What is bank innovation through UX design?

The digital age requires a new way of operating and thinking from the financial industry. And, this is not possible without innovation in banking services. We could define bank innovation as using new technology and service processes to provide solutions that better serve customer and business requirements, meet their needs (often unarticulated) and move the market to the next level of development.

Today, we hear a lot about digital banking innovation, because digital technology transforms the way that banks operate. Banking digitization leads to the closing of bank branches, focusing instead on online channels: mobile banking, wearable banking, desktop banking and, in the near future, conversational and virtual and augmented reality banking. In general, Fintech innovation is the only way to move banking into the future.

The main question is how to best provide innovation in banking services. It is not enough to buy or develop innovative banking solutions for long-term success because the digital age requires not just new technology, but innovative banking ideas that will help banks to meet customer needs. This is what banks can learn from innovative Fintech products in the banking sector.

In other words, in the digital age, financial innovations start with the users, not technology.

Check out the best UXDA articles about bank innovation.

Liv Bank Case Study: Lifestyle-Driven Innovation of MENAT Digital Banking

Through a strategic and forward-thinking UX approach, we expanded the Liv ecosystem to three groundbreaking solutions: the Liv X app for seamless lifestyle and financial management, an immersive spatial banking experience for enriched user engagement and the Liv Lite app to empower children's financial education.

The Illusion of Completion in Banking Digital Transformation

The digital transformation of banking is an illusion—modernization will never truly end. Traditional banking, with branches and manual processes, is obsolete. To stay relevant, banks must operate like tech companies, driving continuous innovation and enhancing customer experience.

Emirates NBD Case Study: Driving Ecosystem ROI with Strategic UX in Middle East Banking

This case study delves into how the strategic UX approach transformed Emirates NBD’s digital ecosystem, setting a new standard of excellence for digital banking worldwide and solidifying the Emirates NBD brand’s position as a leader in the Middle East financial industry.

On-Device vs Cloud AI and the Future of Personalized Banking UX

Integrating AI into banking services will obviously revolutionize the user experience in financial services, offering real-time advice and 24/7 transaction monitoring. The main question is which AI will serve banking first ─ on-device AI or cloud-based AI? Let’s compare!

AI as a Humanizing Force in Financial Brand Marketing

There is another promising area of AI use for financial brands ─ marketing and brand communication. The UXDA team assessed the potential of humanizing financial brands using ChatGPT and Midjourney by creating digital mascots based on the mobile service interface.

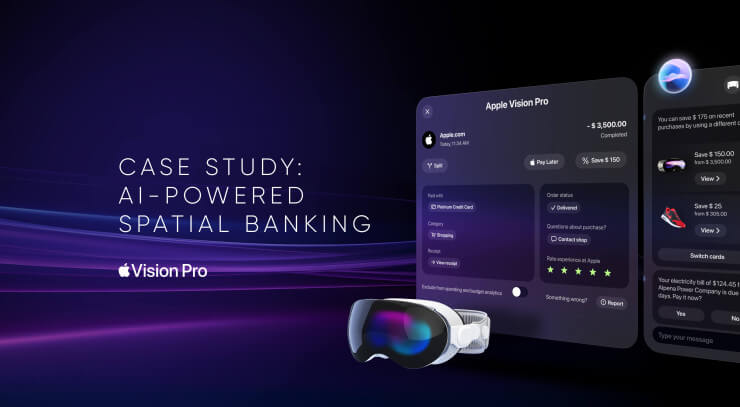

UX Case Study: Implementing AI to Shape the Future of Spatial Banking

Apple Vision Pro could start the next digital revolution. Wizards from Cupertino offer a mind-blowing spatial experience on the visionOS platform. But how could spatial banking feel and look?

Future Banking Trends: Enable Next-Gen Financial UX

Future Banking Trends include technologies such as Generative AI, the metaverse, the blockchain, embedded banking, DeFi with CBDCs, and open banking which are creating the next-gen financial UX.

UX Case Study: Challenges of Business Banking Transformation

SME owners often face the challenge of adapting business strategy to a highly dynamic environment while simultaneously managing day-to-day financial operations. It's like Formula 1 racers, where only precise and quick decisions can save them from failure.

Musk’s Global Bank Ambition for X: Tackling UX Challenges Head-On

Knowing Elon Musk's large-scale approach, his intention to turn X into a bank could have disruptive consequences for the banking industry. However, the conflict between the existing UX patterns of a social network and the implementation of financial functions can complicate the transformation.

Aligning Financial CX with Brand Strategy in Digital Banking

Can your financial company get more from design than just a standard interface for digital services? Absolutely! But there is one thing without which it is impossible to get the most out of your design initiatives.

Surviving Digital Disruption Through UX-Driven Banking Innovation

As the usage of physical cash diminishes and digital consumption skyrockets, traditional banks are undergoing a seismic shift to adapt to changing customer preferences. Digital transformation is reshaping industries and consumer behaviors, and the banking sector stands at a crossroads, poised to redefine our financial experiences in unprecedented ways.