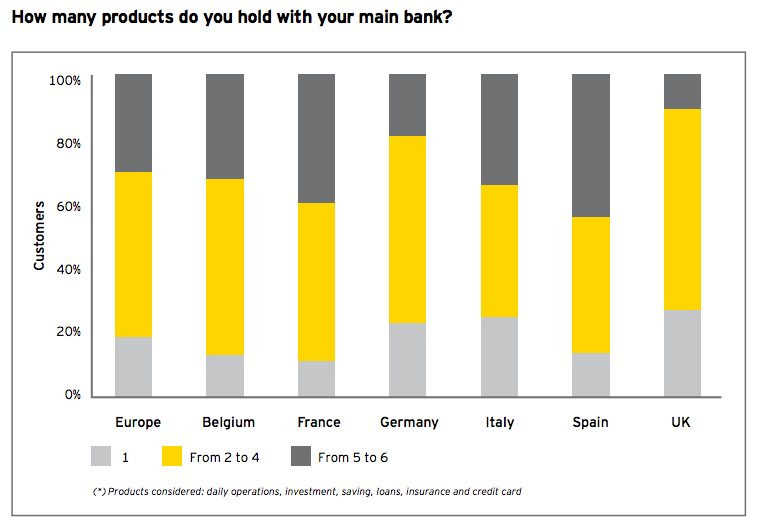

Our brain not made to be good with an understanding complexity of finances and banking. Available financial solutions aren’t easy. An average bank offers a lot of financial services, but 70% customers use only 2 or 4 of them.

Source: Ernst & Young

Reframe finance for human brain

Historically banking system forced us to adjust for it. As a result, a lot of us don’t like banks, because we don’t understand them. Now we have a digital banking technology, that can reinvent this system and adjust it for human nature. Make it transparent and easy to understand for everyone with help of customer centered design in banking. User centered digital financial services will raise human awareness about finances and will reduce the stress and discomfort thinking about finances.

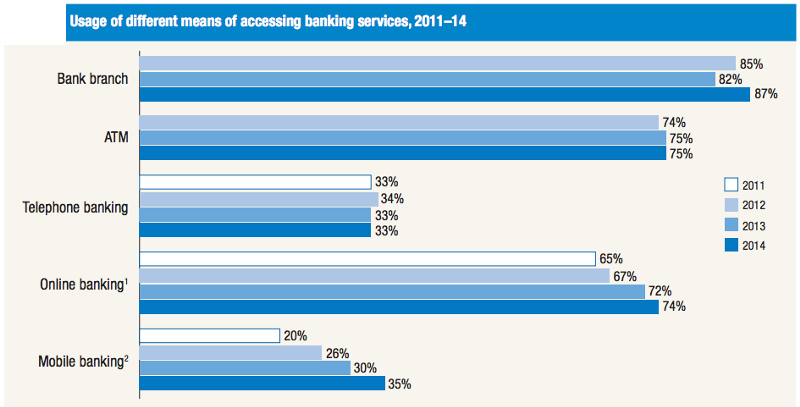

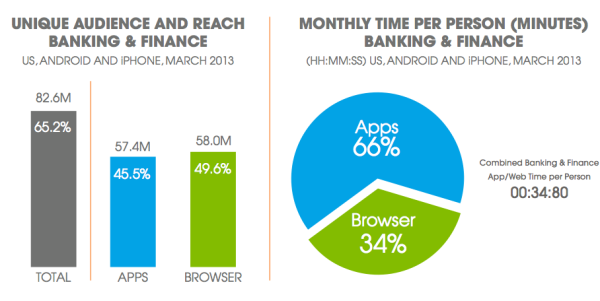

75% of people are using online banking and 35% — mobile. They are in need for human-centered financial solutions.

Source: Federal Reserve Board report www.federalreserve.gov

Source: marketingland.com

A little analogy. Have you ever thought about door handles? Why exactly have they are shaped the way they are? They are shaped so our hands can be easily placed on them and pull to open the doors. If it there wouldn’t be this anatomically fit design — doors would be hard to use. If we would remove door handle on inwards direction doors, humans brain will still figure how to get in-just by pushing. That is intuitiveness. But self-opening automatic doors that are an experience — you don’t even need to touch anything.

Source: Designer - Jeon Hwan Soo

In the world of digital services, an experience is not shaped by our anatomic, but of our behavioural patterns. They are uncovered through psychological tests and researches. It is time, to understand human motives, needs and behaviour to create solutions, that will speak with users on familiar human language. It is time to create self-opening, automatic doors for financial solutions.

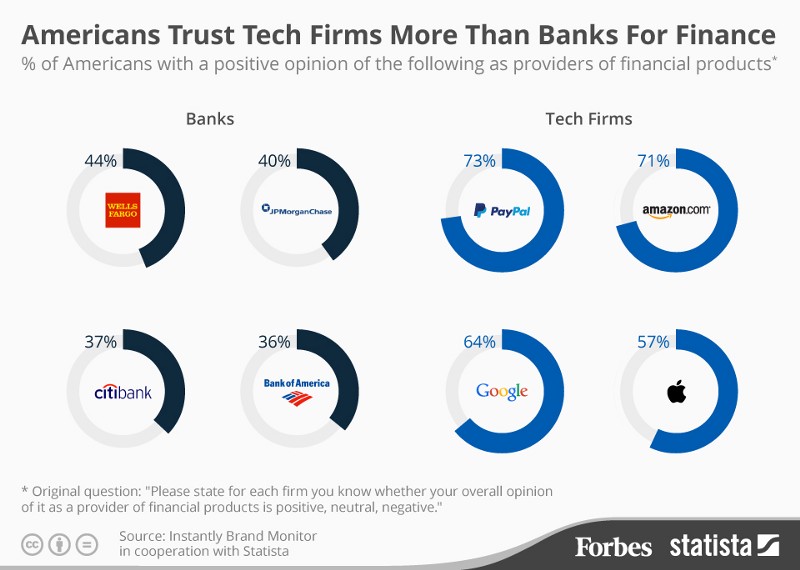

Financial institutions, banks are very aware of our situation and human psychology, but they don’t usually tend to help us. And even if they do so, they give us bigger credit limit. Who’s to blame — of course, if it’s not in our nature to be rational and all super finance smart, then banks should take a step to help us manage and teach us good financial manners. This is the only way to increase customers trust in finance.

Banks know about our finances better than we do. Imagine again if you are down your favorite bar and after two drinks receive a notification on phone saying — “Hey go easy tonight there is vacation coming up, you might better save for that!” Let’s start saving.

And this intelligent approach can be done across all financial services using a latest banking technology we have. When you are paying a bill, I am sure you don’t want to fill 20 field form of why and how you want to pay. You just want to finish it quickly and with less pain as possible, since intentionally giving away money causes no happiness in most of us. If I as a millennial am opening my bank account and it already annoys me with unnecessary information about pension funds, it scares me away, I’m not that old, and what does that even is?

Reinvent financial user experience

There are rare occasions when innovative financial services use user centered design process to help their users to teach them what finances actually are. And I know that thinking user way it is possible not to only make their money management easy, but also to introduce them and explain in their own language any sophisticated financial product. What and how taxes work, what are stocks and bitcoins are how they work and why they would be relevant to you.

Only through understanding humans and enchanting digital user experience, it is possible to bring finances closer to humans and make them adapt and not another way around. Doing things natural way and improving user experience using new banking technology innovations it is possible to improve customers short term and long term financial situation.

Get UXDA Research-Based White Paper "How to Win the Hearts of Digital Customers":

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

If you want to create next-gen financial products to receive an exceptional competitive advantage in the digital age, contact us! With the power of financial UX design, we can help you turn your business into a beloved financial brand with a strong emotional connection with your clients, resulting in success, demand, and long-term customer loyalty.

- E-mail us at info@theuxda.com

- Chat with us in Whatsapp

- Send a direct message to UXDA's CEO Alex Kreger on Linkedin